Debris from the collapse hits investors left and right.

Some startups succeed beyond anyone’s wildest dreams. This is the lure used to get investors from around the world to pour money into VC funds and mutual funds that invest in these miracles at ever higher “valuations” before they become miracles, before they have profits, or even revenues. The idea is to get in on the ground floor of a miracle. No price is too high. But now the miracles are deflating, reality is resurfacing, and a brutal drawn-out process has set in.

Yahoo investors are now coming to grips with this, because it’s their money that went down the drain when it bought Tumblr for $1.1 billion in 2013. At the time it recognized $750 million of that investment as “goodwill,” an intangible asset on which Yahoo blew tangible money. In January, it disclosed that it wrote down that investment by $230 million. And on Monday, it disclosed in its annual 10-K filing that it might write off “some portion or all” of the remaining goodwill.

But Tumblr is still out there, people are still using it, and revenues are creeping up. It’s just that after all these boom years when everything soared, the rout back to reality has set in, and its valuation is now being viewed with a more realistic eye, even at Yahoo.

Numerous startups have recently raised desperately needed new money at much lower valuations, including fitness-tracker maker Jawbone, whose valuation plunged 55% in that “down round,” and Foursquare, whose valuation was cut by 62%.

These are one-time occasions that happen only when the company raises new money. But when mutual funds take an ax to the startups in their portfolios and chop them down to size it can be a brutal monthly ritual.

Mutual funds are late-stage investors. They’re not venture capital that takes huge risks with tiny entities chasing big dreams. Mutual funds want to get into the game after most of the risks of utter failure have been overcome. They want relatively sure bets. They expect to profit from the last boost in valuations associated with an IPO or sale. And they are willing – or rather, they were willing – to pay big bucks, thus pushing valuations even further into the stratosphere.

But that money machine has collapsed.

One of Morgan Stanley’s mutual funds, the Institutional Fund Trust Mid Cap Growth Portfolio, wrote down its stake in intelligence-community and law-enforcement darling Palantir Technologies by 32% to reflect the declines in January. That’s quite a plunge during a month when the Nasdaq dropped “only” 9.9%.

Since of October, Palantir had a “valuation” of $20 billion, according to WSJ’s Billion Dollar Startup Club. But that Morgan Stanley’s chop-down won’t impact the illusory “valuation” on that unicorn list, which only changes during a round of funding.

Palantir has raised $1.9 billion over the years. Morgan Stanley made its investment in 2012 and 2013. Since then, Palantir raised funds from PE firms, but unlike mutual funds, they don’t need to let their investors know about the bloodletting among their illiquid investments.

While it was at it, Morgan Stanley also axed 25% from the valuation of its stake in Dropbox, which had obtained a $10-billion valuation during the last round of funding in January 2014. And it slashed by 27% its valuation of Flipkart, an Indian e-commerce company, valued at $15 billion in April 2015.

Which shows to what extent the “valuations” listed in WSJ’s Billion Dollar Startup Club have become a joke.

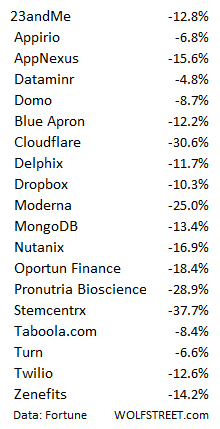

And now mutual fund giant Fidelity took an ax to the startups in three mutual funds – Fidelity Blue Chip Growth Fund, Fidelity Contrafund, and Fidelity Growth Company Fund – according to Fortune which analyzed the 39 startups in these three funds. The write-downs are for valuations as of January 31 compared to December 31:

That is not to say that Fidelity has lost a ton of money on every one of its startup investments. Not yet, at least. Fortune:

Some of these marked-down shares remain well above cost basis. In some cases, such as with Dropbox, Fidelity is in the money on some of its securities (Series A stock) and losing money on some (Series C stock).

Of the remaining 20 startups that are not on the write-down list, 19 had “stable valuations,” including Airbnb, The Honest Company, Jet, Pinterest, SpaceX, Snapchat, Uber, and WeWork. And one was a winner this time around, Blue Bottle Coffee, whose valuation increased by 13.3%. But according to Fortune, “it’s a bit of a dubious distinction since the new carrying value remains more than 53% lower than what Fidelity paid for its shares last May.”

Startup booms, despite heated protestations to the contrary during the boom, are inevitably followed by busts. The bigger the boom, the bigger the bust. The cycle impacts in dramatic ways the local economies focused on these booms, such as Silicon Valley and San Francisco.

During the boom, money washes ashore from all over the world tsunami-like and for years sloshes through the streets knee-deep, bringing in new people with huge compensation packages who spend their money. New restaurants pop up to cater to this moneyed crowd, and home prices and rents soar, and a million other things happen, including majestic construction booms which on their own push up economic activity.

