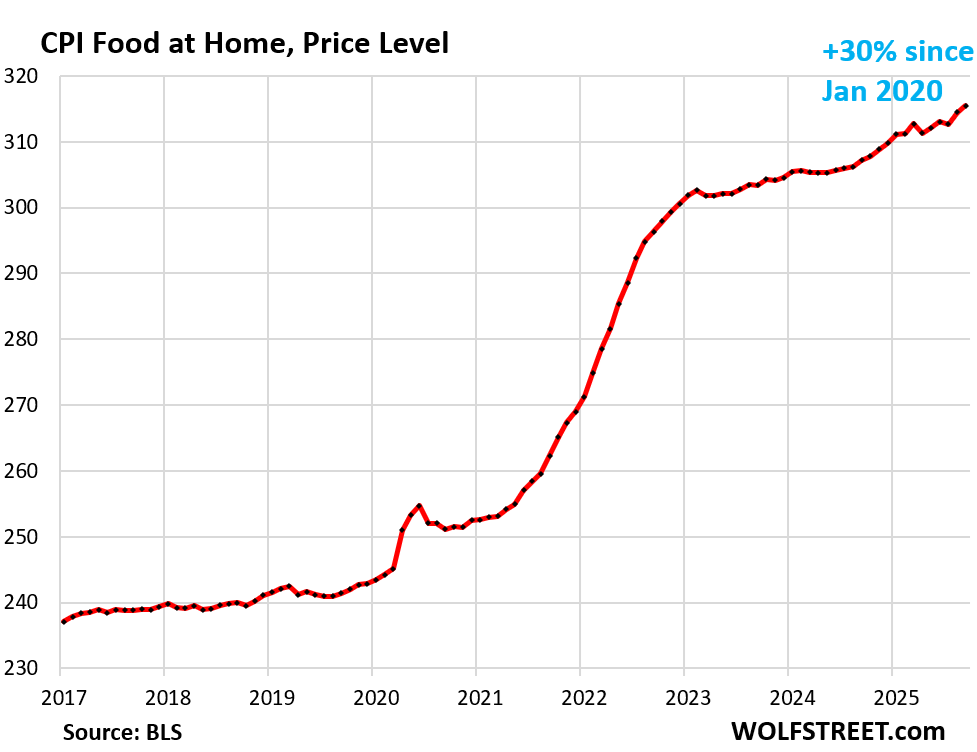

CPI for food at home has surged by 30% since January 2020. Food prices are nothing to be trifled with.

By Wolf Richter for WOLF STREET.

The CPI inflation index for “Food at home” rose by 0.32% in September from August (4.0% annualized), and by 2.7% year-over-year, the worst increase since August 2023, as per the data released belatedly by the Bureau of Labor Statistics today. Since January 2020, the CPI for food at home has surged by 30%.

The CPI “Food at home” tracks numerous categories of food and drinks that consumers purchase at stores and markets and consume off-premise, such as at home. But their prices don’t march in lockstep. Egg prices have re-plunged for months off their avian-flu spike and continued to drop in September. But beef prices soared. Coffee prices dipped off the huge spike. And dairy has been plateauing at very high levels. Hundreds of food and drink items form the overall food at home CPI.

This chart shows the price level of the CPI food at home: A surge in 2021 through 2022, a tiny dip in early 2023, and then continued but slower price increases that started re-accelerating in mid-2024. By now, prices of food at home have risen by 30% since early 2020.

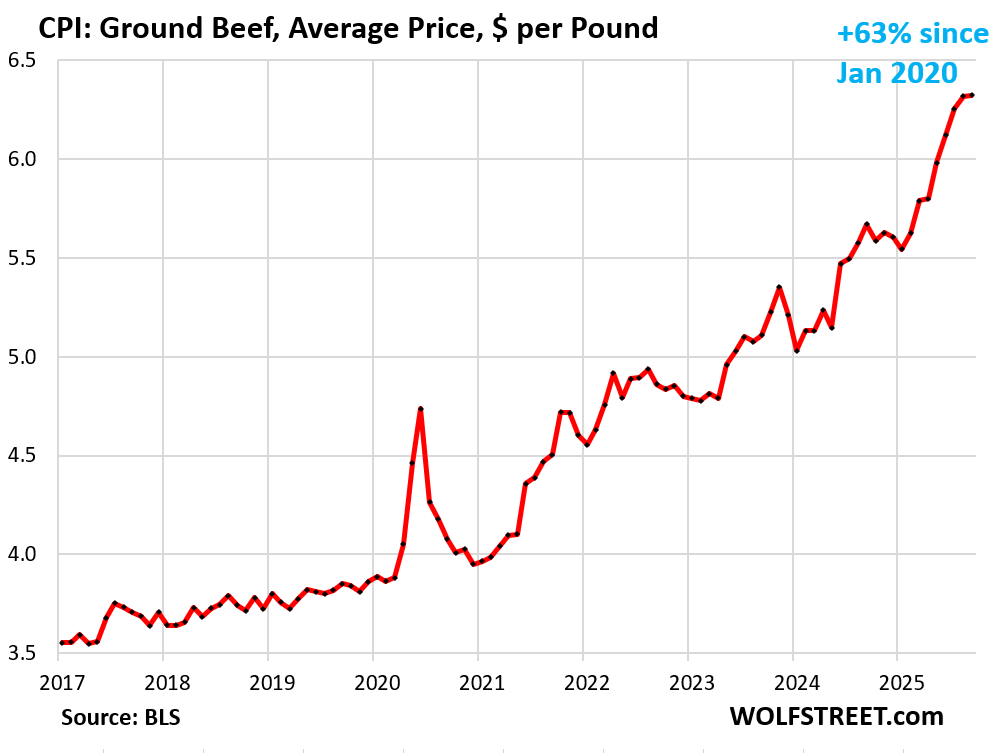

Beef prices have been soaring for five years, as the US cattle herd has dropped to a 64-year low for a number of reasons, causing tight supply. Americans’ demand for beef despite high prices has continued to push prices even higher. Americans gripe, moan, and groan about high beef prices, but don’t give up on their beef easily.

Overall beef prices spiked by 1.2% in September from August, and by 14.7% year-over-year. But there are signs that the multi-year surge is beginning to slow.

For example, the average price of ground beef, which had exploded by 63% since the beginning of 2020, ticked up only 0.1% in September from August, which got lost as a rounding error, and the price per pound remained at $6.32.

