But it still predates the 5% & 6% holy-moly mortgage rates, whose impact on prices we’ll only see in a few months.

By Wolf Richter for WOLF STREET.

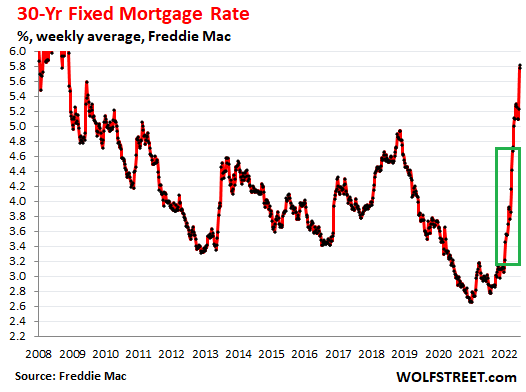

The first “deceleration” and “signs of a tipping point” cropped up in the S&P CoreLogic Home Price Index, which was released today. But today’s data for “April” consists of the three-month average of closed home sales that were entered into public records in February, March, and April, representing deals that were made a few weeks earlier, roughly in January, February, and March, funded with mortgage rates prevalent at that time and earlier for home buyers with pre-approved mortgages with rate locks when they were pre-approved, so roughly based on the mortgage rates prevalent in December through March, ranging from 3.2% to 4.7% (green box):

Other indicators of the housing market that don’t lag as far behind have shown more advanced shifts in the underlying dynamics, including sagging sales amid a surge in supply in May, a sharp drop in mortgage applications in May and into June, and a surge in active listings in May.

The S&P CoreLogic Case-Shiller Index will gradually begin to reflect those dynamics over the next few months. Today’s release for “April,” looking back at a period earlier this year, when mortgage rates were a lot lower, still reflects the mad scramble to buy a home and lock in the mortgage rates at the time before they rise even further.

The National Case-Shiller Index still jumped by 2.1% in April from March, but that was down from the 2.6% spike in March. Year-over-year, the index spiked by 20.4%, but that was down from the 20.6% spike in the prior month. This suggests “further deceleration ahead,” said CoreLogic Deputy Chief Economist Selma Hepp said in a note this morning.

“In particular, there is a buildup in overall active inventory as fewer buyers are rushing to make offers, resulting in an increase in the share of homes that have reduced their prices from the original list price,” Hepp said.

“Also, there is a notable deceleration of monthly gains in the Western markets where a rush to lock in favorable mortgage rates pushed home price growth higher in prior months,” Hepp said.

The top three most splendid housing bubbles.

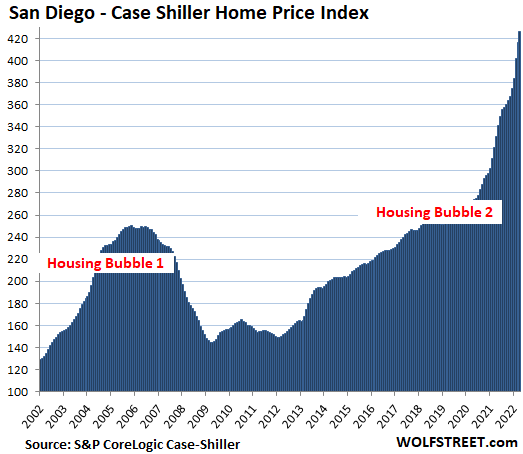

San Diego metro: Prices of single-family houses jumped by 2.3% in “April” (average of February, March, and April), but that was down from the 3.7% spike in “March.” Year-over-year prices spiked by 29.0%, but that was down from 29.6% in March – hence first signs of “deceleration.”

The index value of 426 for San Diego means that home prices exploded by 326% since January 2000, when the index was set at 100, despite the plunge in the middle.

This price growth of 326% since 2000 is 4.5 times the rate of CPI inflation (+73.2%), which crowns San Diego the most splendid housing bubble on this list, followed by Los Angeles and Seattle. All charts here are on the same index scale as San Diego.

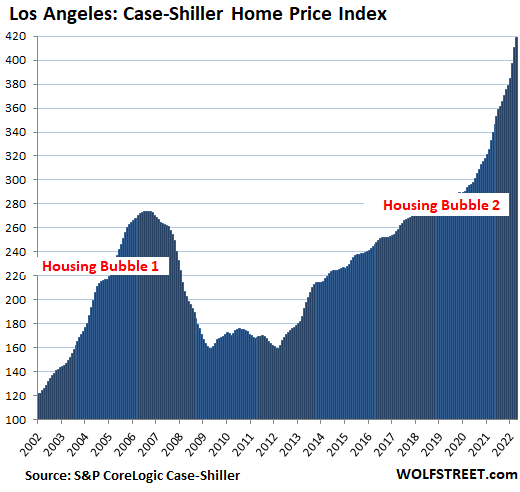

Los Angeles metro: The Case-Shiller index jumped by 2.0% in April from March, but that was down from the 3.3% spike in March. Year-over-year, it spiked by 23.4%. The index value of 419 indicates that house prices exploded by 319% since January 2000, making the Los Angeles metro the second most splendid housing bubble on this list:

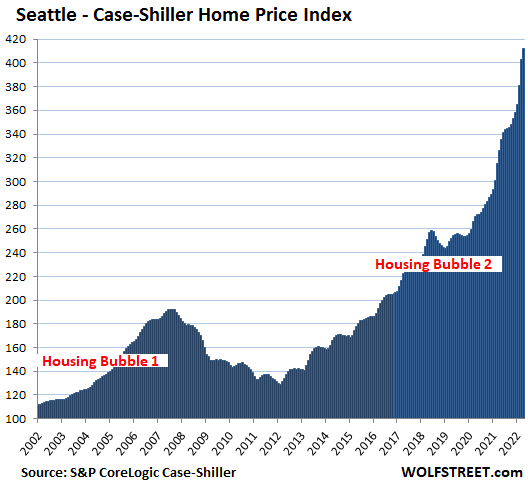

Seattle metro: The index jumped by 2.3% for the month, but as crazy as that seems, it was less than half the 5.6% spike in the prior month – another sign of the “deceleration.” Year-over-year, the index spiked by 26.1%, but that was down from 27.7% in the prior month. Since January 2000, house prices spiked by 312%, 4.3 times the rate of CPI inflation:

It’s just house price inflation.

The Case-Shiller Index uses the “sales pairs” method, comparing the price of a house when it sells in the current period to the price when it sold previously. It incorporates adjustments for home improvements. By tracking how many dollars it took to buy the same house over time (methodology), it measures the purchasing power of the dollar with regards to the same house, and is thereby a measure of house price inflation.

The other most splendid housing bubbles in the 20 City Case-Shiller Index.

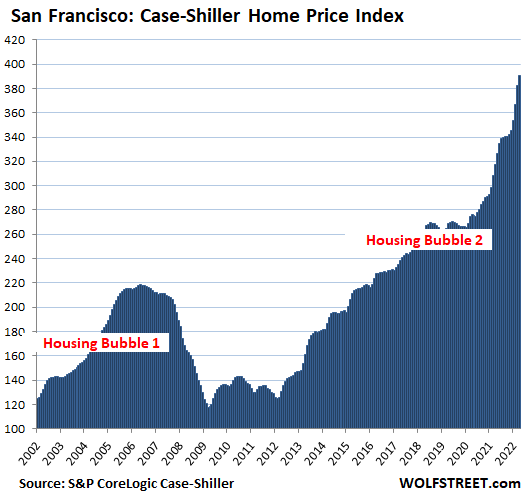

San Francisco Bay Area (five-counties covering San Francisco, part of Silicon Valley, part of the East Bay, and part of the North Bay): House prices jumped by 2.2% for the month, but that was just about half of the 4.3% spike in March. Year-over-year, the index jumped by 22.9%, but that was down from the 24.1% spike in the prior month – hence the “deceleration”:

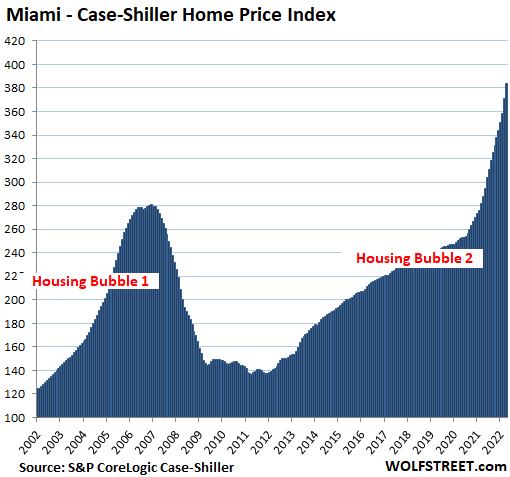

Miami metro: The index spiked 3.4% for the month, down from the 3.6% spike in the prior month. Alas, year-over-year, it spiked by 33.3%, up from 32.0%, the fastest ever in the data, faster even than at the apex of the Housing Bubble 1, before Miami’s epic Housing Bust:

