But China’s renminbi keeps losing ground.

By Wolf Richter for WOLF STREET.

The US dollar, still the #1 reserve currency held by central banks, keeps losing share in bits and pieces ever so slowly against a mix of other reserve currencies as central banks diversify their holdings of dollar-denominated assets to assets denominated in other currencies. And they’re also adding to their holdings of gold.

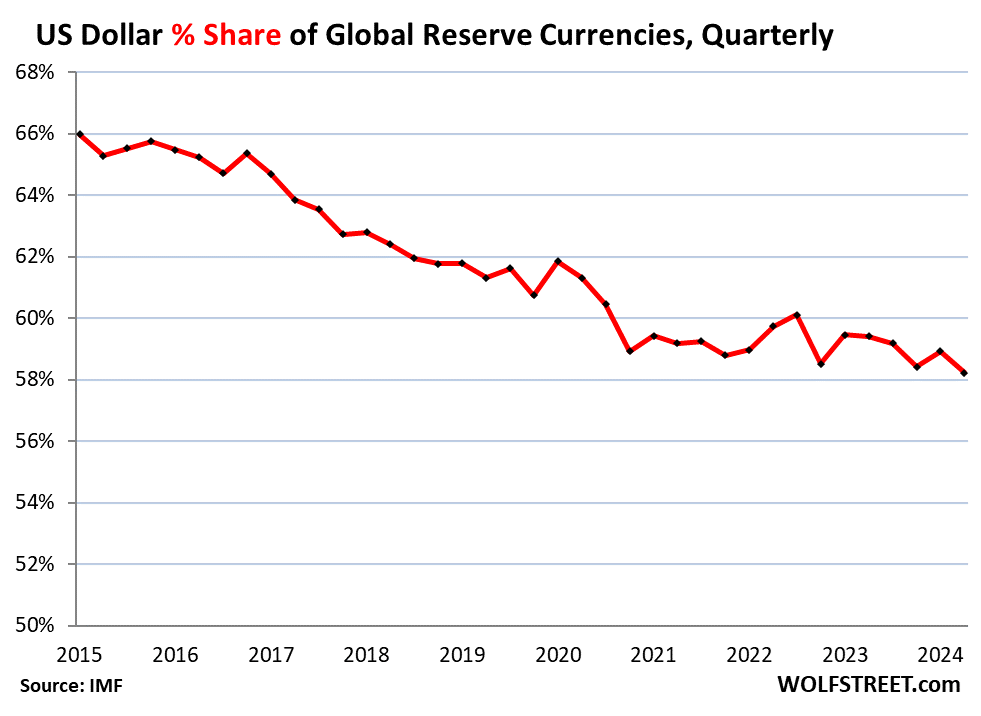

The share of USD-denominated foreign exchange reserves – assets that central banks other than the Fed hold that are denominated in USD – ticked down to 58.2% of total exchange reserves in Q2, the lowest share since 1995, according to the IMF’s new COFER data.

Over the past 10 years, the dollar’s share has dropped by about 8 percentage points, from 66% in 2015 to 58.2% in 2024 so far. If this pace continues, the dollar’s share will kiss 50% in 10 years.

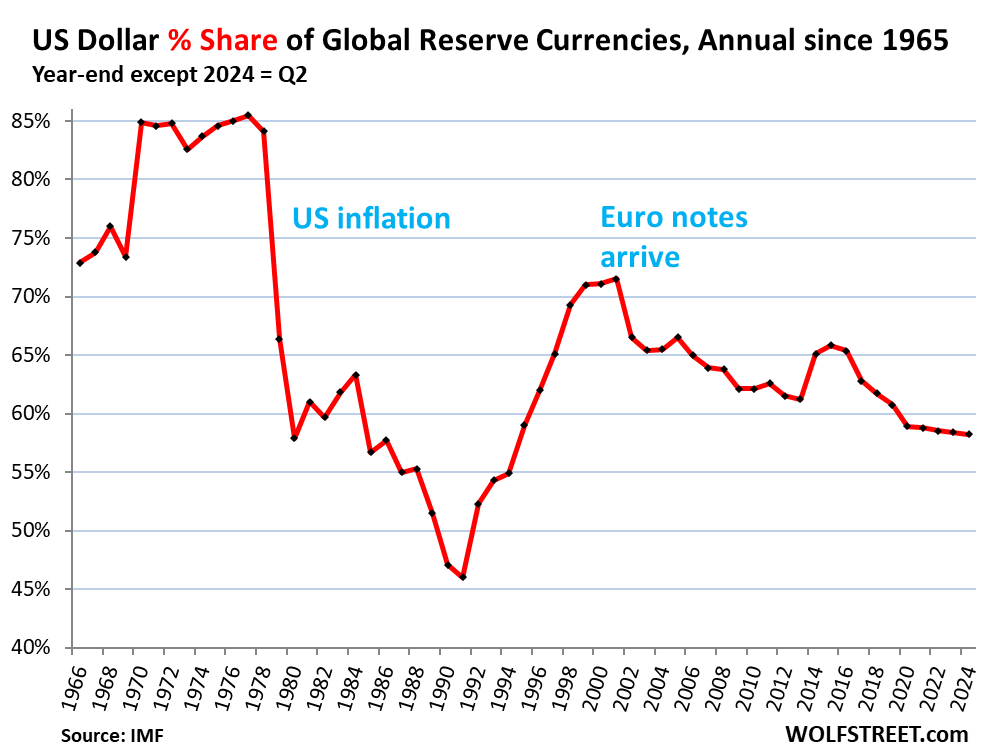

The long view back to the 1960s shows that the USD’s share of global reserve currencies was a lot lower in the 1970s and 1980s. The share collapsed from 85% in 1977 to 46% in 1991, as inflation had exploded in the US in the 1970s and into the 1980s, and the world lost confidence in the Fed’s willingness to get this inflation under control.

By the 1990s, with inflation on decline for a decade, confidence returned, and central banks loaded up on dollar-denominated assets again, until the euro came along, which combined the major European reserve currencies into one, making it a solid alternative to the dollar.

The chart shows the share of the USD at year end except in 2024, for which we use the Q2 figure.

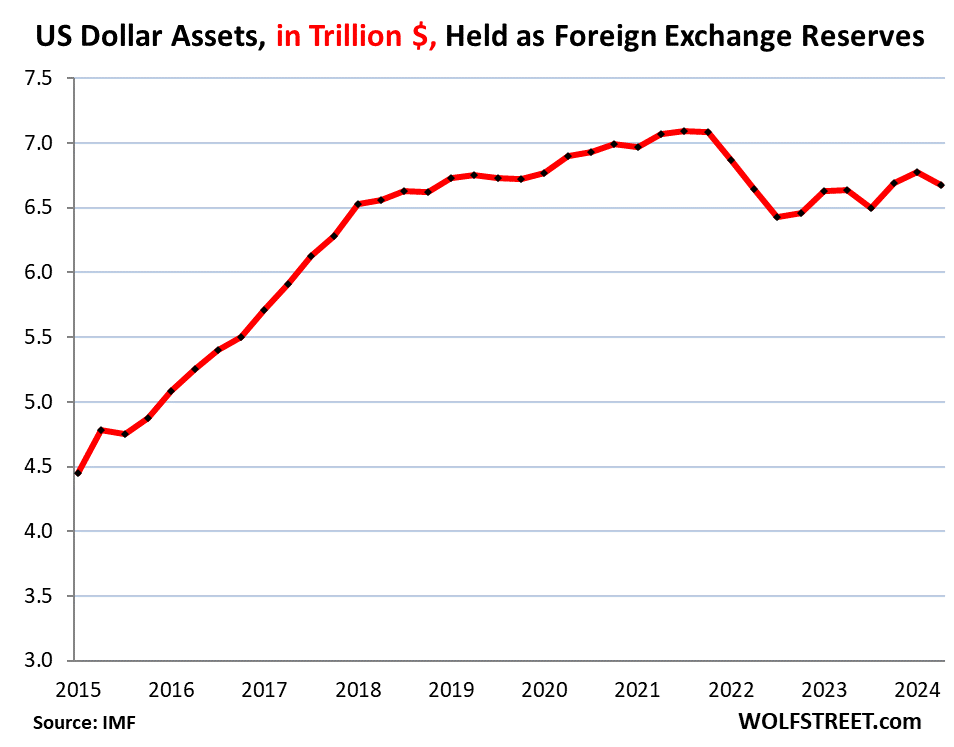

In dollar terms, central banks held foreign exchange reserves in all currencies of $12.35 trillion in Q2. Of this amount, holdings of USD-denominated assets dipped to $6.68 trillion.

These US-dollar denominated assets include US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks, held by central banks other than the Fed.

Excluded are assets denominated in a central bank’s local currency, such as the Fed’s holdings of Treasury securities, and the ECB’s holdings of euro-denominated assets.

Central banks have not been “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed much and are not far off the peak in 2021. But as overall foreign exchange reserves grow, they’re taking on assets denominated in many alternative currencies, and the dollar’s share of the total declines.

