Historic spike in Seattle. Sharp increases in other metros. New York condos fall.

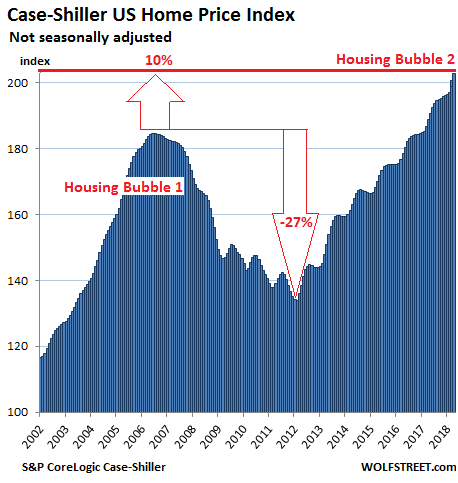

Homes prices in the US surged 6.4% in May compared to May a year ago (not seasonally-adjusted), and 1.1% from April, according to the S&P CoreLogic Case-Shiller National Home Price Index, released this morning. The index is now 10% above the crazy peak in July 2006 of “Housing Bubble 1” in this millennium — a phenomenon that after its collapse everyone had called “bubble” and “unsustainable,” but which by now has become the new-normal rock-solid base upon which to build a solid housing market, apparently. The index is now 51% above the bottom of “Housing Bust 1”:

Real estate may be local but prices are impacted by national and global factors, such as monetary policies and offshore investors for whom “housing” in the US is a global asset class and in many cases also a way to get their family and assets out of reach of their own governments. These local and global factors inflate local housing bubbles. When enough local housing bubbles come together at the same time, even as some other housing markets don’t see a lot of price movements, they turn into a national housing bubble, as seen in the chart above.

The index is not inflation adjusted — in fact, it’s itself a measure of inflation: of asset price inflation, specifically of housing price inflation. What you see in the above chart is that the dollar has lost purchasing power with regards to housing in the US since the bottom of “Housing Bust 1” in February 2012 — as the amount of dollars needed to buy the same homes has jumped by 51% since then.

The Case-Shiller Index is based on a rolling three-month average; today’s release is for March, April, and May. The index is based on “home price sales pairs,” comparing the sales price of a home in the current month to the last transaction of the same home years earlier. The index incorporates other factors and uses algorithms to arrive at each data point. It was set at 100 for January 2000; hence an index value of 200 means prices as figured by the index have doubled.

So here are the most splendid housing bubbles in major metro areas in the US:

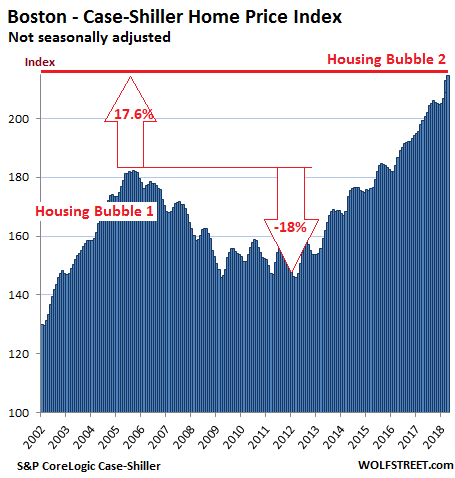

Boston:

Home prices in the Boston metro, according to the Case-Shiller home price index, jumped 7.0% from a year ago. During Housing Bubble 1, from January 2000 to October 2005, the index soared 82% before dropping. It now tops that crazy peak by 17.6%:

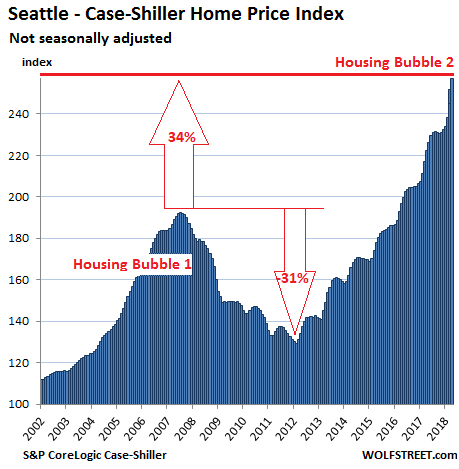

Seattle:

The Case-Shiller index for the Seattle metro index spiked 2.2% from the prior month. This comes on top of the spike in April which in terms of points — up 6.6 points — had been the biggest monthly jump in the data series. Over the past two months, the index has soared 5%! Over the past 12 months, the index has jumped 13.6%. It is 34% above the peak of Seattle’s insane Housing Bubble 1 (July 2007). Note the historic spike over the past two months:

