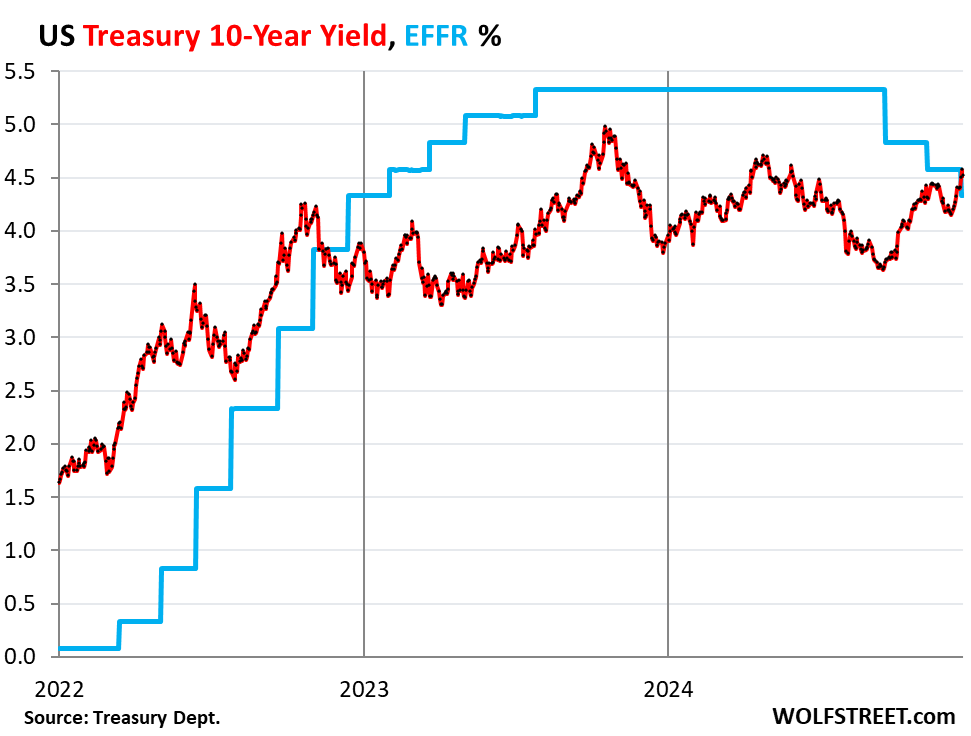

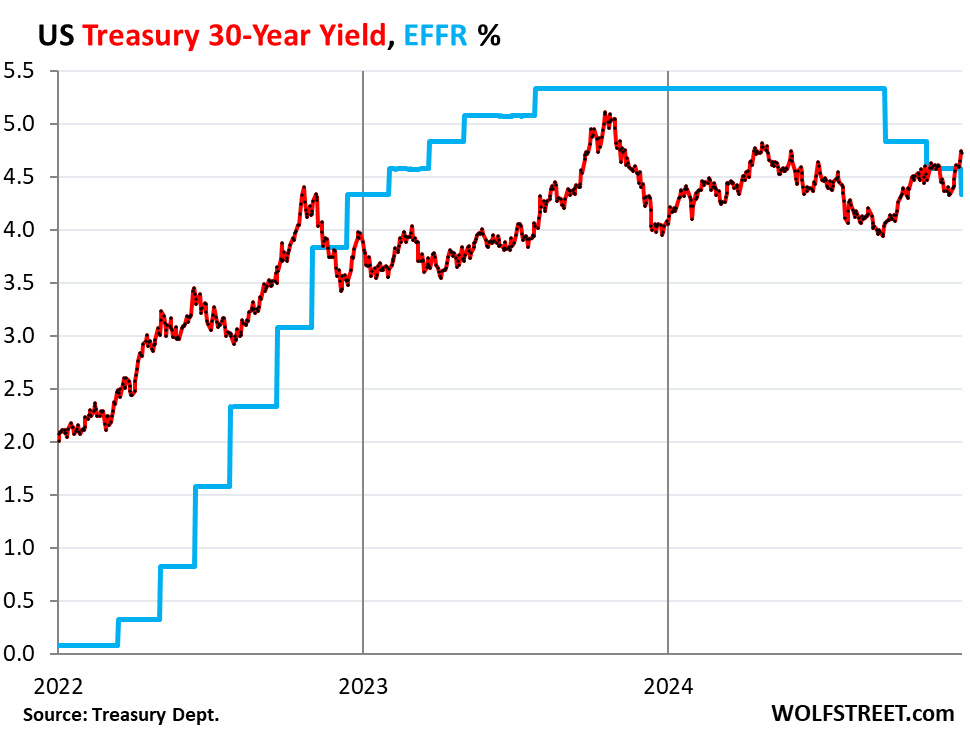

Since September, the Fed cut by 100 basis points while the 10-year Treasury yield rose by 87 basis points! There are now doubts about further cuts.

By Wolf Richter for WOLF STREET.

When the Fed cut its policy rates on Wednesday by 25 basis points, it laid out a scenario of higher inflation and higher “longer-run” policy rates, and projected only two rate cuts in 2025, half the rate cuts it projected three months ago.

Then, to top it off, people who listened to Powell at the press conference walked away thinking that there might not be any rate cuts next year, that the “recalibration” phase of the Fed’s monetary policy was already finished after only 100 basis points in cuts, and that we may be on the cusp of a new phase.

As this emerged on Wednesday, the S&P 500 index tanked 3%. And the Treasury market is showing this thinking.

Short-term yields didn’t fall at all this week. The rate cut was already 100% priced in, and now there is no more rate cut priced in within the short-term window of those securities. On Friday December 13, the yields of 1 to 6 months were all at 4.30% to 4.33%. And that’s where they also ended up on Friday December 20.

And they’re now right at the Effective Federal Funds Rate (4.33% after the rate cut), which the Fed targets with its policy rates.

