The Condo Bust is spreading, after the most extraordinary Condo Bubble maybe ever.

By Wolf Richter for WOLF STREET.

Fairly steep declines of condo prices have been spreading to more and more cities. Here we’re looking at prices of mid-tier condos in some of the bigger cities.

Condo prices in the markets on this list have dropped by 12% to 28% from their respective peaks in 2021, 2022, 2023, or 2024. Each city has its own chart below, with some additional data. Prices through September, seasonally adjusted.

The 23 bigger cities where condo prices fell 12% to 28% from their peaks:

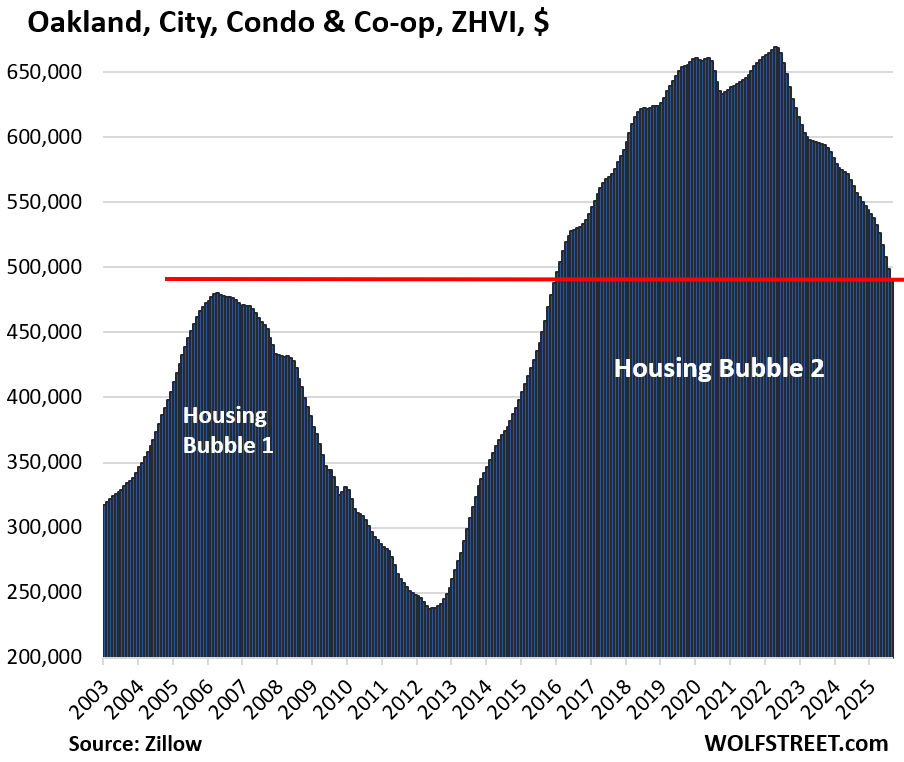

- Oakland, CA: -28% (2022)

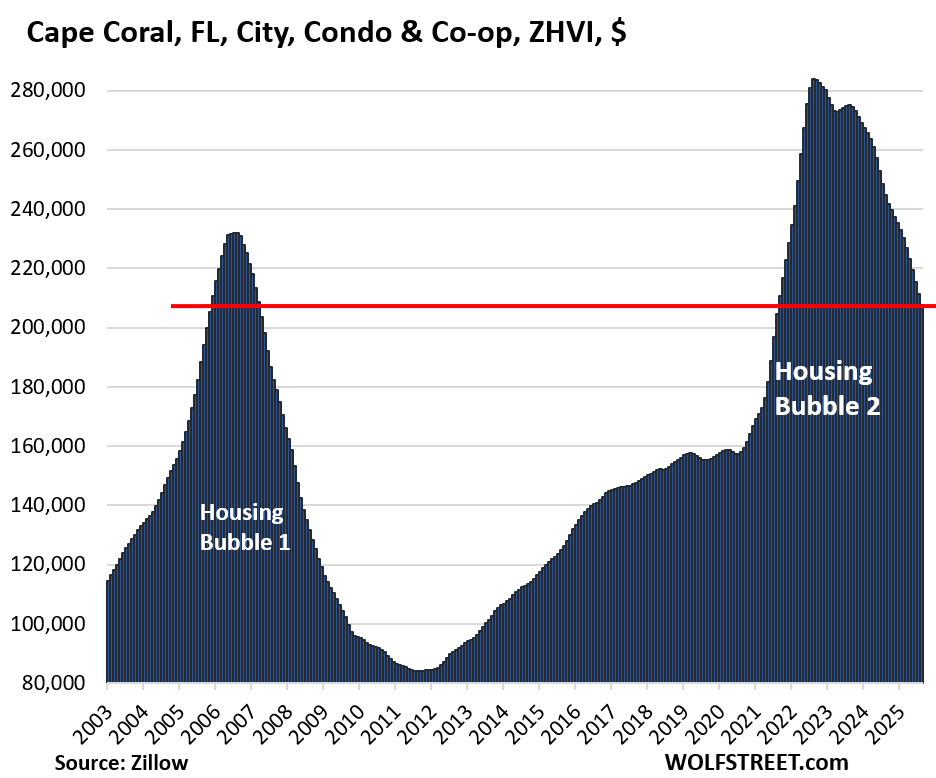

- Cape Coral, FL: -28% (2024)

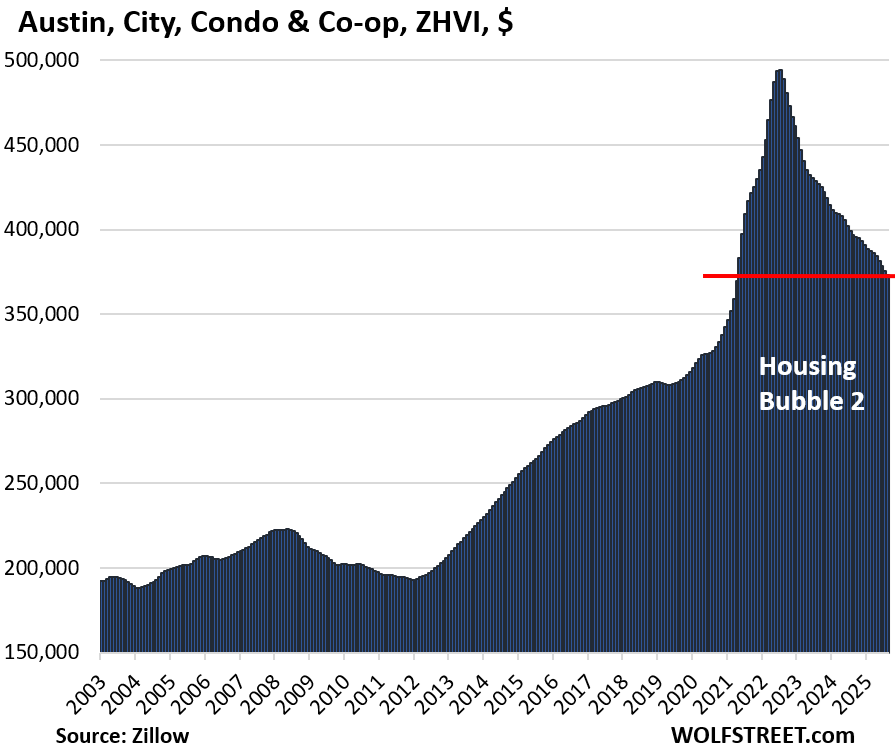

- Austin, TX: -25% (2022)

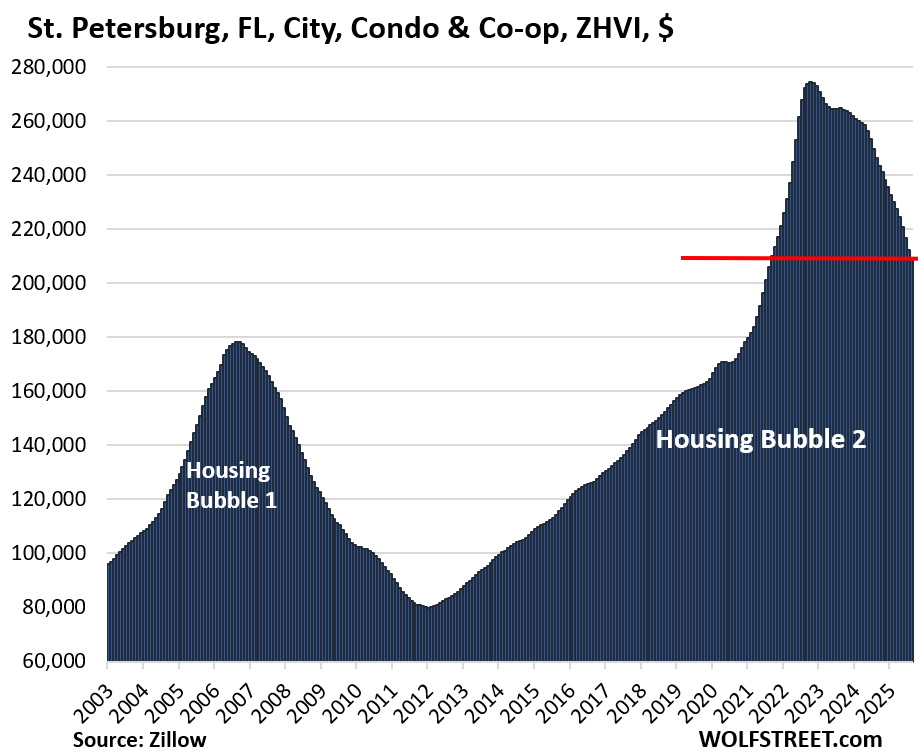

- St. Petersburg, FL: -25% (2022)

