How does it compare to German, Japanese, and Chinese yield curves?

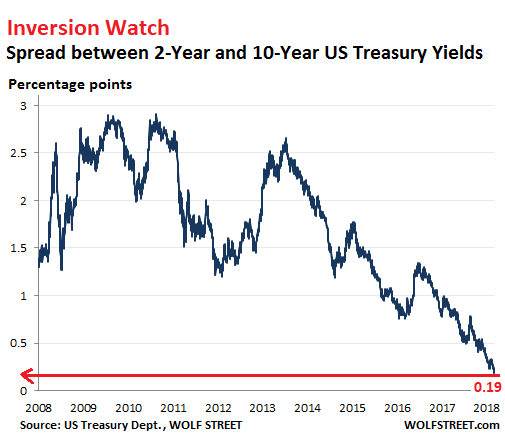

On Friday, the US Treasury 2-year yield rose to 2.63% and the 10-year yield remained at 2.82%. This squeezed the spread between them to just 19 basis points, the lowest since August 2007.

This is a further step in the “flattening yield curve,” where short-term yields and long-term yields move closer together. Unless the 10-year yield gets on the rate-hike bandwagon and jumps, it might soon be lower than the 2-year yield – a condition called yield-curve “inversion.” This happens as shorter-term yields rise following the Fed’s rate hikes but long-term yields refuse to budge. The way it looks, it is hell-bent on doing just that:

If the line in the chart above drops below zero, with the 2-year yield higher than the 10-year yield, the yield curve has “inverted.” In the past, this condition was followed by recessions.

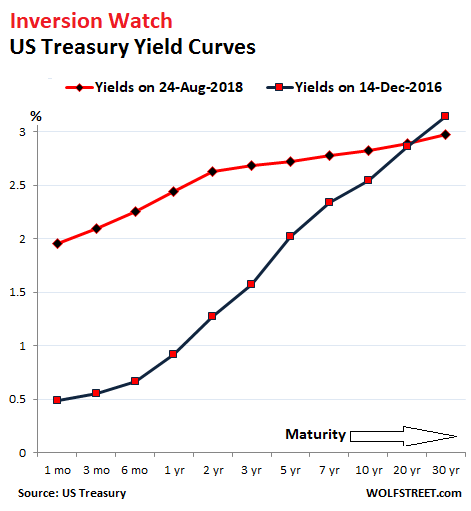

The chart below shows the yield curves on December 14, 2016, when the Fed got serious about raising rates (blue line) and on Friday August 24 (red line). Note how the red line has “flattened” compared to the black line, especially from the 2-year yield on out. The 19-basis-point spread between the 2-year and the 10-year markers is tiny compared to the 127-basis-point spread on December 14, 2016:

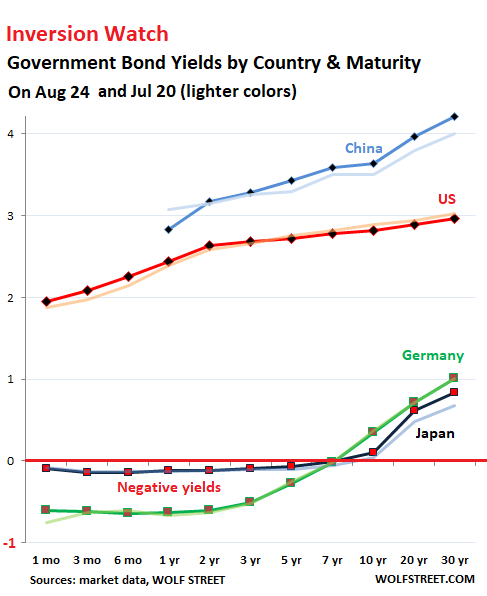

How does this situation compare to the government bond markets in Japan, Germany, and China?

When it comes to government bond markets, the term “market” as a place where price discovery takes place is essentially a misnomer these days because there is no market in the sense that real price discovery is taking place, in the era of zero-interest-rate policies, negative-interest-rate policies, and massive QE (Eurozone), stealth QE (China), and QQE (Japan).

Here are the yield curves of the US, Japan, Germany, and China, with current yield in brighter colors and the yields of July 20 in washed-out colors:

Japan (dark blue line with red markers):

With the 2-year yield at negative -0.11% and the 10-year yield at positive 0.10%, the spread between them is 21 basis points – wider than the US Treasury spread! Japanese yields of 7 years and below are negative, but only slightly, and their end of the yield curve is flat. Note how the yield curve steepened from the 10-year yield up as the 20-year and 30-year yields rose from July 20 (light blue line).