The other major reserve currencies.

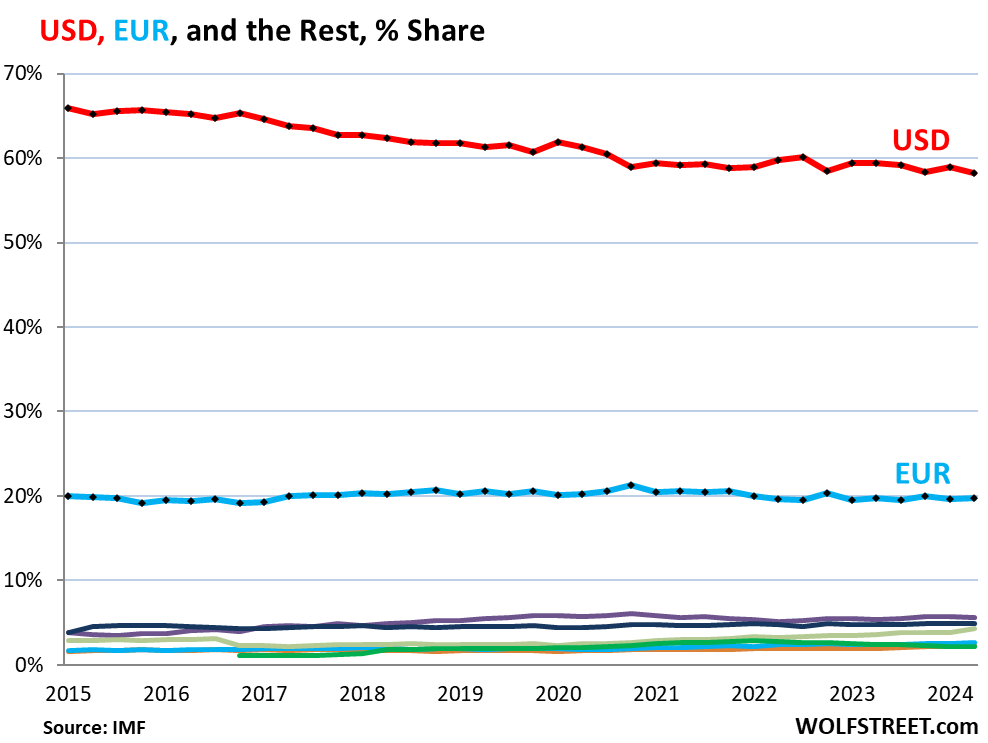

The euro is the perennial #2, with a share that has for years been stuck at around 20%. In Q2, the share was 19.8% (blue line in the chart below).

The major alternatives to the USD and the EUR, the “nontraditional reserve currencies,” as the IMF calls them, are the colorful tangle at the bottom of the chart.

The rise of the “nontraditional reserve currencies.”

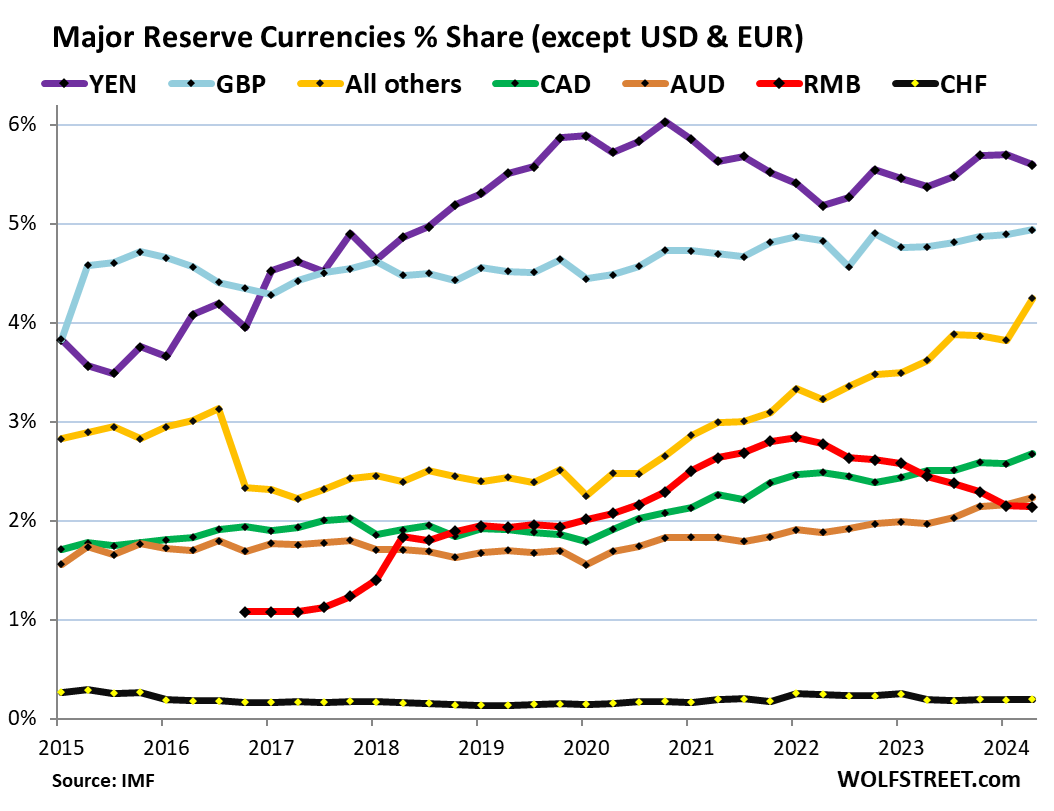

Here we hold a magnifying glass over the colorful tangle in the chart above. And what we see is that these other currencies, except for the Chinese RMB, have been gaining share since 2015, while the dollar has been losing share and the euro has been hanging on to its share.

So it’s not one currency that’s gaining against the dollar; it’s that a lot of “nontraditional reserve currencies” are gaining share.

“All others” (yellow in the chart below) are a large group of currencies, whose combined share has soared to 4.2% in Q2, from 2.5% at the end of 2019, the biggest gainer, composed of currencies that are not listed separately in the IMF’s data. The RMB used to be part of this group until 2016.

The diversifiers. The IMF said in a 2022 paper that there were 46 “active diversifiers”: central banks in advanced economies and emerging markets, including most of the G20 economies, that have at least 5% of their foreign exchange reserves in “nontraditional reserve currencies.”

The Chinese RMB (red) is the exception. When the IMF added the RMB to its basket of currencies backing the Special Drawing Rights (SDR) in 2016, the currency was seen as the coming threat to the dominance of the USD as global reserve currency. China is the second largest economy in the world, and it makes sense that it would have a major reserve currency.

But that has turned out to be not the case. The RMB is handicapped by capital controls and convertibility issues. Central banks appear to be leery of holding RMB-denominated assets. And it plays only a small and declining role as a reserve currency. Even the Australian dollar (brown) now has a larger share than the RMB.

Percentage share of major foreign exchange reserves in Q2 that the IMF’s data lists separately:

- Japanese yen, 5.6% (purple), third largest reserve currency behind USD and EUR, despite the plunge of the yen’s exchange rate against other major currencies.

- British pound, 4.9% (blue), fourth largest reserve currency.

- “All other currencies” combined, 4.2% (yellow).

- Canadian dollar, 2.7% (green).

- Australian dollar, 2.2% (brown).

- Chinese renminbi, 2.1% (red).

- Swiss franc, 0.2% (purple).