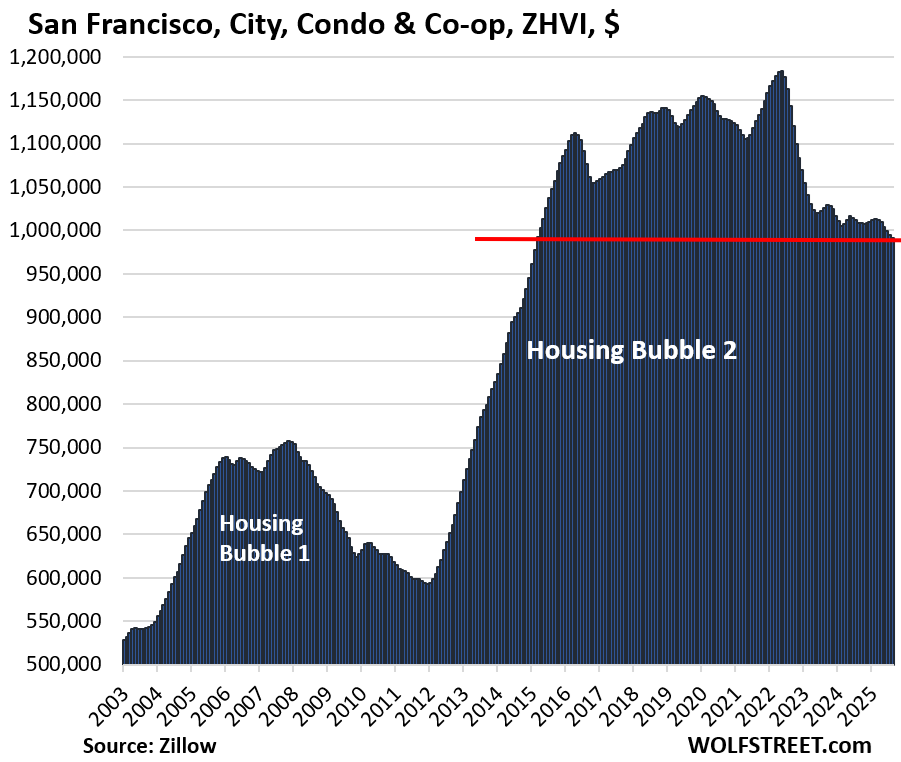

- San Francisco, CA: -16% (2022)

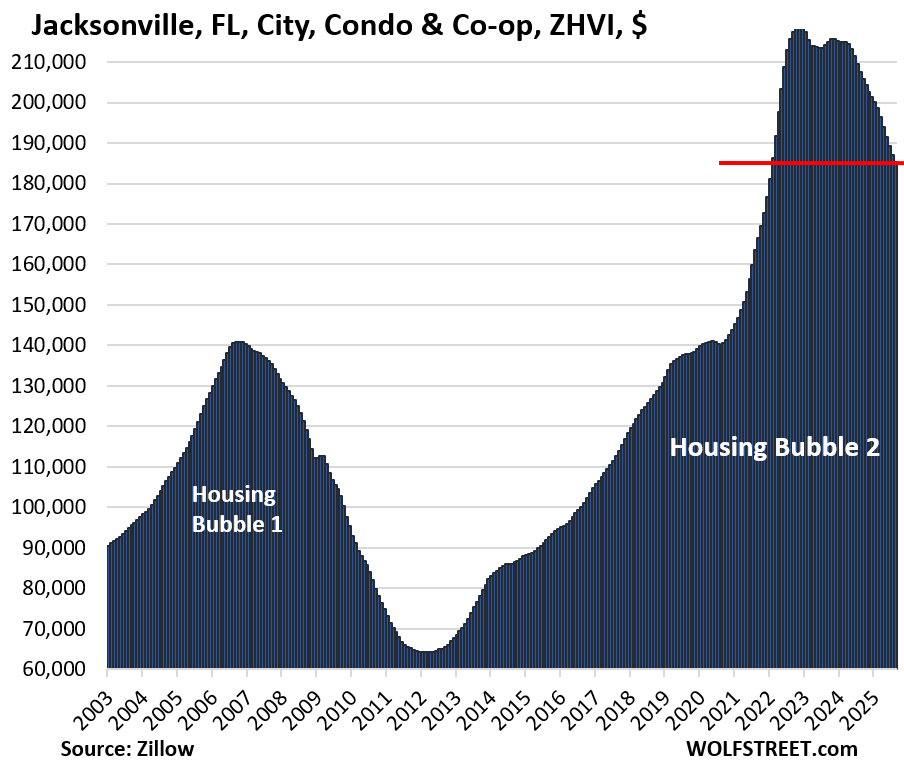

- Jacksonville, FL: -16% (2022)

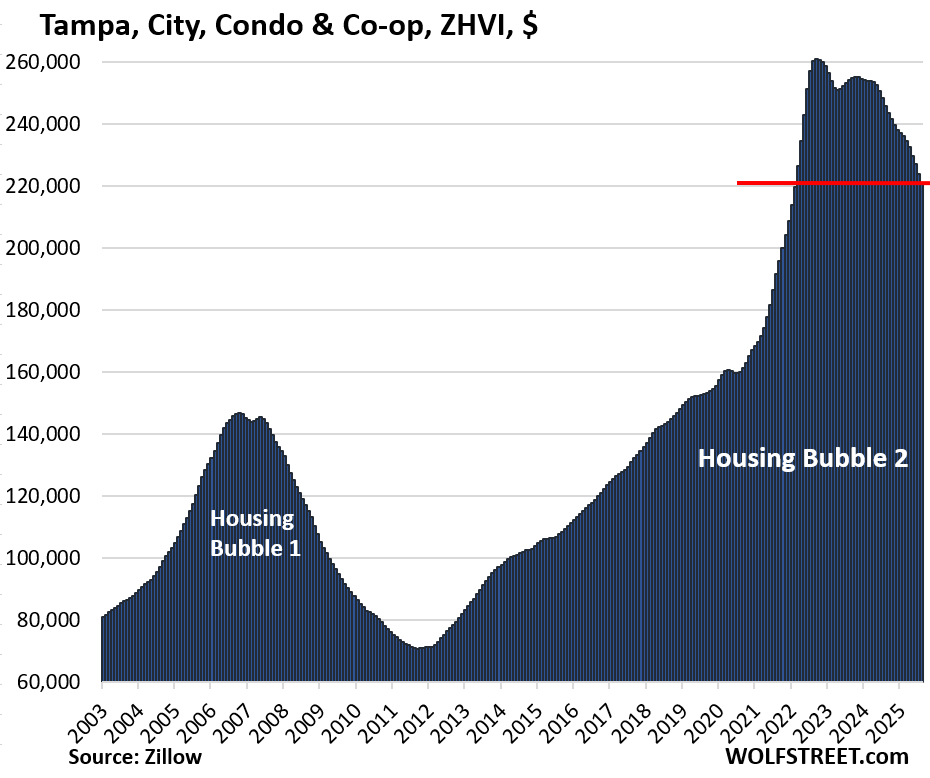

- Tampa, FL: -16% (2022)

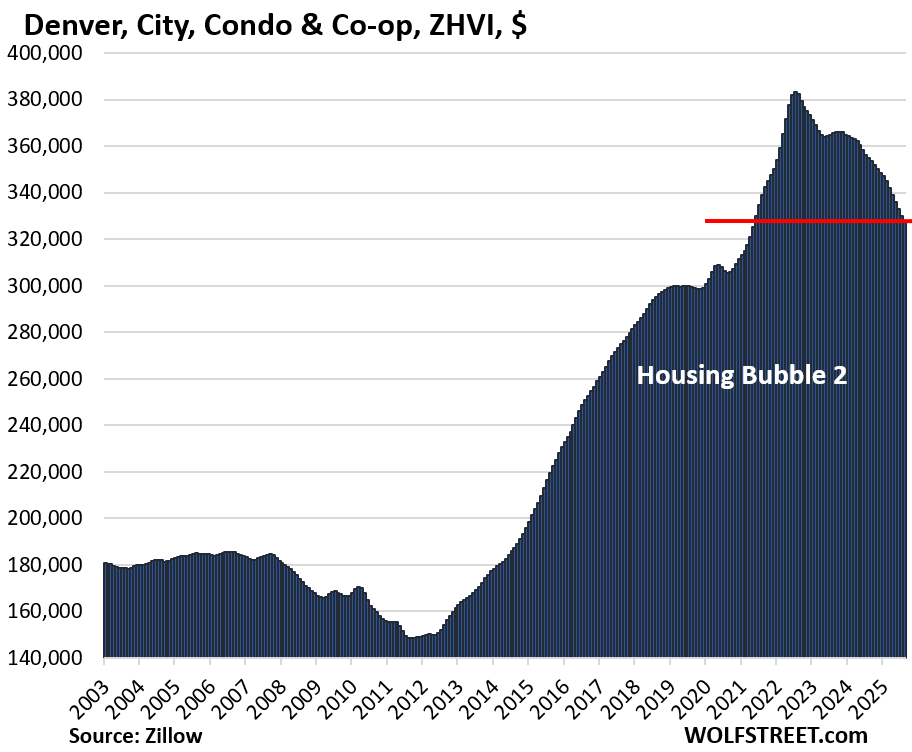

- Denver, CO: -15% (2022)