The amount of Japanese government debt has ballooned, but the market has withered as a majority of these securities are held by the Bank of Japan and government-controlled entities, such as the Post Bank and the Government Pension and Investment Fund. There are days when not a single 10-year JGB is traded. So forget price discovery. The BOJ runs the entire show.

The BOJ’s short-term interest-rate target is a negative -0.1%. In September 2016, it also introduced “Yield Curve Control” as part of its QQE bond-buying program. This policy directly manipulates the entire yield curve. The stated purpose is to keep the 10-year yield near but above 0%. So what you see in the chart above is what the BOJ wants.

Germany (green line with red markers):

The ECB’s “deposit facility” rate currently is negative -0.4%. Its large-scale QE program pushed the entire yield curve down, and short-term yields deeply into the negative even for countries in shaky fiscal condition. German yields are negative through 7-year maturities, with the 8-year yield just barely in the positive (0.11%).

The German yield curve is flat through 3-year yields then steepens as yields become less negative and finally slightly positive. With the 2-year yield at negative -0.61% and the 10-year yield at positive 0.35%, the spread between them is 96 basis points — over four times the spread between equivalent US yields!

China (light blue line, blue markers):

The spread between China’s 2-year yield (3.17%) and the 10-year yield (3.64%) is 47 basis points, up from 36 basis points on July 20. So its yield curve too has steepened. Chinese government bonds play a relatively small role in the gigantic debt bubble in China, consisting of bonds of other government entities, their off-balance-sheet vehicles, state-owned enterprises, and China’s corporate sector in general, all of them now a massive, opaque, convoluted tangle. This “hidden debt,” as it’s called, is the newest puzzle the Chinese government is trying to figure out how to even quantify, as it is struggling to keep it all from imploding.

In the US, where the Fed has been raising rates “gradually” since December 2015, a flattening yield curve is part of the deal. An inversion however, would be unwelcome. But given the Fed-manipulations of the Treasury market over the past decade, an inversion might no longer indicate what prior inversions had indicated – and there have been discussions at the Fed to that effect.

But neither the ECB nor the Bank of Japan have raised their policy rates yet, and so their respective yield curves remain untouched from those effects. However, both have backed off from QE. The ECB will stop QE entirely by year-end, and rate hikes are on its menu for next year, which will doubtlessly trigger more yield-curve fireworks down the road.

Five economists at the Fed’s Board of Governors published research results that encourage the Fed to not wait on tackling inflation because, in the current dynamics, “outsized deviations of inflation from its target are a plausible outcome.” Read… Fed Economists Deliver Ammo for Hawkish Approach to Inflation

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I hope they do no more than 1 more this year. To me the economy is slowing already and looks to do so more so with the trade issues.

“economy is slowing”…

You are correct. The global economy.

The current Fed policy of a strong dollar which is indicative of global liquidity tightening, and is fighting against the “Triffin Delemma”, causing margin compression among the emerging markets.

Think Venezuela, Brazil, Argentina, Turkey, South Africa, and what the Fed is deathly frightened of is the contagion spreading! Too late. Collapsing margins have been on the move for some time. Global trade has been weak and growing ever weaker since 4Q 2017.

Now mix in a trade war that has started and trade avenues become very fragile. To raise rates again will blow up the FX market. The EM/G7 FX volatility ratio is the highest since… you guessed it! 2008

There is an old saying; ‘When goods are prevented from crossing borders, then armies often do’.

The Great Devaluation draws ever nearer.

What do you see as a response to this?

John,

Inflation is purely an economic price event, whereas hyperinflation is purely a currency event.

Currently, because of Fed fiscal actions and the administrations international trade actions, there is a dollar liquidity crises within the emerging market sector.

This has sped up the international movement away from use of the dollar. As this international financial direction gathers faster momentum, the dollar grows ever weaker with further loss of credibility, which has caused inflation to bloom.

Eventually, if events proceed on the present course, this loss of credibility in the dollar will lead to a loss of confidence. Which in turn is a currency event, that will result in hyperinflation and a Great Devaluation. The so-called “reset”.

Against which currency is the dollar weakening?

None, the USD is the strongest buck in the drawer.

That is its problem.

All other currencies are weaker causing everything to be more expensive, since most trade is priced in US dollars.

This is causing a movement away from using dollars and “weakening” the dollars use as the global reserve currency.

