292 Union Pacific engines idled in Arizona Desert

Total US rail traffic in April plunged 11.8% from a year ago, the Association of American Railroads reported today. Carloads of bulk commodities such as coal, oil, grains, and chemicals plummeted 16.1% to 944,339 units.

The coal industry is in a horrible condition and cannot compete with US natural gas at current prices. Coal-fired power plants are being retired. Demand for steam coal is plunging. Major US coal miners – even the largest one – are now bankrupt. So in April, carloads of coal plummeted 40% from the already beaten-down levels a year ago. The AAR report:

Rail coal traffic continues to suffer due to low natural gas prices and high coal stockpiles at power plants. Coal accounted for just 26% of non-intermodal rail traffic for US railroads in April 2016, down from 36% in April 2015 and 45% as recently as late 2011.

Only five of the 20 commodity categories saw gains. Of the decliners, coal was the biggest. But petroleum products also plunged 25%, and grain mill products dropped 7%. Even without coal, carloads were down 3% year-over-year.

But it’s not just coal. In April, loads of containers and trailers fell 7.5% year-over-year to 1,028,460 intermodal units. They transport goods for retailers and wholesalers. They haul parts, components, and assemblies for manufacturers. They haul imported goods from ports and borders to different destinations across the country, and they haul goods to be exported to the ports and borders. They’re a measure of the real economy.

For the first 17 weeks of the year, total rail freight fell 7.8% from the same period a year ago, with carload traffic down 14.3% and intermodal down 0.8%.

But there’s hope, because there’s always hope. AAR Senior VP of Policy and Economics John Gray:

“We expect non-coal carloads to strengthen when the economy gets stronger, and we think intermodal weakness in April is probably at least partly a function of high business inventories that need to be drawn down before new orders, and thus new shipments, are made.”

Ah yes, inventories. We’ve long bemoaned their ballooning to crisis levels.

It didn’t get any better at the end of April: for the week ending April 30, carloads plunged 14.1% and intermodal traffic dropped 8.6% from the same week a year ago.

The impact on railroads is now very visible – and not just in the numbers on their income statements.

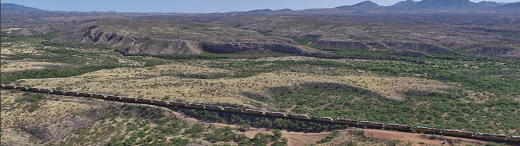

Here’s how Union Pacific is dealing with this issue, via Google Earth, on May 3: 292 engines idled on a siding west of Benson, Arizona, along I-10, for a stretch of nearly 4 miles. Note how the line of locomotives curves and fades into the left edge of the photo – an once majestic and haunting sight, all these powerful machines idled on a track in the Arizona desert (click images to enlarge):

These engines are expensive pieces of equipment. When they just sit there, not pulling trains, they become “overcapacity,” and they get very expensive. Then there are engineers and other personnel who suddenly become unproductive. Some of them have already been laid off or are getting laid off.

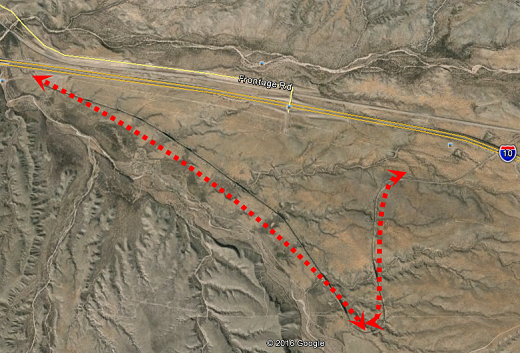

What you see parked there is a big drag on earnings. And a very sad sight. I added the red line for clarity:

The person who sent me these pictures lives and works in that neck of the woods. He said:

“I remember back in 2008-2009, hundreds if not thousands of rail cars stacked along I-10 in AZ-NM on side rails. I have not traveled east bound in a couple of years. I suspect rail cars may be piling up. They need to be parked somewhere. We may head over to Carlsbad Caverns in eastern NM soon, and I will keep an eye out…”

This scenario is playing out across the country, railroad by railroad, perhaps thousands of engines and hundreds of thousands of rail cars – an enormous capital investment – parked mostly out of sight somewhere, “overcapacity” that is now waiting for better days, and the end of the US transportation recession.

