“There is nothing inherently dangerous about a real estate cycle,” ratings agency Fitch explained in its latest report. “It only becomes dangerous when market participants forget there is one.”

Fitch rates Commercial Mortgage Backed Securities. So it warned: “CMBS cannot afford a repeat of the 2008-2009 experience.”

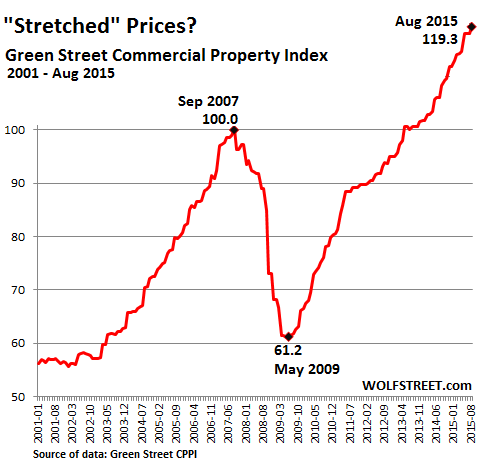

Commercial property prices in the US rose 1.1% in August from July, and 10.2% from a year ago, according to the Green Street Commercial Property Price Index (CPPI). They have soared 95% from May 2009 and are now 19.3% higher than they’d been in September 2007, the peak of the crazy commercial property bubble that collapsed spectacularly during the Financial Crisis.

“While commercial real estate values have continued to move higher, the pace of appreciation has slowed compared to earlier in the year,” Green Street Advisors explained to soothe our nerves. The report went on:

Cap rates appear to have leveled out over the past few months. And given the current state of capital markets it doesn’t look like they’ll move any lower. Real estate is looking increasingly expensive versus corporate bond yields, which have been on the move higher. Additionally, pricing in the market for publicly traded REIT stocks suggests investors there share the view that property values are stretched.

And this is what the Green Street Commercial Property Price Index looks like. I mean, it doesn’t look like a bubble or anything:

The chart shows how much smaller the prior bubble was than today’s monster. And it wasn’t a bubble either until after it had imploded, collapsing to 2004 levels and taking down CMBS bonds with it. Then the Fed reflated the whole thing to its current glorious state.

CMBS bonds made it possible then, before they blew up. And they’re making it possible now. But some folks have already gotten cold feet, including GE.

In April, GE became famous as a market timer: It’s a “strong seller’s market for financial assets,” it said and began to unload the bulk of the assets held by GE Capital, including $26.5 billion worth of financial assets tied to commercial properties.

And now Fitch Ratings is warning – softly, in order to avoid fraying the nerves of the industry that feeds it – about the commercial property cycle. Things have been awesome for the past seven years. But real estate goes in cycles. And cycles are cycles, not straight lines:

Weakening loan characteristics, declining underwriting quality, and concerns about originator, banker, and rating agency competition are not new items on investors’ minds. And there are reasons to believe that this time around will be different.

I added the emphasis because the phrase, “this time around will be different,” used without even a scintilla of cynicism, briefly took my breath away, after all the US economy has been through based on this time-honored hope. And the report goes on to explain what’s different this time:

For instance, pro forma income is greatly discounted or ignored altogether and perhaps most importantly, credit enhancement levels are substantially higher. But market participants can ill afford to forget how quickly performance can change.

There are always reasons why this time around, it will be different. But what is this “it” that will be different? Another crash of the commercial property market and an implosion of these CMBS bonds?

And unnerving comparisons to the crazy pre-Financial Crisis peak keep cropping up in the report:

In 2007, the average Fitch debt service coverage ratio (DSCR) across 40 fixed-rate conduit transactions rated by Fitch was 1.05x compared to 1.18x in 2015 year to date. But the difference is largely attributed to the current low interest rate environment. The average Fitch loan to value (LTV) in 2007 was 110.7% right on top of the 110.3% thus far in 2015.

A loan-to-value ratio of 110.3%, now that “values” have been so inflated? Chilling.

But given the two reasons why “it” will be different this time – pro-forma cash-flow increases are ignored, and credit enhancements are higher – Fitch concludes that “it’s unlikely that the next twelve months will bring the same level of misery that followed the September 2008 peak.”

Comforting words. Whatever happens over the next 12 months in commercial real estate, it is “unlikely” going to be an implosion.

But it is important to remember that economic cycles are, by definition, cyclical. The current upturn commercial real estate has been enjoying since 2009 will eventually come to pass and the CMBS market can ill afford to forget the tough lessons learned in previous cycles.

Fitch laments the “potential for short memories in the commercial real estate market,” and the fact that some CMBS originators “haven’t been around long enough to experience a full cycle much less multiple cycles.” Thus they might lack “the perspective and tools necessary to conduct thorough analysis and respond appropriately to unanticipated stress.”

