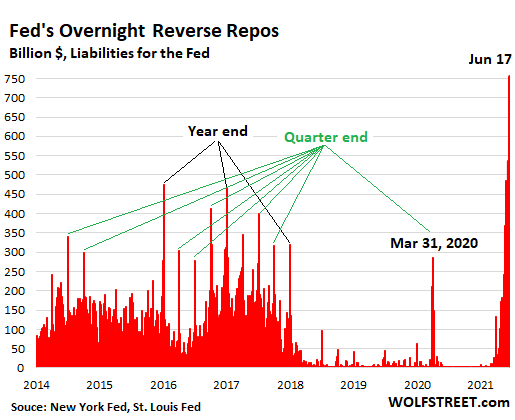

Yesterday, the Fed raised its interest rate on overnight reverse repos, and this morning, a giant sucking sound of cash.

By Wolf Richter for WOLF STREET.

The Fed sold a record $756 billion in Treasury securities this morning in exchange for cash via overnight “reverse repos.” This was up by a stunning 45% from yesterday’s operations of $521 billion. There were 68 counterparties involved. Yesterday’s overnight reverse repos had matured and unwound this morning, to be more than replaced by today’s tsunami.

During the period starting in 2014 and then abating with the Fed’s quantitative tightening in 2018, the US financial system was also creaking under a massive amount of cash following years of QE, and the Fed drained some of that cash out via reverse repos. There too were spikes, but they came at the last day of the quarter, and particularly at the end of the year.

This time, overnight reverse repos (RRPs) spiked during the quarter, and today they spiked into the stratosphere. Yesterday, the Fed had hiked the RRP offering rate to 0.05% (from 0.0%), and this morning, a giant sucking sound of cash (please forgive me, Ross). The RRP balance of $756 billion drains over six months of QE from the market:

The New York Fed, which handles the overnight reverse repo trades, does not disclose which specific counterparty it dealt with today, but it has a long list of approved counterparties that include the biggest banks and broker-dealers (Primary Dealers) plus Government Sponsored Enterprises (GSEs), such as Fannie Mae, Freddie Mac, etc., and asset managers with money market funds.

They can now make a risk-free 0.05% on their excess piles of cash by handing this cash to the Fed, in exchange for Treasury securities.

The yield on short-term Treasury bills has recently been close to zero or sometimes at zero or briefly below zero, with the three-month yield mostly in the range of 0.01% and 0.025%. Today, with the RRP offering rate at 0.05%, the three-month yield rose to 0.038%, the highest since March.

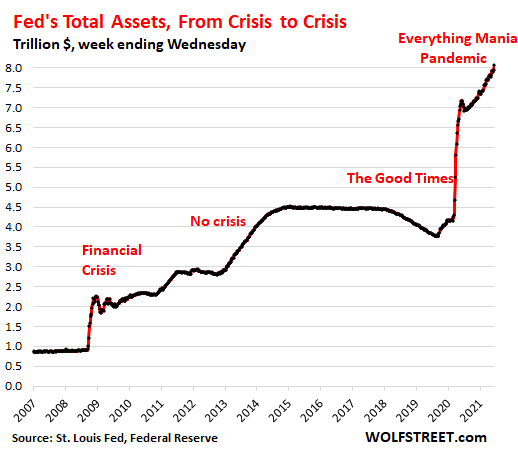

Tsunami of cash a result of QE: Fed’s Assets jump past $8 trillion.

Even as the Fed was busy draining cash from the system, it continued to add cash to the system via QE. The Fed’s total assets on its balance sheet for the week through Wednesday, June 16, jumped by $112 billion from the prior week, to a new mind-bending record of $8.064 trillion.

Over the 15 months since the money-printing craziness has started, the Fed has piled an additional $3.75 trillion in assets on top of its existing mountain, and has more than doubled its assets since September 2019, when the repo market blew out and triggered a massive bailout.

The two primary factors in the $112 billion jump in total assets over the week were:

- $24 billion increase in Treasury securities, to $5.15 trillion.

- $84 billion increase in Mortgage-Backed Securities (MBS) to $2.33 trillion, along their typical pattern, after having declined one week and stayed flat for three weeks. The net increase over the four weeks was $50 billion.

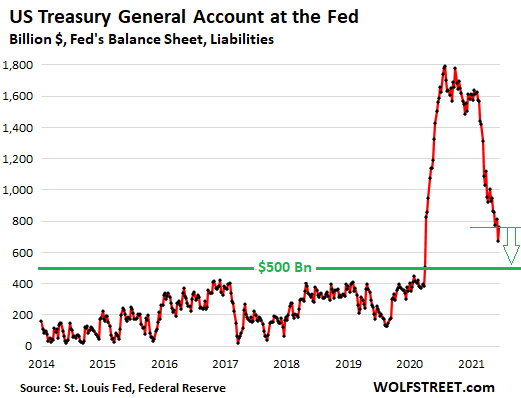

The Drawdown of the Treasury General Account (TGA).

Among the distortions that came out of the money craziness last spring was that the federal government issued about $3 trillion in new debt to fund the various stimulus and bailout programs. The Fed bought about $3 trillion in assets over the time and thereby monetized that newly issued government debt.

But the government didn’t actually spend the $3 trillion in newly borrowed money. Instead, a big portion remained in its checking account, the “Treasury General Account” (TGA) at the Federal Reserve Bank of New York, which ballooned by $1.4 trillion and reached a peak of $1.8 trillion in borrowed but unspent money by July 2020.

This $1.4 trillion that the government had borrowed and that the Fed had then monetized didn’t go into the economy and the markets but sat in the government’s checking account.

The Yellen Treasury early on formalized a plan to draw down the TGA to $500 billion by the end of June. But the timeline appears to run further into the summer.

As of Wednesday, according to the Fed’s weekly balance sheet today, the TGA balance rose by $92 billion to $765 billion. $265 billion more to go:

The Treasury Department draws down the TGA balance by spending more cash than it takes in through tax revenues and new debt issuance. The cash that the government thus spends was already monetized by the Fed last spring, but has been sitting in its TGA until it started entering the economy in February, when it too flooded the land with cash.

This rapid drawdown of the TGA contributed to the distortions that the Fed is now trying to mop up with its overnight reverse repos, still handing out cash via QE with one hand and mopping up cash even faster with the other hand.

With inflation hotter than it expected, the Fed is trying to slow the pace at which it’s falling further behind. Read... Fed “Had Discussion” on Tapering, Pulls Rate Hikes Closer, Raises Interest Rates on Reserves (IOER) & on Overnight Reverse Repos

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Wolf, George Gammon spoke about this recently and I’m wondering your thoughts. While QE borrows treasuries from banks and RRP lends pristine collateral (treasuries) to banks, isn’t this all sleight of hand and ultimately jawboning? It seems like it’s just recycling over and over.