On paper, slow economic growth might look OK-ish, but in the US, where there’s significant population growth, it’s toxic. That’s why the numbers are hushed up. Read… Why this Economy Feels Even Lousier than the Lousy GDP Print

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I really don’t want to sound like a total jerk (but I am), but, I have been reading article like this for a few years. Baltic Dry Index DOWN, shipping DOWN, employment (real) DOWN, pay DOWN,….etc……

Ok, Ok, Ok. BUT, why is it that there seems to be no effect when I look around? Car sales are doing great. People are out and about. Disney World is stuffed (I live in Florida), Bush Gardens is packed, SeaWorld has lines, Lego Land is busy…….

it makes no sense.

Ask the railroad workers who’ve already been laid off or who know that they will be laid off soon if there has been “no effect” on them.

But I get your point. And I agree with you: when we look around in our neighborhood, for many of us, everything seems sort of normal.

NO FREIGHT FROM CHINA = NO CONTAINERS TO PULL VIA RAIL.

NO FRACKING IN THE DAKOTAS = NO OIL TO BE DELIVERD BY RAIL

NO RAIL CONTAINER FREIGHT = NO FREIGHT FOR TRUCKS

NO OIL DRILLING IN CANADA = NO EQUIPMENT BEING BUILT IN TEXAS

SHALL I GO ON?

Two points –

1 – US trucking freight rates for flatbed, Van, Reefer are all really soft right now…dispatchers saying it feels like ’08/’09 with carriers offering under a buck a mile in many locations.

2- Quote “On paper, slow economic growth might look OK-ish, but in the US, where there’s significant population growth, it’s toxic…”. Just thought I’d put this population growth in context. From 2015–>2020 US population will grow an aver. 2.62m annually…of that annual growth, 1.72m are 65+yr/olds vs. 900k 0-64yr/olds (according to very optimistic US Census estimates). That really shouldn’t even be classified as growth and more so “population longevity”.

Easy point is fast growing 65+yr/olds are relatively poorer consumers than 25-64yr/olds which are barely growing and whose incomes are stagnant…although the US is far better off than most other developed and developing nations in this regard.

and china making so much damn stuff that the world is gorged on it.

that too.

Yup. The same was true in the 1930s Depression. I’ve been looking closely and census and economic data. Some localities and some occupations were running pretty much normally, while other places and job descriptions were smashed.

It will all self-correct in the autumn when iPhone 7 arrives. Til then we must simply enjoy driving our newly leased pickup trucks on cheap gasoline over the empty tracks seldom inconvenienced by slow coal trains. Sure, we all need to borrow a little more to ensure Hillary’s election. But we can pay that back when the post-2009 economy hits cruising altitude.

Back in January, Apple cut iPhone production by 30% which was supposed to go at least to the end of March… However, their first quarter report was absolutely dismal, and their stock has taken a pretty good hit as a result. People haven’t been buying their precious iPhones, and that trend will continue even with iPhone 7.

Roscoe P Coaltrain for president. Stay calm & keep shopping folks.

If the iphone 7 does anything to the economy, it won’t be for the US. I bought my gd an ipod a couple years ago engraved with her name – and I tracked it from China.

I can give you the report from the “Carlsbad Caverns” area right now. We have built several new rail yards in Carlsbad area recently to handle frak sand, oil & produced water, in addition to potash from the local mines. ALL are in major slump-the last year. Their are rail cars for potash, frak sand, and produced water parked on sidings in every available spot-hundreds, maybe a thousand. One of the largest employers “Intrepid Potash” announced they may file banco. Stock price from $64 to $1.44 in last 7yrs. Covenant grace period up on May 13……that was in last Sundays paper….

