The most corruptible, lopsided pricing mechanism.

By Clint Siegner, a Director at Money Metals Exchange:

A respectable number of Americans hold investments in gold and silver in one form or another. Some hold physical bullion, while others opt for indirect ownership via ETFs or other instruments. A very small minority speculate via the futures markets. But we frequently report on the futures markets – why exactly is that?

Because that is where prices are set. The mint certificates, the ETFs, and the coins in an investor’s safe – all of them – are valued, at least in large part, based on the most recent trade in the nearest delivery month on a futures exchange such as the COMEX. These “spot” prices are the ones scrolling across the bottom of your CNBC screen.

That makes the futures markets a tiny tail wagging a much larger dog.

Too bad. A more corruptible and lopsided mechanism for price discovery has never been devised. The price reported on TV has less to do with physical supply and demand fundamentals and more to do with lining the pockets of the bullion banks, including JPMorgan Chase.

Craig Hemke of TFMetalsReport.com explained in a recent post how the bullion banks fleece futures traders. He contrasted buying a futures contract with something more investors will be more familiar with – buying a stock. The number of shares is limited. When an investor buys shares in Coca-Cola company, they must be paired with another investor who owns actual shares and wants to sell at the prevailing price. That’s straight forward price discovery.

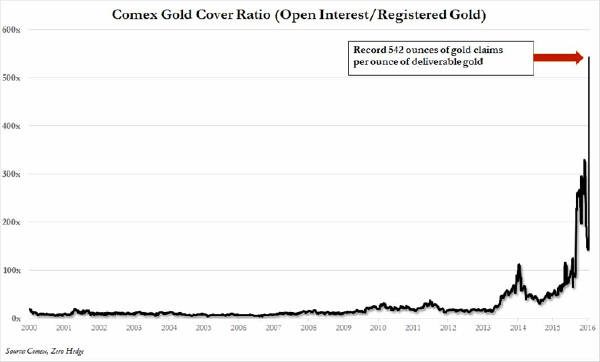

Not so in a futures market such as the COMEX. If an investor buys contracts for gold, they won’t be paired with anyone delivering the actual gold. They are paired with someone who wants to sell contracts, regardless of whether he has any physical gold. These paper contracts are tethered to physical gold in a bullion bank’s vault by the thinnest of threads. Recently the coverage ratio – the number of ounces represented on paper contracts relative to the actual stock of registered gold bars – rose above 500 to 1.

The party selling that paper might be another trader with an existing contract. Or, as has been happening more of late, it might be the bullion bank itself. They might just print up a brand new contract for you. Yes, they can actually do that! And as many as they like. All without putting a single additional ounce of actual metal aside to deliver.

Gold and silver are considered precious metals because they are scarce and beautiful. But those features are barely a factor in setting the COMEX “spot” price. In that market, and other futures exchanges, derivatives are traded instead. They neither glisten nor shine and their supply is virtually unlimited. Quite simply, that’s a problem.

But it gets worse. As said above, if you bet on the price of gold by either buying or selling a futures contract, the bookie might just be a bullion banker. He’s now betting against you with an institutional advantage; he completely controls the supply of your contract.

It’s remarkable so many traders are still willing to gamble despite all of the recent evidence that the fix is in. Open interest in silver futures just hit a new all-time record, and gold is not far behind. This despite a barrage of news about bankers rigging markets and cheating clients.

Someday we’ll have more honest price discovery in metals. It will happen when people figure out the game and either abandon the rigged casino altogether or insist on limited and reasonable coverage ratios. The new Shanghai Gold Exchange which deals in the physical metal itself may be a step in that direction. In the meantime, stick with physical bullion and understand “spot” prices for what they are. By Clint Siegner, Money Metals Exchange

After a blistering five-year boom of near limitless possibilities, it is suddenly getting tough in another asset class – one that mere commoner millionaires are not invited to play in: the high-dollar art market. Read… Another Asset Bubble Cracks: Art Sales Plunge

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for explaining everything about the rigged COMEX market. Until people wake up, they’re going to keep on getting the shaft, while the bakers are getting the gold.