Now, add in the Fed’s current policy of raising rates and shrinking its balance sheet. The first causes debt in US dollars to rise in cost, and the second is causing a dollar shortage among emerging markets.

And these EM nations have a large amount of debt that is US dollar based. Only problem is these nations must first earn, in their local devalued currency to pay their debt cost in dollars, which costs them more to purchase!

The USD’s use grows ever “weaker”.

The history so far and the trend now is that countries don’t increase use of a disappearing currency like the Italian lira before the euro, the Turkish lira now or the Argentine peso now.

Before the euro, real estate in Italy was priced in US$.

When Zimbabwe ended its currency, after reaching the billion note, it dollarized. Now the government still issues IOU’s but they are in dollars.

In Turkey they aren’t listening to Erdogan and selling dollars to buy lira. Turkey’s wild real estate and infrastructure boom has come to a screeching halt: it can’t buy the imports needed, including oil with lira. The scramble now is for dollars or euros.

So let’s say we are going to equate ‘weakness’ with ‘volume of world transactions’

Which currency or currencies is overtaking the dollar? Not in price appreciation but in use.

It isn’t the yuan which accounts for less than 2 % of world trade.

A currency is not just a medium of exchange it is a store of value. That is the problem for these soft currencies, of which there are suddenly so many.

nick kelly,

Suggest you follow link. Read.

http://www.strategic-culture.org/news/2018/08/23/weaponizing-us-dollar-is-accelerating-global-de-dollarization.html

ps: You will never read such a report in the MSM.

The asset bubbles, debt and inequality are piling up and many seniors who did not want to take too much risk are hurting and SS is not and has not kept up with inflation by any means.

As you can see by the yields around the world they are hugely positive for getting cheap credit which caused (partly) the last crashes.

Have you not seen the huge risk due to the search for yield, and the debt being taken due to low interest rates? Covenant-lite loans etc.

When the system was not allowed to fail and when it was not fixed and addressed when it was “rescued”, here we go again. And now Pres Trump has deregulated the financial system (with Congress) yet again a 180 from his position as a candidate.

I don’t know if the Fed cares about any of this but I assume they do to some extent and know if they raise interest rates or back off too much we are in big trouble. There may be a sweet spot where debt won’t strangle us and credit will back off. This world coordination is also new so we will see how it plays out.

As you pointed out in a previous article the Fed can prevent yield curve inversion simply by selling some of their 10 year treasuries and buying 2 year treasuries. The Fed decides the slope of the yield curve, they are the decider.

The Fed will soon need to start buying up a lot of U.S. government debt anyway. The current government has doubled down on deficit spending. Currently taxes cover only about 2/3 of government spending and that looks to shrink to 1/2 – the rest will need to be paid for by the Fed eventually. They are able to find other sources to buy treasuries at the moment, but that won’t last, soon the Fed will need to start funding the government that Americans refuse to pay for. Outright monetization of the cost of government spending – what can possibly go wrong.

I find it curious that anyone still takes modern currencies serious anymore. I see no reason to earn any more currency then is required to live hand to mouth, there is nothing left to invest in and anything put into savings will be confiscated by central banks via inflation.

I currently earn much more then I need to survive (I earn more then the cost of groceries – my only expense) but I plan to quit my engineering job in the new year and work part time for minimum wage ($15/hour). There is simply nothing I can do with the excess earnings and the Fed fully intends to confiscate any savings by inflating away the value. Why should I stress myself, working long hours, for money that is being devalued with no investment opportunities to be found.

I design machinery, mostly for the export market, but without any financial incentives I say let the Germans, Japanese and Chinese do it. In the meantime, I can collect free health care, food stamps and get fresh produce from local food banks (I like to eat healthy). There is simply no longer any reason to keep running on this hamster wheel, I quit. My time on earth is worth something – I’m not a slave working for a central bank.

That was powerful comment.

I want to point out, once again, a case I read about recently. A highly-educated, high-earning couple working for a big firm in (or near) Silicon Valley were at risk of becoming homeless due to rising housing costs.

My point is that stuff like that starts in places like California, then slowly leaks out to the rest of country (and world).

In short, since the government controls the entire economy, shouldn’t it be a just economy?

@ Van

Your time on earth is, indeed, worth something. It is good to have choices, and as an engineer you will always be able to build and fix things. You can’t put a price on that.