90 days same as cash? Sounds like the local appliance store. 8 trillion in the books, from here to infinity! MMT test drive.

Joe,

Under QE the Fed buys treasuries and bonds from the US Treasury, from banks, or from the market. In reverse repos the Fed sells securities to the banks in return for their excess cash.

JoA

I cannot get a definitive handle on whether the Fed is allowed to buy Treasuries straight from the Govt, or whether they can only buy them ‘second hand’ from third parties. If the former, that is pure Zimbabwe or Weimar and renders the whole QE charade pointless. It’s hard to believe it can be allowed in a post-Friedman economy with a reserve currency.

Auldyin,

Not impersonating JoA here, but I’ll give your question a shot.

In terms of QE, not repos:

When the Fed rolls over Treasury securities that are maturing, it can do so directly with the government, exchanging the maturing security for a new security, rather than paying Wall Street to play middleman.

But when the Fed buys new Treasury securities, it goes through its Primary Dealers (the biggest banks and broker-dealers that have an account with the Fed).

Thanks for that Wolf.

I get the rollover, that’s neat, and I would say legitimate because technically there is no new money just a continuation of previous money.

The dealer bit is harder for me (and hopefully foreign central banks) to swallow unless the trick is for the dealers to buy from the Govt first, then to immediately sell to the Fed. That would boiler plate the legal trail and the time delay in settlement could mean the dealers were never out on a limb. Absurd but legally legit because the Fed is not buying from the Govt.

I think I might have got it at last, it’s been buggin’ me for ages.

Thanks to JoA for raising the point.

Auldyin,

When the Fed rolls over maturing Treasuries it does not replace them “with a new security of the same maturity (such as 5 years)”. Instead it replaces the maturing securities with whatever the Treasury is issuing on the maturity date in proportion to the size of the Treasury offerings. For example on June 15, $11,032,000,000 of 3 year notes the Fed owned matured and the Fed replaced them with $3,493,466,600 in nominal 10 year notes with 9 years 11 months remaining term, $5,332,133,400 in 3 year notes and $2,206,400,000 in 30 year bonds with 29 years 11 months remaining term. (The Treasury splits big offerings across a few months issuing some of them after the “original issue date”.) It is the Treasury policy, which under Secretary Yellen has skewed toward longer terms, that determines what the Fed acquires in rollovers. The Fed does not advise the Treasury on its “refunding”. Instead the Treasury Borrowing Advisory Committee (TBAC) of the private sector Securities Industry and Financial Markets Association (SIFMA) provides advice. The Fed, which runs the auctions, does not participate in the bidding for its own account (it does submit competitive bids on behalf of “Foreign and International Monetary Authorities”) and the total amount it will invest that day is disclosed but is an add-on to what the Treasury is offering.

The 24 primary dealers are all broker-dealers but these days most of them are subsidiaries of banks or bank holding companies. Four of them are subsidiaries of the four largest U.S. commercial bank holding companies. Two are large U.S. investment banks, subsidiaries of bank holding companies they were forced to create to get TARP capital from the Treasury in 2008. Three are independent U.S. broker dealers. The other 15 are broker dealer subsidiaries of foreign banks, four in Canada, three each in Japan and the UK, two each in France and Switzerland and one in Germany.

You obviously have not understood what the Federal Reserve System really is.

As the author of “The creature from Jekyll island” said so succintly, neither is it “federal”, nor are there any real “reserves”, and it definitely is not a “system”.

The Fed is owned – at least the information that is in the public domain about its ownership – by the exact same private banks that it “deals” with for the government. Who owns it exactly is unknown and the subject of much speculation and conspiracy theories.

So your question is moot.

One could also call it a giant scam.

DS

Thanks for that. I wondered what all those folks did in all these skyscrapers all day. I would hate to have to audit these money trails, that is one tangle of wool, I’m glad you are keeping an eye on it.

Joe,

This may have come out wrong in your comment. Maybe that’s not what you meant. So let me just clarify first: With QE, the Fed BUYS Treasuries. With RRPs, the Fed SELLS Treasuries.

OK, with that out of the way, we can move on to your interesting “sleight of hand” suggestion:

The Fed did way too much QE and knows it. Now there is a problem with too much liquidity. But the Fed cannot suddenly do a U-turn and sell Treasuries outright to undo the damage it has done with QE and to get rid of the liquidity. That would turn markets upside down. So it’s accomplishing the same thing (selling Treasuries) with reverse repos, which markets don’t worry about. Yes, sleight of hand in that sense.

Shld go here…There’s a remarkable difference in all this: Apparently, the Fed thinks it can’t even so much as stop QE expansion in a period of hightened inflation and rebounding growth, and just go nuertral. If that’s the case, seems a notable sink down the rabbit hole, so to speak. If the Fed thinks it can’t end QE now, how can it ever?

What about the additional 4T of stimmie teed up?

Wolf – could the Fed be doing a kind of covert “Operation Twist” with the REPO proceeds? Would we know that? Do you know what maturities the Fed is buying at any one time? Why is the 10 year dropping so much?

MJS,

No, the Fed could not do a “covert” anything with Treasuries. Yes, we would know about it. Every Treasury security that the Fed buys and is holding is disclosed by CUSIP number. For example, here are the results from today’s Treasury purchases:

https://www.newyorkfed.org/markets/desk-operations/treasury-securities

In addition, each Treasury security is tracked, and holders are known because they have to receive coupon interest payments and the principal payment when the security matures. If you want to do something “covertly,” you might want to choose cryptos not Treasuries.

Wolf – Curious what your opinion is on what happens once the Treasury has been drained of excess cash? So right now, the Fed is pumping over $100 billion into the debt markets each month and essentially financing the deficit out of reserves. But once the Treasury cash is used up, they need to go out to the bond markets and float at least $250 billion per month, on top of refinancing debt that comes due. So instead of $100+ billion being pumped into the markets, there is a need to finance the difference = 250 – 100 billion or so – 150 billion per month.

Seems like higher interest rates will be the result. I also noticed that rates had moved much higher right up until they started to drain the Treasury and then rates fell back down. So does the Fed actually have the ability to come out and tell the markets that it must raise its intervention in order to prevent long dated rates from rising? Wouldnt that be the moment when the riskiness of that move would actually cause the markets to just dump all Treasuries based on the risk involved?

gametv,

The Fed is contemplating raising short-term interest rates. So the first thing it wants is higher long-term interest rates to keep the yield curve steep enough. That is why the Fed will end QE (designed to push down long-term yields) before it raises rates. And it did so last time (2014).

The Fed has welcome higher long-term rates earlier this year and late last year. Slowly rising long-term yields – in an “orderly manner,” as Powell had said – would be something that the Fed at this stage wants, and it has said so.

And yes, once the government has to go out and borrow again to fund its deficit spending, after the drawdown of the TGA, even as the Fed is starting to taper QE, this is going to put some upward pressure on long-term yields. That is expected and part of a tightening cycle. Yellen has already come out and said that higher interest rates are OK. She knows what is coming.