Lets put a picture to your post. Chart for Intrepid. Tis ugly!

http://marketrealist.com/2016/03/intrepid-potash-headed-towards-bankruptcy/

Thanks for the info!

And why in the world is agricultural fertilizer down? Are people not eating either?

Because these indicies are leading recession indicators for the most part. The fundamental economy (commodities, shipping indicies) always slows down before the real crash, which I expect to be sometime this fall possibly between early November and late December. Also, the middle class still has access to credit (for now).

I don’t agree that amusement parks are doing well. Retail is not doing well at all. Auto sales may be doing well on the surface but this due to subprime auto financing, and that bubble will pop soon enough.

Don’t be fooled by media propaganda either. The FED and its media cheerleaders will never admit to the truth, that this economy is sick and dying.

The $ is in danger since 50 Years. The US debts are not payable.

It is only the lack of competiton which maintainthe $ in use.

The battle between traditional $ owners and petro $ owners weakens the $ on a gigantic scale it is useless to try to decide by many airforce based wars.

It does not make sense to say US economy is dying. The social system

of leadership through financial procedures must be abandond.

Return to J.F. Kennedys propositions. And the States will flourish.

“My fellow Americans, ask not what your country can do for you, ask what you can do for your country.”

If any President or bartender would utter those words today, he would be laughed off of the podium or out of the bar.

That’s cuzz it’s based on fantasy…ALL OF IT !!

@Centurion: I think it’s all about “escapism”. Most of what you listed is feel-good stuff on which people are spending their diminishing discretionary cash.

I live in CT. Right now our legislature is fighting over closing a huge budget gap. One senator just commented that income tax revenues are significantly down – but cigarette, alcohol and lottery revenues are up. So the nearly-broke populace is smoking, drinking and hoping for that big winning ticket! Very sad picture of trends in our society.

That a good point TeeJay,

That was the experience in the Great Depression.

Although how the urge to escape manifests changes as technology changes. History doesn’t repeat, it rhymes.

The Great Recession saw a drop in makeup and movies, and alcohol. As people, used up what’s left of their makeup, watched movies for free and drank cheaper alcohol.

Isn’t that how it devolved at the fall of the USSR, what, 20 some years ago?

Bread and Circuses circa 140 BC.

Federal income tax receipts are WAaaaay UP! Why isn’t CT’s? Need to raise rates . . .immediately.

I live in Florida , about a month ago went to Disney Village (use to be called something else back in the day) which is free admission. Tons of people there starting in the late afternoon , but I didn’t see many people caring bags, just walking around or having something to eat.

Everything was apparently awesome in 2007 as well. Then very suddenly it wasn’t.

What you have to understand is that the central banks will deny collapse with all their might — they will throw everything at this.

You might note that nearly 30% of all new car sales are to subprime buyers.

What cannot continue – will stop. And it will stop very suddenly. Impossible to know when particularly when you have the might of the central banks pushing back.

beware thee the “normalcy bias” as it has this nasty tendencyto bite you in the keister everytime Remember how the presstitutes laughed at Peter Schiff in 2006? How did that work out for us all?

I would almost be willing to bet that all those people “stuffed” into Disney World, Busch Gardens, etc. are there on credit. Most are not paying cash for those trips. I’m sure that some are, but for most of them, it’s just another maxed out credit card trip so that they can feel like everything is “normal”. I do understand what you are saying though, things seem pretty normal here where we live in Dallas, too…but I see certain things changing. The article above is talking about the beginning of the problem. It takes a bit for it to trickle down all the way.

http://www.cjr.org/resources/?c=disney

Last I looked, Disney was the 3rd largest multimedia company in the world. Who didn’t grow up with the mouse? The link above list their endeavors.

I agree with you, people are grabbing for that last bit of “programmed” normal.