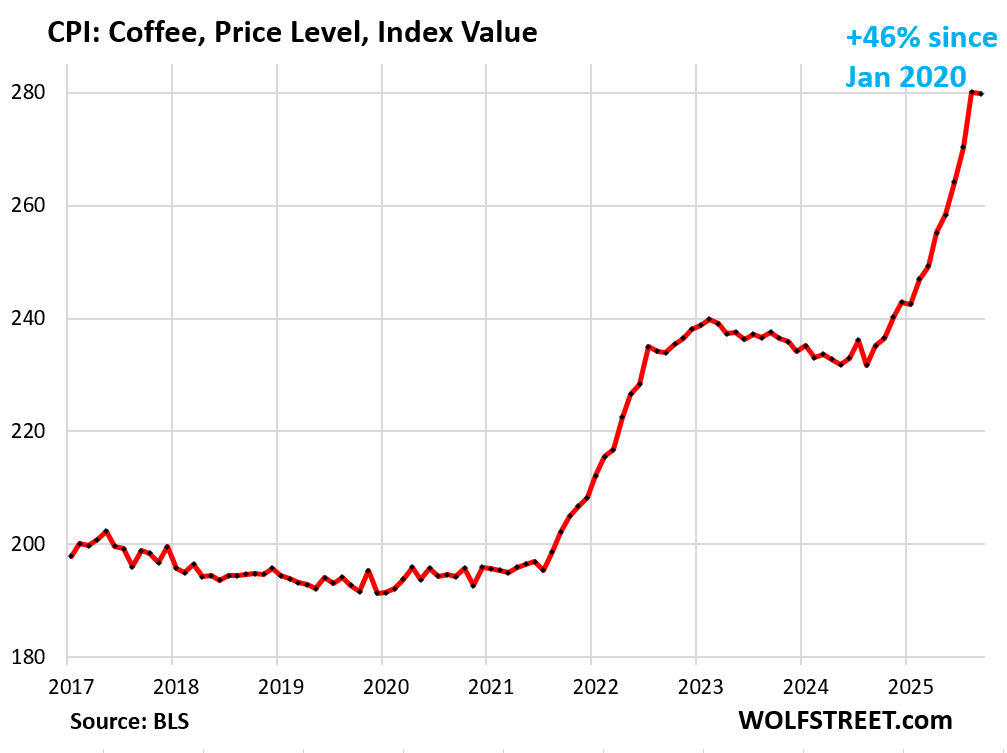

The CPI for roasted coffee – includes roasted whole bean, ground, and instant coffee – dipped by 0.1% in September from August, after the multi-year spike that came in two phases, roughly following with some lag global commodity prices of green coffee beans:

- +22% from Jul 2021 to Feb 2023

- +21% from Aug 2024 to Aug 2025.

Since January 2020, the CPI for coffee spiked by 46%.

Green coffee beans, as a global commodity product, are traded on various platforms, and prices are very volatile, often driven by fears of droughts, bad harvests, market forces, and now tariffs.

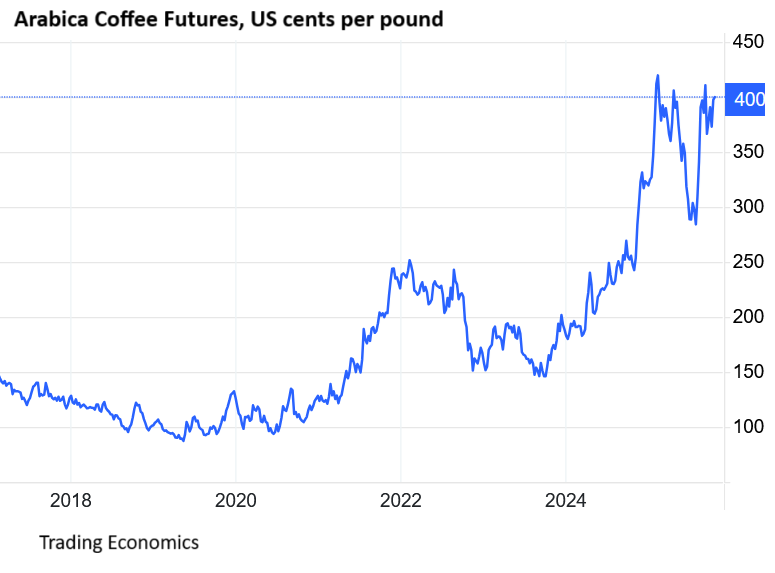

For example, Arabica coffee futures prices (chart below via Trading Economics):

- +150% from mid-2020 – early 2022

- Then they gave up part of that spike.

- +125% from late 2023 – late 2024.

- In 2025, they spiked, plunged, and re-spiked and are now just below where they’d been in early February, as futures markets reacted strongly to tariff announcements.

These are violent price movements that don’t pass through to retail prices of roasted coffee. Since early 2020, coffee futures exploded by 300% while the CPI of roasted coffee sold by retailers rose 46% over the same period.

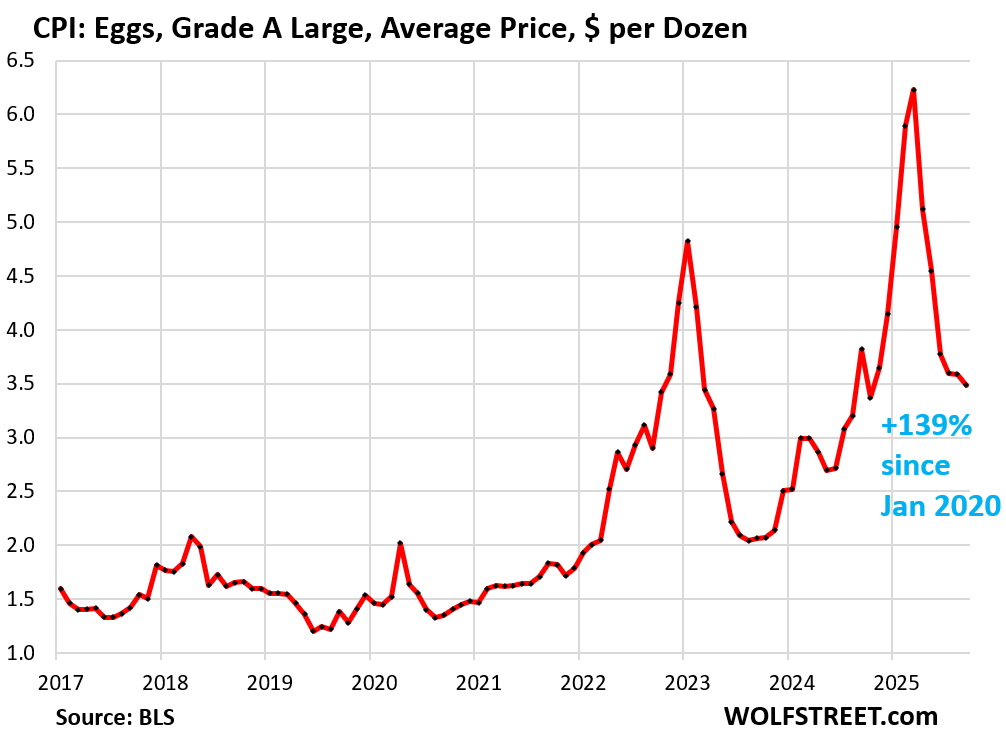

Egg prices have now collapsed after the spikes, but are still high. The avian flu came in two waves, the first in 2022 and the second in 2024, each triggering shortages of eggs, empty shelves, purchase restrictions when eggs were available, and huge price spikes.

