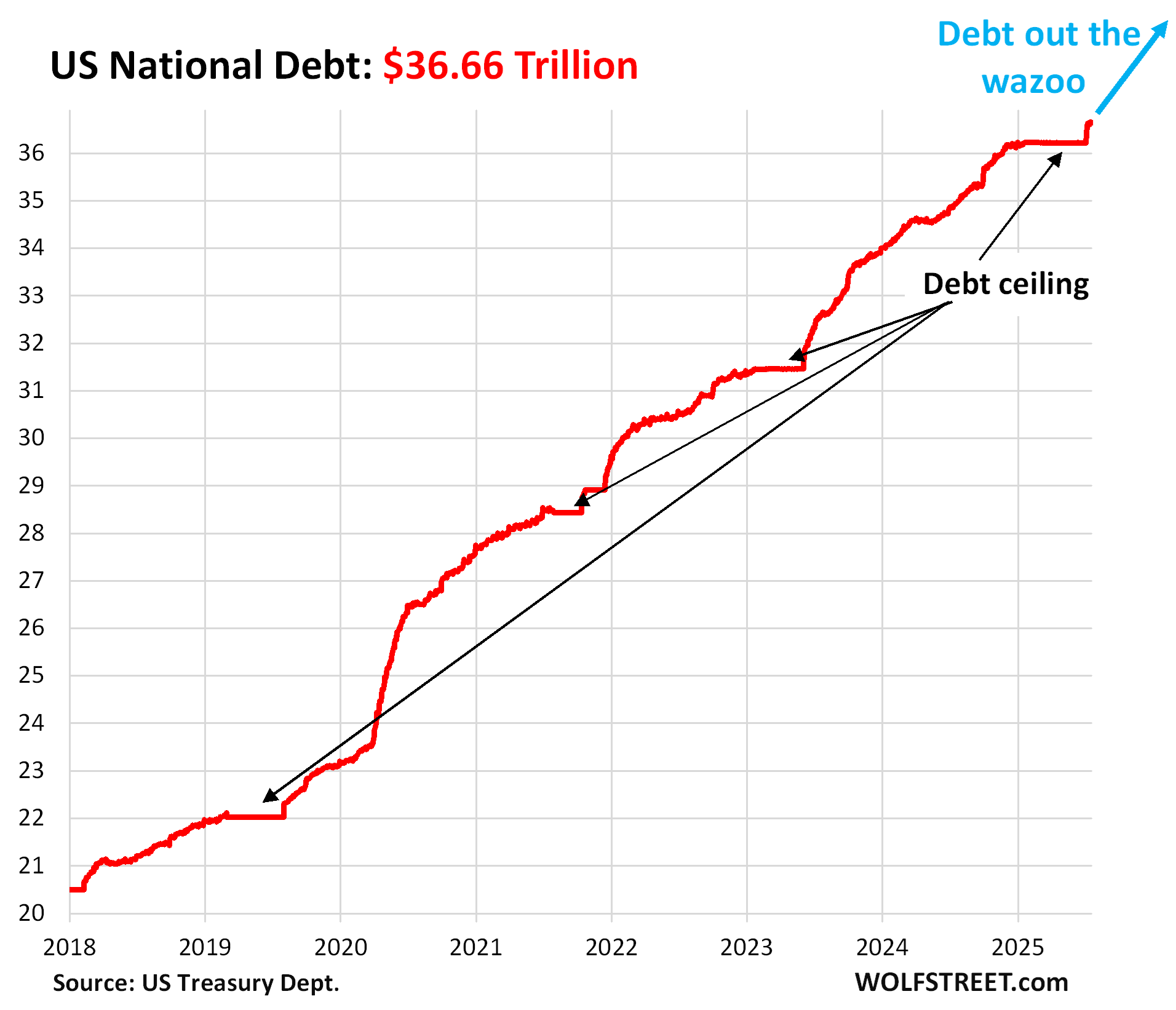

US Treasury debt surged by $441 billion since the debt ceiling, to $36.7 trillion. Foreign demand for this stuff is an increasingly important issue.

By Wolf Richter for WOLF STREET.

The recklessly ballooning US national debt has surged by $441 billion in the two weeks since the debt ceiling was lifted, and by $1.71 trillion in 12 months, to $36.66 trillion. How this debt will blow out during the next recession when tax receipts plunge and expenditures explode is not anything we’d want to even think about.

Will foreign investors continue to buy this debt or will even more of it have to be absorbed by domestic investors? That question is high up on the worry-list. So far, there has been enough demand to keep long-term yields relatively low in this inflationary environment, with the 10-year yield currently under 4.5% and the 30-year yield at around 5.0%. A lack of demand would push Treasury yields up, and mortgage rates with them – until enough new investors find it appealing and buy it. So we keep an eye on who is still buying this debt.

Demand from foreign investors.