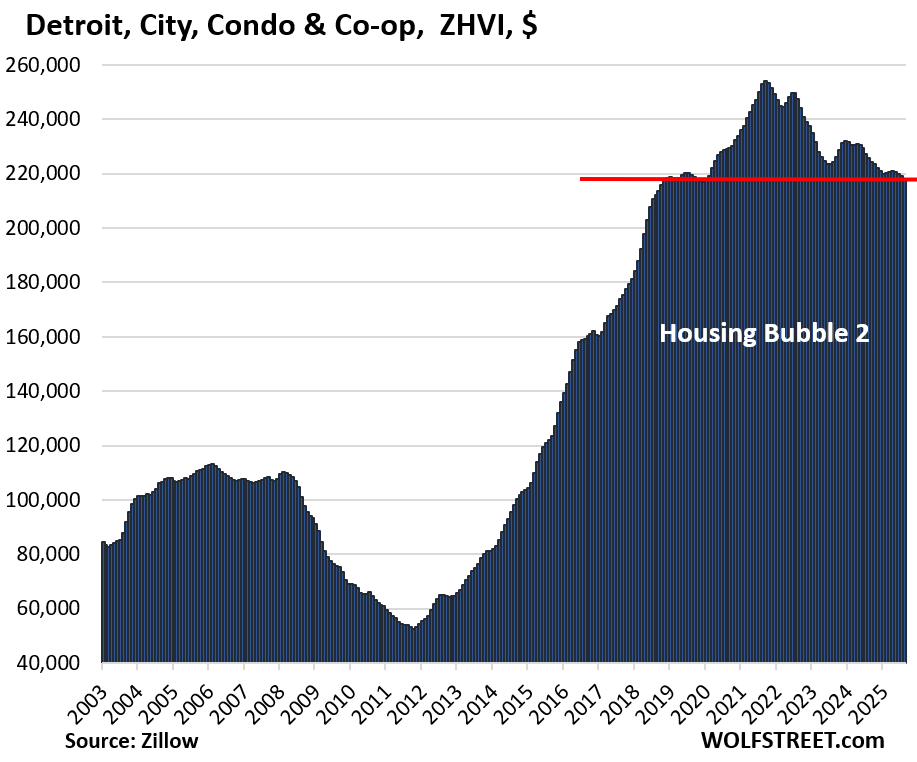

- Detroit, MI: -15% (2021)

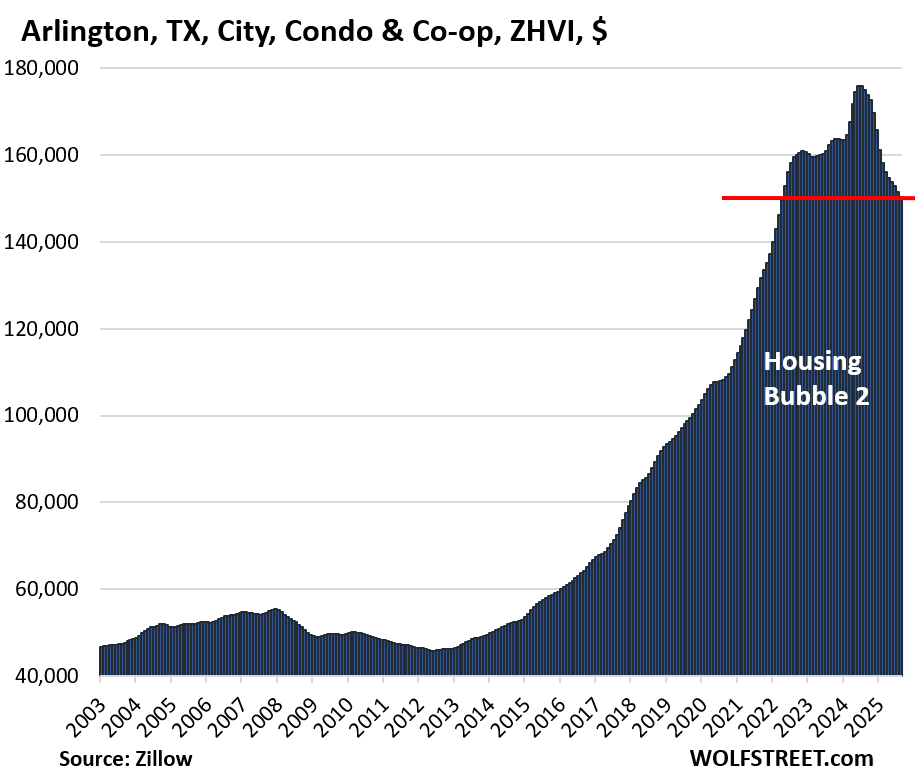

- Arlington, TX: -15% (2024)

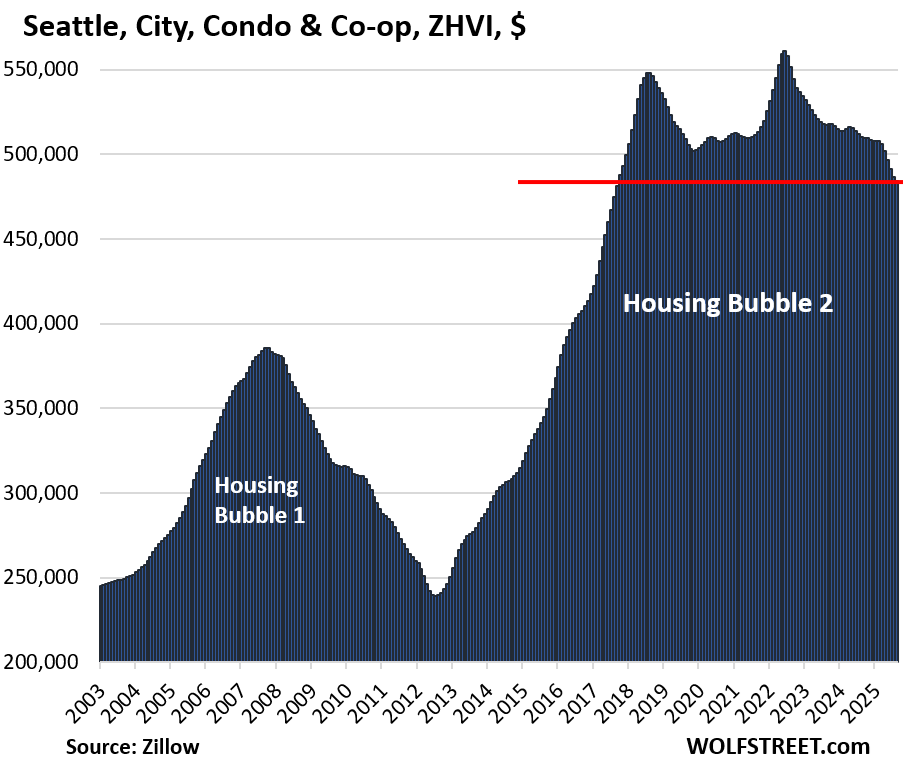

- Seattle: -14% (2022)

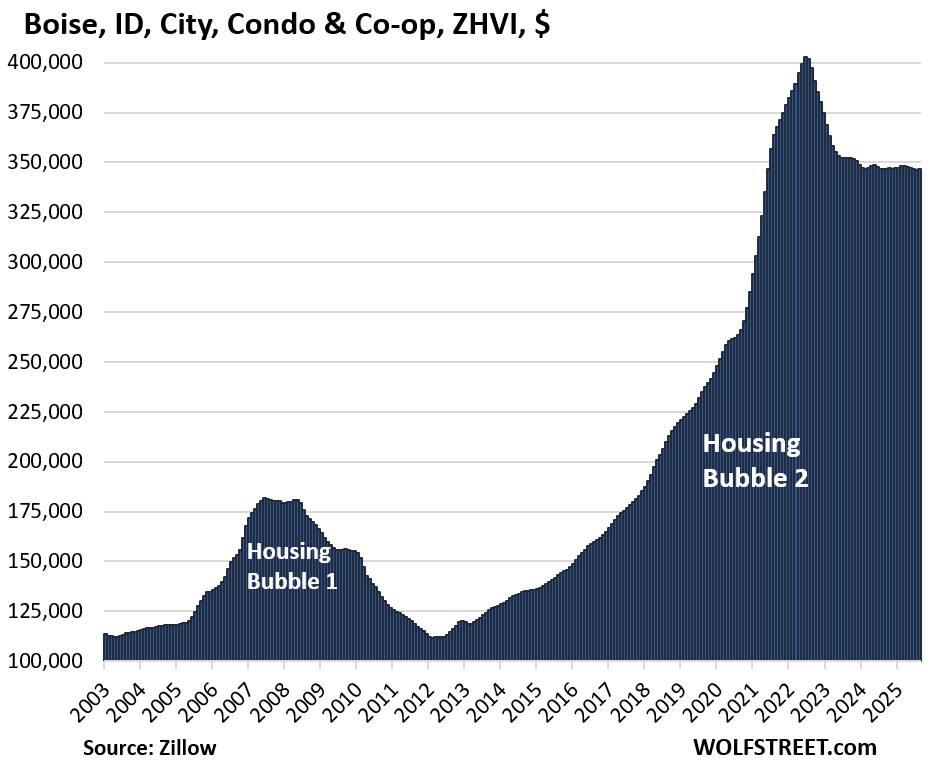

- Boise, ID: -14% (2022)

