“The Chicago Business Barometer declined 5.7 points to 48.7 in September as Production growth collapsed and New Orders fell sharply.”

These are the propitious words with which the Chicago Business Barometer by MNI Indicators started out this morning. And it wasn’t the first of the regional manufacturing reports to have conniptions about the sudden deterioration in manufacturing.

The report goes on:

The drop in the Barometer to below 50 was its fifth time in contraction this year and comes amid downgrades to global economic growth and intense volatility in financial markets which have slowed activity in some industries.

Respondents blamed, as the report said, “China’s economic woes” (about 30%) and problems in Europe (20%). Of the five components, only Employment rose. Supplier Deliveries was unchanged. As for the rest, it was morose:

Production led the decline with a sharp double-digit drop that placed it at the lowest since July 2009. New Orders also fell significantly and both key activity measures are running well below their historical averages.

Order Backlogs remained in contraction for the eighth month in a row. The oil price plunge pushed the Prices Paid index to “the lowest since July 2009.”

So “the scale of the downturn in September following the recent global financial fallout is concerning.” The report fretted about the “disinflationary pressures” and output that was “down very sharply.” And it concluded: “We await the October data to better judge whether this was a knee jerk reaction and there is a bounceback, or whether it represents a more fundamental slowdown.”

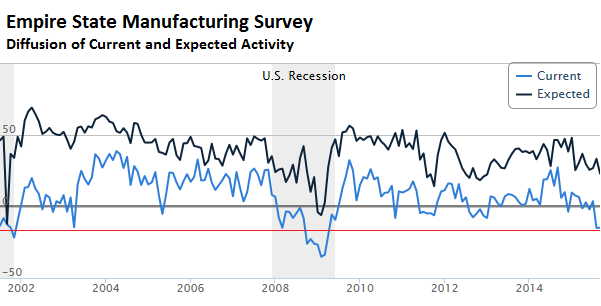

Two weeks ago, the Empire State Manufacturing Survey had already warned about September, after a nasty August, with its current conditions index for the second month in a row at the worst level since 2009.

Employment levels, hours worked, general business conditions, new orders, and shipments were all in contraction. And expectations of future activity deteriorated further.

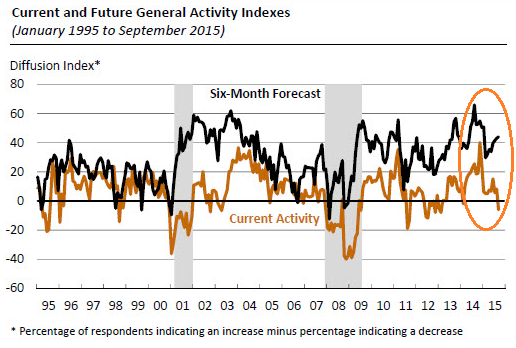

On September 17, it was the Philadelphia Fed Manufacturing Business Outlook Survey that rained on the parade, with manufacturing conditions that were, as the report said, “mixed.” While some indicators in the survey – new orders, shipment, and employment – remained in positive territory, its broadest measure, the diffusion index of current activity, plunged from 8.3 last month to -6.0 in September.

It was the first time since polar-vortex-February 2014 the index was negative. “Evidence suggests” that some of the responses regarding general activity “may have been negatively affected by the volatility in the stock market and international news reports.”

But hope reigns supreme: the six-month forecast (black line) rose despite the multi-month malaise in current activity (brown line):

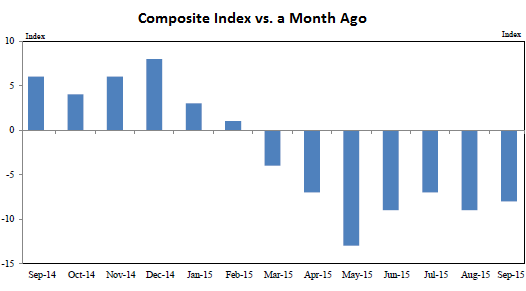

On September 24, the Kansas City Fed offered up its view on the debacle spreading across the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma, and Wyoming; and the northern half of New Mexico. On a month-to-month basis, the Manufacturing Survey’s composite index (average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes) looked like this:

On a year-over-year basis, the index fell from -9 to -13. The indexes for new orders, employment, and capital expenditures dropped further. The indexes for production and shipments improved a tad to less bad. But the future composite index and the indexes for the future production, shipments, and new orders all dropped to their worst levels since 2009.