NEVER buy any paper instruments which will be worthless after the collapse Buy physical and be prepared to defend it because after the dollar tanks you will need it to stay alive in my humble opinion

Bakers are getting the Gold! brings an entirely new meaning to the saying

‘ A Bun in the oven’ I always thought a Bakery was a crumby place to work, I had no idea they made loaf or death decisions on Gold.

Sorry, late night.

You might wonder why the regulators allow such flagrant dishonesty. The answer is that the Government doesn’t care. In a free market, gold acts like a report card on the government. The politicians don’t like that one bit, so, for years, they have tried to discourage citizens from holding gold. They have not been terribly successful. From the politicians point of view, if people won’t cooperate, then let them be burned. This gives the bullion banks a license to steal.

The key take away is to avoid “paper gold”. If you buy gold, buy physical gold and take possession. Don’t allow anyone else to store it for you.

The other answer is that the citizens don’t care either. That’s the summary of our world isn’t it? It’s not Planet Earth, it’s Planet Don’t Care.

Someone is sure to sneeze and bring this house of cards down.

With a 526:1 leverage, it will only take a minuscule fraction of the “investors” requesting physical delivery of their metal to create the “Mother of all Short Squeezes.”

This will quickly determine if the NY FRB and Ft Knox gold vaults are empty, which no independent audit has been able to determine for at least the last 50 years.

Dear George, A short squeeze is not likely anytime soon. COMEX rules do not require the contract seller to deliver physical gold/silver to the “buyer”. Sellers can settle in cash.

It will be interesting to see if the Shanghai Gold Exchange will overcome western government(s) market manipulations of paper contracts. The Chinese may just go along with price suppression until a new Asia-centric monetary and economic order is in place.

I recently posted a comment where I said that the prices of gold and diamond jewelry have never been higher. I was reminded by another commentator that the price of gold in really down, and by a lot. This is another disconnect in the market. Gold jewelry is expensive (over valued) because of scarcity. With all the gold going mostly to China and Russia the jewelry markets are charging a premium for gold. The prices are really ridiculous. They can keep their gold and diamonds.

How many US$ would one need to purchase physical gold (wink, wink), then “stand for delivery” of the real stuff at the COMEX in order to be 100% sure this volume will break them?

Or will they just pay you back the US $ and tell you to take a hike?

If you have the “intelligence” to buy gold or silver coin, then you are doing this in anticipation of serious problems.

Therefore, why would you NOT want this gold and silver in your own hands? It would be like buying, on line, a few rifles and hand guns, and the correct ammunition, but letting them stay at the on-line dealer.

Really?

You are guying guns, ammo, gold, silver, survival food since you think/feel all hell is going to break out soon (like in the next 6 months). Well, if all hell breaks out, there is no way the dealer can ship you your items when no truckers dare to truck. When everybody calls (if the phone system works) the dealers all in the same week, demanding their stuff, there is NO WAY IT CAN BE DELIVERED.

So, if you REALLY, REALLY, REALLY, are buying gold and silver for “the collapse”, then it only makes sense to have them with you.

This is why my home is a vault and and an arsenal. We have 6 months.

So, what are the “rules” after a collapse? How does one use gold and silver to make purchases? In this modern technological world, it would be less than six weeks before counterfeit “gold” and “silver” started appearing, and how would you know? Then the people selling “counterfeit detectors”..etc etc. which actually permitted counterfeit precious metals to pass as “legit”. No one talks about how they would use a bullion bar, one ounce, to buy food. “Keep the change”??

How long do you think you would live in your arsenal and vault, before someone decided that you had something to protect, and decide your “stationary spot” was their “long term project”??

I recall a neighbor in the Sierra Nevada mountains, a nuclear physicist who attended the Bikini Atoll blasts in the 1940s. He drove a D9 Cat, and built for a super-secret client, a home that was a bunker, waiting for the breakdown of society. That was in 1979.

Some thinking is very recyclable.

After a collapse, the country will likely be ruled by warlords comprised of former law enforcement organizations. It would be wise to make friends with them before the collapse.

How does one use gold and silver to make purchases? Coins. Sure the gold bullion coins are high value but silver bullion is useful for smaller purchases. “Junk Silver” coins, halves, quarters and dimes pre 1965, can be used for everyday trading. These are US currency although you would be crazy to use them at face value.