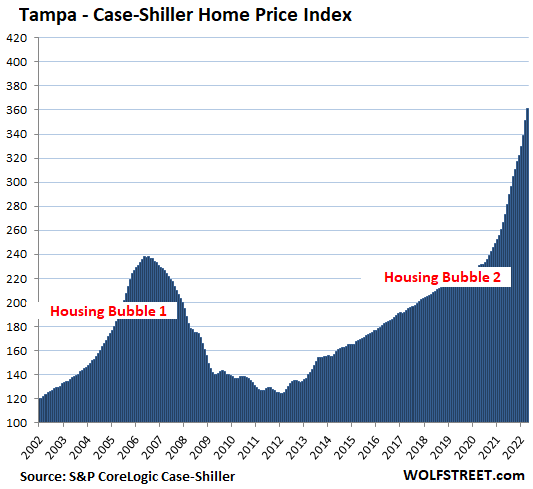

Tampa metro: House prices spiked by 3.0% for the month, but that was down from the 3.7% spike in the prior month. Year-over-year, prices spiked by 33.3%, down from 34.8%, which had been a record that had out-spiked the craziness just before the Tampa’s epic housing bust:

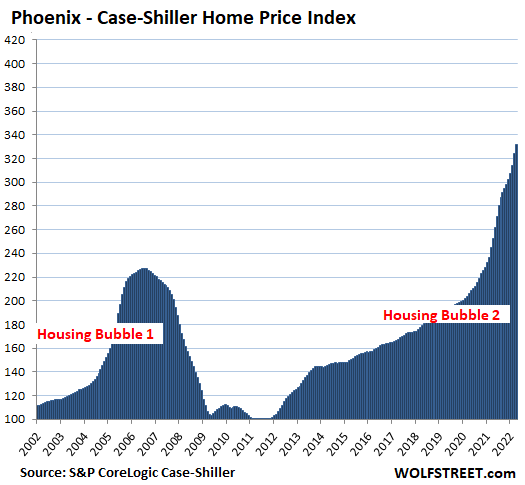

Phoenix metro: The index jumped by 2.5% for the month, down 3.0%. Year-over-year, it spiked by 31.3%, down from 32.4%, and the 10th month in a row of over-30% year-over-year spikes:

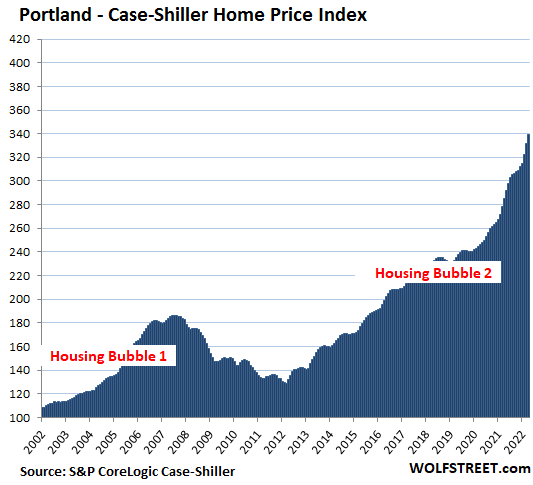

Portland metro: +2.2% for the month, down from +2.9%; and +19.1% year-over-year, down from +19.3%:

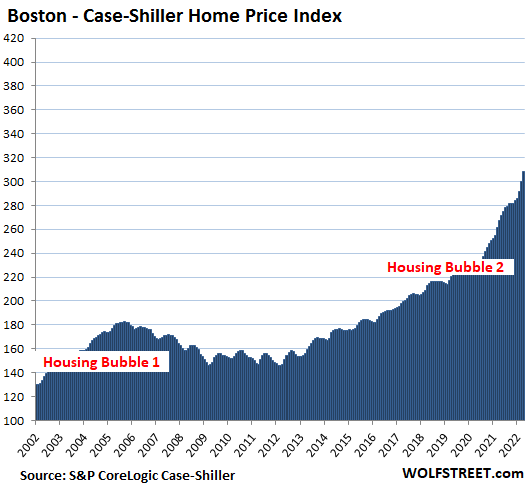

Boston metro: +2.8% for the month, up from +2.6%; and +15.1% year-over-year, up from 14.5%:

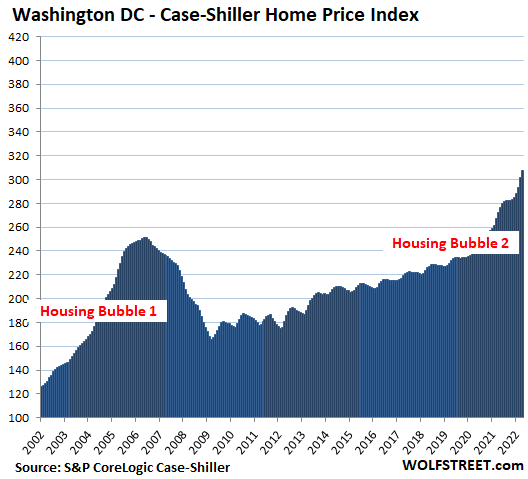

Washington D.C. metro: +1.9% for the month, down from +2.9%; and +12.7% year-over-year, down from 12.9%:

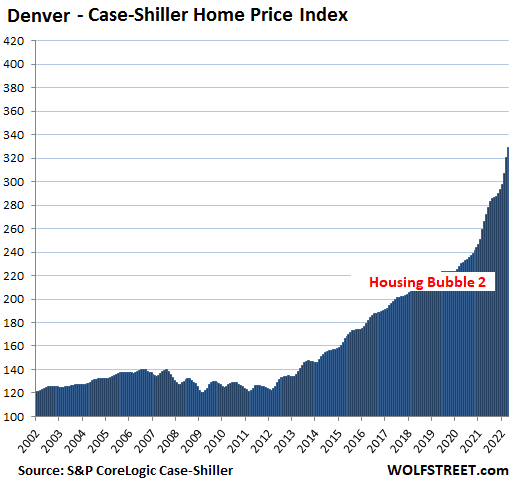

Denver metro: +2.5% for the month, down from 4.5%; and +23.6% year-over-year, down from 23.7%:

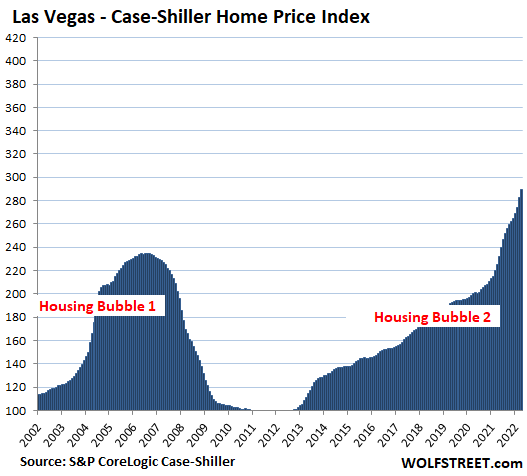

Las Vegas metro: +2.3% for the month, down from 3.1%, and +28.4% year-over-year, down from 28.5%:

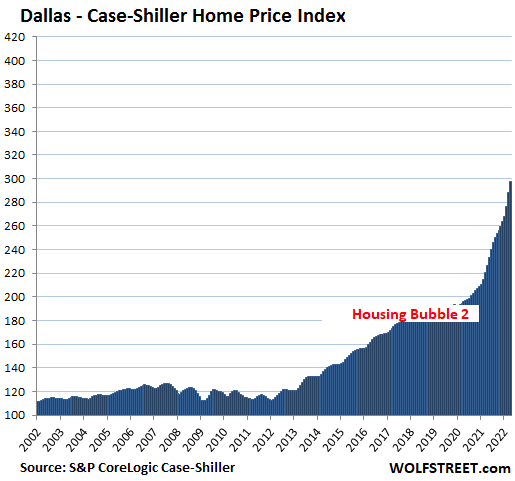

Dallas metro: +3.2% for the month, down from 4.3%; and +31.0% year-over-year, a new record, up from +30.7%:

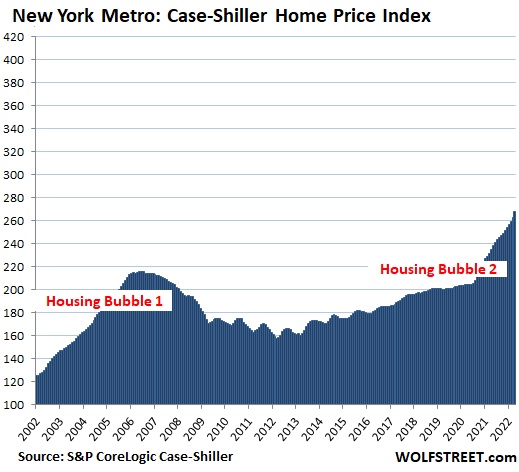

New York metro, the huge market within commuting distance to New York City (“New York Commuter,” as the Case-Shiller calls it): +2.0% for the month, up from +1.6%; and +14.3% year-over-year, up from +13.7%. With its index value of 268, the New York Commuter metro has experienced 168% house price inflation since January 2000, 2.3 times the rate of CPI inflation.

The remaining cities in the 20-City Case-Shiller Index (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) have had less house price inflation and don’t qualify for this list.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Proof that a primary residence is a good investment, on the way up! Those are fabulous charts for homeowners.

Investment:

the action or process of investing money for profit or material result.

Everything is a good investment on the way up! See sh*t coin (pick any of the 20,000)

unlike crypto

houses are real assets that you can kick

I’m fine with my recent purchases – I don’t care about today’s value

only cash flow

I think “cash flow” is the most ridiculous accounting gimmick ever invented. What happens if you lose your job? What happens if inflation eats away at your cash flow?

