The amount of money investors have plowed into startups has reached record highs. In 2014, investors of all kinds, from angels and VCs to big asset managers, invested $48.35 billion in startups, “only” the third highest year on record, but the highest since the crazy bubble years 1999 and 2000 when investors blew $55 billion and $105 billion respectively, even as the dot-com bubble was already imploding. Investors at the time were just a little slow in giving up hope.

But the “valuations” are getting crazy. The price at which new investors buy into a startup during a round of funding determines the “valuation.” As investors have become more eager with other people’s money, and as hedge funds and big asset managers have jumped into the fray in late-stage rounds, they have sent valuations on vertigo-inducing trajectories.

Slack, one of the innumerable startups that over the years have claimed to have found the successor to corporate email, just inked a new deal with investors for $160 million in funding that jacks up its valuation to $2.76 billion. The round is expected to close over the next few weeks. “People familiar with the matter” purposefully leaked this to the Wall Street Journal as part of the mega-hype that the startup scene needs in order to attract ever more money.

Slack launched its app only about a year ago. At the time, it wasn’t even in the Billion Dollar Startup Club, that ever growing group of startups with valuations over $1 billion. But in October, it raised some money at a valuation of $1.12 billion. And five months later, its valuation jumped 146%.

Unlike some other startups in the Billion Dollar Club, Slack has a revenue model. Of its 500,000 users, 135,000 pay a monthly fee of at least $6.67 per person, according to the Wall Street Journal. So at least it has some revenues, if minuscule compared to its valuation.

But on Friday, just after the funding deal was signed, Slack disclosed that it had been hacked, and that messages between users and some user data had been compromised, including usernames, email addresses, and encrypted passwords. Businesses with confidential information love this sort of thing.

“It’s unclear when Slack discovered the breach or if new investors were told of it before they agreed to the deal,” the Wall Street Journal reported dryly.

Valuations of other startups have increased even faster over the last 12 months. For example:

King of the Hill Uber saw its valuation soar by nearly 1,000% in 12 months, that’s by $37.4 billion, to reach its current valuation of $41.2 billion. Snapchat gained 900% during that time, or $13.5 billion, with a current valuation of $15 billion. The US Intelligence Community’s darling Palantir, which counts the CIA among its early investors, didn’t do too badly either, as its valuation rose by nearly 300%, or $11.2 billion in 12 months, to $15 billion. Pinterest’s valuation jumped by 190%, or $7.2 billion, to $11 billion. Airbnb booked a 300% increase during that time, or $7.5 billion, and now sits on a valuation of $10 billion. And so on. Startup valuation fever has reached the state of delirium.

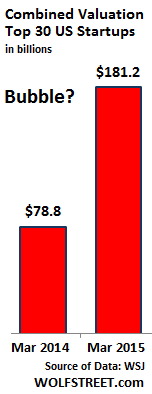

The combined valuation of the top 30 startups in the Billion Dollar Club has soared by 130% since March 2014, from $78.8 billion to $181.2 billion. That’s a gain of $102 billion in 12 months for 30 companies.

During that time, some of the companies fell off the list, like Fab, which is now struggling to survive. Others exited out the front door via an IPO, such as GoPro. And companies like Slack moved up into the top 30. So this startup index, if you will, is in flux.

Each gain was decided by a relatively small number of people behind closed doors, where each knew what was expected: ratchet up the valuation with the current round to enrich earlier investors, just like future investors are counted on to ratchet up the valuations further, to enrich current investors.

So be it if some of the startups haven’t figured out how to get a serious amount of revenues. But they do know how to burn cash in prodigious quantities. In fact, all this cash flowing their way, supported by the idea that they can always get more, encourages them to burn prodigious amounts of cash.

This process is self-feeding. As long as new investors keep piling in with other people’s money to drive up valuations, earlier investors see their investments balloon and are willing to make more investments. And other potential investors see that, and they get in line to put their money to work at even higher valuations. Hence the incessant hype about valuations, and the purposeful “leaks” to the media.

But turning a valuation into cash for investors requires that there are more investors at the far end with more money to bail them out, either via an IPO or via a corporation that can use its own shares as currency, of which it can always print more. That exit is open only in a raging bull market, such as the current one.

Such an exit will saddle future investors with huge risks in return for relatively puny gains, at best. Only a few of the companies will thrive. Most of them will fall on hard times when the money runs out. Many will become penny stocks and disappear after they burn through their cash, leaving in their wake a lot of capital destruction. It’s just a question of whose capital will be destroyed.

Even while the startup bubble roars ahead, Corporate America is sinking into a very somber reality. Read… Worst Revenue & Earnings Declines Since Crisis Year 2009

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

FIRE! EXIT?

When dumb money piles in, the smart money gets out. Man the lifeboats!

Cowabunga! Serf’s up, pal! It’s like fracking with no cap-ex and on steroids. Please form two lines please. Useful idiots to the left and Greater Fools to the right. The smoking lamp is lit. Smoke’em if you got’em. Tonight’s movie will be Gone With the Wind. Oh Rhett! Wherever shall I go? Whatever shall I do? Frankly my Dear, I don’t give a damn!