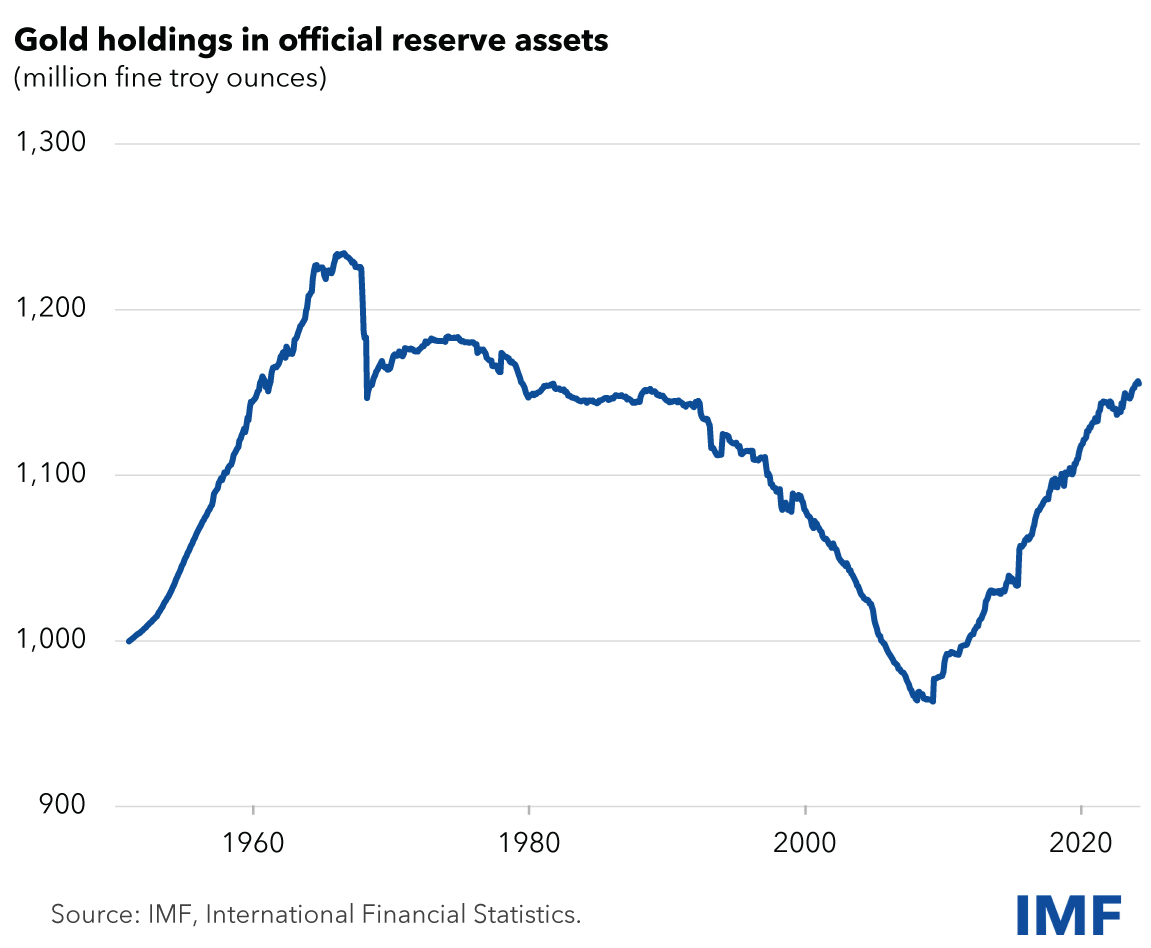

Gold has re-emerged as a favored central bank reserve asset.

Gold bullion is not a “foreign exchange reserve” – the data above. It’s a central bank “reserve asset.” So it doesn’t really fit into this discussion of foreign exchange reserves. But it can replace foreign exchange reserves, such as Treasury securities, on a central bank balance sheet. And it has been doing that.

Central banks spent 50 years unloading their gold holdings. But over the past decade, they’ve been rebuilding their gold holdings.

They’re currently holding 1.16 billion troy ounces, roughly back to where it had been in the 1970s, according to the IMF. At today’s price, that’s $3.1 trillion in gold, compared to $12.35 trillion in foreign exchange reserves (chart via the IMF):

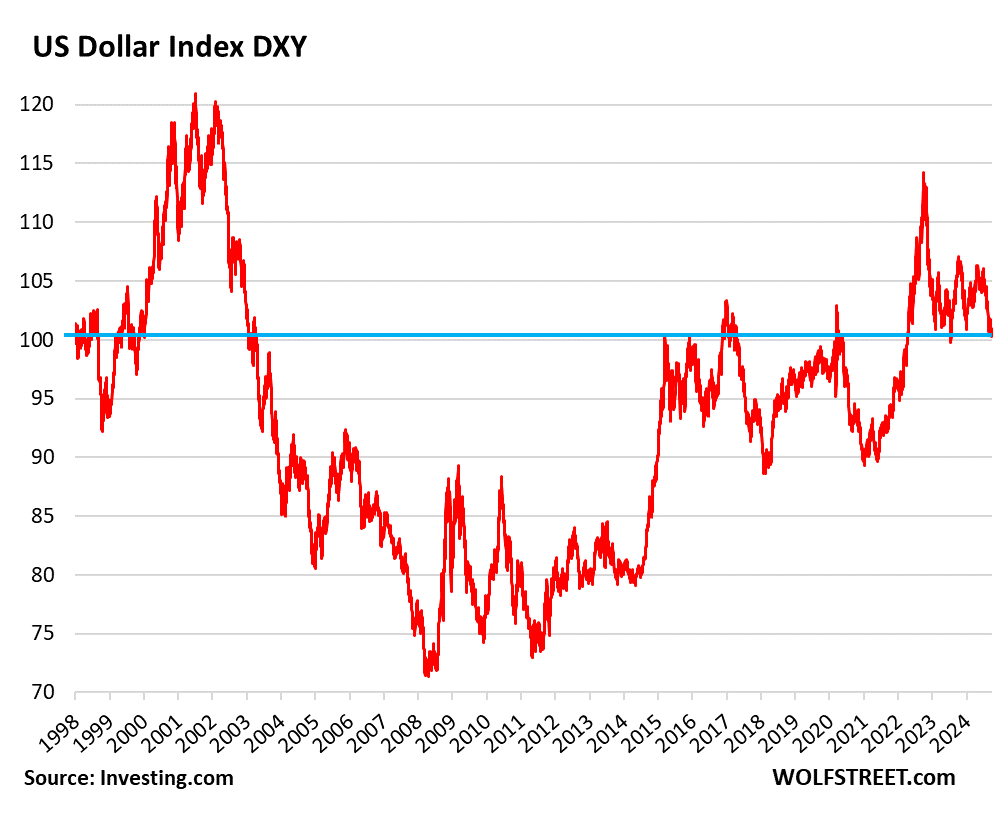

USD-exchange rates impact foreign exchange reserves.

Foreign exchange reserves are all reported in USD. Holdings in currencies other than USD are translated into USD at the exchange rate at the time. So the exchange rates between the USD and other reserve currencies change the magnitude of the non-USD assets – but not of the USD-assets.

Japan’s holdings of USD-denominated assets are expressed in USD, and they don’t change with the YEN-USD exchange rate. But Japan’s holdings of EUR-denominated assets are translated into USD at the EUR-USD exchange rate at the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-USD exchange rate, even if Japan’s holdings don’t change.

Despite major turmoil in exchange rates, over the long run, the Dollar Index [DXY] hasn’t moved much. The DXY tracks the USD exchange rates against a basket of six currencies (EUR, YEN, GBP, CAD, Swedish krona, and Swiss franc). And the DXY, currently at 100.4, is back where it had been in 1998:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well stated article from Wolf as usual!

Stated well indeed…

Speaking of the world reserve currency, “pieces of eight” was once that currency, the Spanish dollar, chop it up 8 times for coinage. Then it was the British pound.

Wow, thanks for the factual presentation of the currency markets as we currently understand, as laymen. I have a different interpretation than the popular view of the data.

First is the track of the yen, which after massive reproduction only gained a couple of percent of the constellation of shadow dollar currencies.

If thousands of years of history can be believed then the dollar at some point will lose reserve status. Not in my lifetime (10 years more hopefully) but in many people’s grandkids lifetime.

Been reading about potential for bitcoin to slowly become a countries investment similar to gold. Seems like El Salvador and now Bhutan have quite a stockpile at current bitcoin price. Pretty crazy if you ask me.

I’d say the “Treaty Of Westphalia Era” is over and sovereignty and sovereign debt don’t really mean what they used to.

Bad time to be a peasant…(but then it always is)……or maybe EVEN in top 5-10% money wise?…..all that youth wasted trying to learn a corporate (a primary social machine) niche to fit into. Most would be safer if they were a field grade military officer…..combat dues either faked or paid, (although even that doesn’t count much anymore).

As Señor Cartminez said when accused of cheating for the third time in basketball (one on one), “What does THE scoreboard say, Esse?

As usual I am too far out of the box…but all I have to call ‘Me” or “I” is language and the culture I’m in.

The hardships you describe as youth wasted is exactly the opportunity for the motivated teen.

Suit yourself..missed main point, anyway..but I was struggling to make it…and nicely.

But yeah, I lived it up BIG TIME as a kid….Jr year of HS when I started hanging out with the Indians to maybe 31…. and bit after 80s double recession blew over…lots VB, anyway…..no time spent getting richer…just made it on take-home from age 14, whatever it was……seldom searched for better jobs…just went with flow….DID search for DIFFERENT jobs.

sure I live in a dump now…so what?

We need another but nastier counterculture.

What’s your story, anyway….seems like there is some integrity there….not so much lately…..probably just me.

After decades of massive trade deficits there are so many dollars floating around it is just easy to use them for trade and as a backstop for managing countries currency’s

What is not reported is that U.S. banks share of trade in dollars is being threatened by other payment systems. That is countries with dollar reserves will buy say oil in dollars but not go through New York or London. Long term dollars will decline in value as their utility decreases as these alternate trading systems also facilitate direct trade.

Well, however it turns out, the saga of bitcoin will be cited.

A currency without an army to back up it’s claims have always failed in the past.

Living in the UK and dealing with the broken toilets and delayed or cancelled trains and chronic infrastructure failures (like Japan having 50% more road per capita) the fact that the pound is at 4.9% makes me feel like smacking my own head in disbelief.

That aside, the only way for countries with large dollar reserves to get out is to abandon the mercantile policies of effectively dumping goods into the US market, which is a western culture borrow and spend live it up etc. So the problem is only if its disorderly and too rapid. A gradual divestment of dollar reserves is great for the US .