Best I can tell total return on sp500 is up more than the the hottest of the housing markets above in 20 years since total return at end of 2021 was just over 10% per year the last 20 years. Average retail investor doesn’t use leverage on stocks though. People who put 10% or less down on a house 20 years ago could cash out now and have a heck of a return on capital.

Very poor definition.

That’s why I use “investment”, “investing”, and “investor” in quotes when using it.

It’s usually (overwhelmingly) speculation.

Most supposed “investment” doesn’t create any new value. It’s profiting from price changes. That’s also how anyone profits from speculation.

Another distinction is that actual investments make an economy or society actually wealthier. That’s doesn’t ever happen because of rising asset prices.

As for the homeowner, while they live in it, it provides a hedge against rent increases, enables them to get into more debt (by “cash outs”), increases property taxes, and increases insurance premiums.

It’s important for the property to at least maintain relative value with other homes when moving.

Anything anyone does is a speculation. Including driving to work. You measure the risks and benefits as best you can. And most people get in the car and drive.

A.F.

When I first moved to California (Thousand Oaks) in 1981/82 time-frame, I was shocked to see that many homeowners had two or three mortgages on their property.

Where I came from (Connecticut), that practice was unheard of back then.

Those “cash outs” you mention have been going on for a long time in California.

”Purchase money Second” mortgages were common around that time AA, in order for folks without the cash for the down payment to buy.

Cash loaning ”partners” were very willing to ”help out” as long as the deal looked good.

Every RE broker could line one up to make a deal work,,, and the inflation being SO high made the second almost as secure as the first – at that time.

Really kinda sad to see houses we paid around $30/SF selling these days for over $1,000SF in the bay area.

Guess we were just ”lucky,” eh

What Wolf doesn’t understand is housing markets can be very different. Wolf I wrote a comment when Toronto housing home prices were average 500K and you said they were a bubble but they are now 1,6000,000$$ At the time I said you don’t understand the Toronto area market. Even now prices are stable and as interest rates rise. Ok a depression, which I don’t rule out, will crash home prices but a recession at the most 10 to 15 % will knocked off home prices! If you request i can send you the reasons why your bubble call was wrong and the subsequent increase by 200% of home prices. I would never pretend to be an expert on 500 housing markets as all have different dynamics!

correction to 1,600,000 in above comment

Greg, bubbles always inflate way bigger than anticipated and last way longer than expected. I hate to sh#t in your Easter basket, but your observation actually supports the bubble hypothesis. It definitely doesn’t refute it.

“Greg, bubbles always inflate way bigger than anticipated and last way longer than expected. I hate to sh#t in your Easter basket, but your observation actually supports the bubble hypothesis. It definitely doesn’t refute it.”

Agreed. In one of my econ classes years ago they gave a short history of the South Sea Bubble and it showed the same kind of ridiculous price appreciation, way beyond any sensible connection to value or income. And it held up for years, with a lot of people chastised for “missing out” on all the gains. Bubbles like that can be sustained for many many years if enough powerful insiders band together to keep it going, as indeed the Fed did here in the US with ZIRP and QT. But that just means the collapse is going to be even more horrific when it does happen. Canada and the USA have major housing bubbles simply because income can’t anywhere near keep up with home prices. The Federal Reserve should have never allowed such asset inflation in the first place.

housing everwhere in the US is a massive bubble that will sink along with all the other financial bubbles caused by corrupt congress and the corrupt Fed. Housing prices in Toronto are simply absurd.

100%

They are like ticket scalpers. Investors should be building new homes for people to live in not flipping homes or buying them all up to rent out to the less fortunate.

What did you have to say during Housing Bust 1.0…or to the tens of millions whose interest returns have been cut 75% over the last 20 years…all to make this doomed, repeated, volatile stupidity possible?

It was a brutal downturn. When my spouse was cut back to part time in ’09 we almost lost our home and our rental. It was a fire sale to sell all the crap we’d accumulated just to stay afloat.

Vowed that I would never put myself in that position again. 10yrs later I was debt free. I’ll never borrow a dime from anyone ever again.

this

never again

“Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves.”

― Norm Franz, Money & Wealth in the New Millennium: A Prophetic Guide to the New World Economic Order

Exactly, You have to be prepared. I was a custom home builder when the GFC happened, once it became clear that building was OVER I bought a new Freightliner Tractor (for cash) and 7 days later I was making a nice living trucking. Besides being debt free, I had a lot of liquid investments, a CDL, a Journeyman Plumbers certificate….. My wife and I used to drive OTR together, but now she had a job she liked in the medical field (with good benefits) so I went out solo. Thank god for GPS and Satellite Radio.

That’s the right attitude. If only this was more prevalent in the US, Canada and Australia, maybe we could have all avoided this everything bubble to begin with, even the Fed’s attempts to keep inflating it.

Out west,

I am debt free as well, but I am rethinking about the merits of living debt free in a highly leveraged world.

If you live debt free and conservatively then your time to financially do well is in the middle of a recession when highly leveraged people are distressed sellers.

My biggest strength is I am not much of a consumer any more, so I am not tempted to borrow. But real estate is tough to do without using leverage when all prices are based on leverage.

yup – it’s a corrupt fiasco aimed at manipulating asset prices to give the illusion that all is well in our bankrupt country.

Tulips also, briefly, met these requirements. These are actually evidence of massive bubbles. LOL

Still, we can comfort ourselves by reading news about Chinese-CCP real estate developers, the ginormous bubbles they created, and their Chinese victims: just imagine you bought a condo to be built in the future but left incomplete-uninhabitable on land leased for 20-50 years at most, for 30 to 50 times your annual earnings (by borrowing from family and anyone you know) then its value went down 50% to 80%. Some condo buildings are now even getting demolished before they were even finished or ever occupied. LOL!

I watch prices at our local beach. I saw a house on Zillow that was purchased at top of market in 2006 for $850k. A few years later they tried to sell, but sold over ten years later for $350k loss. It’s currently for sell for about $900k. With Fed created volatility it’s more important than ever to get the timing correct.

I watch prices too. I bought a rental for 62k. Sold it 1 year later (2020 feb). It sold for 96k. They in turn sold it 8 months later for 132k. Then it sold for 142k July 2021. When has anything gone up so drastically without any recourse.

Outwest,

You realize those charts are not a reflection of how good things are but how bad things are?

Your primary residence is your home.

Your home is not an investment.

That’s certainly been my attitude. The only people it’s remotely like an investment for, I think, is my children who will inherit it.

Your definition for investment is tautological, as it uses the word “investing”.

On average, the primary residence has a relatively mediocre to low ROI. Especially when you figure in transactional costs, taxes, and borrowing costs. Housing is best considered by most as purchasing an asset for primarily consumption, like a car or boat, where you might get lucky and make a profit, rather than a serious investment unless you are actually trying to maximize returns from renting it out or otherwise generating income.

People get confused because home depreciation is not as bad as some other big assets and it sometimes served as a forced savings plan while paying off a traditional mortgage, assuming they were not already extracting equity through additional financing. But it’s not really a true investment, just a less stupid way of spending money unlike, say, a boat or car, because the odds are more in your favor of getting a return rather than a loss upon sale.

You can always cherry pick data to make an “investment” look like a good investment. Even consoles, GPU cards, stamps, or tulips!

What’s maybe new is the national volatility of SFR’s with the boom caused by loose lending standards and low mortgage rates followed by a crash followed by a boom caused by super low mortgage rates and WFH. Historically, I believe you could see that degree of volatility in local markets, but I don’t think it has been seen on the national/international level for this asset class.

“People get confused because home depreciation is not as bad as some other big assets”

Hmmm. Really? I believe it depends on which country you own a home.

We in the US suffer from a positive bias on this point. Such a long period of economic prosperity translating to exponential population growth in rising SOL. This is what ultimately underpins home appreciation. But the US’ population growth has hit an all-time low, SOL in prolonged decline and the economy is structurally weakening….

When you look at those charts, just remember the Fed was suppressing mortgage rates all the way up to the end of the graph. Could they really be that incompetent? The mistake has already been made. There are going to be some angry people when the booze runs out.

I am noticing a lot of open houses here in San Diego which echoes a similar trend at the end of 07/beginning 08 just before the bubble popped.

Rancho Santa Fe was the canary in the coal mine last bubble in late 2003 which signaled to me to sell in late spring 2004, just missing the absolute peak on a price per square foot basis by a few months.

I see inventory has more than doubled since the start of the year. SD RE is toast and my prediction is that all the gains from the start of the plandemic on will be wiped out and then some – depends on the fundamentals of each market

We pray, for the benefit of the next generation who cannot currently afford to buy homes for their families, and for the the economy in general, that all the gains since the start of the pandemic will be wiped out and then some. That will be best for everyone. Those who succumbed to FOMO and bought will be hit hard and may lose their homes, but this is a lesson we need to learn. Shame on those who orchestrated this disaster.

Open houses, price reductions, removing the listing for a week then re-listing, and sales falling out of escrow all happening now.

I am in San Diego and I can corroborate your observations:Lot of price cuts and open homes.

Sd home prices are way way over priced.

It has to come way down. Lets wait and watch.

Here in Southern California we rather love the notion of $100,000 houses now selling in the $2 million to $5 million range and it makes it really easy to sell an existing house and simply buy another for all cash. We really hope that trend will continue to accelerate and nearly nobody has their houses on the market right now to further that wonderful goal.

My old home (sold 2 years ago) in Vancouver WA (a fast growing suburb of Portland Or) I track regularly to get a handle on prices.