Our income is about 1/2 of what it was, but we make it be enough. Tonight we had one of the finest meals we make, all from the garden. Ciambotta. mmmmmm, with home made bread. Sometimes we have bruschetta with our own garlic and tomatos, once again on our toasted bread. Tonight, after supper we went out and picked blackberries. It was a beautiful evening with strong clearing wind. Elk were in the driveway. All these things are free. Good luck with your plans.

The price of anything is the amount of life you exchange for it. (Henry David Thoreau)

Yield curve? I figured things were ready to crash several years ago, got my ducks sorted out, retired, and thought about popcorn. QE kept the plates in the air longer than I thought possible. While I think the economy is rigged and getting worse for most, I am more upset about the decline in civility and basic values/manners. It’s a strange world out there, and maybe not so good. We’ll approach it, accordingly.

Paulo, as to that strange world out there, we avoid it, accordingly.

Van, there are still many things to invest in, you just have to look harder.

First off, you can continue to invest in yourself. Then your family. Then your community – relationships have great value, especially in difficult times to come. This doesn’t necessarily need currency.

Second, if you fear monetary inflation, there are better stores of value than bank savings. Many options will give you risk-diversification at minimum and potentially some outright capital appreciation. Some are overpriced but not all. Even the ones that are currently overpriced might be better than bank savings in the long run. What the bank savings will give you is the option to take advantage of future opportunities.

Third, instead of taking a minimum-wage job working for someone else, if your income needs are low, you might try either starting your own business or joining a startup company.

Don’t just stick your head in the sand and waste your time earning profits for someone else while you collect minimum wage. Instead, use your financial freedom and your time to advance the changes that you want to see in the world.

Sounds like a cop out! You could always buy hard assets or how about donating your excesses to a charitable cause such as the food banks you so willingly take from. The sky is falling mentality doesn’t resonate with me.

van_down_by_river,

I assume you’re just testing the waters with your idea of quitting your job as an engineer and working part-time at a minimum-wage job and start collecting handouts — and that you’re not all that serious about it.

But I totally get your urge to escape the rat race. But your plan is not going to get you out of it.

When I got to the point that I needed to change gears, I quit my job and went on a trip. This trip, in its convoluted manner, ended up lasting over three years and took me to over 100 countries, sometimes hanging out in the same place for months, sometimes moving on quickly. It was totally awesome.

It was a huge investment of sorts (career), but I think it paid off in terms of understanding. And it was just an awesome thing to do. I didn’t plan it that way, I just got unstuck and ended up going from country to country, mostly overland by local transports, all across Asia, Europe, Africa (26 countries), the Americas, from Alaska down to Terra del Fuego, and on to the Antarctica. And then suddenly, it was time to go back and start over.

And I met my wife doing this. And a lot of other wonderful people of all kinds — and some nasty ones too. Best thing I’ve ever done.

I was in my early 40s at the time. I wrote a book about the first leg, which is where I got unstuck:

https://www.amazon.com/gp/product/B00613TA56

Inspiring reply, Wolf. Inspiring.

Sometimes you just have to shove out into the fast water and go for a reset. Plus, it’s the journey…the day to day along the way.

Replying to a few up-thread comments I thought it might be better to work part-time at a higher paid job than many hours under employed.

In a way, I got unstuck through travel, too. Drafted, Korean war times, service on Mindanao, PI. Observation of civilian life there totally changed my outlook on the world.

Went to college on the GI bill, left Detroit and its factories for better horizons.

I did this too, though I didn’t have much of a career to abandon — I quit regular work to go live in Southeast Asia for some years, I got married, and I found that when I paid a bit less attention to it, my career actually developed. My wife and I worked in Micronesia and ended up emigrating to Canada when we had children.

However — I learned that one has to be very careful before checking out. The first time was easy, I was young; however, our first son was born in Thailand right when the Great Financial Crisis hit, and we were thinking about starting a more regular, stable life. It took us several years to manage that. Don’t bet on the world collapsing — right now, I get paid every two weeks and the money that goes into the bank is not being inflated away. I have a tendency towards a pessimistic mindset myself, and I remind myself occasionally that money didn’t vanish during the Great Depression, it didn’t vanish in 2008, it’s probably not going to vanish next year, or next decade. In fact, during those episodes, the things that produce money — i.e. jobs — became rare and highly coveted.

It’s good to check out once in a while. The difference between myself today and myself when I was 30 is that now I care a lot more about how, after I get tired of being checked out, I’m going to check myself back in again.

Jim Rogers did the same thing, and then he just basically dropped out. McLuhan wrote a book about it, Take Today, The Executive as Dropout, I reco it for all college students and read it twice if you are a business student,

I’ve traveled a lot too.