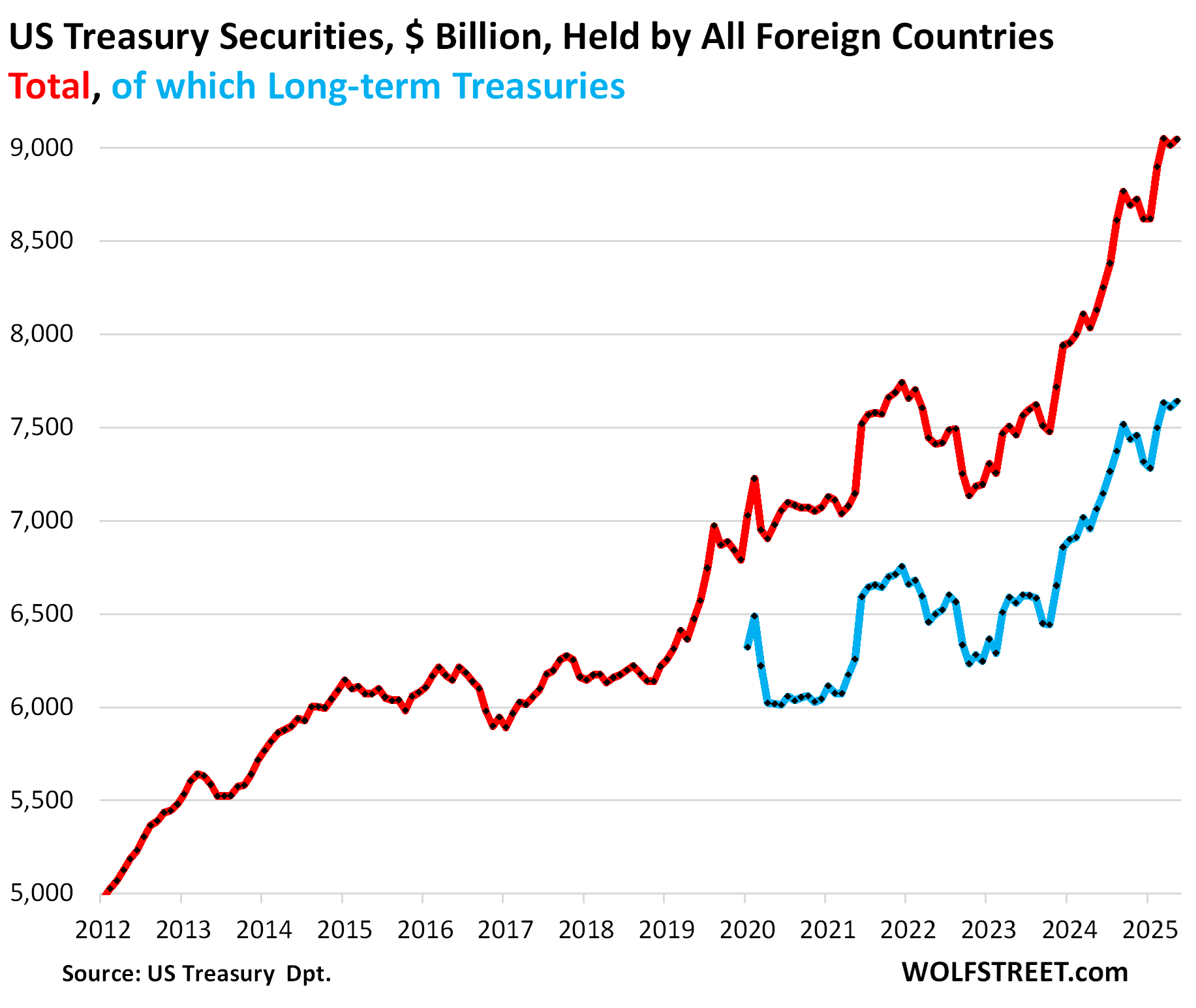

Foreign investors increased their holdings of Treasury securities by $32 billion in May, and by $915 billion year-over-year, to $9.05 trillion, just a hair below the record two months earlier, according to Treasury Department data Thursday afternoon (red line in the chart below). Of that total, $7.64 trillion (84.5%) were long-term Treasury securities (blue), and the rest were short-term T-bills.

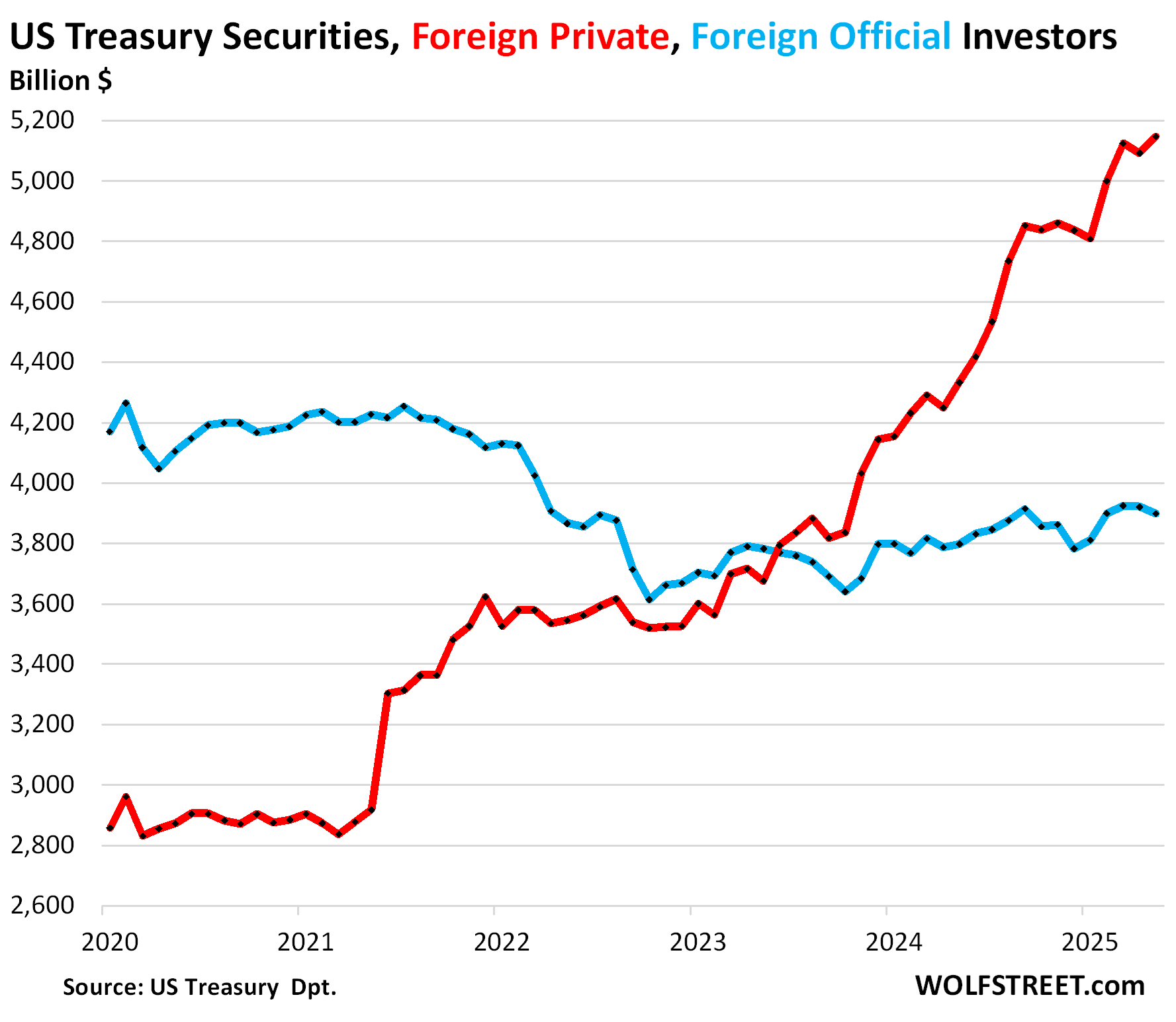

But “foreign official” holders, such as central banks and government entities, have trimmed their stash of Treasury securities over the years. And their holdings dipped again in May to $3.90 trillion (blue in the chart below).

Private foreign investors – such as financial firms, companies, bond funds, individuals, etc., in foreign countries – have piled on Treasury securities from record to record. In May, their holdings jumped by $55 billion, and by $815 billion year-over-year, to a record $5.15 trillion (red).

China and Hong Kong v. the Euro Area.