It peaked about 6 weeks ago at $1,350,000. At this time Zillow (the most aggressive with pricing) has it at 1,295,000.

My current home in Indianapolis is down about $20,000 but the pricing here is much lower in general.

So……it looks to be starting down.

I am in Portland and already renting 😉

I expect prices to drift lower 1% per month on average for the next few years.

Wolf – I think you have a stalker

His stalker has to be okay with really cold water, riptides, fog, inattentive boaters… he’ll drag up early. And may require rescue.

My apologies WSF for having a giggle at your handle.

You are absolutely correct. Peak to trough will take years and, on average, drift lower by a small number every month.

I kind of doubt it will be that slow and steady. I think some investors will panic. Offshore investors and second home buyers living off savings and stock cash outs will act like a school of fish if it becomes clear it’s on a long down slide.

Yes I think the slide accelerates as the Crypto fall-out turns into real losses for creditors on a larger scale. The need to shift assets to maintain liquidity will eventually spill into housing which is already poorly positioned. A burgeoning glut of availability with start really showing downtrend and the 20+ percent of houses that are purely speculation and not lived in, will find their way to market, then perhaps more of the variable rate mortgages as rates continue to increase. Pop goes the bubble!

That must be quite a house! I built a beautiful house on San Juan Island with a water view for $400k a year ago. 2000 sq.ft. with a 1300 sq. ft. shop.

I’ve been watching the Denver market closely. It seems like what’s gone under contract in the last few weeks is pretty much all under ~$600K, so it very much looks like the higher end of the market is drying up. Many repeated price cuts on the higher end homes. Not huge, 10-20k on a $900k home, but the prices are starting to soften at the top. Bear in mind, these $1M homes were $500k 10 years ago.

Correction, I said “higher” end but I’m talking about the middle of the market. A million seems high to me, but now it’s just a house. A friend joked “I always dreamed of living in a million dollar house, I just thought it’d be a lot nicer than this one”.

I am seeing the same in South Denver suburbs. I believe the peak will have been April or possibly May of this year. Prior to that time things were selling within a week often over asking price. Now things are sitting for several weeks and there are price cuts. Still not a lot of inventory in my neighborhood and there are still a lot of people moving here, but I think the price peak here just passed.

I am following the sales and listings in my piece of paradise in Naples, FL. Listings of SF homes are up from 525 on 3/1/22 to 1,350 today. When I compare the closed sales for the last 7 days of June to the same period in 2021, sales are down over 50%!! We are getting close to the end of the greed phase of the cycle.

On Zillow Las Vegas was at 3800 on Memorial Day weekend. Now it is at 5800.

I expect LV and Phoenix to be at the center of the next crash, again.

The above charts (all ten in the aggregate) make housing bubble 1 look sane by comparison.

One house I’ve been watching since listed has already seen 17% price reduction in little cuts here and there over two months.

Wild ride to the top in Phx but so long as there are still 500sq ft houses listed for $500k we haven’t even come close to the bottom.

Cem

Think of it like a dam. First a small crack leads to a dribble. Then the wall collapses and then the flood.

Your Correct Las Vegas and Phoenix likely will lead the Price drop

However this time Intensified Vastly due to Covid and most importantly Water as Lake Mead has dropped so far they had to drill Lower Taps to feed the City. Water restrictions Lawn removal

on and on and don’t forget that Covid has slashed Casino Income.

I bought a Fixer direct from Wells Fargo Foreclosure Dept unbelievable Deals Feb 2012

Like a 2,000 SQ 4 Bedroom 12,000 SQ Lot Good Neighborhood

10 Mins to downtown same to the Strip $62,250 Cash

Rehab costs where about$10,000 with a New Roof AC ($5 K )

Sold in 2017 $230,000 now its $456,000 Redfin so missed the boat Humm

This time it could be Much worse with (1) Water Issues (2) Covid / Casino Income …. Jobs ….

Las Vegas is a Adult Comic Book always has been But without Water, lawns, Covid , Casino Income the place always was a

Desert anyway it will be interesting to Watch this time what about the Water ?

I lived in PHX from 2001-2011 with a break of about one year. Most of it I’d call a dump.

I guess to someone leaving California it’s cheap and appealing but not otherwise. Life quality wasn’t bad, but the summers are just brutal.

Back when I lived there, there were a decent number of good paying tech and FIRE jobs, but it wasn’t much of a (regional) HQ market. Incomes were at or below the national median. LV is far worse even though housing is cheaper.

Logically, I also expect the housing decline to be faster and deeper. The main qualifier I have is that the government will almost certainly implement another mortgage moratorium on GSE paper to forestall a price decline. I’m also expecting a partial temporary retracement of the bond bear market which I think is going to surprise most people. Nothing moves in a straight line indefinitely and this includes mortgage rates.

AF

What do you portend the affect of current, and future, water levels of lake Mead and lake Powell will have on the LV, AZ, and southern Cali areas?

To the above post on water impact in PHX and LV, I have no idea.

When I lived in PHX, I was renting. I didn’t know when I was going to leave, but I knew I wasn’t going to stay. My employer of 18 years did me a favor and laid me off, giving me 48 weeks of severance.

I can’t see Naples existing in its current form in 10 years. About 2/3 of the population is over 70, living in overpriced mcmansions that will be impossible to maintain with climate change and super expensive energy bills.

“Lots of people seem to be really motivated”

“It’s a gully”

(From “The Big Short”)

In depression,banks trade your account for a farm . As told by my grandmother.

Tim McxLean and Rockhard…..thanks……this is what is called channel checks. The stats are usually slow but the people know what is happening in their local markets.

Hopefully the SoCal bubble will pop harder than the giant pimple on my face when I was a teenager.

Sellers asking price still in land of Hopium. $1m for modest home in areas like Ladera Ranch or Placentia still seen being listed..Insanity..quoting a certain RE agent YTuber

I just don’t understand how people eat the NAR’s nonsense about “there is a housing shortage so prices will go up.”

You either qualify for a mortgage or you don’t. So if you don’t qualify due to high mortgage rates and you can’t make up the difference with savings, then you can’t buy the house. Shortage means nothing in this case.

The NAR is now backing off that claim. It’s acknowledging that the market is softening or “normalizing” or whatever.

The term is shifting. The market is shifting. Price improvements are wide spread with houses in good locations are getting 5 to 10 offers, not 30 offers anymore.

/S

The Titanic shifted before it sank.

I drove past my vacant lots today. They are building new houses in both areas. Unsold inventory has risen from ridiculously low levels. Ten years ago there were for house for sale signs everywhere. Not today. I understand some people were moving out of certain neighborhoods causing investors to worry. Northerners have been moving into my area.

You know things are starting to look bad when propagandist Lawrence Yun back off on telling you there’s a never ending shortage and hinting at market softening. Think he was telling people market was “softening” in 08-12 too

So, it’s a bubble? Will this one will pop like the first one?

Anybody think incomes in LA have gone up nearly 400% since 2000?

Those 3 bedroom houses with 8 cars parked in front argue otherwise.

The index numbers (y axis) illustrate just how much unthinking blind faith in magic and endless ZIRP money printing lie behind the “healthy, booming housing mkt”

Yep, this is what so many of us have been trying to say to the crowd that keeps bleating that “housing can only go up! it’s not a bubble because there’s such a shortage!” As usual the bubbles get over-thought like crazy to try to justify “this time it’s different” thinking. A bubble has the same basic nature everywhere for every asset: when prices soar way beyond what incomes can realistically pay without massive debt (and even worse when the asset is for basic needs, like healthcare, education or shelter). Housing in the USA is way beyond what incomes can afford, which by definition makes it a huge bubble. And it fill find a way to burst, one way or another.

People have short memories. It was only 14 years ago that there were tons of bank owned properties sitting with the notice taped to the door. The deadest market I have ever seen. I talked to small town realtor that didn’t sell a house in an entire year.

My recollection is that 8 million SFH went through foreclosure (out of 50 million SFH with a mortgage, and 75 million SFH total) in Idiocy 1.0.

That was enough to lower Bubble Idiocy 2.0 sales volume to about half that of 1.0 but the scary thing is that the Fed/DC seemingly doesn’t care about the repeated bubbles they are creating.

They have ZIRP and apparently no other tools/refinements to try and mitigate the repeated ruins (each of which takes a big chunk out of the country economically).

@CAS

Its because its all a ponzi scheme ;)

That is very true, as inflation levels reach a point where the standard of living is closer to third world conditions.

Housing has to decline in price enough so that this is not the norm or case; whereas a home like this is not a crowded group or boarding house.

From a mortgage calculator, for a 30 yr mortgage for a $500,000 loan,

at 6% (current rate), the monthly payment is $2998

at 3% (lowest rate since 2016), the monthly payment is $2108

Mortgage lenders will typically not want to lend to someone who is paying more than 38% of household income on mortgage, property tax, property insurance, and HOA fees.

Home prices have to come down because they are still priced like the 30 year mortgage is at 3%.

What kind of fool would loan money with only 20% down on a market that has that kind of history? Oh that’s right you and I will be bagholders if market goes south.

I’m not sure if people really understand the math related to the increase in mortgage rates from 3% to 6%. Assuming a $400k loan, 30 years, fixed at 3%, the monthly P&I payment would be $1,686. Same loan at 6%, monthly P&I would be $2,398, a significant increase of 42%. In order for the P&I payment to remain constant at $1,686 per month and assuming a 6% fixed 30 year mortgage, the loan amount would be roughly $281k.

