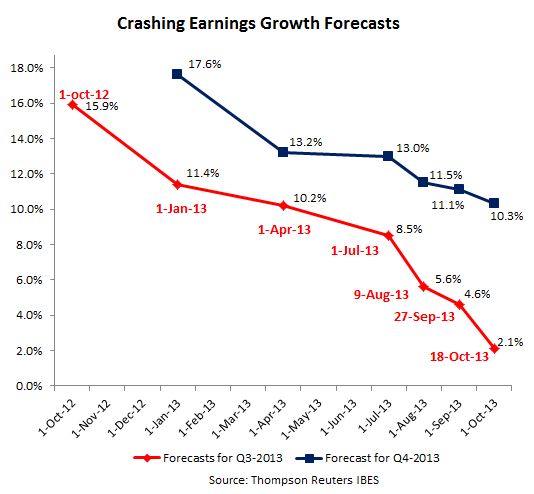

Earnings estimates for S&P 500 companies for the third quarter have been crashing for a year. On October 1, 2012, our brilliant analysts on Wall Street estimated that earnings would leap 15.9% year over year in Q3 this year. As of Friday, these same brilliant analysts have chopped their forecasts down for the same brilliant quarter to a measly growth of 2.1%, according to Thompson Reuters IBES.

They’re now forecasting that earnings would grow at the rate of inflation, nothing more. The next step down would be negative earnings growth – shrinking earnings. Our brilliant analysts have lowered the bar all the way down to the floor.

So how much hype and BS does Wall Street dish out? Endless amounts, in the never-ending scheme of inflating stock prices and shuffling this paper into the portfolios of retail investors. So this is how Thompson Reuters glorifies this horrid earnings performance:

Of the 85 companies in the S&P 500 that have reported earnings to date for Q3 2013, 64% have reported earnings above analyst expectations. This is higher than the long-term average of 63% and is below the average over the past four quarters of 66%.

And this is what happened to these “analyst expectations” – the steep red cascade – the very bottom of which 64% of the companies are now beating:

Meanwhile, the S&P 500 stock index has soared nearly 20% this year and has hit a new high on Friday. On what basis? If reality still had any kind of influence, stocks would have fallen along with earnings estimates. But not when the Fed is printing money in a drunken frenzy. What will cause the music to stop? The end of the Fed’s drunken frenzy.

We’ve had a flavor of it. When the Fed was merely mumbling in a corner of the room about possible future tapering, things started to collapse in the emerging markets, in the mortgage market, and elsewhere. That scared the dickens out of them.

Now they have moved it out a bit, but unless they want to blow up the entire system, they will have to stop printing someday. So watch out.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()