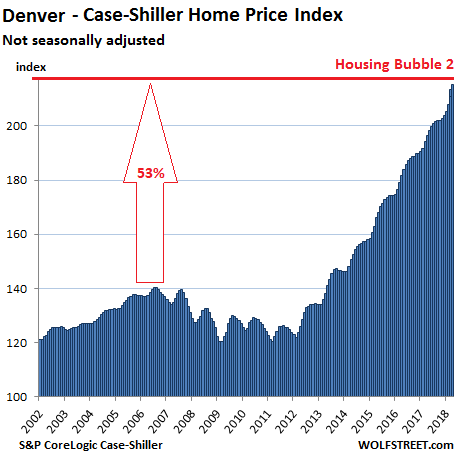

Denver:

The index for the Denver metro, which in May booked its 31st monthly increase in a row after a historic spike in April, is up 8.5% from a year ago and 53% from the crazy peak in July 2006, with a historic spike in April:

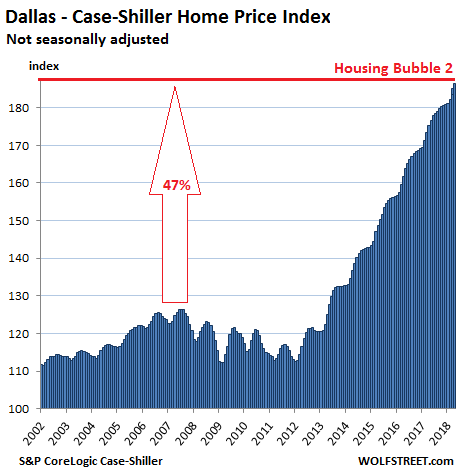

Dallas-Fort Worth:

Home prices in the Dallas-Fort Worth metro, according to the Case-Shiller index, rose for the 52nd month in a row, and is up 5.7% from a year ago. Since its peak during Housing Bubble 1 in June 2007, the index has surged 47%:

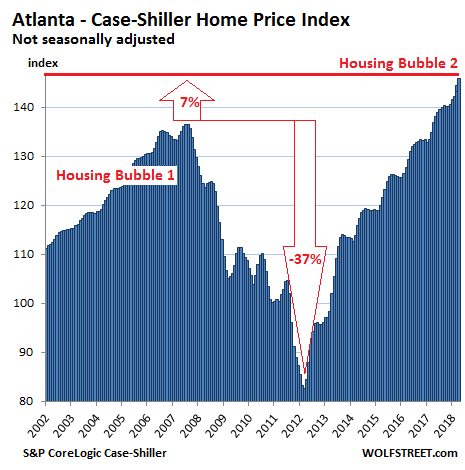

Atlanta:

The Case-Shiller home price index for the Atlanta metro rose 0.9% in May from a month earlier and 5.7% over the 12-month period. It now exceeds the peak of Housing Bubble 1 in July 2007 by 7%:

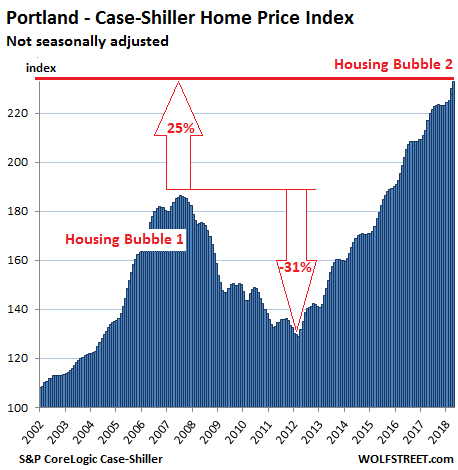

Portland:

Home prices in the Portland metro in May jumped 1.2% from a month ago, 5.9% from a year earlier, and 25% from the crazy peak of Housing Bubble 1 in July 2007. It has ballooned 132% since 2000:

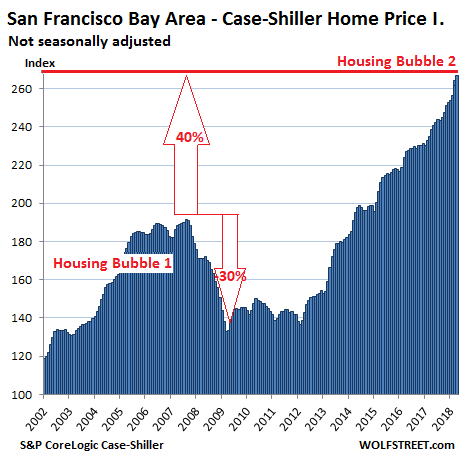

San Francisco Bay Area:

The index for “San Francisco” includes the counties of San Francisco, Alameda, Contra Costa, Marin, and San Mateo, a large and diverse area consisting of the city of San Francisco, the northern part of Silicon Valley (San Mateo county), part of the East Bay and part of the North Bay. In May, the index jumped 1.1% from the prior month and 11% from a year ago. It’s up 40% from the insane peak of Housing Bubble 1 and up 167% since 2000. Note the spike over the past two months:

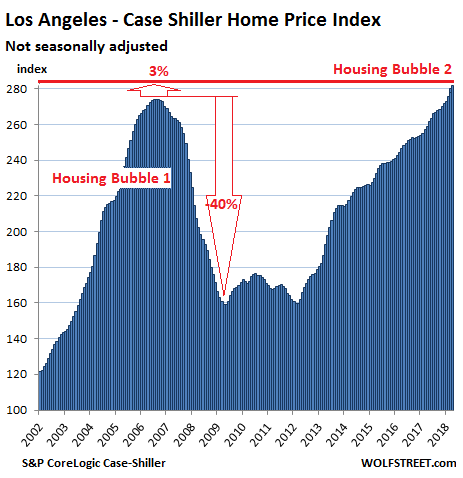

Los Angeles:

The Case-Shiller index for the Los Angeles metro (this includes Glendale homes for sale and many other smaller suburbs) in May rose 7.6% year-over-year. Between January 2000 and July 2006, the index had skyrocketed 174% before totally cratering. The index now exceeds the peak of Housing Bubble 1 by 3%:

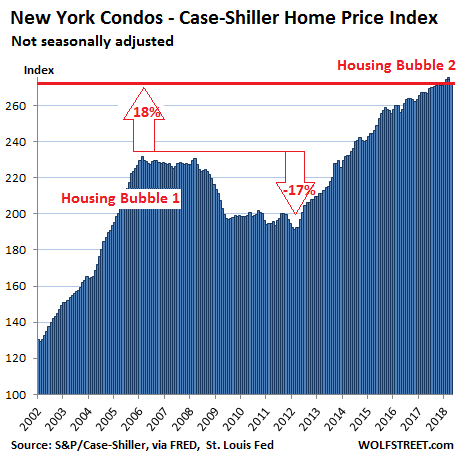

New York City Condos:

Prices for condos in the New York City metro did the unthinkable in May: they fell. The Case-Shiller index for condos fell 0.5% for the month, the second month in a row of declines, after having fallen 0.5% in April. But this index has produced many monthly dips over the years that turned out to be blips. The index remains up 2.4% from a year earlier. It’s 18% above the peak of Housing Bubble 1, having surged 173% since 2000:

So New York City’s condos are dipping, compared to Seattle’s gorgeous spike. For most of the metros in this list, the sharp acceleration over the past few months either continued unabated or is only backing off a tad.

No, the biggest apartment construction boom in the US is not taking place in Seattle, despite the countless cranes. Denver is by far #1. New York isn’t even in the top 25. And it explains why rents in Chicago are collapsing. Read… Biggest Apartment-Construction Boom-Towns Are Not What You May Think

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Don’t worry, Suzanne researched it”

For those who aren’t familiar with that reference, I present the TV commercial that is the purest essence of the 2000s housing bubble —

https://www.youtube.com/watch?v=20n-cD8ERgs

That never gets old……EVER.

+1

I don’t always make important life decisions with my wife – but when I do the broker is on speakerphone.

This is firmly misguided analysis. it is not the fluctuation base don micro economic factors but the long-term trends that are important. For example, Boston may have gone up and down in the last 16 years, but over those 16 years, encompassing before, during, and after the bubble – the compound appreciation rate has been ~ 3.1%. This is no more than historical annual appreciation for the last 50 years. There is NO bubble in cities like this. You even stated that this graph IS an inflation graph since home prices make up so much of inflation to begin with.

Yeah, you’re correct, it’s “the long-term trends that are important,” if you live long enough :-]

But this is a boom-and-bust cycle, as you can see from the charts, and after the boom comes the bust. If you extrapolate the long-term cycle from the top of the current boom, without including the next bust, you’re going to get a blue-sky long-term trend.