Look on the plus side. If the UK should be bombed I doubt we would even notice as it’s such a run down hell hole already.

My coworkers who vacation there say it is actually pretty nice.

Yes, well the collapse of an empire is never pretty. Like the sinking of a ship a tragedy in one sense else a miracle.

Too bad archaeology/anthropology don’t get much money at all unless some entrepreneur envisions a “tourist attraction”.

Which can lead to BS in the name of profit.

The people speculating on the loss of global reserve currency status of the dollar tend to forget that there needs to be a viable alternative.

And there isn’t. Countries might not like having to deal with dollars (and euros if the idea of seizing, not just freezing, foreign assets to punish Russia ever gets executed) but what other currency or group of currencies can take the place?

That is also the reason for the rise of gold as asset but gold cannot replace foreign currencies, or a global reserve currency, when im/exporting.

They also forget that dollars & euros are essentially fungible as FX assets in the eurodollar system – European banks can get a dollar loan from the Fed (via the ECB) anytime they want via the Fed’s FX swap lines.

Compare the % of dollars+euros vs other currencies over time. King eurodollar isn’t being replaced anytime soon.

A global reserve currency is only good as long as the currency can be traded for raw materials, food and industrial products. Holding US dollars, Japanese Yen or Euros do not make taht much difference, less the fluctuations in exchange rates.

The health of the reserve the currencies may better be considered against how much nations amass in strategic reserves of oil, wheat and other commodities.

To me it look like more countries are stocking upp with reserves of commodities.

Sam’s – …perhaps add: “…as the proprietor of the currency provides a police force that can ensure a bare minimum of geopolitical stability…”.

may we all find a better day.

That’s parta/sorta what I was struggling to say above DO, thanks.

Think I have heard a phrase that refers to jerking off, only the organ involved is the brain…..the sport of old men? My sport?

NBay – …would say that applies to most of us, at any age (…and to those who don’t, i’d use a phrase credited, I believe, to Tom Waits: “…I’d rather have a free bottle in front of me than a prefrontal lobotomy…”). Best.

may we all find a better day.

re “gold cannot replace foreign currencies, or a global reserve currency, when im/exporting.”

Sure it can. There are already several gold-backed currencies out there. They trade on the stock market. They have tickers like PHYS, GLD, IAU. They are all trusted by market participants to accurately track the price of gold, less a modest annual fee.

Shares in any of these could, in principle, be transferred from one party to another as part of a business transaction. it would be an electronic transaction not substantively different from any other payment. The lack of such a mechanism is a political, not a technical issue.

There are many tens of billions of dollars in these funds already, and they could easily be scaled up.

A gold backed currency is not the same as actually USING that gold to trade.

For trade between countries you want either currency of the country you are trading with (if you are importing) or a form of global reserve currency (and gold does not have that status anymore).

Further what you describe ARE NOT gold backed currencies. They are speculative funds betting on that the price of gold rises faster then [insert target here].

Wolf-

You stated: “At today’s price, that’s $3.1 trillion in gold, compared to $12.35 trillion in foreign exchange reserves…”

So gold, at today’s price equals about 25% of the current dollar value of foreign exchange reserves. Is there a chart that shows this ratio over decades, and is this important?

Also, where do SDR’s fit into this discussion, if at all?

Thanks.

By endless rounds of exorbitant money printing in last 15 years, FED eroded trust in U.S dollar. Other CBs (ECB most) followed the suit. That eroded confidence in all developed world currencies. With the slightest panic in the market, FED and others are ready to flood the markets with money in the blink of an eye, destroying their credibility, as they did many times. And autocratic states currencies are not trustable for obvious reasons.

This led to an increase in gold as a reserve, since 2009. I think the trend will continue like this. Crytocurrencies can also start being used as reserves. I used to think that cryptocurrencies are all ponzi schemes. Now I think differently. I believe that they are less ponzi then CB currencies. In last 5 years, I realized that CBs can recklessly print trillions of curency in a few weeks and easily get away with it. But that is not possible for a cryptocurrency due to technical limitations (generation of a cryptocurrency takes a certain amount of computer processing time minimum).

Yeah yeah yeah, we’ve heard all this before… for decades. The only erosion of dollar confidence is in nations considering or actually invading other countries.

AND, for heaven’s sake, the Fed does NOT print money. The US Treasury is the only body permitted that privilege. The Fed, which is operated by the nation’s commerical banks at the behest of the federal government, influences liquidity. M2 expands (or contracts) primarily through commercial lending. And since the velocity of money is stubborn, the only way you can increase GDP is through increasing the money supply. It’s primarily the decisions of the private sector to seek more or less credit that increases the money supply.

This idea that people globally are losing confidence in the USD is a figment of the imagination of those who bave been cheering against the US$ for decades. So when exactly is the sky gonna fall this time?

“So when exactly is the sky gonna fall this time?”

According to the graph of gold holdings of central banks, sky had fallen about a decade ago. Since then, central banks increase USD value of their gold holdings from 1T to 3T USD. These are the same organizations that issue fiat monies – now they apparently don’t fully trust their own notes (unlike 4 previous decades).

No one has mentioned the BRICK’S alliance.It would be very foolish not to consider this into the equations, especially when considering the huge gold purchase by China last month.

One should also take into account the fact that there hasn’t been a transparent audit of American gold reserves since 1957.

A friend of mine was in Dubai recently and the taxi driver refused American currency. Things are more serious than you realize.

1. “No one has mentioned the BRICK’S alliance.”

You’re not paying attention. The biggest economy and currency by far in the BRICS is the C, China, and its currency is called renminbi (RMB), and it’s prominently mentioned in the article, and it has been losing share for years, and it’s down to a share of just 2.1%. And that’s the biggest currency of the BRICS.

2. “A friend of mine was in Dubai recently and the taxi driver refused American currency.”

If that’s even true… because this smells fishy to begin with. Every taxi in Dubai has a terminal for electronic payment via credit card, where the amount is charged in the local currency which is the dirham of the United Arab Emirates, and then your bank converts it into USD. Cash (dirham) is still used, but make sure you have small dirham bills because drivers often don’t have change, and then you’re going to leave a huge tip that you didn’t mean to leave…

So your friend was trying to pay a taxi driver in dollar cash where drivers don’t even have change for larger dirham bills, LOL? Your genius friend doesn’t have a credit card? He could have also gotten dirham at the airport and at every ATM. Duh.

A taxi driver in Europe may not accept dollars either. They have local currencies. In Dubai the local currency is the dirham, it’s the legal tender in Dubai. It’s up to the drivers to accept foreign currencies if they want, and unless they can make a lot of extra money (at your expense), they don’t want to accept foreign currency. Why should they?

For you to use this — your friend trying to pay a taxi driver in Dubai with USD cash – as a likely fake example of “Things are more serious than you realize” reveals your own ignorance or your intent to spread manipulative bullshit, and probably both.

My neighbor’s cousin’s hairdresser was just in Las Vegas and the cab driver refused to accept his payment in British pound notes! Can you believe that? What on earth is the world coming to?

If the driver had to use a cuerency exchange to change a small amount of USD to local money, the fees would eat up most of it.Traveling around Asia I like to carry a good amount of the local currency for these small transactions.The recipients appreciate it.

You may heard this decades, but it is happening now. The trend may reverse and dollar may increase its share as a reserve. Even if it doesn’t it is still more than half of the global reserves. Even if the current trend continues, it will still be the dominant currency for long decades. Everybody knows that. But the trend is decline, even though it is slow.

“AND, for heaven’s sake, the Fed does NOT print money. The US Treasury is the only body permitted that privilege. ” Ok, that is genius.

We all know that. Treasury prints the paper money. That’s a word trick. What we mean is that FED expands the money supply through its balance sheet (through thin air)

“when exactly is the sky gonna fall this time?” Nobody said that. Perhaps never. This is only a trend. No historical change happens overnight.

“the only way you can increase GDP is through increasing the money supply” – excellent idea – deserves a nobel prize in economy. No need to work on to improve productivity, technology, education and governance. Just increase the money supply and magic: the GDP increases. Why is not everybody doing this instead of struggling with other things to increase GDP?

LoL. Stil dreaming

And if one believes the Fed’s obese balance sheet is benign, which of course it isn’t. They would hold your POV.

Well the excess reserves with Fed earning the FFR while fully fungible as cash equivalent. Corruption being sold as the way it is, the mysterious bid under the asset market.

I wouldn’t bet on any scenario over the next 40 days until the next president will be selected.

Then we will see who they represent.

Sky is going to Fall by the end of 2025

At least gold is a metal that has been valued in history. Cryptocurrencies are nothing. There are many thousands of them, anyone can make their own, it’s easier to make cryptos than making T-shirts. They’re not even currencies. They’re tokens to speculate with. Those people that complain about fiat currencies and money printing and then fall for this stuff that anyone can make as an alternative are just funny 🤣

Touting crypto, one would have to ignore very recent history, where something like $3 trillion in paper prices utterly collapsed, on the back of rug-pulls, crumbling mismanaged offshore exchanges, etc. The “assets” vaporized back into the vapor they always were. And they could never function as the barest payment system. All kinds of vulnerabilities of Web3 are not close to resolution, versus currency systems with global reach and hundreds of years of evolution and functionality behind them. Lots of money is flowing into DC from these promoters again, though, so watch out.