The average price of Grade A Large Eggs had soared by 368% from $1.33 per dozen in mid-2020 to $6.23 at the peak of the second wave in March 2025. Since then, prices have plunged.

In September, they continued to fall, -2.8% for the month, to $3.49 per dozen Grade A large eggs, according to the BLS today. They have now plunged by 44% from the March peak, but are still 146% more expensive than they had been in mid-2020.

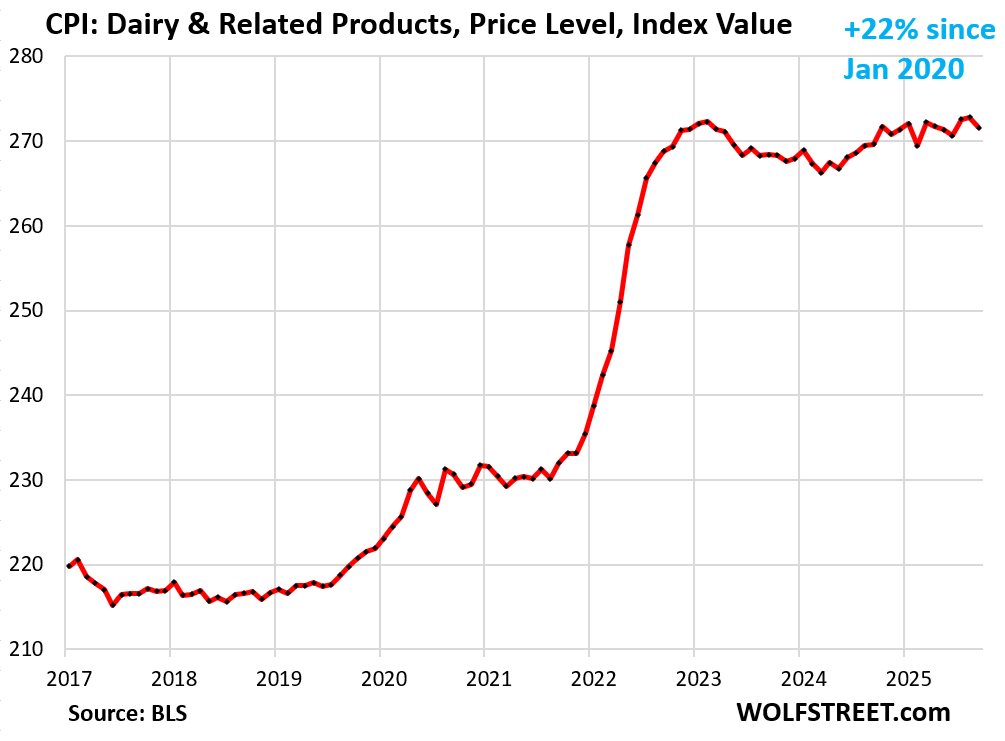

Dairy and related products were another shocker during the high inflation years of 2020 to 2022, when they spiked by 22%, and prices have remained at these high levels since then.

The CPI for dairy and related products declined by 0.5% in September from August, according to the BLS today. Year-over-year, it rose by 0.7%.

Major categories of CPI food at home.

Beef, coffee, eggs, and dairy are among the most volatile food categories. But there were other categories with price spikes, all for their own reasons. For example, prices of baby formula spiked in 2022 and 2023, amid shortages, suddenly putting enormous pressure on families with young children, while other consumers never noticed it.

The category “Coffee, tea, etc.” in the table below also includes tea and “other beverage materials.” The CPI for coffee shown in the chart above is just for coffee (ground, whole-bean, instant).

The category “Beef and veal” in the table is far broader than ground beef, the example in the chart above.

The category “Eggs” includes all types of eggs, not just Grade A large depicted in the chart above.

| MoM | YoY | |

| Food at home | 0.3% | 2.7% |

| Cereals, breads, bakery products | 0.7% | 1.6% |

| Beef and veal | 1.2% | 14.7% |

| Pork | 0.5% | 1.6% |

| Poultry | 0.1% | 1.4% |

| Fish and seafood | -0.3% | 2.1% |

| Eggs | -4.7% | -1.3% |

| Dairy and related products | -0.5% | 0.7% |

| Fresh fruits | -0.5% | -0.2% |

| Fresh vegetables | 0.0% | 2.8% |

| Juices and nonalcoholic drinks | 1.4% | 3.1% |

| Coffee, tea, etc. | -0.1% | 18.9% |

| Fats and oils | 0.3% | -1.7% |

| Baby food & formula | 1.3% | 0.6% |

| Alcoholic beverages at home | 0.0% | 0.3% |

Rising and spiking food prices, and these continued high food prices after a spike, cause a lot of hardship among consumers that aren’t rich who suddenly have to make all kinds of compromises to put food on the table. Food prices are nothing to be trifled with.

And in case you missed it: Massive Outlier in Owner’s Equivalent of Rent Pushed Down CPI, Core CPI, Core Services CPI: Something Went Awry at the BLS

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I stopped eating red meat in 2017 and I cannot fathom going back. Cholesterol dropped to levels where I am no longer at risk for needing to take medication, resting heart rate is in the high 40s/low 50s, I’ve gone from 285 lbs to 205 lbs, and my body just generally feels so much better. Chicken, fish and plant based proteins are 10x better.

Well done. The problem with red meat, particularly in the US, could he hormones and type of feed. We eat only grass fed several times a month, but our primary meat source is game – venison, wild boar, occasionally wood pigeon- and locally sourced chicken and turkey. We’re in our 70s and have never felt better.

@John,

Same here, People need to start reading labels.

One cup of milk has 16g of sugar.

Poison consumption of everyday foods is incredible..A large majority have ZERO Fiber and high sodium/calories, Fiber is key to slow carb intake so pancreas can process properly.

lots of veggies with moderate fish and chicken.

Have a fantastic weekend.

Sugar in milk is lactose and is naturally occurring. Unless you’re lactose intolerant or drinking a gallon a day, milk is great for building muscle and maintaining bone density. If you want less sugar plus more protein buy fairlife.

Since I’m lactose intolerant, we make yogurt and kefir at home several times a week. The cultures live off the lactose and convert it. The end product has so little lactose that I can eat/drink any quantity I feel like. Cheese and other dairy products also have very little to nearly no lactose.

lactose intolerance is “normal”. The majority of the world is intolerant.

