These crazy days of ours, if you want to have confirmation the economy is sliding into trouble, look at stocks: for stock-market jockeys, crummy economic data indicates that the Fed won’t raise interest rates. And stocks jump.

Maybe not jump, exactly. But the S&P 500 rose 0.9% for the week, its third weekly gain in a row, following another decline in industrial production, weak retail sales propped up by autos and restaurants, falling wholesales and business sales, rising inventories, a lackluster employment report…. The word “recession” is floating around, and when it hits, stocks might make a big new high. That’s the twisted hope.

And now Moody’s has jumped on the recession-warning bandwagon too, with a logic of its own.

First, there’s credit: the spigot is getting turned off.

For the last three weeks, only two junk-rated companies were able to issue bonds in the US. And just in the US: “This is shaping up to be the worst October for the worldwide issuance of high-yield bonds” since October 2011, wrote John Lonski, Chief Economist at Moody’s Capital Markets Research. He warns of “reduced access to financial capital.”

But unlike October 2011, when the euro debt crisis caused wild gyrations in the bond markets, which then recovered quickly, this time around, there might not be an easy recovery: average yields and spreads are still low in comparison to 2011, but the average expected default frequency (EDF) for US/Canadian junk-bond issuers, which was 3.85% in October 2011, is now a “much riskier” 5.20%.

Then there are deteriorating corporate revenues and profits.

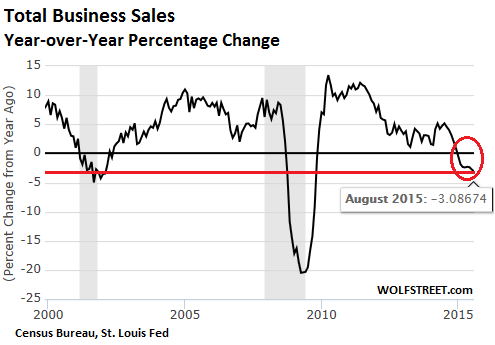

And Moody’s ties them to jobs. Hence the risk of a recession. Total business sales have been shrinking year-over-year, something they have done in recent years only during the prior two recessions:

But OK, this time it’s different. Revenues in the energy sector collapsed by 32% in Q2 from a year earlier. So the rest of the revenues should look sound, no? No. Moody’s removes energy from the equation:

The year-over-year increase of core business sales, or an estimate of business sales excluding sales of identifiable energy products, is likely to slow from Q2-2015’s already well-below-trend 2.1% to 1.7% for Q3-2015. The latter would be the worst showing by core business sales’ yearly percent change since the category shrank by -4.2% in Q4-2009.

They “Now compare unfavorably with pre-recession showings”

Moody’s continues:

Given the maturity of the current business cycle upturn, the latest deceleration by core business sales hints of rising recession risk. For the year-ended September 2015, core business sales probably rose by 3.2% annually. For all of 2015, that growth rate is expected to be slower than 2.5%.

By contrast, during the 12 month spans prior to the start of the previous two recessions, core business sales increased by 4.7% for the year-ended November 2007 and grew by 3.8% for the year-ended February 2001. Thus core business sales already, and are likely to continue to, underperform what held prior to the last two recessions.

Slowing business sales by themselves aren’t enough for an official recession. The NBER, which decides when a downturn becomes an official recession, uses all kinds of factors beyond just two quarters of negative GDP. Prominently among them: jobs.

And there’s a link between core business sales and jobs.

When sales are hot and rising, employers hire new people, and people work more hours and make more money and spend more money, which causes sales to tick up even more, which causes employers to hire even more…. The fundamental virtuous circle of economic growth, in theory. So Moody’s says that core business sales have “considerable influence over private-sector employment”:

For the current cycle, the moving yearlong average monthly increase of private sector payrolls peaked at the 262,000 jobs of the span-ended February 2015, which coincided with the most recent 5.0% peak for the yearlong annual percent growth of core business sales.

A subsequent deceleration by the annual increase of core business sales to the prospective 3.2% for the year-ended September 2015 helps to explain the deceleration by the average monthly increase of private-sector payrolls to the 217,000 jobs of the year-ended September 2015.

But 217,000 jobs per month – those were the good old days. For September, the Bureau of Labor Statistics reported a gain of only 142,000 jobs and for August a revised 136,000 jobs.

If core business sales “do not accelerate materially,” Moody’s said, growth could drop below 100,000 new jobs per month. In this manner, core business sales “warn of jarring slowdown by private-sector payrolls.”