They printed money

It will make sense when the rising oceans – climate change – drowns Florida. Starting with Miami Beach which is just sitting out there exposed to the rising sea.

Look around at the weather. 2013 was the hottest year ever recorded globally. Then it was 2014…then 2015 was the hottest year. Rising oceans, mega forest fires etc…etc. Now 2016 is going to smash all heat records. Do you see a pattern here? It’s going to be worse in 2017 – 2018 and on and on to extinction.

We talk about the economy while ignoring the basic Laws of Physics. We talk about coal and fracking as if it is not connected to the destruction of our ecosystem. Reality has a hard way of intruding on illusions. We had better wake up! If this sounds like fear mongering then you are not paying attention to reality.

Raising taxes and utility costs will go a long way to solving global warming but, really, they deed to reduce the population by . . what did they say? . . .4 Billion?

I also noted Miami is becoming flooded and Brickle Ave. is now underwater. A rising tide floats all cars . . as they say. I hear Newport Beach, CA is next for the rising tide. Maybe they’ll see it in the next few years. Sea levels are selective in where they rise. Some here, some there.

Because people are stupid and they have been fed so many lies that they will not believe it till it all crashes! It will not be gradual, it will happen in one feld swoop ! That is called shock & awe and that is what they want. You are a sleep which is exactly what you have been conditioned to be! You will then be easily controled because you have nothing to back you up and then you must do what you are told!!

Because the government is printing money like mad, and racking up the debt doing it.

I just drove from Washington, DC to Orlando. DC and Orlando are busy but every stop we made on the way we saw 1 to 4 businesses boarded up. Not good once you get outside the LA, San Fran, DC, NYC, etc. “regional bubble economies”.

Its because the printing press is going strong and interest rates are at zero, this will change soon.

I think you are correct but it takes a bit for a slowdown to work its way through the system.

I’ve worked for one of the large railroads for just short of twenty years. What’s happening right now is the same exact thing we went through in 2008. We watched it start happening in 2007. In the area I live, just before the economy went to crap, folks were driving around in new cars, RV’s, and purchasing 3000 square foot homes. Boom! You know the rest of the story.

One thing that concerns me is both Big RR’s are cutting management positions as well. I’ve not seen that happen in the past.

Thanks for sharing. The signs are all around for those paying attention. I was in residential construction for a long time (central florida). In 2006, one of the subdivisions I was doing, a little 60 lot affair, sold out quickly with prices nearly doubling. Even the guy hooking the houses to the grid bought a house for speculation. I likened the moonshot in prices (my home had more than doubled in value) to the blow off spike you see on the chart at the end of a bull market. It suggested to me that the end was a lot closer than the beginning & Will Robinsons robot was shouting, danger, danger. Almost nobody I talked too saw what was on the horizon.

When they start cutting management positions, you know it’s serious.

Pay is not down. Instead, we are seeing some wage increases, and especially in higher paying jobs (fewer though they may be). Retail is down, but leisure and entertainment are up.

Also, employment is not down, at least significantly. — This week’s Barron’s talks about how the Australian dollar is a future indicator for commodities and hence the market. I think we are seeing the completion of one cycle and the start of another. That is why the picture is confusing. also, I need to study the credit cycles. Where are they now? – Baltic and other transportation measures show decreased activity. Yet other measures show selective consumer driven improvements in narrow slices of the market. — the other factor not discussed is changes in median income. That has declined over the last several years, yet we see some wage increases. What’s the truth? The real canary in the coal mine is when restaurants go out of business and fast food begins to hurt. Since that isn’t happening yet, I would say that the US economny will continue to muddle through drifting into recession in the next six months. – Supposedly, Congress has lifted some taxes and created more incentives for business. Fine, but that is not good enough for a robust bounce back.

because we cloud ourselves with illusions as not to see the dark side of the world. we only focus on what you just said about Disney and cars. no one looks in the dark cracks and crannies of homelessness in abandaned warehouses and alleys or under bridges.