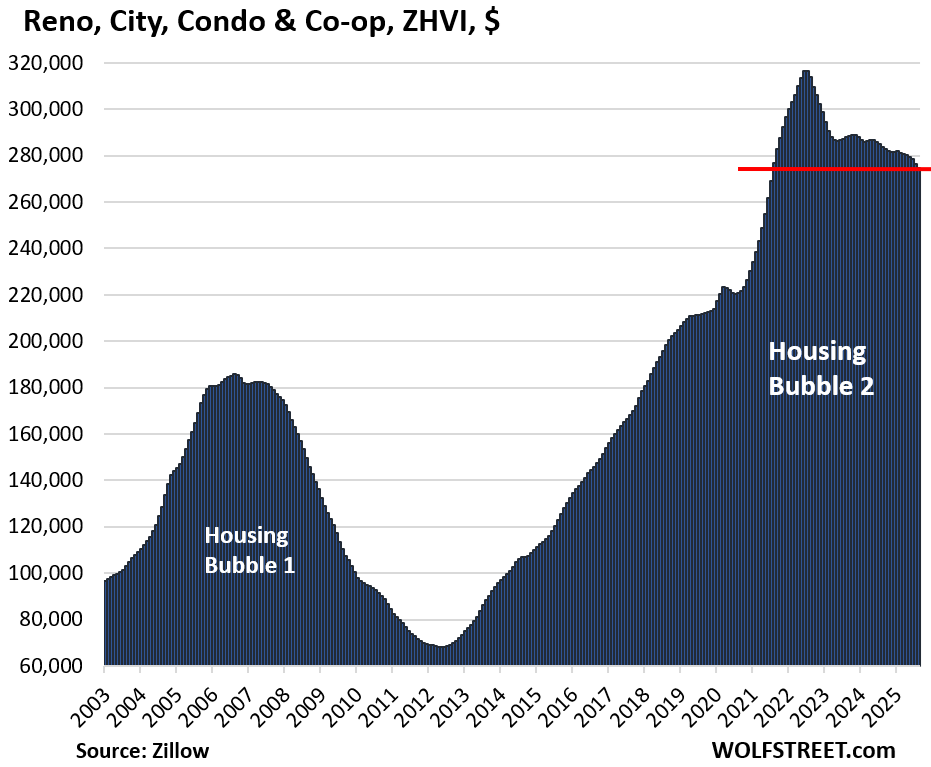

- Reno, NV: -14% (2022)

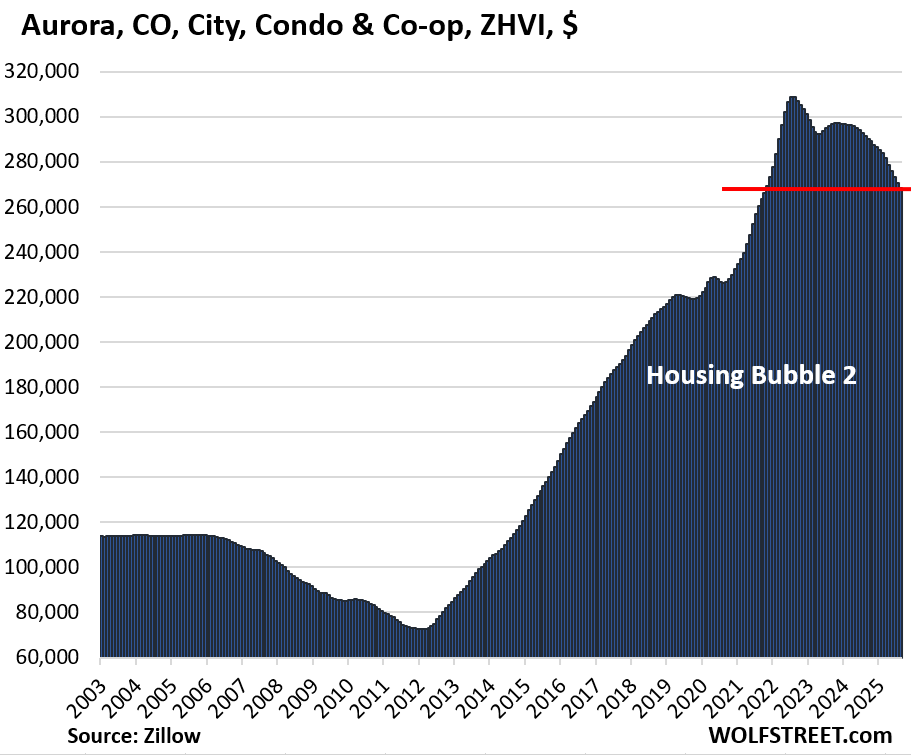

- Aurora, CO: -14% (2022)

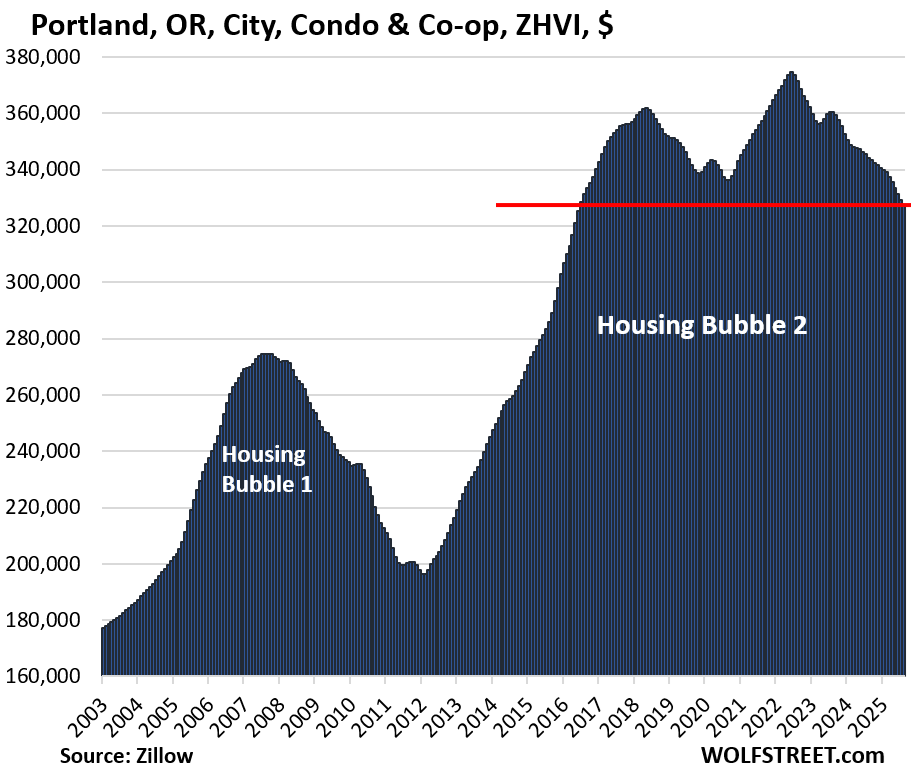

- Portland, OR: -13% (2022)

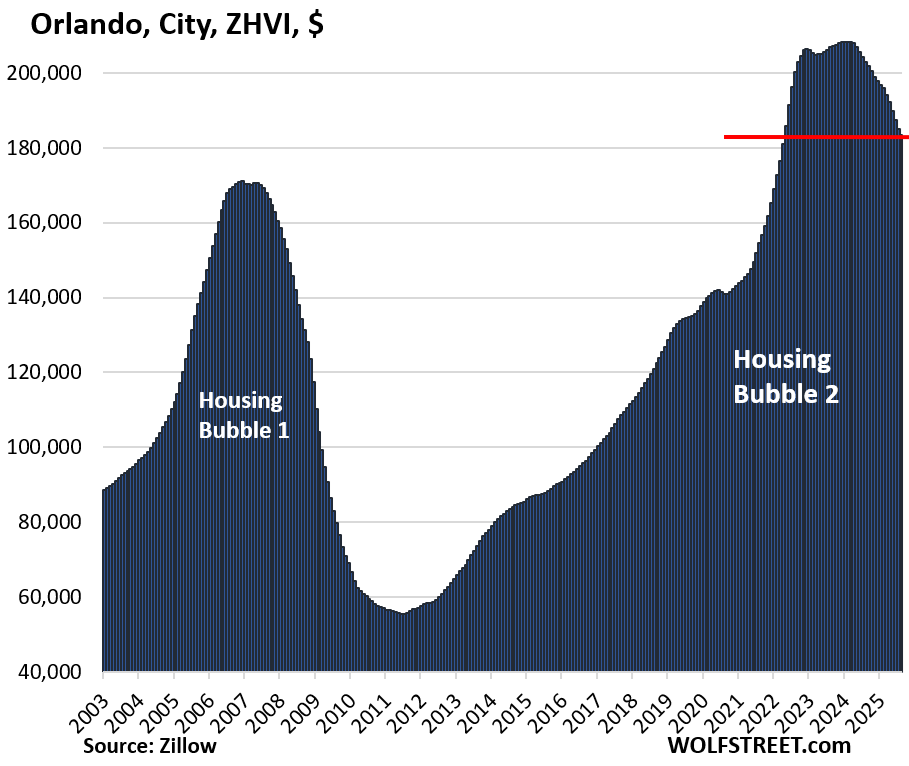

- Orlando, FL: -13% (2024)