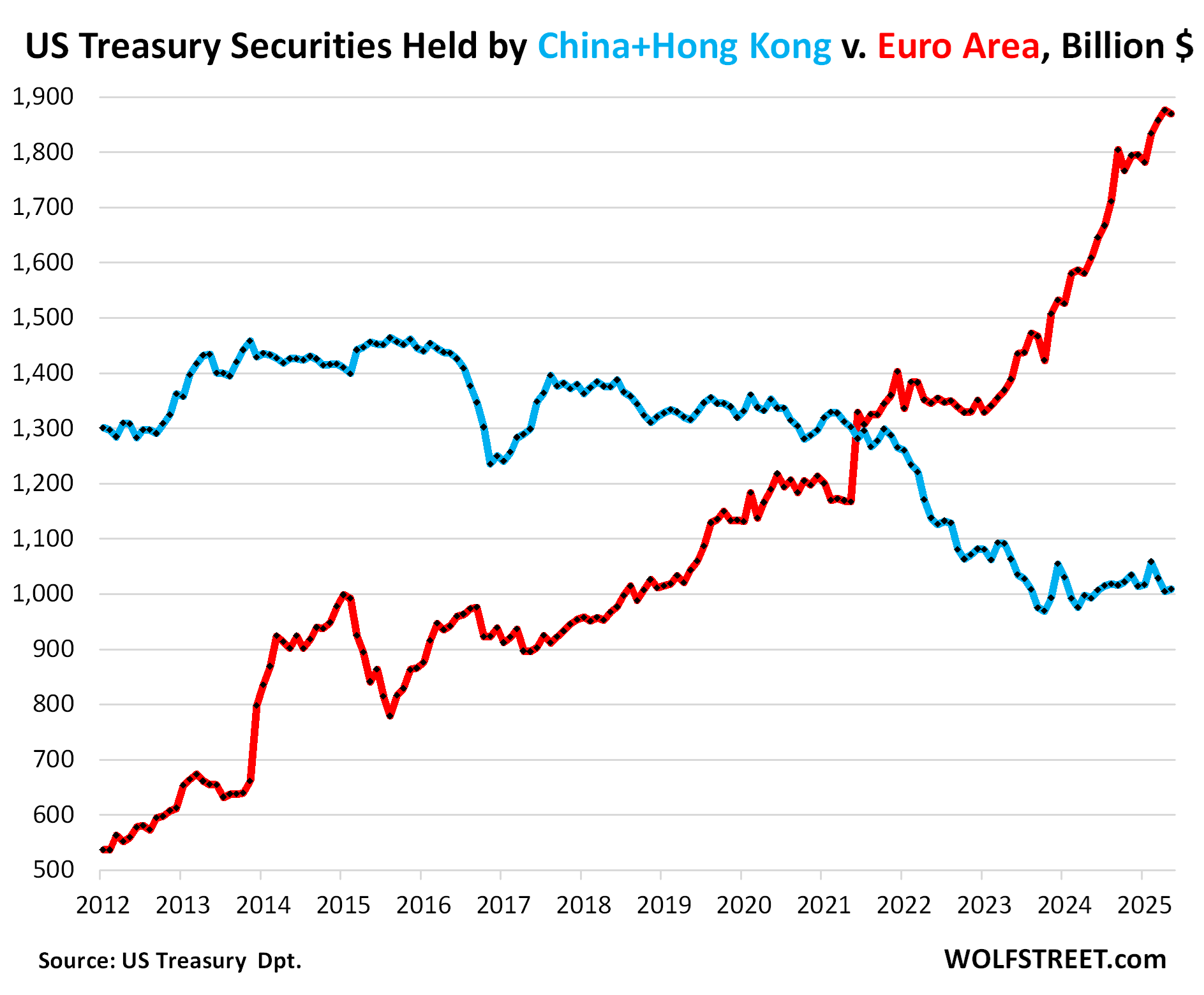

China and Hong Kong combined have reduced their holdings from $1.45 trillion in 2015 to $1.01 trillion in May, up marginally from the low point in October 2023 when they ended the years-long process of unloading.

Month to month, the holdings of China and Hong Kong combined ticked up by $4 billion, and year-over-year by $16 billion (blue).

The countries of the Euro Area have bought US Treasury securities hand-over-fist for the past 12 years, more than tripling their holdings, from $534 billion in 2012 to $1.87 trillion now (red).

Month over month, their holdings declined by $6 billion from the record in the prior month. Year-over-year, their holdings surged by $261 billion.

The biggest holders in the Euro Area are the financial centers (Luxembourg, Ireland, Belgium) and France, whose banking system also functions as a global financial center. Their combined holdings, at $1.53 trillion, account for 82% of the Euro Area’s total holdings. More in a moment.

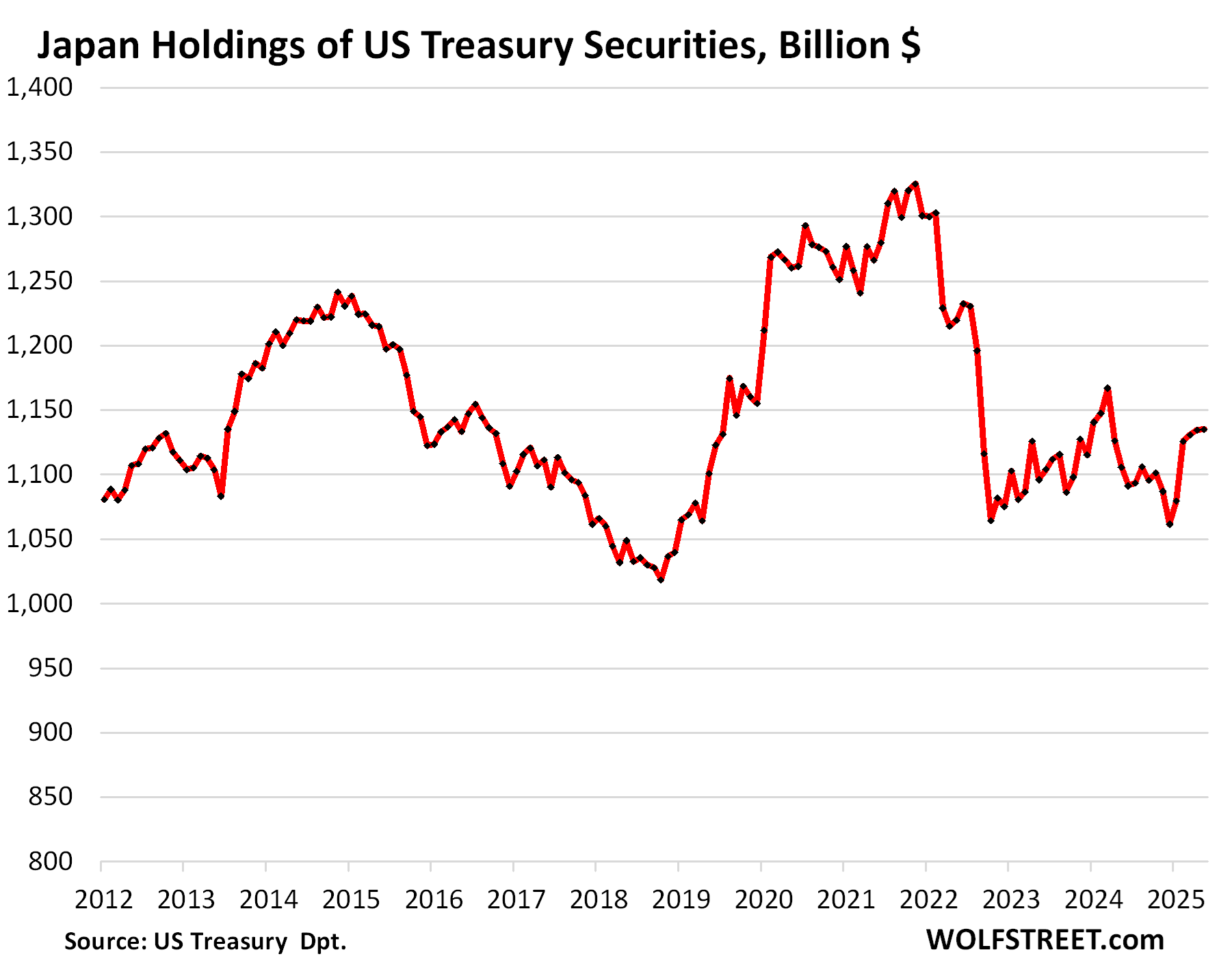

Japan’s holdings of Treasury securities were roughly unchanged in May from April and rose by $29 billion year-over-year.