Which boils down to that “rising recession risk.”

As credit ratings agency, Moody’s is all about debt. What matters isn’t whether or not there is a recession, but what the Fed is going to do. And this is what Moody’s envisions: not only ZIRP as far as the eye can see, but if fewer than 100,000 new jobs are created three months in a row, “the expected direction of US monetary policy would probably shift from a rate hike to additional stimulus.”

And thus Moody’s confirms that the emergency monetary policies, designed to keep the decrepit, top-heavy, malodorous financial system from collapsing on top of its chieftains, have become a permanent fixture. Without these “emergency” policies, the economy is now deemed to be a permanent basket case, while the financial markets would simply give up their ghost.

But the monetary policies have allowed companies to load up their balance sheets with debt to the point that even Goldman Sachs finds it “increasingly alarming.” Read…. The Wrath of Financial Engineering: It’s Now Eating into Earnings

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I find it fascinating that restaurants seem to benefit from a deteriorating economy. You’d think people would eat at home where it’s much cheaper than eat out at a restaurant.

I can’t figure this out, unless restaurants include McDonalds where food stamps are redeemed.

According to several sources recently read, apparently Millennials are driving restaurant sales. It appears that they are more interested in their digital devices and socializing with their peers than getting into the home ownership game. Living in their parents’ basements, or three to four in one apartment or rental house, frees up a lot of cash for dining and drinks. And, so I’m told, they are in no great hurry to change that behavior.

Makes sense…no car or home loan, leaves plenty enough cash to hang out at cafes/bars.

I think the growth in Waiter jobs is due to the retirement home where old folks live, like myself.

We have lots of nice young people working here! They take our menu choices for lunch & Dinner and bring us each course when we’re ready for it.

Many of them are working their way through College. Some have even followed my advice to get their Frosh/Soph courses done at the local Community college, debt free.

I’ve helped a few of ’em buy used cars to avoid big depreciation losses (on a BRAND NEW CAR!). Ya know, CarFax and know the owner.

It’s not as easy when I could find the ‘best’ sellers in the newspaper.

Cars are getting better these days, so the kids are doing ok.

They fuss about that FICA guy until I explain they’re building up one kind of retirement plan that only exists in America.

It’s odd that Waiters and Bartenders are lumped into one employment group. Nobody at our home serves booze. I usually fall asleep after dessert.

Conclusion: There are 40 to 50 million baby-boomers? 10,000 new ones each day. I can’t figure how many homes there are. But, like my place with 295 people there may be 30,000 ‘homes’ around America. We have about 45 young people working here, part time. So, does 2 million Waiters seem like a valid number?

I don’t see how 9 to 12 dollars an hour is going to get the American economy to any kind of lift-off ?

Perhaps Sir Wolf has business contacts that are far smarter than I am. That shouldn’t be difficult!

Smile at a stranger, every day!

R.O.F.

It’s real simple. They’re lazy! And the credit cards will eventually max out again

Keep in mind, the grocery cost has gone up too so a home cook meal is not as economical as it used to be.

The restaaurant thing is a facet of ‘the cycle of poverty’. I know lots of poor people and when they get a bit of cash they immediately spend it on whatever treats they desire. I live in a rural valley and it is a mindset with many of my neighbours. (Might as well, I don’t have anything, anyway). My oldest brother has been that way his whole life. He lived in a shitbox in Paris, but would send us photos of skiing trips at Grenoble, scuba diving in the Med, stuff like that. They ate out all the time and still do even though he is always hitting us up for ‘loans.’ Now, as he approaches old age it is no joke. He is pushing 70, still broke and still trying to get the occasional ‘loan’. I bluntly told him that any money we have left will eventually go to our children. I suggested he read ‘The Ant and The Grasshopper’.

And isn’t that what it is really about? Delaying gratification and sticking to goals + walking the walk with a direction in mind. All this with some luck and caution? Ultimately it can pay off. The alternative is to live in the folks basement, ask relatives for money, and always being worried about the future with occasional splurges. When people mention millenials eating out all the time and living for today I immediately think of my oldest brother. It all seems fine until no one reaches for their wallet to pick up the cheque, anymore.

There will be a recession and it can be very hard depending on your economic health at the time. I have gone through many of them and have been very vulnerable at the time. I have been poor and lived month to month. I have also never missed a mortgage payment or bought a car on time. I drove a jalopy and rode a bike. We never ate out, or if we did it was a big deal.