Yeah, for the crypto bros they need to name one exchange that hasn’t been a rug pull that got shut down or fined by the SEC for screwing their customers. I can’t think of one. Now they may retort that you should have self custody but without a reliable exchange how do you buy and sell? Or did the fact that buying and selling just got offloaded to black rock, fidelity and others make that go away?

And no one has been able to explain why a halvening should be bullish. If I’m a miner I’m supposed to work twice as hard now for the same reward? Sounds just like the USD, but on a much quicker timeline if you ask me.

The contradictions are everywhere but the gamers aren’t capable of critical thought. When bitcoin came out i thought it was a brilliant concept with some obvious flaws (like a very slow transaction rate) but its gotten so perverted that its a shadow of its original self.

I heard that there’s a growing market for beany babies that have been sewn into beany baby airplanes. There are plenty available but 18 of them were airplanes that were upside down. The upside down ones are worth tens of thousands of dollars now.

It’s very confusing because you can turn any one of the right-sided beany babies into one that is upside down. Who’s gonna judge which are the authentic ones from the fakes?

What the heck does “mining Crypto mean” I’ve heard this used many times and don’t know what people are talking about.

Digging up the earth looking for coins?

Good question. Mining crypto means doing complex calculations on super computers that can take days. Computing one token takes quite a bit of computer time, hence energy. That’s why it is costly. And for the same reason, the amount of bitcoin cannot be doubled in a couple years, as fed does to dollar and ecb to euro.

Bitcoin was designed so that insanely difficult cryptographic math problems have to be solved, millions of times, before 1 Bitcoin is awarded to the server that did this math. The math is so hard, entire data centers have been built to calculate and do this job. But this “proof of work” is what it takes for new bitcoins to be added into circulation. There are only 12 million (iirc) of them to be awarded, so there is a land grab aspect to earning them.

The work to do the math is called “mining” but it’s just a metaphor because you dig, dig, dig and occasionally find a big gold nugget.

Make sense?

Paraphrasing the Seven Dwarves choir:

“It ain’t no trick,

To get rich quick,

If you dig, dig, dig,

With a shovel and a pick,

In a Mine (distant echo: “in a mine”),

In a Mine (“in a mine”),

Where a million diamonds shine….”

Substitute [12 million bitcoins] for “million diamonds,” and possibly this is the origin of the mining metaphor?

It’s called “mining” as part of the grift to trick you into believing that cryptos are an actual thing rather than an electronic gambling token.

Enter the casino if you wish, by all means, but at least be clear that you are doing so.

“Mining” represents wasted energy without any human related purpose. Apparently that creates “value”.

When energy is used by AI, at least there is a chance that the system can do lots of helpful things. And AI energy usage is getting more efficient over time, as the technology improves.

For BTC the energy is wasted for sake of the wastage. For BTC there is no way to improve the mining process to be more efficient. By definition the mining must waste energy, not create something of value.

I think it means computer searching the block chain for orphan bit coins.

None of these responses answer my question. Can someone speak English for a change.

Guess it is kind of like the greater fool theory. But do not be fooled if any government wanted to shut down crypto mainly referring to $BTC they could and maybe that will eventually happen. Gold Reserve Act of 1934 comes to mind. Kamala Harris is NOT crypto freindly…..

Perhaps you should look at the amount of currency of all countries together, and figure some of these numbers as a percent of that total. Gold’s percent of this total in 1972 verses it’s percentage today might be interesting. Perhaps we are going to see an ever higher gold price as central banks buy more of it. How much is to much paper.money in the world? How much does gold and other assets appreciate per unit increase in the International money supply?

I gave you the figures for the totals just above the gold chart:

“They’re currently holding 1.16 billion troy ounces, roughly back to where it had been in the 1970s, according to the IMF. At today’s price, that’s $3.1 trillion in gold, compared to $12.35 trillion in foreign exchange reserves (chart via the IMF):”

At today’s prices, couldn’t the Fed dump their gold (first one out wins!), hand the money to the Dept. of Treasury, and reduce the national debt?

Then buy it back once it goes back to $35? Clearly a win-win.

Dollar reserves held in mid 2018 were roughly 6.6 trillion…….today roughly 6.7 trillion…….

BUT……..the purchasing power of those dollars is down 25% and most GDP’s have grown significantly in that period.

So dollar dumping is occurring faster than the charts indicate. In fact it’s almost a flood of dumping. In real terms.

The gold holdings in ounces is back to the 70’s but the value of that gold has exploded.

It’s going faster than we like to believe.

The purchasing power of every other currency has depreciated as much or more than the dollar.

“In fact it’s almost a flood of dumping.”

Feel free to send me all those useless dollars you don’t need.

They know that the buyers have cash and the bids are increasing. LOL.

What do the sellers of stock on the NYSE know that we don’t know…..they know that if they sold a share in 2000 vs today they have lost their shirts……

The DXY since 2018 is only up a smidge……Try again,

That proves my point… all first-world currencies are losing purchasing power. Not just $$

“The gold holdings in ounces is back to the 70’s but the value of that gold has exploded.”

Consider that you *yourself* are still using dollars as a yardstick for how to measure value. You’re even pricing gold in dollars!

Gold is priced in every currency…..

You wrote “the value of that gold has exploded” meaning the gold is now worth a lot more dollars than before.

Sure you could put it another way, and say our dollars are worth a lot less bc you need more of them to buy the same oz of gold. But that’s not what you wrote.

We’re so used to using dollars to measure the value of things that it’s unconscious. I agree inflation is a problem, but no serious financial player is dumping dollars for gold.

You’re arguing that dollars aren’t real money, but you subconsciously price everything in dollars – even gold.

Btw I’m not hating on gold in general… I have a small amount myself (silver too). It sits in my safe in the other room. I’m glad I have it and wish I bought a little more when prices were lower.

ShortTLT,

as a safe repairman for 20 years I advise hiding rather than locking up. Its what I do. just sayin.

but as to your comment about wishing to have bought more gold when it was cheaper… why? You need a few more ounces for a good doorstop or something?

Do you think that 1300 was a good value but 2600 is just way too much? based on what?

This is the fundamental flaw in the reasoning of everything gold market (and I think its by design). If you only care about the price, and believe that the gold market is real, then there is NO reason to buy physical ever. Just buy and enjoy the convenience of ETFs and other paper/digital games.

(not picking on you, just pointing out a very common misconception about the reasons for someone to buy physical gold).

Bungee,

I view the gold as an insurance policy. I’d only be using it in the event of some major financial calamity that I can’t even concieve of.

I guess you’re right that it’s not wholy logical to want more at 1300 vs 2600 in that scenario.

Don’t worry about the safe tho – it’s bolted to the floor and booby-trapped.

“Booby-trapped”? Sounds like this could be a good sequel to the legend of King Midas:

Midas, turning everything, including his hamburger sandwiches, French fries and even his ketchup into gold, starves to death. His wife, Queen Midas,

wandering about in great distress, discovers his trove of gold down a secret passageway.

But, since it was booby-trapped…

Short…….Gold is priced in every currency…….it’s not gold is being priced……it’s dollars being priced in gold.

Gold is money…..dollars are a credit from the FED.

fred flintstone,

JP Morgan made ALL his profits and wealth on this “credit from the FED.” That’s what a bank does. He didn’t give a hoot about gold and disparaged it by calling it “money.”

“Money” is a term that means a lot of different things.

My Random House Websters Unabridged dictionary lists 20 meanings of “money,” but only one of the 20 definitions is related to gold, and only in terms of coins:

3. gold, silver, or other metal in pieces of convenient form stamped by public authority and issued as a medium of exchange and measure of value.”

Gold suffers in the necessary “money” component of being a medium of exchange. Try taking your gold to the gas station to fill the tank. Then try it during times of extreme economic stress and chaos, as many gold bugs like to envision it. One would have to balance the gold slivers, scale, chemical assay ingredients, gas pump, and AK-47 in one’s hands, while fending off the attacking zombies. Maybe here is some kind of fraud-proof digital medium that could represent a certain weight of gold, but I haven’t seen it yet. (The dollar used to be a paper version of it.) Maybe innovating that is your first billion in wealth!

Phleep – in that scenario it’d be like paying cash. The pump stops when you hit a certain amount of gas.

Oh, and everyone knows to take a co-pilot with them when refueling during the zombie apoclypse, duh.

pfleep, there’s a lot of “value” in that scenario. It’ll employ a lot of extra people (immigrants can be substituted if there’s a zombie labor shortage), Smith & Wesson’s and Rugers’ stocks would get a bump, demand of acids and other caustic chemicals would increase (Yara International), and undertakers would get a lift (no pun) with the increased number of dead who were foolish enough to try to get their cars refilled at gas stations during the ongoing chaos.