Despite the large fluctuations over the years, current holdings are roughly where they’d been 12 years ago.

Since 2022, Japan has tried to put a floor under the plunge of the yen, and in the process sold large amounts of its dollar-holdings, including Treasury securities. The Bank of Japan is now engaging in QT and has accelerated QT, which may have been more important in forming a floor under the yen, than the government’s sporadic foreign currency interventions.

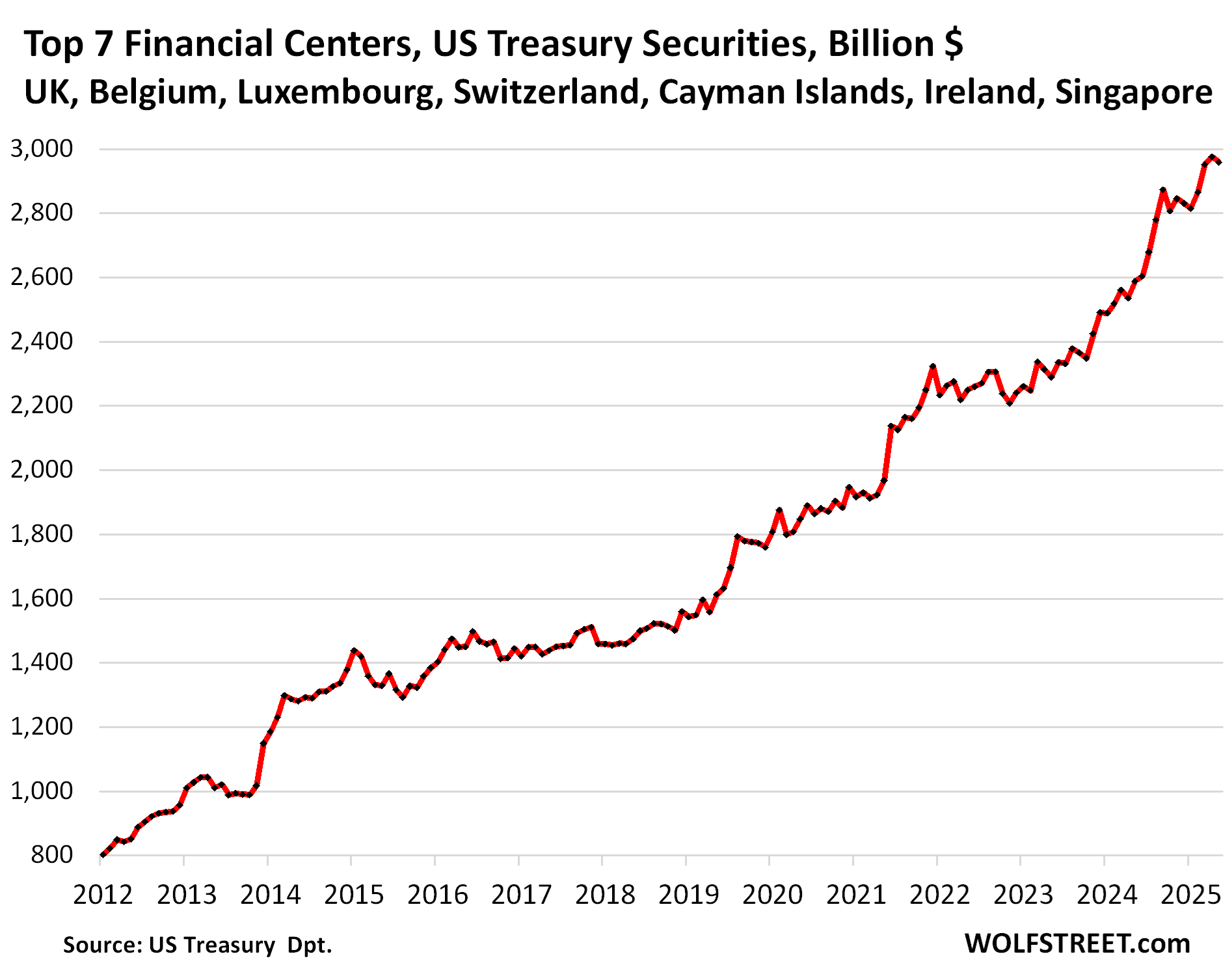

The seven largest financial centers have been on a massive buying binge. Their holdings surged to a record in April, but in May declined by $17 billion, to $2.96 trillion. Over the past 12 months, their holdings surged by $370 billion (+14%!).

But a portion of the holdings at these financial centers are held by US entities. These countries specialize in handling the financial holdings of global companies, individuals, and governments. Ireland is a favorite for US Big Pharma and Big Tech to store their profits. Belgium is home to Euroclear, which has $40 trillion in assets under custody for companies, governments, and wealthy individuals around the world. The United Kingdom here means the “City of London,” the top financial center in the world.

Changes in May, and total Treasury holdings:

