“A drawdown much like the one we saw in 2009 and 2010.”

Transportation is a gauge into how well the real economy is doing. And it just keeps getting worse.

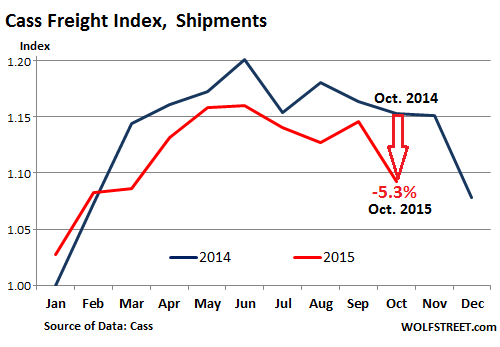

In October, the number of freight shipments in North America fell from September, in line with the patterns of the past few years, but it fell more sharply than before. And year-over-year, shipments dropped 5.3% to hit the worst level for October since 2011, according to the Cass Freight Index, after having already plunged in the prior month to the worst level for a September since 2010.

Cass put it this way:

This month’s decline was much sharper than in recent years and can be directly correlated to falling imports and exports as well as decreased domestic manufacturing levels. Burdened by bloated inventories, and under the shadow of a possible interest rate increase by the Federal Reserve, businesses cut back on new orders placed in the last three or four months. This is resulting in lower import volumes, less freight to move, and faltering industrial production. With the dollar still strengthening, export growth decelerated in the third quarter.

With the exception of January and February, the index has been lower year-over-year every month, which makes for a very crummy year:

The index is broad. It tracks shipment data from all kinds of companies, no matter what mode of shipping they choose, including truck and rail. But it does not cover bulk commodities, such as oil, wheat, coal, etc. It’s based on “$26 billion in freight transactions processed by Cass annually on behalf of its client base of hundreds of large shippers,” as Cass explains. These shippers form a “broad sample” in all kinds of sectors, including consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail.

Ah, retail…. Retailers are already blaming the debacle on the weather.

Macy’s was the latest retailer to confirm why transportation is having a hard time: revenues dropped 5% as earnings plunged 46% in the quarter ended October 31. While at it, it lowered guidance for the year, with sales at stores open at least one year declining 1.8% to 2.2%.

“Spending by domestic customers remained tepid, especially in key apparel and accessory categories,” said CEO Terry Lundgren. He also blamed tourists that weren’t digging deeply enough into their pockets. Its shares plunged 14% on Wednesday and are down 44.6% from their high in July. Party over.

Companies across the US have been dogged by these sorts of unpleasant revenue declines. And where revenues are from selling merchandise, rather than services, the story involves transportation.

Commenting on my article a month ago about the freight debacle in September, “Harvie” supplied some boots-on-the-ground color:

I own a fleet of 15 trucks that go on the road delivering all kinds of freight, and I can tell you it’s extremely slow. This should be our busiest season for the 4th quarter but it feels like it’s January. With the price of diesel being low and low amounts of freight moving, the rates for all truck loads have dropped significantly. Meanwhile our insurance payments increase every year.

I’ve spoken to numerous freight brokers also, and they say the same.

This comes at the totally wrong time. Trucking had been booming in 2014. Capacity was squeezed. Rates were rising. Trucking companies went on a buying binge. Then came 2015, and now trucking is suddenly slowing down.

But it’s not just in trucking. This is what Cass said about rail shipments – note the plunge in intermodal (containers):

The Association of American Railroads reports that October traffic was down 4.3% from 2014 levels. More importantly, though, is that carloads dropped 20.7% and intermodal fell 20.3% from the previous month.

Rail has been hit particularly hard by the rapid drop in industrial commodities caused by the steady decline in industrial production. Coal, petroleum, and ores were down, while grain was up. The reductions in energy production are being felt throughout the freight community as shipments of not only petroleum, but also pipe, water, sand, and other drilling materials have dropped off significantly.

Some commenters on my mid-October article added some granular details: “Also noticing CSX freight cars sitting idle again like was happening in 2009.” And “Tuba” observed: “I take an annual train trip to Reno, NV. One of the stops is Grand Junction Colorado. Normally this is a mostly abandoned very large train yard. This year I was surprised to see hundreds of idled Union Pacific locomotives as far as the eye could see.”