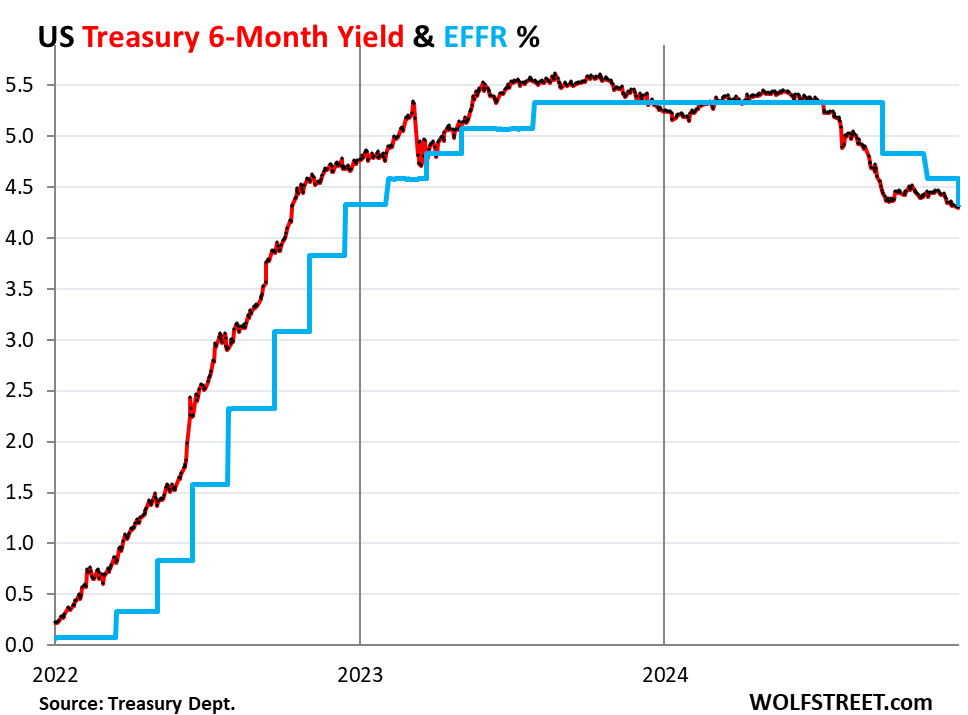

The 6-month Treasury yield sees no rate cut within its window. It had priced in each of the three rate cuts about two months in advance. It also priced in the rate hikes in 2022 and 2023 with a similar advance. During the March 2023 banking crisis, it briefly saw a pause that didn’t come. And in January 2024, it started pricing in a rate cut but then gave up on it. Now it has settled into a no-rate cut scenario within its window over the next few months:

The yield curve un-inverted entirely.

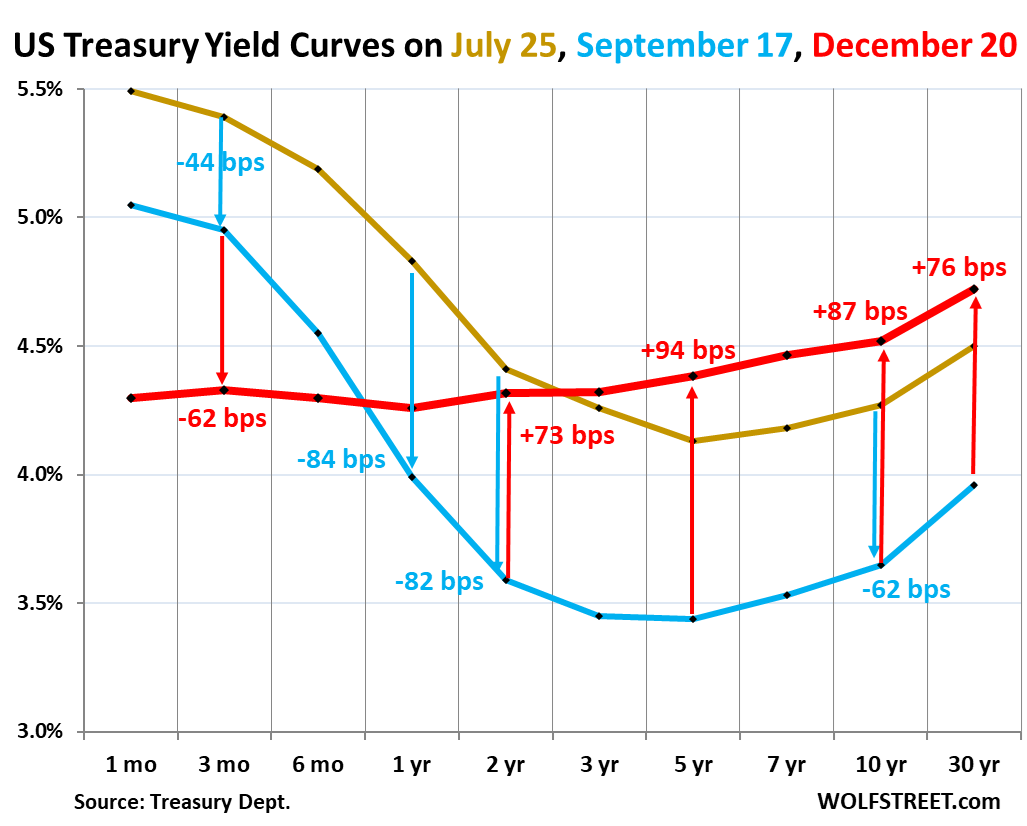

While short-term yields stayed roughly put during the week, everything from the 1-year yield and longer rose. At the long end, the 10-year yield rose by 12 basis points to 4.52% and the 30-year yield rose by 11 basis points to 4.72%.

The chart below shows the yield curve of Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: July 25, 2024, before the labor market data spiraled down (which was a false alarm).

- Blue: September 17, 2024, the day before the Fed’s rate cuts started.

- Red: Friday, December 20, 2024.

The yield curve had inverted in July 2022, when the Fed’s big rate hikes pushed up short-term Treasury yields very fast, but longer-term yields rose more slowly, and so the short-term yields blew past them.

But the yield curve is still fairly flat, with only a 22-basis point spread between the 2-year yield and the 10-year yield. Over time, as the yield curve normalizes, it will steepen, and the 2-to-10-year spread will widen. This could happen in two ways: With shorter-term yields falling or with long-term yields rising, or both.

Yields v. the Effective Federal Funds Rate.

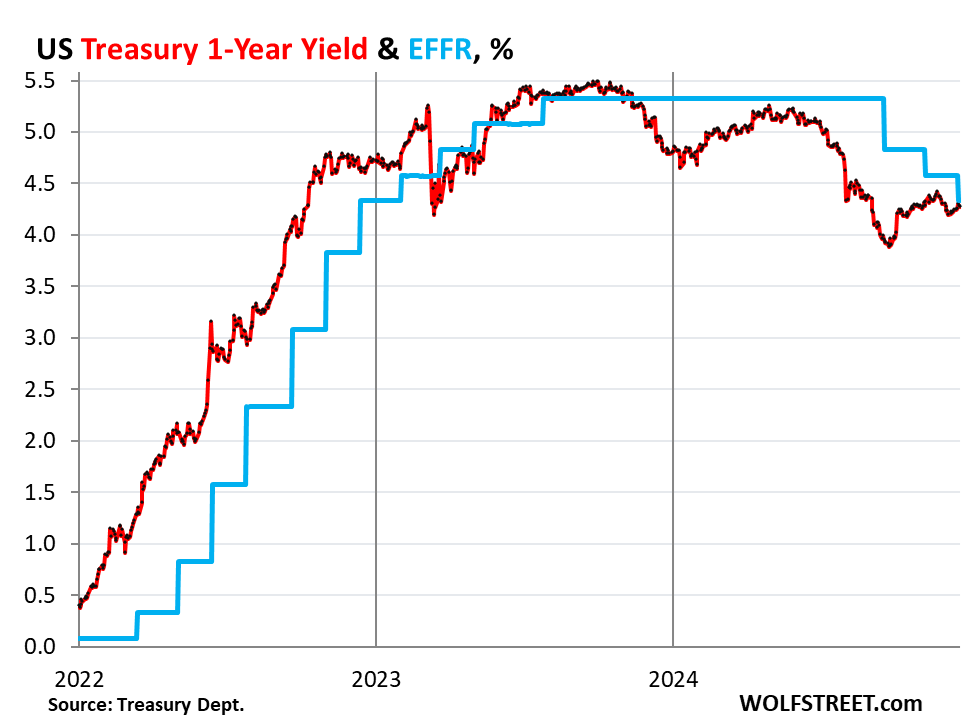

On Wednesday, the Fed cut its target range for the EFFR to 4.25% to 4.50%. The EFFR then dropped from 4.58% to 4.33% (blue in the charts below). And here is how Treasury yields of 1-year and longer reacted.