But now that the boom has turned into a bust, the money is receding. And things are unwinding. Read… This Will Crush the Insane San Francisco & Silicon Valley Housing Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is just the opening salvo.

Just wait until Uber’s valuation drops to a reasonable level. Same for Airbnb. Anyone calling it a “stable valuation” is selling snake oil, still.

I would suspect that Fidelity write downs are probably superficial at best. With revisions from 7% to 38% you can be sure that the actually over valuation is more like 100%. I welcome a collapse in this nonsense.

These are monthly changes in valuation. If you get 10 them in a row, pretty soon it adds up to some real money.

Greed creates stupid!

It’s (as a term used often at Naked Capitalism) a self licking ice cream cone!

This is the natural result when the cost of capital is artificially suppressed.

When the powers that be manages to pump the Nasdaq just like today, maybe the valuations will come back up?

That would be the plan. Get the crowbar, and pry open that IPO window again, otherwise, Austin, we’ve got another Texas sized problem.

But basically Central Banks haven’t lost control yet as opposed to the narrative that has been making the rounds.

Yea, the Chinese are trying this, too. Not working there, either.

Possibly rhetorical question: I assuming once an .com stock falls thru some threshold relative to its IPO price (>66%?) it hardly ever comes back, and once it falls below some tipping point (90%?) it never comes back – has anybody seen a chart analyzing this?

Good question – and real problem.

The issue is this: if these post-IPO startups continue to lose money and need to raise money even after the IPO (via follow-on offering of shares, convertible debt, etc.), they MUST have a high stock price. Tesla has been doing this very well. It manages to keep its stock price high despite mega-losses, and every year it goes out and raises more money by selling its overpriced shares and convertible debt.

Once the stock price collapses, the game is over for money-losing startups. And investors see that, and they stay away, and the stock drops further. Then clients and customers see that, and they stay away….

Just like the ghost cities the Chinese built….. these apps and other businesses are nothing but an apparition, created from the slosh of massive waves of easy credit.

The tide is going out, and a whole generation will realize they have no britches on.

My most wealthy friend owns a company devoted to the humanitarian task of developing stupid phone apps that nobody uses and nobody cares about, such as one where you press a button and a funny noise is played, or where you keep track of how much you run everyday, for people to (not) see it.

But, to be fair, his profits are going really down since last year.

No disparagement to “Jawbone”, get a load of this jawbone, …”Wall St. gains as weak data spurs stimulus hopes”… to a revised tap on the shoulder …”Wall Street surges as data points to economic recovery’…

http://www.zerohedge.com/news/2016-03-01/todays-rally-explained-just-two-headlines

This is some funny shit, no? A recovery my ass.

This insanity is the logical and natural result of years of money printing and interest rate suppression.

One day people will ask themselves ‘What were these idiotic central bankers thinking?’

I don’t think they are idiotic. I think they know exactly what they’re doing, they know they are destroying the economy and they will keep doing so. Cui bono?

The already rich benefit, of course.

The trouble is that academics with no real work experience are running the Fed, and maybe a few other central banks as well.

I was an academic for a decade. One of the things I learned in my years in academia is that only about 1 in 100 academics has any common sense at all. Most academics are over-educated fools who couldn’t succeed in the private sector if their lives depended upon it. I finally walked away from academia because I couldn’t stand the lunacy anymore. It was the smartest decision I ever made.

Well said VegasBob!

I’ve had the (dis)pleasure of working with many PhDs over the years and few have a lick of common sense. In my experience, many folks with no college degree or an associates or bachelors are much better at solving real-world problems.

Yes, academics, without proven successful real world experience, are worse than dangerous, anywhere in government administration, or politics.

its an extension of the old basic

“those who can do. Do. Those who cant. Teach.

University’s and research institutes/faqcilitys, are full to overflowing, with those, who can only Teach.

The “goodwill” line on the balance sheet has always struck me as a glaringly obvious invitation to either irrational optimism and/or deliberate misrepresentation. Its only use is to create collateral for borrowing. There is material for a joke in there about taking something to the bank, but I havent the heart to make it up.

I’ll try:

CNBC News Headline: “Goodwill Stores to open Investment Bank”.

Meh. Best I could do :/

Does this push GDP up any, last I recall was 1% growth…. “ABOVE expectation” by a small margin. Amazing how close the guestimates are considering the FED admits they don’t have insight (or hindsight is their gauge perhaps?).

The last I heard, we live on a finite planet.

So the idea that we can have infinite economic ‘growth’ is an absurdity.

Yet people with 180 IQ continue to believe in perpetual growth. That’s because it is no longer a matter of logic but of belief, exactly as religion. They just can’t stop believing in growth despite any rational arguments presented.

Point out how long we haven’t been stepping our feet on the moon for example, and see how much goalpost shifting nonsense you can get from both the intelligent and the dumb people.