Even cows get lactose intollerant when they are grownn uo.

that is you. Try feed the same to growing children and you will have a rebellion. Also, while it is marvelous to lose so much weight, low heart rate doesn’t translate to good health automatically.

It is possible to feed kids healthy food. Not only is it good for them when they are under your care, but long term they develop healthy diet and eating patterns. I do my best with my own kids, exposing them to lots of healthy dishes and a balanced diet. We aim for Mediterranean diet at home although we are not fastidious about it.

I agree. Healthy diet is important. We eat everything but no fast food, pizza, processed meats, or soda.

Beef is still very important too for children who swim everyday and need thousands of calories. The cost of protein is getting ridiculous. Wages did go up for many but not so for nonprofit organizations. This put pressure on a lot of families.

When we talk about car prices, we often ignore how much more expensive everything else have become. In comparison, car prices barely matched inflation. Food prices have gone way beyond inflation.

I don’t agree that beef is “important.” Anyone can choose not to consume it at all.

Serious doubt about resting heart rate in the 40s unless you are cycling 100 miles per week type of cardiovascular fitness. Which may be true.

I know a guy who has a low heart rate like that who is not fit and never was fit and does not have a healthy heart.

Below 60 bpm could easily be bradycardia, not usually a healthy situation outside the cohort of very fit athletes. It could mean an electrical problem in the heart.

Unless you’re a very tall individual your problem was being overweight and you’re likely still overweight so it has nothing to do with what you’re eating. Check your body mass index BMI for the truth.

That’s really a stunning currency depreciation relative to the most essential of essentials. Are there any historical parallels of this in American history? This is like 1780-1790 France level of economic disruption for 50%+ of the population. A massive and tangible decrease in the living standards of Americans.

1. “Are there any historical parallels of this in American history?”

Much worse, even in my time as adult. I remember them well.

In the 5 years 2020-2025, overall CPI +25%.

In the 5 years 1978-1982, overall CPI +58%.

In the 5 years 1973-1977, overall CPI +49%

2. “A massive and tangible decrease in the living standards of Americans.”

No, because you have to figure income into it, and it also surged.

Over the same period 2020-2025 that CPI rose by 25%:

“Disposable personal income” +40%

“Median personal income” +34%

“Median family income” +34%.

During the initial inflation spike, incomes rose more slowly than inflation, and people fell behind; then incomes rose faster than inflation, esp. at the low end of the wage scale during the labor shortages, and for younger workers, and people caught back up and then out-earned inflation. But obviously, older workers nearing retirement and retirees saw small increases in incomes. That’s always the case. Big wage increases happen in the prime working years.

In the 5 years 1978-1982, overall CPI +58%.

In the 5 years 1973-1987, overall CPI +49%

there’s a typos in one of these ranges..

Yes, thanks. “1987” should be “1977”

How does this play out in the real lives of working people as opposed to these median incomes. You used to do more reporting on the economic inequalities in US society as opposed to just these generalizations that are useful in understanding the broad state of the IS economy but less useful to see what is going on in the various stratum of US society

Median = in the middle. You make a list of 101 people by wealth, wealthiest on top, poorest at the bottom, and the #51 is the “median.” It means that 50 people are wealthier and 50 are less wealthy.

What people don’t get with the high inequality (wealth and income) in the US is that the people in the middle (the range around the median) are still fairly well to do with pretty good and rising incomes and substantially higher asset prices (homes, 401ks, etc.). Those are the numbers I gave you.

It’s just that the wealth of the top 10% has blown out, while the wealth and incomes of those below have also risen substantially but quantitatively not as much as the top 10%, which increased the wealth and income inequality.

This increase in inequality has occurred by the blowout at the top that exceeded the increases of the lower ranges.

People wrongly conclude that those below the top 10% don’t have anything and don’t earn anything, and this BS comes from an endless series of stupid-ass clickbait headlines.

While my food costs have gone up significantly, it is nothing compared to the inflation AND shrinkflation you’ll find when going out to eat. I have been meal planning since the pandemic, and love being able to control ingredients, portion sizes, and avoiding the tipping culture that has gotten so egregious and unpleasant.

I’ve never really liked eating out. I have no idea what’s in the food, how old the food is, how clean the kitchen is, or how it was prepared. My wife is a vegetarian. We cook a lot at home. I can make a shrimp or flounder meal at home in 20 minutes that costs 1/10th of what it would cost at a restaurant. And I get to avoid driving, parking, waiting to be seated and that long wait to get my bill. Our eating out time is usually associated with social time with friends.

Our food costs, both groceries and eating out, make up a small fraction of our household income, so we don’t really notice the price increases. Not to mention we shop at Aldi, ethnic stores and privately owned fish houses where prices are low to start with.

Shrinkflation is the one that really gets to me. 64oz to 54oz and now 46oz orange juice? I’m done buying from companies that pull that.

Thankfully I am pretty much food independent and grocery shopping is just for a few “luxury” items that I can’t easily make, but I know most aren’t so lucky.

I noticed Gatorade bottles used to always be 32 oz and are now 28 oz. LOL

1. For CPI, this stuff is measured by the ounce, and the package size doesn’t matter.

2. they haven’t been 32 ounces in years. For a while, they ran both 32 at Safeway, and 28 at Walgreens (I know because we buy this stuff for our long hot hikes, sometimes on the road). Then the 32 vanished from Safeway too, that happened years ago, I think well before the pandemic.

We had a family dinner for 4 at Chile’s a few weeks back- even with no alcohol dinner with tip still came to ~$83. And the food was just okay. My wife and I both agreed we won’t be doing that again anytime soon.

$83 is not expensive for 4 people. They need to pay salaries and rent with that money. Less then $20 will be for the stuff you’ve consumed.

“$83 is not expensive for 4 people. They need to pay salaries blah blah blah”

Inflationary mindset right here.

IIRC, I used to pay over $200 for four people for dinner at Ernie’s or The Blue Fox back in the early ’80s, so, no, it’s not just inflation, but ya gotta understand what you are getting and the entire experience. We like to go out once in a while and splurge, so different strokes for different folks, eh!

Been hearing recent prices like that for four people at the big mac place, and THAT might be inflationary as we used to pay $0.25 USD for burgers there,,, LOL

‘course I will always remember gasoline for a dime a gallon in SoCal during the gas wars of the early ’70s!

Keep it down @John. If people start realizing these articles come with free health advice Wolf is gonna add a paywall

Vegetarianism is much cheaper and healthier.

That’s how Bill Walton ended his career – becoming a vegetarian

For the less affluent; food shelter and energy form a large part of cost of living. CPI figures become meaningless. They feel the pain.