You’re asking me to go out on a limb to see how this might evolve, and so here I go out on a limb:

Long-term yields will be rising, and the new issuance at higher yields will absorb capital that might have gone into other things. Mortgage rates are going to be higher, and the housing market is going to slow. Higher yields = lower prices in the bond market. And I can see lower prices in other asset categories, including stocks.

This assumes that the current spike in inflation is in big part “temporary.” If it turns out that 5%+ CPI inflation persists next year and threatens to spiral higher rather than calm down, the scenario may change in serious ways because the Fed will then crack down. No one wants double-digit inflation.

Wolf said, “This assumes that the current spike in inflation is in big part” “temporary.”

That is a huge assumption considering we have already seen the inflationary impact of stimulus, and we have a whole new stimulus beginning in a month or so. Not only will households start receiving monthly stimulus, they will get large lump sums in the form of tax credits when filing their taxes next year.

I don’t see how we can assume that the inflation will be temporary when we are continuing the very actions that are causing it to begin with….

So why are yields at the long end crashing? The answer to the question about Yield Curve Control was the moment. We are already buying what does it matter if we buy something different? The market took that to be QE forever might be called YCC NOW! RRPO is the banks directly monetizing. Should the YC reinvert the Fed will go back to buying the short end. We are going negative.

reverse-kiting?

“The Fed did way too much QE and knows it.”

Which is just another example of why the people in charge such as Weimar Boy Powell should be fired and replace with competent leaders. The FED panicked and shot its entire wad, much like Barney Fife with a handgun. That’s not how you handle a “crisis.” A measured, methodical approach to any problem is best.

The distortions in the economy from both the FED and .gov have done significant and everlasting damage going back 25 years. It’s time to scrap the current model and start over.

Up until I start hitting comments like this I have been learning a LOT! about what actually IS going on. And finance is usually difficult or even boring for me, but this has been a good read.

I have no interest in people who just want to shoot the devil and then go looking for a savior.

I will be re-reading this article tomorrow, just to let it further sink in.

So I re-read and all the mumbo-jumbo terms have been defined and quantified in my brain (for now, it may vanish in time) And the “sleight of hand” and “out on a limb” parts go into probabilties and decisions not yet made…..and by who knows who?

Along that line, the Fed is a corporation, and it meets with other important corporate leaders and talking heads in Davos and Jackson Hole. I figure any decisions are really made elsewhere in smoke filled rooms, and those two gatherings are just “parties” (or possibly boring duties to most of the participants) to give the impression something important is being decided, and to give the MSM something to report on. I’d even bet the MSM picks up a lot of the tab, somehow, for the whole show.

Needless to say, Wolf (so far) doesn’t contribute any money, or get an invite.

And I still think we are in an international era mostly due to a Pax Atomica rather than a Pax Corporata, at least in most developed countries.

In places where people are dying/wounded/displaced/starving in quantity it must be real human hell, though, and those areas are growing.

Isn’t the reason markets don’t care about repos is because they are only an overnight holding and may or may not be repeated the next day? That would mean it’s only a temporary measure in a long-term trend.

Whoops- meant reverse repos

They will continue as long as there is demand for them. They’re designed to be temporary and they WILL go away when the Fed starts reducing the assets on its balance sheet, as they did in 2018.

Friday 18: Dow hammered, gold hammered, crypto hammered…

Oil… not hammered. WTI 72$.

If this trend keeps up (average 2020: 38$) the Fed’s nervous thoughts about raising .25% in 2023 will seem like words of comfort.

See: oil shock 1974.

$150 per barrel oil will bring me the new truck I want at a liquidation price.

Basel III has kicked in. Hence Gold is to be suppressed by a strong $.Triffin’s Dilemma.

If you had written 3 counter parties it might be more accurate. Analysis on 68 counterparties will reveal a few actors. They like to hide behind complex corporate word salad. Unrelated to the global cyber bank crash about 16hrs ago – not half!

Wisoot,

I know it’s a lot more fun to make up stories. But the approved counterparties for the Fed’s repo operations are listed on the New York Fed’s website and are the biggest names among banks, broker dealers, Government Sponsored Enterprises (Fannie Mae, etc.), and money market funds. If you have a money market fund, it’s probably listed.

There’s a remarkable difference in all this: Apparently, the Fed thinks it can’t even so much as stop QE expansion in a period of hightened inflation and rebounding growth, and just go nuertral. If that’s the case, seems a notable sink down the rabbit hole, so to speak. If the Fed thinks it can’t end QE now, how can it ever?

The assumption that they ever intend to stop is in question.

Go back to 2019…

Record stock prices.

And record employment…

Did QE stop?

(Bernanke said QE was temporary and would stop when things returned to normal. Unemployment was north of 7% and the Dow was crica 10K in 2009 when he said that)

If the Fed is engaged in MMT, there will be no halt IMO.

Only blowback from the damage of inflation may have an impact.

historicus,

QE stopped at the end of 2014. The QE unwind when the balance sheet started shrinking started in late 2017. The QE unwind continued until mid-2019.

Since you never seem to read my articles about the Fed and its balance sheet, I will post the same chart here that is posted in the article above, so maybe you will look at it now for once, so you can see what actually happened with QE. You have been a valued commenter here for many years, and I have posted the data on the Fed’s balance sheet for many years; now the challenge is to bring those two together :-]

Wolf – you come across as a defender of the FED at times. When the FED stops increasing their balance sheet, yet maintains the bloated level, they are still interfering with the free market. Only when they sell off all of those assets into the free market are they no longer manipulating it. And their paltry selloff of assets, per your chart, is so small as to be considered embarrassing.

Depth Charge,

The Fed is bad enough as it is, based on the facts, and we don’t need to make up stuff to make the Fed look bad. So I try to get folks to stick to the facts. And there are some simple well-defined terms we use to describe what the Fed does. If you get into Fed fiction, you lose your credibility.

And what you think was a small amount of Quantitative Tightening trashed the stock market, brought the housing market to a standstill (with mortgage rates at 5%), and blew out the repo market, which is when the Fed did its U-turn.

Can you enlighten us more on this crash?

I count around 60 counterparties listed at the NY Fed. They are each apparently authorized for $80 Billion in reverse repo. So that maxes out then around 4.5 trilly. At this rate we will be there by next week and certainly by month end. And where do they stash the cash after they top out at the Fed? If you said BTC you’r a lucky JACKPOT WINNER!

The FED had to hike the overnight rates, to prevent short term Ts going negative. In FEDish: rate would not stay well withing the targeted range close but above zero. Imagine banks would usw all those 765B$ buying the short term treasuries…

I would not mind when banks would finally use gold to park cash… but that’s probably not going to happen to soon.