I know that you and many other folks would rather skip the next bust in this boom-and-bust cycle and go straight on to the next boom, but that’s wishful thinking.

Wolf

Love your articles. Something I don’t see enough of though is the increasing percentage of price reductions, which is one great indicator of where the market is headed.

Found this lovely article in seeking alpha regarding just that.

https://seekingalpha.com/article/4185206-housing-market-bigger-bubble-2008-popping

I would like to see you include this data in any future housing buuble article.

Tim, the flaw in your argument is; under true free-market Capitalism a used man-made house or building wouldn’t be “appreciating” in the first place! The only limited resource is the actual plot or raw-land; not the man-made structure.

In other words, under true Capitalism, on average, the plot of land would keep its valuation up with inflation and yearly property taxation, but “not” the actual man-made structure!

Since WW2 we’ve introduced these pref tax treatments; the MID mortgage interest deduction along with itemized property tax etc deductions. Then pref tax-treatment via capital gain exclusions for primary residences, and the generous cap-gain deductions for other real estate.

(LOL) Tim, the real estate industry has been destroying the country, and creating an egregious wealth-disparity; going back to right after WW2. Heck, all our major cities have blighted or rotted out from the inside!? Again, that’s not true Capitalism!.. (lol) Actually owning a 4000 sq ft centrally AC’d home for a family of four, or owning a 2nd or 3rd private vacation property; is simply “not” true free-market Capitalism. That’s the plutocrats in gov’t promoting, (what Dave Stockman calls), “mal-investment”!..

Yes, Manhattan is a blighted mess.

I mean how can you not look at those spikes and charts and just shake your head or do a face palm??????? Incomes so completely disconnected from the rise in housing………..It’s not a matter of if it’s always a matter of when that bubble really bursts A LOT of Americans are going to feel the pain. The sad thing is, it’s THEIR fault! We are all adults and people should understand how things work and what they can afford. What pisses me off is all these people that are going to be underwater and upside down are going to be begging for handouts and appealing to whatever .gov agency i.e taxpayers to bail them out. I’ve been waiting on the sidelines, stupidly enough, to get into this housing market and I know dozens of others like me. Maybe it’ll never happen but I’m hoping the whole thing blows wide open. I don’t care anymore. Our economy is such a ponzi scheme at every level. Housing, healthcare, FANGs blah blah blah. Bezos’ parents investing $250K and becoming billionaires……..that type of wealth accumulation is backed by NOTHING but 0 and 1’s on a computer screen.

As a kid in SF our Sunday paper (Hearst, what else!) comics (First page was always, “Maggi and Jiggs”….a spoof on the wealthy….from a wealthy newspaper mogul) was the place to go to….Across the top of the Comics section was the saying: “What Fools These Mortals Be!” Very apropo to how humans behave. Especially where “……Greed is Good!”

Paid little to no attention over these past few years, to all the annalist’s who were calling a “Top” in the markets. A majority of the economic/politico fundamentals just did not add up to their incessant mouthings of an imminent economic catastrophe.

At the present mark in the global credit cycle and adjoining financial fundamentals, within a mixture of global political complications, the “picture” has become surprisingly clearer.

We are indeed within a topping process that has not that much further to run. I don’t see it continuing within the status quo past this Autumn. If we make it past the year end, that will be a miracle. This is not to say that everything will end with a bang. Far from it. The topping and subsequent dive of the markets is all part of the process of equalization and revaluation. This will arrive with a surprise and be a long and drawn out affair, with much pain.

i still think we have a ways to go, but what do I know. There should be bookies taking bets on what mix of inflation and interest rate numbers it will take to pop this bubble and the bonus number on if this going to be a soft or a hard landing. Something like 4.5/6.25/hard!

Housing prices are definitely rising faster than household incomes. Who is approving these loans in this day and age when AI, offshoring, leveraged buyouts, trade wars and synergy eliminate thousands of jobs each day?

Banks and lenders don’t care. Our faux capitalist economy run by a kleptocratic oligarchy only cares about short term gains at the expense of long term financial health and prosperity. Dot gov will bail everyone out anyways even irresponsible American homeowners and consumers because congress and banks and corporate America is one big revolving door. And the stupid American people are either a part of it or too zombified and pacified to do anything about it. It’s you and I and our family and neighbors that work for these banks, that work for the govenrment, that work for these lenders, that are real estate agents etc…get my point? WE ALL are a part of this mess indirectly. I see kids in my area driving around in brand new cars………Jeeps, BMW’s etc. And these are not necessarily super wealthy kids or a super wealthy area. Just households with dual high income upper middle class salaries. Probably not much more than $150K incomes. Why would you give your teenager a brand new car anyways…….it’s idiocracy……American teenagers should go tour Syria and Iraq and gain a little perspective in how the rest of the world lives and what our conspicuous consumption has and is doing to our future as a nation and the rest of the world.