Putting this in perspective and assuming the down payment on the house would be relatively consistent, the loan (or home price) would need to decrease by roughly 30% for a buyer that is qualified at $1,686 per month. I understand that other variables are present but let that sink in a moment, a home would basically need to decrease in value by 30% to maintain the same monthly payment. And since the majority of home buyers need loans to purchase a home, the increase in rates effectively prices them out of the market creating a cascade effect resulting from a lack of new home buyers (no new first time buyers prevents old first time buyers from selling and moving up the ladder, so forth and so on).

I’m not saying that home prices are going to decrease by 30% but when you start to see new listings stack up faster than the BS out of Washington, well Houston, we have a problem. Here’s a link to the tip of the iceberg in the Phoenix area as listings have skyrocketed over the past 30 to 60 days.

I would also like to remind all the people out there that make reference to the fact that a 5 to 6% mortgage rate is still low by historical standards. Well it is but not when you apply it against a home that is overvalued by 50%. That’s the problem as a 5 to 6% mortgage rates do not work for a home that is selling for $600k plus (the price driven higher by reckless Fed policies), when it should be selling for $450k.

I don’t believe sellers have truly digested the impact the 100% increase in financing costs (from 3% to 6% in record time) are going to have on their homes. As listings stack up and the length of listings increase, sellers had better reset their expectations and understand just how impactful the increase in interest rates will be. Or as the old saying goes, “those that sell first sell best”.

Yup. What I tell people is this… for every 1% increase in rates there is roughly a 10% decline in the loan amount for a fixed level of monthly payment. Your example has a 3% increase in rates, and you observe a 30% decline in the loan amount for a fixed level of monthly payment, exactly equivalent to my rule of thumb. This effect is huge. It will eventually wreak havoc on the RE market. And there is every reason to expect rates to go much higher than 6%.

Right now the Fed funds rate is 1.75%. It was 0.25% until recently, and was 0.25% from about 2010 to 2016.

The 30 yr mortgage rate bottomed around 3% and now is about 6%.

So how much more do you expect the 30 year rate to increase if the Fed funds rate increases to 3% or 4% ?

To 8.5% like it was back in May 2000 ?

Yup, good points, sadly though lemmings are only program to repeat certain taking points over and over again like parrots..”Interest rate is low” that was and in some cases still is their parrot narrative. Have friends and relatives telling need this but can’t even tell you what the FED does or what’s Federal funds rate.

What won’t ‘be different this time’ is the certain bailout by the federal government of lenders. People will get shunted to the curb, but the bag holder who lent ridiculous sums of money to fuel the bubble, will get his money back. It would be cool if the owner got bailed out, but lost the home, which would go back to the lender. Who would not get bailed out.

Feds hold a lot of MBS,ship might sink

The market in Los Angeles is far worse than that. Right now the inventories are still pretty low, even though then have doubled in some areas. Homeowners STILL believe that prices only go up.

What it all takes is a year or two of price declines, driven by a lack of demand. That is all it takes for the psychology to finally change. When people believe that home prices will continue to fall, and there are some foreclosures hitting the markets of people who got sucked in during the bubble, then sellers will finally collapse and sell at more normal prices.

The smartest homeowners know that cutting prices now, even aggressive price cuts, is smarter than waiting for the first round of comps to come rolling in. As reduced price comps come rolling through the market, buyers will use those reduced comps to ask for even better deals.

This is going to take a while folks. We should force the Fed to liquidate the whole pile of bonds it has purchased and let the economy and market get back to a place of normalcy.

When are we gonna hold the ringleaders for this shit show accountable? For All the price fixing, collusion, double dipping and market setting that goes on with realtors, mortgage brokers and their bankster buddies.

Looks like racketeering to me? A RICO charge for the lot of ‘em?

Never all are part of crooked cartel ,only bottom feeders,take the brunt or die .

The Case-Shiller 2.3% April month to month increase in home prices is 27.6% annualized. Housing inflation seems to be at warp speed. I would like to see housing prices go down and me be able to buy a finer place for pennies on the dollar. It is not happening. Wage growth is only 5%. The stock market is decelerating.

Give it some time DH.

Though there is certainly no certainty that any particular local RE market will go down as far as last time, based on prior crashes it is very likely.

When our modest cottage here in the saintly part of the tpa bay area has gone up from approximately $85/SF to slightly over $350/SF since ’15, ya just gotta know it’s going to go back down at least somewhere close to $100 IMO (after ( to use suny12’s term ) being involved with FL RE since ’57.)

Will repeat having watched a couple of ”fixer” houses on a sailboat water canal in Palmetto asking $885K each in ’06, then go to auction for $225K in ’09!!!

Of course, it COULD be different this time, eh?

Last time they built homes faster than they created jobs. Now there are WFH jobs. There was crazy loose lending before the foreclosure crisis. There are recent reports of a SW Florida tourism slowdown attributed to airline schedule disruptions and high gasoline prices. It is resulting in decreased room bookings, that affects restaurant revenue, etc.

I have cash on the sidelines.

I watch a guy that says Tampa area is going to have a heck of a bust. He seems to have the data to back it up.

I think if there is a collapse, it will be faster this time because of social media. In 2008, Facebook use was still mostly limited to college students who had no property. Now in 2022, plenty of 30-70 yr olds are all on social media platforms of various kinds, and any anxiety about a crash will probably spread faster.

DH, I second the advice from VintageVNvet. The RE market moves slowly, though I expect the decline will eventually accelerate.

In the beginning the decline happens at snails pace

But then it happens quite fast.

No love for Boy-See?

“When are we gonna hold the ringleaders for this shit show accountable”

That would be the criminal counterfeiting FED . Jail time for these creeps

would be the start to saving our nation.

I looked at the Sacramento area on Zillow last night and had my first “holy moly look at all that inventory” moment.

The inflection point is becoming visible to the naked eye now.

Now if only .gov can resist doing something stupid like 40 year zero down interest only mortgages or AirBnB host subsidies.

In my S.F. south bay neighborhood, three months ago, my zip code only had 4 homes for sale on Zillow. Today it is nineteen. Just adding to the antidotal evidence…

140 homes for sale on Zillow in my zip code in SF (94109), which is a huge number. They’re all over the place, from $400k to $41 million, lots of “price cut” by $75,000 or whatever. This is really happening.

This is the “housing shortage” coming on the market, hahaha

My county has went from ~1200 listings last month to an eye popping 1978.

County north of me went from 300-400 a month to 1300ish.

It’s… Beautiful.

Thought I would have a look at my home town’s namesake in the USA, so went to zillow Manchester NH. Found a 2200 sq ft 3 bed house/3 bath house for roughly $569,000…..wonderful house but couldn’t believe how cheap it was…compared to my inner city Manchester UK prices. That’s roughly £460,000, chicken feed… lol. Maybe I should look at other areas to see the crazy prices….

At least the “housing shortage” was transitory.

$400K? Is someone listing a porta-potty?

JeffD,

A tent in our back yard, or similar :-]

Just kidding, kinda. These are small condos. Condos are ice-cold in SF. Year-over-year, the median condo price dropped in May. There are now three listed under $400k in my zip code. I just looked at one of them more closely. Seems like a decent condo with new-ish kitchen stainless steel appliances, etc., but it’s just two blocks from the Tenderloin, which is not a great location. Been on the market for a while.

That’s only something Canada would do, Trudeau already brought in $40,000 tax free saving accounts to save for a down payment for a home while Canada has the second biggest housing bubble in the world.

I think the cost of housing (even if it goes down) will still be relatively unaffordable for many years; I think we are seeing a re-set in the standard of living in the United States that will be a long term trend. How long? difficult to say. Factors include….Part of it is due to deglobalization, part of it due to increasing cost of financing, i.e. interest rates, part of it due to financialization of housing by investors.

“I think we are seeing a re-set in the standard of living in the United States that will be a long term trend. How long?”

Try effectively “forever”.

The social decay is so extensive and the economic rot so deep, it will easily last as long as it will matter to anyone reading this blog.

It would be one thing if there was actually an indication for even a hint of a trend change but there isn.t.

The country is still digging a deeper hole. We’ll find the surface eventually, on the other side of the planet.

Doing more of what’s failed spectacularly.

Sounds like an episode of Stranger Things.

…and part due to world demographic shift.

Make no mistake. Government at all levels financialized housing on the behalf of investors. They could get rid of all the laws that make housing attractive as investments, and houses would once again become affordable. The key word being “could”, which is another way of saying won’t.

Yep. I watch this guy from Tennessee with the tiny home business. His business is off the charts. He has about 50 employees plus he has contracted with about 15 Amish subcontractors in Kentucky to build tiny homes.

The majority of his customers are single women. Cheapest model is $20,000. If you have no where to put it he will rent you a lot with water, sewer and electricity service for $200 / month.

I knew a couple here in San Diego living pretty close to the beach and far beyond their means from the 90’s into 2007, helped mainly on the float from their townhouse equity. They sold out at a “lucky” moment around ’07, actually exiting with cash over and above paying it all off. I meanwhile duly paid off my townhouse mortgage, scrimped and watched my pennies. I made it through the GFC bust, modestly. Now my townhouse is a life raft here, a ticket to a very liveable life, and almost paid off. Their “luck” ran out. They are on a crazy rental treadmill which is no fun, waiting for a bust to bring back reasonable prices (but also end their jobs). Even a deep housing bust (on the GFC level) would leave my family members in substantial positive equity.