It’s all very complicated. I try to read a lot of people. Lacy Hunt has some good charts. One shows long term high and low interest rates of each business cycle for roughly 100 years. Lag time of low rate is about 4 years on average after recession and if trend continues the low rate for this recession would be definitely a negative rate.

Some say that QE can create the equivalent of negative rate. Some say that QE doesn’t loosen conditions immediately but actually tightens in the short term.

There is a school of thought that Fed is trapped and we are going to drift slowly into deflation unless Fed is given new tools by congress then they can create the inflation they clamor for.

Lacy Hunt makes pretty convincing argument that current over indebted situation is going to result in disinflation or deflation unless system is changed by congress and that probably will require a major crises to get agreement to change system.

Great presentation by Lacy Hunt on a recent Wealthion video. I find Hunt very easy to follow among the deflationists.

My take away is to be in cash for now, and watch for changes to the federal reserve act.

Congress and tools cannot stop the laws of physics, or economics. We cannot skew the free markets, and continue in that direction for ever.

Because of human nature, every action taken by the Fed to artificially alter markets, and consumer behavior has a consequence, and that consequence is usually negative in some respects.

There must be a revision to the norm at some point. The more we interfere with the markets, the more the momentum of correction will over shoot the norm in the other direction before returning to the norm.

SMOKE AND MIRRORS

“The New York Fed, which handles the overnight reverse repo trades, does not disclose which specific counterparty it dealt with today…”

While not today’s breakdown, this link has COUNTERPARTY (not Participant) sums for each month end.

https://www.financialresearch.gov/money-market-funds/us-mmfs-repos-with-the-federal-reserve/

Any idea why Fidelity is always #1? They were 2x Blackrock (#2 highest) on 12/31/2015, now they’re 4x Blackrock on 5/31/2021. They’re still 3.25x Goldman (#2 highest 5/31/21).

Just business model differences?

Forgot to include Fidelity was at $195B, and is almost assuredly the reason why the cap was raised in March from $30B to $80B, and why they keep including the phrase:

“…the per-counterparty limit can be temporarily increased at the discretion of the Chair.”

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210616a1.htm

Didn’t Fidelity’s stable return fund get in trouble in the Great Financial Crisis? I think Bill Gross was using some dangerous derivatives as well to juice his bond fund. Some of these firms juice returns or profits by taking hidden risks.

I am an old timer and don’t understand half of what is going on with all of this but it worries me. These are huge amounts of money and it is borrowed money these people are playing with. How many times in the past have we the average person been told just trust us, we know what we are doing and then when it all goes wrong the little guy is left to pick up the pieces?

Welcome to the game of musical chairs! Where there are always too many chairs (debt), and never enough butts (yours and mine)!

I cannot imagine the professional fees generated for the lucky few just in the last 24 hours…the costs must be astounding…and before long that cash will be moved again, generating yet another round of professional fees.

Now I get it…

You sure something like this isn’t automated? Who ultimately is paying the fees? Why would any angle of this be a percentage-based fee?

Bingo.

One big “toll booth” owned by ….. who runs the Fed?

The thing that is pretty clear is all of the high finance doesn’t help the real economy in the long run. History teaches that over and over, but it’s in nearly no one’s interest to sacrifice the dessert today for a healthy body tomorrow.

5% inflation and near zero Fed Funds…a situation created by the Fed…and one that has never happened before.

And the Fed, directed to fight inflation….promotes inflation.

Fed mechanics, Reverse Repos while they still QE seems like pouring gas on the fire while you hold a fire hose.

Until the Fed declares they will fight inflation, all else is just fluff, smoke and broken mirrors.

It seems the Fed is chasing its tail,

yep…..

inflation isn’t transitory right now….

I drove up 5 on Tuesday, most semi’s I have ever encountered in 35 years ago, went fishing out of LA Harbor, 30 boats still moored outside of breakwater, inside is full.

we are heading for a cliff and the fed is driving us…

Add in the effects of what’s happening with the west’s climate and extremely low water levels. Project forward what the price of a head of lettuce will cost by fall, if any is even available. Extremely wet center of the country might have a similar effect on grains. The higher rental cost because now the pension funds, along with PE funds are buying houses to rent because they can’t make any money anywhere else forcing the general public out of housing.

Two of the main ingredients for a stable society, food and shelter both going a lot higher for different reasons..

Sure looks to me we are moving into a period of high costs and instability. Doesn’t look very Transitory unless your timeline is in the hundreds of years and not just a few.

A friend of mine bought a small home in tiny town of Louisburg, NC 3 years ago. She bought it for around $57,000. She did very little other than live in it. Realtor said list it for $125,000. Go to the beach on Wed and she will have multiple offers when she gets back on Sunday. She said it might go for $150,000. Too hot if you can get 2.5 X in small town USA in three years.

“Fed mechanics, Reverse Repos while they still QE seems like pouring gas on the fire while you hold a fire hose.”

Right. Just look at the trajectory of increase in their balance sheet following the parabolic rise in early 2020. There is no justification for what they are doing right now. The $120 billion per month is pure insanity. It’s like they continue it just to try to act like they know what they’re doing in order to save face or something. Weimar Boy Powell should be arrested on the job and led away in handcuffs.

If the IOER and RRT interest is about the same, what compels the participating institutions to “lend” huge sums to the FED? Why not just keep the money in ER?

Because not all participants have access to ER – that’s only for member banks.

Because hodling cash is a big no no for a bank. BASL III accords assess penalties to banks that hold excess cash. The thought being that it would incentivize banks to lend the cash out at a profit to keep system going. But nobody is out there borrowing at that massive a scale so banks lend to zombie companies, Archego’s, margin accounts, anybody really that wants to borrow a lot just so the bank can earn something….but then they STILL have excess cash. The cash belongs to customers so bank needs it available, it used to use it to buy day, week, or two week government debt but government isn’t issuing new debt while it draws down the TGA. So banks are left to get penalized for their cash. FED offers reverse repos overnight until government gets back to selling mucho mas short term debt. If Fed started tapering now they’d have to start it back up at end of summer when TGA gets back down below $500B. Might as well do the reverse repo thing as a salve until government starts borrowing again.

Alex

I think I have seen you on Wolf Street in the past. This was an excellent response / recap outlining the 3 major player roles in this charade: Govt (US Treasury), Fed and Banks.

Thanks !

Yes but the money isn’t real. The Treasury bonds aren’t real, and the excess reserves ditto. The portion of what Treasury issues and Fed accepts, which contributes to spending is real. The reserves back MM accounts, should there be a run, then the money would be real. Liquidity can be “mopped up”. If the infrastructure bill falls flat, (and this is worrying the market right now) then the money supply has to contract, which is always painful, and tightens credit. Fiscal spending is the tail wagging the dog. When Fed reached the limits of monetary policy they tapped into fiscal. Half the country wants them to fall flat on their ass and all the bloggers. Be careful what you wish for.

