Double-digit drops from peak in San Francisco Bay Area, Seattle, San Diego, Phoenix, Las Vegas.

By Wolf Richter for WOLF STREET.

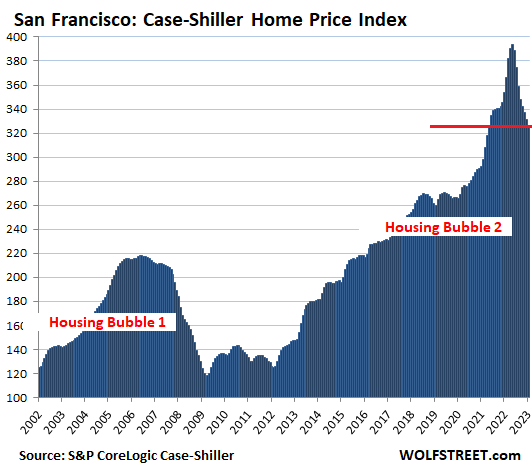

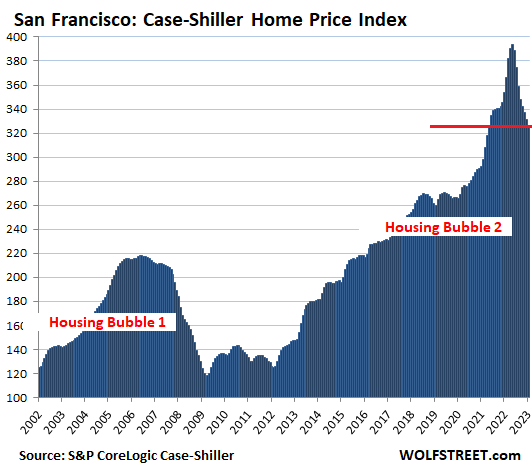

View of Housing Bubble 2 in the San Francisco Bay Area:

This time, it’s not an unemployment crisis that is taking down the housing market. The labor market is still tight with big pay increases – though the tech and social media segments have begun to wobble. But it’s mortgage rates that have reverted to the pre-QE normal levels of 6% to 7% amid CPI inflation in about the same range. And they’re clashing with home prices that had spiked maniacally under the Fed’s QE and interest rate repression.

And so home prices dropped further, according to the S&P CoreLogic Case-Shiller Home Price Index for “January” – which is a three-month moving average of home sales that were entered into public records in November, December, and January, reflecting deals made largely in October through December.

On a month-to-month basis, today’s Case-Shiller Index for single-family house prices dropped in 19 of the 20 metros that it covers. Miami was the only exception, where the index remained essentially flat. The 10 biggest month-to-month drops occurred in:

- Las Vegas: -1.4%

- San Francisco Bay Area: -1.3%

- Seattle: -1.4%

- Phoenix: -1.2%

- Dallas: -0.9%

- Denver: -0.9%

- Chicago: -0.5%

- Portland: -0.7%

- Tampa: -0.7%

- Washington D.C.: -0.7%

Prices down the most from their respective peaks (ranging from May to July 2022) in these metros:

- San Francisco Bay Area: -17.1%

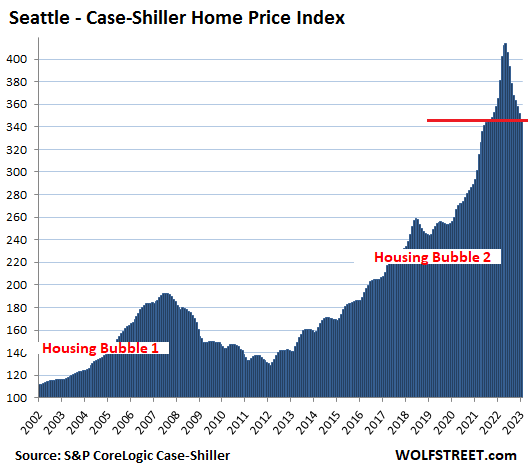

- Seattle: -16.3%

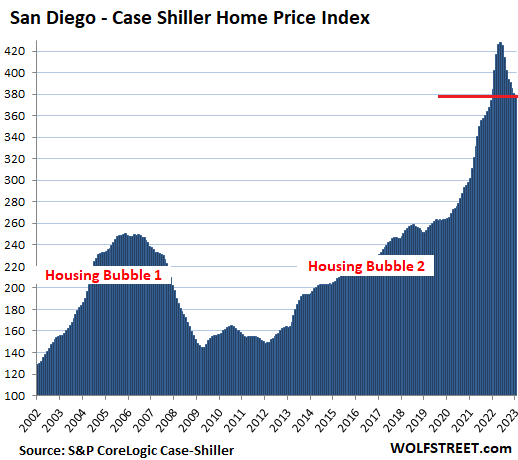

- San Diego: -11.5%

- Phoenix: -10.5%

- Las Vegas: -10.1%

- Denver: -9.5%

- Portland: -8.6%

- Dallas: -8.5%

- Los Angeles: -8.3%

- Boston: -5.7%

Priced down year-over-year now in four of the 20 metros:

- San Francisco Bay Area: -7.6%

- Seattle: -5.1%

- San Diego: -1.4%

- Portland: -0.5%

Down faster than up is a rare occurrence in housing markets, but it’s happening in the San Francisco Bay Area where prices fell faster in the eight months since the peak, than during the eight months leading up to the peak. The metros of Seattle and Las Vegas got close (percentages from and to peak):

- San Francisco Bay Area, peak in May: -17.1%; +15.7%.

- Seattle, peak in May: -16.3%; +19.7%.

- Las Vegas, peak in July: -10.2%; +11.6%.

Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors (methodology). This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices, but it lags months behind.

The San Francisco Bay Area housing market is not only impacted by mortgage rates, but also by the stock market – especially by IPOs and SPACs, which have mostly collapsed, and by the tech and social media giants that are now laying off highly paid workers. But these home prices released today are based on closed sales in January and earlier, so the recent fireworks are still not reflected. That’s still to come.

The Case-Shiller index for “San Francisco” covers five counties of the nine-county San Francisco Bay Area: San Francisco, part of Silicon Valley, part of the East Bay, and part of the North Bay.

- Month to month: -1.3%.

- From the peak in May: -17.1%.

- Year over year: -7.6%.

- Lowest since May 2021.

Seattle metro:

- Month to month: -1.4%.

- From the peak in May: -16.3%.

- Year over year: -5.1%.

- Lowest since September 2021.

San Diego metro:

- Month to month: -0.4%.

- From the peak in May: -11.5%.

- Year over year: -1.4%.

- Lowest since January 2022.

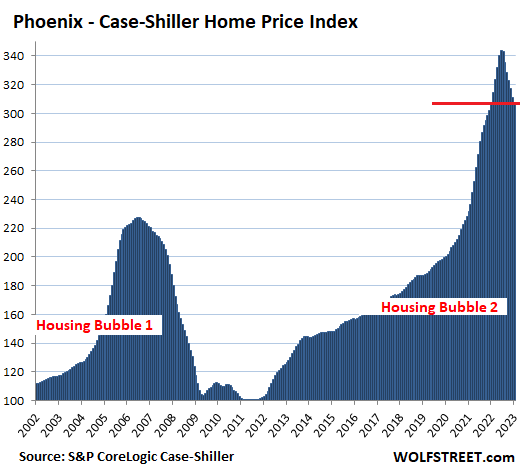

Phoenix metro:

- Month to month: -1.2%.

- From the peak in June: -10.5%.

- Year over year: flat

- Lowest since January 2022.

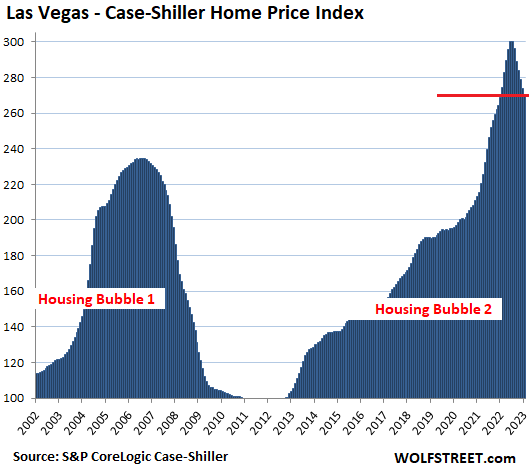

Las Vegas metro:

- Month to month: -1.4%.

- From the peak in July: -10.1%.

- Year over year: +0.4%

- Lowest since January 2022

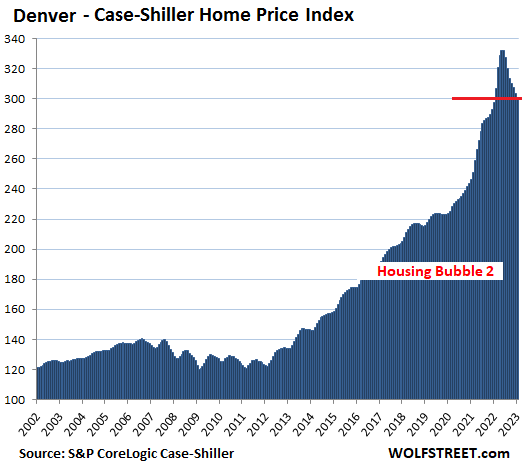

Denver metro:

- Month to month: -0.9%.

- From the peak in May: -9.5%.

- Year over year: +1.0%.

- Lowest since January 2022.

