Here are the numbers. Peak chase-for-yield by institutional investors?

Most of the brick-and-mortar retailers that have filed for bankruptcy protection to be restructured or liquidated over the past two years have been owned by private equity firms – including the most recent major casualty, Toys ‘R’ Us. Part of how PE firms make money is by stripping capital out of their portfolio companies via special dividends funded by “leveraged loans” – more on those in a moment – leaving these companies in a very precarious condition.

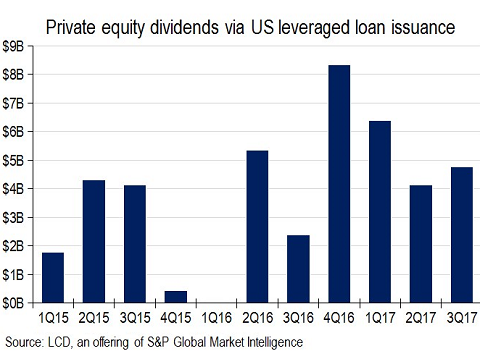

So just how much have PE firms paid themselves in special dividends extracted from their portfolio companies? $4.76 billion in the third quarter, bringing the year-to-date total to $15.3 billion. So the year-total for 2017 is going to be a doozie.

In all of 2016, this sort of activity – “recapitalization,” as it’s called euphemistically – amounted to $15.7 billion, up from $10.5 billion in 2015, according to LCD, of S&P Global Market Intelligence. LCD’s chart shows the quarterly totals:

“This high-profile recap activity is a sign of the times in today’s still-overheated leveraged loan market,” LCD says:

Deals such as these typically proliferate when there is excess investor demand, allowing borrowers to undertake “opportunistic” issuance, such as corporate entities refinancing debt at a cheaper rate or, here, PE firms adding debt onto portfolio companies, then paying themselves an often hefty dividend with the proceeds.

As private-equity-owned retailers that are now defaulting on their debts have shown: this type of activity where cash is stripped out of the portfolio company and replaced with borrowed money is very risky.

Leveraged loans are provided by a group of lenders to junk-rated over-indebted companies. They’re structured, arranged, and administered by one or several banks. But leveraged loans are too risky for banks to keep on their balance sheet. Instead, banks sell the structured products to loan mutual funds or ETFs so that they can be moved into retirement portfolios, or they repackage them into Collateralized Loan Obligations (CLO) to sell them to institutional investors, such as mutual-fund companies.

A record $947 billion in leveraged loans are outstanding. They trade like securities. But the SEC, which regulates securities, considers them loans and doesn’t regulate them. No one regulates them.

So why can PE firms strip record cash out of their portfolio companies while loading them up with this risky debt? Because credit markets have gone nuts.

After years of yield repression by the Fed and other central banks, there is huge demand for products that yield just a little more, regardless of the risks. “Excess demand scenario” is what LCD calls this phenomenon. “Hence the relative surge in dividend deals, which are popular with private equity firms, for obvious reasons.”

Despite the risks, as LCD gingerly points out, “institutional investors are keen to maintain strong relationships with private equity shops, which borrow frequently, so in bull credit markets these deals continue to find a home.”

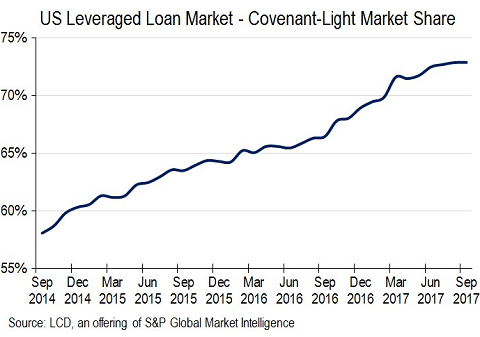

And these already risky leveraged loans have been getting even riskier for investors: In the first half of October, 82% of all leveraged loans issued were “covenant lite,” almost matching the full-month record of 84%, in August, according to LCD. As of September 30, 72.9% of all US leveraged loans outstanding had a covenant-lite structure, the highest proportion ever. So $690 billion in leveraged loans were covenant lite.

