How many years would it take first-time homebuyers, earning a median household income, to save enough money for the standard 20% down payment on a median home? Are you sitting down?

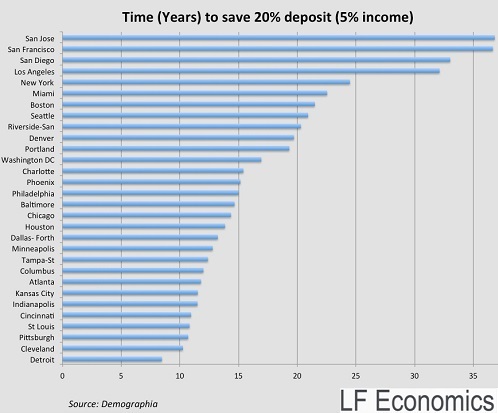

An impossibly long time in many cities, Lindsay David of LF Economics (and a contributor on WOLF STREET) found in his report on mortgage stress. He looked at 30 large US cities, using their local median incomes and median home prices. It assumed that young households could accomplish the tough feat of saving 5% of their income, year after year, through bouts of unemployment, illness, shopping sprees, family expansions, or extended vacations.

The results are stunning – if just a tad discouraging for first-time buyers.

In my beloved and crazy boom-and-bust town of San Francisco, where a median home (for example, a two-bedroom no-view apartment in a so-so neighborhood) costs $1 million, it would take – are you ready? – 37 effing years.

Given its higher median income, San Francisco is only in second place. The winner by a few months is another Bay Area city, San Jose. In San Diego, it would take 33 years. In Los Angeles, 32 years. First-time buyers might be retired before they scrape their theoretical down payment together. Theoretical, because in reality, too many things change, and they’re chasing after a moving target.

So lower your expectations and step down to buy a below-median home? Here is what TwistedPolitix found on the market in that price category:

Yes folks, step right up and get your 700 sq. ft. home in Redwood City, California, heart of the Silicon Valley, for just $649,000! The American Dream! 1 bedroom, 1 bath for just $3,154 per month on a mortgage with super low interest rates if you put down 20%.

If you pay the mortgage back according to the standard 30-year schedule, in April 2045 you will have paid $1,135,721 for a tiny little [bleep] shack. Brilliant!

And that 20% down payment would still amount to $130,000. How long would it take first-time buyers with a median household income to save up this much money? About a quarter century!

In New York City, fifth place, it would take just under 25 years, followed by Miami, Boston, and Seattle. In ninth place, Riverside-San Bernardino, CA, just over 20 years. In tenth place, Denver, just under 20 years. This puts five California cities on the list of the top 10 most impossible cities for first-time buyers to buy a home in.

Of the 30 cities in the chart from LF Economics, there’s only a handful where a household with a median income, and able to save 5%, can come up with a 20% down payment in about a decade.

It gets easier when people refuse to move out of their parents’ home. If they don’t pay one dime in rent or help with cable TV or whatever, they might be able to squirrel away 30% of their median income. To come up with a 20% down payment in San Francisco or San Jose, it would take them a little over 6 years.

But for the hardy folks trying to make it on their own, it’s impossible. They probably can’t even save enough for a 3% down payment, which in San Francisco would set them back by $30,000. Charge it on a credit card? Hardly. So perhaps they can bamboozle mom and dad into helping out.

Driving home prices into the stratosphere has been top priority for the Fed. It’s called the “healing of the housing market.” The higher the home prices, the more they’re “healed.” It was designed to bail out the banks, their stockholders and bondholders, such as Warren Buffett who is the largest investor in the nation’s largest mortgage lender, Well Fargo, and presides over a vast finance and insurance empire. It was part and parcel of the Fed’s successful plan to inflate all asset prices via waves of QE and interest rate repression, come hell or high water.