“It feels like someone just flipped the switch to ‘off’ without any concrete reasoning,” one of the executives commented.

Exporters blamed the strong dollar: “The strength of the US dollar has hurt. Our business is down more than 50% from two years ago.” Importers (“cement from China”) praised the strong dollar. And there was this revelation: “We have seen increased weakness in international business.”

On September 28, the Dallas Fed dished up the Texas Manufacturing Outlook Survey. After a really bad summer, the production index refused to improve, “suggesting output held steady for a second month in a row after several months of declines.” Other indices rose from bad to less bad:

Perceptions of broader business conditions remained weak in September. The general business activity index, which has been negative all year, rose 6 points to -9.5. The company outlook index plunged to -10.3 in August but recovered somewhat this month, climbing to -5.2.

The labor market deteriorated further. Employment is for the fifth month in a row in contraction (12% of firms reported net hiring, 18% reported net layoffs). And the hours worked index plunged from flat to -11.1.

Comments variously blamed the oil bust, the strong dollar, and financial markets. Among the gems:

“We are doing layoffs for the first time in decades. The market is very ugly, and the U.S. dollar has made us very uncompetitive with foreign suppliers.” – Executive in Fabricated Metal Manufacturing.

This is the suddenly darkening picture of US manufacturing, sprinkled with eerie comparisons to nightmare-year 2009 and references to financial markets around the world. It’s no longer just oil. It’s the crash in China, the bear market in Germany, the drop in global stocks. “Volatility” in the stock markets is cropping up.

And there’s the Philadelphia Fed’s precious reference to “international news reports.” If these manufacturing executives would just stop checking their smartphones, for crying out loud!

Manufacturing accounts for 12% of US GDP and employs about 9% of the US workforce. So when manufacturing gets in trouble in the US, it isn’t necessarily the end of the world; because you can always make it up with fast food.

Junk bonds just suffered their worst sell-off since October 2011. It was linked to worries about the global economy and the commodities rout. And it’s turning into a vicious circle for stocks. Read… Next Shoe to Drop on Stocks? Junk-Bond Meltdown Hits M&A

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“So when manufacturing gets in trouble in the US, it isn’t necessarily the end of the world; because you can always make it up with fast food.”

Wolf you must be one hilarous guy in person. Thanks for continuing to document the train wreck.

I would not sniff at fast food. It is a conduit for storing perishable source of energy into a non-perishable chemical form of energy.

I never really enjoyed poetry, English classes, or the like, but when someone says somethings so pristine and so clever, it is a rare desert. I love your comment; “It is a conduit for storing perishable source of energy into a non-perishable chemical form of energy.”

Regards,

Cooter

Perhaps, dessert?

Increasing weakness??

Knee-jerk reaction?? ROFLMAO!

One of the manufacturing sectors that the U.S. has is farm and agriculture equipment, and they’re hurting big time as farmers aren’t spending this year. The combination of a strong dollar and weakening global demand has brought wheat, corn and soy prices to below cost of production. This will probably not change for quite a while.

A new top-line combine is a huge investment, and John Deere has plenty to sell, so they’re in no hurry to make more.

Up here in Minnesota, Arctic Cat and Polaris manufacture ATVs and snowmobiles, but that’s still just a tiny piece of the puzzle. Polaris is now in the motorcycle business as well.

On a related note, sort of, you can think of it as manufacturing consensus, MSNBC kept harping on the fact that Trump hasn’t spent a dime on tv ads. A major candidate not spending money is bound to hurt their numbers. Expect the advertising business to be impacted too.

i’m in manufacturing…..this is much much worse than 2009

please elaborate with details of what you know. (if you would)

“It feels like someone just flipped the switch to ‘off’ without any concrete reasoning,”

that’s my line right there,

The US Dollar took a nice nosedive versus all currencies (except the Ruble and a few others). There’s no reason why the Dollar should be so high. We printed plenty of money to cheapen it. The number of outstanding Euros isn’t equal to the number of dollars – but they’re getting there. Manufacturing down across the whole world. But not every single country. Vietnam, India, and a few others, are doing fine.

Wolf, I think the “off switch” is the decline of Fracking. Fracking was the life preserver in 2009. Anyway, I’ve noticed job postings have slowed.