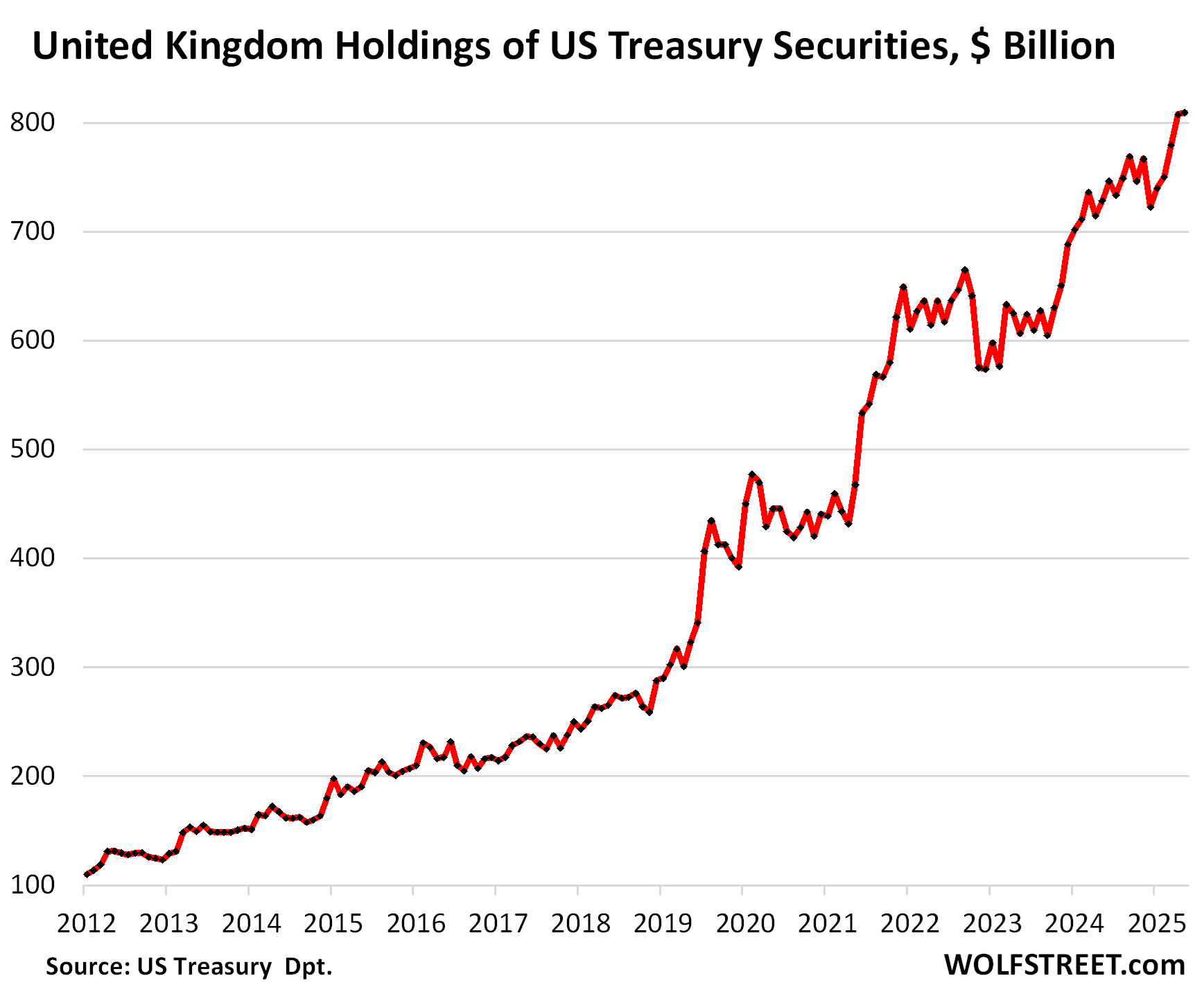

- United Kingdom: +$2 billion, to $809 billion

- Cayman Islands: -$7 billion to $441 billion

- Belgium: +$4 billion to $415 billion

- Luxembourg: +$2 billion, to $413 billion

- Ireland: -13 billion to $327 billion

- Switzerland: -$7 billion to $304 billion

- Singapore: +$2 billion to $249 billion.

The United Kingdom — actually the “City of London” — is by far the biggest financial center:

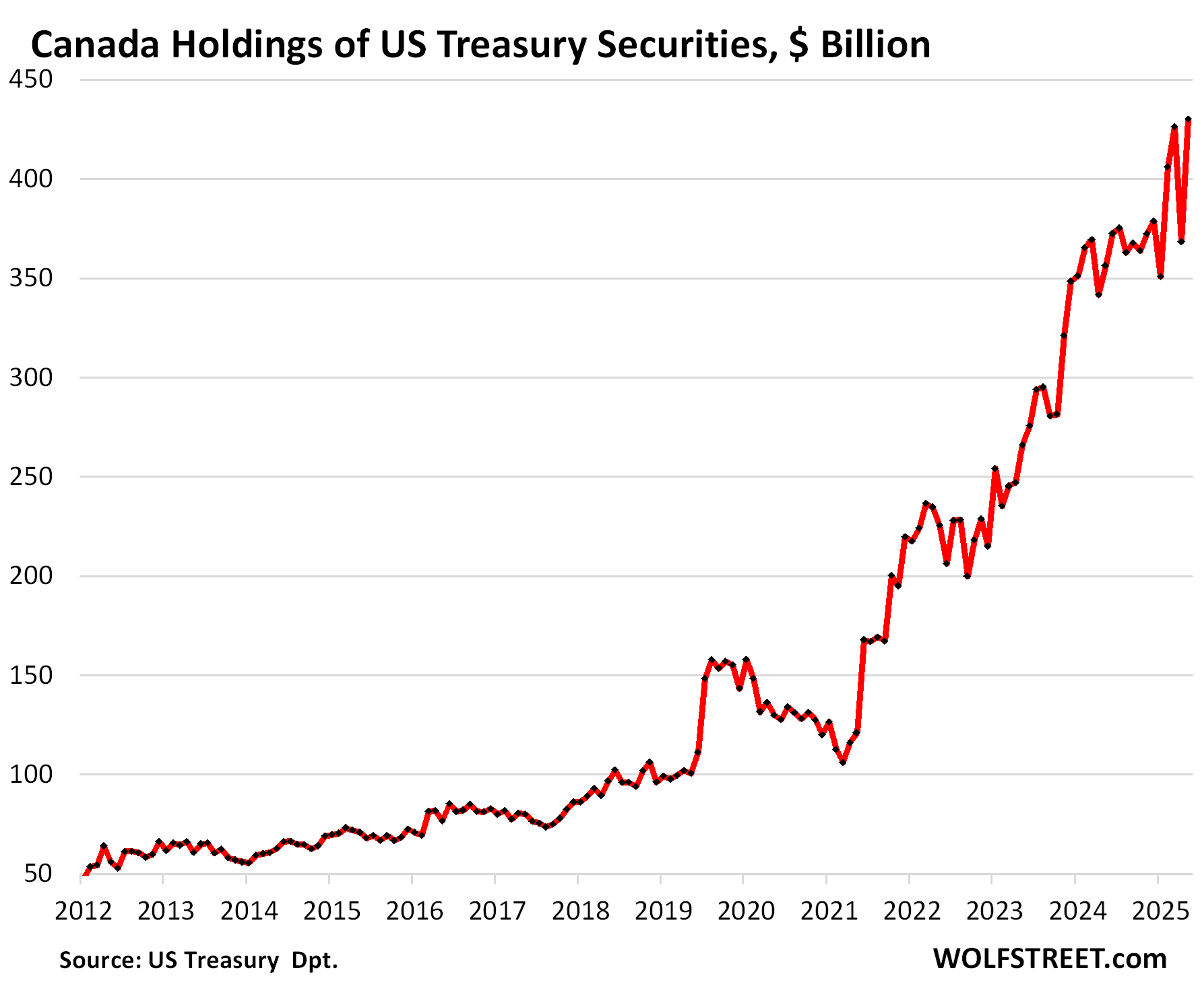

Canada’s holdings majestically re-spiked by $61 billion in May, to a new record of $430 billion, undoing the massive plunge in April.

The trade chaos, which is intensely felt in Canada, has introduced unprecedented volatility in its Treasury holdings. But but but… they hit a new record. Since March 2021, holdings have more than quadrupled!