What I am getting very pissed off about is interest rates and the manipulation to keep the free party going. I have been a taxed milch cow my whole working life, paying a high percent deducted at source. I dutifully paid off three houses along the way starting with a shack. We also saved plus put money away for the future. It’s called a budget. Now, my desposits earn nothing while the cost of living increases. Now, we are threatened with NIRP…..spend your money or else. If it gets any worse I’ll wait until the recession hits hard, pull my money out of term deposits and buy more land. The kids can get it when I’m gone. People put down property purchases but it always has more value than a new Ford or VW. It’ll sure be better than a cruise with a bunch of other grey beards. Like I said, it is just ‘The Ant and The Grasshopper’, plus threats and theft by Govt. policy.

I hear all the time that it is no longer possible to get ahead. Student loans, no jobs for degrees, property too expensive…..”oh poor me”. Bullshit, I say. First of all, don’t do what everyone says you should. Maybe people need to stop and think long and hard about career choices ‘before they pick their school’. (Imagine that). I have a degree, but I did most of it by correspondence when I was in my thirties, (that was before the internet and I used the BC Govt Open Learning Agency to access courses. I also picked up trade certification and commercial pilot ratings. My parents paid nothing and I did not take out a loan to live on campus. There is no reason why working people cannot get ahead if they want to. It takes decades, not months. And there is much fun to be had along the way.

I did all the right things and have nothing to show for it. The system is stacked against you. Enjoy what you have with your children while you can, nothing you have is really yours, you just haven’t noticed it yet. Rather than leave your children another taxable “asset”, help them out now, they will cherish the memory of it. I remember every subway token I got from my family while I was in school. The lost house, business, and savings were a wake up call for the future.

Interesting point surfaces here. Obviously, your brother is a sponger.

But let’s think historically: people didn’t live very long, 50% dying before 30 until very recently.

Of those working people who grew old, it ended in the ‘workhouse’ (Britain) or charity hospital, etc, elsewhere.

However much they saved, however hard they worked, that was the likely prospect: so, what point saving? Better to enjoy the shining hour of sun.

Saving is a bourgeois strategy, and the bourgeoisie were, until post WW2, a very small % of total workers.

Below a certain threshold, it is a better strategy to spend and enjoy, and then throw yourself on society.

As a Roman poet said ‘You can cellar as much fine wine as you like, but someone else will drink it…..’

According to this piece on the David Stockman site http://davidstockmanscontracorner.com/end-the-fed/

“[A]ccording to the Social Security Administration’s wage records, there were 100 million workers who held any kind of paying job during 2013, who earned a collective total of just $1.65 trillion that year. That amounts to the incredibly small sum of just $16,500 per average worker. And not for a small slice of the labor force but fully two-thirds of all Americans with a job.”

For those who tell the poor to just get a job (Paulo), obviously there aren’t many if two thirds of our total work is only averaging only $16,500 per year… Anyone who says anything disparaging about the working poor or those who can’t find a job is arrogant, stupid and greedy.. totally disengenous. No wonder WalMart has had something like 16 quarters of declining revenues.

It isn’t all that easy any more.. I did what you did and got ahead. Lived below my means and invested and saved but from all I read, those days are over for the majority. All the big money goes to the Monopoly players/owners and there is scant left for “We the People”.

I didn’t say, “just go get a job”. I’m saying it is still possible to get a job, find another, and get ahead. Of course this won’t work for everyone, but the kind of folks that read this blog instead of playing video games or boozing it up at the pub seem to have already scoped this concept out.

I am not rich, by any stretch of imagination when compared to the ‘investor class’. But I have been given the opportunity of free public education to grade 12, and affordable post secondary opportunities. I was also provided a work ethic to follow as my folks worked hard to rise out of a Great Depression childhood to middle class. As well, I have not been devestated by medical expenses due to living in Canada. It was the lottery, no doubt about it. I am grateful.

When my son was 13 I had three jobs one year. I taught high school, flew bush planes after school and on weekends (on call), and did renovations during the summer (when I wasn’t flying loggers into camp). Once, I hired my 13 year old son to help me hang drywall. It was for a ‘job training school’. One day, my son looked out the window at a group of guys outside having a smoke on class break and he asked me, “Dad, if these guys are out of work why aren’t they up here doing the drywall”? My reply, “good question, I don’t have an answer….. now give a hand, here”.