This chart shows the surge in the proportion of covenant-lite loans to total leveraged loans over the past three years:

So what’s the big deal? When there is no default, there is no problem. But when defaults do occur – as they have a tendency to do – or before they even occur, investors in covenant-lite loans have less recourse and fewer protections, and losses can be much higher. As long as investors clamor for risky debt in their energetic chase for a little extra yield, these covenant-lite loans are going to fly.

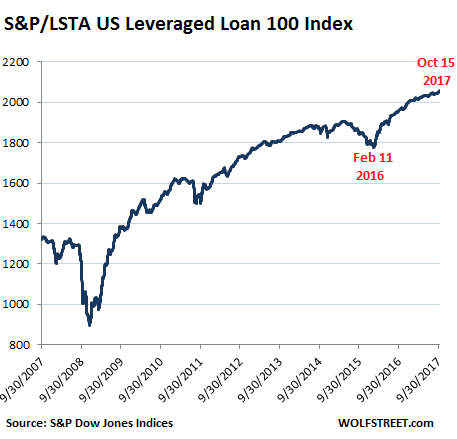

The leveraged loan market has been sizzling. The S&P/LSTA US Leveraged Loan 100 Index has now set an all-time high on every single day from September 25 through October 15. And that’s how it has been pretty much since the recent low on February 11, 2016:

In this kind of Fed-engineered credit market, where risks no longer matter, and where institutional investors are chasing yield and plow with utter abandon other people’s money into risky assets, it’s logical that PE firms are stripping as much cash as they can from their portfolio companies before these companies – like so many retailers now – are toppling.

Why is anyone still buying retailers from private equity firms? Read… IPO in March, Crushed Today: PE Firm Pushes another Retailer into Brick-and-Mortar Meltdown

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

PE firms are stripping the assets and, effectively, selling them via non-recourse borrowing. Buyers of this unsecured debt end up with little or nothing.

I’ve written this a million times:

No entity should be allowed to pay dividends if they exceed a reasonably-defined period’s cash flow or GAAP profits. Period.

Of course, then these payments would get called “fees” – and all such material fees within the first 5 years should be disclosed as part of the acquisition. They’re actually an all-but-guaranteed price-reduction, transferring risk from current shareholders to future bond holders.

…something like “We’re buying Jerk-Water Inc for $500M, but we’re going to require payment of $1.5B in management fees over the next 3 years; if our fantasized turnaround plan is unsuccessful, we will not reduce our fees, and it is highly likely Jerk-Water Inc will incur debt to pay these fees. If this happens, it distinctly possibility that Jerk-Water Inc will materially struggle as an on-going concern with this much extra debt.”

The trick is defining & requiring fee disclosure (lots of room for creative fudging).

Wolf,

I look forward to the day when there is a comprehensive, rear-view-mirror examination of the private equity segment of the marketplace, where that examination provides an assessment of the good and bad that p/e firms have done to the economy. My individual assessment is that when you look at the number of jobs created/destroyed, the landscape of defaults, the utilization of capital, or an unlevered balance sheet, to fund special dividend payments, or some other financial benefit, the once great and mighty P/E firms and their stakeholders (not investors) will be seen as just another form of piracy.

Mitt Rmoney’s career and fortune in a nutshell.

See the Appelbaum book about Private Equity. That is a solid, documented work that is very useful in learning about the industry and habits.

Enquiring Mind:

Just out of curiosity, are you referring to “Private Equity at Work: When Wall Street Manages Main Street” by Eileen Appelbaum and Rosemary Batt?

I just looked it up based on your comment, it seems interesting.

Everyone forgets why we have regulations in their capitalistic “utopia”, till it all comes tumbling down, yes Mark it does rhyme.

What is really new Wolf?

The rich and powerful have always plundered the masses throughout history.

America was an accident of history. The notion that “All men are born equal and are endowed with inalienable rights…” is just that, a notion.

Being born and gaining adulthood in a 3rd world country gives me a good perspective of where America might be a 100 years down the road. Things do not collapse all of a sudden; but gradually. They slightly get worse and the next generation’s reference point of nice gets eroded and gradually a downward spiral.

While Wolf’s guidelines prohibit politics, I would argue that unless the American people demand a better governance – their grandchildren’s lives will be no better than of those in the 3rd world countries.

A hippy may say – so what and a part of me agrees “All men are born equal” so we all should share the pain.