The 1-year Treasury yield, 4.26%, 7 basis points below EFFR:

The 2-year Treasury yield, 4.32%, at about the EFFR:

The 10-year Treasury yield, 4.52%, 19 basis points above EFFR:

The 30-year Treasury yield, 4.72%, 39 basis points above the EFFR:

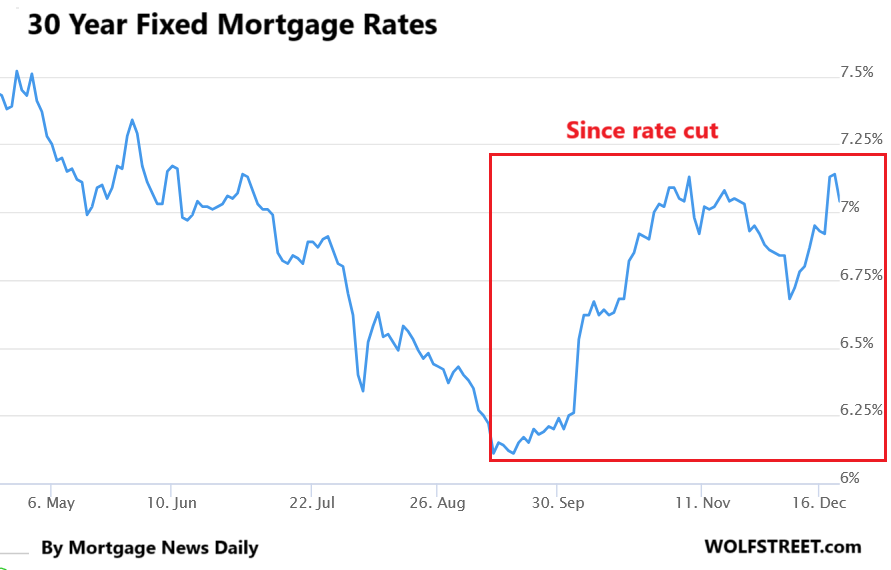

Mortgage rates back above 7%.

Since the initial rate cut in September, the average 30-year fixed mortgage rate has risen by nearly 1 percentage point, from 6.11% to 7.04%, according to the daily measure from Mortgage News Daily.

It roughly parallels the 10-year yield, but is higher, and that spread between them varies but is fairly wide currently due to some factors that we analyzed here. A wider spread and a higher 10-year Treasury yield means higher mortgage rates. So maybe it’s time to get re-used to these kinds of mortgage rates that were normal before 2008.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You’ve previously said that you have no appetite for long duration bonds. Obviously, it’s too early after just a week of a non-inverted yield curve, but does this move whet your appetite at all?

Not really. 10 years is a long time to be sitting on an underperforming asset. It’s just not very appealing yet, given what we know about supply and what we guess about inflation.

It will be interesting to see what happens if and when the 10-year yield goes back to 5%. Last time (Oct 2023), huge demand suddenly exploded on the scene the literal minute it hit 5%, and the yield re-plunged. It wasn’t at 5% for more than a few minutes. Neither the 10-year auction before or after was anywhere near 5%. My gut feeling is that next time, it will break through 5% and stay above it, and auction yields will be above 5%. Just my guess.

The Treasury Secretary should adjust the quantities of the various offerings to prevent supply from swamping demand, but with the fiscal plans pledge during the presidential campaign and repeated since, they are going to have to sell something!

With the TIPS real yields back to almost 2.5% it’s historically a good time to buy a ladder that you plan to **hold to maturity**. Nobody’s going to get rich off of 2.5% real yields, but a 30-year ladder right now has an effective withdrawal rate of 4.6% which is a lot higher than Morningstar’s recently announced 3.7% “safe starting withdrawal rate” for 2025. And it keeps up with inflation by design. So, if 4.6% works for you, and especially if it’s not all of you portfolio(!) take the win.

“Treasury Secretary should adjust the quantities of the various offerings to prevent supply from swamping demand”

They’ve already been skewing new issuance away from coupons and into bills. They don’t like going above ~20% bill issuance.

Would you be inclined to tie up funds for 10 years if it does go above 5%? Long time to take money off the board but the stock prices seem to be in la la land as are the housing prices.

As you get older, you should always diversify your assets and not just hold stocks and cryptos which can blow up and take some or all your retirement funds away.

So to me, the decision is not “10-year Treasuries or stocks,” but “10-year Treasuries or other fixed income investments” (T-bills, corporate bonds, etc.). To stay with zero-credit-risk products more specifically, the decision is: 10-year Treasuries or T-bills.

I’m not ready yet to switch some of my T-bill funds to 10-year Treasuries, that’s what I’m saying. There is always the risk that you miss the boat, that 10-year yields will plunge back to 0.5%, but that risk is pretty small. The bigger risk is that yields will go higher from here. That said, if yields go past 5%, eventually I’m going to start nibbling at 10-year auctions. I’m just going to be patient here, and take the risk that I might miss the boat. But that’s just me. If 30-year yields go high enough (well past 5%), I might even nibble on 20-year and 30-year bonds. But that’s a real gut check.

Heavenly father,

Let us pray for the institutional buyers, SVB, SIGNATURE bank, Grandpa, my neighbor, etc…who bought the 30yr @1.3%, the 10yr @ 0.5%, & Geman bonds @ negative rates during 2022.

5,000 year low rates. I believe Grant’s observer rang the bell at the top of that one.

I feel likevi just experienced history on that one.

Like watching the Berlin wall come down.

That market scenario looks about right and follows the similar pattern of the 1970s Bear market in Bonds.

As memory serves, in 1976 treasury note yields reached 8%, and those bonds were scooped up and called the magic 8s as rates retreated for a while.

By the late 70s those bonds were deeply underwater and Treasury bonds started being issued at double digit yields.

One notable quarterly bond issuance was dubbed DC 10s, “crashed

on takeoff” by Wall Street bond wags as performance of those bonds right after issuance mimicked the crash of a jetliner that year.

Well, all the puppets on MSM have assured us that:

1. This time it’s different.

2. Trees grow to the moon

3. If you ever want to retire with dignity, we must send wall street your last dime.

4. Michael Sailor is our patron Saint.

Please tell me the difference between a class of kindergarteners & wall street.

Kindergartens do less damage.

No one should feel very proud of our financial markets. The Fed is facilitating a massive pump & dump on behalf of wall street.

I’m struggling to understand how any of these predictions on future changes can have any basis in reality when in less than 30 days there’s going to be a loose cannon rolling all over the deck of the USS Financial blowing holes through not just the deck but clear through the hull as well? All these financial predictions seem to be based on what historically has been fairly predictable cause and effect of a society who’s fundamental rules and principles remained intact over time. Facing what I believe is a fundamental dismantling of every social and governmental norm that we have ever known how can anyone think that they can even begin to predict what is going to happen?