Whoever’s President within that period of time would get a lot of credit for goosing the economy – putting food on people’s tables and chickens in their pots.

A dollar is worth 10 dimes. Or…a dime is worth .1 dollars. A barrel of oil is worth 70 dollars….or 70 dollars is worth a barrel of oil. Any thing that is easily exchangeable can be evaluated in terms of the others.

Moving on from semantics about gold not being money…it’s ranked a ‘tier one asset’ by the central banks’ bank, the Bank of International Settlements. It ranks far, far above most of the paper issued by the 200 or so countries in the UN. Don’t even ask about the rouble or by its more appropriate spelling, the ruble.

One of the ‘tests’ sometimes put forth to prove that gold isn’t money: ‘But you can’t go to Mc D and get a burger with it….’

Nor can you with any of the huge denomination US or Canadian notes. They are no longer legal tender but they are still money. To exchange them for normal transactions you will have to present them at a bank and then wait a few days as it sends them to a central authority. But check collector value first.

If you’re at Fenway park with a $20 bill, good luck finding a vendor that will accept it. None of them will – that $20 bill is as good as toilet paper.

$20 bills are not real money either (inside Fenway Park).

I’ve never had to use paper currency as toilet paper, but, who knows?

I’m not certain, but I believe the U.S. owns the world’s largest Gold holdings at the NY Federal reserve.

Maybe. But it hasn’t sustained a deep audit. Nor is the Fed audited other than a superficial report they issue.

B

The Fed undergoes a FINANCIAL audit every year.

What you people are clamoring for is an OPERATIONAL audit, not a financial audit — you already have the financial audit, and you’re disparaging it. You people want to know who everyone is talking to, what they’re talking about, how they made various decisions, etc. Congress initiated a couple of operational audits after the financial crisis over the bailouts. So it has been done. They’re posted online, huge documents, and you can look at them, and I wrote about them here at the time.

Seems like in the end land and gold are the only lasting stores of wealth, the first for utility and the second for posterity. In 1000 years the human population of 500 million or maybe 14 billion or somewhere in between will still be living on and growing food on land and somewhere in vaults gold will still sit as the emergency foundation of all financial systems as it does now. Perhaps trade will be done in paper money called “Quid” or “Swifts” and the crypto boys will get all excited about Bitcoin CCLX (each generation limited to ~21 million, just start a new generation). But in the end all of that made up stuff blows away and people worry about eating and having a place to store their stuff.

At the “end”, most people just want the pain to stop.

This is why I like having my wholly-owned realty as a hedge against whatever stressors happen to values (AI revolution, etc.), because I’m not that smart, but humans will still have to live somewhere.

The source of all wealth is people (provided that they have available energy sources), full stop. Every single “source” of wealth requires people to be realized, sequestered and/or traded.

If you are looking for countries that have low or limited taxes on real estate check out the countries in Carribbean.

Prior to the pandemic many of these countries were quite cheap compared to real estate in the US.

That being said the problems with real estate in those countries are:

1. Similar to real estate in other countries it can’t be moved and is subject to changes in taxes and laws.

2. Transaction taxes are quite high on real estate purchases and often higher for nonresident buyers.

3. While many of them have democracy based systems of government that could change (Grenada was a good example). And most likely you are going to be a minority in the country and easy pickings in times of crisis or revolution.

4. Prices for everything else are much higher than non island type countries. Those countries that rely on tourism and so called tax havens have fragile economic basis. Health care is expensive and in many cases not world class.

5. The weather is great…. except for the occasional wind that wipes everything out and of course once in a while a volcano wipes out parts of the islands too.

If you are still interested check out the BVI, Barbados, and the Bahamas. Avoid Jamaica.

Some countries still offer citizenship for investment as well.

Is there really a bit of land anywhere that is not owned and taxed by some government? Somewhere I can pound 4 stakes in and not pay tribute to a LandLord ?

Dollars are becoming so worthless, I’ve noticed a lot of my customers and banks are using cash denoted in $100 bills. I’m wondering when the Fed will start printing $500 McKinley bills? Or maybe some Grove Cleveland $1000 bills.

They used to have bills far larger than $500 and $1,000. From Museum of American Finance:

“The $10,000 bill featuring the portrait of President Lincoln’s Secretary of the Treasury, Salmon P. Chase, was the highest denomination US currency ever to publicly circulate. Although a $100,000 bill featuring the portrait of Woodrow Wilson was issued, its purpose was to transfer funds between Federal Reserve Banks, and not to pass in retail transactions. Since 1969, the highest denomination note issued in the US has been the $100 bill.”

“Since 1969, the highest denomination note issued in the US has been the $100 bill.”

Well, adjusted for inflation that would make the case for issuing a McKinley $500 bill even stronger. Why not start printing them now? I know why they aren’t doing it. The government wants to move towards a cashless society so they can tract everything you are doing and tax every transaction at the same time.

The decline of cash transactions in ordinary people’s day-to-day lives has vanishingly little to do with the gubmint (or Bill Gates or the WEF or the UFOs) and a great deal to do with the rise in the use of credit cards as a means of payment by consumers wishing to take advantage of rewards programs.

(Or, put another way, by consumers wishing to avoid the effective “tax” on non-credit card transactions that consists, roughly, of the amount that businesses pay in merchant fees to fund those rewards programs, and that they pass on to the consumer as slightly higher prices)

According to a Fed payment study in June credit cards amount to only a third of all transactions. The majority (56 percent) are debit cards. I don’t think many debit cards have loyalty programs.

MustBeADuck

Yes, but…

In terms of dollars, the average payment with debit card was half the size of the average credit card payment, and in terms of dollars spent, credit cards are still on top, but barely. Many consumers prefer credit cards – those consumers that can get them – because their bank account isn’t directly exposed as it is with a debit card, and credit cards have more consumer protections (I never ever buy anything with a debit card for those reasons).

Debit card: $43 per transaction on average

Credit card: $96 per transaction on average.

In total dollars spent per year:

Debit cards: $4.55 trillion

Credit cards: $4.88 trillion.

BTW-1, checks have fallen out of use for small purchases, but they’re still used for big purchases: the average payment by check was $2,430.

BTW-2: cash withdrawals from ATMs amounted to only $730 billion for the year.

This is from the earlier 2022 study that actually discloses dollars. The more recent study you cited (the one I have seen) only discloses percentages of the number of payments, not of the dollar amounts of payments.

“The majority (56 percent) are debit cards. ”

You got to be nuts to use debit cards. Ms Swamp’s Suntrust Debit card stolen out of our trunk in 2010, while we were playing golf. The card got laundered to criminals who used it to by a truck, buy electronics and even get laid by a prostitute in NYC. All done in the span of 48 hours. $3,000 cleaned out of the Suntrust account. It took us months to get the money back.

The pressure on the IRS to collect more taxes from the everyday people to pay for the wealthy peoples tax cuts is enormous.

Well, Pea Sea, if the “gubmint” collapses, so will the currency. You may need to use it as toilet paper.

We used to have those large denominations because we didn’t have computers. So to do a large business transaction, the money had to exist in some practical form. Could you imagine having to verify a $1 million transaction in $100 bills as opposed to $10,000 bills? Even a check back then still had to eventually involve the movement of cash.

In a modern world, the revival of the mckinely dollar may be the first indicator of hyperinflation on the horizon. Damn near close now. We are 1 more omnibus bill like the one they used to hold covid relief hostage away from it, at least thats how it feels. I believe this is no secret, countries see this, they just have no alternative to the dollar.

And people who don’t understand that just because inflation has “slowed” / “stopped” has nothing to do with the current inflated state of the dollar are going to be GOBSMACKED by this when food goes from barely affordable to prices that being on the revival of great depression style cooking.

The financial illiteracy (and inability of the average American to understand statistics) are really sending us down a scary path. If the dollar hyperinflates, even at just 50% adoption by the world, that 50% of the worlds economies who are more f***ed than eastern europe in 1990.

Use of cash today in terms of payment amounts is less than 10% of the combined payments of credit cards and debit cars. IT’s used for only small purchases (of the legal kind).

This is an interesting article but not one I am drawing any conclusions on. Doesn’t seem to be anything that will upset the status quo money cart and certainly not in the short to mid term.

“Doesn’t seem to be anything that will upset the status quo money cart and certainly not in the short to mid term.”

Correct. That’s why I post them — to tamp down on this endless dollar-collapse BS.

For the US economy, it could very well be long-term a good thing if reserve currencies are more diverse, and not dominated by the dollar.

Succinct summation : Buy Gold.

But who is selling the gold that central banks are buying? What do they know that we don’t?

The producers may be the major sellers, I reckon.

So how is the price going to keep rising if demand is always met by new production while very little gold is permanently consumed (after recycling)?

Wolf, I think the people selling most of the gold are the mining companies. They need the USD to cover their expenses, and put a smile on the faces of people in the Wall Street casino.