I agree with you but for one statement. Homeowners will not be bailed out, responsible or not. 2008 proved that..

I live in metro Seattle and have given up trying to understand who or what can afford to buy these places. An article in The Stranger looked at a landlord survey done by the U of WA and universally they’re “pissed” at efforts by the city to build affordable housing. (What right does one have to live in a city one can’t afford) pretty much sums up their attitude but when this finally breaks, in JMO, it will crash at least as badly as 2008. I wonder if these 4,236 landlords that responded to the survey will ask for help when they can no longer pay the vig? Did 2008 create a notion that those with money can always expect to be bailed? I think heads will roll before that happens again..

“Homeowners will not be bailed out”

homeowners probably not, dead beats absolutely. I personally know a couple that just stopped paying the mortgage. They lived 48 months rent free and all the while the property taxes got paid…….AKA a bailout. They blew the money instead of saving it.

BTW once the rising prices aren’t then we’re going to start to see what really caused this insanity……..i’m willing to bet there are skeletons in the closet just waiting to show themselves.

From the perspective of a hedge fund manager or faux hedge fund like a bank or university, what is a mortgage loan? It is simply a playing chip in the Universal Casino. It’s two uses are as a token to be amalgamated with others in a security that is then peddled to suckers and corrupt pension fund managers, and as a way to increase the money supply so the Ponzi scheme can continue for yet another year to pay for their personal bonuses and buy Bugattis.

ps: Bumper sicker recently seen driving around Seattle on a Suburu: “Eat the Rich:

Is that the future?

I have no idea how anyone is buying these houses. I just saw an ad for homes in Anaheim starting in the low $800K…….Median household income (it’s kinda funny how that has become the norm…quoting the the whole household….which is most likely 2 ‘or more?’ income earners) in Anaheim is $79K so that’s 10x incomes…….how can this be????????????????

$100K down and your payment is still over $5K a month…..something isn’t adding up.

It’s an ‘investor’ market. Consumers are on the sidelines.

That’s like our area. House prices are 1.3 million. Most people earn 100k or less. 13x’s income. It used to be investors and foreign buyers, but there gone now. So houses are not selling.

Who is approving these loans you ask? The People’s Bank of China and it minions.

What are they (the lenders and the buyers) smoking?

Hopium. Weapons grade, apparently. Leading cause of residential urban smog. Impairs judgement, destroys lives, very addictive. Socially acceptable; national policy. Has been known to cause global economic collapse.

It’s the public mental health crisis nobody wants to talk about. I certainly don’t. I’m busy trying to come up with the Next Pathetically Useless Fad so I can get rich exploiting peoples’ gullibility, irresponsibility, narcissism, and self-destructive tendencies. If I can just keep up the cynicism I can break tradition by having it before the IPO, and not after, if nobody beats me to it this time.

The atmosphere in the business that I’m in feels EXACTLY like 2007. I’m predicting a “crash” in the next 9 months

Begbie, I second that feeling.

For the last two years most of my industry as well has “over” hired and has 2/3 of staff/freelance employees idle.

Its going to be a question of liquidity soon if the Fed stays on path.

Crash? Won’t happen. This time is different.

Well Trump’s talking about another 100 billion in tax cut for the wealthy. Don’t worry guys!!! There’s still more tax cuts on the way to prop this Ponzi. We are not at zero tax yet.

A young Real Estate agent in San Mateo CA told me that RE assets rarely lose their value. “Buy a house. Or a condo. Or an apartment building. Best thing to do with your savings”, she said.

I asked her if she had considered buying igloos and sell it to the Eskimos when they run out of ice. I think she thought I was nuts.

Walking down The Promenade in Santa Monica I over heard two gorgeous girls talking on the street: “Yeah totally, so i’m a yoga instructor Tuesdays and Thursdays and work at a real estate agency over the weekend,”.

I got her business card, it said. “Director / Actor / Producer and Realtor on the back” Good for her to save space.

Would you get fashion advice from a blind man?

Is she a real-life version of Lionel Hutz from The Simpsons? If so does her card turns into a sponge when you put it in water?