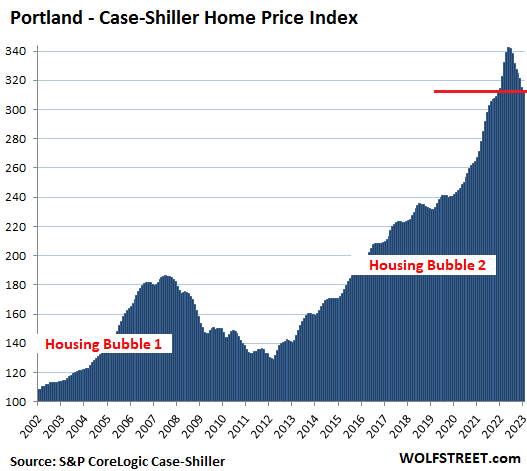

Portland metro:

- Month to month: -0.7%.

- From the peak in May: -8.6%.

- Year over year: -0.5%.

- Lowest since December 2021.

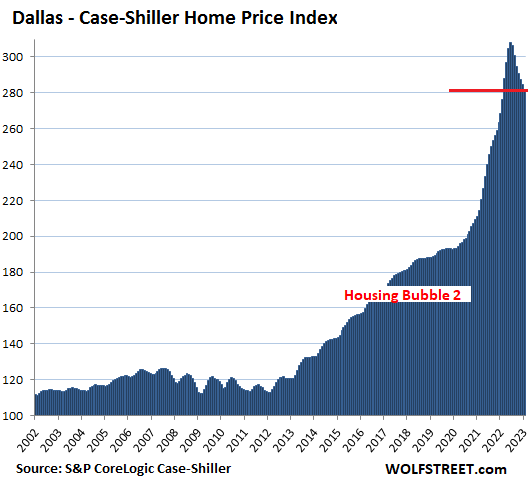

Dallas metro:

- Month to month: -0.9%.

- From the peak in June: -8.5%.

- Year over year: +5.0%

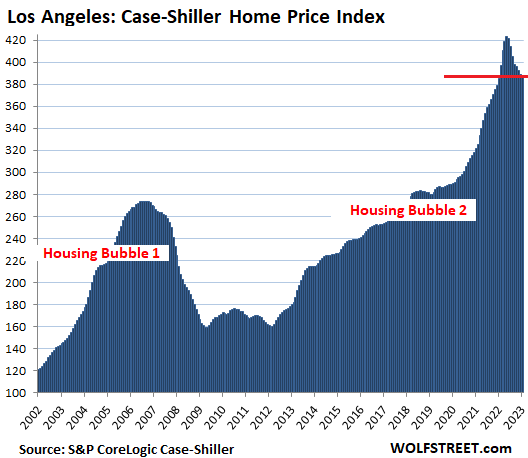

Los Angeles metro:

- Month to month: -0.2%.

- From the peak in May: -8.3%.

- Year over year: +0.9%.

- Lowest since January 2022.

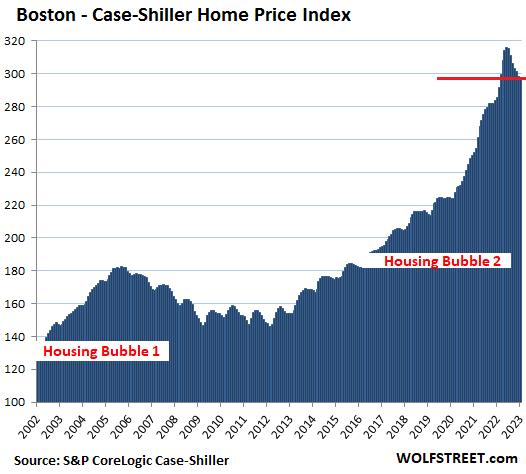

Boston metro:

- Month to month: -0.3%.

- From the peak in June: -5.7%.

- Year over year: +4.2%

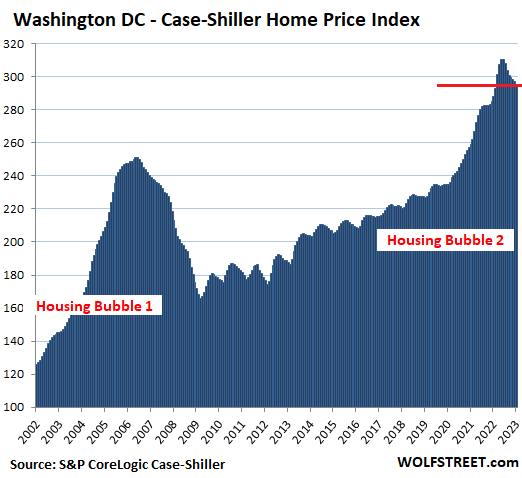

Washington D.C. metro:

- Month to month: -0.7%.

- From the peak in June: -5.0%.

- Year over year: +2.4%

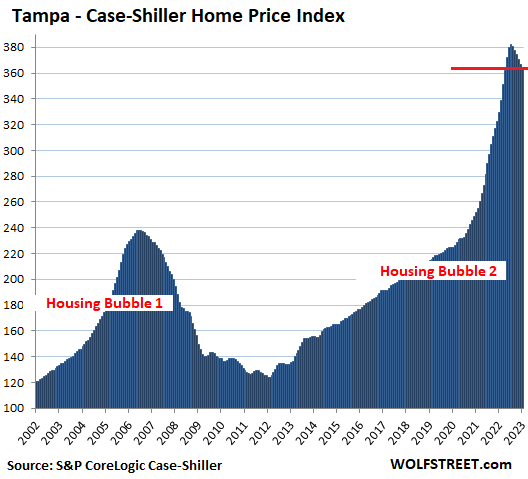

Tampa metro:

- Month to month: -0.7%.

- From peak in July: -4.7%

- Year over year: +10.5%

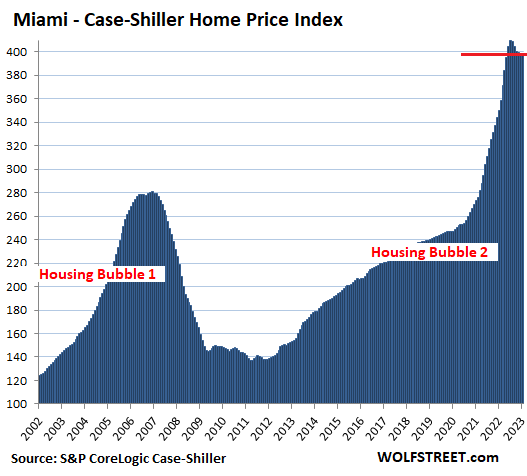

Miami metro:

- Month to month: essentially flat (less than +0.1%).

- From peak in July: -2.6%

- Year over year: +13.8%

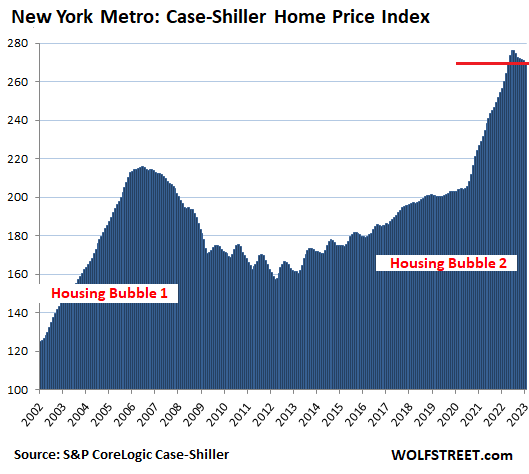

New York metro:

- Month to month: -0.4%.

- From peak in July: -2.3%

- Year over year: +5.2%

For the Miami metro in January and also in December, the Case-Shiller Index had a value of 399 points. The Case-Shiller indices were set at 100 for the year 2000. So Miami house prices are still up 299% since 2000, despite the recent dip. This makes Miami the #1 most Splendid Housing Bubble in terms of price increases since 2000. Miami has moved into the #1 slot because its prices have fallen less than the prices in Los Angeles and San Diego, the prior #1s at different times.

The New York metro index value of 270 indicates that house price inflation since 2000 was 172%, and as crazy as this still is, it forms the tail end of this list of the Most Splendid Housing Bubbles.

In the remaining six markets in the Case Shiller index, home prices have risen far less since 2000, and so they don’t qualify for this list. But in all of them, prices have declined for months. The declines in today’s Case-Shiller index: Chicago (-0.5%), Charlotte (-0.3%), Minneapolis (-0.9%), Atlanta (-0.3%), Detroit (-0.6%), and Cleveland (-0.6%).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

FRED has not update yet with the Case-Shiller “Jan” values, at least for me I can only get “Dec” values still. The Federal Reserve is too busy?

FRED lags data by a day or so.

I gave you the link (in the 2nd paragraph) to the original source (S&P CoreLogic) where it’s all ready for you to download and look at. No reason to wait until FRED gets around to regurgitating part of it.

According to zillow, my home in the Cincinnati area just made a new all time high. Cincinnati, the next hot market?

Ummm, no. Your sports teams alone prohibit such things.

Zillow estimates are always completely inaccurate. Compare the comps of homes sold in your neighborhood- same size, condition and location for a more accurate number and remember the sold date is generally a month behind agreement to buy.

Bengals?