I know some of the coin dealers here in the wilds of Wisconsin. They tell me that local people have been selling silver, and buying gold for most of 2024. They have taken in so much old 90% silver coin that it has to be shipped off to wholesalers in Arizona and Colorado, while the scrap silver (jewelry, etc) goes to smelters in Chicago & Milwaukee.

They tell me buyers want the modern, quarter, half & one ounce size gold coins (these have a premium). The old gold (mostly pre-1933 and odd weights) are being retailed in shops at “melt”. So sellers get less than the gold value when selling to a coin shop.

The local coin shop owners are worried about the bullion prices. They don’t know if gold is wildly over valued, or if silver is under valued. So they want the smallest possible inventory of PM’s.

OK. This has been an odd rabbit hole to go down. But maybe some of your readers will find it interesting ?

Old ghost. This is in the rabbit hole also. The gold and silver bullion brick and mortar businesses in the U. S. are undergoing a major change. Just as the internet wiped out bookstores and other small business, coin stores that deal in bullion are having to compete with the likes of Costco, Walmart, Amazon and bullion sellers that dominate the internet. The interesting aspect to this realignment is when the persons who purchased online want to sell, they run to their local coin dealer and want to sell. Many of the vendors they bought from don’t repurchase and the sellers don’t want the cost of shipping and insurance, plus waiting two weeks for payment. This causes an imbalance in demand and supply locally and the seller is paid less by the local dealer to compensate for the extra cost of providing the immediate service of liquidity to the seller and maintain a normal profit margin. Change is a constant.

How do the gold futures markets feed in to this conversation?

Does the “marginal trading” that determines the direction of daily gold prices occur institutionally in the futures markets, versus at retail local shop?

I read that Gold ETFs had seen an outflow even as prices of gold were going up. Quite odd. So for some reason, the retail investors would rather have stocks or Treasuries than a gold ETF share.

This was happening over the 1st 6 months of the year so I am not sure what the flow status is now.

This is a great article. Thank you Mr Richter.

How is the price going to go up……..

One of the largest buyers are the citizens of India. They love it for all kinds of reasons.

As the Indian economy continues to grow at a rate that meets or exceeds Chinese growth in the 2000’s the wealth in the country grows…….and where will they put a portion of that wealth……yellow rocks. We are talking about 1.4 billion people.

I could write another 12 books about additional long term demand.

The real issue is where will additional supply come from….it takes a dozen years to get an operating mine into operation.

The facts are obvious, gold is a sanction proof asset that is totally convertible into anything that retains value better than fiat and has a limited supply.

“gold is a sanction proof asset that is totally convertible into anything that retains value better than fiat and has a limited supply.”

Which is why CBs and Gubmints HATE the citizens to get too much of it!

China doesn’t want the citizenry to exchange in anything but their currency. Same in the rest of the “free” world, which is why they invented the wealth effect.

The GOLD:SPX ratio was 7.8 in Jan. 1980. It is currently less than 0.5. If the market value of the US GDP is considered to be increasing more rapidly than a lump of metal (or barrel of energy, etc.) than the investor will put more weight into the one increasing faster.

I agree with sound money, but realize that market makers: make the market. If the government wanted to confiscate gold, make transacting in gold illegal or any number of things, then the market would quickly turn away from it.

One a side note of valuation, I mentioned that “an ounce of gold can always buy a fine suit” to my dad. He replied: A hamburger is minimum wage.

Living in a place without any fast food: this is true! I used to joke that “I lived in the land of the $10 burger.” That was 20 years ago and now it’s $25-30 (which is nearly the minimum living wage in my town).

Foolish humans, a piece of gold…

The world currency is lies, deception, fear and war, with an occasional smile and kind gesture.

Such stuff on this fine sunday,….forgiveness of others and oneself is also a currency used with great returns.

Value will always be denominated in something. Own the value and not the denominator and you will be fine.

It appears that the dollar lost a majority of that 8% drop in the first chart during Trump’s term. Seems to have bounced around under Biden. Will a second Trump term, with its chaotic economic policy making decisions, see a similar drop in dollar value?

Part of the dollars unique valuation is its backstop of US legal institutions and the ability to enforce legal settlement matters.

The Euro in 2nd place to the dollar is not the same as if the RMB were in 2nd place. That would be something to worry about. But those 2nd, 3rd, 4th, and 5th place below the dollar are all dependant in ways to the US—military protection, the soundest banking although ugly, etc.

The biggest threat to the dollar is its own government spending like drunken dogs. No, not sailors, at least they can keep the ship from sinking.

Some say the US has weaponized the US dollar by increasing the threat of sanctions during most disagreements lately.

This is leading to a distrust in the USD and/or some countries thinking they better have a hedge in gold as every CB accepts gold as payment and it really hard to sanction.

“every CB accepts gold as payment”

When was the last time you bought something from a central bank?

“Some say the US has weaponized the US dollar by increasing the threat of sanctions during most disagreements lately.”

This. It’s just geopolitical prudence.

China doesn’t want its currency to be used as reserves in other countries central banks — that’s part of the reason to have capital controls in the first place.

I generally find Vincent stimulating and think his thoughts on reserve currencies are reasonable — from May:

“”Achieving strategic autonomy is China’s guiding star,” Deluard said, emphasizing that reducing dependence on the dollar is crucial to avoiding U.S. leverage and reprisals, as demonstrated by Russia’s situation. “You could take the Russia story as a catalyst.”

China’s efforts to increase the yuan’s use coincide with its rapid stockpiling of gold, oil, copper and other resources. Analysts believe the actions are also aimed at enhancing autonomy.

Deluard compared the strategy to the U.S. creation of the Strategic Petroleum Reserve after recognizing the risk of dependency on Middle Eastern oil

But the share of China’s RMB dropped to just 2.1%, the lowest in years. On the reserve currency front, China is going backwards. RTGDFA

Did “Vincent” forget to tell you that?

Vincent and I need to talk more?

Re: “The RMB used to be part of this group until 2016”

Here’s the Fed reply, I guess:

August 30, 2024

Internationalization of the Chinese renminbi: progress and outlook

“The Chinese renminbi fraction of allocated official foreign exchange (FX) reserves has more than doubled from 1.1 percent in 2016 to 2.8 percent in 2022 (see Figure 6). However, since then, it has declined to 2.3 percent as the exchange value of the Chinese renminbi depreciated. This decline also suggests that Western sanctions on Russia have (so far) not led to a material increase in renminbi reserve holdings. At this level, the renminbi remains a niche reserve currency with a fraction comparable to the Australian and Canadian dollars but lagging the British pound and the Japanese yen and being nowhere close the euro or U.S. dollar. This picture is unlikely to change in the near term, as a recent survey indicates that only a small fraction of central banks look to increase renminbi reserves”

What was the question, lol.

LOL. The CNY is roughly unchanged today from where it was in September 2022, at 7.01 CNY to the USD, with some ups and downs in between. Look it up before you post this BS.

AND the value of China’s holdings of USD-assets are not impacted by the CNY-USD exchange rate at all ever.

And so the share has dropped by 25% (from 2.8% to 2.1%) since Sep 2022 because the CNY-USD exchange rate hasn’t changed? And because the CNY-USD exchange rate doesn’t even impact the value of the US-holdings?

Don’t you ever run out of BS to post, I mean like a sudden BS shortage? That was a rhetorical question because you will google around until you find some BS to post here.

*adding to a thread above but don’t want that narrow, little space

demand for gold is denominated in dollars (or other currency). gold isn’t like oil, corn or any other commodity which are needed by weight…by volume…by amount. Supply and demand metrics wont apply to gold. it isn’t used up so there is always plenty of gold and there are always plenty of buyers for gold and the beauty is that the price doesn’t matter at all. Gold could be a million dollars an ounce and your refrigerator would still cost the same. Same as how some BS modern art can sell for hundreds of millions and it just doesn’t matter to you because you don’t need that art for anything.

It’s not about gold going up. Nor is it about the dollar going down. It is if the ability to buy at the paper price is an illusion of sorts. And a gift if you want it. And yes, people who buy paper gold as protection are crazy.

The real questions are: what do the big boys (central banks and some others) pay when they buy gold in tonnage? The conspiracy theory (that i believe, obviously) is that its a lot more than spot. Perhaps many multiples of. Very opaque transactions. They just kind of announce that they added to their holdings.

Why does the U.S. stubbornly mark it’s gold holdings at $42/oz?

Why did Gordon Brown sell at the low?

Gold doesn’t continue to go up unless its paper is floating along in a commodity bull market. But when the market breaks, gold gaps up and stays up. thats what we hold it for other than basic wealth preservation. everything else is just the oldest trick in banking being played for the thousandth time – lots of paper pushed around and no real gold. don’t believe me? just wait.

bullion banks give ounce denominated loans. think about that. Why does that even exist in todays world? (and can you see how it is a carryover from the gold standard days? which led to the Grrrrrreat! depression?)