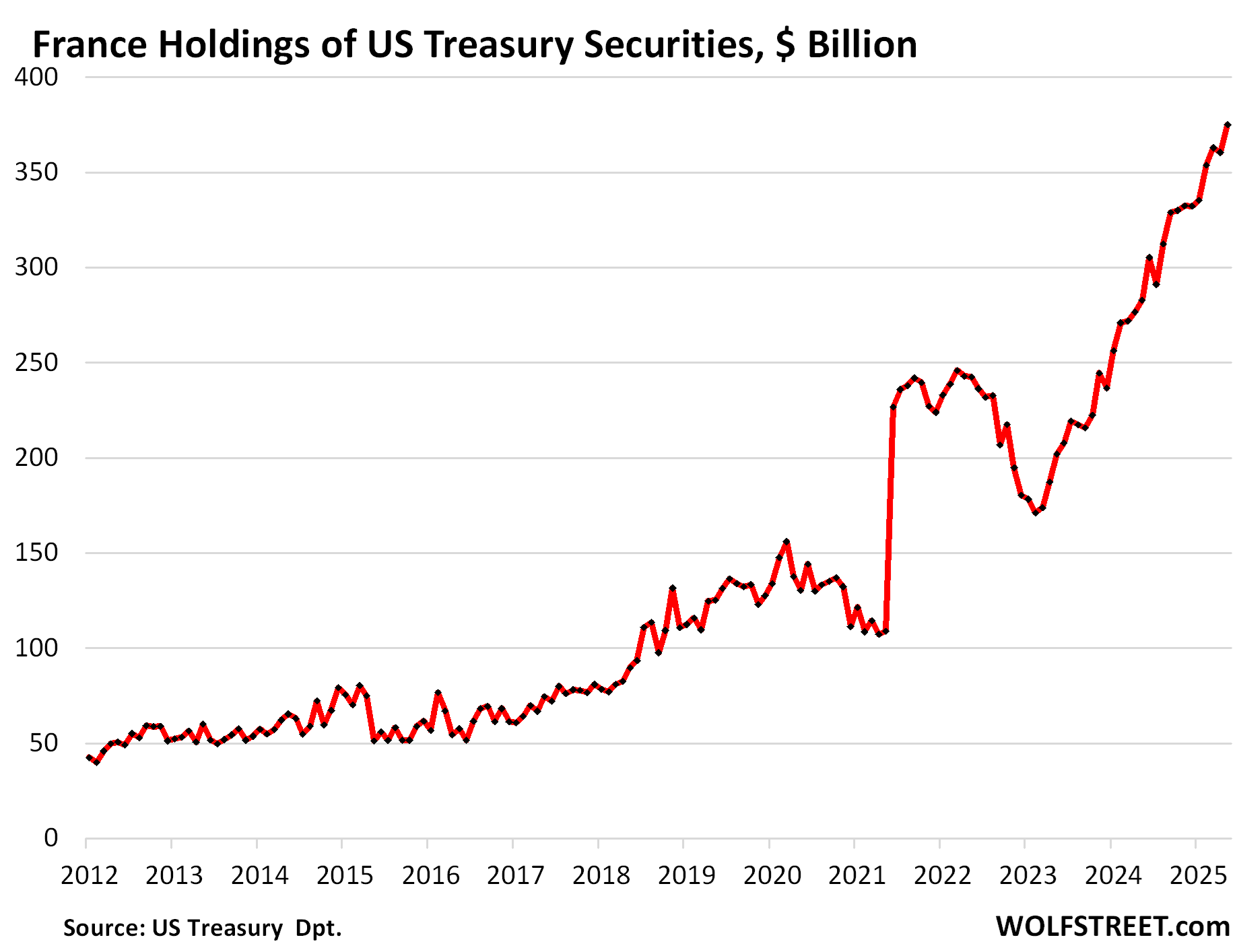

France’s holdings jumped by $15 billion month-to-month, and by $92 billion from a year ago, to a record $375 billion. France’s megabanks are global financial centers.

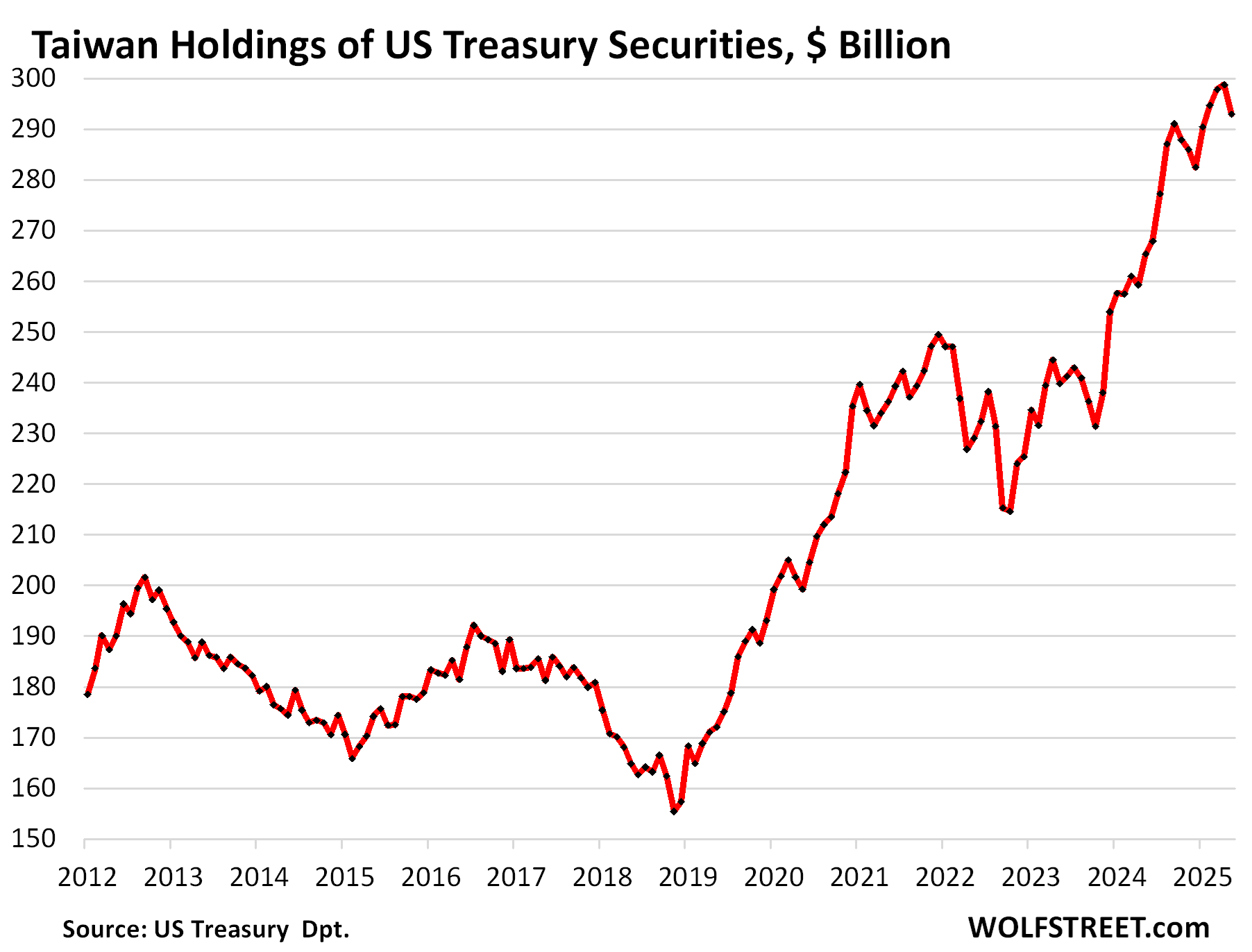

Taiwan’s holdings fell by $6 billion in May to $293 billion, but were still up by $28 billion year-over-year:

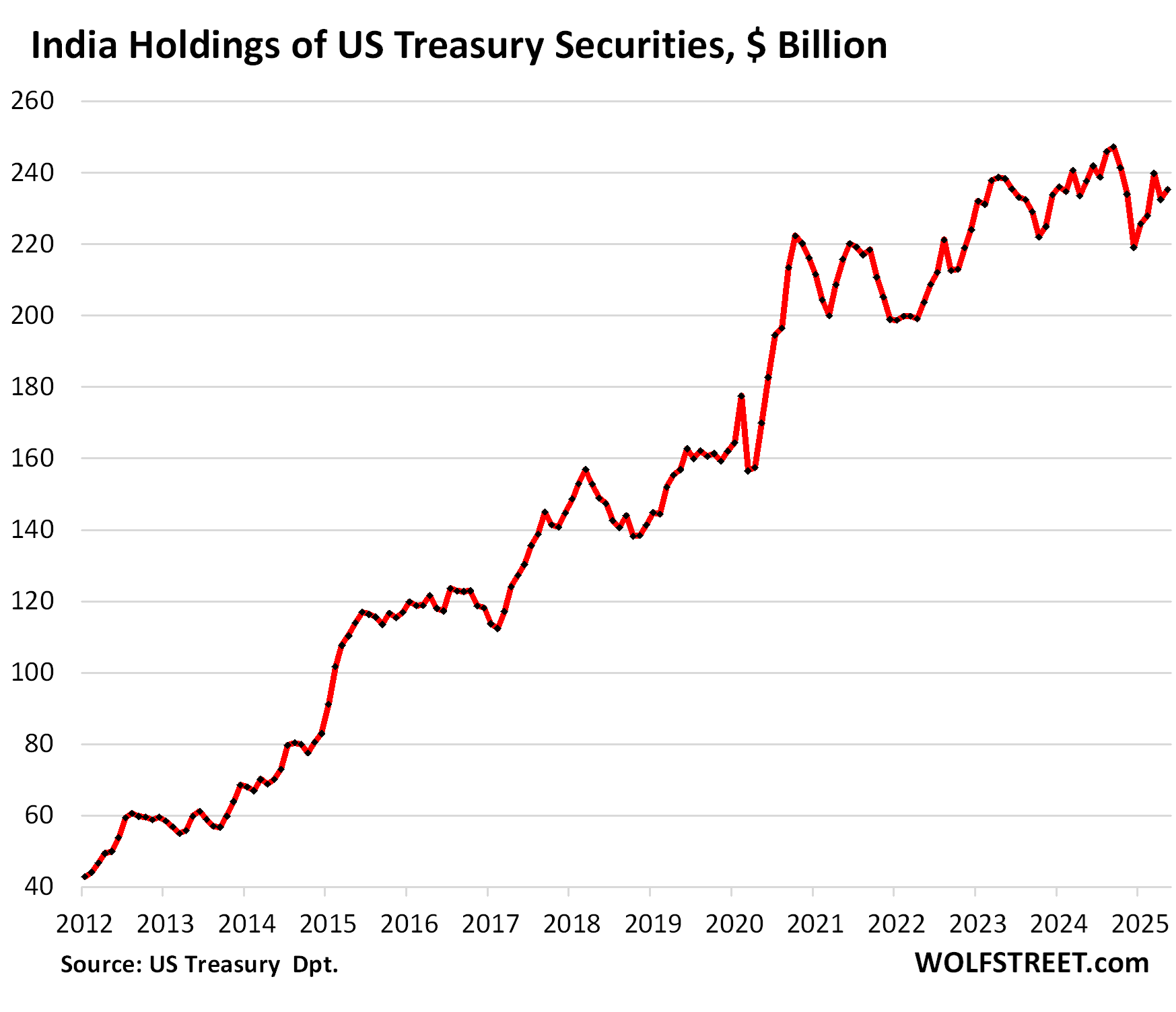

India’s holdings edged up $3 billion in May, to $235 billion, but were still down by $2 billion year-over-year. The high was in September 2024 at $247 billion:

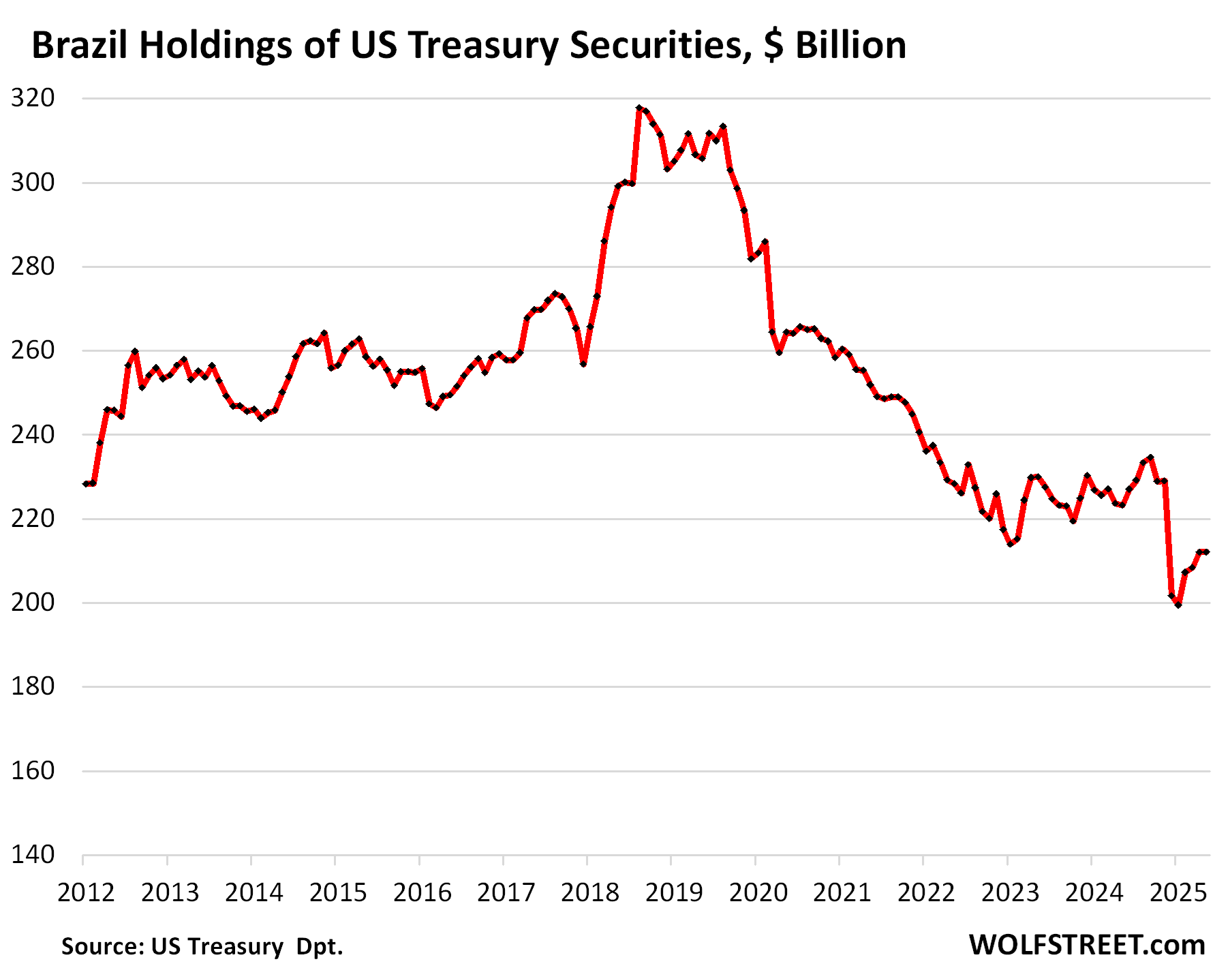

Brazil’s holdings were roughly unchanged at $212 billion in May, and down by $11 billion year-over-year. Since the peak in 2018, its holdings have fallen by one-third:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The graph showing the National debt and it’s escalation from 2018 to current is absolutely mind boggling.