Inflating the prices of stocks and bonds is one thing. People don’t have to live in them. Not so with homes. People have to live somewhere. By inflating home prices, the Fed has inflated the costs of everyday life for all Americans. No big deal for the wealthy. But woe to those on a median income.

The effects are pernicious. In its report on housing, California Housing Partnership Corporation has this to say about California, “the largest and wealthiest state” of the US, where housing is particularly, to use the Fed’s term, healed:

We lead the nation in the number of people experiencing homelessness. We lead the nation in poverty rates. We lead the nation in overcrowded rental homes and severely rent-burdened households. We lead the nation in the largest shortage of affordable rental homes.

If housing costs are factored into poverty rates (which federal measures do not), then the percentage of people living below the poverty line jumps to 22% in California, up from 16.2% mentioned in federal reports. In that respect, according to the report, the worst is Los Angeles County with a poverty rate of 26.9%. Orange Country, one of California’s wealthiest counties, has the second highest housing-adjusted poverty rate, 24.3%.

These housing costs are confronting people with what the report calls impossible choices: “Rent or groceries? Rent or medication? Rent or a bus fare?”

People who pay a large part of their household income for rent or a mortgage, or who save assiduously for a huge down payment, don’t have much cash left to contribute to the overall economy. Most of their income simply gets confiscated by inflated home prices, or the resulting high rents and associated expenses. It’s channeled to landlords, PE firms, and REITs that own the homes; banks and investment funds that own the mortgages or the mortgage-backed securities; and a million other entities. Most of it becomes part of the grease that keeps Wall Street from squealing. But nothing happens with that money to move the real economy forward.

And renters that stretch to the maximum to pay rent won’t ever be able to save for a down payment to buy an overpriced home.

In this ingenious manner, the Fed has created today’s struggling consumer class that doesn’t have enough money to spend and then gets blamed for not borrowing enough to fire up the languishing consumer-dependent economy.

In Canada it’s even worse. Even “second-time buyers” can’t afford to buy a home without help from mom and dad. Read… Canada’s Magnificent Housing Bubble Goes Nuts, Cracks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Even if borrowers have their mortgage interest rates reduced to zero, paying off the principal is still an impossible feat as a human-working life time is not long enough.

The only people who don’t seem to understand this principle are fools and economists.

So much for the Keynesians and the Fed’s attempt to project real estate as an investment asset class.

Back when the last boom was building and all kinds of slick mortgage options were being pushed, I told some of my buying friends to forget the interest on the loan, the insurance, and taxes. Just divide the price of the home by 360 and see how you feel about that as a mortgage payment. I got a lot of blank stares like I had just explained string theory to my dog. It was all just going to magically work out. And don’t get me started on those buying property to flip. Most people just don’t want to get left out of a boom. Like the man said, if you look around the room and can’t pick out the sucker, it is most likely you.

Well, since I have you here, ask me about some great property investments I have for you on the Alabama Gulf Coast. It’s real estate. How could you lose?

California is living on borrowed time. When the ‘great collapse’ comes it will be the great migration in reverse. Oklahoma may not look so bad afterall. I don’t know the exact trigger; there are a few key ones out there right now: Drought, future major earthquake, and mickey mouse tech industry implosion.

Peak oil, climate change.

Wolf, you paint quite the bleak picture for those in their early and mid twenties. For many university graduates, you can add student debt load to the equation, and this makes it nearly impossible to own even a modest home in most of the U. S.

California has ridiculously high priced real estate as mentioned. “Location, location, location.” as the cliche goes. Want a little shack on the beach-front in La Jolla? Per square footage, it’ll go for 15 to 20 times the price of my modest home in south Minneapolis, and that’s been true for a while. And don’t forget that unless California gets water from rain and snow soon, there’s gonna be a crashing of home prices when the water is gone.

On a national basis, we’re not that far off on valuations though. A decent first-ring suburban home in the Twin Cities can be found for 150k to 200k, which is attainable. My home, which I’ve owned for twenty years, is valued at 2.6 times my purchase price.