The current administration has made it perfectly clear for some time now that they have every intention of completely dismantling the administrative state. It seems to me that all these great financial minds are attempting to predict which direction the ship is going to go once it’s rudder falls off.

Full speed ahead I guess but I see rocks ahead and I’m not sure if my life jacket is up to the task at hand. Despite all the best intentions and efforts of the Biden administration to bring financial stability to a post pandemic world the skyrocketing long-term mortgage rates have had a crippling effect on real estate sales nationwide. Even if the next administration doesn’t go through with any of the plans that they already have in place to commence if the long-term mortgage rates continue to escalate I don’t see how anything is going to change for the better?

Some people just want to watch it all burn down. 🔥

“Best intentions and efforts of the Biden administration “?!?!?!

“I guess (their) best wasn’t good enough.”

I’m going with kramartini here.

“The current administration has made it perfectly clear for some time now that they have every intention of completely dismantling the administrative state.”

Freudian Slip Chet? How’s that Inflation Reduction Act doing? So far the ACA has resulted in monopolized health”care” at skyrocketing prices.

The dismantling will continue until moral improves.

Agree with some of the first part but long term mortgage rates going higher is much needed and would be a huge benefit to our society to clear out more of the speculative hoarding fueled by cheap debt that has put a heavy expense burden on renters and people wanting a starter home. Plus industries supported by discretionary spending would get a big boost it people had less housing expense. No more MBS buying, ever! It was a stunningly bad idea that’s causing a lot of long term damage.

Chet Traverca-

“All these financial predictions seem to be based on what historically has been fairly predictable cause and effect of a society whose fundamental rules and principles remained intact over time.”

If the “rules and principles” that caused the effects of the past 200 years were so predictable, how did we find ourselves in:

– the 1820 depression

– the Civil War

– the 1920’s depression (though it was over in an instant)

– the roaring 20’s

– the 1930’s depression

– the two” World Wars”

– the Cold War

– the Great Inflation of the 1960’s and ‘70’s

– three 50%+ stock market declines since 1970

– intractable federal deficits, leading to today’s unprecedented debt levels

– and a dollar that buys about 2% of what it bought 110 years ago?

The past was not a well-managed utopia of stability and good policy decisions, and the future (especially if you’re only considering the next 4 years) will most likely not be so apocalyptic as you expect.

P.S.-

Merry Christmas!

It is a little surreal to read these comments, and realize just how little most people understand what is actually happening, and that nothing can change it.

I would recommend that everyone study and understand money destruction, and how it works. Next, study the derivatives market and understand the implication of quadrillions of dollars of derivatives actually means. Finally, take a walk or study some online videos of the downtown sections of the major cities in the US like SF, LA, Portland, Seattle, and others and get a real understanding of just how much CRE is sitting empty, and how much debt is involved that is going to default.

When you understand the amounts of debt involved, and the fact that all that debt is being used as an asset to collateralize more debt, and that debt is being used to collateralize more debt, you begin to see the reality of the situation.

The FIRE economy has for decades produced money without any corresponding real value, and when it implodes, most of that money will dissapear in a very short period of time.

1. “Next, study the derivatives market and understand the implication of quadrillions of dollars of derivatives actually means.”

Derivatives are valued in “notional value.” When you buy way out-of-the-money call options (derivatives) of a stock from a failing company for just a fistful of dollars, the notional value may be hundreds of thousands of dollars. You only stand to lose your fistful of dollars, but the notional value will be hundreds of thousands of dollars. In addition, a lot of the derivative transactions can cancel each other out, the amount one party loses is the amount the other party makes, but both engage in derivatives with the same notional value, and both notional values are counted – so double-counted. “Notional value” is meaningless, which is why it’s called “notional.”

2. “get a real understanding of just how much CRE is sitting empty”

Total office CRE debt amount to about $5 trillion spread across investors and lenders around the world. The US government guarantees $1.1 trillion (multifam) of that. So that leaves $4 trillion in total CRE debt on investors (CMBS, CLOs, banks, REITs, PE firms, insurance companies, hedge funds, pension funds, etc.) around the world. This is a hugely diversified.

Office CRE, whereof you speak specifically, amounts to only about 17% of total CRE, so to about $850 billion. Nvidia can lose that much in a week and nothing happens.

And you can tell if you pay attention to my articles instead watching YouTube horror-show clickbait: A lot of the office CRE debt has ALREADY IMPLODED, and guess what??? Nothingburger.

3. “and the fact that all that debt is being used as an asset to collateralize more debt,”

Twisted BS.

@SFMurph

Anyone whose “inflation expectation” is 6% per year will certainly not be buying bonds at current interest rates.

The market still contains lots of people who remember the 1970s, and we have NO TROUBLE AT ALL imagining 10% inflation. All you need is an expensive, failed war and an irresponsible/incompetent Congress.

I am not going to bet against stupidity.

That includes me. I was in the oil business in the 70’s and saw the whole saga close up. The fundamental problem was huge global inflation primarily fueled (no pun intended) by the massive increase in oil prices because of events in the Middle East. Between 1970 and 1980 they increased tenfold. Not a misprint. Tenfold. And this at a time when oil was an even more important energy source than today. Imagine if Brent which is around $72 a barrel today went to $720 in the next ten years! At one point in the early 70’s the price of oil surged four times in a year. Again apply this multiplier to today’s prices and imagine the effect on inflation. There were some other factors like US spending on the Vietnam war but THE big factor was the oil price take off. This is how we ended up with Volcker’s 19% Fed funds rate in 1980.

Inflation got worse after the US withdrew from Vietnam…

If the FED didn’t validate those oil prices, there would have been widespread deflation in other prices. In fact, the FED more than validated the increase in OPEC’s oil prices.

kramartini

Inflation was taking off before we left Vietnam largely driven by the cost of financing the war which was running at 3 or 4 billion a month by the late 60’s. It then got a huge boost from the run up in oil prices consequent upon the closure of the Suez canal in 1967 and the subsequent oil embargoes, etc. of the early 70’s. Vietnam undoubtedly played a role which is why I mentioned it but what pushed it into the stratosphere at least in US terms was the oil price surge. It just impacted everything.

Spencer

Sorry this is nonsense. The Fed didn’t “validate” these oil price rises. They were essentially at the mercy of them. Another factor at the start of the 70’s was going off the Bretton Woods fixed exchange rates because our gold reserves were being exhausted. It’s fair to say the Fed followed a loose monetary policy starting in the late 60’s initially because Johnson wouldn’t raise taxes to pay for the war but hard to see what else they could have done without creating a massive recession. The notion that tight money would have caused a general deflation in prices other than energy prices is ludicrous. Sorry.

Joe: Haven’t you heard of the elasticity of demand?

During the U.S. Golden Era in Capitalism (not optimized), the annual compounded rate of increase in our means-of-payment money supply was about 2 percent. During the decade ending in 1964 aggregate monetary purchasing power, AD, money times the velocity of circulation, increased at an annual compounded rate of about 6 percent. In the subsequent 9 years, the increase was more than 13 percent, and in 1972-73 nearly 30 percent.

All figures taken from the Federal Reserve Bulletin.