It is pretty sparse for jobs right now, I know this. The time to have set up was a few years ago and the way to start is have no debt and put some money aside to get ahead. Why anyone would believe ‘society’ will ultimately look after them is beyond me. Sure, ‘they’ will to keep the crowds off the street but when push comes to shove the ruling class will look after their ‘circle of friends’.

regards and best of luck going forward.

Paulo:

Thanks for your post. Your story is quite inspiring. I agree with you one hundred percent. We should be prudent and hard working and take responsibilities for ourselves. The sad part is that the Federal Reserve’s monetary policy reward irresponsible risk taking and reckless behavior, and punish the prudent and hard working people like you.

Its a chicken and egg situation, Paulo. As the generations go by things become more and more lawless, starting at the top and rotting all the way down to the bottom; and the more rotten things get the less reason there is for anyone to believe things could be changed, and so worse and worse it gets until your government is no longer simply corrupted but co-opted by a carousel of opportunists, thieves and charlatans that grow more and more bold with every lie they get away with . It is pointless for these young people to save for a whole raft of reasons and intuitively they know it.

Lawless for those at the top but not for those near the bottom. The US has more people in jail than any other major country in the world. There is lots of implied law for those with little while totally lawless for those who play the Monopoly game with our lives and resources. For the Marie Antoinettes there is nothing wrong with our system.

Paulo

You struck a nerve how you obtained your education. I am very similar, extension and night courses to get an AA degree, GI bill to become air transport pilot, been self employed about 40 years in several businesses, my most recent and most successful is a vineyard and winery. My parents paid nothing, I even earned the money for my first car.

We have 6 wonderful children, all college graduates and financially successful. I believe hard work and commitment works, it still worked for my children, and my first grandchild entered college this semester.

I am disgusted with the lazy entitled society, the dependency, the acceptance of big brother and lack of freedom. But, it still is a country that has allowed me to fulfill my dreams.

My Bullshit Detector is out on you! This move into your own place is pure Eurocrap! I come from the South! Everybody is ” living off the family farm! I and my kin are the exception! There are no Govt Open learning agencies where I come form! I worked and took out. Loan for college! U like you, I had to pay taxes because, I am single and have no children! There is no gratification in living from paycheck to paycheck, just to se it frittered on a bank bailout for a bank that is not a part of my community! You can tell that you can make it if you try to some other fool!

“following another decline in industrial production, weak retail sales propped up by autos and restaurants”

And yet, one has to wonder about autos. The auto business is international, and the Chinese ain’t buying, VW is dying, and there’s an emissions crackdown coming on many other EU based auto companies. But the auto stock ETF, CARZ, came back strong from its a few weeks ago. (see chart below).

http://finance.yahoo.com/echarts?s=CARZ+Interactive#{“range”:”1mo”,”allowChartStacking”:true}

Since Moody’s (a Buffet owned corp, along with the bank, Wells Fargo, that Moody’s turned a blind eye to) gave high ratings to both the subprime CDOs and the ARS (Auction Rate Securities), right before they imploded, perhaps the monoline is due to finally call one right.

Have you looked at the stock for Autozone (AZO) or O’Reilly’s (ORLY)? Look at the five year growth. When new car sales collapse, usually used car sale prices go up and repairs of older cars rise. What will happen to these two stocks, if new car sales collapse?

What will happen to AZO and ORLY? Depends on what happens next.

They have gone up 3 to 5 times respectively in last 5 years. Both already have high P/E ratios. Both long term charts already look like hockey sticks. If this next down turn is just a recession, I imagine they will just have a bad hair year and recover but if this turns into something more significant, then with the debt they both have and the parts mostly made somewhere else, they could just as easily go BK along with much of the rest of big indebted corporate America.

So in other words, stocks will continue to head upward. Time to put even more money into this ongoing bull run.

My response to Xabier is precisely that of Dr. Johnson to Boswell when he tried to defend Rousseau: “Sir, it will not do. You may tell the judge that you did not intend to shoot the man through the head, but he will hang you nonetheless.”

And Rome collapsed from this very disease. They called it Panem et Circenses.

The more I think about the twisted paradigm of stocks, where they rise on the prospect of a recession, I think this.

If something can’t continue forever it won’t. Economic news cannot continually get worse will stocks go higher. Eventually you’d be paying a fortune for shares in a company generating no earnings.

We’ve been living in a Fool’s paradise due to sick Central Bankers and their monetary heroin. But we’re just about at the end of the road in my opinion.