Rapidly appreciating home prices are an abject failure of housing policy. Homes ought to depreciate in over time – just like cars do – as the construction deteriorates and the home becomes dated. Look at Japan, where homes are built with an expectation they will lose value, be demoed, and rebuilt to a modern standard every 30-50 years.

The core of the problem is financializatiom and the restriction of housing supply in the face of rising demand. Zoning restrictions and NIMBYism put in place by current homeowners prevent sufficiently dense housing stock to be built in areas where it is needed. We also live in a society that has heavily financialized homes where most people count on their home, rather than financial assets, as their biggest “investment”. They are counting on ever higher home prices to shore up their finances and make retirement possible. I wish change were possible, but with so many in on the Ponzi, I don’t expect falling home prices anytime soon.

Mark You are Wrong Take a look at Zillow and you will see lots of slashed asking prices On the east coast anyway I get the feeling we are near or at the top Of course if the FED stops tightening all bets are off

Well, when you reward the PE and banker the very stock that they decimated at pennies on the dollar, incentive the heck out of bulk purchases on .25 fed float 100% leverage….you get the picture….

Pottersvilles were written into real life, the biggest heist of wealth the world has ever seen..

Housing stock was the final fix, the Michelangelo of financial shenanigans by our fed, banks, pe, ratings agencies, govt. agencies, congress and potus, change banking charters, home ownership by pe and foreign pe….reward the specs…thats America my friends…

Peak America is in the rear view mirror my friends…

“The core of the problem is financializatiom”

That’s the “core problem” behind virtually everything wrong. Delayed gratification and savings replaced by excessive accrued debt used to provide instant gratification while living outside one’s means with the totally unproductive leech factor of interest involved in virtually every transaction.

The core driver is the incredible power of advertising since the early 20th century, propelled forward after WW2 creating the “necessary illusions” (Google that phrase and watch the doc) that are the basis of the “American version of free market capitalism.” We are in the “Age of Debt” (and financialization of everything) and we won’t look back. The “boulder of Sisyphus ‘Free Market Capitalism’, modern version will roll back and crush humanity. Beware….

Bad, yeah, but looks tame compared to the stock market.

SPX is up about 85% from the late 2000s high (Case-Shiller up 10%).

SPX is up about 400% from the post-crisis low (Case-Shiller up about 47% from the post crisis low).

Pick your poison I guess.

I think the differen is.. housing is a basic human need and every must have a roof over their head

Not the case with stock

Anyway all assets are inflated because of cb policy of low rate and qe..

True, but you don’t have to buy, you can also rent.

When you take out the monthly up and down spikes, average nationwide rent has grown much closer to incomes than have home prices.

i’ll just leave this here …

https://www.theguardian.com/world/2018/jul/13/canada-shopping-cart-design-homelessness

raoul, thank you for the above link. It speaks to the normalization of homelessness, as its prevalence increases. It is fitting that this special purpose cart for the homeless was developed in the Canadian province of British Columbia, where homelessness accelerates at much the same alarming pace as RE appreciation, which in turn keeps pace with the explosion of money-laundering, much of it by foreigners, in BC’s casinos, whose laundered money is then “invested” in housing, often left empty.

https://news.gov.bc.ca/files/German_Gaming_Final_Report.pdf

I can’t attest to other markets but there are some structural problems in Denver right now–a lot of the “low-hanging fruit” that would otherwise be affordable has been bought up and turned into rentals .

Mix that with many localities making it virtually impossible to build anything other than single-family homes (or no homes at all) and I don’t see Denver getting better any time soon.

You guys still don’t get it… There is no bank lending, these purchases are for cash. Dirty money from Russia fuels Dubai, New York and Croatia. Dirty Money from China fuels Sydney, Vancouver, Seattle and San Jose. Dirty money from Columbia and Peru fuels Panama. Secret banking is outlawed but secret real estate is the new “piggy bank”. No tenants, just empty buildings like the London Shard, Dubai bujai khalifa, The Tower building in Panama city or 30% of Vancouver condos. For an example watch this: https://www.aljazeera.com/programmes/insidestory/2018/06/dubai-money-laundering-hub-180613192659667.html

I talked to my former real estate agent in Seattle last week. She says the market is stalling. The last listing she had went under list by 25k and no bidding wars

I realize 25k doesn’t sound like much of a drop but it’s a chill from the bidding wars that can up a listing by a nice percentage

It was a 1.2 million house. You know a regular kind of house any more in Seattle

Up here in the Olympic peninsula my updates from Zillow are now about 60% price drops vs Pendings. Price cuts of up to 100k It was red hot up here the last three years and now the last four months a definite slow down

Inventory is rising pretty quickly in Seattle as well. It was historically low before, so now it’s just getting back to sane levels. Hopefully it continues into a correction so I can afford to buy a house.