I would suggest broadening your view of what is happening around you. I live in a rather well to do suburb of the SF Bay Area. I go to a fitness club often where I am a member. I don’t venture very far from where I live as I don’t have to any more. If I were to make some judgement on the US economy on what I see on a daily, weekly, yearly basis, I’d say there is nothing wrong and things are good. However with deeper examination, as I actually talk to people, everyone has a bleak outlook, has scaled back, knows someone who is near homelessness.. And if I take a drive 20 miles radius from where I live, things look awful – buildings falling apart, not been painted for what looks like decades, weeds, sidewalks cracked, junk vehicles parked on what was lawns, junk and trash.

And I could go on but this is just a brief snapshot of what I see in the fascist state of Commiefornia. the suicidal state that is the model for complete corruption.

Two words. Borrowed money. Three words. Increased national debt. All these numbers are preludes of what is coming. Hold on cause after Obama walks out the door and slams it shut. 2008 will look like a picnic.

Because people are spending money they do not have it is called credit!

Plus……..anybody that plies the Interstate highways sees that there’s no shortage of trucks. Maybe the rails have priced themselves out of the game with Ponzi style rates.

BUT the economy is suppose to be good! O’Bummer said so. And we need Billary to be our next President to continue this great recovery.

Don’t be naïve. Trump and HRC are on the same page.

If elections mattered plutocracy would take over and elected democratic government would preserved only as a useful façade. Some people suspect this has already happened.

If elections REALLY mattered, the government would outlaw them!

As George Carlin once noted: “Forget the politicians. They are there to give you the illusion that you have a choice. There is no choice. You have owners. They own you”.

…and your STUFF !

Loved George Carlin and he was way before his time May he rest in peace Aaron Russo too

Wow…a picture is worth a thousand words. Thank you to the reader who sent those pics!

I noticed this last month regarding 10% layoff at BNSF which is based in nearby Ft Worth:

http://www.star-telegram.com/news/business/article69326397.html

From thin air the money came to create the bubble economy, into thin air the job bubble goes.

A Texas company that makes rail cars, in my area, is laying off 25% of its workforce. They claim it is because of the oil slowdown.

Thanks for the info. That’s interesting. It took longer than we expected. We warned about tank-car makers in Dec 2014….

http://wolfstreet.com/2014/12/01/saudi-arabia-declares-oil-war-on-us-fracking-hits-railroads-tank-car-makers-canada-russia-sinks-venezuela/

We subscribe to Railway Age and Progressive Railway and according to them everything is at a safe level. Most of their stories have to do with how great everything is with public transportation grant funding from Congress.

“Most of their stories have to do with how great everything is with public transportation grant funding from Congress.”

So their focus is on what the transportation industries can have ‘given’ to them from the government coffers with all that free money stolen from the public & printed up by the CB. Interesting.

Just about all financial metrics that matter have been heading south for awhile but until the stock market heads that way in a serious manner, many will pay no attention.

Grant funding from Congress! Ah, capitalism, the free market.

At some point the millennials will insist on being cut into the helicopter drop and burying their student loans in a 500 year bond.

Ah, corporatism, and the unfree markets !

Why do they stash the idled engines in the middle of nowhere? Or are they hiding the tell tale signs of economic collapse?

they put them near tracks in the middle of nowhere, because the weather there is awful for humans, but good for expensive equipment that you don’t want stripped by humans, or ruined by rain and bad weather. Dry heat is fine.

Of course, I could be completely wrong.

there’s always SANDSTORMS……..that must be great for engine maintainability, no?

The sandstorms are usually west of where they are, closer to and in the Phoenix area.

Same reason “retired” military aircraft (and scores of civilian models) are parked at Davis-Monthan AFB in Tucson at a facility nick-named “The Boneyard.” DoD reportedly saves millions of dollars each year by cannibalizing parts from retired jets.

Because the dry climate is the best environment to guard against the corrosive effects of weather – same reason they park old/broken jet airliners out there.