This sort of “stress” is always “unanticipated.” A bubble, particularly a real estate bubble, doesn’t exist until after it implodes. No one – especially not the geniuses at the Fed – can possibly ever see it while it’s ballooning before their very eyes, as for example in the chart above. And when it implodes, they all feign surprise and assure us once again that no one could have possibly seen it coming.

But bond investors are getting nervous. Read… The US Bond Market is far Larger than the Stock Market: If Even Part of it Blows, it’ll Dig a Magnificent Crater

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Let’s see – another RTC (resolution trust corp)?

We learn history so as not to repeat it.

From Wiki:

The Resolution Trust Corporation (RTC) was a U.S. government-owned asset management company run by Lewis William Seidman and charged with liquidating assets, primarily real estate-related assets such as mortgage loans, that had been assets of savings and loan associations (S&Ls) declared insolvent by the Office of Thrift Supervision (OTS) as a consequence of the savings and loan crisis of the 1980s. It also took over the insurance functions of the former Federal Home Loan Bank Board (FHLBB).

Between 1989 and mid-1995, the Resolution Trust Corporation closed or otherwise resolved 747 thrifts with total assets of $394 billion.[1] Its funding was provided by the Resolution Funding Corporation (REFCORP) which still exists to support the debt obligations it created for these functions.

Not all commercial real estate is created equal:

” (Bloomberg) — Obamacare and an aging U.S. population are spurring purchases of medical office buildings, with investors sending prices to a record on bets that Americans’ demand for health services will increase.”

On the other hand:

(BI)”All across America, once-vibrant shopping malls are boarded up and decaying.

Traffic-driving anchors like Sears and JCPenney are shutting down stores, and mall owners are having a hard time finding retailers large enough to replace them. With a fresh wave of closures on the horizon, the problem is set to accelerate, according to retail and real estate analysts.

About 15% of U.S. malls will fail or be converted into non-retail space within the next 10 years, according to Green Street Advisors, a real estate and REIT analytics firm. That’s an increase from less than two years ago, when the firm predicted 10% of malls would fail or be converted.”

The Fed is going to go negative for sure. If that’s the case, gold will probably go to the moon.

If you look at the building in south FL it seems to be booming. I can see it but I still don’t feel it. The number of jobs and wages are not correlating to the activity. There is a real disconnect between the building and the economy here.

All the big players know the moral hazard has been established. “Developers” and the banks are in this symbiotic relationship where each needs each other to get rich. So the money is being lent out after the Fed graciously cleansed so many balance sheets after the last fiasco. Everyone involved in the current “development” is counting on the same again. They all know this will implode at some point, but hey, can’t fault a guy for making a buck (or a million or ten million).

I think Trump would rather be making money developing property, but the system is so broken it can’t be done anymore. I see his candidacy as a visible fracture in the banking and regulatory system. A visible tipping point. If I assign good motives to him, I see him as trying to salvage whatever he can of the country that made him rich. Everybody else is trying to strip mine what’s left.

If that Apprentice rubbish hadn’t come along Trump might be in trouble. The whole casino bit is TU

Vespa, the RTC is the father of the sub-prime. They took loans more then 90 days non-performing and lumped them into mortgage backed securities. The ratings companies gave these securities AAA ratings. Someone took a loss on these securities.

Here in UK, commercial property investments are definitely bubbling. The smart money started getting out a few months ago: it takes anything between a few weeks and a few months to sell the really big stuff. Even at auction, there is normally a 6 week lead time.

Part of the problem is that valuation surveyors are valuing the jnvesment, not the property, which results in prices being equated to the cost of borrowing and what other buyers have paid for similiar invesments,mrather than the fundamental value of rge property itself. Another part is that inexperienced amateur buyers are competing with themselves and driving the prices up, to the chagrin of the experienced professionals.

Usually what happens is rhat the money supply is tightened whereupon prices fall but the banks having rebuilt their capital ratios are flush with cash so are giving sizeable loans. An interest rate rise of only half or one percent isn’t likely to make much difference. The only thing I can foresee to bring the market down is if rhe banks decide to enforce a stricter lending criteria such as loan to value covenant, thereby obliging investors to inject more equity ot default.

As it is, the market is riding high on sentiment, that property is safer than being in a volatile stock market. Running for cover only to find that the roof over your head is supported by hot air.

The funny thing is those same socialist progressive politicians and bankers will blow bubbles with their interest rate and money printing. Then they will call for rent control because of unaffordable housing.

That’s right, Marie. But fear not. They will just blame the greedy capitalist landlord when the intended poor folks are kicked out of the rent controlled buildings and the politically connected hacks move in, and complain that the building is not being maintained and the light in the foyer.?

Should say “light in the foyer is out.” I was interrupted by two guy’s mooching gas money. Wrong truck.?

The problem is all this money that has been printed Has gone to a few Making the rich get richer The money hasn’t trickled down excluding the vast majority. The chickens will come home to roost Eventually and it won’t be pretty