I tell people, “You should travel so you know you should travel.”

And in the free form way you describe, backpackery.

Many people WANT to travel, but I don’t think most can appreciate the “outside the box” type benefits till they get out and do it.

I describe it as, “flinging myself on the other side of the world, and seeing what happens.”

Your last line is priceless!

Wolf there is a richness to your writing and perspective that is very rare and it flows from your richness in experience and your willingness to open yourself to it. I will be ordering your book.

THANK YOU!

ALL-CAPS despite prohibition against ALL-CAPS, well, as my old boss used to tell me back in the day, “Yes, but my name is on the building.”

:-]

Did the same thing myself. Backpacking over land from NZ to the U.K. where I was scheduled to study, I ran into Chinese mortar fire in Thailand and, more dangerously bad water in India where I lot 20kg in six weeks. After getting out of hospital in H.K. I went to Japan, got married and ended up as a professor, business consultant, diplomat and military officer trainer and small business owner. A great ride ! Now back semi retired in NZ.

van_down_by_river,

Your comment shows how burnt out you have become with your current situation, but there is a lot of bs in it as well. An educated person with a pile of money in the bank is not getting any benefits in any US state, unless they willingly break the law. Your decision to become a human extraction system has caught up with you. You definitely need a vacation, but more than that you need to be of service to humanity in some way.

Hmmm. The only thing for me. I like my software job drastically more than any m other jobs I have had on the past including other office jobs and food service… And I generally work a little under 40 hours a week…

So for me i will milk it until i get aged out probably in my mid 50’s.

But good God if you don’t need the money don’t work at a job you don’t like or are over worked at. If you like engineering you can find a more relaxed position with lower expectations to control your hours.

I admit though your story has more dramatic flair. So perhaps you are just hammering home the $15 min wage :)

Van,

Your savings may be worth less because of the Fed’s wrongdoings, but if the Fed’s plan is as you fear – a permanent reduction in interest rates to support high asset prices and wealth concentration – you must realize that any stream of income has now increased in price, even if it is not liquid or tradeable.

That would include your job, for example. Your lifetime earnings can be valued like any other income stream, and if you discount those earnings at these low rates, the value of your career just skyrocketed (albeit in fiat currency). This may more than offset your loss of earnings from savings.

Therefore, why would you derail the one asset that likely has increased your real net wealth despite the Fed’s efforts to derail it, by trading your engineering job for a part-time gig?

Have you thought about that?

I admire the clarity and honesty in your thought. I agree the central bankers have put way too many bad incentives in place. They don’t have the tools to fix things, and they should just leave things alone. Their patchwork only gives the illusion of a fix. They’ve created many more problems for us in the long-term. What would have been a bumpy path has now turned into a ravine.

Good luck with food stamps and free healthcare or even “healthy” food from food banks…poverty is not what it’s cracked up to be….I used to play chess with some homeless guys years ago and they gave me a lot of insight into their lifestyle. If you leave your job, leave with as much cash as possible even though inflation steals it, you will need much more than you think.

VDBR, ALWAYS (a big word), in the totality of the Financial History of Mankind, it has paid off, eventually & thus far, to own Large Multinational Equities and hold on to them no matter what. Weimar Republic, et al.

Of course, “this time could be different” HaHa.

Maybe though, this is the beginning of a new paradigm & you’re right.

See a psychologist today.

Also, stop reading economics blogs now. While you may follow the writing trends well, most economic writers are goofballs who couldn’t analyze their way out of a paper bag if given 5 tries. You appear to believe the nonsense they write.

Economics is extremely simple. The charlatans make it look complicated to scam you and me. Most people believe them, They tell a good tale.

Yes, lots of economics proffered by those in charge is nonsense, the ECB and BOJ being at the top of that heap. Don’t lay down and curl up into a little ball just because lots of pundits are dumb enough to believe them and use their game plan as truth and beauty. Everyone lies and they do so to further the goals of the people they support.

Talk to someone, assuming you’re not playing us with your comment.

PS: rising rates in the US are a great thing. Incomes are rising and scammers are in terror.

Van,

PS; Think of yourself as Yossarian in Catch-22. Re economics – everyone really is lying to you. The ECB and BOJ really want you to believe you can sell eggs below cost and still make a profit. Most pundits go along and get angry at those who disagree.

In a nutshell, that describes the current conditions with the comment that inflation is all in asset values. The inflation in goods and services is a past century concept that cannot materialize with automation, and cheap labor. It WILL roar it’s ugly head with resource exhaustion of every kind. After all, they only make more consumers, not resources.