I think the question was if Fed pays 0.15% interest on ER (excess reserves) and 0.05% on RRP (reverse repo), why banks chose RRP over ER.

One reason is that not all RRP participants are banks and don’t have access to ER.

Another reason may be a ceiling on how much a bank can keep as ER.

Bought short-term treasuries a little too soon, looks like. I should wait for the taper, eh?

PHYSICAL Gold will be better. The inflation, taper etc. are for suppressing Gold price in view of Basel III. Gold has higher weightage in Basel III which has just kicked in and Banks need to buy Gold. Macron’s suggestion that the G 7 sell Gold is also for the same purpose. Sell high and buy low.

Better too soon, than too late. Everybody seems to be trend follower these days. How is the Fed going to stop asset bubble decline when people start feeling the pain of losing money?

Losing money hurts a lot more than missing out.

But the Fed is buying via QE the Treasury debt you say is in short supply….you say “the govt isnt issuing new debt”

If the Fed tapered now wouldnt that solve the “not enough government debt” issue?

Seems they have a QE promise to somebody, and are using the RRP rather than breaking the promise. Tangled web.

It would help if they tapered certainly. Then the banks and money market funds could but the stuff Fed is buying now instead of being shut out AND there would be a bit of reduction in RRPs…BUT as soon as the Treasury spends down their cash pot then the Fed would have to kick back QE or rates would spike and it would look like they didn’t have stuff under control. People would say why should we trust the Fed? They were doing QE, then they stopped, now they restarted.

So really the RRP is only temporary and will not be needed in same nominal levels once the treasury’s cash is spent and they start financing the huge structural budget deficits extant.

It really makes sense that they’re doing QE at same time as they are doing RRP when you understand Yellen trying to burn off all her excess cash.

You are right on except government borrowing just crowds out real savings which is just another word for investment. Got to have real savings to make things better in the long run.

Government borrowing just eats the seed corn. Gives a pop today, but ensures growth will be lower tomorrow. We are going to be sub 1% real growth when we get out of this recession if we are not careful.

I jiz keep say’n, all ponzis eventually do what . . . ?

You can’t taper a Ponzi scheme

‘debt was pyramided on top of unrealistic debt in an orgy of speculation’… sounds familiar.

Didn’t want to take our medicine in 2009. We are twice as sick now. Maybe they can extract 10 more years of savings out of grandma to save the system.

Old School:

“Didn’t want to take our medicine in 2009.”

Best comment by far.

There’s nothing complicated here.

“Simplicity, Clarisse! Simplicity!” (Silence of the Lambs movie)

In 2009 it was not “we” who did not want to take our medicine.

Had the crash been allowed to happen in 2009 without the bail outs the banks would have been in real trouble as they were not positioned to deal with a massive deflation and default situation in real estate. The Fed serves its member banks and so did what it needed to do to facilitate them, not what was in the best interests of the American people.

But Basel III and Gold are threatening the manipulators.

[Checking Federal Reserve playbook to answer question] Ok, right here on page 146, paragraph 2, line 3: “Ponzis go on forever.”

Wolf, with the recent rate change is that transactional or accrued for the few hours these operations last overnight? These values seem to be heading exactly where you hypothesized about a month ago to $1T nightly. Where does it stop? Can they stop?

These have to be annualized rates. Otherwise, the Fed paid out 378 million dollars on that 756 billion RRP from last night.

Yancey Ward,

In terms of the “$1T nightly” — Nathan Dumbrowski was referring to a comment I made a couple of weeks ago where I said that the RRP balance might spike to $1 trillion on June 30, because at quarter-end the banks are into this, and the RRP balance is expected to spike. That is what the first chart also shows.

Now this estimate looks a little thin by today’s $750 billion balance already. But who knows.

Nathan Dumbrowski

In terms of your first question, the rate is an annual percentage rate. So to get the 1-day amount of interest the Fed pays for the whole shebang, it’s something like 0.05% / 365 * $750,000,000,000

In terms of of your last two questions – “Excellent questions.”

That’s what you always say in an interview when you don’t know the answer. And then you proceed to answer a question that wasn’t asked…. And that’s what I’m going to do :-]

This will stop and unwind when the Fed starts reducing the assets on its balance sheet. But this is a long way off. So now the Fed is reducing the liquidity out there without reducing the assets on its balance sheet. It’s selling Treasuries, but it’s dressing that up as reverse repos, and that contract is a liability on the Fed’s balance sheet (cash it owes the counterparty). I think that the Fed thinks it’s pretty smart. All the Wall Street people know what’s going on here. But the markets don’t react.

Now imagine what the markets would do if the Fed were to suddenly sell $750 billion in Treasuries outright?! That would be a hoot!

Jamie Dimon with his 500 billion is waiting for the day when the Fed will do a fire sale.

Which means he’s not as scared of inflation as he is of a market crash.

Jamie has a crapload of silver and has been manipulating the price for years.

Where is Soros Jr and Drunkenmiller Jr, time to break the dollar. ??

“But the markets don’t react.”

But why not? To me, it doesn’t seem a rational response.

It’s the mass-psychology, if you will, of the markets. The most astounding and irrational things happen in the markets because of this mass-psychology.

The markets don’t react because they are manipulated environments, simulations of the model du jour, playing out in real time. It’s a giant f’king video game.

“It’s the mass-psychology, if you will, of the markets. The most astounding and irrational things happen in the markets because of this mass-psychology.”

Some would call this “sentiment”, Wolf

I may not be interpreting correctly, but here is what I get when calculating .05% interest on a trillion dollars:

.05% of 1 trillion = 500,000,000 (annual)

500,000,000 / 365 = $1,369,863 (daily)

If it was 5%, then $136,986,301 daily

Yes, that’s correct.

.05/360=$10,416,666.67 daily

Oops, misplaced the decimal point should be $1,041,666.67 daily.

Sorry!

@Wolf, if “the Fed is reducing the liquidity out there without reducing the assets on its balance sheet” then does that mean there will be less money floating around below the Fed? And if so, even if the Fed rates do not go up, does that mean the banks’ rates to ordinary customers and small businesses might go up and also be harder to get?

#1. yes.

#2. Good question :-]

thanks

So, the Fed appears to really Be a horsesassfly .. sticking its proboscis into a putrid mass of maggoty repos, as it simultaneously emits fly$pec ulation$ upon it’s preying Finsect cronies .. whilst the poor plebs can only look down in disgust and horror, immobilized as it were, stuck to an ever-inflating No-Lowlymoke Strip!

Got it.

Where’s the Raid when ya need it..

… or maybe even some BillBlack Flag .. to knock though those tough bankster exoskeletons ..

Definitely need another Bill Black!

Michael Gorback

“Definitely need another Bill Black!”

????