Bombardier of Canada to lay off 3,200 in railcar manyfacturing: http://trn.trains.com/news/news-wire/2016/02/17-bombardier-layoffs-coming

Ouch! Thanx for the link

More than ouch.

Those jobs are gone.

In the future those cars will be made in, india, Mexico, or china. And imported into North America.

Off topic, thanks for the 100% reserve link. I’m always seeking to broaden my knowledge base.

Some of the other links and references in that are good.

3 countries that produce crap, junk and trash – just what the US needs. I do recognize that SOME things from Mexico and China are of higher quality but that is simply due to USA manufacturing standards and/or ISO standards. Left to their own, these countries haven’t the brains to produce a 1920’s toilet.

What about insider ownership, rarely do we hear much about insiders loading up on or bailing out of stocks, seems like. Is that b/c it simply isn’t a reliable or cornerstone metric?

And yes, thanks to whomever assembled and submitted this detail!

Peddling fiction, indeed!

I’ve noticed here in Cambridge MA a collapse in food prices. I paid 69 cents a dozen for eggs today. NO SALE. Pork was $2.29 a pound. Across the board food prices were throwbacks to I can’t remember when. Beer prices even fell.

What’s strange is Cambridge’s economy (Harvard, MIT and Tufts) is on a tear. Bars are full, rents are astronomical but food is dirt cheap. This may be a sign of a narrowing of growth across the country,

“I’ve noticed here in Cambridge MA a collapse in food prices. I paid 69 cents a dozen for eggs today. NO SALE. Pork was $2.29 a pound. Across the board food prices were throwbacks to I can’t remember when. Beer prices even fell.

What’s strange is Cambridge’s economy (Harvard, MIT and Tufts) is on a tear.”

You’re in a college town. The students are going home for the summer.

ALL college towns across America are booming due to increasing tuitions (and the various building projects that they spawn), as well as the various investment funds that build there in the hopes of ‘unlimited rents’ in a ‘no cap tuition world’.

A perfectly reasonable and balanced long term business plan for a stable society.

My guess is the rate of increase in rents in college towns mirrors that of the tuitions. Tuitions will never drop so neither will the rents.

Cambridge has always had the same number of students. Also, those kinds of price cuts are too high to be retail driven. Students eat in the dining halls. There is actually only one grocery store near Harvard. It’s on Mass Ave.

Harvard and MIT are largely graduate schools. That said, tuition at Harvard has gone down. The total is $60,000 but the average student pays about $14,000.

The reason rents are up is research grants. A friend of mine (At Tufts) just got $30 million from Paul Allen to study muscle cell growth. They have 45 post docs.

MIT is insane. Google, Pfizer… a lot of companies have huge research facilities on campus. There are a gazillion startups. MIT’s nano labs are packed.

Please let us know if any of your grocery stores close in the next few months…and I wonder if refrigerated rail cars have affected the just-in-time food supply. Thanks.

sorry wolf… misclicked my addy

Agnes, I’m not exactly sure what you mean. Was your question meant for me (any of my grocery stores closing)?

We have a few opening. There’s not a lot of land here. There’s also a pretty serious labor shortage.

There are more idled UPRR engines than that in Idaho and Oregon.

And in Grand Junction, Colorado. Three deep and they go on and on. It’s been like that for a few years now.

Grand Junction, CO too! Maybe 150 total locomotives.

If you believe ShadowStats, which I do, the U.S. has been in a recession since at least 2005.

Of course, for many millions who have always been poor, and lacked any recourse, it has always been a depression, regardless of the pretensions of the news media. The poor don’t get much attention, but their ranks are sure to grow, and they won’t get much attention either.

As you know, the very existence of a middle class is an accident of history, brought on when TPTB lost quite a bit of control to the socialists in the years after 1929. All previous human history had been characterized by a relatively small and wealthy class dominating a mostly poor and disempowered general population. Efforts are presently underway to restore the historical order.