Actually it was the opposite. The war was the major factor in inflation, but the oil situation was blamed by the government which never owns anything it does.

If the inflation was really a result of the oil spike, then it would have reversed when oil fell, and as we all know that did not happen.

Wars are the most inflationary factor in any economy, because the lions share of the money spent on war, is simply stolen.

It therefore adds to the money supply without a correlating increase in goods and services.

People need to understand how the mechinism by which they are being robbed really works.

jdog,

The war caused it 100%. I know from being at both ends of that scam. I slept in the bush and I slept at a Senator’s home. Plenty unimaginable waste at both ends.

I bought my first house in my early twenties in the mid ’70s through the SBA and was paying approximately 16% interest as I recall. I would have never been able to qualify for a loan without the SBA and it was a stroke of luck that I even managed to pull that off but my point being that people were still building and buying homes then as they continue to do so today. As a property owner in Mississippi I have watched the value of my real estate skyrocket in just the last 4 years and I have begun liquidating some of those assets that I had previously thought would have to be passed on to the next generation before reasonable profits could be taken.

If even a handful of the campaign promises are lived up to I don’t see any way that inflation could possibly do anything but skyrocket. No offense to the bond markets but my money is going back into gold.

What I get from this is that there’s no expectation of 0.99% 5-year teaser variable mortgages, and $1.5 million dollar homes in the middle of nowhere, while Tbills, CDs and Guaranteed Investment Certificates will at least be above ~4% for now?

Sounds like a deal to me!

Here in Canada people were boasting in the summer of 2021 and early 2022 how their homes doubled and quadrupled in value overnight.

That was when savers were getting 0.5% high interest savings and 1% 5-year GICs before the interest rate hikes.

Re “ how their homes doubled and quadrupled in value overnight.”

They were wrong, misunderstanding the difference between price and value. The house might have doubled in price, but the value it delivered (providing shelter etc) did not change.

Put a different way – the price increase wasn’t a real change in value because the only way to get benefit from it was to sell and move to a less expensive house. The best benefit would have been to borrow like crazy at near-zero rates and then invest in ways that paid for the loan + interest.

Thank you SO much BG for quick summary of delta between Price and Value,,, SO very important for all market participants in every market to understand thoroughly, especially these days, but really ALL the time…

Finally gave up several decades ago when close and dear ones insisted they had made major ”profit”,,, when, in fact, they had actually LOST ”value” in spite of much better ”price”…

Similar challenge to be sure for those folx unable to understand difference between ”gross” profit from their biz and ”net.”

Absolutely 100% correct BG:

If I woke up tomorrow and zillow said my house is worth $1, I wouldn’t care – it’s still the same house! My roof didn’t get any smaller, my walls aren’t less insulated… I still get the same value out of it.

People in Texas were cheering about their houses Dublin and tripling in price but then when their tax statements so to doubling and tripling they were not cheering as much and then their homeowners insurance skyrocketing on top of that.

I tried to tell him that it’s not the price of their home going up it’s the purchasing power of their money is going down, but they just look at you like a deer in the headlights.

The ten year will be going into 6-7% territory if Trump’s promised tax cuts and spending actually happen. The federal spending cuts are preposterous since 90% of the budget is effectively untouchable. This means the budget process and debt ceiling raise probably in about April are going to be interesting!

Define “untouchable”? If anyone thinks that Trump is beyond vivisecting social security and Medicare along with Medicaid I personally believe that they are completely delusional. You were trying to predict the behavior of a man who has never had to once in his entire life suffer the consequences of his immoral and illegal activities. He has never once in his entire life shown the slightest bit of compassion for anyone else on this planet besides himself and other billionaires like him. Add the fact that he is no longer a president but he is in fact a king. Thanks to the recent Supreme Court that he handpicked it is a fact that he is a king and not in name only. Thinking that you can predict what such a king is capable of doing, willing to do and in all probability will do is a mistake that far too many people have already made.

As someone on a fixed income and dependent on social security benefits the safest way forward for me appears to be exchanging five generations of real estate investments for physical gold and a temporary resident visa for Portugal. The application process is free, any and all income brought into the economy is tax-free, the minimum monthly income requirement is approximately half of what I currently have, I become a member of the EU and will be able to take up residence in a beachfront cottage at a fraction of what it’s currently costing me to live in the poorest state in the United States the great hate state of Mississippi. Not that I plan on returning to work but I would be able to do so anywhere in the EU as well as travel anywhere in the EU visa-free… Not to mention a hundred or so other countries outside of the EU. Maybe not the best choice for a younger man but for someone with nothing better to do than wait for the gates to open this appears to be a no-brainer for me. I only feel sorry for the millions of other Americans who are not so fortunate to have such opportunities.

I might be wrong but the next 4 years here in the United States for anyone but the wealthiest will prove to be the darkest 4 years in the history of this country.

The total dismantling of the administrative state is going to have far-reaching effects on far more than the financial markets and how anyone can think to be able to predict just what that’s going to be now is beyond me.

Everything is on the table. Nothing is untouchable. This is a once in a hundred years power grab.

After smoking the stink…I foresaw the devil, and it was me.

… the beast will be upon us soon …. minions at his side….nowhere to hide….thank God short term rates are steady….something to lean on….

If you want the option to work in the EU, I do not believe you can just get a free Portuguese visa. It’s not easy to move to and work in the EU. A free visa to be in the Schengen Zone for more than 6 months or to retire in the EU would be rare. Portugal’s D7 visa for those with sufficient passive income is not terribly expensive, but you won’t be able to spend much time not in Portugal.

Portugal is a fine choice. I thoroughly enjoyed a visit there recently.

Depending on how bad things get here as the plutocrats and neo-autocrats rush to obliterate our democracy, I imagine countries with easy immigration rules for Americans and others will start putting on some more restrictive policies if the numbers of expats balloons.

Already the Portugese and Spaniards are having citizen protests against foreigners coming in under easy immigration policies and driving up their housing prices in desirable areas like Lisboa and Barcelona.

The flip side is how tense Europe may get if Russia is able to start bulldozing Ukraine, other former USSR countries, and then threaten Poland and others, if NATO and US resolve is seriously weakened.

Easy there fella, we somehow survived the other 4 years, we will survive these as well. And something has to change regarding the social program spending, we are writing checks we can’t cash. It might not be this administration, but in the next 10 years, it will hit the fan if we do nothing. And Portugal is great for someone who already has money, but about the last place in Europe to try to build wealth.

I think your info re Portugal is out of date. All income is taxable now and visa applications are backlogged to the loon. You should double-check your facts.

TDS happening on steroids here;

What do you mean by “administrative state” and is it the same definition used be those who want to dismantle it?

seems like a pretty political post

as if 12 of the last 16 years never happened

The Federal budget is $6.8 trillion. About 61% ($4 trillion) of this is mandatory spending on SS, Medicare, Medicaid, ACA, VA, CHIP etc. Then there is about 14% interest on the debt or just under $1 trillion. This leaves 25% or about $1.8 trillion of which over half is defense spending. Republicans have just passed a $900 billion defense budget. Trump may try to vivisect this as you put it but (and I don’t dispute he’s deeply irrational) there are other players in this process and I believe it is somewhat delusional to believe Republicans in congress are just going to go along with this destruction because the consequences would be dire in all sorts of ways with all sorts of political consequences for Republican incumbents which is why I said it would be interesting.