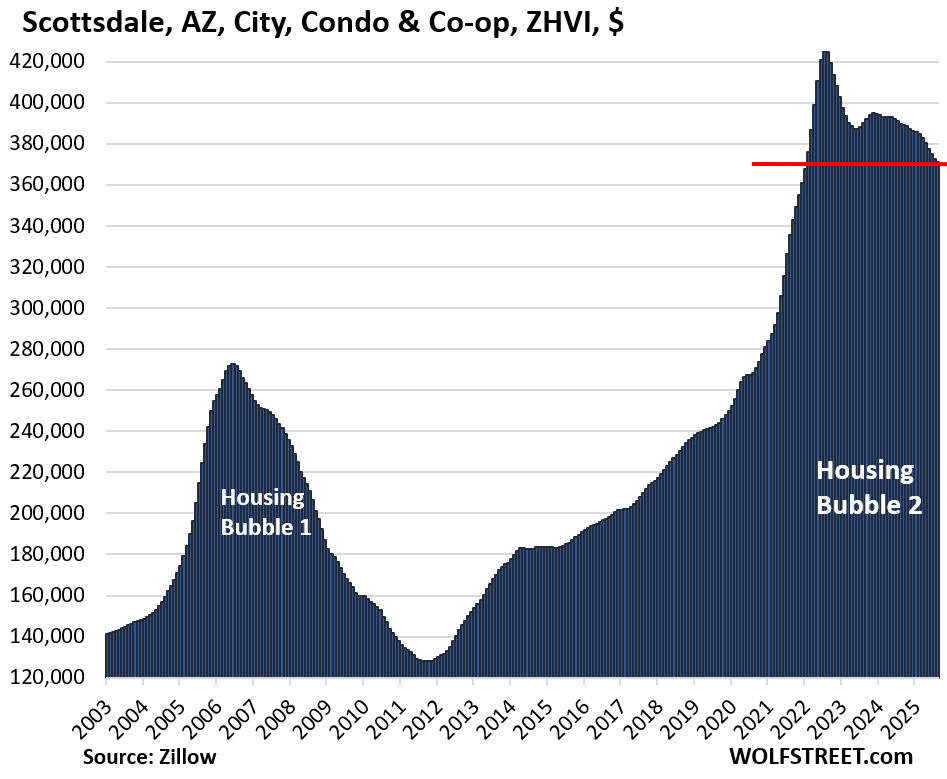

- Scottsdale, AZ: -13% (2022)

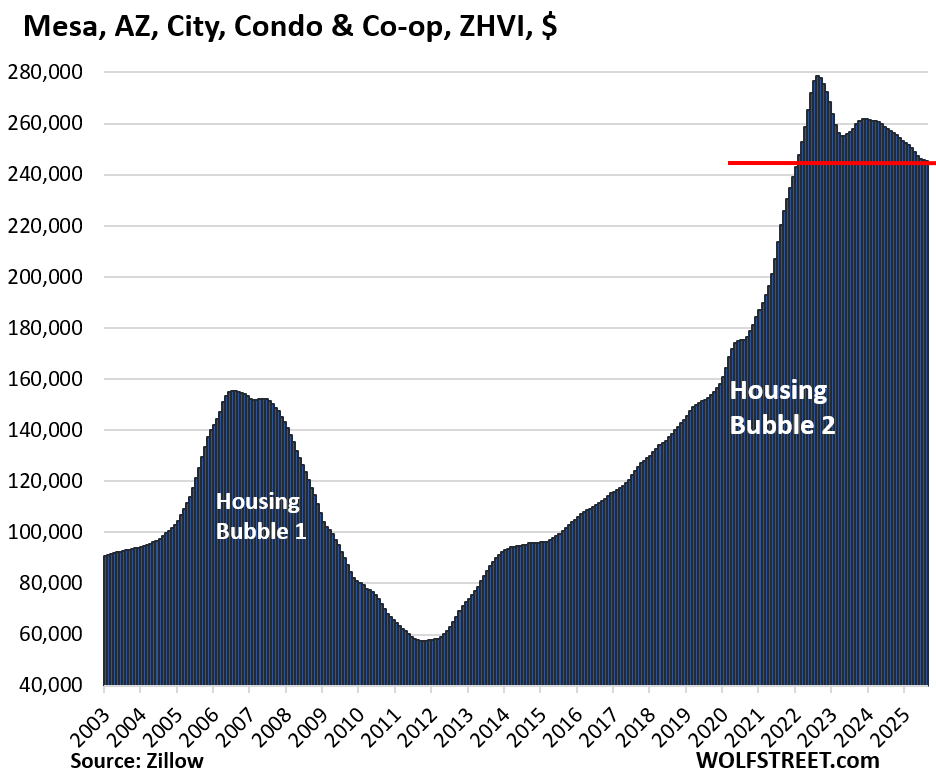

- Mesa, AZ: -12% (2022)

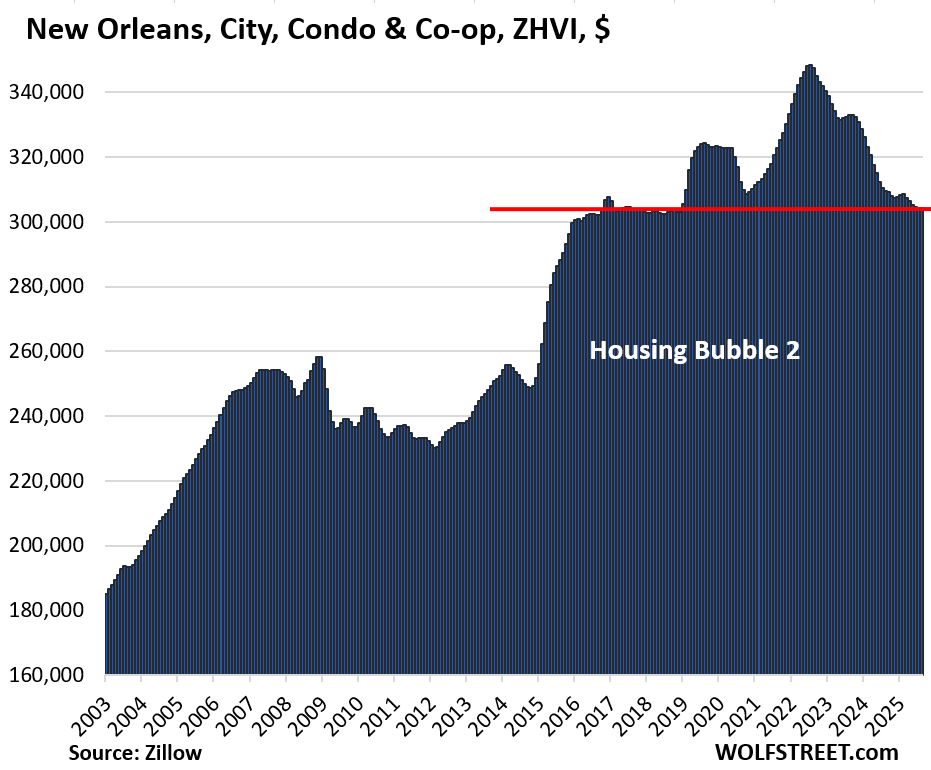

- New Orleans, LA: -12% (2022)

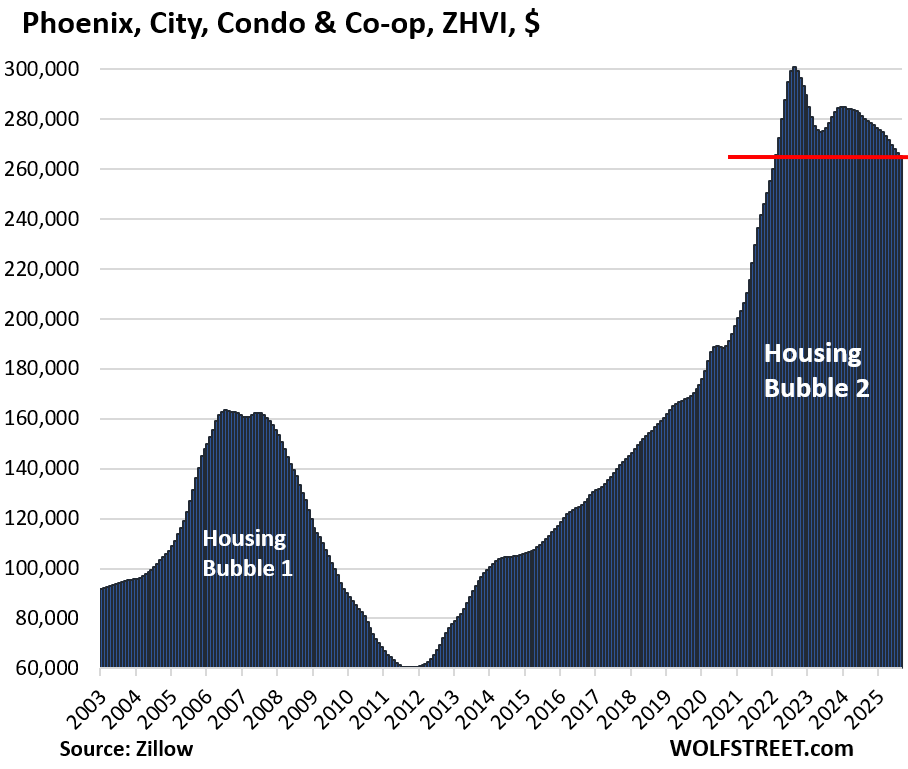

- Phoenix, AZ: -12% (2024)

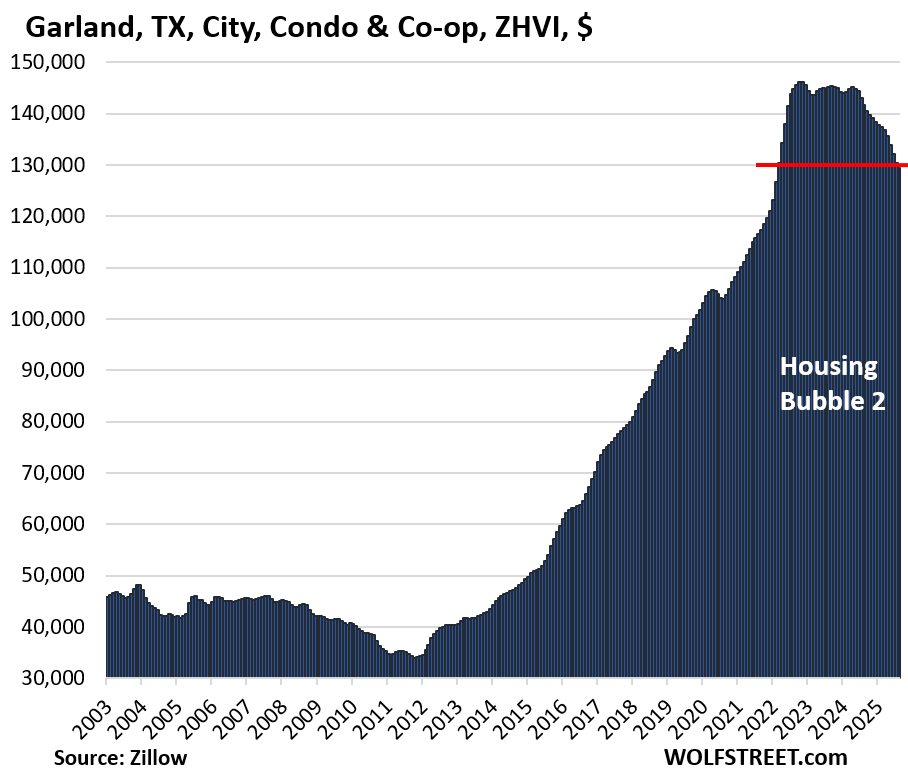

- Garland, TX: -12% (2022)