The comments here that either condemn or uphold home ownership without reference to wise choices in whatever conditions, over pretty long time horizons, strike me as superficial.

I completely agree with you. If you plan on keeping, by all means buy, buy, buy. Inflation will do the rest.

For the short term when you buy you need to time it well. I buy only when things are depressed (not hard to feel it, I never sell). If you duck it up it’s straight to the poor house forever (or bankruptcy). But people put so much of their ego in a house (or a car). They treadmill their life for a show. And their fake friends don’t really care anyway.

As for renting…I never do except for very short terms. These days if something happens and you get sick or lose a job, you could lose a rental quickly and be in the street real fast.

If you bought right and enjoy a house appropriate (or lower) for your means, it ‘s piece of mind and a home.

Buying now is completely insane in some markets. Fortunately people are figuring this out. What a mess. It is a consequence of utterly stupid monetary policy. I sure wish there was a movement to change the way our policy is handled, but most people in the US don’t even know that we have a central bank or what it does.

The rich are stockpiling cash,should be great opportunities in 12-18 months my guess

AGREE w u, like totally scJ!!!

Very sorry indeed to have folks who have absolutely ”no dog in this fight” making SO many and SO hurtful ”decisions” for WE the PEONs,,, AKA WE the WAGE SLAVES and WE the folks on ”fixed” incomes.

Really a travesty of the notion of ”democracy”,,, eh?

“CLEAN HOUSE,,, SENATE TOO” was a very popular bumper sticker several decades ago,,, but really and truly needs to be brought forward.

Make NO missed steak about WHO makes the laws that POTUS can sign or not…

Most of the comments reflect the propensity to leverage home equity to buy mor stuff. Home upgrades and cars maybe tuition and vacation. Just points to people living beyond their means. I did not have furniture in our first house until we saved enough to buy. It’s called common sense. I truly don’t understand the logic behind borrowing to look cool or feel important. Most homes are money pits and need constant maintenance. I don’t see a house as a piggy bank. But banks think otherwise and lure us in. Capitalism probably. But the buyer still needs to be aware. And therein lies the problem. We aint that bright regarding money and deserve what we get. So in essence we are see the results of ignorance. How nice.

People have used the term “home ATM” which isn’t quite accurate, as an ATM provides access to cash already in the system.

It’s really the “home money printer” as money is created when the bank increases leverage.

Real estate leverage was the primary driver of this inflation, with fiscal stimulus close behind.

The Vietnamese have a phrase called, “Trying to show up.” It’s quite derogatory.

The problem is that we dont have real capitalism, we have crony capitalism that is enforced by government fiat. Anyone else notice that the industries that are most regulated or financed by government – housing, education, healthcare – are the areas where prices have surged and we get less value?

The core and only problem we have as a country is our government. Bunch of crooks and incompetents. Our business sector is quite strong, but it needs proper rules (legal and regulatory) to work effectively.

What’s striking to me visually (nice graphs as always) is the vertical line in prices and the vertical line in interest rates.

Clearly exceptional times. The opposites all at once.

It will break. The break can only be on the downside for prices IMO. It takes exponentially more money to maintain the vertical in prices, and the vertical in IR is sucking money out.

When housing turns from such apices, it’s usually painful and goes into a self fulfilling tailspin.

It’s just not sustainable.

Amazing stuff. Biblical.

Agree completely. I hope the banking system can handle it. Best outcome would be asset price corrections without another financial crisis, if possible. I think the taxpayer will be the bagholder since most mortgages are gov’t issued afaik.

The next NAR HAI (Housing Affordability Index) is due out a week on Friday.

According to my estimates it will be below the previous all-time low recorded in 2006.

Will be interesting to see if NAR makes a big fuss about this or not.

And also what it might mean for the future of house prices going forward.

If it’s not substantially below 2006, it has to be fake.

Recent mortgage rates aren’t noticeably if at all lower now versus then.

Housing prices in the major markets at least have risen faster than incomes, often a lot faster.

Other expenses such as property taxes and insurance are higher too.

When Wolf Street has a story on housing, I get the urge to check on listings in my 55406 neighborhood, west side of the Mississippi in Minneapolis & 55105, east side in St Paul. This is southeast of downtown Minneapolis, and north of MSP airport.

On the market are older single family homes, solidly built, for the most part. The price per square foot for what is quite a bit of inventory for sale at this time seems to be in the midrange of $200 to $300.

$400k, or less, will buy a very nice, century-old 3 bedroom, 2 bath close to the river & right dead-center in the Twin Cities metro.

“Location, location, location.” Not being in the 20-City Case-Shiller index is a good thing for buyers in MPLS & St Paul, I would think.

In my area of coastal SoCal the smaller, junkier fixers in poor locations (busy street, etc.) that used to fly off the market are now sitting even with price reductions. The really buffed-out big beauties are still moving and fetching peak dollars – listed in May and closing in June. However the big homes in need of some work are not moving as fast and seeing price reductions. A few people have paid $500K premiums for the identical floorplan that has been updated, it seems crazy but that’s the market.

My observations are that the inferior homes peaked a few months ago and are on the way down, and the beauties are at peak and will be on the way down shortly.

I’m noticing something similar in the Bay Area.

Seeing a similar trend in the burbs of PHX. Previously the criteria to spend a minimum of 500k was that it was a house that was standing – lot location, upgrades, basic maintenance not considered. Now seeing a flood of homes, many under the magic 500k mark listed, the previously manic purchases of the 2 bed or built 20 years ago and only changed lightbulbs sight unseen are now starting to separate in price from well kept and updated listings.

Just wait – I’m sure someone in Washington is busily drawing up plans for the “Cash for Crapshacks” program!

Here in my small slice of southern NH, listings have increased significantly in the past few weeks. Attractive homes in good towns and nice neighborhoods, priced appropriately, continue to sell at a swift clip. Less desirable homes are now sitting for a few weeks at a time, and overpriced homes are experiencing one, if not several price reductions. Buyers are still out there but the supply-demand dynamic is finally tilting more in the direction of the buyer. Home prices are likely peaking as we speak. For anyone who was “lucky” enough to buy in the past few months, well lucky you, you just bought at peak market! Where prices go from here (plateau, slight decrease, full fledged swan dive off a cliff) remains to be seen.

My question is with double digit inflation for the foreseeable future. In the 70s housing appreciated roughly in lock step with inflation with interest rates going up . Cant put your money in stocks. Cash returns below inflation. Whats your guys take on comparing now to the 70s

The late Morton Shulman always said never pay more than 3 times the husband’s gross annual salary for a house. This was back when women didn’t work in Canada during the 1970’s.

I adhered to the same standard (3x’s primary income home purchase price – not mortgage) our entire life…. never took out a home equity loan nor refinanced to “cash out”. Rolled equity from house to house – never bled off a dime as, to me, it wasn’t “real money” and could evaporate at a moments notice.

Refinance to catch a better rate? Yep. Then pay the same payment as before and pay down the balance faster or toss one extra payment per year against the principal. Doing the latter can take a 30 year mortgage and amortize it like a 15-ish year mortgage without the extra stress of having to consistently hit the 15 year payment as it’s optional. Nothing better than being debt free (have had paid off houses since I was @34).

Houses are for living in. If they happen to appreciate, great. If not, so what? You lived there. You have to live somewhere.

I recently read an article on the new trend of “stuffing” that appeared on some millennial financial site. “Stuffing” is a fancy name for the way my Mom budgeted back in the 1960’s and she learned from her mom…. putting your budget money in cash in envelopes. Food. Clothing. Emergency funds. Etc. I guess what’s old is new again.

We also play a silly mental game. We “finance” every durable we buy. We borrow the money from ourselves, and pay it back with interest. Takes discipline, but as it becomes habit, you find you can build a nice nest egg without depriving yourself. You make money on you.

“Whats your guys take on comparing now to the 70s”

Not much of an analogy. There was no housing bubble in the 70’s. No worldwide asset mania or economy supported by fake “growth” either.

I know a biologist in San Diego who would use HELOC’s on his residence and second house in order to invest in housing developments on the east coast. Being religious, he watches this youtuber who preaches the good news of Jesus and HELOC’s in the same breath. Pretty crazy.

He took out the latest HELOC about 6 months ago.

LOL

The steadfast love of the Lord never ceases; his mercies never come to an end; they are new every morning; great is your faithfulness…. Go out and get a HELOC, spread his word!!!

Lamentations 3:22-23

Friends.. have you ever been so low that you fall out of bed and don’t even hit the floor? So low that the skeeters won’t even bite you?

Well, rejoice in a HELOC! Send me the proceeds, and I’ll write your name in my big gold Bible, send you a green prayer cloth and a gold coin to keep in your left shoe.

Just last week, Ms Mamie Johnson sent me her HELOC proceeds and the very next day, her son got out of prison! And, the Lord brought her a BRAND NEW LINCOLN CONTINENTAL!!!!

Tell your friend you were reading a book that says “the debtor is slave to the lender”.

Think of it as investing in foreign currency or visiting a country where the dollar is strong. Strong CA dollars, being invested in weaker East Coast places whose dollars go further.

Leverage is an absolute wonderful thing. The problems arise as the leverage ratio increases. Debt is also an absolute wonderful thing. He problem arises when debt to capital ratio raises. Those ratios can get very high, astronomical even, and things may turn out OK. But sometimes, there’s a hiccup that sends it all crashing down.