Bullion Bars are for large storage and are not suitable for individual transactions. That is why nobody talks about using them to buy food.

Your concerns about counterfeiting are overstated. It’s not that easy to create a convincing counterfeit coin. Those familiar with the appearance of the coins would spot them and the weight would be off or it would be magnetic, etc.. The most common scam today is reslabbing numismatic coins.

Your comments about law enforcement reminded me of the aftermath of the Katrina flood in New Orleans. The cops spent the day before and the days after stealing everything they could find. Including breaking into banks, businesses, and homes. I expect you would see more of the same especially if they knew the whole country was up for grabs.

What makes me happy is looking at sterling silver flatware on Ebay. Sometimes I also like to check what I call the “ebay price of silver”…take any 3 or 5 auctions that have settled recently for 1964 junk silver (not 50 cent liberties, they have a premium), multiply the face value by .76, this gives you ounces of silver. Divide the dollar amount by the number of ounces and average the 3 or 5 auctions. This is a very liquid market :) Ok so I just this minute did this and the average price for today was 18.11(21.64/oz. +15.79/oz.+16.91/oz divided by 3). Of course you get many small pieces, which is nice. Sometimes the Ebay price of silver can be up to 2 dollars over the comex price but not today.

I rephrase my previous question:

“I want to break the COMEX. How much money do I need?”

Just ask for delivery

Indeed! With a 526:1 (and increasing) leverage the demand for physical delivery of only 1 ounce in a thousand should be ample to initiate a “run on the bank” and collapse the house of cards as there will be a nasty feed-back loop. The will also be the derivative effects.

So why is nobody breaking the bank?

How much money does one need?

Gold yes, Silver no. Nothing is mentioned on Comex about delivery for silver, and I looked assiduously….but a few(several?) years ago the comex announced that shares of slv would count as “deliverable”.

James your question doesn’t make sense but let me ask you: Who can run out faster; COMEX – out of paper or you – out of money?

Cheers.

Is COMEX not supposed to deliver physical to people who invested in or gave them physical for storage purposes?

What you are saying is that COMEX can chose, at will, between giving those people fiat money, instead of their physical, even if they want physical delivered.

I call that a default.

With respect, I think you are mistaken.

You’ll never break the comex. You’ll be quietly paid off with a generous price in paper currency and the betting on “price” will continue even as you accept their cash.

Governments want and NEED it this way, which is why their “regulators” do nothing.

Ok, if that is a way to make profit, let’s see how far we get.

We crowd source 10 000 people, each with US$ 1 000. We then buy $10M physical gold and wait till their physical stocks are at the lowest.

We then insist on physical delivery, shout DEFAULT, if we don’t get the physical price in fiat + 10% NOW. Rinse and repeat a week later.

Anyone remember the Hunt brothers? They found out that when the house stands to lose big, that the rules of the game get changed.

John in Indy

Good point!

Much depends on why he wants to break COMEX. If for personal profit, then the Hunt brothers should be a somber warning, but if the intent is to help a corrupt and archaic institutions to collapse before than can inflict additional damage to the socioeconomy, then IMNSHO the only thing that is required is “incite” a “run on the bank” by motivating a *TINY* fraction of the people who own paper gold to demand physical delivery. With 526:1 leverage it would only require 0.19% of the owners to completely strip the available gold, but most likely even if only 0.05% requested physical delivery (c.1/4 of available gold) it would be enough to create a massive short squeeze and chaos.

George,

How much US$ invested in “gold” would that be?

What I find amusing is that the author is criticizing a system in which the value of a ‘real’ commoditiy is being priced using a fiat currency that is printed with a careless disregard for any sense of proportion or value. The use of futures contracts is just a symptom.

It would appear that commodities can only be valued in relation to other commodities. How much is gold worth in oil, or cotton or steel…

Fiat money is just fairy dust!

Bingo.

This is exactly what I say all the time.

“Fiat money is just fairy dust!”

Let me know when you’re throwing away your fairy dust. I’ll have my people send an armored convoy and minions to sift it out of your trash. Keep the gold, thanks.