BUT, we are a greedy species and it isn’t unnatural to care about your progeny’s (or down the chain) well being. Doing otherwise is irresponsible parenting.

My approach is much more modest. This is just a financial article. It has nothing to do with the collapse of civilization or America or the next 100 years or anything like that. It’s just about a special way of making money for PE firms with a special kind of debt-funded dividend — and to what extent this debt has been growing in a market that is clamoring for it.

There are no grand themes beyond that in this article :-]

Wolf, while I value your approach to the financial facts, let’s be clear about the “grand themes” that your readers extract (and I think you must intend) or we wouldn’t be here.

We don’t need you to tell us that what is going on is an unprincipled abomination, there are other websites for that. As one rogue said back in the eighties, the only reason GM isn’t selling crack cocaine is because the CIA has the market cornered.

I guess what I’m saying is, we come here for the financial info, but let’s not call what predatory PE firms do “special work.”

truth always

Cute little throw-away line “The notion that “All men are born equal and are endowed with inalienable rights…” is just that, a notion.”

You (and others with little or no real experience) trivialize the analysis with a standard of perfection, which no nation (or, for that matter, individual) will ever achieve.

Name another country that fought a civil war defending the proposition, that uses affirmative action to further the proposition. Significant blood and treasure have been spent pursuing the goal

I’m not sure what 3rd world country you were educated in, but my travels to 80+ nations in Latin America, Africa, large chunks of Asia and many EU countries (Spain, Greece, or Italy anybody?) prove your comment dead wrong…and millions who immigrate (or those wanting to immigrate) to the USA know it. Compare that to USA outbound USA emigration.

Chip,

Read again what i said and then read up some history books. I am from India which has had 1000s of civil wars over 1000s of years of civilization. Quoting civil is shallow insular knowledge of native Americans.

I never disputed America is better country to live in – that is why i moved here.

My point merely is that America is slowly devolving from its great perch and will over a 100 years (or more) become normalized like other countries did.

India and China did control 70% of the world economy 400 years ago because of their large populations even back then. So what?

America dominates due to its strongest military as well as control over dollar.

That said, nothing lives forever.

I was suggesting that unless careful steps are taken, all systems devolve. Not that America isn’t a superior place to live. That said i have spent roughly 1/2 of my life in India and America each and visit the former. If there are other better places to live, I wouldn’t know firsthand since i have travelled afar but not resided elsewhere

This is the 3rd law of Thermodynamics in play.

as has already been pointed out, this is a financial blog, not political

?France liberty equality fraternity ? Switzerland

The lenders for these loans, and the “investors” who buy the securities, must have very large portfolios of such loans and the loans that result in loss must be small enough to have a minimal effect on their total profit. In the same way credit card companies pool their losses. Otherwise, why would they do it? The only stripped companies that I read about are the ones that fail. But there must actually be quite a few who succeed despite the handicaps.

We’re still in the bull phase. Imagine the next recession.

Financial Fraud. Its apparantly the american way now.

It’s Fraud only if it’s illegal. Otherwise it’s shrewd business. Especially if you can get government to support you, say by keeping interest rates low and pesky regulation off in the wilderness.

I agree with you cdr. Most publicly traded companies are fair game, in our current system, to be targeted for a LBO.

If you want to buy a company that has assets to use as collateral, and you have cash and credit available, you’re good to go. According to Investopedia, most LBOs have a ratio of 90% debt to 10% equity. As Wolf states, “After years of yield repression by the Fed and other central banks, there is huge demand for products that yield a just little more, regardless of the risks.”

So, you find a company with assets, put down some cash, borrow a bunch (at an artificially low interest rate) based on the company’s assets, buyout the company, and package up and sell a CLO. All of this is a perfectly legal way to make money.

Wait, I thought these people were “job creators?”

*Job cremators

Investors in AT&T say their annual 5% dividend yield evaporate in one day last week.

The yield chasers will learn soon. All it takes is some minor turbulence and your annual yield is gone, and then some.