According to Zillow? LOL

This market will not normalize until people quit looking at Zillow every day to check how much money they made on their house while they were sleeping. This will take a long time 😂

I’m working on flip in Tucson

we have NO INVENTORY for nicely done homes

lots of – fixer uppers(ones which sit until priced right)

had one 3 blocks away go on 1st day at TOP $$$

seems like folks here didn’t get memo

then again – if you have home and can afford payments

no reason to go looking right now

mostly the 35,000 NEW TRANSPLANTS buying

When the market is going to be down 40%, as mortgages are blowing up, and all heck is breaking loose, I’m still going to get those comments here. It never stops 🤣

Jim, just quit your job, go out and spend your new found wealth. Buy a car, go on a cruise, throw a few parties.

Our houses are earning to make America prosperous, we will never have to work again.

LOL. This is my pet peeve. People aren’t giving enough credit to the highly manipulated, farcical algorithms at Zillow for distorting the housing market and keeping sellers in fantasyland with delusional asking prices. I think many would be surprised at how much stock people put in “Zestimates”. I see this behavior all the time – even from real estate agents. These are probably the same people who don’t know the difference between their level 2.5 “FSD” Telsa and the imaginary level 5 fully autonomous car that you won’t see on public roads anytime this decade. People put too much faith in crude algorithms and ignore their oftentimes insidious nature. We used to have vetted journalists and newspapers as arbiters of the truth – now we have algorithms dishing up most of what people see and read on a daily basis with the sole purpose of driving engagement. Don’t get distracted with SkyNet – “dumb AI” is already wreaking havoc on society right now. But back to my point: you’ll know housing has bottomed when sellers start suing Zillow over misleading them with their artificially inflated Zestimates. I’m watching a number of homes in LA drop in price in lock step with their declining Zestimates yet not selling because this moving estimate is a good 6 months behind reality.

Sell it, then tell me how much money you made.

Zillow got out of the ibuying business in November 2021 because they were overpaying for houses at that time, yet people still gravitate to their zestimate lol. They admitted they didn’t know what they were doing.

joedidee: 35k transplants to Tucson lol. You have low inventory, but you also have low demand just like Phx. There is no mania going on in Tucson other than one or two manic, delusional FOMO types. You gave me a good laugh for the evening. Tucson lolol, hilarious.

There are definitely markets that are chugging along just fine while others are cratering. Hint: markets that rose 20%-30% over past 5 or 6 years (cumulative) are not feeling the same pain as those that rose 40% over a couple years.

The test is greater north of the border where the 15 year gain is two to three times greater and with far, far worse affordability metrics.

Moved out of a rented apartment in family home recently (elderly, was caretaking). The details are tedious, but said family member’s estranged children from across the country saw the Zillow price and thought they struck gold. They swept in quite brashly to catch the top of the market, stuffed dear old mum into a home, and 5 months later they are still trying to collect all their gold but instead they’ve been dumping money left and right into massive home repairs that weren’t reflected in their tasty Zillow zestimate.

Not updates, mind you. Real work: full electrical, 60 years worth of rotted layered roofing atop rotted wood, foundation repair and sealing, rotted decks in need of full replacement, full plumbing, and a particularly concerning issue with the septic and well (we used bottled water for everything when I lived there). And there’s about 15 other issues before you get to the cosmetic stuff. Glad to be out of there.

As they say, God doesn’t repay debts with cash.

Should have saved some long boring reading by saying, a real estate agent (not appraiser) valued the house at less than half of the Zillow value, and that was being generous, about 1 1/2 years ago well before the children rode into town. They knew better, of course.

I saw this constantly as I shopped in the 250-300k range the past two or three years. Its still ridiculous on the East Coast.

Zillow is pretty accurate here in Denver, mostly showing 10% drops, concordance with Case Schiller. And this matches what is happening here, 10% drops in price so far, hopefully more to come, my daughter is looking for a condo, and I would love to pay less property tax.

Happy1: Zillow still inaccurate in AZ in some cases. A friend put her house on the market for a crazy price about a month ago, about 100k over what it should be. The friend took it off the market because it wasn’t selling. Zillow had the zestimate at the lower price originally, but after she listed it at the higher price and took it off the market, the zestimate showed the 100k higher price. Lol You can’t make this crap up it’s so in your face.

Pending home sales rose for the third month.

Meanwhile active inventory is historic low.

I fear that there won’t be a meaningful correction. Sellers seem to be a scared of losing their low-locked in rates.

The dumbing down of America is caused by people getting their info from reading headlines, LOL.

Pending home sales inched up 0.8% from the prior month, having ticked up for the third month in a row from the lows during the lockdown (April 2020) and still PLUNGED 21% year-over-year.

OK here we go (click on the blue text to get to the article):

Don’t Let the Headlines Fool You about a Tiny Month-to-Month Uptick in Pending Home Sales: Still -21% from a Year Ago, -25% from 2 & 3 Years Ago.Spring selling season volume lowest since Housing Bust 1

Demand is meeting low inventory. Yikes. It’s gonna be a looooooong grind.

If interest rates come down we might even see increasing RE prices.

I keep seeing articles about pending homes sales being up for month now?! Doesn’t look like a crash can happen if there is strong demand that meets low supply?

“I keep seeing articles about pending homes sales being up for month now?!

LOL. Vision impaired? Since you never actually see anything?

Compared to the prior three Februarys, the index value of contract signings plunged…

By 21% from February 2022

By 25% from February 2021

By 25% from February 2020.

Have a good look:

https://wolfstreet.com/2023/03/29/dont-let-the-headlines-fool-you-about-a-tiny-month-to-month-uptick-in-pending-home-sales-still-21-from-a-year-ago-25-from-2-3-years-ago-have-a-look-at-the-chart/

So my house went up 55% at its peak and dropped 10% and this is called a bubble?

I’m not sure u know how bubbles work.

My house I bought in 2008 dropped over 50% in value by 2010. Now thats a bubble

A dip in yields amidst a small bank run unleashed a wave of greed directed at real estate—no end for this housing mania.

No, housing mania has ended.

Banks are losing deposits. They must generate more interest to compete, for which they must lend at higher mortgage rates.

Good report. So many mainstream media headlines only report YoY median prices, which, despite the headlines, are not very impactful…yet. Once we get into May and beyond, the prices will reflect peak to present day which will be a whole other story. Salt Lake City peak to trough is down 17%, though YoY shows a much less dramatic number.

My guess is when May or June comes around, whenever the peak was last year for SLC, the realtors won’t be sending out their cheerleader reports to show it. They are sending out the misleading reports right now, showing YOY increases, and many people are taking the bait. Crooks.

In Ca where I am they aren’t so much doing that as lying about sales. For some reason they report more sales than incoming inventory each month for at least the past 6 months, but inventory has increased a lot. Magical math.

Spot on!

Man! Vegas and Phoenix were hit with a Meteor in the 2008-2013 down times. Holy Mackerel.

Here’s to hoping Phoenix gets hit again.

My spreadsheet of homes in a NOT TO BE NAMED SUBDIVISION have dropped $ 40K + since I started tracking in October. Some have multiple (more than 5) price reductions. Hoping this downward slide continues. I certainly don’t want to overpay and end up like all those who bought in early 2022, underwater when the bottom is hit.

Sorry, I know it is selfish, but everyman for himself.

Jim Bob, you’re not selfish. It was selfish of those who went and bid up the prices of homes the last few years. They are the ones who helped create this bubble.

what small investors dont really understand is that they have one big advantage over big investors…the ability to liquidate 100% and even go short. big sellers simply cannot sell all their assets without driving prices down rapidly. so they merely reallocate small portions. the people investing other people’s money dont cut allocations to zero because if they are wrong, they lose clients.

you can go 100% cash in a down market and then buy in when the blood is in the streets.

the financial media will NEVER tell you to do this. they need people invested in the next sucker rally in a down market.

Yahoo Finance and Market Watch often refer to readers as Traders but NEVER suggest you sell anything? They just trot out the latest buzz stock or bond to BUY! True Traders sell as well as often as they buy.

Don’t feel bad.

You may think the price dropped for you only but it is available to all :-)

For *decades* housing appreciated maybe 3% per year.

Then the geniuses at the Fed tried to “optimise” the US economy out of getting its ass kicked by China.

Result – Fed turns US housing mkt into a rigged casino run inside a madhouse.

Look at those yo yo’ing graphs

More downside to come?

haha as long as it’s still showing this..I am sure I will still hear plenty of folks in OC or fancy LA…but but but..not in my area…it will only flatten then go up up and up…

“Los Angeles metro:.

Year over year: +0.9%.”

Btw, I thought it would be the other way around, at least that’s the way it is in the stock market?

“Down faster than up is a rare occurrence in housing markets,”

Interesting how the corporate real estate investors like Pretium Partners and Invitation Homes starting buying homes in 2012 and many others like them followed suit. Prices start to increase very quickly after 2012. Corporate real estate investors purchased almost 30% of all of the single family homes in the U.S. that sold in Q1 2022 when prices were still going up. And they are still buying.

Easy sort: just pass a law that single family homes have to be on the market for six months before they can be bought by a corporation.

Love that idea! I really do. But then politicians are making big money from these corporate real estate investors so my guess is there will never be any sort of legislation like this.

I would go one further and outlaw any concentrated ownership of single family homes. Maybe allow corporations to build new homes, but not buy existing homes.

The whole purpose of government backed finance for real estate was to increase home ownership, so why do we allow corporations to compete against potential home buyers and drive home ownership down?

“why do we allow corporations to compete against potential home buyers and drive home ownership down?”

Because the rich own the government , lock stock and barrel ?

I’m sorry, but I was under the illusion that the USA was the land of the free.

Reading your post – and others in the same vein – leads me to conclude that the virtues of liberty, independence and initiative have departed the land.

