Corporate Credit Ratings by the Big Three US Credit Rating Agencies: Credit Risk and Risk of Default.

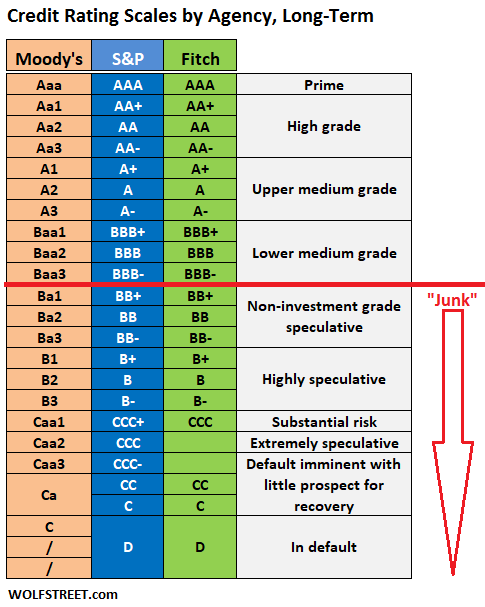

Here is my cheat-sheet for the long-term corporate credit ratings that the three major US rating agencies Moody’s, Standard & Poor’s, and Fitch use and how they fit into major categories. The red line divides “investment grade” (above the line) from what is often called “speculative,” “below investment grade,” “high yield,” or lovingly, “junk.” The scale goes from very low-risk triple-A at the top to very high risk, and finally “default” at the bottom.

Bonds can also be designated “NR” (“not rated”) or “WR” (“withdrawn rating”) after a rating agency has withdrawn its own ratings for a variety of reasons, such as lack of credible information.