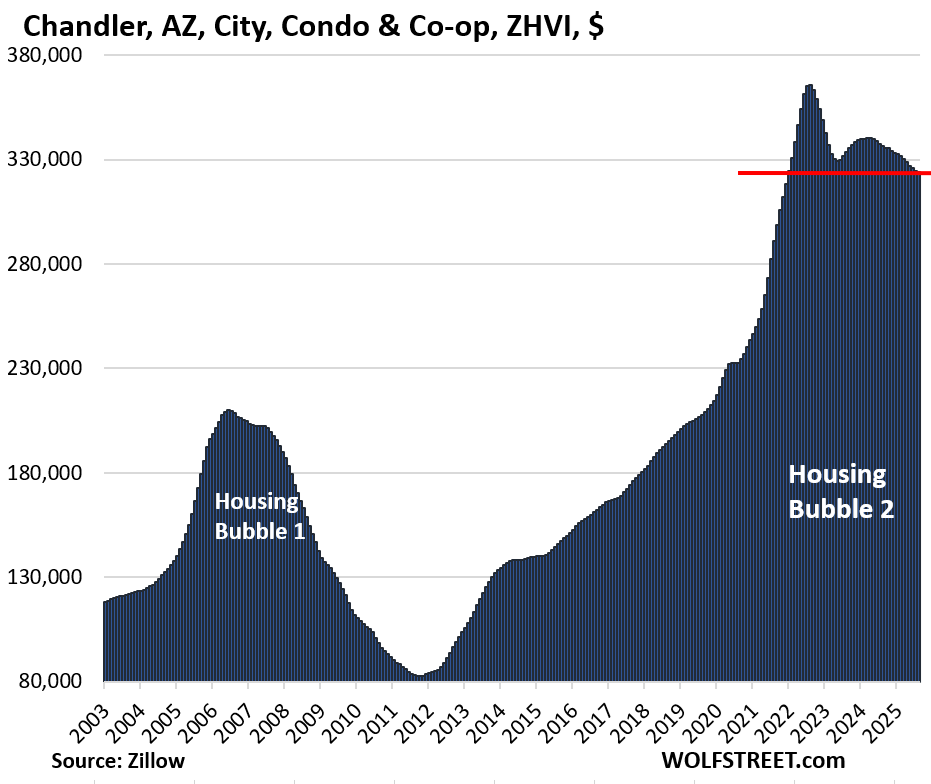

- Chandler, AZ: -12% (2022)

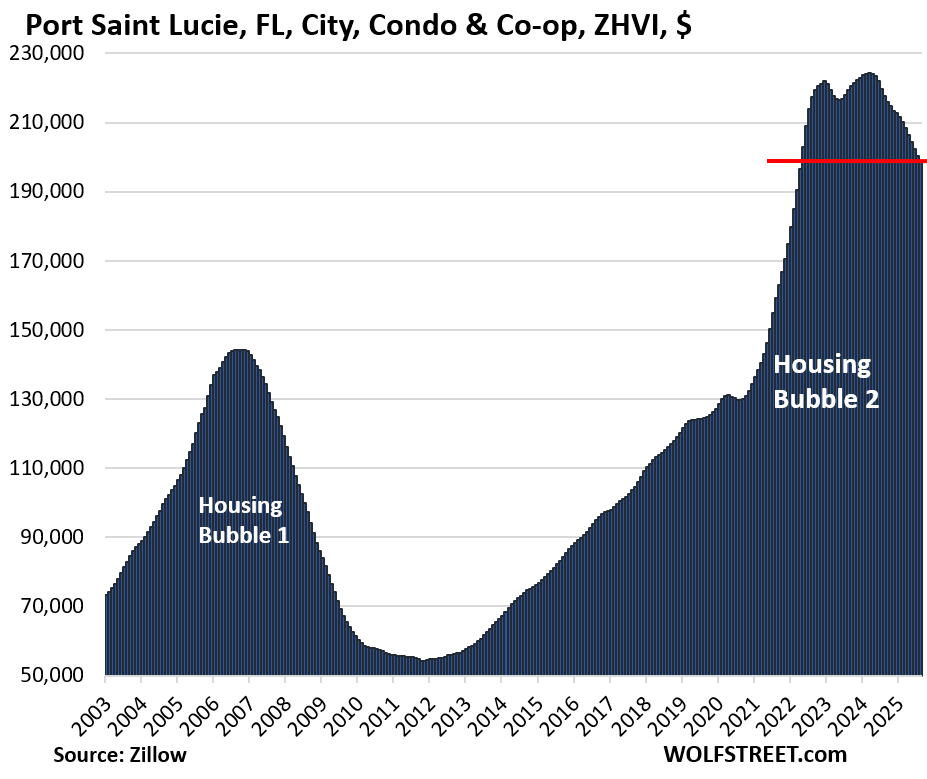

- Port Saint Lucie, FL: -12% (2024)

Cities that are too small to be included: Because the list was getting too long, I removed from the list of cities we track here some of the smaller cities in Florida and put them on this new too-small list (and their charts are no longer shown). Florida has some cities that are well-known, high-priced, and are centers of big urban areas; but by population of the city itself, they’re too small to be included here, which complicates the list. So now they’re on the too-small list, which is just a sampling of the many smaller cities with big drops of condo prices.

For example, prices from the peak in prior years:

- Killeen, TX: -42%

- Sarasota, FL: -21%

- Fort Myers, FL: -21%

- Bradenton, FL: -20%

- Naples, FL: -16%

- Lake Worth Beach, FL: -15%

- West Palm Beach, FL: -15%

- Boca Raton, FL: -14%

- Kissimmee, FL: -13%

- Clarksville, TN: -13%

- Greenville, SC: -12%

- Lakeland, FL: -12%

Didn’t make the 12% cut-off: There are many bigger cities where mid-tier condo prices have declined from their respective peaks in 2022, 2023, or 2024, but not enough to make the 12% cut-off. Here are some salient examples (year of peak):

- New York City, NY: -11% (2022)

- San Antonio, TX: -11% (2024)

- Plano, TX: -11% (2022)

- Corpus Christi, TX: -11% (2023)

- Houston, TX: -10% (2024)

- Raleigh, NC: -10% (2022)

- Colorado Springs, CO -10% (2024)

- Sacramento, CA: -10% (2024)

- Salt Lake City, UT: -9% (2022)

- Dallas, TX: -9% (2023)

- Stockton, CA: -9% (2024)

- Washington, DC: -8% (2022)

- Atlanta, GA: -8% (2023)

- San Jose, CA: -7% (2022)

- Fort Worth, TX: -7%

- Las Vegas, NV: -7% (2022)

- Nashville, TN: -7% (2022)

- Oklahoma City, OK: -7% (2023)

- Miami, FL: -6% (2023)

- Los Angeles, CA: -6% (2022)

- San Diego, CA: -6% (2023)

- Long Beach, CA: -6% (2023)

- Memphis, TN: -6% (2024)

- Honolulu, HI: -6% (2022)

Year-over-year, prices declined in 22 of the 23 cities here in September. (exception: Boise unchanged), topped off by:

- St. Petersburg: -15.8%

- Cape Coral, FL: -15.7%

- Arlington, TX: -14.2%

- Oakland, CA: -12.8%

- Jacksonville, FL: -10.8%

- Tampa, FL: -10.2%

- Orlando, FL: -10.0%

- Port Saint Lucie, FL: -8.7%

- Garland, TX: -8.6%

- Aurora, CO: 8.0%

- Denver, FL: -7.6%

Condo prices in many of these cities, after running up for years, exploded from early 2020 through mid-2022 by 50%, 60%, 70% or more, in just two-and-a-half years, amidst an astounding FOMO-driven buying behavior and general investor-mania during the Free-Money era which created what was perhaps the most extraordinary condo bubble ever.

In the 10 years to the peak, prices exploded by 180% (Oakland), 200% (Jacksonville, Tampa), by 260% (Arlington, TX), 300% (Detroit, Aurora, Chandler), and 350% (Phoenix, Mesa). And by 500% in San Bernardino, CA, where prices have just started to decline and haven’t made the list yet. This stuff is just nuts.

Now these bubbles are deflating. The charts below, going back to 2003, visualize that process.

In some densely populated cities, such as San Francisco, condos often make up a bigger part of home sales than single-family homes.

Methodology and data: These prices here are seasonally adjusted three-month averages of “mid-tier” condos and co-ops in “cities” (not in Metropolitan Statistical Areas) from the Zillow Home Value Index (ZHVI), which is based on millions of data points in Zillow’s “Database of All Homes,” including from public records (tax data), MLS, brokerages, local Realtor Associations, real-estate agents, and households across the US. It includes pricing data for off-market deals and for-sale-by-owner deals. These are not median prices.