I’m beginning to think all this in and out is more to do with cleansing the ‘junk’ (mbs, etc) off the financial institutions balance sheets and giving them the chance to replace it with decent Treasuries. All the trash could be left to die on the Fed bal sheet if Powell never tapers.

It’s certainly one Hell of a game to try to follow.

“never tapers it”, the junk, not the treasuries. oops

Basel III and Gold,

That miniscule interest rate hike would be what drove the sharp increase from the day prior, not an impending collapse of the economy?

US is the Sick Man of the Western Hemisphere.

The end is near…..

Guess I picked the wrong day to stop sniffing glue.

That is the only reference in this thread I understood?. If one of you would help a sorta bright retiree get this, I would like the help.

Imagine a fly with one wing. All it does is go in circles but it looks busy..

There ya go, and no math!

George, envision a circle of guys passing around a really hot potato. It’s like that except the potato never cools off.

It goes like this George,

The investment banks buy, the Fed sells. Tomorrow the investment banks sell and the Fed buys.

REPEAT daily….

“The Fed bought about $3 trillion in assets over the time and thereby monetized that newly issued government debt.”

The Federal Reserve seems to think the best way to solve a debt problem is to cancel the debt and that is essentially what is taking place. Consider the following example. If you borrow $10,000 from someone but don’t have to pay interest on that amount and can roll it over forever, is it a loan (debt) or a gift? In practical terms, it’s clearly a gift and even the IRS would consider the missing interest a gift through their applicable federal rates for minimum interest.

The government borrows trillions of dollars by issuing debt in the form of Treasury bonds. The Fed prints money and buys some of these bonds from the market via primary-dealer banks. And just like the example above, the government doesn’t have to pay net interest on the debt purchased by the Fed and it presumably can be rolled over forever.

Does anyone believe that the Fed is going to unwind its balance sheet in any meaningful way? There will likely be tapering at some point but that is only slowing the growth of the balance sheet expansion.

And if the Fed’s balance sheet doesn’t get unwound, QE becomes a form of debt nullification as the monetized debt sits harmlessly on the Fed’s balance sheet and doesn’t need to be serviced. So the nation’s debt burden is more like $20T if you subtract the Fed’s balance sheet ($8T) from the national debt ($28T). And historically speaking, it’s even less than $20T when accounting for the higher interest payments received from MBS that are remitted to the Treasury, and the lower interest rates generated by QE for future debt issuance.

In other words, the Fed through its bond-buying program is neutralizing a sizable portion of the nation’s debt. And the resulting liquidity, ultra-low interest rates, and government spending propel asset markets higher which drives up the cost of housing and countless other items.

The point here is that they’ve completely transformed the financial system. In the past, rising interest rates would have acted as a restraint for too much debt issuance with the bond vigilantes in charge. Now, this market-disciplining mechanism is being bypassed with the printing press such that debt and interest payments are not the main considerations for economic policy regardless of political posturing.

We appear to be entering a new era of unchecked printing and spending where the limiting factors are currency devaluation and inflation which are systematically being understated as the wealth disparity of the nation widens. Shouldn’t this be explained to the public and debated by political representatives before giving such unrestrained power to central bankers?

Unfortunately no. Did you even watch the last debates? If anything people want to hear about money as little as possible, even though economics is always the number 1 issue. So they want to hear about spending. Which is fine, but then don’t act surprised when your kids are college graduates and can’t afford a house without selling their soul to a company that is part of the problem.

“. . . don’t act surprised when your kids are college graduates and can’t afford a house without selling their soul to a company that is part of the problem.”

Seems like that is our current situation.

Yes, this is permanent monetisation of the debt. And in a few years time they won’t even pretend anymore that the government is borrowing. The central banks will finance government deficits outright. Central Bank Digital Currencies (CBDC) will enable that. They will issue money directly to the government to hand out. It is debt free money. It has been the game plan all along.

“It is debt free money. It has been the game plan all along.”

Maybe that little detail should have been publicly discussed and debated somewhere along the way.

I guess we really are all Keynesians now.

“They will issue money directly to the government to hand out. It is debt free money. It has been the game plan all along.”

Yep free money to consume things with. We didn’t need those pesky interest rates anyway.

jrmcdowell

The Fed is engaged in “taxation” by pushing inflation and then not addressing it per their mandates.

The Fed is engaged in “minting”, for they apparently have “digitally minted” the money supply (M2) up 27% in less than a year.

MINTING and TAXATION are powers of Congress and Congress must answer to the voters.

Those two powers may NOT be delegated.

Who does the Fed answer to?

“The RRP balance of $756 billion drains over six months of QE from the market”:

That’s true, the Fed is “lending” Treasuries to the market on a daily basis and it keeps getting rolled over but not sure that all aspects of QE are being undone. If the Fed still receives the interest payments while lending these Treasuries, then the debt nullification aspect of QE remains.

Also, the long-term rates don’t seem to be affected which is one of the goals of the Fed buying the long-term bonds. And unless the reverse-repo is mandatory, the liquidity is essentially there if a counterparty wants to use it. If not, they can roll it over to the next day.

If QE were truly being undone, that liquidity would be removed from the market permanently. Reverse repo seems to be a way for the Fed to loan Treasuries to the market to keep money-market rates from going negative without undoing all the (asset) market driving forces of QE.

Precisely! With the caveat that I don’t work in finance and could certainly be missing something, this seems to be a crucial distinction that people who should know better are missing.

Guaranteed duration of the withdrawn liquidity is key! If the money market fund (or whoever) is lending the cash has access to it on a day’s notice, the money wasn’t really withdrawn; it might as well be in their own bank account. It seems the money market fund (or whoever) just doesn’t know what else better to do with it, but wouldn’t be buying speculative assets anyways, seeing as they’ve chosen to invest in a nearly 0% vehicle. So, there is minimal effect on the market mania and the RRP just reduces the systemic risks associated with holding vast sums of cash, since now it’s held by the most trusted entity.

Wolf, between your WTF and Holy Moly headlines…they are really starting to remind me of this one Youtuber that starts everyone of his financial video with “Holly Smoke everyone…”

Crazy time we live in…the WTF and the Holy Moly is starting to sound like Good day mate to us negative nellys…

Phoneix_Ikki,

I don’t think I’ve ever seen times this crazy, in terms of business, finance, and money. And it shows up in the charts and the words I have to use.

You might have noticed that the line in my charts changed color last year. It went from black or dark-blue to red. The reason I did that was because some commenters had confused the frequent spikes on the right side with the edge of the chart. They made comments that didn’t make sense, until I figured out what they were seeing. Then I changed the line to red, and now no one is confusing the spikes with the edge of the chart. This is one of the many changes that came out of these crazy times.

Sure you’ve seen times this crazy. It was called the late 60s and early 70s. You just don’t remember. Well, at least I don’t, staring somewhere around 1971. I’m pretty sure I was back by 1975.