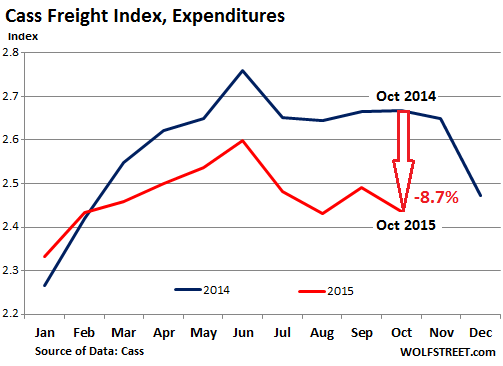

Declining shipments and “abundant capacity in the trucking sector” are pressuring spot rates all around, and so freight payments by shippers “plummeted,” as Cass said, 8.7% year-over-year and hit the lowest level for an October since 2011:

Cass finds that the lousy Q3 GDP growth “was indicative of the economic headwinds facing the economy.” Among them, the strong dollar, “the weakening world economy,” and this:

Inventory levels remain a looming problem as the Federal Reserve has been actively hinting that an interest rate hike is very possible in December. The combination of record inventory levels and an interest rate increase will cause a significant hike in inventory carrying costs. This will most likely drive a drawdown much like the one we saw in 2009 and 2010.

It’s unnerving how these references to the Great Recession keep cropping up at every twist and turn these days.

So who is going to pull the global economy out of its funk? No one knows. But it’s not going to be China. That’s what China’s trade fiasco is saying. Read… China Trade Swoons, Collapse of Containerized Freight Index Hits Worst Level Ever, Global Slowdown Worse than Forecast

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

With apologies to WSC: “never has so much hinged on so little”

How in the name of God have we reached a point where the fate of the developed world apparently hangs on a lousy .25 of one percent PER ANNUM?

What sound or even dubious business plan is a go or no- go depending on its financing going up by a quarter of a percent?

And as I commented here and in Canada’s Globe and Mail, even Ben Bernanke has broken protocol and publicly advised Janet Yellen against an increase, citing ‘outside threats’, presumably the vulnerability of the BRICS.

Given all this pressure, wouldn’t it be funny if Yellen channels Margaret Thatcher and raises by half a percent.

Well it would be funny for a while.

Benny (of The Courage to Print fame) Bernanke is playing his part, as requested. Rates WILL NOT GO UP, but he has to act like they will. Anyone notice what happened to the Fed hawks? This is Just part of the theater.

Zero rates (as I have commented here in the past) DESTROYS capital. This isn’t exactly insightful. It isn’t like no one figured this out before ZIRP. So, one has to conclude that the monetary masters don’t really care about capital, but instead have other goals. Adjust your decision calculus accordingly.

Fed rates won’t go up in December … or ever … until Mr Market takes rates up, at which point the Fed won’t be in control. But you can bet your sweet ass they will have Greenspan’s Bernanke’s Yellen channel Clint Eastwood’s Dirty Harry, pretend to draw down a loaded .44 Dollar Mag on the bad guy ZIRP and threaten thus: “Did s/he cut rates six times or only five? Well to tell you the truth in all this excitement I kinda lost track myself. But being this is a .44 Dollar Magnum, the most powerful currency rate hike in the world and would blow your FX head clean off, you’ve gotta ask yourself one question: Do I feel lucky?”

Feel lucky. They only know how to cut. Sadly, we all live in the real world, but they live in the movie and the theater is good.

Let’s talk about something else, it is both more productive and applicable.

Regards,

Cooter

Cooter is right. No one in the MSM would dare to mention that that very banks which own the Fed are getting money virtually interest-free with which to scarf up the world’s resources at rock-bottom prices (this was revealed in the Senate report, but all but unreported), so why would they ever stop? And as it offers the excuse for not paying savers anything while still getting to charge them double-digit rates on their credit cards, a virtual- well, no, literal, trifecta.

The very nature of money has been hidden (even from economists, hence 2008).

All banks create money out of nothing, private and Central Banks.

This appeared quietly on the BoE web-site last year.

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneyintro.pdf

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

The underlying problem is that the global monetary system has failed with too much debt in existence.

The current monetary system has the following characteristics:

1) It is debt based, new money can only be created from new debt

2) It uses compound interest

Compound interest is an exponential function that, without prudent lending, will run away to infinity at some point.