The layoffs at MSNBC must have been hard on you.

Chet, your team lost. You are supposed to be unhappy. It is normal. I would recommend you not make any major decisions until you see what is really going on.

Thurd,

All other human suffering set aside, (difficult to do for me…I’m just an invalid old snowflake), I am looking forward to how people like you and some others above respond when YOU finally figure out what is really going on….if that is even possible.

Because as for me, I have learned the phrase, “ignorance is bliss” is anything but a rare trait when applied to humans.

But I truly have no idea in hell what will happen regarding your “we won” thoughts and expectations. (I DO know I will shoot myself before going to Bible School again)

BTW…..I wrote in Bernie, like in 2016 and 2020, but am in CA, so my Prez vote truly doesn’t count.

Oh, FWIW….Portugal has been facing some of the nastiest effects of some recent climate changes. Good for Villa prices, though.

And yes, I have hospital level TDS….really sick.

And with any luck the final stages of TDS are fatal, right after one’s curiosity is satisfied. Only disease I was ever glad to have.

Is this called a “bear steepening”?

The reason I ask is the fall in yields and climb in price on the t-bills before this cut.

The Fed pretty much tells the market what its next move will be, and short-term yields react to that verbiage, and so the cut was 100% priced in well before the Fed actually cut. That’s why short-term yields fell in the weeks before the cut.

Yes, I think it is a bear steepening, as in, this kind of uninversion is the kind you get when you ARENT getting a severe recession.

Rather, it seems inflationary.

I am still quite cautious though with the outlook of the economy… households are stretched financially. The massive increase to the money supply portends devaluation of the dollar.

Part of me thinks that rising rates and nominally strong markets are no reflection of economic growth but rather are just a manifestation of devaluation of the dollar, not so much compared to other currencies, but to the power of purchasing things. I think the astronomical increase in money supply has not yet fully shaken out, so rates are resisting the (political) moves of the Fed, who wants to promise a rate cut, even though the environment doesn’t fully align with a classic recession phase of a cycle, but instead is more suggestive of stagflation.

It’s called a bear steepening when the long end of the curve increases but we also have the short end of the curve dropping (which is a bull steepening). So instead, you might call this a twist of the yield curve.

I firmly believe the 10-yr will be over 5% before too much longer, perhaps by March.

Dang that would be nice.

Wonder what the best use of the interest is? Does one reinvest it, spend it (if taking retirement) or just hold it and pretend like your past money did not get killed by inflation (which it did).

In a way, a treasury is how to transport your money into the future and negate inflation, kind of, with little risk besides loss of use of the money.

I should get frozen in a Cryonics sleep chamber for 200 years and see how much money my 200 year treasury has made me…thank for the idea sucatash… Plus in 200 years I should be able to order a new brain, this one’s getting kind of slow.

Great comment Home toad!

Personally I think my brain is barely OK. It’s just full of … stuff.

My body – all 7 decades of it – could certainly use replacing though.

I’m curious, when one considers the kind of world that one would be waking up into 200 years from now based on all the ultra Conservative scientific predictions over the state of the environment at that time why in the world would someone want to make such a journey?

It’s too late for me to die young and leave a pretty corpse but it’s 71 they’re still room for a little fun…hopefully.

Considering my utter lack of optimism over what is to come of the next 4 years at this point it can only get better from here, so is Alfred p Newman once famously was quoted as saying… “What me worry? ”

Damn the torpedoes full speed ahead.

Chet,

tbh republicans believe in hypocrisy, then in following years they even violate that with new hypocrisy

Like being the party of law and order, dealing out punishments, yet electing a felon whom nominated a man for AG who’s just a horrible horrible person.

See the hypocrisy violation over and over?

And the defenses are “but but but” and finger pointing.

It usually boils down to “we’re right, you’re wrong. Do what we say or else.”

Blah blah blah

Home Toad,

Your comment had me searching for a clip from the Austin Powers movie, where the recently thawed-out Doctor Evil menacingly demanded ‘One MILLION Dollars’…

Great fun.

I’m not sure there’s a country in the world where I’d want to bet my life that it would still exist 200 years from now, certainly not the USA.

10-year agencies are starting to poke above 5%.

If this next auction is above 5%, I’ll run down the street exclaiming “merry Christmas to all!”

Seems like a major shift in expectations.

How does this affect the federal government’s largesse? Is there suddenly recognition that there might be a problem with the high debt level? Or is inflation going to negate the impact of higher borrowing costs?

DOGE has everything under control!

Seriously, taxes will need to be raised even if waste is cut.

If Federal spending was just reset to 2019 levels there would be no need for this. We have a massive, out of control spending problem.

To return to 2019 levels as a percentage of our economy requires a cut of 6% of the current budget. Whether you consider that massive is up to you.

You probably have what I would consider a massive spending problem, Happy.

Does that mean anything in the big scheme of things?

Most Americans agree the gov’t is spending too much. But no one seems willing to agree on what exactly the gov’t should stop funding to fix the “out of control spending problem”.

No more Medicaid? No more military? No more Social Security?

Or just keep insisting foreign aid + department of education are entirely responsible for the $1.8t deficit, and as soon as they’re eliminated, there will be tax cuts a-plenty ?

Wonder how much home builders were predicting rates would go down and thus the cost of mortgage rate buy downs? I would think it would definitely be cutting into margins more than they expected.

They bent over and heard a loud ZIRP!

Lol 😂

I’ve been adding “zirp” to everything around the house lately. “Gotta zirp the dishes, holy zirp batman!”

“Try the new Zirp soap flakes. Add nothing to your laundering cycle and still end up with the cleanest of the dirty shirts! Zirp…it’s the zip in your zilch!! (Zirp is a registered trademark of Zirpco Industries, a wholly owned subsidiary of Big Bro Co.).”

…time for a new edition, illustrated by R. Crumb, natch, of ‘ZIRP Comix’…

may we all find a better day.

7 year treasury looking NICE at auction. :) might be 4.58! Woo, knock on wood

Meh. I can still get 4.5% on a 6mo CD at my bank. Need more yield for that kind of duration.

It’s when the yields dry up that you will be wishing for the long duros baby!

Fed wants those yields dry. But economy is resisting.

So short term, the best we could hope for in mortgage rates would be 6 to 6.5%, based on historic spreads, if they normalize to 1.5 to 2%? And if the 10 year climbs higher, then 7% is the new norm?

Going to take some time for the housing market to stabilize to these prices. Some markets, like the Northeast are way too stubborn.

Maybe they’ll just stay flat for years while inflation takes continual bites out of them, unless something breaks in the economy.

I sincerely hope that the next time something breaks, it’s a minor slide and the government finally sits back and does nothing. The post free money playbook, first for institutions, and later for everyone, has to have a limit.

In the northeast, ny, I see home prices not moving at all. Inventory is higher so I wonder why prices do not move. Maybe need more time, any hypothesis?