Interest rate suppression is nothing new. It’s usually done to finance World Wars and it’s confusing that we are doing it in peaceful times.

Unfortunately, it looks like QE is going to become a permanent feature of central bank policy. Stated goal of 2% inflation combined with stated goal of “full” employment essentially guarantees negative REAL interest rates on pretty much everything.

Just to clarify, it’s impossible to determine when “full” employment is achieved, so there’s no reason to ever to stop suppressing interest rates.

“It’s usually done to finance World Wars and it’s confusing that we are doing it in peaceful times.”

Let’s not forget that we were in Aphganistan for something like 20 years. That was a lot of spilt milk for very little to show for it. Also, Iraq, and now the pandemic on top things off. During which time tax breaks for the top whatever percentile were voted in repeatedly.

I’ve heard some of you say that Vietnam was not a pay-as-you-go plan either, and contributed to the inflation on the 70s. I wonder if the numbers are comparable, between spent treasure in the Vietnam era to this era.

Americans like to pay later because they hope to shift costs to strangers and/or the next generation.

It’s all talk to influence the markets. In business they teach you if you don’t say it with data you are just giving your opinion.

If it wasn’t BS the Fed would give hard numbers. For example our policy is 2.0% average inflation over trailing 36 months.

Markets are rational. (ROW is crazy) The global pandemic is the financial equivalent of W2. This is the new Marshall plan, with the same post war wrangling with Russia. A lot of that infrastructure spending will be on imported goods and services. They blow that up Jan 6 will be a picnic.

Me too Wolf,,, was in the SM and RE market(s) since the early 1950s, when my God father in fact, as opposed to those on my list, was doing his very best to educate me in both those mkts.

Crazy crazy times NOW,,, and, thank the Great Spirits of all kinds, WE,,, that would be the family WE, are out of both…

Other than that, no matter how many ”markers” one might have these days, they, those markers, are either ”out of date” or ”way too late”,,,

and IMHO, that will continue EXACTLY how it was when someone(s) tried to corner the market (s) many times, so expect similar again today…

Thank you for this informative post and your other related posts over the past few days. If I’m understanding this Fed policy set correctly, the Fed is continuing to purchase Treasury debt securities and Mortgage-Backed securities of longer duration from the Primary Dealers at a rate of ~$120 billion per month, with Fed payment for those securities made by increasing the Primary Dealers’ reserve accounts at the Fed.

Concurrently, the Fed is selling Treasuries to selected institutions in exchange for Cash and an agreement by the Fed to repurchase those Treasuries the next day. This is being done to reduce the level of Cash liquidity in the financial system stemming in part from Treasury drawdowns of its Treasury General Account at the Fed, and could presumably be discontinued entirely or in part anytime the Fed perceives there’s a systemic liquidity issue.

Are these two policies, which appear on their face to be substantially in conflict, the best solution to liquidity risk, capital constraints on the banks, and interest rate management, or are those even the Fed’s primary policy objectives? After 12 years and trillions of dollars of Fed purchases of Treasuries and MBS under QE-ZIRP, I have yet to see the Fed formally and publicly justify this policy, or now that of this suddenly large Overnight Reverse Repurchase Agreement program.

1) In 2008 the two macho guys bent and narrowed the EFFR pipeline

during the orgy.

2) The Fed open market committee should widen them, perhaps between NR and 0.35, for more freedom.

1) Use what u got : suck liquidity out of the private markets to raise US saving account in the Fed. The higher TGA goes, the more infrastructure funds will be available without raising Fed total assets, or taxes on the middle class. The upper 1% will pay min taxes.

2) US gov cornered the market, but politicians don’t care. All they care is a compromise.

3) Please zoom RRP Q1, Q2 2021.

Politicians care about lining their own pockets. That’s why they trust the Fed and stand aside while the Fed runs the entire government.

Wolf, This looks like the repeat of John Law and Mississippi bubble. Any comments on that?

If I am not mistaken John Law is considered the first Central Bankers. My understanding was French Government was over indebted and king didn’t or couldn’t pay market rate of around 4 – 5%.

John Law solved the problem for a while convincing people that Mississippi stock was equal to or better than gold backed deposit. Like all bubbles the inflated stock prices future income was an illusion. John Law was a smart man especially with numbers, but he wasn’t as smart as he thought he was and his complicated scheme collapsed.

After reading the comments I don’t understand what the issue is here. The fed is printing money as QE but that money they “put into the market” is just getting flipped in another way that goes back to them so as to not spook the market because nobody really cares about it.

Is this not the fed limiting the free money just in different terms? If I’m understanding it right, is the fed moving towards a 1:1 ratio where they’re not really adding to the money supply? Wouldn’t this stop inflation that occurring at some point. Guess I’m thinking in non financial scholar terms.

If I was throwing out money and passed out 100 dollars a day but collected a 100 to stick in the stash I drew from, that means the system is at balance and I’m not inflating or deflating the currency. If interest rates are near zero when I take back 100 I’m barely paying anyone anything and if I hand out 100, I’m barely getting anything in return.

Maybe I’m just thinking in micro economic terms or something. I cant pretend to understand most of what is going on with the articles here, I just know that on the ground level for a working class schmuck, new entry in housing is unattainable, vehicles are priced out of reason, everyday expenses are rising noticeably, and outside of working for a fast food joint, wages haven’t moved at all from what I’ve seen.

The wealth gap just seems to grow wider with fanciful stories about millennials who “made it” by gambling on GameStop or buttcoins and now have 4 houses and you can too, just spend 40 dollars a month for our online website that is just thinly veiled advertisements passed off as articles. Don’t forget, adblock is something the communists use and hurts the good guys at Megacorp LLC. I’ll say it again, I eagerly await the crash.

What I like about the USA is that all the numbers you need are often given out asap. Take new unemployment figures, you give them out every week(unlike three monthly) and as a result you can judge some of the madness caused by the Govt and the Fed.

For new unemployed you see figures mostly above 400,000 every week for the last year but allied to it, firms crying out for staff. That’s why if I want to work out what’s going on here in sunny England and in Europe I use USA numbers and your crazy madness as a form of forecast, as the USA is usually months in front…….

There is one madness we don’t have (up to now), regarding many of the homeless who live in California and camp on the streets. Doctors in the UK are not allowed to give out morphine as a painkiller, unless people are really sick and almost dying or if they are in hospital after an operation, even then it is highly regulated.

Ignore what anyone says. If you know their political position, you know what they will say. Everyone is waiting for someone to slip up and mistakenly say the truth. It will never happen. No one will ever say the truth unless it accidently profits them. If someone slips up, a handler will immediately tell you what was really said.

There’s no secret wisdom given to the herd. Only lies.

Look at numbers. Follow the money. Estimate the herd greed response to lies. Use math. Learn math yourself because they don’t teach it anymore.

Anyone else having trouble connecting to Kunstler site this morning for Friday post. He must be right over the target, unless it’s a paid holiday for him.