The Condo Bust in charts:

In the little tables for each city below, the metrics from left to right: price decline from the peak, change from prior month (MoM), change year-over-year (YoY), and remaining increase since January 2000.

| Oakland, CA, City, Condo Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -28% | -1.3% | -12.8% | 153% |

Lowest since December 2015, nearly 10 years ago, and nearly back to the peak of Housing Bubble 1: In each of the last five months, prices dropped by 1.3% to 1.8% month to month. That’s steep!

| Cape Coral, FL, City, Condo Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -28% | -1.8% | -15.7% | 145.1% |

Back to where prices had first been in 2005, 20 years ago, below the peak of Housing Bubble 1. Boom-Bust, Boom-Bust.

| Austin, TX, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -25% | -0.2% | -5.9% | 113% |

Lowest since April 2021.

| St. Petersburg, Fl, City, Condo Prices | |||

| From Oct 2022 peak | MoM | YoY | Since 2000 |

| -25% | -1.6% | -16% | 193% |

Lowest since August 2021. Prices had already plunged 1.9% in August, 2.0% in July, and 1.8% in June.

| Tampa, FL, City, Condo Prices | |||

| From Sep 2022 peak | MoM | YoY | Since 2000 |

| -16% | -1.1% | -10.2% | 266% |

| San Francisco, CA, City, Condo Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -16% | 0.0% | -1.7% | 139% |

Lowest since March 2015.

| Jacksonville, FL, City, Condo Prices | |||

| From Nov 2022 peak | MoM | YoY | Since 2000 |

| -16% | -0.8% | -10.8% | 153% |

| Denver, CO, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -15% | -0.4% | -7.6% | 137% |

Lowest since May 2021.

| Detroit, MI, City, Condo Prices | |||

| From Sep 2021 peak | MoM | YoY | Since 2000 |

| -15% | -0.6% | -3.3% | 265% |

Lowest since September 2018.

| Arlington, TX, City, Condo Prices | |||

| From Jun 2024 peak | MoM | YoY | Since 2000 |

| -15% | -0.8% | -14.2% | 236% |

Back to April 2022.

| Seattle, WA, City Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -14% | -0.2% | -5.2% | 136% |

Lowest since September 2017.

| Reno, NV, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -14% | -0.7% | -3.6% | 246% |

| Aurora, CO, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -14% | -1% | -8% | 205% |

| Boise, ID, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2001 |

| -14% | 0.2% | 0% | 221% |

| Orlando, FL, City, Condo Prices | |||

| From Jan 2024 peak | MoM | YoY | Since 2000 |

| -13% | -0.9% | -10.0% | 160.5% |

| Portland, OR, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -13% | -0.3% | -5.0% | 110% |

Lowest since June 2016.

| Scottsdale, AZ, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -13% | -0.2% | -4.9% | 196.4% |

| New Orleans, LA, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -12% | 0.4% | -1.2% | 100% |

Back to mid-2016.

| Phoenix, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.2% | -5.2% | 237% |

| Port Saint Lucie, FL, City, Condo Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.8% | -8.7% | 242.6% |

| Mesa, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.2% | -4.5% | 209% |

| Garland, TX, City, Condo Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.2% | -4.9% | 196.4% |

| Chandler, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.1% | -3.6% | 214.7% |

Condos are facing a lot of issues, including:

- Prices that exploded over the past few years, driven by FOMO-addled buyers, including investors, and ended up being way too high.

- Hefty special assessments for long-neglected big repairs.

- Big increases in HOA fees at many properties, in part driven by spiking insurance costs.

- Fannie Mae’s ever-expanding Blacklist of condo buildings that makes financing a unit in one of those buildings very difficult, and sales may be limited to cash buyers.

- The end of Free Money: Mortgage rates are roughly back to a normal range.

- Foreign-based owners who’ve had it and want to sell.

- Investors in condos to rent them out are facing stiff competition from a wave of new higher-end apartment buildings that developers are trying to find tenants for.

And in case you missed it: The Most Splendid Housing Bubbles in America: Price Drops & Gains in 33 Large Expensive Metros in September 2025

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Good, keep it going… More and steeper drop and faster.. Go Big or go home right?

These are condos. Terrible investments due to ridiculous HOA fees

Thanks WR for this report.

I guess the downturn is starting slowly but surely.

Condos are the first dominos to fall usually followed by SFRs.

I will say so far it really seems that price decreases have for most part seemed to avoid the north east though will say for sale signs are on the increase.

Outside of Boston was to a large degree the first “silicon valley” decades back and had a lot of defense contractors along with the major hospitals and colleges,still…..,a lot of that is gone and really have not seen what is replacing it and keeping the pricing so high ,especially as you get away from the city regions.

I think in a lot of cases, it’s the parents who are funding the kids. Throughout the “Northeast” white collar parents have accumulated a lot of money and they are realizing they can’t be buried with it. So, it is being gifted to the kids for buying a condo or house (who aren’t going to refuse the money regardless of how crazy prices get). Maybe it’s payback to the kids who will have to dig the parents out when they get snowstorms in their old age.

Also, watch those condos; they are great canaries for how the rest of the market will perform in the not too distant future.

That’s one of the big problems in having government policy that intentionally makes the wealth gap worse.

Can you tell us what you feel the covernment is doing to “make the wealth gap worse”?

ApartmentInvestor, between you and SoCal Beach, I feel like you’re either trolling or being intentionally obtuse.

The Fed from 2009-2021 made inflating the stock market a goal to create a “wealth effect” and spur consumer spending.

The top 10% own 90% of stocks.

This isn’t difficult.

@TSonder As a small business owner I feel that the government making it ~10x harder and more expensive to start a small business has really made the wealth gap worse and I have friends that think we need to go to a 50%+ estate tax after $1mm so I was really asking what you thought was the main government policy making the wealth gap worse (not trolling). @Wolf the Bring a Trailer site has a way to click a commenter’s name and see every post he (or she) has made that I really like to see where someone is comming from (often over a decade of posts). Is this an option in your blogging software?

1. The real wealthy people don’t pay estate taxes.

2. 50% estate taxes would destroy every family owned business or farm of any decent size

Let’s say a popular family restaurant earns $500k a year. After taxes it’s $350k. Valued at $5M. Parents die. The estate owes $2.5M. No choice but to sell the restaurant. Who has $5M except private equity? They buy and asset strip the business and shut it down.

Be careful with the this area is different narrative. Seen it all too common with NorCal (SF) and recently with Austin and look at where they are at now. SoCalers seems to have this same my area is different mentality, so far they are claiming victory as percentage drop still marginal at best but usually time will reveal the truth.

Northeast might seem like they are immune and bucking the trend but if the fundamental and sustainability reasons is not solid, it will eventually go the way of certain previous invinicible high flying market as well.

Yes, but my area is different LOL. Good point Phoenix! I remember in 2004 I was in a graduate program in So. Cal and an accounting professor I had made a comment that he felt the housing market was going to enter a major correction. Most of my peers spent the remainder of the class arguing why it wouldn’t happen here because people want to live here, we are close to the beach….blah blah blah. Well, two years later, my home dropped ~40% in N. San Diego. As you mentioned, “time will reveal the truth”.

@Justin It is important to remember that areas “are” different (some will go down more than average and others will go down less than average – and a few might even continue to go up)…

A home dropping in value doesn’t matter unless you need to sell. I bought in 2008 at $175k. Value dropped to $155k in 2011. I lived there and sold it in 2022 for $435k. It only matters if you’re an investor or need to sell.

Have you missed the biotech boom? Metro Boston has had a boom in venture capital for this industry. Tech is doing well thanks to companies wanting proximity to MIT. And while defense has had its ups and downs, Raytheon remains a big force in MA.

BAE has a big presence just over the NH border in Nashua and Merrimack.

Greater Boston has been shedding jobs for several years now due to the high cost of doing business in the area. Add the fact that New England is a very old region with a low birth rate it does not make mathematical sense that these prices will hold. The math isn’t there. IMO I could see stalled growth in the region for the foreseeable future.

One more thing to add – people here have this false sense of reality and believe MA is too big to fail and seem to ignore all of the warning signs. Time will tell.

The weather is also depressing.

For what it’s worth: the assessor for my NH municipality said they aren’t going to reassess for at least the next 2-3 years because they are predicting prices have plateaued.

Salt Lake City – SFR Appreciation is flattening. Inventory is refilling. Condo’s / Townhouses have been built in every vacant lot…Condo/TH Appreciation is flat now.

Area is taking a breath.

People keep coming but the flood has backed off a bit.

Infrastructure built for the 2002 Olympics is now maxed out.

How much is enough???

Ahhh I am on the list now! Well at least I know I won’t get hit by a hurricane…

No, you’re not on a list I have. But your comments arrive flagged as potential spam. Maybe they’re getting routed through a spam server. Sometimes this goes away on its own.

Interesting, I seem to be getting that same potential spam filter automatically as well…or maybe not accidental flagged…:/

Yes. Can both of you try a different email address (fake is fine) with at least 10 letters in the handle and without numbers and without dots, underscores, etc. in the email handle, something you can easily remember, such as notmeagain@gmail.com or whatever.

The first time you do this, the comment will certainly go into moderation. But maybe the second time, it passes.

If that doesn’t work, trying out a different screen name might work.

It happened to me few times in the past, but I think I just mispelled my name or something 😆.

great charts! that list of issues is quite compelling with no quick fix to arrest the slide in sight. somebody is going to be hurting or is this where our nationalized mortgage industry puts all taxpayers (and their children) on the hook to share the pain? and of course all mortgage industry executives will get their bonuses.