You can expect the economic statistics to steadily worsen until that has been achieved. In due course the NBER will declare a recession, for what it’s worth, and perhaps may someday declare an end to it, and perhaps that might matter, but I doubt it. Perhaps the equity markets will stay inflated anyway. The rich do have to put their money somewhere, and it can’t all go to the Caymans, and stocks are as good a place as any to put it.

There’s a trick to being poor but happy. If you figure out what that is, but sure to post it here for the benefit of others.

Thankfully, there is another line in Candide.

“Do you think,” said Candide, “that mankind always massacred each other as they do now? Were they always guilty of lies, fraud, treachery, ingratitude, inconstancy, envy, ambition, and cruelty? Were they always thieves, fools, cowards, gluttons, drunkards, misers, calumniators, debauchees, fanatics, and hypocrites?”

“Do you believe,” said Martin, “that hawks have always been accustomed to eat pigeons when they came in their way?”

“Doubtless,” said Candide. “Well, then,” replied Martin, “if hawks have always had the same nature, why should you pretend that mankind change theirs?”

“Oh!” said Candide, “there is a great deal of difference; for free will——” And reasoning thus, they arrived at Bourdeaux.

Can free will thrive in a rapacious society?

“Can free will thrive in a rapacious society?”

Is your will really ‘free’ if it can be so easily manipulated by the rapacious?

And would it matter if your will is ‘free’ if you are the only one who is resistant to manipulation? Bernays believed your question would be irrelevant.

“It’s a recession when your neighbor loses his job. It’s a depression when you lose yours”

-Harry Truman-

And recovery is when incumbents get voted out of office.

EVERY last stinking one of them!

“At his best, man is the noblest of all animals; separated from law and justice, he is the worst.” – Aristotle

The 2008 GreatER Depression is finding its legs.

Wolf: My comment about grocery store closings was directed at Towlie…but I misclicked my email addy and the message I got back said my comment was being moderated. I did not want you to have concern about your site , so as a courtesy I was trying to inform you of my clumsiness.

When Radio Shack was just about to go out of business, we were temporarily flooded with slightly cheaper-than-usual goods because our store was chosen as a funnel to sell as much as possible before BK announcement was made. I wondered if a store (Safeway/Albertson’s) in his area was trying to offload goods ahead of an announcement.

Thanks, sorry.

Got it. thanks.

I am over here in UAE .. Go to Qatar, see slowdown in and growing ex pat departures. If interest rates were anywhere near normal levels in the so called developed World, I wonder what the economies would have looked like over last few years? This is the biggest ” kick the can down the road” exercise the World has ever seen. In the transportation industry which I know very well, signs of recession have been witnessed since mid 2015 and it is generally said this industry sector has a 12 month indicator of Global activity. Make your own minds up on that perspective.

Wolf, Railway age published this jaw dropping fact earlier this week . The amount of Hopper cars in storage is over 50,000 and new ones coming out of new builds are going directly into storage. Tanker cars ? Over 50,000 in storage and over half are DOT 111 that are still owner by leasing cos and have financed by banks that will not be scrapped for about 10 more years. They still have money left in them and the banks will not get rid of them. Thousands of new tanker and hopper cars are being built and going into storage without ever seeing service. the backlog orders for new ones has fallen 75 pct in the past 2 years as new orders have crashed. est that 50 pct of these cars will never be used again. Tens of thousands of intermodal well cars in storage also as China imports have crashed. all of these are being stored everywhere including scenic tourist railroads from Washington to New Hope Ivyland In PA. Rates are from 4 to 12 dollars a car per month or per day. It is getting to the point that even Iowa Pacific Holdings is adding trackage to add storage just for extra space. Sad that the media is so clueless to what is really going on

Thanks for posting this. We are all tied to the economy in various ways & are individually aware of specific metrics others may not see. Because the local economies vary so much, these type of posts add a lot of value to this site & is one reason I keep coming back.