I lived in NY and if I go back to my “NY State of Mind” it tells me that this is a very expensive place and you have to live somewhere. So you bite the bullet, accept it, and pay the price to live there. The flipside is that your job is most likely linked to NYC and you get paid top dollar. Your second half should also be getting paid top dollar. The parents are most likely from the area, so they have TONS of money and they help their kids out with huge down payments.

This was my experience in NY, minus the loaded parents who were not able to hand me $100K for a down payment. A handful of my friends got the down payment assistance from their parents during the run up to Housing Bubble 1. One in particular got the “bail out” assistance from the in-laws in 2010 while he was trying to sell his overpriced home which he bought in 2005, almost at the peak of the madness. They wanted to upsize and move on from their “starter” home which dropped on value the moment they bought it. $400K for 1,500 SF, built in the 1940s, zero updates, no garage. “It’s a bargain”

NY Metro also has lots of family who pool their money together (Asians in particular) and also multigenerational living is a normal thing. There’s just so much money in NY it’s hard to wrap your mind around it unless you’ve seen it.

Work from home and flight to rural areas has really f**ked this up in northern New England. Us rurals can’t compete with home prices based on NYC, BOS & Southern New England salaries. I was fine with the cities and exurban areas being expensive due to proximity, but now people have ruined far-from-everything areas like mine (closest Walmart is a 1-hour drive away). I know a lot of people here wouldn’t like this, but I’d love to see the stock market crash hard. Nothing seems to change people’s tunes, at least in my lifetime, like seeing their investments go way down. I say this as someone with more or less all their investments in real estate. Yes, my RE values would crash too, but they’re all held for the long term, and at least I’d be able to buy some more and offer reasonable rents again. The process of watching people with way too much excess money overpay for rental properties, jack up the rents, make very little profit and then turn it over to someone else for a absurdly inflated price needs to end and I unfortunately don’t see this happening without a very big stock market correction.

digger dave, that’s one thing the pandemic temporary, as it seems now, work from home thing did. it reset the housing market nationwide to the higher income area. how long it’ll take to reverse is anyone’s guess.

but what you say is what i’ve thought for a long time, that the bubbled up stock and crypto market is driving inflation, and they won’t be able to get it under control until it’s back to where it should be, which means p/es under 30.

A stock market correction could work some serious magic in many areas. A reset is needed. There is no price for risk anymore, and the mentality is that stocks,crypto,etc just yield insane amounts without 0 risk and it’s the new way , the only way, to get rich. That mentality is dangerous and never holds up long term. FOMO

Blake,

Yup. The book ‘Fooled by Randomness” goes into this.

In a nutshell anything can happen, and the past has zero correlation as to what will happen, it’s just reminiscent of the past what does happen. And no one can say 100% why what happened, happened. So it’s best to use as much caution as you can.

Schiller is a great “cautioner” to read his works.

I just discovered him, phew was I ever risking my bacon before. His book about the dot com crash was written right before it and was really informative.

Just have to admit that there is so much info out there and ya gotta keep reading it all. And then you won’t even be close to as good as a pro in the game or an economist.

House prices are notoriously sticky. Given the deficit is running around 6.5% of GDP and likely to go higher the only direction for the ten year is up with all that implies.

The current residential market is at or near record low affordability, and the last time this happened was post 2007. Supply and demand has not gone out of style, but it sometimes takes a little while to catch up in a less liquid asset like SFR.

Not post 2007, thinking back, I believe it was late 2005 without looking it up.

The housing market that was the causa proxima of the 2008/9 crash started to tank in September 2006. By the Spring of 2007 it had turned into a rout which is when all those sliced and diced MBS tanked.

I agree. We are defying the laws of economics right now, temporarily levitating, but I imagine we aren’t gonna float for much longer. Now we just need the herd / narrative / perception to catch up, and then the shift should occur in prices, etc.

Right – without some sort of event why sell?

I everyone’s been trying to wait this out. Inventory is up but prices aren’t substantially dropping. I think the indication of true weakness would be 0% to negative month over month price changes in March – July. Right now seasonality just seems to have returned to the market. It will be interesting to see what happens this Spring now that inventory levels are up from 2019 in a number of large metros.

I think some other trends that will be 1) people who never planned on being permanent landlords hitting the 2 of 5 year residency rule and needing to sell or give up their capital gains exclusions 2) people who bought airbnbs in 2020/2021 realizing they require a lot of work and may not be really profitable now that travel is dying down and markets are saturated. 3) and here in Colorado, one more bad snow year (this year so far is ever worse than last year) and I think a lot of the airbnbs for the i70 resorts will be in trouble

how long are people going to wait out holding onto empty houses, paying thousands in mortgage, taxes and insurance each month?

As long as they can hold onto a positive outlook, I suppose.

Good point…Boomers got bailed out with government 1st Aid at every turn since 08.. younger generations got hosed on housing bust opportunity. That ship has sailed govt has little left in the kit..

This isn’t intended in anyway to be a political post but given political and economic systems are intricately tied I am happy to sit in short term treasuries until I see what the next 2 and potentially four years will bring with change in administration. I could argue any position from it will be irrelevant, to a good thing to a bad thing for interest rates so going to simply wait and see.

Unrelated I wonder how market valuations will hold up. I get market valuations are complex and based on current and future projection but Tesla having the combined market valuation of next 29 auto companies combined with a fraction of the volume of even Toyota alone it is hard to explain. In my mind, the US is less than a decade away from having a competitive EV market and of course the world market is already there. I worked the 90s at Intel where the seemed dominant and unstoppable and then the Smart Phone came along with commodification of chips and they are a shadow of their former self. No reason in my mind not to expect that although high tariffs will slow it here.

Yeah, the market has been extremely volatile of late. And if anyone remembers 2022 took a nose dive in the new year. I was hoping 2025 would be ok, but I’m on the sidelines too mostly atm.

The stock market is likely to end its long term bull run and begin a substantial and protracted bear market by mid-2025 or so, with periodic counter moves.

The impact on housing prices and crypto will probably be delayed a bit, but the confidence shaker ought to be something to behold.

IMO.

Portfolio managers use an asset class called “Cash and cash equivalents”. Naturally, Treasury notes fall within this class. So how do we accept BLS claims that the CPI is running at less than 3% while I can buy a 6 mo. $100 note for $95.70; a discount of 4.3%. I am essentially buying cash from Treasury, right?

1. No, “Treasury notes” are NOT in “cash or cash equivalent. Notes are securities of 2-years to 10 years, and they’re not cash and not cash equivalent. Cash and cash equivalent are cash in bank accounts, T-bills, money market funds, commercial paper, and other short-term instruments.

2. The Fed’s policy rates are well above CPI and may therefore be “restrictive” (or maybe not). We have discussed this here endlessly. The EFFR is 4.33%. That’s the blue line in charts #1 and #3-#6 here. That’s the rate the Fed controls. This means that the “real” EFFR (EFFR minus CPI) is now positive 1.6%. For many years under interest rate repression, the real EFFR was negative with Fed policy rates BELOW CPI. Today’s spread between EFFR and CPI is about where normal used to be before the interest rate repression began in 2008 with QE. So this is a pretty good place to be for now.

The deficit must be cut before rates will fall.

I know this sounds stupid, but how about just some tax increases?