That readers of this esteemed blog could countenance more government control over what either individuals or corporations can invest in is, quite frankly, a sentiment more compatible with dwellers in North Korea.

IanCad:

Government has always had a fundamental role in securing and maximizing freedom for the population.

I’m extremely hesitant for any government to get more involved in housing than they already are. But if it’s true that corporate buying is crowding out families and individuals from purchasing primary residences in the areas where they work, then that both undermines the government’s stated goal of enabling home ownership, as well as reducing the freedom of much of the populace.

I know many people right now eager to buy. Some want to move, some would like a second property, and some want a first home to raise their family in. But basically no one can afford anything right now. **It doesn’t look or feel like freedom to me.** If the govt can do simple regulation to dissuade corporate buying in a way that may enable more people to move, own, and improve their lifestyle, then I might be in favor.

Why don’t we just outlaw ownership of property in general and let a new communist leader dole out homes as they see fit. /s

What an idiotic comment. Are all you real estate haters in favor of communism too? That’s the principal behind your argument. I worked my ass off to acummulate rental properties for my retirement and afterward, for my heirs.

Your brilliant solution – Take everything away from the hard working investors who risked their capital and spent their time building something and give it to all the poor renters who missed the real estate boom for the last fifteen years.

I suggest you go visit Cuba or Venezuela and see how that worked out.

Been to Cuba ”pre Castro takeover” and it was a MESS,,, dad would dress in ”PEON” clothes and we, in this case the Family WE were not allowed into any casino/nightclub,,,

BUT, and it really is a BIG butt,,, almost ALL of the PEONs in Cuba in the mid 1950s were more than happy to HELP our family any way they could,,, including the captain of the ”bum boat” on which we went out to the reef who tried his best to stop dad going deep and spearing a barracuda…

Then, when back to the dock, it appeared to this youngster ALL the town turned out to help the dance line taking that ‘cuda to be roasted by our hosts,,, and then shared with everyone….

Cuba in the ”pre Castro era” WAS a wonderful place, in spite of the mob and Batista,,, but only for those able to ”tie into” the peons…

IMHO, THE CUBAN PEOPLE” will once again ”prevail”,,, likely as soon as Raul kicks the bucket…

IanCad:

The government is so deeply involved in the housing market in the US that ANYONE calling it a free market shows their uninformed hand.

CCCB,

I think you misread gametv’s comment. You may disagree with gametv, I haven’t even thought through the implications of his idea, but ending concentrated ownership of single family homes is hardly the principle behind communism. The explicit goal of communism, after all, is concentrated ownership by the state. Arguably, gametv’s idea is more akin to breaking up monopolies and trust busting that occurred in the United States at the turn of the 20th century. It’s an acknowledgement that individuals are at a disadvantage when competing with the wealth of large corporate interests.

In any event, gametv never suggests state ownership or mentions banning individual investors, much less taking “everything away from the hard working investors who risked their capital and spent their time building something and give it to all the poor renters who missed the real estate boom for the last fifteen years.” You came up with that on your own. Your comment would be far more persuasive if it focused on the value provided by landlords to their tenants, and the considerable risks involved in owning rental properties.

@IanCad

“I’m sorry, but I was under the illusion that the USA was the land of the free.

Reading your post – and others in the same vein – leads me to conclude that the virtues of liberty, independence and initiative have departed the land.”

Should have copied this entire post.

I think you should do a cursory history of the corporation in the USA. From the foundation through almost the entirety of the 19th century the corporate entity was very restricted in their economic activities. They were formed for a limited specific purpose. They had to report to the State board periodically to renew their charter.

The founding fathers were very aware of the dangers of corporate power (East India Company, etc.) and put a very tight leash on them.

The building out of the railroads and the interstate implications began the process of unwinding these arrangements. Corporations only grew in power.

I don’t know where this home of the free BS plays in your mind but it is time for the US to gain some sovereignty back from these vampire corporations that are draining the blood of our economy.

@CCCB –

There is a big difference between promoting communism and disuading that peculiar government sanctioned collective called the Corporation.

and incidentally, have who ever met a rich man or substantial proerty owner who didn’t “work his ass off” —- at least in claim

The problem would be mostly solved by ending loose monetary policy. It’s predominantly if not entirely the existence of the credit mania that makes this malinvestment possible.

Raise cap rates/hurdle rate of return and corporate buyers wouldn’t be paying stupid money prices for housing. No sentimentality with corporate buyers.

I imagine it is much easier to invest in Treasuries and such. These PE firms moved into real estate because collecting rent became the only yield above one or two percent, plus the equity ride up. Hopefully they will move out now as they are sitting ducks for new taxes and maintenance never ends. There are better alternatives. States are now proposing laws against corporations (Minnesota) buying SFH. Plus a whole lot of people are going to have a hard time covering these rents with AI threatening. I’m keeping the faith that the tide is drastically turning on RE.

AF, you MUST be very intelligent , similar to Wolf,,, because you both AGREE with me SO MUCH…

Hope you are doing well in Atlanta,,,

AND know when to get out…

VintageVNvet,

I’ll do my best to agree with you more often. ;-)

FHA does this with REOs. They require the home be on the market 30 days before investors can submit an offer.

It’s not enough. They just drop the price after 30 days.

Hate this idea ! Why should I as a seller be required to wait or accept a lower offer when I want to sell, a house that is mine. Sorry a free market is the only fair market.

Seriously?

No zoning either?

No building permits?

You “free” market folks need to think a bit if you really want free markets.

Corporations have an unfair advantage (limited liability) that should make them ineligible to purchase residential houses.

You answered your own question Jeff:

YES, again IMHO, RE MUST BE a ”free market” ,,

In spite of all the attempts by allegedly professional RE manipulators, especially those claiming various and sundry ”professional status.”

OTOH, due to the fact of RE being SO ‘physically stable” that local GUV MINTs can and DO tax the ”heck” out of it,,, there will absolutely continue to be challenges for WE PEONs who dare to continue to at least try to FIX as in ”rehabilitate” any and all RE,,, for now.

( FYI, was in RE majorly, from 1961-2019, especially fixing up old stuff that needed a TON of rehab/fixing.)

Easier option, tax those properties for what they are, commercial properties, which are taxed higher in many districts. If the property is owned by a business it should be taxed like one.

My last three rentals I’ve received financial documents in the mail for the owners, leading me to believe they don’t file their houses as rentals.

AGREE TOTALLY J:

TAX on residential RE MUST reflect clearly delta b/t ”owner occupied as ‘homestead”,,, and all other owner situations…

IMO, that alone would do the trick to at least slow down, if not stop all together the current trend toward the hedgies and PE folks…

”POWER TO THE PEOPLE” Especially the people who are willing and able to move into every area and do their best to make every area a ”local neighborhood” of folks who will connect locally.

1st TD

They’d be fools to be buying right now, all anecdotal was that Corp money was stepping back at these prices

I am still getting calls from investor/corp buyers. They just want to buy way, way, way under market. At least that’s the only thing I can think of.

10-4,,, many postcards and letters since getting a new phone recently that has somehow stopped all the spam calls and texts,,,

ALL cards indicating willing buyers paying cash with no inspection, etc., etc.

CRAZY RE mkts, still…

Similar to 2006, but even more crazy than then.

We get endless stories about all these cashed up investors who will pounce on SFHs as soon as prices wobble here in the UK as well. But what ‘investor’ is going to dump their money into an asset that is, at best, net yielding around 2.5% when they can get 3.5% on a 10 year gilt? I mean, if they are obsessed with bricks and mortar, they could just go into commercial property which has already repriced by ~20% due to comparative yield performance of REITs.

It works on FTBs and other buyers because many of them believe that real estate is the only investment in town, and if money is not in houses it’s sitting under mattresses or something.

The other story we get is how the median rent paid is still less than the median mortgage payment, which conveniently ignores the fact that here most people are on 2-5 year fixes, so are still benefiting from interest rates that are no longer available to new buyers.

Like crypto, you can tell how speculative an asset class has been by the number and sophistication of the spruikers that surround it.

Wonder what our mortgage friends are thinking. Especially those who granted and hold mortgages from late 2021 to early 2022. Looks like any appreciation, or equity if you will, has been erased with an accelerating down side. Do you think at some point down the line they start reviewing their small down payment loans for risk?

So many are soo deep in denial or just don’t look at it as closely as people around here, any slight dip in value won’t get them to go into concern mode. Even a 15% drop peak to now will still probably be acceptable to them since the general perception is that, this is not a start of a crash but instead just a small drop or level out before repeating the uptrend since 08..

Know plenty of family and friends still think SoCal is invincible and the price will never come down despite data showing otherwise, guess as they say denial just ain’t the river in Egypt anymore, plus one can always find some anecdote evidence justifying price is still strong, people overbidding…etc

You mean the government? That’s who guarantees most mortgages since the GFC, at taxpayer (those who actually pay taxes) risk.

I’m with the people who laugh at the “not in my area” comments.

But when I make an offer on several different houses in Phoenix, I find out they have multiple offers over asking.

To those of you who will now automatically say “you must be a real estate shill propping up the market.”….have you made an offer on a decent house in your neighborhood lately?

“Multiple offers.”

“Above asking.”

“Sorry, we stopped taking offers Sunday night.”

This is the reality on the ground. Two things can be true at once. This data shows average price drops. But there is still rampant, frothy demand to buy a house. And I don’t want to prop the market up. I want it to adjust to reasonable pricing.

It is frustrating to see automatic knee-jerk comments like “REAL ESTATE SHILL” from people who seem out of touch with the reality that it’s still extremely difficult to get an offer accepted on a house.