Aggregate home value in the U. S. went from $14 trillion in January 2001 to $23 T in January 2006. It crashed down to just under $16 T at the end of 2008, and it is now near the level it hit nine years ago. Wolf, do you have any insight into where we should be for aggregate valuation?

Thanks, and good luck to those who’re trying to but their first home!

Wolf,

Another great article. Do you have any thoughts on how long this mania will last?

There are strategies available to young people in this country for not only acquiring a house, but land and their own fiefdom, so to speak.

They begin by “getting out of town”

This isn’t going to end well. A market collapse is the least important aspect. The pot is boiling and when it blows it will destabilize everything. What’s left of the middle class is as insulated as the elites. Take a look at countries where young people lack opportunity and you will get a glimpse of what is coming.

I posted this previously; the coming generations will not live in houses do to the facts in this article by Wolf.

Here in “Comifornia” the building of “social” (mass) apartment housings has begun. Millenials will “enjoy” their block apartment housings surrounded by gyms, restaurants and “hipp” retail outlets like Apple, Juicy, game keeper etc.

Social media, social housing, social lifestyle = socialism!

RECOVERY!

Sounds like the life in a city in Germany, France or Spain. One could do far worse.

The RE Agents and Moorgate lenders keep trying to convince people to ” buy now before it’s too late “. ” These prices are rock bottom ! ” or ” you’ll be able to retire off the home ! ” I’ve heard that so many times here in Canada. It’s all s scam ! It’s an illusion to separate you from your money. Fraud plain and simple and the Gov’t should be ashamed of themselves for allowing this to happen. Bad decisions by our leaders will cost us our children’s and there children’s future. We are looking at a few lost generations if this keeps up.

What are thoughts about changing amortization tables so that homeowners have more principle up front. It would be interesting to see what new thinking there

is on this subject.

It doesn’t matter what you put down. Income is the important factor. If you lose your income and savings you will lose your house no matter how much equity you have. I lost a house I purchased with a 40% down payment. I lived in that house for ten years. When the economy tanked we lost our income, then our savings, and the equity disappeared. Even if we had owned the house outright we would have lost it. That’s the real America.

Petunia. Sorry you had to experience that. Too often in our modern world, those who play by the rules are plowed under by the impractical actions of those who don’t. I remember realizing the paradigm was changing in the early 80s when I went to buy a new car. I had a high paying job for our area and my wife did as well. At the dealership, we stood out as a stable reasonably well-off couple who in years past would have been swarmed by eager salespeople ready to make a sale. Instead, we were ignored as the sales staff ran to those on the lot most likely to be talked up to the higher priced models and/or might need more financing at a probably higher interest rate. The world was tilting toward the put-them-in-a-car-they-can’t-afford-and-repo-it-in-a-couple-of-months paradigm. It was a sobering realization. The world that I had prepared for was slipping away. Responsible=Bad. Irresponsible=Good. And here we are.

In the Rosegarden area of San Jose a 1 bedroom 1000sf house is listed for $799,000! Insane.

Back when I was paying an appalling amount of money for my shoebox with a view in Sausalito I’d look down at the marina and think…why not. In fact, I knew some people who did live on boats, not the houseboats on Richardson Bay, but real boats. When you are paying $1000 per square foot for a nothing house a boat looks like luxury housing at a bargain price. True, you have depreciation instead of appreciation ( if housing can still appreciate in the Bay Area) but a used 42 Grand Banks motor yacht can be had for $300-400,000 and it has as much square footage as that Redwood City toy house and you don’t need furniture. You have gorgeous built in cabinetry and its a boat! It can take you out fishing or across the bay for a day sail. Even down to Mexico for your vacation! Don’t know what Marina fees are these days and Sausalito is going to be high but it would likely be about what your property tax would be on $700,000 home for a slip in San Rafael or Alameda.