I’ve known people who have been in debt up to their eyeballs since college. They’re still alive, have traveled to many places, had many houses, flipped houses, lost houses, drive nice cars, kids go to expensive summer camps, etc. They barely have enough cash to save for 1 month of expenses, but as long as husband and wife have a job, the bills and debts get paid and life goes on.

This all works until one (both) gets old, loses the job, has to live on SS and meager savings, and then is hoping he (or she) can move in with the kids, who, of course, really don’t want that to happen.

Yup cause you know Jesus was always preaching about HELOC and how leveraging to make more money with greed coming out of the eyes are guaranteed ticket to heaven

Most of those graphs are parabolic and thus unsustainable. Maybe the fed finally grew a pair and will stay the course come what may, or maybe they’ll fold like a cheap suit the minute they hear the creaks and groans of credit markets locking up (the one thing that terrifies the Fed above all else). Only time will tell. The Fed probably will continue the effort to fight inflation, maybe even valiantly. But nobody acts more carelessly and recklessly than scared politicians looking to buy votes, regardless of the party in power. The next housing crash will undoubtedly be met with mortgage forbearance and rent moratoriums at a minimum. That precedent has already been set. Who knows? Maybe we’ll even see all sorts of debt foregiveness… Student loans could be offloaded into the national debt. Maybe “cancel” the portion of a mortgage that is underwater? Rent assistance for all whether they need it or not! Who knows what schemes desperate members of congress will cook up in the coming financial crisis?

It’s so frustrating that I and so many like me now have to try to anticipate how the government will reward irresponsibly next and position ourselves accordingly. I’d really rather just play the clean game with honest earnings and savings to support a reasonable quality of life. But nope, that’s been out of style for decades.

Follow China,s lead take the pain,let free markets work. HAHAHA

I just found out that one of my younger coworkers gave his 2 week notice last Friday. He is maybe in his late 20s. Just got married. He said his landlord raised the rent from $2400/month to $3000/month for a small 2 bedroom apartment. (in Ventura County, So. Cal). He found a job in Arizona.

Some of these landlords are defintely greedy as F$$$ that’s why I wish they take it in the chin if rent price start to crash..

Is his landlord Dave Ramsey? In that case he is still a good Christian cause the Lord will understand adjusting rent to market rate…

Any landlord now has extra risk due to rising rates, inflation, and potential moratoriums. Why shouldn’t he be compensated for it?

That’s an indication that the landlords perhaps should have been more careful about buying their properties at the peak of the housing bubble, forcing them into a situation of demanding unmanageable rents that just spread even more pain into the community and trying to offload their expenses on those least able to afford it (renters often living paycheck to paycheck). The rising rates and inflation were an inevitability given the outrageous extremes of the housing bubble; my wife and I have been landlords for small properties but we’ve been very careful about avoiding real estate in bubbles, so no sympathy for the landlords who got in way over their heads as they contributed to this Everything Bubble. Ultimate culprit here though is the Federal Reserve for such over-extended QT and ZIRP to fuel these asset bubbles, this is part of the suffering it causes to communities.

should read, ” for such over-extended QE and ZIRP” not QT (QT obviously being one of the solutions for this mess)

Landlords are not charity organizations and a buzzard’s gotta eat same as a worm.

Agreed. I was a landlord for a while, my mom was a landlord for a long time. My post about the young man (with technical degree) leaving the state was just to highlight how this housing/rent bubble has ramifications far and wide (as if we didn’t know this already).

Exactly Harvey; that young man is a good example of how the free market works.

Of course, he could have called the landlord greedy and wished ill upon him, but he had better sense than that. Good for him.

I heard rent increases lag house price increases. With house prices up 25% year over year in some places, expect rent to follow. Now that mortgage rates are high I would think demand for rental units are only going to increase as homes are even more out of reach.

I also heard that 13 million people are on the verge of getting evicted as moratoriums have ran out and a lot of people haven’t paid up. Not sure if this is true as there was a lot of rental assistance handed out.

Ever thought that maybe measuring house price changes against changes in the CPI is the wrong thing to do?

The CPI from 22 years ago isn’t the same CPI as it is now.

Or maybe there is a better metric to measure the change in house prices?

HousesRuS,

RTGDFA

Yes, it’s the wrong thing to do.

It (the A in the acronym = article) will tell you that the Case-Shiller index IS an inflation index, namely of house price inflation. It’s conceptually wrong to adjust one type of inflation index with another type of inflation index, just to make it look better somehow.

If you had read the article, you would have seen the comparisons between house price increases and CPI increases.

In addition, about 33% of CPI is housing cost inflation. So you would adjust house price inflation (Case Shiller index) with CPI of which one-third is housing inflation??? Sheesh.

If you want to compare the Case-Shiller house price inflation index to the housing inflation index in CPI to see how they differ, I have a chart for you – and absolutely read this because it explains it:

https://wolfstreet.com/2022/06/10/false-hopes-of-peak-cpi-inflation-prices-of-services-housing-food-fuel-spike-dollars-purchasing-power-goes-whoosh/

Aren’t you guys in Cali still receiving stimulus checks?

So it’s: take the increased property tax from inflated property values and use some of this dough to hand out more stimulus to make prices inflate even more.

Check.

Around the country, states and municipalities are still floating in cash from all the stimulus measures and inflated tax revenues, and they’re all trying to spend this cash somehow, and they will spend it, one way or the other, which will, yes, provide further fuel for inflation, and yes, make it difficult for the US economy to slide into a recession, because all this spending is still going on.

Craziest economy I’ve ever seen.

I’ve commented before, but this is an excellent chart.

It shows the bottom of the GFC housing bubble and shows how far the Home Price Index has deviated from the CPI Owners equivalent of Rent.

I think the Home Price Index will start falling and the CPI Owners equivalent of rent will rise.

When both lines intersect again, I will buy a dozen houses. It will be the optimal time.

I have a very quick question for anyone knowledgeable: How long does it usually take to close an all-cash residential real estate sale (single-family house)? I’m asking about the period of time from accepted offer to closing, thanks.

We closed in 10 days. 3 days of open house and acceptance of offer, home inspection. No mortgage on the home and cash offer.

Some factors…

is the inspection “waived”?

is there a “punch list”?

are there liens on the house?

A would suspect a “clean” deal would be two weeks.

But I stand to be corrected.

For conventional & practical purposes as long as it takes for the title company to provide a title report/policy – 7 to 10 days, using the title company for escrow.

Foreclosures are another story, bid one day close the next.

Listed on 5/12, deal signed on 5/16, Docs signed by 6/06, Funded 6/07. Conventional w 20% down. 💰💰Thank you😉😉

When we sold my mom’s house to an all-cash buyer, it took 5 days after the offer was accepted. There was no inspection, appraisal, or contingencies.

It was a busy 5 days with hurry-up-and-wait forms to be signed. A notary showed up at 9PM one night to sign and Fedex the forms back by the next morning.

It took coordination and skill by the buyer, seller, RE agent, title company, and even the cash bank wiring of money.

It’s amazing to think 6% mortages is “holy moley”. A rate that was low for all of history, until a guy named Greenspan turned the whole world into a ponzi scheme.

Quit picking on Alan.

The next escalation will be when potential sellers just walk away from their homes on sale and the millstone around their neck which is the mortgage they still have to pay for a house they do not live in any more and that noone wants to buy. Once the attitude that everything is going downhill anyway sets in, it will be an avalanche. CDS on commercial banks are rising fast. Someone is smelling a herd of rats.

A severe drop in housing, IF it happens, will be an invitation for the Fed to intervene….again.

6% sounds high for a 30yr….

but it is still beneath inflation rate….and the replacement cost of a home is still running very high (labor and materials). These two elements make it “different this time”.

imo

Had been wondering this too, but I strongly doubt it this time since inflation is now much higher and in danger of becoming runaway, uncontrolled inflation with nation-wrecking potential. The only reason Greenspan and Bernanke could even consider previous rounds of ultra-loose monetary policy to inflate previous housing bubbles is that inflation was still low, or at least manageable. Now, however, US inflation has reached that dangerous self-fulfilling stage, where businesses and sellers out-do each other to raise costs out of fear that they won’t be able to manage their expenses otherwise, and knowledge that the dollars they’re earning lose buying power every week. This means we’ve reached the true end of kicking the can down the road and just re-fueling more bubbles–sustained, runaway inflation is much more dangerous to a currency, economy and nation than an asset bubble collapse or even a deep recession (which is after all, temporary, resets prices to normal sustainable level). The Fed now has to go full Paul Volcker, and the coming recession prob. early 2023 will be rough but cleansing, and necessary, like the 1983 one.