Wolf,

I think this particular essay of yours should be sent to the various governors of the Federal Reserve. Seriously. Personally, I believe that Greenspan and Bernanke were largely unaware of the size of “shadow banking” and the breakdown in mortgage lending standards. In spite of the conspiratorial thinking of some commentators here, I do think that the Fed leadership is trying to keep things functional. And, because they are only human, they may overlook something like this “recapitalization” that you’re bringing to readers’ attention. I think the essay is exceptionally clear and focused. And, thank you. I wasn’t aware of the dynamics underlying this stuff.

Haha That’s great Defend Greenspan and Bernanke You’re extremely naive if you believe that Conspiratorial thinking indeed Sad and pathetic

How Now,

Actually the Fed and other bank regulators (particularly the OCC) have been warning banks about leveraged loans since late 2014. The Fed is worried that banks will get stuck with them when the market turns. This happened during the financial crisis, causing some big losses for the banks.

The Fed, as bank regulator, is looking at banks. It’s not looking that much at PE firms. But it’s also aware that the credit market has become “frothy.” I think that’s why they’re now unwinding QE and raising rates. That has been my interpretation for the past 12 months or so (when I stopped calling it the “flip-flop Fed”).

Wolf

The issue with PE loan risk (or loan risk resulting directly from PE activity) is an interesting test of Federal bank regulators allowing individual banks to use their own risk models.

Yea, yea, I know all of this risk stuff is a “trade secret”, but if I pay for it when it blows up, regulators should have a look & say about these models before they go boom.

Good to hear regulators are pushing banks now; didn’t know that (they should push harder).

The reason quants have full time jobs is because the models change all the time. Even if the firms willingly gave the models to a regulator, they would all have a hell of a time figuring out which model produced which result. No I am not kidding. I would buy a ticket to watch that show.

If the FED is unwinding QE, then why does ECB, and BoJ keep printing? Isn’t it a favorite theory that there is serious herding aka groupthink mentality among this bunch?

Like vultures picking the bones. They have no remorse over the jobs lost.

Not vultures … predators. They support the people who promote low rates via think tanks, educational institutions, media, and government. Once low rates are available they hire people who understand how to navigate the maze of laws given a specific objective … such as leveraged buyouts that amass large profits to the principals. Then they execute.

This is a basic plan. Today’s institutionalized low rates combined with central bank market puts, implied and actualized, close the loop. A desperate search for yield brings in the suckers.

This is the free market scenario. The European scenario involves a more totalitarian approach where socialist objectives replace LBO orientations. Both depend on continued government support for the few at the expense of the many. The free marketeers support the robber barons. The Europeans support the socialists and the Euro-project.

My impression of much of western europe is that the socialists, free-marketeer and robber barons are all the same crew.

If you go back to 2008 and trace the defaults, you will see that a default is in the eyes of the beholder. When the homeowners stopped paying, that wasn’t quite a default, when the cash flows stopped, that wasn’t quite a default, when the mortgage companies imploded, that wasn’t a default either. When the big banks unloaded their positions, then magically, the defaults were recognized.

Ten years later nothing has changed. You don’t know what the real credit quality of any instrument really is, until you find out the hard way.

Interesting concept – credit quality is in the eye of the beholder. To the lender who is owed money, it becomes more valuable if a bailout or buyer appears … especially if it provides a remedy for the search for yield.

I can almost hear the sales pitch … Buy this debt. The yield of 5% is astronomical given the other rates available today. Only a sucker would pass it up. And, given the current rate environment, it’s a decent sales pitch. In days gone by not too long ago, 20% would be the going rate for sucker high risk retail debt. All thanks to the money printers.

Correct. Absolutely correct.

Ten years later nothing has changed. You don’t know what the real credit quality of any instrument really is, until you find out the hard way.

You aren’t kidding ! And it isn’t just debt instruments either. When you look at the companies’ doctored earnings and the off- the-balance-sheet debt you don’t know whether to laugh or cry. Some of the most successful companies owe a noticeable part of their “profits” to finagling their taxes. We have become a parody of ourselves.

IBM just announced increased earnings and the stock is flying. It turns out all this money is not from operations, but from some tax dodge. America, what a country.

Mitt Romney is smiling right now. This is his bread and butter way to make money.

I claim b.s. on blaming the Fed. Congress makes this legal. The Fed is just doing its job of keeping the banks appearing solvent. Congress could make this activity illegal at any time.