Wow.

According to that chart, in Denver it would take 18 years to save for 20% down on a home. Ouch. Well, when prices climb 10% in one year, is it really a surprise?

We saved for four years and came up with 20%, and combined that money with generous gifts from our families (parents and grandparents.) When they offered to help us buy a house, I cried. I was so excited and started dreaming of a place to host Thanksgiving and create memories with our future children.

Then, out of nowhere, prices continued to climb very quickly (at an alarming rate, actually,) making our down payment look smaller and smaller until we couldn’t justify buying a shack for $250k that needed significant updating. I’m not talking cosmetic stuff…I mean the electrical was from 1960 and the sewer was totally shot. “Sold as-is!” Give me a break. These places are trashed yet prices in the area we liked went up literally $100,000 in a matter of 6 months. One day, decent homes in the area we liked were selling for $220k and just several weeks later, a comparable home sold for $370k!

And that’s why we’re not buying right now.

20% downpayment is 1 thing BUT what if one buys at peak and ends up upsidedown on a mortgage worth more than the house not to mention having lost the 20% down payment?

I bought my 1st townhouse in Northridge north of LA 3 years after I graduated in 1989 even with partially paid student loan. Guess not doable now…

renting is still cheaper in socal than buying……by a lot,

and i have ZERO hope of ever being able to buy a house.

Hell of a long way from 40 acres and a mule.

More like .25 Acre and no pets.

Canada has the highest consumer debt in the world. The Government of Canada has a balanced budget but Canadian consumer debt is 1.8 Trillion. There is more land in Canada then anywhere in the world. More water. More oil and gas, including natural resources. What happened?!

In the 1970’s, land was cheap. One could buy a home in Toronto for 25 thousand or a mansion for 50 thousand. When Prime Minister Trudeau got into power, he opened the doors, allowing all kinds of immigrants into Canada. This is not a bad thing. Immigration increases diversity and makes the joint less boring. Certain members of this ethnic group, not mentioning any names, gravitated to certain areas. When they came, they saw cheap land and they bought it, selling it back to members in their homeland for a bigger value. In the 1980’s, such a move exploded the value of homes in Canada.

At present, in Toronto everywhere you go in the city, you will find a construction site, building a condo. If you drive into the city on the expressway, you will notice a wall of condos going up. It is that obvious. It is not just one, or two, going up, it is more then the entire amount of condos in the state of New York. They are expected to remain empty and house no one. One ponders the fact government officials are getting rich off of this arrangement.

What’s being missed here is a discussion about the bigger picture. The Fed has an important but limited role in the economy, and limited tools to work with, rate manipulation being primary. There was no serious fiscal stimulus plan put out to dig us out of the latest economic melt down. All we did is bail out the banks and let The Fed do what The Fed had no choice but to do. Inflated housing prices are a symptom, not the goal. Simultaneously, thanks to NAFTA and other free trade agreements we’ve chased all our manufacturing jobs overseas to third world countries where corporations can pollute and abuse their labor force with no repercussion. Its cheaper to send raw materials across the globe to be used in foreigner’s manufacturing plants and shipped back to us than to just keep it here and thus keep jobs here.

“…squirrel away income…”?

You missed the point for many of us. What’s “income”?

Lots and lots of parent gift money here in DC. When a parent pulls from their own hard-earned retirement stash to fund a 20% down payment in DC for their kid, it’s a lot of money. When the market softens, I predict we may see a worse fallout than 2006. Now instead of one generation being exposed to risk from a bad investment we will have two – one on the cusp of retirement.

The implications of this on our economy are terrifying.

Thanks, Melissa, but you’re 12 hours late…

I was on the radio this morning talking about that article and its implications. But I didn’t think about the two-generation aspect you just brought up. I whish you had written this comment 12 hours ago! This is truly frightening if it plays out this way. I think the parents’ generation in Canada is even more tangled up in this.