CPI figures include food, shelter (rent + OER), and energy (gasoline, electricity, natural gas, heating oil, etc.). In fact, CPI is dominated by those three. Combined those three account for 54% of CPI.

Wolf, in some articles you mentioned “hedonic adjustment” for inflation, i.e. price for Toyota Corolla went up $1K, but it now has Blutooth, so the price did not actually increase. Do they play tricks like this with food, shelter, and energy? Can they “adjust” prices of eggs, or butter, or heating oil?

Bluetooth capability only costs about $10.

andy,

Your Bluetooth example is obviously a joke. In reality, an F-150 went from a three-speed automatic to a 10-speed automatic as standard equipment. So that’s just one item of improvement. There are countless improvements on a modern vehicle compared to the POS sold 30 years ago.

Hedonic quality adjustments are not used for food at all.

Here is more information. The article contains a link to the BLS list of products with hedonic quality adjustments.

https://wolfstreet.com/cpi-hedonic-quality-adjustments-for-new-used-vehicles-consumer-electronics-other-products/

Alcohol CPI reduction:

Beer: This is easy to do at home, switch from fancy beers to malt liquor, some have a smooth taste with a real kick at the end.

Wine: Fancy wines can be substituted with the fortified variety; you can read the labels all over the areas where people are enjoying America’s ridiculous housing price alternative by using the nation’s coast to coast outdoor camping facilities; i.e., homeless.

Gary…..,Colt 45 and Boones Farm it tis!

Actually,I always liked Colt 45 so no suffering here!

Perhaps ironically, in my mind anyway, the “conservative” thing to do is to manage one’s affairs first, for example by eating healthy, and by disciplining oneself not to fall into drug addiction (“just say no”). Yet here we are subsidizing Argentine beef, and attacking Venezuela (and confronting Canada?) for supposedly shipping or enabling illicit drugs here. Mention of food prices seems to be far down someone’s list, in the halls of government. Meanwhile, on the menu politically are alternative “problem solvers” I find unpalatable.

Maybe it is far down the list because Trumps inflation is on pace for his 5 years at 7.8 vs Biden at 23% … We had 10 major spending bills in 4 years 2020-2023 only to be beaten by World War 2 …. both parties share that gasoline … democrats pushing green deals we did not need that hurt energy hurt … and we took to long to reverse COVID rent and housing rules which drove up costs that further made inflation “stubborn” …

Argentine beef…reason is two fold. One, they have a historical problem with economy, so we help, BE CAUSE, WE WANT cheaper beef. Importing at lower cost, we drive down beef prices. Prices are high because we will pay, so why would the industry lower their profit margins? They won’t, but now, they’ll all complain because their is competition. We, the consumer benefit.

Argentinian beef is less than 2% of the beef supply in the US and will do nothing to ‘drive down’ beef prices at all.

I would like to see a post making an effort to (very broadly) break down the input prices of beef.

I’m willing to believe that the fairly mind-boggling shrinkage in US beef consumption/cattle herd since, say, 1970 (near the peak I believe) is at least partially due to changes in US consumption patterns (chicken healthier than beef, targeting of cholesterol, etc.) but the scale of the herd shrinkage and the escalation in prices really makes me think there must be additional factors at work (vanished tax breaks? just in time cows?, beef packer concentration?, competing demand from overseas?, etc.).

In many ways, beef and chicken have swapped places in the American diet since 1970 – which is fairly dramatic if you think about it (macro changes in things as fundamental as diet tend to occur pretty darn slowly).

Again, I’m willing to believe that health campaigns played a role – but the shift is so profound I think there must be more to it – and cattle raising would not seem to have a massive number of inputs/complex supply chains (compared to, say, a car). Yet the supply has dramatically evaporated since 1970, with prices accordingly going up – the only question is if this is really 100% due to organic (vs. price driven) demand destruction.

induvial might have cut back on beef, but over those decades, the population grew a lot, and beef consumption grew with it. I just looked that up the other day.

Remarkable that the 3% CPI print is met with analysts predicting more rate cuts.

Its as if the world is upside down.

The Fed has morphed from stable prices to 2% to 3% deserves a cut!

Where is the economic journalistic intellectual inquiry?

The “hey Mr. Powell, what about this, and this and this?”

I’ve read somewhere that central banks had a 1% ‘ceiling’ for inflation (because PhDs know low inflation is better for the economy). Then it was a 2% ceiling. Then the ceiling became a ‘target”. I’m waiting for Fed governors to tell us a 3-4% target is better for the labor market.

Pretty much all of that is stuff you hallucinated.

The prospect of 3% target became a hot topic ~15 years ago because we discovered that a 2% target doesn’t allow rate cuts to overcome severe economic shocks, thus forcing QE.

“The Price Spikes of Beef, Coffee, Eggs, and Dairy”

Let them eat lamb. If you still believe the old government health propaganda then eggs – or at least their yolks – are bad for you. So is dairy.

Of course those taboos were based on a mixture of no evidence and dishonest evidence, but that didn’t stop many governments from advocating them. Cholesterol as poison – dear God, what nonsense.

You would have been better off taking your dietary advice from Jeeves – eat fish aplenty. Or from me: eat a mixed diet because it protects you from dangers the medical trades understand, from dangers of which they are ignorant, and from spurious dangers which they entirely misunderstand.

Also mixed diets are more fun. Which is an important point in at the joyless, puritan world of dietary advice.

There’s plenty of evidence showing increased risk of mortality with moderate to heavy egg consumption in patients with higher risk of cardiovascular disease. Certainly something that can be discussed with one’s doctor. Regardless, most people understand a well balanced diet, like the mediterranean diet, along with exercise and good sleep hygiene is the way to go.

As long as your mixed diet includes fruits and vegetables in abundance, and avoids white carbs, added sugar, deep fried and processed junk, then you’re good. Also meat in moderation, but fish a’plenty as you say. Dietary cholesterol has minimal impact on serum cholesterol (sounds like you know this), and this is widely accepted nowadays by the medical community.

Still controversial: Though saturated fats do raise serum cholesterol, they may not be as bad as once thought (though I think red meat more than small amounts is bad for other reasons). PUFAs from seed oils may promote atherosclerosis and other inflammatory conditions because the omega-6 fats promote upregulation of certain pro-inflammatory oxylipins. MUFAs prominent in the Mediterranean diet don’t do this, and omega-3 fats in fish counteract it, and these ideas are less controversial.

Seed oils, corn syrup, and refined/bleached flour are the worst things you can eat and they are found most in most processed foods at the grocery store.