Your understanding of the nature of value is childish and unbecoming, although it’s possible that it is merely ideologically motivated. A mature understanding would know that before the end, anything can be worth everything, because in the end, everything, absolutely everything, is worth nothing. Nothing at all.

Some people cannot think outside the box because they have made their box into a fortress prison. Best of luck to you on an eventual escape.

I take my leave of all of you now. You would do well to remember all that I have told you. And if you don’t, well, is no skin off my nose.

Come away! O human child,

To the waters and the wild

With a faery, hand in hand.

For the world’s more full of weeping

Than you can understand.

And thank you, Mr. Richter, for being such a tolerant and gracious host.

Ia manuia.

500:1 is a very large short. Do they have access to their own gold mine or maybe they’re the miners themselves?

I was surprised to learn gold miners were short while prices were falling yet, gold miner equities totally collapsed in spectacular fashion.

Yep, it’s definitely rigged!

I love how on the Comex only 1 contract in 2500 gold futures contracts actually ends up being settled with physical gold. The London Gold market is ten times larger than the Comex and is far more important. However yet again it is largely a massively leveraged paper fraud. The Chinese now have one of their own banks participating in the London Gold Price Fix. Once the draining of gold from London to Shanghai by Chinese Banks is complete the US/UK price rigging shenanigans will be over.

https://www.bullionstar.com/blogs/bullionstar/infographic-comex-gold-futures-market/

“……Once the draining of gold from London to Shanghai by Chinese Banks is complete the US/UK price rigging shenanigans will be over…..”

…and to continue in Shanghai.

There is only proof to the contrary that the Chinese would embrace free market price setting.

Sorry, but no it won’t.

All the COMEX or the London fixers will do is change the rules.

They’ll change them so that they will survive and others will lose. They have done it in the past and will do it again in the future.

They will win regardless and others will lose.

It is simple as that.

The article is all very well but there’s only one slight problem: it’s BS.

First of all, THERE’S NO SUCH THING AS A ‘BULLION BANK’. The concept simply doesn’t exist. Sorry to bust that bubble.

Secondly, when you talk about a poor little investor nervously offering up his bid for an ounce of gold and being slaughtered by a ‘bullion bank'(!) slamming him down with his sell orders, you conveniently forget that there is just as likely to be a large order from another of your ‘bullion banks’ (trans. significant buyer) on the other side of the trade as well.

Take it from me, an erstwhile director of one of the biggest offices of the once-largest FTMs (futures commission merchants) in the world, there is no rigging, no casino, no ‘lop-sided mechanism’ at all. I have absolutely no axe to grind. It’s just arrant nonsense. Sorry.

Sorry Richard. That is what the writer is trying to say:

” They are paired with someone who wants to sell contracts, regardless of whether he has any physical gold. These paper contracts are tethered to physical gold in a bullion bank’s vault by the thinnest of threads.”

There is nothing on the other side. Just an ENTER key on a keyboard.

James, there’s nothing on EITHER side. Don’t you see that? The one cancels out the other. Futures trading is a zero-sum game. Stock trading is not. It is possible for both sides to make money in the stock market. It is not in commodities. (Please don’t argue this point. It is a fact. I really do know what I’m talking about)!!

But that is exactly the point. If there is nothing on either side, why bother calling them gold futures? Why not call them nothing futures? It is done in order to dominate the gold market and prevent price discovery. Instead of letting increasing demand drag the price higher, they offer false supply to keep price low, manipulate sentiment and steer investors into other directions. The few who do take posession of gold and silver benefit from a lower price however, and mining and exploration doesn’t grow as it would have with a higher price, so eventually this system will lose control, when those who stand for actual delivery can’t be satisfied.

You really don’t know how futures wortk, do you? 98% of contracts traded in the futures markets have nothing non either side. Your polint is meaningless. This is how futures work. You’re just making it up as you go along to try to spin some fanciful idea that is meaningless. I am a professional and it is excruciating to have to deal with your fantasies. You have absolutely no proof of what you say. “The offer false supply to keep the price low…” You are not required to own the underlying commodity of ANY futures market you trade and most operators don’t. Your point is utterly absurd. You need to stop now before you become the laughing stock of this thread.