Two years ago Vancouver put a 20% foreign buyer tax on Real Estate, a few months later over 60% of WA state sales were to Asian buyers. In July 28ths Market comment https://goo.gl/B5oFjG Look for the section China Exits Global Real Estate to see why there is a drop in demand for housing .

Prices are rising but sales volume is dropping. Not a good place to be as a buyer, especially when interest rates are rising and money supply is shrinking.

In 2006-2007 prices kept rising on declining volume as sales stalled on the lower end of the market.

In the bay area trust fund kids and tech bro’s are 90% of the buyers. About half the tech bro’s work for companies reliant on Venture Capital to keep the lights on.

Wolf

Real Estate is always about the local market. I am a builder of hi end homes in South Florida. This market is very dependent on flight capital from Latin America…always has been.Having said that, there is a trend towards NE coming for smaller properties particularly the waterfronts. They are not concerned so much with $/sqft more the wow factor I am hearing from Realtots the election in Mexico are causing an up tick inquiries from the wealthy Mexicans concerned about socialism. One thing is for sure very few of these homes are for locals.

Any chance you can produce a chart for our SFH in Miami? That would be awesome.

Thanks

Paco,

My charts represent the big metros where home prices have surged past the prior bubble. That’s the theme. According to the Case-Shiller index, Miami is still 18% below the prior bubble, so it doesn’t quite fit in. The thing with Miami is that the prior bubble was so fast and so huge that it’s now having a hard time duplicating it. During Housing Bubble 1, the index jumped 133% in less than five years — and then gave up most of it.

So maybe I should start a different theme in a different article where the Miami metro would fit in. I’ll think about it.

During the increase of the real estate bubble in South Florida, except for the price of a house, Florida was still a cheaper than the NE place to live. The bubble caused the real estate taxes to rise as prices rose. The bubble also coincided with over a handful of hurricanes which exploded the cost of insurance. These two factors, taxes and insurance, are constraining the rise of prices in Florida. On an average priced house, let’s say $300K, the taxes and insurance will be at least $10K a year. With the new tax law, I expect this will act as a further constraint.

What does NE mean?

Ragnar- – Nebraska … Kidding! She means the Northeast.

“There’s never been a better time to buy”

Wolf,

Gonna sound like a broken record here, but do wish you have the data for Silicon Valley proper. Basically Santa Clara county. I am curious to know how come that dataset is excluded from the “Bay Area” and how that compares with the rest.

I can’t get any Case-Shiller data on the southern half of the Bay Area. The index only covers 20 urban areas around the country.

Given that the 5-county San Francisco index is so broad, I would think a multi-county index centered around San Jose would be similar in terms of percentage changes.

For example, Case-Shiller covers the Los Angeles metro and the San Diego metro. The shapes of the charts look almost identical. Only the absolute index numbers are a little different. So Maybe in the Bay Area, it would be similar — in other words that the 5-county SF chart is more or less representative of the 9 country Bay Area.

Prices may still be rising, but in many cities price rises are decelerating. Like projectile motion, prices slow before reaching a peak, stopping, and ultimately accelerating downward.

https://www.zerohedge.com/news/2018-07-28/housing-market-could-be-headed-broadest-slowdown-years-bloomberg

Wolf, how can I short U.S. housing?

You can short the Case-Shiller index on the CME. Find out more:

http://www.homepricefutures.com/

Caution is advised :-]

You can short builders, REITs or some real estate services firm..

I understand that the graphs are displaying housing inflation. But an inflation adjusted graph might show how housing inflation compares to inflation across the economy.

the case-shiller nyc condo index isn’t a very good metric for nyc because it doesn’t include cooperative apartments which is the most common type of private housing here.

The S&P CS Methodology is silent on whether or not co-ops are included in the condo index. It only says that neither co-ops nor condos are included in the single-family index, which makes sense. Can you provide a source?

not sure if this source is definitive but…

https://therealdeal.com/issues_articles/how-credible-is-case-shiller/

“But Case, a professor of economics at Wellesley College, defended the index, saying that co-op sales have too many variables to be included”

Thanks!