I volunteered at the food bank, and would not describe the food there as healthy, so keep your daytime job, and just go volunteer there.

Free healthcare? How do you collect that in this country?

If you think minimum wage is free ride, then you got a nasty experience coming.

The lower the wage is, the harder the job is, the more controlled it is, and the more shit you will have to eat while smiling from ear to ear! Really!! That is, sadly, how the world is!!!

Working for Amazon Fullfilment you get to be a fleshy robot for 8 bucks an hour. This will suck and ruin your health, why do it?

It is better, much, better to take leave and blow a years savings on travelling. Or blow a year on starting a consultancy business.

I.M.O. there are plenty of good investment opportunities, they just look different than they did 20 years ago.

Please consider the possibility of you being depressed. It’s a nasty disease, it colours everything “negative” and everyone stupid! With some discipline and treatment, it can go away again and funnily enough, new opportunities show up and people stop being arseholes.

You think our toilet paper currency is eroding your engineering salary. Try living on a budget, while earning your current salary, based on a $15/hr income.

Make it while you can, you may be forced into something paying $15/hr or less soon enough.

I never finished high school and did exactly that, walked off the job fifteen years ago at 42, I was a machinist, held six engineering titles, was a network admin., quality manager, and a operations manager.

What do we have 12 million people producing, and 330 million talking heads.

Every where I look people are lying , stealing, and cheating, these same people are always complaining, yet never produced nothing, I think all productive people should quit their jobs, and let the people have nothing, after all it is what they deserve nothing.

I could draw a map of a upper middle class neighbor hood that I live in, government pensions, disability, government workers, people working from home, oh and tax evasion to get free obamacare.

Van we gave them everything they have, necessities, luxuries, and the military equipment to protect them yet they hate us.

I never took from another, I would hope you are only kidding about free stuff life is too short to covet your neighbor’s house, or you would be just like them.

The 10-year yield has been oscillating between 2.7 and 3.1 for two (?) years.

I’ve always thought that the rule of thumb was that the 10-y yield has to be near the expected-inflation + 2%.

So either the market expects the inflation in the next 10 years to be around 1%, or fixed-income investors + pension funds are buying the 10-y bonds at Costco (by the truckload, that is) and bringing down yields due to the excessive demand.

A third explanation could be that European/Japanese/Chinese fund managers are buying the US 10-y because their equivalent bonds are returning zilch.

A fourth explanation could be that there is a lot of cash sitting around and people would rather get a real return of 0% than a -2.5%.

A fifth explanation could be that investors are leaving stocks and buying bonds as faith in future market highs is declining.

It seems to me that all the above weigh down on the 10-y’s yield. If it weren’t for that demand, I believe the yield would have already surged to 5%.

If none of the scenarios above explains the current yields I’m unable to find a cogent explanation.

Concerning: “The 10-year yield has been oscillating between 2.7 and 3.1 for two (?) years.”

The 10-year yield hit 2.7% for the first time in this cycle at the end of January. So it has been oscillating 7 months the range you indicate.

Two years ago, August 25, 2016, the 10-year yields was at 1.58%.

The 10-year years goes up in big surges with many months of go-nowhere oscillations in between.

If inflation is 2% as the Fed has repeated stated, then interest rates of 2.7% with zero wage growth are contractionary and the Fed ought to consider immediately slashing interest rates now or risk moving towards recession. By Fed data that is an obvious conclusion.

Is it not true – as you yourself have written many a time – that the Fed is in fact looking at asset prices as it’s actual measure of inflation? (side note: how sad it that, that the Fed has to resort a vastly inferior date set because its own reported data is so blatantly fraudulent even the Fed knows it’s a fraud?)

And to the next point: If the Fed is now using asset prices as an inflation measure, an extremely strong case can be made that is has massively failed to rase interest rates in a manner consistent with it’s mandate.

I don’t think the Fed has been using assets as a measure of inflation. Most of Yellen’s time at the Fed they were bubble blind and claimed assets weren’t overvalued as economists tend to have a nihilistic sense of supply and demand and never think as to why there might be really stupid undesirable reasons for the demand of an asset. They don’t realize their own policies create that demand in the first place and can eventually lead to huge crashes in value when they change course. General equilibrium be damned when they are the “exogenous shock” to the economy. You won’t see them recognize their role. It’s only doubt of their own understanding lately that seems to make them wonder if there really is a bubble economy all around them as even they are surprised at sustained asset price increases. The funny thing about misrepresenting statistics is if you’re consistently off by even a little bit percentage wise with the same directional bias, the power of compounding will eventually prove the empire has no clothes and the truth will be laid bare.