You’re wallowing in RE propaganda: “Multiple offers” and “over asking”

“Multiple offers” and “over asking” mean zero in real terms.

If you put a home that you think might sell for $500k on the market at $100k to stimulate a “bidding war,” you’re going to get a bidding war. Then you might sell to the high bidder for $450k, and everyone reports gleefully about the multiple offers and the bidding war and the over asking, LOL.

Nother example, you put a home on the market at $500k, and it doesn’t sell. So you pull it off the market a month later, and then another month later put it back on the market at $450k, and it still doesn’t sell. So you pull it off the market, and put it back on the market a month later at $400k, and then it sells for $420k – now it’s “over asking” LOL

Do you see the propaganda here?

This happens ALL THE TIME. That’s why I totally ignore “over asking” and “multiple offers.” They mean zero. All they allude to are the machinations of the RE sales industry. And that’s why I stick to actual data to avoid that kind of claptrap.

There are always outliers as well, supply and demand curves are curves not blocks, there will always be some activity at the tails but over time things work back to the middle. Individual transactions do not speak to the macro environment

I knew Wolf would come in and tell the outliers they were stupid.

But sorry, there ARE outliers. I am looking at pre-retirement homes in a resort community SoCal. And anything on a decent location is going in a matter of days at asking or above, and asking prices are like there has been no downturn.

Are there houses not selling in this division, or with price softening? Yes, on the major boulevards in and out of the subdivision, but anything on a culdesac, no, and premium golf-course locations go within 48 hours with multiple bids. And not at a lowered asking price that Wolf think happens when someone doesn’t agree 100% with him.

So there are exceptions. These will be on golf courses, beaches and other places that will never soften, even in a downturn. Places where people who don’t care about interest rates want to have their own house.

I’m with you that there are outliers.

The issue I’m attempting to bring to light is that even outliers are being derided as “shills” and “liars” in Wolf’s comments across multiple articles.

There are feverish, wild-eyed zealots in the comments sections who leave zero room for nuance, and want to dismiss ANY examples of 2023 sales being similar to 2022 as lies and propaganda.

I 100% agree with Wolf’s data. Why must everyone be deemed a liar/shill?

Whatever, I also heard an outlier that the Sun never sets in SoCal. Can you confirm?

lol. last bust beach homes 1 blk from beach in Huntington Beach that topped out almost at 1.5 mil were selling for as low as $750k. today 2.5mil up. Rents dropped by over 50%. I rented a 1 bd apt in HB by Newport Beach on Hamilton by Brookhurst for $1050 mo. was at peak arounf $1800. Same unit today is almost $2500. Its going to be as always, supply and demand. It amazes me how many in denial about the upcoming renters exodus/bust. There were few renters last bust from layoffs and everything is riding on the renter which most are barely hanging on even now. The layoffs are just starting. My business is completely dead already no buyers. Hold on tough times likely ahead.

I’d be one of those outliers. Have to agree with you 100%. Stuff on the less desirable streets, close to noise, etc is sitting. Most everything else south of the 8 (San Diego), which I tend to watch the most closely, goes really fast. Prices have corrected here but nothing like what was prognosticated, and lately I’ve seen things go on sale for pretty high numbers again, and go into escrow quickly. There’s simply no where near enough inventory to satisfy the local population, let alone the cash buyer retiree wanting out of snowville. If I read the post correctly, and I’m sure I’ll be corrected, this data is reflecting activity from the last few months of 2022. Well, something changed here since then and us boots on the ground folks are seeing it, whether anecdotally or through local stats, before the big name report companies put it all together.

I better break out the steak because I see a black eye coming my way.

Townhouse near me had a for sale sign for one day. The monthly nut at current interest rates would roughly be 2x my rent of a slightly less worthy unit with a $150,000 down payment. A lot of talk on reddit from people trying to buy and stuff still moving rapidly. Need overshoot in inventory and job loss.

Wrong. In my area of Raleigh-Durham the For Sale signs are taken down before a week is up. Houses go very fast, listing prices are rising, average sales prices are up double digits YOY. This is real data. Around the US there are areas with a strong RE market.

Here’s a shocker: there’s more to the country than 20 big cities even if you city slickers don’t know it.

According to Redfin weekly housing data, the Raleigh, NC Metro area market stats as of 3/19/2023:

Off the market in 2 weeks: DOWN 17.9% Y/Y

Median Days on the Market: 50.80 days, UP 27.30 days from a year ago

% of Active Listings with Price Drops: 5.4%, UP 4.4% from a year ago

Median Sale Price: $417K, UP 1% Y/Y, DOWN 7% from the peak of $449K (8/7/22)

According to Redfin weekly housing data, the Durham, NC Metro area market stats as of 3/19/2023:

Off the market in 2 weeks: DOWN 10.6% Y/Y

Median Days on the Market: 48.50 days, UP 17.80 days from a year ago

% of Active Listings with Price Drops: 3.8%, UP 2.1% from a year ago

Median Sale Price: 391K, DOWN -5% Y/Y, DOWN 13% from the peak of 447K (6/5/22)

Ted, you were just smoked by Johnny5.

From Redfin Market Conditions:

“In February 2023, Durham home prices were down 1.9% compared to last year, selling for a median price of $379K. On average, homes in Durham sell after 54 days on the market compared to 29 days last year. There were 264 homes sold in February this year, down from 291 last year.” Summary: prices down, number sold down, DOM up.

“In February 2023, Raleigh home prices were down 1.2% compared to last year, selling for a median price of $390K. On average, homes in Raleigh sell after 44 days on the market compared to 33 days last year. There were 390 homes sold in February this year, down from 508 last year.” Summary: prices down, number sold down, DOM up.

Where is “your area”? Can you provide some data from a site? Because the data I see is actually opposite of what you say.

I agree that the sales tactics you are describing are to blame for some examples.

Your reporting is excellent, and I don’t doubt the -10.5% correction shown by the index.

The past 3 of the houses that inspired my comment were not one of these propaganda sales you mentioned.

The most recent one went under contract in 2 weeks and is pending. The realtor didn’t even want to know my number. She said “honestly we’ve got enough, the seller chose to stop looking at offers because we got bombarded over the weekend.”

It was a small, updated 2 bedroom 1 bathroom house in a hipstery neighborhood near downtown Phoenix.

It was listed for sale at $421/sqft 2 weeks ago.

I pulled up 3 houses sold on the exact same street, same block, going back to September of 2021 (well into the home price bubble runup):

$346/sqft

Sold Date: March 24th 2022

$355/sqft

Sold Date: September 14, 2021

$421/sqft

Sold Date October 29, 2021

The house I was looking at went under contract for OVER $421/sqft this week. No failed listing, re-listing, price drops, etc.

The final numbers will show when the sale records.

But if what the realtor says is true, and the house indeed sold for over $421/sqft with no concessions, it shows an example that buyers are still having an extremely hard time getting their offers accepted even at peak value, let alone the -10.5% from peak they might dream of after seeing the charts.

I’m not an agent or a shill.

I am rooting for house prices to drop.

People telling stories like mine are being immediately labeled as liars or shills, as if they’re making up stories that cannot possibly be true under any circumstances.

My only aim is to show that in various neighborhoods, the fomo is still out there, and the buyers reporting these experiences aren’t all brainless drones regurgitating realtor propaganda.

We need transactions aka suckers for price discovery to happen

I don’t think you’re a liar — though I do wonder why you’re not voting with your wallet given that you seem to agree that it’s nuts to be out there shopping right now.

I see it, too, in the areas I track. I think in some ways what you are seeing is an exaggeration of your own reflection — willful buyers who were hungry & poised to buy irrespective of a correction. It’s the last gaspers. Saw it in ‘08 and ‘09, too. Who knows — their recklessness will probably be rewarded with a bailout when it all goes to hell, while the prudent & the shrewd are left screwed once again. I really hope not.

You may be right, but I don’t know. All things being equal, smaller homes typically sell for more per square foot than larger homes in the same area. Were the other three houses you list the same size as the 2 bed/1 bath that recently sold for more than $421/sq ft?

Also, you mention the recent sale for over $421/sq ft was updated. What was the condition of the other three sales you list?

Finally, October 29, 2021, was well into the price run up, but 7 to 9 months before the peak. The home which recently sold above $421/sq ft according to the Realtor may have sold for below peak pricing even if it was above $421. You haven’t really provided enough information to assess the status of the market in the Phoenix neighborhood you mention.

Downtown Phoenix in the older and historic areas are hot RE markets. ASU is still expanding downtown. Just a Phx resident for 68 years verifying the info.

Prices did drop during the last RE crash but shot right back up again.

\

There are outliers, like I stated below, but the market is not on fire like many realtors suggest. I have a hard time believing most realtors. I’ve caught too many in lies.

Geezus – really? Phoenix?? It’s nigh unlivable.

Josap: i think you are remembering the last RE crash incorrectly. It took a long time for Phoenix real estate market to come back after the last crash. Other markets shot up, like Denver, way before Phoenix did. Phoenix came back slowly until about 2016 it started taking off somewhat but nothing compared to Denver though or other cities. Phoenix was lagging. I know, I came back to Phx in 2018 from Denver, and bought a home in NE Phoenix, great home with a pool, and it was so inexpensive compared to Denver. 2018 was still affordable in Phx. I wouldn’t pay what I sold my house for in 2021 in Phx.