Commodity “exchanges” once served a legitimate purpose but that was back in the days of hard money. You couldn’t game the system by betting on the price of wheat when you had to settle your bet with money you either had or would have to borrow at whatever interest rate markets set. There was no zero or QE funding available.

Today we use a virtual monetary system to speculate on the price of physical commodities. We only allow this on commodity exchanges. I could not,eg, sell cars as a virtual dealership and hope I could make delivery by finding the exact car at the agreed price on some genuine dealers lot. My buyer would not accept a cash settlement in lieu of the car he wanted!

I don’t disagree with anything you say. But I was making a different point: there are buyers and sellers on both sides of the market so the “manipulations” of one cancel out the manipulations of the other. I would agree that in very thinly traded markets it is theoretically possible to drive up (corner) the price of a commodity (see Trading Places!) but disaster always strikes under that scenario and (as in the case of silver and the Hunts in 1980) the perpetrators always have their heads handed to them in the end.

Gold lovers always claim a conspiracy when the price drops, but never when it goes up.

“Gold lovers always claim a conspiracy when the price drops, but never when it goes up.”

That’s BS -lumping all Gold ‘ lovers’ together.

Those that know – know that the Price is manipulated BOTH Up & Down ! – – Profits are skimmed both ways.

Thin market, that seems to be the time gold most often craters. From my observations that’s typically Sunday just following midnight west coast US time.

I have no proof this time of the week is thin, just assumed so by observation. It occurs to me though, if investing in gold, you’re at the mercy of the world’s 3 best traders.

No, by “thin” I did NOT mean buying gold at 2 a.m. When we talk about a “thin” market, we are referring to commodities which are not widely traded (like rhodium or molybdenum).

Wow, gold sure raises passions. Haters and lovers all get excited.

One huge speculation says there is no gold anymore in ft Knox.

When greenie pushed the price down to 250 or so the spec was he had sold it all.

Just as yourself, why would he sell any after pushing the price so far down, when he could then buy all that cheap gold with paper he had unlimited supplies of.

One day we will find out just how much….

For insight read his essay Gold and Economic Freedom. 1966

That’s why I LOVE bear markets in gold: all the gold bugs get egg on their faces and no amount of lies, misrepresentations, hype or just plain misstatements will save the day. It just goes down because at the end of the day, it’s just a commodity like all the others. It is not “special” or “indispensable” like… like… the U.S itself!

As I keep saying, If it doesn’t have any utility it is not worth much.

Septic organisms. Cigarettes. Liquor. Chocolate. Soap. Salt. Multivitamins. Worms. Dry Bleach. Needles .Thread. Lime(calcium)for soils. Fertilizer. Fishhooks. Nets. Lumber. Nails. Aspirin.Kitty litter.Clothespins.Antifreeze(so toilets don’t freeze).candle-wicking. How am I doing Petunia? :) :) :) But the reason I am for Silver (who cares about Gold? not me) is because I have Hope that Trade will revive after a disaster and that the tbtf will not.

FWIW: When the house of cards collapses, the biggest loss will not be assets, but the feeling of mutual trust on which so much of our economy operates. For the most part the assets will still exist, e . g. the brick and mortar physical plant, gold bullion, etc., albeit the ownership and utilization will change. Trust and confidence among individuals and between the individuals and their government will take years to restore, severely retarding socioeconomic/cultural recovery.

Poor Richard. I thought you were so clued up and I could learn a thing or two from you.

Please inform Central Banks – nett buyers of gold for years now – of the fact that they are buying a commodity! I am sure they will be shocked!

Also inform big banks of their stupid mistake that gold is being traded on their currency desk, not the commodity desk.

They used to think the world was flat, remember? In the mid-1970s they thought we were headed to a new idce-age, remember? Want any more examples of people’s stupidity? I have plenty in my little list, you know… Trading gold as a currency (it isn’t) instead of a commodity doesn’t feature very high in the annals of human stupidity…

I no longer pay any attention to gold or silver price,as its all rigged phony baloney.The shtf dollar collapse price will be the true price.When that event does happen,Silicon Valley drones, unless they have a skill to barter will be sol