My real estate agent says the prices would never go down in san Diego

We are truly special and different

Yup just like in the 50s when tobacco industry was telling everyone smoking doesn’t cause cancer…what can go wrong there?

The strange thing is even in Canada there are tons of economically depressed areas that are losing population where housing is cheap. In parts of Nova Scotia, New Brunswick and PEI you can buy a house on the water for 100K Canadian. These are places that are losing population every year and there are more houses than there are people who want them.

Real estate is very local. There are also plenty of very nice places in the US, especially in the Southeast (comprised of both small and large metro areas) that have decent weather, a good quality of life, and even a growing population and are still quite affordable.

No one is forcing folks to live in LA, Seattle, Boston, NYC, the Bay Area, etc. but many people seem to act as if they are.

People go where the jobs are.

This. Unless you bring your job with you (something online, some product you make and sell online, etc.) why move to a place where there are no jobs and you’ll be homeless?

I know people like waterfront property, but aren’t those areas also prone to noreasters? I don’t think a lot of people like having huge crashing waves of ice cold seawater plowing into their home thanks to climate change. In addition, a lot of jobs have left those areas. My hometown of Rockford, Illinois has a very affordable housing market, but it also has had the biggest percentage population drop in the state of Illinois over the past five years, and the state of Illinois is losing residents much faster than the rest of the USA.

Good afternoon Wolf. Thank you for an excellent research and well written article. It’s hard find a sensible person with clear vision these days.

I wanted to ask you for an advice. I am located in a ver hot market, San Diego. Prices for housing and rent are terrible here. I have lived here for 15 years with a hope that one day I will be able to buy a house here. I immigrated and started from 0. It seems that I will not be able to fulfill my dream of owning a home here. I managed to save about $50K for a down-payment, but it is nothing for a home that costs over $500K. What would be your suggestion to folks like me? Should we wait for the crash and buy then? In this scenario I am afraid that banks will not give me a loan or one could loose the job too. I believe that I am in a better position than many, since now I have a government job. It doesn’t pay 100k per year, but it is safe. At least that is what I think. Please share your thoughts on this matter. Thank you very much! Alex

Alex,

I don’t and can’t give that kind of advice. Others charge an arm and a leg for this type of advice — most will tell you to buy no matter what, that you can’t time the market, that housing always goes up, that you can’t lose money in real estate, etc. I would never give this advice for free. I’d also charge a huge amount for this type of advice :-]

All I can say is this: Put your financial life under a microscope, check your family situation, and verify that your income is huge and reliable for years to come. Then look at the data on housing. And draw your own conclusions.

One of the questions you’ll have to ask yourself is this: How much of a paper loss are you willing and able to take? Or will you have to sell the home in a few years, and then perhaps convert the paper loss into a real loss? Can you afford to do this? Once you start thinking in those terms, you should get some clarity.

Get enough of folks like you and “Occupy the Federal Reserve”

Why? Things are expensive because those who buy those assets pool money from FED printers or from the words of the FED guarantees. Without the FED, they will have to borrow from you. If you are poor, they would NOT have source of funds to buy stuff. The FED is your competitor and the rent seekers do the dirty job. Root of the problem, they do NOT need to borrow from you to raise asset prices, therefore the asset prices have nothing to do with your income.

To what degree are institutions involved and how has this reshaped the housing sector? E.g., Blackstone, being one institution, is the largest SFH owner in the U.S.

How will house prices fall in the above, and other, key metros if the institutional players simply continue to hold their long-term investments?

Why do you keep referring to the 2007 bubble pop as “number 1”? It wasn’t the first. It was just another in a long line of bubbles. As we can see, when the current bubble pops its going to show “#1” a false label and bring into question your writing. Just saying.

– The spectacular rise in Dalls-Forth Worth can be (partially) attributed to the recent changes in the tax code. It made living in that metropolitan area much more attractive.

– But it was already a trend BEFORE 2017. In general the states in the middle of the US have lower taxation. And are less expensive for e.g. retirees.

– In that regard I am surprised to see that prices in California keep rising. But perhaps that’s limited to the coastal cities ?

for the data bank* :

2 bedroom house, 1100 sq.ft., built 1926, Richmond, CA, suburban neighborhood.

After $ 80K in repairs and improvements, SOLD, June or July, 2018, for

$ 530K.

*from personal friend

My thought is that CA real estate is very expensive, and anyone who wants to buy, should : 1) follow Wolf’s advice; and 2) consider moving inland where real estate is more affordable, and you don’t have to worry about tsunamis.