Saturated fats raising cholesterol (LDL) may or may not be a problem, depends on the individual. The garden variety cholesterol test only measures the weight of ALL the LDL particles. That’s just barely above useless. The LDL needs to be broken down into categories, small/med/large. The small dense LDL are the problem. You can have modest LDL but with high concentration in small LDLs, and it’s 6x higher risk for heart disease. Some people produce a lot of small LDL from saturated fats, some don’t.

Bottom line, junk your doctor’s cholesterol test and pay (out of pocket) for an “advanced lipids” (called NMR at Labquest). That OR get your ApoB measured, which is kind of a shorthand for all of this. >90, you have issues. <90, good. <70, great.

Agree. The older cheaper way measures LDL cholesterol (LDL-C). NMR measures LDL particle number (LDL-P). ApoB is a proxy for LDL(+VLDL)-P because there is one ApoB molecule on each LDL and VLDL particle, and it’s a cheaper test than NMR. It’s the particle number that really matters. The reason LDL-C does work (though is inferior), is that at a population level, it correlates pretty well with ApoB. But for some individuals, it will make the wrong call.

my Dr. says the ratio between the good and bad cholesterol is the important metric.

physical activity raises the good cholesterol, so I am told.

JJ, your doctor is wrong. The ratio is barely meaningful at all. It is (almost) all about your small LDL particle count and/or your ApoB. This isn’t even disputed anymore, it’s an issue of a lot more depth of understanding required and very very slow dissemination of that info among docs.

This has been known for 15-20 years (and I have been personally involved for that long). Don’t believe me, use the AI engine of your choice to research it.

Gatto

Doesnt the good cholesterol flush the bad cholesterol?

And doesnt exercise increase the good cholesterol??

AI doesnt think, it only can spit back what someone put into it.

JJ, by “good” you mean HDL, and no, it doesn’t work that way. The role of HDL isn’t completely clear (but there is definitely a correlation between higher HDL — but not too high — and lower cardio risk. The roles of the various sizes of LDL particles, however, are very clear.

AI is actually very useful for this subject, as it digests thousands (millions?) of pages of research. Ask it for citations/references to back up what it says.

Gatto,

JJ is actually right about avoid consulting AI for health information here or at least be very careful with it. We learned about this in glaring way from a health IT expert who did a demo showed us the flaws of even the best AI’s and how it can deliver correct appearing but seriously false info on these topics. As he explained, even though you are right the AI can do an amazing job of digesting and summarize thousands of pages of research, it gets confused on the actual accuracy and cannot actually evaluate what’s true, what’s false and which papers just have bad data or wrong conclusions.

In fact the AI can make things even worse by over-emphasizing apparent claims that just appear a lot or once had some favor, but turned out later to be debunked or got disproved. And even worse, it’ll dress it up so looks authoritative even though wrong. Not at all disagreeing with a lot of what you put here I’ve heard this too about the LDL, and AI can be OK to do some general summaries esp for things well established or maybe mention things easy to miss. But it can be a huge problem when try to make suggestions based on what’s true and false because that’s extremely hard to evaluate. And also unpredictable, this can completely change with each new model and new training.

As being fair it’s hard even for professionals to do that, it’s why they specialize so much over so many years and have to use their expertise, knowledge and experience to go through the data and figure out what’s accurate or not, it’s why they have these expert reviews. Would just suggest, be careful with the AI here and use it with great caution. We haven’t used it much for health but for a lot of other topics in just procurement or supply chains we run into this, it can do well to read a lot of things and summarize but there are huge problems to figure out what info is good and what’s bad. And even the top AI researchers admit you can never really solve this even if you built a huge data center using up all the power in the city for a day, it’s just one of those things doesn’t have an answer you can just program or train on.

If you’re listening to anything random people say about health on an economics blog, you’re not doing it right.

$37 Trillion of federal debt will be repaid with inflated dollars.

Rising food prices just another symptom of money printing.

There is no ‘money printing’ going on whatsoever, and the Federal Reserve continues to SHRINK its balance sheet.

Most money is created by banks by writing loans.

One of the weirdest conversations I ever had was talking about how banks loaning money increases its supply (like a basic economics thing used to estimate how the reserve levels impact the ultimate multiplier of dollar creates) and got a weird rant about how that’s Keysian economics and thereby wrong. Like out of left field. I learned to stop talking to that person about economics.

It’s the interplay within the entire banking system of rising collateral values triggering bigger loan values which trigger bigger deposits (cash for banks) that create money.

This can only happen in the banking system overall. An individual bank cannot create money to lend, it MUST HAVE the money already (cash, reserves) that it then can lend out. A bank that runs out of money collapses.

@Wolf – I have never understood this in any detail (how banks loans etc end up creating money). Would love to see a full article about it. Or maybe point me to an explainer. I have heard you say this before and tried to do my own homework but failed.

It doesn’t matter whether or not we understand all the details of it. It’s part of how the modern global economy functions. Just forget about it. I don’t understand why people get so hung up about it. I mean, gold bugs, sure, they want the price of gold to explode, so they will say anything to get there. But in reality, it really doesn’t matter.

“$37 Trillion of federal debt will be repaid…”

Brewski: Thanks for the laugh!

Refinanced? More accurate.

Also? You’re already a Trillion behind!

We went on the Mediteranian diet a few years back and it appears to be working pretty well. We only eat red meat on special occasions and then it’s usually roast lamb vs beef. Most restaurants have lowered the quality of their entrees and increased the price so it’s made it even more expensive to eat out though we still do especially to view sports events on a big screen TV, or listen to live music.

This 30% increase in food at home since Covid money printing, does a pretty good job of framing the overall loss of purchasing power in general.

Of course, different rates of inflation for different products and services, but keep in mind that inflation of prices and wages after a steep increase in the money supply is a messy and somewhat unpredictable process across all products and services. And it takes time to finally adjust out.

I’ll say it again for all the Fed washers, This massive inflation impulse was no accident or stupidity on the part of the Fed and Biden administration. They took advantage of the Covid shutdown to do what has been difficult to accomplish in the past….place trillions directly in the hands of the spending public.

The COVID money printing machine was started under Trump 1.0

There are many stories of business owners getting new GMC trucks with PPP money that never had to be repaid.

Yes the response to the pandemic was strong and way more than enough what made it worse using your logic and statement is Biden adding 5 more spending bills 21.22 as well as extending rent and housing rules instead of reversing them along with energy restricting policies that have driven up a large input factor for goods and transportation …

Im not going to get into a partisan mud fight with you. Both administrations spent wildly from 2020-2022 and The Fed exacerbated it with massive QE in 2020-2022 which has damaged housing to this day.

You must be new here.

“Hamburger Helper” was introduced by General Mills in 1971[2][3][4] in response to a meat shortage and rising meat prices.“

And everyone is overweight where we need weight reduction drugs.

But anybody who has grandmas or great grandmas recipes is going to eat good without meat all the time. Example: Pasta Vazool, Jambott.

