Today was one of those bad-hair days for the beleaguered, no-renaissance manufacturing sector in the US. Bad-hair day because it wasn’t terrible to where you wanted roll up into a fetal position and hide under the table, but it wasn’t good either, just the kind of crummy disappointment we’ve seen more or less for years.

And if we ever sit down and wonder why this economy “feels” so much worse than the overall economic numbers, lousy as they are, we need to look at some of this data on a per-capita basis. Because that’s what each individual really feels. If you have a bigger pie, but you slice it into more pieces, each piece might end up being smaller.

So today, the Census Bureau released its durable goods report for May: lousy, lousy, lousy – and for the year so far:

New orders for manufactured durable goods, adjusted seasonally but not for inflation, fell for the third month in four, down 1.8% from April and down 2.2% year-to-date from the same period a year ago.

Excluding transportation, new orders for “core” durable goods rose 0.5% from April, but fell 1.3% year-to-date.

Excluding defense, new orders fell 2.1% from April and were down 1.1% year-to-date.

OK, aircraft orders got whacked, and they’re big and volatile. So non-defense capital goods excluding aircraft – a category that covers everything from farm machinery and computers to institutional furniture – is an important measurement of business spending, and it showed what businesses have been doing for a while: they cut spending. While orders inched up 0.4% from April, they dropped 2.6% year-to-date.

So overall, just lousy.

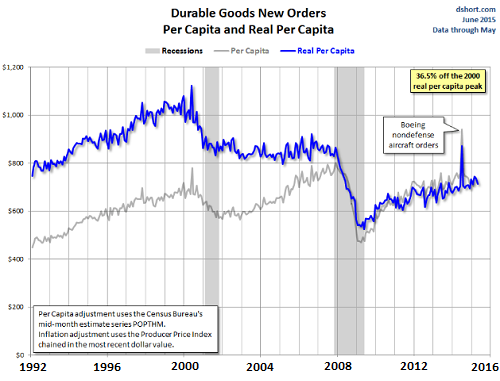

But here is the problem with how this economy feels for individuals: the US population has grown every year, even during the worst economic slump since the Great Depression. And this already weak economy looks a lot worse when projected on a per-capita basis and adjusted for inflation.

Turns out, durable goods orders per capita and adjusted for inflation are now 36.5% below the 2000 peak!

Doug Short at Advisor Perspectives tracks this in the chart below. He divides the durable goods data by the Census Bureau’s monthly population data to get per-capita durable goods orders (gray line). Then he adjusts it for inflation to get “real” per-capita durable goods orders (blue line). Hence, the relentless step-function deterioration since 2000:

These per-capita durable goods orders dropped sharply during the recession of 2001. It was logical. Businesses slashed capital expenditures and operating expenses, and it rippled through the economy. But during the recovery, when businesses and consumers began to boost their spending, they didn’t boost it enough to make up for population growth.

Nominal durable goods orders before the Financial Crisis were higher than ever before. But adjusted for population growth, they’d grown in a painstakingly slow manner and never fully recovered. And adjusted for both, inflation and population growth, they remained flat, and there was no recovery at all before the Financial Crisis hit.

Then during the Financial Crisis, per-capita durable goods orders fell off a cliff, but recovered in the same anemic slow manner as during the prior recovery – despite or because of the totally insane amount of monetary stimulus the Fed has drowned the economy in. And thus, the “recovery” of durable goods orders on an inflation adjusted per-capita basis remains a sad joke.

This step function will repeat itself when the next recession comes. And it will come, unless the Fed has finally succeeded in totally controlling every aspect of everything. When it does come, we already know what will happen: per-capita durable goods orders will react with a sharp drop-off followed by a weak and incomplete recovery, or perhaps on an inflation adjusted basis, no recovery at all.

So there are some real reasons to fret about bonds. And yet, these are still the good times. Read… Wave of Defaults, Bankruptcies Spook Bond Investors

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Financial correction, and unemployment, followed by a recovery in stocks, bonds, the financial sectors, and Mcjobs for those who, must to eat, work that cheaply.

Compounded by untenable both illegal and legal unskilled immigration. Creating a huge unskilled labour Glut.

Low wages due to a labour glut = low tax take, and no demand for anything but essentials by the masses.

Make pie bigger, or reduce the amount of mouths eating it, so that every mouth can get a decent meal.

Basic animal husbandry.

Growth in economy usually proportional to growth in population

Restrictions population growth bad for economy

We have much financial engineering not producing anything of value

Solution would be to use technology to enhance productivity of workers

Human innovation is a very strong force

It’s been growing exponentially since renaissance 500 years

There are two economies and two ‘recoveries’. The immigrant (legal or otherwise) and lower working class may account for much of the population increase, but almost nothing of the fruits of the recovery enjoyed by recipients of free fed money. So looking only at the per capita basis glosses over that rather salient fact.

The economy is broken because all the spending and investment has been misdirected to non producing activities. I’m in Florida and I see the big money here being used in highly unproductive ways.

They pour hundreds of millions into political campaigns that ultimately enrich just a few. The financial sector is busy scheming to create projects they can bribe politicians into endorsing and whose purpose is to create fees for just a few. The real estate developers build billion dollar projects with low wage labor and then turn them over to another set of low wage workers to oversee. The quality is irrelevant and the deterioration is immediate, but a few walk away with big money. The overall economy seems to run on wasting money to benefit a few.

…institutional furniture (got whacked)…

Furniture isn’t needed in the U.S. for workers whose jobs are replaced by automation or sent overseas.

Seems like the foundation of durable good orders might have the same problem as the new Bay Bridge suspension rods.

The economy feels lousy because it is. Get used to it. I don’t see it improving any time soon. We are nearing the end of our first lost decade or, arguably, our second. Trace back the indices twenty years and you’ll see we are right back to where we started. The last 20 years were built on a foundation of economic BS and there’s not much that can be done except having to roll around in it for a long time.

Lousy? It sure doesn’t look lousy based on all the people eating in restaurants and driving around in new bling.

I suspect there’s more loot flowing around that the current measurement models aren’t capturing. Perhaps because the peasants are learning to keep more loot off-the-books (but, who knows).

Lots of new cars with 84 month loans at subprime rates. Also more leased cars due to cheap monthly cost. Not a financial model that will work for very long.

When the price of gas dropped I saw more people eating in restaurants, as the price creeps back up there are fewer people dinning out. Just my observation at a very local level.

You should live in Louisiana! We never recovered from the recession.No raises since 2008!

exactly right cl. I moved my mother from the Midwest to the west coast about two years ago. We drove across country. Much of the country is not on the receiving end of the fake recovery.

The Midwest is still plugging along. But a lot of that plugging is from malinvestment in things like ethanol plants. Expect the Iowa caucus to be flooded with promises of more Federal subsidies to buy votes. Other states are dust bowls (CA, OK & increasingly TX) the Appalachian states are crumbling with the loss of fracking and coal, the rust belt is still the rust belt. Abandoned manufactories crumble under mass graffiti or have become vacant lots. And you talk about new cars and bling? Tosh. The economy never came back.