I was driving along PA 61 near Hamburg, PA and I passed 4.5 miles of tanker cars on the railroad next to highway 61. Whats up?

I just searched the internet, these are empty tankers that hauled the fracking oil from the midwest.

see:: http://www.readingeagle.com/news/article/nowhere-to-go-railroad-cars-that-once-hauled-crude-now-parked-in-northern-berks-county

No worries. The next GDP number will still be positive.

Denial ain’t a river in Egypt…

I typically believe this stuff, but how do we know this pic is current vs. 2009, etc? Without having the backing it seems to be hard to pallette.

I have the originals with date.

It’s done by Google Earth (satellite). If you know where to look, you can find these things yourself.

To Brent, I live near where these locos are stored! I drive past them. I have observed them from afoot on desert. I have been observing them since at least March 2016. I just saw them again yesterday 5-7-16. More locs had been added since my last look.

They are located South side of I-10 starting at Empirita Rd exit (291 I think) and ending near Cienega Creek draw at approx mm288.5 three mi straight line west of start point. The RR siding doesn’t run straight line so 31/2 – 4 mi is accurate.

Please remember folks, unemployment is 4.9% and, btw, I have a bridge for sale up in Brooklyn NY – – submit offer to 1600 Penna Ave Wash DC

One of your best articles Wolf. If bloggers have an awards ceremony for the best financial piece, you should submit this one. The photos are self-confirming. Great job.

Thanks!!!!!

Wolf, what are your thoughts on shorting UPS? I see this company as a disaster that leveraged to the hilt. They owe their pension 8 billion, and a plan they supposedly got out of 3.6 billion. They have an internal ROR assumption of 8.75% (laughable).

If container shipping falls, how does UPS not price cut? They already have negative equity. Finally, they borrowed 4.5 billion last year to fund stock buybacks.

I’n thinking UPS is a $20 stock that’s selling for $100.

If you read my article….

http://wolfstreet.com/2016/03/08/this-is-why-i-dont-short-anything-anymore/

…you will find out why I personally don’t short anything anymore. Have fun!

.

Two Things Will Kill You. Or Two Things To Watch Out For.

.

.1 Front Running. They see the order you place and front run you beating you by a few seconds. I knew this was happening for a few years, and could not figure it out, but then realized what was happening and they all admit it.

.

.

2. Algo’s. It is illegal for a person to conspire with a person to raise a share price.

.

.BUT WHAT IF it is written in code where computers see short interest and can act together to blow out a short based on nothing but numbers ( no news simply numbers).

.

. I believe this is happening. The Algo’s control and no person can be blamed.

The ONLY Way to MAKE mONEY On Movement

Is to Create The Movement

And the Algo’s are designed to Create the Movement.

.

.

Caution is advised.

Air cargo is down too -1.05% (%chg over 2015) Reference DOT, Bureau of Transportation Statistics. http://www.transtats.bts.gov/freight.asp.

Good stuff, Wolf. Trucking miserable, too. Railroads now drive down trucker rates to nothing. Still, like you point out, railroad cars parked everywhere (everywhere!). I have flown over all west coast ports several times in the past few months to see a grand total of 2 ships processing at any one time. Sometimes it is zero. Zero at Long Beach, LA, Port Hueneme, Oakland, Portland (always has a few grainers), and Seattle – EMPTY. This has been going on since the normal seasonal downturn in late December, but it has not come back. This ‘economy’ has a twilight zone quality to it now; huge swaths of it make no sense at all and prices are all over the map for similar services or goods.

And of course there is the question of why does a private company get to have the right to print the reserve currency and loan it out at interest?

Why doesn’t the US govt do that – and use the interest to build schools, hospitals, roads, bridges … or reduce taxes.

(that’s a rhetorical question)

Because your last name is not Rothschild

I work for an engineering firm that performs design work for the railroads, such as ports and transfer stations, and that sector of our company has had projects cancelled or on hold for four years now with no end in sight of ever being brought to life.