When money creation lies with banks, there is always the over-whelming desire to increase profits by lending out more than would be prudent (their profit comes from the interest received).

The temptation of jam today, makes borrowers forget about the penury tomorrow.

The system relies on prudent lending by bankers who are purveyors of the debt products, e.g. loans, mortgages, etc …

The temptation to increase profits though increasing interest payments and debt was too much and they developed ways to take no responsibility for repayment of loans through things like securitisation and complex financial instruments. In the sub-prime fiasco we saw NINA (no income, no asset) loans as no one cared if the money got paid back.

Individual players can post profits and collect bonuses by issuing bad debt but their actions together will bring down the debt based monetary system as the compound interest repayments overwhelm the system.

For the last seven years we have seen rock bottom interest rates, the last ditch attempt to keep the compound interest mounting up under control.

For all intents and purposes the global monetary system has failed already, the FED rate rise will show us once and for all if we really have maxed. out on debt and cannot take even a 0.25% rate increase.

The underlying problem is that the global monetary system has failed with too much debt in existence.

The current monetary system has the following characteristics:

1) It is debt based, new money can only be created from new debt

2) It uses compound interest

Compound interest is an exponential function that, without prudent lending, will run away to infinity at some point.

When money creation lies with banks, there is always the over-whelming desire to increase profits by lending out more than would be prudent (their profit comes from the interest received).

The temptation of jam today, makes borrowers forget about the penury tomorrow.

The system relies on prudent lending by bankers who are purveyors of the debt products, e.g. loans, mortgages, etc …

The temptation to increase profits though increasing interest payments and debt was too much and they developed ways to take no responsibility for repayment of loans through things like securitisation and complex financial instruments. In the sub-prime fiasco we saw NINA (no income, no asset) loans as no one cared if the money got paid back.

Individual players can post profits and collect bonuses by issuing bad debt but their actions together will bring down the debt based monetary system as the compound interest repayments overwhelm the system.

For the last seven years we have seen rock bottom interest rates, the last ditch attempt to keep the compound interest mounting up under control.

For all intents and purposes the global monetary system has failed already, the FED rate rise will show us once and for all if we really have maxed. out on debt and cannot take even a 0.25% rate increase.

Maybe this isn’t the place, but I can’t help but feel this …

https://www.youtube.com/watch?v=KMHgp81iKLw

Maybe the day draws near, or maybe it is a mirage. I am numb. But still I claw to the top of the job-skill-heap, hoping for a wage in the end when the heap is mostly liquidated. I don’t have a choice.

Regards,

Cooter

In a deflationary world of chronic over-supply we need to increase demand.

Most classical economists differentiated between earned and unearned wealth.

Adam Smith:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

Bankers and landlords are parasites that should be taxed for Government spending, earned wealth should be kept. Bankers create the money out of nothing in the first place, there is not going to be a lot of earned wealth there with 80% of it going into real estate, asset price inflation.

Income tax only started one hundred years ago on a permanent basis, before that the parasites were taxed.

In fact, all rentier activity is detrimental to the productive parts of the economy, siphoning off prospective purchasing power to those that like to sit on their behinds.

If we were still able to recognise the difference between earned and unearned wealth we might realise that encouraging rising prices of stuff that exists already is not very productive, e.g. housing booms.

Same houses, higher prices, higher mortgages and rents, less purchasing power.

As the rentier economy booms, rents and interest repayments on debt escalate and purchasing power goes down leading to the current debt, deflation.

We need to re-learn the distinction between earned wealth and unearned wealth.

The productive side of the economy and the unproductive, rentier side.

US and global freight indexes are down for some pretty straight-forward reasons. The masses are struggling to stay afloat, and they’re tightening up on discretionary spending. Businesses see this, and they’re cutting back on production.

ZIRP, QE and NIRP are wealth redistribution schemes that add to the 0.1%, and subtract from the 99%. I would place the starting points of this inequality at the NAFTA ‘free trade agreement’, and the November 1999 signing of The GLB-Act by Bill Clinton. These were both engineered by the two party status quo, the Fortune 500 cartel and the Banksters – all in lock step.