Another 50-70 percent and it starts to look reasonable!

I’m starting to wonder if it will ever look reasonable at any price. With the reported softening of the RE market, I started watching the prices of my favorite ocean view condo where I live in Honolulu. The prices are softening but this $1.3M condo carries with it a rapidly increasing $2000+/month maintenance fee that does not include property tax, electric or important insurance. All of these extras could easily fund a luxury condo rental in other amazing areas to live in the world that is paid for by TBill/Note/Bond interest on the $1.3M condo principal without me being “owned” by the condo or worrying about the possibility of special assessments.

“it a rapidly increasing $2000+/month maintenance fee that does not include property tax, electric or important insurance”

Wow, this is just bonker to the moon……even if we disregard the chance of any price correction and continue to assume housing will go up every year by mid single to low double digit, that carrying cost will eat you up alive, if strictly view from the whole housing is the best investment lens…another thing to point out the silliness of house humpers logic..

I’m not shocked at all by Florida. Every reason you listed describes Florida, where other areas only have some of those issues.

What does shock me is that Chicago isn’t on the list. Population of Chicago continues to slowly decrease, so why prices aren’t is hard to explain.

Chicago didn’t have as big of a bubble. In fact, i think i saw Chicago “bubble” chart once on this website and Wolf only posted it because of numerous “not in my city” comments.

To be clear, is the data actual sale price data or ‘for sale’ price data? With the number of actual sales falling, perhaps these numbers are too optimistic for the markets as a whole.

Actual sales prices.

I don’t see these prices in those cities as “optimistic.”

However, there are cities where prices are still edging higher.

Especially in Florida and California where HOA fees and Insurance have skyrocketed. Who can afford over $1000 a month for HOA when including special assets and the affects of inflation?

Just Look at your charts…just look at your charts! Housing Bubble 2 is a Mega Monster!

Imaging going to the chicken farmer and seeing normal sized chickens. Five years later, you return to visit Mr. Chicken Farmer and he has super-dosed his chickens with steroids, and you are now seeing 75-pound monster chickens running around everywhere. Massive, crazy and freakish. Thus is the monster that has been created with this current housing bubble.

Boston Metro region still avoiding the steep decreases seen around the country. It’s resilient here.

Stock-market benchmarks flat to lower as Treasury yields remain below 4% and gold retreats

The FED tightened reserves in August, but that didn’t stop the market’s momentum. Are reserves “binding”?

Detroit certainly looks like an opportunity. The Trump Tariffs will have a long-term, positive impact on the American automobile industry. Car making is Michigan, and Detroit is its largest city. I don’t understand how it has landed on this list.

Pull up a list of car assembly plants that have been built in the US over the last 40 years. Compare the number built in Michigan to the number built in the other 49 states. Assuming you’re implying growth in factory employment will lead to housing revival, your optimism for the industry in Detroit may be misplaced.

Things could change but recent history isn’t on your side.

Detroit is a hollow shell of what it once was, and will never be again. The spec crowd built a lot of condos and now reality is setting in, again.

Condos are good when bought cheap and rode hard.

Then die or go to the old folks home when the huge assessments hit. Florida style baby.

Don’t do it.

Detroit & Metro is where RE investors go to disappear.

No growth. No appreciation. No way out.

Bloated state gov, 81B budget in a state of 10M.

New Jersey does the same 10M for 50B,

what’s wrong with this picture?

Most plans and subsidies for battery plants have been a bust.

A123, Gotion-Marshall Ultium-Lansing, Akasol.

75 years ago when everything was manufactured here, sure, boom times.

Detroit, Fint, Jackson, Battle Creek, Kalamazoo, Grand Rapids, Bay City, Saginaw… all former manufacturing power houses of the Midwest.

Now, busted industrial wastelands and rust belts.

Mostly government, university, and healthcare jobs now.

Very little innovation. No growth whatsoever.

It appears that long term interest rates are continuing downward. If this continues, it will likely slow the drop in housing prices.

I don’t expect a housing crash, but do see prices stabilizing around these current numbers and staying there for some time.

Jack Ma introduced 996: [9AM to 9PM] x 6 days/week. In SF startup

employees are on 996. They sleep under the desk. The AI rush is on. Startup failure rate after 1Y is 20%. After 5 years 50%. In 1999 workers were on 996 to become millionaires. In 2025, after 500,000 layoffs, programmers on 996 are afraid to be tossed out to the street.

Wow, if I’m reading this right then despite all the complaining about SF prices the fact is that condos are more-or-less unchanged in price since the housing bust after adjusting for inflation.

“Price elasticity of demand (PED) in the housing market is defined as the percentage change in the quantity of housing demanded divided by the percentage change in the price of housing. It reflects how responsive consumers are to price changes. Generally, the elasticity of housing demand is considered low, meaning that consumers do not significantly alter their demand for housing when prices change. This is primarily because housing is a basic necessity and a durable good, with few close substitutes available, especially for owner-occupiers.”

The housing bust #2 has been ameliorated by the FED validating housing prices. The FED is not “tight”. Inflation is still accelerating. Lowering interest rates isn’t going to solve any unemployment problem.

It’s not just condos in my opinion.

When you look at the charts with the zoom out, the massive credit impulse since about 2011 is crystal clear.

As housing prices for this asset class price explosion over the last ten years deflates back to the norm, it will very likely result in a 70% decline from the recent peak. The only way that has any hope of NOT reverting back to pre impulse levels, is with the unlikely condition that household incomes increase by 300% to be able to afford anything in relative purchasing power by the consumer. This is the everything bubble and the deflation is just beginning in all these assets that have been artificially pumped up by massive amount of credit.

Curious – is your last name George?

Regarding your comment – finally someone with a brain. I don’t think a 70% pullback is unreasonable or unrealistic. Many people, I believe, think this current real estate market just ‘happened’, or is a creature of normal market forces. It’s not – we got to this point due to three factors –

1) MANIPULATION 2) MANIPULATION and

3) MANIPULATION.

The fall will be much more devastating than what happened to Humpty Dumpty.

Heh, I’m predicting 80% to get back to affordability for young people.

Young people are going to have to be able to buy by the time they’re 30 if people want housing demand to return – and that means housing capped at 2x their median wages. Means national housing prices can be no more than $100k

It’s even worse than that if the costs for other things (insurance, repairs, etc.) continues to stay where they are. Then I can see 90% drop easy.

Anyone who’s in residential RE who doesn’t sell now is screwed.

One of the biggest problems is we are about to undergo a large loss of population. Something that has not been in our experience, ever.

Now, Should 10 million leave in the next 3.5 years, how many less living spaces are going to be occupied, and how many fewer businesses and jobs are going to be gone. I can easily imagine outside of retirement home building and a few hot markets, that house construction and apartment construction crater. But it takes sooooo long for the effects to come into what everyone can obviously see. So there is tremendous resistance to this time it might really be different and have a much bigger impact than anyone anticipates.

But hey, it’s the easiest job in economics to project another quarter of the same old 1% growth, about 3% annual, and get a steady paycheck. Wolf at least gets to read the data in an honest way, and still be paid to do it. That alone is refreshing.

Condos have always been rate and payment sensitive, and those assessments ain’t going to be cheap. In reality, all housing has costs, and it is extremely difficult for people to get that they are frogs being boiled. On my local nextdoor there was a long complaint string from some 70 year old guy living in a half million dollar, 4 bed 3 bath complaining about his 6.6k annual property tax on an $1100 monthly fixed income. Well duh. Frog nearly done. Time to make the sauce. Old Herb Stein said it best, things go on, until they don’t. Ask yourself how many older folks are planning to move and downsize, and just don’t do it. Tons.

The hardest lesson in my life is inertia. In politics, in the economy, in business, in life. Change is hard, and doing it is the real test of adulthood.

Things will change, and don’t to heck in a straight line. The financialization of living into max asset prices is ridiculous, and will fail. You can’t sell new cars to the top 15% and have enough used cars into the market, and same goes for everything. I am amazed at how reaching for bigger margins has destroyed so much of American business, instead of cutting costs and selling more of less expensive. A good $25k car would sell, but it ain’t sexy enough to make them cheap and durable. Moah cupholders and infotainment systems. Chrome galore and $100k lux trucks to go through the takeout window.

How many of those 10 plus million won’t leave? How many are living 2-4 people to a room? How many of them undercut American workers wages? How many didn’t pay taxes and take advantage of local public services? How many of them send a big portion of their earnings back home and don’t spend it in our economy? How many commit crimes and how much does it cost to incarcerate them? How many of them drive without insurance? What happens when they become old and destitute? What would be the advantage if they stayed?

Idont – …you forgot to include the responsibilities of those who hired them…(…a variation of a more recent comment/proposal thread-taxing 3% mortgages and asking if someone should be held to later account for gubmint lack of coherent recognition and long-term oversight/regulation of an issue if that someone took an apparently-prudent advantage of the extant legal/fiscal environment at an earlier time. ‘moral hazard’ vs. ‘victim-blaming’ vs. gored oxen/collateral damage, here?).

may we all find a better day.

Here in the heart of Silicon Valley, prices are relatively flat for the first time in many years (I’ve been here 45 years and owned a home for 35). We had a bad time around 1991, just after we bought our home. The next door neighbor’s house was owned by a speculator that had to sell. Our home value dropped 20% and we were forced to buy mortgage insurance. Since then it has been a steady climb in value with homes always selling quickly. We have been very lucky. Recently, things have changed and sales have slowed. However, a developer just bought a scraper on a 7,000 sq.ft. lot for $2.7M and will build. I guess an asking price north of $4.5M even in this market. Another similar home/lot was put on the market at $2.2M, but was taken off market pretty quickly. I don’t know the reason.