What is the daily clearing volume of so-called ‘gold’? (it’s really big. why? for what? do tell)

The ETFs supposedly have physical inflows. But what do they call physical gold? Are they crooked enough to create paper- that tracks ‘gold’. Some sort of delta1 product? Of course they are. it’ll all come out one day. Its a very old, very simple game. you don’t really think that game is dead and gone? that we’ve ‘advanced’ so far beyond such shenanigans?

I think it’ll happen in my lifetime. Probably alongside war. If not, holding gold in peace is a good problem to have. Best of luck to you paperbugs and your yields! But at least hold a little bit of real, in-your-sweaty-little-hand gold. Not everything needs to be productive.

This an add-on to Fred & Bungee:

Why is gold so valuable today? One reason is that foreign holders of treasuries have tired of having loans repaid in depreciated $s and see no end to it. They have learned to use paper gold manipulation against the manipulators—buying low hanging futures, standing for delivery, then placing in their vaults or selling at higher prices on Shanghai exchange and elsewhere.

We read and hear (true or false) that these new buyers don’t really care what the price is as gold moves higher—they just want the gold. Gold has been repressed against all fiat for so long they are unconcerned with $ price.

The west can continue repressing price, others who see gold as the true store of value, as a more reliable store of wealth, may continue to buy as it goes up.

Why Gold? Let’s review the characteristics that have allowed gold to be treasured for all time:

1. Durability— indestructible.

2. Fungible— an ounce is an ounce, elemental.

3. Portable—

4. Divisible—including malleable to coinage.

5. Physical—you can can hold it in your hand.

Add to this that gold is rare and desirable to obtain but not so rare that it is out of reach. Gold deposits are found round the world for those who seek it

Where will future gold come from? Mining and recycling. As prices have moved higher, mine production increased from approximately 2500 tones in 2008 to approximately 3600 tones today.

Get physical.

Unlike treasuries, gold does not pay interest.

Neither do a lot of other assets such as stocks. Gold doesn’t go bankrupt either or default like some countries bonds either.

I’m really tired of people posting that gold doesn’t pay interest.

Put up a chart of the real, inflation adjusted value of US bonds versus gold or the US dollar

@ Gold is Good,

Most stocks pay dividends. Gold sits there like a lump.

Forget the rocks domedone…

Friend in western NC just told me of trying to buy gas with some gold — did not work, ditto food…

Neighbors supplied both, gas for her generator to keep the Oxygen flowing, food for usual.

GET COMMUNITY, not goldbugs!!

your friend tried to skip a step.

first sell gold for money. then buy stuff with money.

let her know for next time.

I like the community message #vintage, “GET COMMUNITY, not goldbugs!!”

But it is quite easy to join the commune, goldbug and macrame all at the same time.

“first sell gold for money. then buy stuff with money.”

But I thought gold was money?

Sounds like acual resources like food & fuel are more valuable in this scenario. Too bad gasoline goes bad so you can’t stockpile it.

I suggest folks look up uses of gold other than ornaments etc. It is essential in aerospace, but for a local use check yr hi- fi outlet for good audio or other cables. The connectors will be gold plated, with an incredibly thin layer of gold that will never tarnish.

When yr old dishwasher or clothes washer won’t respond to the inputs from the dial, very often it’s because the contacts in a relay have become too burnt or oxidized to pass current. That is no big deal in those apps but a huge deal in aerospace. Eg: you press button to open airlock and it won’t open.

Re: all kinds of gold everywhere. The opposite is true.

The majors like Barrick, Newmont, etc. have been unable to find a rich big field for decades. It’s all about

the cost per ton to get a gram or two.

what you say is true but misses the point.

what percentage of annual gold mining output goes to electrical contacts? or gold flaked paint? or anything else with a use? Bet its an insignificant rounding error. There is one use for gold, and that is to store wealth. That is why CBs buy it. Why Saudi princes buy it. And why normal people buy it. Not because it can be used in dentistry.

The only reasonable sounding argument against this would be jewlery which takes up a big chunk of output and scrap. But what is the difference between a gold bar and a gold necklace? not much but the shape. In fact, they often share similar fates; being stored in a box for a couple generations then sold by a grandkid and melted back into the above-ground stock. The jewlery, unlike high-end circuitry or dental fittings, isnt really consumption of gold. And neither is bullion.

Lots of alternatives for jewlery. Not so many for wealth preservation.

Silver has better electrical conductivity than gold.

Yes silver has better conductivity than gold. Conductivity in elements is common with both copper and aluminum being used in wiring, the latter in high voltage lines. But in relay contacts silver would be worse than copper as it is highly reactive and tarnishes easily. Gold comes out of the sea glittering after centuries. Silver is black.

Re: silver as wiring. This happened during WWII.

Hundreds of miles of copper wires were needed for the Manhattan Project but copper was in short supply. So silver stored in Fort Knox was borrowed, used as wiring, then melted and returned after the war. If it seems odd that Knox would bother storing silver, before WWII, there was a long era when silver was a monetary metal.

In 20’s China, ‘money’ meant silver. It collapsed in that role partly because of the Comstock mega lode and modern mining tech. The silver bugs hope for its revival and a second coming of the sixteen- to- one, silver/ gold ratio.

For sure the vast majority of gold buying is monetary, as store of value and recently for its appreciation, a profit. But you can use other things for this. For some apps, gold is the only one. Gold could be 10K per oz and aero/space would still have to buy it.

Taxes on gold slashed in India

The Indian government also buys gold.

China has been buying in bulk for a year

Chinese Rumors Spread-

“Buy gold because China is doomed”

Trump’s reference to the gold standard.

a gold mine depletion problem.

Annual gold production is decreasing

To find a new gold mine

Environmental issues and astronomical investment and time spent – same as gambling.

the effects of war.

Chart records rising gold prices in Japan earthquake – latest earthquake in Japan continues

If the increase in the money supply has resulted in 25% reduction in the value of the dollar in the last 4 years.. Then gold investors need to see at least a 25% rise in dollar- denominated value right? We know that the dollar value of gold is chosen – and the trades are filled in to achieve that ‘price’ . All gold investors in this system, just seem like fellahs who keep taking back the girl.

It’s understandable that people who have lived all of their lives within the empire don’t necessarily even realize that it exists, and therefore can fool themselves into believing that its currency is somehow disconnected from its geopolitical status in the world.

The US dollar will retain its supremacy for as long as the US continues to operate a world girdling network of military installations. It’s power that initially gives a state currency value, not the value of the currency which initially gives the state its power — once established by “facts on the ground” (military supremacy) then the currency can help the empire retain power by influencing comprador elites in its vassal states.

eg – this.

may we all find a better day.

Exactly.

This is why crypto will NEVER become a currency.

No Army.

Unless it’s the “WEFcoin” backed by the US industrial military complex.

This is the primary confusion I still have with seeing PMs as a chaos hedge. Who/ what is causing the chaos? If they have more ammo than me, then what?

The REAL chaos hedge that I have is a strong back and a (dulling but) functional mind, coupled with a location near real producers.

If I can barter service for foodstuffs or cooperatively harvest, process and preserve: my family will eat. Energy is difficult to utilize in the chaotic “apocalypse” scenario where there’s no grid, filling station or therefore destination.

We saw the sharp increase in wood as heat a couple winters ago across the Eurozone.

.22 bricks will be worth way more than gold bricks. Paulo told everyone here that years ago when talking about local BC peppers seen picking up supplies once in a while around his area, Northern Vancouver Island.

Yep.

Europe is increasingly in danger of being relegated to a (admittedly charming) museum for American and Asian tourists.

So, same as it ever then…

Who you going to trust? The Yaun? LMFAO!!!

Full FAITH and credit.

Random coincidence, but the share of USD, EUR and everything else reminds me eerily of the share BTC, ETC and every other cryptocurrency has in the total crypto market.

I imagine there is some underlying mechanism. Quite possible that in any financial system, including crypto, it always breaks down to 1 big major player, 1 small major player and everyone else.

Our trade deficit with China is the largest. Yemen, stevedores strike, low Panama canal water, Long Beach clogging on top of their RE fiasco,

along with higher oil prices might start a recession in China. A lower

trade deficit ==> higher DXY.

The USD is still strong in South America and the islands.

Even the fastest growing economy in the world , Guyana, producing about 650,000 barrels of oil daily has USD shortages.

Surprisingly, the USD has appreciated from GY$205 before oil was discovered to about GY$210-1USD.

International banks in Guyana are actually buying USD at $213-215 GYD.

My Guyanese friends wonder if Guyana is exporting billions of USD worth in oil, and the GDP per capita is higher than neighboring Canada, the UK and many EU countries, why US dollars are scarce in their homeland commanding a premium.

Fun fact: sovereign wealth funds -unlike central banks – do not report their gold holdings. The China Investment corporation (China’s sovereign wealth fund), for example, has assets under management of USD 1,24 trillion.Norway’s (the guys with the oil and gas) 1,6 trillion USD. That has led to headlines like “Is China hiding how much gold it really has ?”.

All in all there are 176 of’em in the world with total AUM of about 12 trillion.

Imagine they start buying gold.

imagine they start dumping the gold they do have, if any.

The gold market price is made by paper gold which is still paper.