President Obama has followed up by appointing the man who rewrote The GLB-Act for Clinton after he vetoed the initial Bill in May of ’99, Neal Wolin, to be Deputy Secretary of the Treasury right after he took power in 2009. That’s right, our Democratic “Hope and Change” President rewarded the man wrote the law that let Wall Street go on a Ponzi-scheme binge and destroy our economy by making him Geithner’s right hand man! Now Obama has added the TPP and TTIP to continue the pendulum swinging to more wealth inequality.

I started to read all the articles from wolfstreet.com daily after finding no information on how slow the freight has been moving and why. Aside from the low levels of freight, the low price of diesel has dropped spot rates probably over 20%.

We’re currently based in NJ and figured with the mega ships bringing more freight to the East Coast we should have a better year in 2016 then 2015. But if no one is buying any merchandise, all this hype of the mega ships is sinking quick (no pun intended).

None of this is a suprise to those who have been lurking around this blog site since Mr Richter kindly spells it out in plain english and simple graphs. The 1% has raped the 99% by the tools of financialization. The backlash should be very interesting. Expect it to get worse.

No worries.

Winter is nearly here and it will all be blamed on the weather.

If there’s one thing central planners, world-improvers and government-trusters fear, ridicule and HATE it’s anecdotal evidence which contradicts their government data.

Macys borrowed to buyback their stock and pump up their earnings but neglected to stock their stores. The Macys closest to me is so small it shouldn’t even exist. They only carry the cheapest merchandise in every catergory. I went there a couple of times to spend money and came home practically empty handed. They need to consolidate at the very least.

I remember that when I was young every department store carried exclusive lines of merchandise. Every store was different. In order for retail to survive they will have to move back to that model.

Just back from France. Lots of small shoe stores, all with cute shoes. Every shop carried a different line of shoes and bags.

No big box stores.

There are lots of big box stores in France. France invented the word hyper-marché (hypermarket, and they’re gigantic). But tourists generally stick to the quaint shopping streets. I would too :-)

Indeed Wolf. And there’s a war afoot among them that’s decimating the field. In a few years there will probably be only four or five chains left at national level.

Food prices are usually very good (except curiously for fresh fruit: you’d be better off in a traditional greengrocer’s or market stall) and the quality above average, as all of them carry a large selection of local and organic products.

However in other respects Leclerc, U, Intermarché etc are the Walmart of Europe: they keep the factory doors in China open!

I’ve been a freight agent ( flatbed & specialize) for 21 years. I’ve never seen it this slow this time of year. For 8 months every day is a little worse than the day before. Rates are down 30 to 40 percent. When I tell a driver what a load pays the comment is something like “your kidding me right”?

There are just way too many trucks for the economy we have. The next 3 or 4 months will shake out a lot of marginal or debt laden carriers. We are not yet at 2008 volume but it seems headed there rapidly.

Today I did a truck and load search on Internet Truckstop within a 100 miles of Ft. Wort. There were 250 tucks and 150 loads. About 50 of those loads were duplicate postings. So really 100 loads. Normally there are about 3 times the loads as trucks.

I would hate to be a banker that financed trucks.

I appreciate your trucking articles. We have been feeling the pain nearly all year. Validation I guess.

Oddly enough I’m having a pretty good month. Sitting here in upstate New York out of my 70 hrs. But I see signs of the slow down everywhere, the truckstops are jammed even in the morning, our freight has taken a slightly perverse tack, I pulled an honest to goodness hazmat load out of St. Louis (first time I’ve been on Hall St. In years) to Virginia. Been spending a lot more time on the East Coast than usual, etc. None of this bodes well. I expect January and maybe February to be in the tank.

It is a fact that two-thirds of the estimated $17.4 trillion GDP of the United States is based on unbridled consumption. That is a whopping $11.6 trillion.

If it is true that the “year-over-year, shipments dropped 5.3% to hit the worst level for October since 2011” and “Spending by domestic customers remained tepid, especially in key apparel and accessory categories,” while 45 million Americans are surviving on food stamps and 95 million are out of the market, then the macro-economic game is almost over.

The FED has cried ‘wolf’ ( no pun intended) for 7 years and whether it raises rates or not in December is inconsequential. The dice has been cast. US consumption is swooning.

Is the FED, a federal agency? No.

https://biblicisminstitute.wordpress.com/2014/08/24/the-corrupt-federal-reserve-is-not-federal/