Have a fantastic weekend.

It’s total effing BS that the politicians are doing this to the country, and cannot be stopped.

Boggles my mind who commits their long term capital for such low yields. I guess the saying is still true; a sucker is born every minute.

For decades, the suckers have been conservative investors in fixed income who have subsidized profligate fiscal and monetary policy, as well as private risk-taking.

They’ve earned a yield, but it has been well below RE and stock market gains.

One has to wonder if conservative investors will continue to be the pinata at the party. Politicians and monetary authorities seem to allow for that.

With so much debt in the system esp. Govt debt, I see , inflating away the debt as only way out unless Govt contains deficit spending which would not happen. It basically means higher inflation, higher asset prices , devaluation of USD w.r.t. purchasing power.

Which benefits………THE PIGMEN WITH ALL THE ASSETS.

Depth, instead of name calling, suggest buying some assets for protection.

Bitcoin might be a balance?

For a good laugh, look up the June 20, 2024 post from the Congress House Budget Committee titled “Via Wall Street Journal: Soaring U.S. Debt Is a Spending Problem.”

It blasts the Biden Admin for using executive orders for irresponsible spending and clearly targets the Inflation Reduction Act renewable energy subsidies, justified as arguing they are irresponsible spending.

The clincher: “If Congress continues to do nothing to rein in out of control spending, the cost to Americans will be great. Since Biden took office, 10-year deficit projections have grown by 80 percent. The revised baseline could be the final wakeup call of the 118th Congress.”

I never understood how the Inflation reduction act would reduce inflation by increasing spending. Am I missing something?

Idontneedmuch,

“I never understood how the Inflation reduction act would reduce inflation by increasing spending.”

The answer is incredibly simple……………..Your eyes and THEIR scale.

I have been reading blog posts and posts on X by Brad Setzer and Michael Pettis for a while now and have come to (somewhat) understand their explanations of the role that (capital account) foreign accumulation of US assets plays in the financing of our (current account) trade deficits. It will be interesting to see whether the current administrations tariff policies have an appreciable impact on the deficits and foreign asset accumulation. I am curious as to whether the readers here —or you, Mish— expect to see any material changes to this foreign asset accumulation resulting from the tariffs? I would also note in this regard that Pettis is no fan of the tariff policies and has written about alternative proposals to tax (via WHT on interest payments) foreign asset accumulation.

I didn’t see Freedonia on the list.

I thought we were already over $37T. Now I can sleep easy.

What’s the breakdown then?

Fed $4.1

SS fund $3?

Foreign $9.05

US private and local governments…$20+ trillion??

Short term money is probably happy enough making around 4.5% right now. I guess I am. I continue to believe the solution is going to be a big increase in the payroll tax structure to “shore up your Social Security”.

From a month ago, all the domestic holders (plus foreign holders):

https://wolfstreet.com/2025/06/20/who-held-or-bought-the-huge-us-government-debt-even-as-the-fed-shed-treasury-securities-in-q1-shedding-light-on-this-iffy-situation/

I love the Canadian chart! I wish they would stop pouting like children and just come back to the negotiating table and get a fair deal done.

A famous Churchill quote about a tiger comes to mind.

oh and their leader was the head of the Bank of England. Which kinda blows my mind

One point is that the base rate as set by the Federal Reserve should be set according to the real economy, however, if you issue so much debt then the quantity starts to put push the real interest rate up, as government spending crowds out private investment.

The US economy is now impacting other countries economies. In the case of the highly indebted UK yields have had to rise not just because of a complete lack of faith in the central banks stoicism in combating inflation, but also because the UK has to demonstrate better value than the USA. While Japan now has an absurdly undervalued currency.

The strains starting to show up everywhere.

For the USA I wonder if Trump realises that while certainly the economy benefits from a reduction in taxation, there is the cost of redirecting 3 trillion USD away from private sector -investment- to public sector expenditure. Anyway, none of the countries seem able to rein in spending so we will see which one blows up first. The UK has been put on notice already by the bond markets.

LoL, our bond market is just beginning to awaken. Just wait as endless streams of refinance and new issuance come to market, especially as the Medicare and Social Security Trusts continues to run down.

Wait until the markets have to eat $20 trillion in issuance in one year.

The conclusion of the recent 2025 Brookings Institute paper on US debt was hilarious:

“By contrast, the U.S. benefits from the

strength of its institutions—including CBO, which pro-

duces high quality, non-politicized analysis; statistical

agencies that produce data independent of political

agendas; and an independent Fed. These agencies

help to maintain investor confidence by preventing

sudden shocks to the market from information gaps or

manipulation. Indeed, CBO has been warning for years

about the pressures underlying rising debt, and CBO’s

projections of the rise in debt from 2024 on have been

fairly stable over time.”

None of this will exist in two years, and our debt market will be out of control as a result. CBO, already puking fiction and ignoring real effects as a result of political pressure.

Welp, the independent Fed is also under severe attack, just like our Supreme Court was coopted.

It is obvious that our political system is failing, and with that failure, our entire system will gradually erode into nonexistence.

As I stated before, we have chosen to accelerate our decline, chosen policies that in the whole ensure the decline will be difficult to reverse with untenable political damage that is the future of failures of our monetary and fiscal systems.

They are inseparable, and solutions are going to end up so painful, they will be impossible.

Apres moi, le deluge.

I’m one of the “Foreign Private” buyers. For the first time in many years, Treasuries are relatively attractive investments. I can’t find any other decent invesments. Credit spreads are low and US sovereign debt offers relatively attractive yields. Equities – particularly US equtiies – are priced to perfection. Property is also expensive, particularly if you believe bond yields are likely to stay high. Long duration treasuries offer a postive real return in all but the most unlikely scenario where inflation considerably exceeds the Fed’s target level for a prolonged period. And there is zero risk with Treasuries. There is no scenario where the US government does not repay its debt in full. Plus there is no witholding tax on Treasury coupon payments.

Native born US citizen Gen-X wants a word, please. You may wanna tamper down on that ‘zero risk, no scenario’ sentiment.

Unlikely, yeah sure. No scenario? Not so fast, my friend.

Heard today Inflation 3.5 to 4% before year end.

Bleh

I am somewhat shocked to discover $441B new debt has been issued since the debt ceiling was raised. I follow the ONRPP and Treasury General Account balances, and both seem to have barely moved in that time.

1) Wasn’t the reasoning for slowing QT (again) that when the debt ceiling was lifted it would quickly empty the ONRPP (and then move onto bank reserves?)

2) Shouldn’t all this new money from this new debt show up in the TGA?

Wolf: Another good factual article. Do you write , more of an opinion articles

I am interested in your opinion as to where this all ends. Bond market, even with high Treasury rates, refuses to buy the debt? Or, hyperinflation someway makes the debt serviceable? Or, a US default? Please take us through your analysis. Thx.

Buyers of Treasuries are picking up nickels in front of a steam roller.

I disagree. 4.3% and paid back in full in 8 weeks. Not nickels nor a steamroller. Decent return and zero risk.

Longer term has more risk like most any asset.