I think Phoenix is going to be an outlier in the market in general for some time to come. It’s estimated that 50000 people are going to migrate to Phoenix per year over the next 10 years due to the employment opportunities that are going to be coming online. (TSMC, among other employers springing up in town)

Personally I’m worried about the water supply there, as well as the average temperature creeping up over time.

Week of march 17-23 there were 456 new listings in San Diego, new pending sales of 480 and sales of 471. The active inventory is 2432 in the whole county. I’m not sure how many total units are in the county but there’s over 3 million people living here. This is an outrageously low inventory for that many people. Folks are coming in from outside the county as well so things are really tight. 95 of the 456 new listings are already in escrow. All of this is sourced from the San Diego Association of Realtors and Mortgage News Daily Data. I suppose I’m a shill for sharing this info but I don’t think so, I’m just observing what’s happening and have a few numbers to back it up. Also, 1.4 drop year over year certainly isn’t the blood bath many were hoping for.

San Diego lost population for the first time in over a decade. At the same time, lots of new homes were completed and put on the market. This stuff is just hilarious.

Sales in February plunged by 33% yoy, median price -1.5% yoy, days on the market more than doubled yoy (California Association of Realtors).

But enjoy your dreams.

…and then the house actually has to appraise if the buyer is relying on financing. Also, offer does not mean diddly squat if it’s mired with contingencies and don’t get me started on FHA requirements. I always always turn down FHA loan offers.

Wolf,

Simply they can lie to you by saying that. Just to get a better offer for a better commission . No one will know.

wait for the renters collapse. More time needed.

Job market will have to weaken noticeably first.

In my complex, its evidence tenant quality has already decreased since I moved in two years ago. Complex allows split (bi-monthly) rent payments. Apparently, some who live here are too broke to float it to the end of the month.

Down here in South Florida, rents have dropped quite a bit, and there’s a lot more inventory on the market.

A lot of people who wanted to sell have held off saying “Ehh, I’ll just rent it out until the Fed pivots and rates drop.” If they can’t easily rent it out, they’ll become sellers.

Apartments I work at are having more trouble finding tenants than normal, and running about 3x more move-outs per month than usual. The company usually worries about all the money we’re losing by having a unit vacant for 7 days instead of 5, but all that’s pretty much out the window now, with units routinely vacant for months. They still don’t want to budge on the rent though, just asking whatever YieldStar says to ask. Barring the gov shutting YeildStar down, I think multifamily rents will roughly track the behavior of home prices that are driven by MLS or Zillow (ie. comps, which are full of feedback effects). Rents haven’t quite “flopped” the other way so the market seems basically frozen where I’m at in CA.

Meanwhile my SFR landlord isn’t raising the rent and is talking about how he’s giving me a deal due to the “souring rental market”. Anecdotal of course.

Cities need to enact capacity requirements, as in “your building has been around 3 years now, it should be 70% full.” I think a policy like that would help the homeless situation in a very fair manner.

AF – I am noticing similar in the complex I live in. Just small things like junkier cars, more car repairs being done in the parking lot, more people per unit, people not picking up their dog crap. This is supposedly a “higher-end” complex.

I agree. I saw the same thing happen in 08 and then 16 (in the UK). Rents went crazy as landlords started unloading properties to try to get out. Only a small number of properties cycle tenants at any point in time, so if you get a few of those being left empty as the landlord attempts to sell, you can easily create a severe supply shortage.

But the rental market is much more perfect than buying, so unless you have rising median household incomes in an area, rents eventually have to revert. You can only pay rent out of earnings.

In the UK rents have been stagnant since 2016. The headline a few weeks back was how rents were now rising at the fastest rate in nearly a decade, but when you read the article the annual rate was 5%. I mean, inflation is 10% here, with wage rises at around 7%, so rents are actually decreasing in real terms during this ‘rental crisis’ (that being said, it is very hard to secure a property due to landlords trying to exit).

I watch a market in Orange County as a barometer of a nice middle class neighborhood. Prices are still insane and some homes are actually turning over. Inventories are at near record lows again.

Sellers are simply not yet flooding the markets with inventory in most markets. And there are still some sucker buyers, who simply cant wait.

Those buyers will regret it.

I think that we will need to see inventories build during the summer and then the homes that dont sell will finally compete for buyers with lower prices.

Keep in mind that hope springs eternal, so sellers need to face multiple waves of downside before they believe that prices can go even lower. There is also no distressed properties in the market right now. That wont happen until prices have already fallen another 15-20%.

When real estate is down for 12-18 months more AND distressed properties hit the market, then we will see how low prices can go.

Property prices haven’t increased,the value of money has been devalued ,printing press running overtime ,digital counterfeit cash . But it increases taxes ,so everything is going great hope I’m not on plane ,train or car when it crashes

I agree. I’ve been looking in several markets and have noticed many of the decent properties go under contract within days, even if they’re overpriced. The junk stays on the market longer. I don’t see this changing until inventory rises.

I am going to copy what someone I despise once said on Twitter…”Prove it or it didn’t happen”

Give us the address of the house or a picture showing this house you made an offer on and have multiple offers so we can see if this house or many like it in your area are getting over or multiple offers at or above market price.

I am open to believe you since this world is nuts anymore so maybe people are that dumb and still FOMOing into houses but just as Wolf said, you can generate bidding wars with a significantly lower price so either prove it or you’re just blowing smoke up our A$$

“I am going to copy what someone I despise once said on Twitter…”Prove it or it didn’t happen””

This made me laugh out loud.

Was that twitter someone our previous POTUS? I can’t wait to see what Stormy can prove, lol!

I wonder what props will be pulled out as evidence during the trial.

Here’s 3 I found that sold in March for well above the asking price after being listed for the zestimate price. Took me 90 seconds to find them.

https://www.zillow.com/homedetails/3711-Dixie-Canyon-Ave-Sherman-Oaks-CA-91423/20033406_zpid/

https://www.zillow.com/homedetails/13905-Valley-Vista-Blvd-Sherman-Oaks-CA-91423/19985457_zpid/

https://www.zillow.com/homedetails/4020-Benedict-Canyon-Dr-Sherman-Oaks-CA-91423/19987119_zpid/

Sorry, I used to live in that area and that’s almost like using homes in Beverly Hills to demonstrate that people in the general populace still have money to spend. All three properties are “south of the boulevard,” leading up into the Hollywood Hills. People who buy there have money, period, and they don’t want to be down in The Valley with the rest of the plebes, so, of course, you’re going to have bidding wars until things *completely* fall apart. It would take a heck of a lot for them to be hurting financially.

The drop hasn’t reached that area yet. It will take time. I think there are areas around Miami that haven’t dropped yet as well.

Another thought—let’s have a law passed where there’s a record or a verifiable log of all legitimate qualified offers on a home to eliminate any shilling by listing agents.

Require a licensed auctioneer to run the bidding.

“But when I make an offer on several different houses in Phoenix, I find out they have multiple offers over asking.”

Knifecatchers are needed for prices to continue going down, but damn, how does a person who reads here end up in the market for a house right now? It’s like a person who watches a crowd of people die on the streetcorner from tranq, then says “oh yeah, I want some of that!”

Timing the real estate market is not always the primary factor people use to buy a house.

Number 1 it’s extremely difficult to find the house you need at the exact bottom or even bottom 10%.

Number 2, based a buyer’s age, financial situation, and other factors happening in their lives, it may still be a good time to buy (especially if they get a good price.

Number 3: I have no idea what “dying on the streetcorner from tranq” is, perhaps you could enlighten me. But whatever it is, it does not seem to be a good analogy for purchasing a permanent shelter at a price you are willing and able to pay.

As long as you sell and buy at the same time, timing doesn’t matter too much.

If you want to downgrade in response to current market conditions, that still involves buying a house.

I live in Phoenix and went to look at a pre-foreclosure that needed a ton of work. Like the sewage pipe to the street was dug out and propped up against the side of the house. The agent told us they needed an all cash offer, 7 day close, leaseback and they already had 18 offers. The thing is the house took about a week to go under contract which seems strange if they really had 18 offers. My point is agents have been using these tactics for the past few years because they’ve been working but who knows how much of it is the truth.

These people have zero compunction about lying. The part they often leave off is that the “offers” are loaded with conditions that most won’t be able to meet.

I was close to putting an offer on a place in St Pete, FL last year. Apparently the listing agent told my agent that there were multiple offers over asking, and even TOLD US what the highest offers were as of that day. Either they were lying to drum up the price, or they were illegally revealing bid amounts of competitors to drum up the price. Some shady sh!5.

House ended up selling for 675k (well over asking price). In a blue collar neighborhood where block homes were selling for 275k just a few years ago. Madness.

Just checked and the Zestimate is now 705k. No freaking way. No chance.

Inventory and demand are in the toilet in Phoenix. I’m in Phoenix as well. Go to the Cromford Index which is what real estate pros use to see what’s happening in Phx real estate. Demand is in the red zone which is not good. Sure, some houses are selling, but I’m also seeing tons of price reductions. With both inventory and demand so low, you may have demand just a little higher than inventory available for certain types of properties, but the market is pretty bad except for a very small number of sales. It is not a frenzy like 2020, 2021, or 2022, not even close, and I expect what little is left of demand to collapse when the spring FOMO wears off. Starting in mid to late June, the market should be even worse as far as demand like it is almost every year in Phx.

In California the house prices only went down by 10% on average during the last 5 busts before rebounding so if you want to buy a house on sale compared to peak then now is a great time to buy!