The Fed is the definition and poster child of regulatory capture. Congress is a co-conspirator.

Meh,

I think the blaming of the Fed is purposefully designed to distract attention from the real culprits. If only the Fed would raise interest rates to (pick your poison), all the world would be working perfectly. We’d have full employment at good pay and a balanced budget!

BS! If only Congress wasn’t owned lock, stock and barrel by Wall Street and performed their real responsibility of representing the best interests of the people in general, we wouldn’t have this kind of garbage happening.

/rant

Kent

Not sure who to blame, but I think you have a strong case:

In 2016, the “top 10” industry campaign contributors totaled about $4.2B (https://www.opensecrets.org/overview/sectors.php?Cycle=2016&Bkdn=Source&Sortby=Rank),

#1, Finance, Insurance and Real Estate, gave $1.09B (about 26%) of the “top 10” total (#13, Defense contractors, gave $29.5M).

Regulators have a lot of somewhat-to-reasonably effective tools, but they are congenitally timid; they need congressional support to be effective, which is hard to get if fin

rest of sentence:

hard to get if congress looks at regulatory targets as “campaign contribution profit centers”.

So maybe ToysRUs was going bankrupt anyway, and this is just a financial salvage job. You go aboard, look the ship over before they open the scuppers and try to limit the losses for maritime insurance. There have always been bankuptcy vultures who buy failing assets, to try and turn a dollar, and provide a soft landing for investors.

I don’t understand your comment. How does loading a company with debt by taking out loans, paying yourself a large fee, then going bankrupt equate to salvage?

Definition of salvage:

the rescue of a wrecked or disabled ship or its cargo from loss at sea.

The main idea is rescue, forget the sea part. How is salvage related to making sure a company goes bankrupt by asset stripping it? Am I reading this wrong? This is not the same as actually trying to make a go of it. Why bother when you can asset strip it?

Think of a salvage yard for cars, where vehicles get stripped down to the bare chassis for parts, which are sold as “salvage parts.”

But I don’t think this would parallel what a PE firm does.

Maybe wreck robbers who lure ships aground to be able to rob them is a suitable analogy ?

A car is a consumable, a ship is a tool, and a company is a claim on future earnings, employee benefits, dividends. A company is more than its book value. In the same way the Fed calls underwater MBS deferred assets. If your home mortgage was underwater in 2008, its probably not now, so mark to market only punishes investors for cyclical events. In short run we die, in the long run its unicorns and rainbows. Does anyone doubt that?

As long the feds don’t back stop this form of debt/leverage , a few nasty haircuts will put Mr. Market back at the helm.

Wolf is there any way to find out what funds bought into this to keep away from them.

There are many of them. Some of them are designated “loan funds.” You can Google >> loan funds << to get a feel for what's out there. They might also own CLOs. As you can tell from the last chart, many of these funds have done well since Feb 2016 :-) The loans are sold as yield products for fairly conservative investors. You could possibly take a bigger bath with stocks, but this type of risk is not what most investors think of when they get into these types of yield products.

Just today I heard in passing that the Weinstein movie concern might be getting PE attention now with its board shake-up. And immediately I thought of the several articles on the subject written by Wolf, and snickered to myself.

Topical thought triggered by Sears Canada going down and investments companies I’ve worked for make in new business.

Though is a healthy company has enough profit margin to fund the future. Hedge funds buy healthy companies and use that cash flow to pay for the debt they used to acquire the company. The resulting company is a sick cow from the get go. Because with the debt payments it no longer has the resources to fund it’s path towards the future.

If one thinks like this, one notes there are a lot of sick companies and industries.

“”As private-equity-owned retailers that are now defaulting on their debts have shown: this type of activity where cash is stripped out of the portfolio company and replaced with borrowed money is very risky””

Theft – pure and simple.

In the late 70’s my wife and I took our savings of 60K and started a engineering and manfacturing company. We worked out of our own pockets for 5 or 6 years – NO loans….. We developed a good relationship with the banks and as we grew we would borrow some money at times to cover the expenses of some larger projects or for buying other machine shops. Overall, we rolled all the profits back in to make the company grow. When we got to the point that we needed to borrow in excess of 50K the bank would require that I would agree to cover the loan from my personal equity in ALL my holdings.