I thought our far “stronger” economy and much better technology since 1969 is supposed to make the same thing easier, right? And aren’t we are still experiencing the same old socioeconomic problems back in 1969, so what’s the excuse?

Oh, safety reasons, yeah because that really stopped us back then too. Then it becomes “people aren’t no longer interested in the moon” because truly we are really are short of volunteers who will die just to get a chance to get there.

It’s both hilarious and depressing at the same time, really.

VegasBob

You’re assuming a stable currency

Hmm. My view is that if a currency is not stable then inflation will exist if there is an ongoing perception of growth.

And inflation, whether real or disguised, is not growth. Inflation is theft by fraud.

Haha, I saw Taboola aka “parasitic worse-than-worthless clickbait generator” on that list. If it dies it would actually be a NET positive for the economy, really. They stuff are so IQ dropping inducingly bad to the point I have even outright blocked URLs containing it’s name.

If we rightfully billed the Internet advertising industry for using all the unnecessary Internet bandwidth that WE paid for and all the security problems they caused to US, virtually all of them will go out of business in like a week and for good riddance.

Cheers for that!

Contrary to what is usually thought, the Fed and Treasury and top leaders know full well the bubbles they’ve blown with QE and ZIRP. One of the major (perhaps THE major) point of those programs was to get some froth into the economy to get some substantial inflation. That is what they are trying to do.

Unfortunately, they don’t understand basic economics. For every point of inflation, the mainstream economy falls back. People drop other purchases or services to cover the rise in food or housing costs for example.

So it’s stagflation writ large. And eventually the bubbles burn out because, really, event these nutso buyers eventually know when it’s time to quit.

Even here in Spain, some of my friends work at startups with no clients or income at all, supported by credit and funding! Clearly this can’t go on forever. Combine this with the adpocalypse and you have the perfect tech storm.

The startup bubble was evident to me when I saw this:

“Can Tech Startups Transform The Weak Palestinian Economy – And Ultimately Bring Peace?”

http://www.ibtimes.com/can-tech-startups-transform-weak-palestinian-economy-ultimately-bring-peace-1187645

I would add: “could they even cure cancer and announce the Second Coming of Jesuschrist?”

Jesuschrist.

It’s less of a startup bubble, and more of a “everything needs to be overhyped to hell and back” bubble. Just like the SJW types with their endless whining over black people/Syrian refugees/etc and labeling others as racists/bigots/whatever, this surely will have no chance of backfiring because people will never get sick of it right? *snicker*

You must have meant, ahem, Jesuschrist 2.0

Well at least ‘Dropbox’ is living up to its name…

The last time around right before the dot com boom busted I was sitting in a coffee shop in San Mateo overhearing some guy pitch this fancy new suture material as a start up idea. I knew that stuff has actually been around for awhile and not so new and fancy.

This time around, though, I sit in a coffee shop and the thing I overheard a few months ago that stands out is some guy pitching an investment in what sounds like a real estate deal except this guy is looking for investors to foot the whole deal and he thinks SSF is ready to be discovered.

In simple terms, the central bankers money tsunami(s) make “throwing stuff against the wall to see what sticks” an investment model. A less than complex algorithm, if you will. And you know when I say “stuff”, I mean something less benign. The same thing happened, as it always happens, in the oil boom. Prospects sell that you couldn’t give away in a more stable market. Wells which could never be funded in a less insane environment, get drilled. Money goes into the pockets of savvy promoter’s and operator’s pockets, but for investors, not so much. Startups, oil, housing, autos………pick your poison; money moves around these sectors, but little value is really created.

Seems like the “zombie apocalypse” has already started in Sillycon Valley. Damned predatory lenders strike again. Loan you money (probably at gun point) and zap! You’re a zombie.

San Francisco was well on its way to becoming the North American Rio (”

Pact in the sun/Slum and skyscraper meet/Billion dollar penthouse/And people on the street”), so maybe the collapse of the “no revenues ever” unicorn app bubble will at least short circuit that.

Sure the downfall will be fugly, but so was the rise, it just had better marketing.

I don’t understand any of these companies, or their valuations. Too old-fashioned, I guess.

But just to play with one example: Uber. Its valuation was north of $50 billion as of July of last year. Maybe it’s come off a bit since. But it’s really nothing more than an app to call a taxi cab.

According to Ibis, the US taxi industry pulls in $16 billion in revenues per year. http://www.ibisworld.com/industry/default.aspx?indid=1951

Now I know Uber is expanding worldwide, but if they were to take over the ENTIRE US taxi and limousine market–all of it–with the 15% transaction charge, you’re still only talking about revenues of $2.4 billion. They don’t have earnings–nothing but losses so far. But let’s pretend also that they become paragons of fiscal rectitude, and have pretax net margins of 40%–one of the highest of any company on earth. Now it’s profits of $1 billion, and a market cap of maybe $18 billion.

This, kids, is what “priced to perfection” means. But what do I know.