At least that’s what my realtor told me. I think I’m going to wait it out a little longer…

The circumstances of every single financial market are unique. Prices are now at extremes never before seen in terms of monthly mortgage payments versus income. As we hit recession, there is going to be max pain in all markets.

We’re still right in the middle of the biggest speculative mania in the history of mankind.

So when will the recession happen? I can’t see one happening until unemployment goes up.

Almost by definition a recession is unemployment going up by about 1.5% -2% since long term real gdp growth is just under 2%. If you are an investor waiting for a recession to be called is too late. A lot of leading indicators say we are close.

If that were my realtor, I’d fire him or her.

The Realturd mantra is “real estate always goes up.” When it finally stops going up they say “it’s just taking a breather.” Then when the price declines are impossible to hide, they say “the declines are over with and it’s going back up.” When it continues going down they say “the declines are over with and it’s going back up.” When it continues going down they say “the declines are over with and it’s going back up.” See a pattern?

Depth Charge, you make me laugh! I love your comments.

Ask a realtor if this is a good time to buy a house. He/she/it will invariably respond “It’s always a good time to buy a house.” I think it is in the Realtor’s Handbook, I forgot the page number.

In San Diego, during HB1, home prices went down by 40% plus.

Even in the most expensive coastal areas, it went down 40% plus.

People used to say, come what may, home prices in San Diego can never go down.

They went down well over 50% in rural areas north of the bay area.

The amount of money from eidl and ppp loans that went to invest in real estate is probably a few hundred billion.

Makes sense. How much of the billions of dollars pulled out of banks like SVB are going into real estate now?

That -10% may be true. However, in the last bust, it was more like 50%….. And even in the nice locations that “never” drop.

We just shaved off one year’s worth of increases, so not much of a bubble burst so far. And this, after a huge increase in mortgage rates. Housing prices are really very sticky so far. Long way to go until we see some real bargains.

Another bubble created by Evil Govern ment. This ride down should be epic. We Shall See.

I hope this is just the beginning. This group notwithstanding, prices are still impossibly, stupidly high just about everywhere.

There is simply way too much money sloshing around in the system right now. There have been extremely slow builds in inventories in things like autos, RVs, etc., but nothing to even remotely suggest we’re back at historic levels. Lots of stuff still getting cleaned out on the regular. We are nowhere near stopping inflation.

People still have too much money.

Lulu lemon is epitome of discretionary spending selling sports pants for $140 plus. It’s stock went up 12% after hours after ER.

Fed tightening is not working.

It’s not working because of the $4-5 trillion they printed since March of 2020, only $500 or $600 billion of it has been removed.

That seems like a lot. Are they bedazzled on the hems or something?

People often splurge when they’re fatalistic or depressed feeling…”these pants will win her back,”

Purchase Confirmation #s tickle a gland that get’s the good juices flowing for .5 a moment. What would be interesting is to know how many pairs of those fancy pants wind up getting returned…

Prices are still too high with the current mortgage rates.

At the end of the day, people buy monthly payment, not the home price.

True. How much down and how much a month are the questions.

There are going to be some fantastic tales misallocated money if the Fed sticks through it enough to fully deflate this current housing bubble.

I am not even on the market for anything, nor have I been searching for fun, nor do I have any money, etc… and I got sent the largest fanciest, most-expensive-cardboard-glossy-stock advertisement for a giant luxery (and overpriced even by luxury standards) condo complex in a distant Boston exurb. They were proudly advertising what any reasonable mind would understand as the worst of all worlds: downtown-Boston-like expensive living, city-like lack of space, city-like lack of greenery, hours away in the middle of nowhere with country-like commutes, and none of the yard, greenery, etc… or any possible near-by country side attraction like a ski slope, national park, etc… that people might consider moving that far out of Boston to have.

I don’t have time (and already dumped the “magazine” which I should have saved for posterity and so can no longer follow up even if I wanted to) but I kind of want to see the research on what the financials and plan for this place is, I have trouble imagining this is destined to be anything other than a hilarious money hole failure of a project.

To be fair I know a few people who moved that far out into condos during COVID when telecommuting became a thing. But they all moved into condos that cost like 1/10th the cost of this ridiculous complex and if they don’t have some greenery in the complex itself they have something valuable to replace that basically next door — like one of them has a ski-slope he literally walks to in 10 minutes with his gear when in the mood. Even there though, many of them are now moving back into the city though a few of them are keeping these places as a “vacation” home where there is something “vacationy” about them like said ski-slope.

But the real question: how many distant exurb “all off the negatives of city and country living in one, maximized!” complexes are going to be revealed when they implode spectacularly assuming a bit more air comes out of this bubble?

There are going to be some fantastic tales misallocated money if the Fed sticks through it enough to fully deflate this current housing bubble.

Amen, I have lots of popcorn on hand and have been expecting this POP for some time.

“Amen, I have lots of popcorn on hand and have been expecting this POP for some time.”

Make sure to stock up on “Just For Men,” unless you like the natural grey look. Jerome “The Societal Butcher” Powell plans on dragging this thing out for decades. Right now we’re in “no landing” mode.

Exactly. With these mini rate hikes, it could take decades. Now is not the time for Powell to be experimenting with his soft landing approach.

I’m confident the interest rate cycle turned in 2020. Not sure longer part of the curve peaked late last year or is in a sideways move now prior to another interim high.

When the interim peak hits, partial retracement from the 2020 low which could last awhile. But not that long after that, rates are destined to go higher and eventually “blow out”.

Doesn’t matter what the FRB does or doesn’t do. They don’t control the trend, except when market sentiment lets them. Look at the recent bank failures and the British pension instability last year.

Yes, I know it was temporary. One of these days it won’t be. There is nothing any government or central bank can do to prevent falling living standards. Neither create any actual wealth.

The UK is probably the major economy in the worst shape now. It will potentially be the first where a sinking currency will cut-off more “free money”, monetary or fiscal policy. If it doesn’t, living standards will decline or crash anyway.

Already old and bald, and ready for this to take a long time. Trillions and Trillions to go.

Augustus,

I am not sure the trend is broken. Its peak to peak and trough to trough. Lets see where 10 year bottoms the next recession.

Is there a significant portion of people moving back into the cities they fled in 2020? If so, that’s good news for declining home prices outside the cities.

Those condos might completely sell out and still be unoccupied.. as “investments”.

Yes, but they are still expensive in high property tax Massachusetts. How long can they be held as “investments” if no one wants to rent them, no one wants to go to them as air B&B, there value keeps declining precipitously because the air is coming out of the housing bubble. Your mortgage payments keep going up, and you pay massive tax on them every year.

A money bonfire is hard to think of as a long term investment.

I am at the point that in the total basket of goods a nice single family home isn’t attractive now. Price plus carrying cost are just too much unless you really need one because you have kids at home.

Nat,

Fellow resident of the greater bean – I’ve always been amazed at all the new ‘luxury’ buildings going up, even 25-50 miles outside the city. I can’t imagine where they’re finding people who are willing and able to afford these prices, AND deal with the expressway/pike traffic.

Exactly. There is a giant complex down in Randolph that overlooks 495 at its widest and also most congested point. It is proudly labeled “luxery condos” in a large sig visible from the highway.

How “luxery” are your condos in one of the poorest suburbs overlooking the freeway obviously made out of cheep prefab bits. Is an over 1 hour commute durring the week (but probably 20 mins on off hours) in some of the worst traffic Boston has to offer a luxery? Is having access to some of the most under funded schools in the city for your kids a luxery? I could go on.

This is one of the worst, but there are so many things like this here.

Wolf how are high end properties handled in the CS index? Are transactions above a certain range thrown out? Palm Beach county is part of the Miami index. We are a haven for the .01 to park their money. They seem to sell it amongst themselves from one LLC trust to the next. Bill Lauder was just confirmed as the person who purchased Rush Limbaugh’s house on PB for $155M. RL purchased it in 1998 for $3.9M. Minor improvement’s were made. It does have 250 feet of beach front and a nice sea wall. Is this property and similar high end properties excluded from the index?

I am sure he can afford it, but he is going to take a massive hit

It’s not an issue because of the way the CS is structured — it’s based on “sales pairs” not median price. So the price of the same house compared to the last time it sold. Please read the methodology. I summarized it in the article in the paragraph starting with the bold “Methodology”: And it links the full methodology. So I’ll repeat it here:

“Methodology. The Case-Shiller Index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors (methodology). This “sales pairs” method makes the Case-Shiller index a more reliable indicator than median price indices, but it lags months behind.”

In other words, in your example of Limbaugh’s house, the CS compares those two prices, figures the price change, weighs it by the years that have passed between the sales (meaning, since the prior sale occurred in 1998, it will have a very small weight), makes adjustments for improvements, etc. If something weird happens, such as a house doubling in size between sales, the CS kicks it out.

Don’t ask me any more questions about the methodology. Read it. The PDF is linked in the article.

The ridiculously expensive houses on the barrier islands are not a good barometer.

Look at the more normal houses in Boca, Delray, Lake Worth, Palm Beach Gardens, Wellington, etc.

While they haven’t crashed yet, they’re sitting on the market a lot longer and I’m seeing price reductions.

The tide has turned.

Crazy that Miami real estate is practically holding up! Apparently nobody sees the FL. flood inundation panic coming there. Miami is particularly poorly positioned as it is built on porous limestone and much of the city is on septic well systems. When the King tide comes in, unwrapped “snicker” bars float around your house, not good for r.e. value!

Readers of Wolf are smart enough to know what to do there.

LOL!!!