Personally signing – personally being on the hook. Why would anyone loan money to someone that has a long track record of asset stripping without making them participate in the risk????????

Wolf, are you gonna do an article calling these private equity firms out? Or this one counts?

Hi Wolf,

Hope you’re well.

Great article once again.

From a US point of view with this going on, why hasn’t Janet Yellen started the tapering sooner, why is it taking so long to increase interest rates even if it is only 0.25%?

Also Trump’s been on about deregulating the banking sector, what is left to deregulate if this is going on already?

Regards

Steve

Stevedcfc72,

I don’t know for sure why the Fed hasn’t acted sooner, but I have my suspicions. One of the reasons is the fact that the Fed’s plan in early 2009 was to inflate asset prices and push investors into the riskiest assets. And this is one of the results of that strategy. So once you pursue a strategy, it’s hard to cherry-pick results.

It tried to stop QE … after QE1 and after QE2 … and each time the markets swooned, so it restarted QE. This time it seems serious. But of course, we don’t know what kind of Fed we will have next year, with all the potential new appointments coming on.

Deregulating the banking sector might not impact the PE firms much (I’m just guessing here). We’ll have to see what kind of deregulation they have in mind. In terms of PE firms, banks might get more aggressive with leveraged loans… but they’re already pretty aggressive with them. As long as investors are eager for these products, banks can off-load the risks. When the tide turns, banks might get stuck with these leveraged loans.

Eliminate the tax write off of interest for such deals and theses deals will stop

I don’t quite understand the PE company bashing. How do you expect public companies to die after the customers have voted with their wallets? Leveraged buyouts are just reverse IPOs . A natural path to oblivion for a failing company.

It might be helpful to understand that it’s not just companies that are getting asset-stripped. The scale clearly shows that it’s the entire country.

It’s all part of the same process to reduce the US to a third-world country, making it easier to plunder and subjugate: offshoring, importing cheap labor, taxpayer-funded corporate bailouts, massive tax evasion, Social Security, Medicare, et al. gutted to pay for tax cuts for the rich, massive expansion of corporate welfare, full-scale loan sharking, increasing consumer rip-offs, grossly distorted markets, corporate information insecurity, massive expansion of convict labor, massive infrastructure underfunding, non-enforcement all around, skyrocketing debt everywhere, phony economic statistics, mass media distractions, absence of disaster relief, and so forth.

The list is extensive. And growing.

Think Mexico, America. Soon enough that will be too optimistic, so if you’re foward-looking, think Haiti. Your masters certainly are.

Meanwhile, resource extraction and ecological degradation are already far past unsustainable. “Unsustainable” means “heading for destruction and ending up dead.” What little accounting there is for environmental assets amounts to less than window dressing, so those are simply wasted on a global scale.

Plunder of the planet continues to accelerate and there’s nothing in sight to slow it down, so it can only get worse, and so it does.

This can only end in tears.

Informative and interesting article, but I think you meant “yield suppression” not “yield repression”. I don’t think the Fed is holding down rates like the landed gentry held down the serfs. “Now we see the abuse inherent in the system!”.

Anyway, again, good article.

one issue they still face while plundering these companies is a fraudulent conveyance litigation action in bankruptcy court. This could force them to pay back the funds moved out if the company subsequently failed after the money was moved out.

My latest on private equity’s asset-stripping boom:

LINK REMOVED BY WOLF — see below for reason

Best regards,

Leo Kolivakis

Publisher of Pension Pulse blog

COPYRIGHT VIOLATION

Leo, in your article that you linked and promoted here, you used one of my charts. ALL CONTENT on WOLF STREET is copyrighted. You did not have my permission republish this chart. This is a COPYRIGHT VIOLATION. Please remove the chart from the article and please remove any other content that you took from WOLF STREET.

You also republished charts from LCD that I had in my article. I do have the permission from LCD to publish them. I don’t know if you asked them for permission, but if you didn’t you also violated their copyright.

Copyright violations are serious business.

You can contact me via the Contact Tab.

I looked at it again. Turns out you republished the entire article without my permission. So you need to take down most of the article, including all the charts.

You can leave three paragraphs (without charts) of my article with a “read the rest here” link to the original article on WS.