You know what they could do with bones! Pigs feet, tripe, livers, etc.

Like the Randy Quaid said in the movie…

“Hamburger Helper…..its purtty good all by itself.”

Why stop with red meat? I stopped eating around 2017 myself. So far so good. Look at the money you will save.

I have always said I wish I had the appetite of a snake and only eat once a month. Not only the money you would save but the time….we spend so much time gathering, prepping, and cleaning. That being said it sure is hard to beat a good steak but at these prices I will have to settle for a pork chip.

Rusty,are you on the meth diet plan?

Highly recommended as you lose desire to eat/have a lot of nervous energy that can be used to get a tooth brush and scrub the house and……,you stick with it your teeth fall out and thus you ever decide to eat again you will still be thin due to a liquid diet.

Kudos to you!

Americans, for no cogent reason, seem to abhor eating rabbit. Easily raised, low in cholesterol, tasty and nutritious, it is never seen in supermarkets. Instead we dote on those disgusting, chemical laden, garbage called chicken nuggets and boneless wings. This, made by centrifuging left over chicken parts such as necks, backs, feet etc. and combining the ‘grey slime’ coming from the centrifuge with soybean, and other fillers then extruding this and calling it chicken. Lamb is another alternative. I never see lamb in the markets except around easter and sometimes in the fall. Are we so programmed by the chicken and beef industries that we fail to enjoy lamb year round ? I personally have tried the veggie based meat alternatives and a couple of tries was enough for this lifetime.

Rabbit used to be poor man’s food in Britain. There was a story – true or not I don’t know – that lots of rabbit in your diet was bad for you: too much protein, not enough fat. Google’s AI says:

“Protein poisoning” or “rabbit starvation” is a form of malnutrition that occurs from a long-term diet extremely high in lean protein (like rabbit) but deficient in fats and carbohydrates. The body cannot process the excessive protein without enough fat and carbs for energy, leading to symptoms like diarrhea, nausea, weakness, fatigue, and headaches. It is caused by the liver being overwhelmed with the metabolic byproducts of protein, such as ammonia and urea, and the lack of essential fats for energy.

Whether this is an AI hallucination I can’t be sure. I’m suspicious of AI because the first question I ever asked of google’s AI got a reply that was simply untrue. Counterfactual. Might as well have been a deliberate lie.

Eating only lean meat, and I mean ONLY lean meat can cause issues that the Goog mentions. This was an issue for 17th-19th century trappers and during the Dust Bowl when people turned to jackrabbits (prairie/desert hare) as a primary food source. The stigma on eating jackrabbits exists to present day. Fine with me, i like a good desert hare chili.

A diet of wild game (or very lean red meat) requires fat be mixed in, additional specific carb sources, and consuming offal. Dried game pounded together with bear fat and fruit is ubiquitous in native diets for a number of reasons, this phenomenon being one of them.

…don’t forget to remember to inspect your game for signs of tularemia, etc…

may we all find a better day.

Is that pemiquinn Elder?

My wife is spending $466 in food every week.

We are a family of 5 in Petaluma, CA.

This feels like hyperinflation.

It feels like an act of war on mankind.

I once went grocery shopping with my wife. As the cashier rang up the bill, I told the cashier the bill was absurdly high. The cashier said nothing back to me.

If I was the cashier I would print out a stack of M2 graphs from the FRED & give it to every customer who complained about the price.

Learn to be a savvy shopper and don’t just throw whatever you like in your cart regardless as to price and your bill will be far lower next time.

Yes. I only buy BOGOs. As long as you’re not picky, it works out well.

What was the point in complaining to the cashier? When I worked retail eons ago, I hated that kind of thing.

My family of 3 – me, wife and dog get freebies from a local church. Stuff that’s still good just past the expiration date. They ask for an id but no financial info.

Next month should be a big score with Thanksgiving around the corner.

Sacramento refugee in Petaluma

You should start looking for groceries online. There are online-only grocers in the Bay Area that may deliver to where you are.

If you buy at Safeway, you will get screwed.

Trader Joe’s can be better on some stuff. Costco has high quality stuff at fair prices with lots of good deals, but often in large quantities.

A lot of the food inflation comes from stores like Safeway/Albertsons that have pumped up their profit margins, and not from the good itself.

Albertsons, which owns Safeway, has a gross profit margin of 27%. Costco has a gross profit margin of 13%. So you see where you get ripped off because you’re paying for that inflated gross profit margin at places like Safeway/Albertsons.

We buy lots of stuff in bulk, such as different kinds of rice, beans, including soy beans to eat and for tofu, lentils, quinoa, chickpeas, etc. Saves huge amounts of money. Think 25-pound bags. If you buy this stuff in boxes of 12 ounces, you’ll get ripped off.

Wolf,

I will have the wife check it out & give it a try.

Check out Weee

Costco/Walmart

Trader Joe

Hardly shop anywhere else.

Quick note about bulk-buying: always compare the unit price.

Captain obvious, I know, but I’ve found many scenarios where the unit price of store brand generics at the local grocer (or Walmart) is cheaper than bulk-buying the name brand at BJs (which doesn’t always have a generic option).

Grocery Outlet is your friend!

Those are large figures, but if salaries and revenues rise in line with inflation, my understanding is that this would erode the burden of our debts, which should be beneficial in the long run. Am I overlooking anything?

MW: Why 10-year Treasury yield may hit 6% in next year or two on ‘problematic’ inflation

I would love that to happen.

and they will be slow to identify and slow to react. We’ve seen the movie before.

Quick to cut, slow to raise.

And it is good that “cumulative” charts of inflation are presented rather than rate of change charts. The cumulative damage should be in full display. Hardly 2% per year.

#ShortTLT

The most remarkable aspect of inflation in the USA, UK etc. is that inflation in China-mainland (PRC) has been close to zero or negative; it is strange because China-mainland buys food and other commodities on the same world markets and makes all the same goods that are imported by the USA, UK etc.

My personal guess is that like the other periods of high inflation that out blogger has mentioned in a previous comment this period has been a government and establishment policy to substantially cut labor costs in real value. Even if and actually because some nominal wages have been rising; in the UK also thanks to booming immigration most wages especially at the lower end have risen less than inflation.

Note: official inflation indices significantly underestimate cost of living increases even if not by the more extreme estimates. In part this is because inflation indices are designed to measure “inflation” of the money supply rather than increases in the cost of living for average people.

Most of the inflation in the US and the UK is in services (housing, insurance, subscriptions, etc.), which are locally produced. There is littler inflation in manufactured good. There is also inflation in food and energy from time to time.

“The most remarkable aspect of inflation in the USA, UK etc. is that inflation in China-mainland (PRC) has been close to zero or negative;”

«Most of the inflation in the US and the UK is in services (housing, insurance, subscriptions, etc.), which are locally produced.»

