It’s been a phenomenal circus, the screaming and hollering on all sides about the “fiscal cliff,” in the media, from lawmakers, from chieftains of our industries, particularly those that feed at the government’s big trough, such as defense contractors, which include some of the largest global corporations. Even NPR this morning postulated that it would cause a million job losses. Hysteria comes to mind.

The fiscal cliff is to the US what the Troika is to Greece: an unwelcome dose of self-imposed half-assed discipline. Self-imposed in Greece because they could send the Troika packing, default on the rest of their euro debt, revert to the drachma, and print themselves into poverty. Self-imposed in the US because Congress passed, and the President signed, the laws that make up the fiscal cliff. And half-assed because it doesn’t mean that either country will ever live within its means.

According to the fear mongers out there, the US would fall off that fiscal cliff if (most notably):

– the Bush tax cuts are allowed to expire, sending us back to where we were before.

– the 2% Social Security tax cut is allowed to expire, sending us back to where we’d been all along.

– the beautifully named “sequestration” is allowed to trim discretionary spending a bit, including defense, whose expensive though cool and often deadly toys amount to a fat corporate welfare program.

To add some spice to the mix, there is the “debt ceiling” that Congress imposed. US Treasury debt might bump into it by the end of the year. If a fight breaks out over it, the world will scratch its head, having watched that silly farce during the spring and summer last year.

So, how dreadful is this cliff?

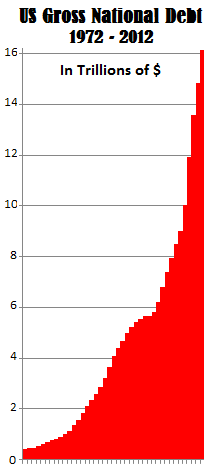

According to the Congressional Budget Office, it would cut the budget deficit in fiscal 2013 by about $560 billion. That sounds like a lot, but during fiscal 2012, which just ended, US gross national debt jumped by $1.322 trillion—to end up at $16.159 trillion. So, if 2013 looks like 2012, the fiscal cliff would cut the deficit by 42%. But it would still leave a huge $762-billion hole. And gross national debt would break the $17 trillion mark.

The graph on the left depicts the skyrocketing US gross national debt from 1972 to 2012. Note the exponential increase since 2001. However, between 1998 and 2000, the trajectory flattened out; the debt still grew but at a slower pace. If Congress and the President want to, they can.

By jumping off that fiscal cliff—more of a mogul, actually—the US would see the trajectory of its debt flatten out similarly. The deficit might drop to 1.2% of GDP by 2021, according to CBO estimates. Still miles away from a balanced budget, a total non-starter in our free-lunch QE culture. The mountain of debt would be much higher still. But it would be a start.

On the other hand, if the fiscal cliff is not allowed to work its magic, the exponential growth of debt will simply continue to its bitter end.

So just how much havoc does living within one’s means wreak?

Households have gone through that. They had to stop living off their HELOCs and their credit cards, and they had to squeeze their budgets to match their incomes. It’s painful. But prudent. Cities and states had to do it, too. It’s the only way to avoid financial disaster. So why is it that Washington thinks it can’t?

The screams that it would cause a recession are deafening. But over the decades that the US has lived far beyond its means, it has lumbered from one recession to the next. Clearly, running up deficits does not prevent recessions.

And there will be recessions! They’re painful, but less painful than blowing up the system. Yet lawmakers, US Presidents, and CEOs—those who’re handicapped by a field of vision that doesn’t extend past the next election or reporting period—are hoping that the moment of reckoning can be pushed out of sight. For them, deficits and debt don’t matter as long as they can feed on that big trough.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()