Same with Phx and Tucson. No one is seeing the elephant in the room. Even though we had many storms this winter, Lakes Mead and Powell were not helped much by it. In fact, Powell was at its lowest level ever in February. Wallstreet is already getting involved in water in the West. Water will be unaffordable. I’m seeing private water companies, Epcor, gouging people on the outskirts of Phx, and the issue with wildcat developments like Rio Verde will only get worse. I’m a native Arizonan but looking to get out. Our state leaders keep kicking the can on water. People are stupid, don’t do their due diligence, then expect to be bailed out from their bad choices.

Also there’s this whole alfalfa farming thing?

Yep, that’s one thing definitely. So many moving parts. It is a little scary if one is paying attention.

city of miami is old and small. much of unincorporated miami-dade county is on the city owned sewer system.

You could mistake these housing charts for charts of cryptocurrency prices.

Looking like crypto from Dec 2021.

We should have a long way to go if the comparison holds true.

It’ll be interesting to see what happens to these numbers when we get to march reflecting some dips in mortgage rates from the first quarter.

Rates are looking at holding the floor so far but we’ll see 🤞

If rates don’t hold the recent lows I don’t see why this bubble won’t reinflate.

Still seems like a competitive market and plenty of people looking to buy with rents rising also.

IF housing makes a comeback I’d guess that’ll only lead to more stubborn inflation and a harder landing in the next couple years

It’s only competitive for the very few stupidly out there trying to buy now. Sales are low, inventory is low, demand is low. Most people can’t afford the current prices. People need to think it through a little more instead of relying on the less than accurate media’s analysis. If there is any accuracy in any of their analysis, it’s way beyond the headlines and buried in the article, so people need to read the entire article and think.

They do tend to go down when cripto crashes. I noticed that. Sales also tend to go down a few days or a week after bad financial news. IDK why it takes a full week or so sometimes. I think some of these buyers aren’t playing with a full deck.

Or the South Sea Bubble. Or the Dow Jones for the 1920s.

Just a coincidence.

It is horrible that Fed turned housing into a boom and bust market. Expect more bad policy as the current bubble implodes.

Thank you Wolf. I love this stuff!

It’s interesting that Dallas and Denver did not experience Housing Bust 1.

Depending on the city, it appears the first Housing Bust was 9 to 10 years from bottom to bottom (2002~2012).

It will be interesting to see when and where this next bottom occurs as the pinnacle appears to have occurred last year.

This next bottom to bottom time frame could be closer to 14-15 years (2022 to 2026~2028).

This next bottom to bottom time frame could be closer to 14-15 years (2012 to 2026~2028).

Denver took a sizable hit during the 2001 tech downturn and didn’t run up prior to 2008 like Vegas and Phoenix.

I am in San Diego. We are special and this time is different.

/sarc-off

Special can mean many things….I would put house humpers in SD in the same special label as Special Olympics

No disrespect to the participants in Special Olympics, I think they are extraordinary in a good way…house humpers in SD, not so much

“Discovered by the Germans in 1904, they named it San Diago, which of course in German means a whale’s vagina.” – Ron Burgundy

How long do we have to wait? In Austin, TX, price went up like 80-90% in two years, then we see a 5-10% drop – it’s hilarious. If one year of high interest rate can’t take it down, do we have any hope?

Yes. As has been mentioned numerous times, the current rate of decline is abnormally fast. You appear to want it to go even faster, but that’s not likely. Got to be patient. The market is tanking even faster than it did during the previous bubble.

The last housing bust took five years to work its way to the bottom, and the Fed’s rate were at 0%, and it did massive amounts of QE. Now it’s the opposite. This stuff is not cryptos that spike and implode overnight.

They sure do seem to explode higher like cryptos. I mean, a 40% increase in house prices in a year in some locales? That’s ridiculous. The FED has so badly screwed up that the speculative fever is still raging out of control. They know it, they just don’t want it to end.

DC

Totally agree!

2% inflation target?

Less see….

2021, 2022, 2023

We should be 6% higher (sans compounding) than 2021

We are likely to be 20% higher.

So why isnt the Fed pushing for prices ROLLBACKS?

They want to stack smaller increases on top of the spike.

That reveals their intent.

Wolf, I wonder if you know where to find analysys like this one for other amrkets (US, UK, Canada). It shows that the cost of mortgade debt is outpacing even the suposedly red-hot rental markets in Australia.

I know that US is a special case because of 30y fixed mortages, but I don’t know, maybe the rules of orginations for 2nd homes are more restrict, or most would be rental investors don’t qualify and go for a HELOC or whatever.

Anyway, found the info interesting and maybe other folks find it also:

https://www.macrobusiness.com.au/2023/03/sydney-and-melbourne-property-investors-bleed-losses/

If inflation really got out of control, might we see ‘the king of all housing bubbles’ where people wanted out of $’s worth increasingly less, and where would you put them in terms of large amounts beside used homes?

Considering used homes are going down in value.. IDK. There is no safe haven for addictive personalities.. Maybe rehab facilities?

Why would people place most of their liquid assets in an illiquid asset (housing) in an economic environment like that?

Gold and other metals would be the first choice if we’re talking about USD hyperinflation. Or maybe other hard currencies like the CHF. Even many company shares would be a better choice. Or a second passport to get out of the country for someone who doesn’t have one already.

Buying residential housing in a future US hyperinflation would be a horrible decision. Probably stuck in an illiquid asset where the politicians would cap the rental income you can charge or mandate that you let someone live in it for free.

Safe as houses is really the only thing the proles know, why would they deviate from their norm?

The proles, as you call them, are looking for a home for their family. Possibly a place where the kids can walk to school. Maybe someplace in between where each parent works.

A place they can afford to live. Wages are up. Middle class is doing well right now. If they have job security, why not buy?

According to ALL the ”old money” folks who I have worked for in the last five or seven decades AF, only a couple of ”assets” have kept up with inflation:

1. Waterfront RE.

2. Fine art, (similar for jewels, etc., maybe. )

This is based on many decades, at least back into the first few decades of 20th century that most on here want to ignore…

Pulled up stock charts of 1920-35 everything crashed ,gold and mining stocks first yo recover . But it’s in a bubble also,deflation is only way out ,this is a GLOBAL debt CRISIS.

This is almost the opposite of 29

We are chock full of liquidity

The biggest threat to these markets is geo political

Its pretty clear the Fed will save everybody

Is that kind of like a lottery where everybody gets all 6 numbers and wins a buck, buck-fiddy?

Wolf, I clicked the Google link it served me up on my evening news speed read. Enjoy your latte care of sufferinsucatash :) hahaha

Thanks Wolf for the great analysis and detail. I expect we will see much more significant data in two-three months or a little more.

I am intrigued by what is also happening in parallel with the US as the European Central Bank and the Bank of England increase their rate, along with Turkey and a number of other countries. The era of cheap money has taken a turn. But most amazing, I haven’t seen Japan in the housing news. I expect there to be much action in Japan this decade as the 30 plus years of cheap money ends. We aren’t so exceptional!

I live in middle TN. Used to be a great place to live. Our town is growing by over 10k people per year. Has grown that fast for the past 10 years, and is projected to grow at the same pace until at least until 2030. Real estate prices have tripled since 2013. There is not an open lot of land in site where multi-family units are not sprawling. On the plus side, crime and drugs are now out of control.

I own 15 SFHs. Rents 3 years ago were $900/mo. Now they avg $1600/mo. There are hundreds of applicants when one of our homes goes on the market. There is virtually no turn time. Last 2 have paid a years worth of rent in advance just to secure a home.

Guy bought next to our worst home last Feb for $205k at 5%. His payment is $1300/mo. Rent is $1200 max as it is a street over from the vibrant and thriving blessing of section 8 housing. He just put it on the market for….$250k!!! These are 1000 sq ft, no garage, gravel drive, single bath shitboxes in one of the worst parts of town! A quarter million for a happy meal. I paid $72k in 2019….

Payment on $250k now at 7% will be approx $1700/mo. I’m telling you, this is completely INSANE and there is NO universe where it is sustainable.

Very sorry to hear that the disease has infected your home. It’s horrible the way this thing has spread. The Fed has enabled all of this.

Thanks for sharing this.

If you think this is not sustained then just curious why can’t you sell few of your homes ?

Actually, I am going to sell everything (including my personal home) and cash out. Equity is 3x times my actual investment. I have a new revolutionary and fairly ambitious idea.

I am going to buy 300 acres and put in a cul-de-sac. Rebuild my home at the end along with my son’s on either side. We own free and clear in brand new custom homes. Going to build a 10,000 sq ft shop along with new recreation area: inground pool, hot tub, pavillion/grill area, pool house, and sports court.

Along cul-de-sac I am going to build 6 x1500 sq foot homes on either side for a total of 12 new homes. Own free and clear, all rent for $1600 per month to replace ones all over town with more money and less maintenance. People can initially opt to use amenities for additional $150 per month..

Over time, I want to transition people to the homes that want to be part of cooperative: butcher, mechanic, heavy equipment operator, HVAC/electrical, framers. The 10k building will house: wood shop, auto mechanic bays, fabricating shop, meat processing area, and gym with room for other ideas: maybe a bakery, coffer shop, country store or event center…

Can invest in dump truck, dozer, skid steer, and track hoe with trailer for heavy dirt work. Can invest in wreckers, dumpsters, portable toilet business, septic business, lawn mowing business, tree trimming business or anything any of the young men in the community want to do for 6 figure idea. Can build homes or buildings…Will have 25 black angus cows, and meat chickens, egg layers, greenhouse for own organic food and sell excess.