That is part of my point: that most inflation is from local USA, UK etc. businesses discovering that they can increase prices to reduce the real value of wages even when the global wholesale prices do not increase (they did increase as documented in this post for some agricultural commodities). Among the services there is retail of manufactured goods and food items. In the USA many wages have grown as fast as prices or more, but many have lagged cost-of-living prices, in the UK most wages have lagged.

An important aspect of the story is that while retail prices of goods and services rose (sometimes more than proportionally) as wholesale prices rose, when wholesale prices fell retail prices did not fall or much less, baking in a shift in pricing power between businesses and workers.

Note: energy prices in the UK and EU have risen much faster than in the USA as the governments of UK and EU boycotted lower priced russian supplies to prefer much higher priced USA supplies, so that made a difference.

Finally, a place where I can bitch about the price of yogurt!

The yogurt section is now like buying a bottle wine — no, wine has gone up too — but a friggn quart of decent yogurt is like almost $7– I thought Trump was going to make groceries cheap again, day one — instead of pretending the cost of living isn’t an issue. What a surprise.

Nonetheless — what a trifecta of problems in cow town: “The avian influenza (H5N1) outbreak among dairy cattle is exacerbating existing labor shortages in the dairy industry, which is heavily dependent on immigrant workers” then, tariffs drifting in with fertilizer costs and assorted unimportant farm stuff — all of which contribute to me dropping out as a consumer, on more and more items.

As an anecdotal aside, I’ve noticed several areas in my grocery store adjusting to inflation– fewer items are stocked, to reduce shrink, less supply, higher prices, less demand — but also, various cheaper brands eliminated, with a focus on higher profit margin — which is also happening with stuff like toilet paper — store brand eliminated, and you’re forced to buy a larger quantity at higher price.

As a sad state of affairs, I stoped buying candy then shifted my focus to ice cream — but now the cows want more money ….

I’m a super cheap bastard, always looking for deals — but the grocer is making this a harder game.

I’m super grateful Trump made things cheaper:

Trump Promised Lower Food Prices On Day 1, 99 Days Later Has Delivered The Opposite

Wait, that should read, As of October 25, 2025, Donald Trump has been in office for 278 days of his second term.

Buy the milk and make your own yogurt. It’s a breeze. Takes about 8 hours to ferment in a yogurt maker. And it’s delicious and a LOT cheaper.

Buy online (produce, frozen fish, bulk legumes, etc.

Be smart, don’t be a laydown. You’ll save a ton of money.

+1 with Wolf. I make my own yogurt. Cost is that of a gallon of milk (about $3.50 in my area). I get somewhere between one and two pounds of yogurt. For the same money, I would get 14-16 ounces of a lower end yogurt.

And I can also drink the whey byproduct.

Whey + a little vinegar + a little tomato paste = Bloody Jane in our household, drunk from shot-glasses while standing in the kitchen.

What I see in that food CPI chart is 25% total inflation from Jan ’20 to Jan ’23, followed by 5% total inflation from early ’23 to late ’25. So as long as we avoid all the dumb choices made in 2020-2023 we can avoid food (and other) hyperinflation again. The overblown pandemic response, QE mania, 3% mortgages, “Stimmy”, endless trillion dollar government rescue bills for people, businesses, cities and States. This is what caused all the problems, and now it’s essentially over.

There will be a lot of pressure to do it again at the next recession. After all, it “worked” once, no?

On another note, it’s amazing to me that the market can drop 1% based on threats of tariffs on China, then recover it based on “hopes,” and then go up another 3% based on no tariffs.

The valuations are getting even stupider and stupider. I’m debating when to get my put options in place, something I haven’t done in years.

“First review (July 2026): On the sixth anniversary of the USMCA entering into force, a formal joint review will be held by the Free Trade Commission.”

Will Trump threaten and/or pull out of the agreement. My guess is yes. Will it affect the prices of beef, produce, cars? My guess yes.

Will food prices be sticky high? My guess yes.

The Nikkei jumped after Sanai Takaichi became the the first female

Japan PM. She is tough like nails. She is Maggie Thatcher of Japan. Trump plus Takaichi vs Xi.

Food inflation is a very big systematic problem. Just avoiding eating out, vegetarianism and not eating beef cannot solve inflation. Low carb or keto diet is better than carb rich vegan foods. In general, keeping bodyweight with in BMI is a very good thing. However, healthier foods are costly than unhealthy food. This brings me to another question, SNAP benefits will run out in many states by October 31st. Do you think this will cause food prices to go down?

Why would food price go down at all? Perhaps retail sales will fall, but lowering prices would have no impact at all on that.

Inflation is rising in Japan, primarily due to increased costs for imported goods and food — kinda sounds familiar.

On October 21, 2025, upon her election, she announced that her government would compile a stimulus package to address rising costs of living.

Almost like Trump promising lower food costs …

The Mediterranean diet is a good plan. And you can save a little money by buying 2 percent milk as opposed to whole milk, as it’s lower in fat and has the highest level of calcium.

Come for the Economic analysis, stay for the fistcuffs between diets in the comment section.

That was the biggest AI-palooza on Wolf Street ever. That Battle Royale of the AIs

Giant Food here in the Washington DC Metro area has Sushi Wednesday. I go there every Wednesday and load up on Sushi for the week. For $4.95 you can get any kind of Sushi you desire, 8 pieces, and it contains enough for a good lunch or late snack. Add some hot Wasabi, and soy sauce, and some garlic chili oil and you are on cloud 9. As Wolf has said many times, the way to beat food inflation, or any product inflation is to STOP BUYING the item and switch to something else.

Get one of those sushi making kits from Amazon and make it yourself it’s even cheaper and much fresher and delicious! I do California rolls with crab or chicken and can eat for several days as much as I want. It’s super easy to do.

Similar to real estate, when it comes to food, location matters. Regardless, the easiest way to a bloody revolution is through starvation. Hence the decades of kickbacks and bailouts for farmers.

Most Americans should probably be eating 30% less food.

Just sayin’ (my scale is too).

Scarry Sh*t (The Halloween Song)

Cloney said to Boney

“I really dig your grave”

“But get yourself some burgers,

You’re like a dietary slave”.

Spooky Dookie!

Spooky Dookie, spooky dookie, spooky dookie.

“Pick yourself a cola,

And get a bag o’ fries.

Don’t listen to them doctors,

They’re paid to sell you lies”.

Spooky Dookie!

Spooky dookie, spooky dookie, spookie dooky.

Telephones are ringing,

Coroner takes the call.

“We got another body,

Looks like a choke and fall”.

Spooky dookie!

Spooky dookie, spooky dookie, spooky dookie.