So much goes in, so much goes out?

My simplistic view shows my ignorance of econ 101.

(I gave up on my Econ 1A-1B preaching, but I still bet NOBODY will hire you to trade bonds without it)

That’s an option. It just pisses people off

I have read numerous articles over the years that calm the Fed follows the market. When you look at the charts, the market is usually ahead of the Fed by a couple of months in predicting rates. Meanwhile, the vast majority believe the market guesses what the Fed is going to do and front runs the Fed for trading profits. It’s an interesting argument, which came first the chicken or the egg?

“the Fed follows the market” is a bullshit statement made by people who can only look at pictures and who don’t listen to or read what the Fed says.

The Fed tells markets well in advance where it is going with its policy rates, and markets gradually follow and price in those instructions about the future.

This Fed avoids surprises. I have posted a gazillion articles about the Fed’s communications about rate moves in the future…. the FOMC policy statement language about future rate moves, the SEP projections about future rate moves, the minutes of the FOMC meetings, the press conferences, the many speeches by Fed governors that discuss the future of policy rates.

On Wednesday (you read this right here), the Fed told markets that there may be only 2 cuts in 2025, and Powell said that there may even be no cuts or just 1 cut. Only morons who don’t listen to this will then say that the Fed followed the market if it only cut 2 times, or 0 times in 2025.

That communication about 2025 was a surprise for markets, but they adjusted their expectations to what the Fed told them about 2025. The Fed will tell you in more detail what rates will do weeks and months ahead of a decision.

And markets follow the Fed’s predictions about future rate decisions and price them in before the rate decisions actually is made because markets DO Listen to the Fed, unlike the Fed-follows-the-markets mongers.

And yet, the federal funds futures market is nearly always wrong.

The federal funds futures that try to predict Fed policy rates are nearly always WRONG. Here is one of my favorite charts, though it’s a little outdated (someone emailed it to me, maybe from the Economist:

The 20 year is at 4.86% today. Long bond-holders have no confidence in the Fed’s ability to deal with inflation. The more Powell cuts, the higher the yields go on 10, 20, and 30s.

But not TOO much excitement….so the banks still work….I forgot that part, and I have been here a long time, too….have NO EXCUSE for overlooking that.

Claim senility?

That’s a really good chart.

Maybe the Fed’s REAL job is just to keep some excitement in the gambling?

(I meant trading/investing….sorry)

Predictions of this going up, and that going down are based on past outcomes. This is a world and an economy that are very unsimilar to the past, much is different and changing rapidly. But, what else is there…the past.

A mystic Wolf is what is needed, foretelling the past and present is one thing but to foretell the future….I predict good things are within reach.

Monkees remain monkees, even if they learn to fine tune their singing and actually master the playing of their instruments. But tossing bones or monkey wrenches into the air doesn’t mean you’re in control of that mysterious monolith that keeps popping up at the frontier edge of existence. One thing that doesn’t change is that the future is always about destruction of the past and building anew upon a foundation of the ruins. The past becomes part to the waste stream but one can always find value or renumerances in that pile…it may take some tough digging. But whether Egyptian authorities or antiquities laws, someone will be waiting and watching to make sure they get their share of your work. Can’t say whether a Good Wolf or a Bad Wolf is a better guide on the path to grandma’s cabin through the Schwartzwald, but I expect most wolves do have boiled monkey as an acceptable part of their diet. I would advise caution and bringing a big sharp knife, a lantern & fuel, and a working compass in case the electricity goes out in the future.

Buy-most insightful…a long time ago I commented that I never have, or will be, seriously playing in these street games of our economic existence, but that I have always valued this, Wolf’s most-excellent establishment, in providing me with the numbers of the various large trucks that constantly intersect the scrums and their spectators…

may we all find a better day.

Well said Dustoff….that’s MY thing here, too……plus some between the lines Soc. and guessing in the comments.

And seeing my thoughts in print……among “relatively well behaved” commenters. (from audio articles)

Wolf, have you considered 2 year treasury floating notes?

” the Fed cut by 100 basis points while the 10-year Treasury yield rose by 87 basis points”

This same situation (opposite directions) happened recently in the UK and the general opinion seemed to be that the market has lost confidence in the reliable actions/response of the central bank.

Hooray for term premium!’

The perpetually-inverted yield curve was like a stretched rubber band… an unnatural state of existence, constantly trying to revert back…

Ok, so now the curve is “flat” and proper, with long paying more than short, the way nature intended. This could be like a soft rope turning into a solid rod – before the Fed would adjust the short end and the long end would flop around randomly. Now, the Fed might be able to walk the short end down a little and the entire structure will shift down with it solidly.

When the Treasury portion of QT ends and the Fed starts buying Bills again (while MBS continue to roll off), the Fed will basically call the tune and if they say that the 4-week pays 3.5% then that’s what it pays, period. The two year and ten year and thirty year might shift down a bit too as everyone else is forced to go out for yield. While I’ve imagined a curve of 4.5% to 6% (4w to 30y), the Fed may be thinking more like 3.5 to 4.5. Straight and flat. Mortgages would settle at about 5.5-6% in that case. I guess the next six months will tell.

“and the Fed starts buying Bills again (while MBS continue to roll off),”

So when QT ends, the Fed will replace at least some maturing Treasury notes and bonds with T-bills, and all maturing MBS with T-bills. This will put upward pressure on long-term yields. And it will keep T-bill yields anchored near the Fed’s policy rates. As a result, the yield curve steepens, and becomes more classic, with much higher term premiums than today’s.

“…the Fed will replace at least some maturing Treasury notes and bonds with T-bills, and all maturing MBS with T-bills. This will put upward pressure on long-term yields.”

Wolf, what’s the mechanism for the upward pressure here? Hasn’t the Fed already ceased being a buyer of duration?

Maturing Treasury notes and bonds are replaced by the Treasury Department with new notes and bonds (“refinanced”) month after month. When the Fed replaces its own holdings of maturing notes and bonds, it buys the same amount of the same maturities at auction, and thus is a buyer at those auctions for the amounts of its maturing securities. You can see in the auction results of how much SOMA (the Fed’s account) bought. When the Fed stops rolling over maturing notes and bonds, but replaces them with T-bills, a new buyer will have to be enticed into the market to buy what the Fed would have bought. Every month, more new buyers will have to be enticed into the market to buy the Fed’s share that it is getting rid of. Those new buyers will have to be enticed with higher yields. This is the opposite of QE’s “Operation Twist.”

In Yield Curve Inversion We Trust.

Meanwhile up North in the frozen wasteland:

“Canada’s 10-year note yields climbed to their highest level since Nov. 28. They were last up 4.2 basis points at 3.2%. The Canadian dollar weakened to a four and a half year low at 1.4268 per U.S. dollar before reversing course”

I think this hints at global pragmatism towards exploding deficits and the pushback from mkts demanding higher yields.

I’m about the only person on Planet Wolf anticipating Yuge gridlock ahead with incoming admin, who will be shocked by the powerful constraints of deficit dynamics.

‘I’m about the only person on Planet Wolf anticipating Yuge gridlock ahead with incoming admin’

You are in more trouble with this crew than can be imagined right now