I get that technically the Reverse Repos drain money from the economy. But is it really effective? So what if big banks swap excess cash for Treasuries overnight? Were they really going to do anything with that cash during non-working hours?

What am I missing here?

Against your stocks they’ll loan you money to maybe build a house or a yacht but it’s up to you?

Basel III and Gold

Doing away with unallocated accounts should be a big deal…

The expected outcome for rising interest rates is at some point the market would seize up again and the large wall street banks would not provide the needed liquidity due to their own situation. So if the Fed is stepping into the Repo market permanently, does it help to build up these reserves? Does it help MM funds to have excess at the Fed in case of withdrawals to stabilize the funds?

Is this the plan?

Gold price suppression in view of Basel III which has just kicked in!

That’s my understanding of the real problem. Banks and asset managers have to have approved assets in case we all want to pull our cash the same week.

It’s a strange place we are in with record high margin debt, record high home prices, record high stock prices, near record high bond prices, record high 4X GDP debt and record high cash levels. Maybe it’s just milking the most out of reserve currency status that real economy has been so financialized. Got to be within a few years of system change.

Maybe there’s little to no demand for treasuries and they are establishing a bid by trading the securities back and forth. Establishing a price, making the market.

The question seems to be, what would be happening if the fed wasn’t doing this? Would there be a bid, would the market exist?

I know I wouldn’t be buying at negative or zero rates.

Mean’t to be reply to Spencer.

Hussman has some great discussions of the Fed’s activities since 2008. I tend to agree with him, that they have done illegal things, and that a lot of the activities they participate in are for “sentiment” or “emotional” reasons. The numbers don’t add up when people say they are in total control of certain interest rates/bond prices.

Sentiment/emotion (…reckless speculation… etc.) mean a lot in markets. If you don’t have a way to manage these in your investing (market sentiment and your own emotions), you won’t last long.

I have learned a lot from Hussman. I think he will end up being proven correct with about a 70% stock market crash unless the financial system is never allowed price discovery and is politicians just centrally plan the system until full swirling down the drain.

Hussman is a very interesting case study. He is uber-self-righteous, in my opinion because he does “bottoms-up” modeling, meaning he believes he has all the “fundamentals at the bottom” understood, and that the markets “must” obey them.

He is short sighted on two counts (Note- I have followed him for a very long time and even invested in his fund(s) for a while). 1. he has admitted that his models initially only went back to about 1945 (way too short a time frame) and 2. market responses to fundamentals can be “changed/manipulated” by things like central banks and governments. Top down/empirical methods have a place, and he doesn’t use them. It’s funny because he does present them on his site(!).

He’s been much too wrong for too long on investing, but his site is an excellent place to learn about market and financial fundamentals.

Buffet is very smart. He solved some basic problems with being money manager.

1. Do it under umbrella of insurance company where people on average pay you 1 or 2% to hold their money. That’s a nice tail wind.

2. Own some whole companies with positive cash flows so there is no daily stock price.

3. Own regulated utilities so you have an ever expanding way to get positive returns that are higher than cash.

4. Own dividend paying stocks so cash is always flowing in.

5. Never get trapped by declining asset prices.

Old School- never forget that Buffet was bailed out. I think Wolf has posted on the Buffet bailout details before.

You might be as smart as Buffet- but he is probably in a better club.

Am I right in thinking that some of this eagerness to collect 0.05% *might* betray some doubt in the minds of the counterparties about the future of the Fed’s ability to continue to suppress interest rates lower?

We are following the same path at Weimer Germany. The way I see it if you do an analog model, we’re like in say 1920 in Germany. Inflation is running hot but is not disrupting normal civilized society. You can still go to the grocery store and get pretty much whatever you need. Gas is getting expensive but you can still fill up your tank. Life goes on. The next step is not so much fun. We will soon see some massive work stoppages and civil discord as wages fail to keep up with inflation. Massive strikes will be commonplace, such as teachers, transit workers, disrupting everyone’s lives and make life very uncomfortable. I witnessed a little of this when I was in NYC in the 1970’s.

Fed RRPing overnight rates and continuing to buy at longer term maturities (QE purchase of UST and MBS) is just yield curve control, no? Raising short term ever so slightly, lowering long term yields ever so slightly…

What exactly is the problem with “excess cash” that these reverse repos are trying to solve? isn’t “excess cash” an oxymoron? Someone told me it has to do with capital requirements. But don’t capital requirements set a minimum amount of capital banks need to have and not a maximum? Why can’t they just sit on the cash and enjoy the security of knowing it’s there?

I think that banks basic business is to obtain shorter term deposits and make longer term loans. They need the interest spread and fractional reserves to have a viable business model. Just holding your cash isn’t going to allow them to cover their cost.

Some say banks are always technically bankrupt because they have mismatch between deposits and loans, but under normal conditions they can statistically manage all of this unless there is a once in 100 year event.

Thing I have little difficulty with is why is the Fed doing an overnight loan. Does this allow for phony accounting? Who continues to borrow money overnight? If it’s legitimate just borrow for two weeks or a month at a time.

Thank you all. This topic and thread has really helped me. Sorry but I was educated in gov’t schools ending in a BS in engineering. These Fed topics boggled my mind to the point that I just passed them by. Now I’m understanding better in much of the above content.

Central bankers are a real challenge for engineers who normally have good math skills and reasoning abilities. Engineers learn the value of K.I.S.S.

Fed monetary policy seems like a Rube Goldberg contraption consisting of part model A and part super computer. It’s always just a little out of reach of a layman from figuring it out.

‘The higher rental cost because now the pension funds, along with PE funds are buying houses to rent because they can’t make any money anywhere else forcing the general public out of housing.

Two of the main ingredients for a stable society, food and shelter’

Of course they are…Zombie clowns attached to screens feed Diet Coke and Xanax while they suck the life from the future. Add the dismal birth rate to practices like destroying the value/quality of housing and food. what in the system hasn’t been desecrated for greed. You shallow hallow empty scum are due payback for all eternity. You have been bestowed with all his powers and this half reality, lowlife, wallstreet sellout is your answer.

BUY AMC. TOO THE MOON.

The reverse repo action is because of the SLR exemption having expired on March 31. It ties into new Basel III tier 1 capital requirements going into effect on July 1.

If you look at recent market action, crypto crashed hard, but stocks, precious metals, real estate I don’t think budged all that much. I’m sure if the Fed had simply stopped QE instead of this reverse repo nonsense, then most assets would have crashed hard.

I admit it’s getting hot under my tinfoil hat, but… How could money be flowing that would cause reverse repos to drain liquidity from crypto, but not from other traditionally money-supply-sensitive assets?

Is that just the overall lower market cap of crypto? Specific market-moving information like Elon tweets? Something else… I don’t need firm answers — feel free to speculate, if you can!