Unless the Fed decides to raise the ten year bonds and all the other government bonds besides the short term ones, people will start to worry.

It does not have to be much, even a 0.1 of the ten year shield would calm people down.

After all the dollar is strong vs about twenty or so currencies that have lost value to the dollar, even Brazil Real.

I think one can rephrase one of Wolf’s statements above, and it still rings true:

“U.S. Government bonds play a relatively small role in the gigantic debt bubble in America, consisting also of municipal bonds, federally-guaranteed bonds of other government entities, pension debts and other off-balance-sheet ‘unfunded liabilities’ such as the Social Security, Medicare and the USPS, bonds of state-owned enterprises such as Fannie Mae, Freddie Mac, and student-loan lender Sallie Mae, and America’s large government-contract-dependent corporate sector in general, all of them now a massive, opaque, convoluted tangle. This “hidden debt,” as it’s called, is a complex puzzle the U.S. government doesn’t even try to quantify, as it is struggling to keep it all from imploding.”

There’s nothing special about China. We just call our debts by different names and sweep them under different rugs when we want to avoid dealing with them.

The reality is that never in the course of human history have so many people owed so much. Part of this is inevitable with the aging population – when you work out who is receiving the interest payments, you see that the bonds and other debts are owed primarily to older, wealthier people who saved or were promised retirement benefits. Most countries have proportionately more elderly retirees than ever before.

Here are some numbers for the USA:

Major Forms of Debt in the United States, August 2018 (Trillions of US$)

15.7 Treasury Bonds held by the “Public” (including foreign central banks as reserves) per U.S. Treasury.

5.7 Social Security Trust Fund (not included above or below)

??? Unfunded Liability of Social Security and Medicare (> 10 Trillion $)

3.9 Municipal Bonds (Debts owed by States, Counties, Cities)

14 Unfunded Federal and Municipal Pensions (and other Benefits)

7.1 FNMA and FMLC (Gov’t-Guaranteed Mortgage Bonds) per SIFMA

1.5 Federal Student Loans (Gov’t-Guaranteed Bonds)

7.5 Corporate Bond Market

3.8 Consumer Credit per Federal Reserve

12.8 Total Bank Credit (includes most of Consumer Credit, also non-bond corporate debt) per Federal Reserve

Total is around 72 $Trillion, over 3 times U.S. GDP.

For more information about various Fed Gov obligations:

https://www.fiscal.treasury.gov/fsreports/rpt/finrep/fr/17frusg/02142018_FR(Final).pdf

Years ago, Lawrence Kotlikoff had the unfunded liabilities at $210T.

Aware of that. The trouble with some of those analyses is that you can get any large number you like, if you make suitable assumptions.

But you can’t get any number < $72 trillion for the USA without assuming some sort of revolutionary change.

If you say the governments’ portion of that $72 trillion is about $40T, and if federal, state, and local government revenues are only 20% of GDP (about $4T per year), we see that the government debt is about 10x its income.

If you earned $100k after-tax per year and had a debt of $1,000,000 (i.e., 10x income), would you be worried? If not, would you be worried if that debt was projected to grow much faster than your income?

So what does this mean? The short term interest rates are easy to figure out. The Fed is raising rates, and in the short term the market as such expects these rates for at least the next 2 years. But what about the 10 yr rates?

There are two ways of looking at the last decade or so. One is that the interest rates have been abnormally low as the policy to try to avoid another great depression. That way expects interest rates to rise to normal historical levels after the crisis is past. The other way of looking at the current low to zero to negative interest rates is to believe this is the new normal from here on.

If you think interest rates are abnormally low, it takes more that a promise of 2 something percent to get me to buy a 10 year bond. Inflation is probably that much over the last 10 years, and if I think this is an abnormal period, then it seems that better rates will come along before that 10 yr bond bought at abnormally low rates cashes in.

On the other hand, if you think this is the new normal, then that 2 something rate doesn’t look bad, and you might even think that the current phase of the Fed is abnormal and soon they’ll be back to low or zero or negative interest rates.

Seems like the market is saying that this is the new normal, and that the aberration is the current rate raising spree and that neither that spree nor the hints of inflation will last over the next ten years.

Seems odd to me. But I’m not a wall street insider with sources on what is and isn’t the new normal. But the markets seems to be saying that they don’t expect the interest rates to rise in the next 10 years.

Scenario: Several large-economy national policy-makers have decided to use debt rather than wealth to fund current consumption (or investment, in the case of China), because wealth generation isn’t keeping up with consumption and/or investment.

The core question remains “how long can debt be substituted for wealth?”

As long as there are debt buyers.

So, to WS-at-large I ask:

“What are the factors which determine when U.S. debt becomes undesirable to hold, and where are we with respect to that/those factor(s)?”

Note that my question pertains only to US debt at national, state/local and household levels.

The interest rate on US debt clearly is one of those factors, but that interest rate is constrained by … how much of our debt is short-term (will roll over at higher rates), and how much higher interest rates reduce economic activity.

There are several other factors, I expect. I’m wondering what others’ viewpoints are.

Thanks in advance if you choose to weigh in.

The way I see it, as long as the debt buyers have a high enough confidence of getting their (time-limited) investment back with interest, there will be buyers.

Note that the deficit doesn’t concern them as such. That’s down the road, for others to deal with. The key is confidence. What other, better, national options do these investors have?

Tom,

I happen to follow the Austrian School of Economic thinking.

One of the main ‘Father’s’ of this movement was Ludwig von Mises.

He said:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved”.

It seems that with all recent decisions by the US power brokers, political, financial, corporate, and military, they are bent on destroying any small bit of credibility left in the dollar as the global reserve currency.

Loss of credibility is followed very closely by loss of confidence. When this occurs, watch for a hyperinflationary event. They occur quite rapidly and are over just as quick. Leaving in their wake not only economic destruction, but societal as well.

I don’t see anything happening to USD when it comes to it being a global reserve currency. USD may not be in its best shape but other alternatives are even worse.

I don’t think I’d ever see USD being replaced as global reserved current for at-least next few decades.

We’d see

Over half the world has moved away from the US international Swift payment system. With Russia and China leading the way.

The EU has now put into motion an organisation to replace Swift with their own European version and forming their own European Monetary Fund to replace the US controlled IMF.

The USD is quickly losing international credibility and along with that goes currency confidence, leading to a Great Devaluation.

Ignoring the facts does not make them go away.

If the line in the chart above drops below zero, with the “10-year yield higher than the 2-year yield,” the yield curve has “inverted.” In the past, this condition was followed by recessions.

Isn’t this the other way around? Isn’t it inverted when the 10 year yield is lower than the two year?

Yeah… me goofball. I changed the 2 and 10 around for whatever reason late yesterday, without changing the “higher” to “lower.” Now I switched them back. Thanks.

Wolf,

Yesterday I had an epiphany car industry question:

Why do car manufacturers award dealerships to someone who is already running a dealership for their compeitor?

For example, in town X there will be BMW and Mercedes dealerships run / owned by the same guy.

From a competitive stand point, wouldn’t / shouldn’t the manufacturer want the franchisee to be FULLY motivated to sell its cars, and not have split loyaties?

What is in it for the manufacturer to work with an owner who already has several dealerships under his belt?

I assume that automakers just want to sell the most cars. These competitors (other brands) are out there anyway, so it doesn’t change much when some of those brands are sold by the same dealer. Dealers of the big brands (Ford, GM, Toyota, etc.) must have separate facilities (separate showrooms) and staff for each brand on the new-vehicle side and in service. But used-vehicle operations can be combined, etc.

But it’s not 100%: A good friend of mine from back in the day is a smallish-town Ford, Lincoln, and Toyota dealer. They were all combined in a showroom. He was under pressure for 20 years from Toyota to build a separate showroom and resisted. But Toyota finally put its big foot down, and he built a separate showroom for his Toyota franchise a few years ago.

The spread between 3 month and 2 year old is just 50 points. Why will people still buy short term and long term bonds?

Most people that are into Treasuries will do a combination, short-term for cash management and longer-term for yield. 50 basis points in this environment is not negligible.

Where your question gets tricky to answer is why people buy 10-year notes when they can get almost the same yield on a 2-year. The thinking is that perhaps in 3 years and later, longer-term yields will be lower than today, such as might be during a recession.

Have we ever seen in history a situation where the 3 month rate is higher than all others? If that happens it would be fun, I guess!

The yield curve is flattening in a falling rate environment, is there any reason to consider that more or less important? Some analysts think higher rates are inevitable, will that shift bring the yield curve back up? In the present short term rates are dropping faster, which says to the Fed, HELLO.