Jay Powell is an investment banker, nearly seventy, independently wealthy, who’s received his confirmation and answers only to a Senate committee. The several governors who are leaving or have left because of insider trading allegations were plausible policy opponents and they aren’t there anymore. Not that they would have opposed QT,, but they could have had undisclosed agendas apart from personal profit. Their absence will not hurt Jay’s autonomy. The White House says to the electorate that tough times are coming, perhaps by way of preparing everyone for another ration of sweetness from Uncle Sugar in the early fall, maybe, before the midterms. I don’t believe the administration actually meant to truthfully say that anything bad could really happen to us and we should prepare for hard times, because few voters choose candidates who persist in slapping them in the face with the slimy sea-bass of truth. And the incumbents like their present gig and are planning to stay a while, even if Captain queeg has to be confined to quarters. Powell could retire after this term, or whenever, and bequeath the mess to lael b., or whoever. All the Fed chair has any reason to be worried about now is his legacy. And Paul Volcker’s image has certainly been rehabbed since the early eighties when builders were mailing him chunks of 2×4’s in protest against the enforced idleness of 20%+ money. Powell wants to look good in the history books, and tough love seems to get you there after people get over hating your guts. The forces that will be brought to bear on Powell in a potential housing/stock/bond correction to revert to QE have to be pretty effective to dislodge him from his present trajectory. He doesn’t seem to be personally interested in politics, thankfully. Given the times we live in, everything could change by the All-star break. Man plans and God laughs.

Unless a plucky staffer pencils in broad scale student loan forgiveness on one of Joe’s cue cards, there’s gonna be a lot of families who’s budgets are roughly $500/month tighter in the next few months because no way is blanket forgiveness gonna happen, and dollars to donuts more than a few people haven’t budgeted their federal student loans back in during this pause.

Now throw in some unplanned children to the Red State Family Budget starting in the next 9-10 months courtesy of SCOTUS and for once Joe may be right–tough times ahead.

My loans are budgeted in and tubes are tied so politically I’m watching from the Independent peanut gallery. But can’t imagine how adding more kids into the population and re-introducing student loan payments in a country that already makes raising a family, affording housing or even meeting basic bills near impossible on a non-inflated day is gonna bode well for the housing market in 2023, wherever the interest rates go.

Not here to debate the morality of student loans nor unplanned pregnancies, but given younger Millenials and Gen Z are square in the crosshairs, its gotta have implications for housing purchase in the next few years.

“It is absurd to put important decision making into the hands of those who pay no price for being wrong.” T Sowell

Bernanke, Yellen and Powell leap to mind.

In a system that boasts of “checks and balances”, who checks the Fed? (really) The Senate Banking committee that seems more concerned with gender balance than an M2 that jumps 40% in two years?

JPOW said the housing market needs a reset for first time home buyers. Don’t hold your breath on a bailout.

What is the difference between a car and an economy ? ( Both are highly complex machines ).

A car, when designed, if it starts to oscillate at speed, requiring slowdowns and maintenance, the designers say it is the fault of the car, not the driver, and redesign the car.

An economy, if it repeatedly oscillates at speed, requiring slowdowns and maintenance, the designers say it is the fault of the driver and not the economy, and no changes are needed.

An economy isn’t a machine at all. That’s where economists go wrong with their crackpot theories.

It more closely resembles a living organism because it consists of thousands, millions or globally, billions of human beings.

Indeed.

1) Price/Rent and Price/Income are very important.

2) Case Shiller (not in real terms) was 136 in 2012, 218 in Mar 2020, now : 301.

3) Primary Rent was 249 in 2010, 339 in Mar 2020, now : 365.

4) Since Mar 2020 : Price/ Rent = 5.

5) Since 2010 : Price/Rent = 2.6.

6) Poor ROA.

7) Option : Price sky high and SPX far from it’s bottom.

8) The vertical high Price/Income ratio is worse, it cannot last.

9) Recessions : rent strikes, evictions, vacancies, repairs, lawyers taxes, mortgages, RE barely move after prolong injuries.

The Austin-Round Rock-Georgetown MSA market has significantly decelerated since the beginning of the year. Active inventory bottomed in February 2022 at 1,461 (79% down from February 2019), and is approximately at 5,796 through June 2022* (30% down from June 2019).

Active Inventory (2022 vs 2019 Change, Count):

February -79% 1,461

March -77% 1,639

April -72% 2,082

May -51% 3,772

June (est)* -29% 5,796

*June is estimated based on Realtor.com weekly year over year data through June 18th.

The shadow inventory that Wolf has previously referred to is now appearing out of “nowhere”:

New Listings (2022 vs 2019 Change, Count):

February -24% 2,456

March -16% 3,204

April -9% 4,032

May +15% 4,984

June (est)* +35% 5,808

Combine the spike in new listings with the drop in closed sales driven by higher rates, and you get your spike in active inventory.

Look at any of those graphs.

Imagine starting working in 2005. You are from a regular background so you don’t get a good job off the bat. You work your way up over 5 years and have enough income to think about buying a home.

You wait 2 years. Not a big deal? Well now the market has outpaced your wages until the present day.

What is the point in working now?

I hope the entire system burns to the ground.

georgist, u are lucky. When the market implode, with your cash, imitate the whales who bought in 2010/12 at wholesale price. Don’t expect a V shape recovery.

Secret drawer lists for privileged/ prodigy buyers surfaced in few markets (in NYC) at a discount, pressing the pyramid below. That’s how the domino collapse start.

Preach it.

I’ll tell you where you end up… renting between a bud smoker with 3 young adult kids on one side of the townhome (sure it’s medical use) and a much older married couple with their green-haired earth-chick crusty daughter on the other side.

What kind of Potemkin economy do we have when 5% mortgage rates spell doom for the housing market? It’s a joke, right? So screw savers and lower rates to 0.25% again so the DJIA rises to 40k! Hooray! The rich are now richer and no one else can afford a home.

The median single family house is now $400k while the median family income is $80k. The long-term healthy and sustainable income-price ratio is 2.6. The US is at 5 nationally with many markets much higher. Sure, this is great for the billionaires who own the companies that bought up all the houses using free money and are now renting them at unbearable prices. Screw single moms…they should have just said “no,” right?

America is being rotted by its internal models of greed and rapacious “capitalism.” The rich make the rules and make the money while convincing the under-educated poor and middle-classes that all is well and right and they could be rich one day if they just behave, work seven jobs and act like Warren Buffet (ie, lie, cheat and steal billions of dollars).

How long ago was it that family homes could be bought and paid for by a single worker (typically the father but that is an outdated sexist model)? What is the average number of incomes in a median household income? Certainly more than one. So even the old ratio is wrong since it applied to single income-earners per household.

Frankly, if Americans bothered to read Marx, they would probably decide that communism would be a really wonderful change from the horrible system they now live under.

Absolutely correct, but unfortunately we have a lot of clueless idiots in the US including nearly 100% of those on Wall Street.

expat

I agree wholeheartedly inequality has gone out of control. This simply cannot be sustained by breaking the backs of the working lower to middle-class. The only way to break this cycle is to substantially increase taxes on the wealthy as the disparity between the rich and poor has reached extreme levels. Houses aren’t stocks. The community and family impact is catastrophic. This practice must be disincentivized through taxation and/or regulation.

Investor Jeremy Grantham said in an interview in 2019:

“I arrived in 1964, and America was a fairly equal place with fairly rapid mobility between socioeconomic classes. Now it’s worse than the U.K. I mean, who would’ve imagined that in 1964. We have one of the most unequal countries in the developed world.”

Grantham also said the wealth inequality in the U.S. is approaching that of countries like Brazil and Chile. “So we have a dreadfully unequal society where the average worker, for an average hour’s work, has not made much increase in real income since the mid-1970s, for heaven’s sake.”

I couldn’t agree more.

Inequality is growing and will continue to grow wider.

IMHO….it is because almost every industry is a monopoly or oligopoly.

Shopping

Basics – Amazon and Walmart and Dollar Tree

Clothing – Macys, Nordstrom, Kohls

Auto – Autozone, O Reily, Advanced Auto

Hardware – Home Depot, Lowes, Menards

Shipping – Fedex and UPS

Cell Phone service – AT&T, Verizon, T-Mobile

Pharmacy – Walgreens, CVS, Walmart

Hospitals – HCA, Athena,

etc.

Usually there are 2 or 3 companies that control a specific industry. The mom and pop stores started disappearing in the 1980s with the arrival of Walmart. Other industries followed and more will follow. I am not sure if there is much left.

Mom and pop store owners were upper middle class in their neighborhoods. They gave back to the community. Local charities and fundraisers.

Now all the money that used to go to the mom and pop stores and filter around the local economy now goes straight to Walmart HQ, Amazon HQ, Dollar Store HQ, Autozone HQ, Staples HQ, Home Depot HQ.

Most of the money leaves every state that does not have one of these monopoly companies HQ location. If I was a state, I would demand that to open a store, then the HQ needs to be located in that state or give incentives for mom and pops to compete.

Maybe it is time to limit monopoly chains and allow mom and pop companies to have a chance. Give local stores a no state sales tax strategy like Amazon was given that allowed it to crush the competition.

Why aren’t the Clayton Act and Sherman Act Anti-Trust laws in the US being enforced at all? The laws are fully in place and can and should be used against the oil companies as well as these idiotic and stupid ‘tech’ companies to blow them apart and get prices on everything down significantly including grocers.

There is a great book called “Cornered: The New Monopoly Capitalism and the Economics of Destruction” by Barry C. Lynn that covers many examples and industries where the giants of each industry hold an effective monopoly over pricing and production and therefore harm the public despite anti-trust laws being on the books.

Matthew Stoller wrote a book about monopolies in America and has a good ongoing substack about it if you are interested in more examples.

Expat, Speaking of buying up all the houses:

I think a big part of the problem is we have income tax government funding. If instead we had transaction tax government funding, those buying up all the houses would have to pay a transaction tax on each one of those houses.

That dynamic vastly increases the risk for those buying up assets, thus discouraging them, and, also, providing an intrinsic inflation inhibiting effect — which obviously we sorely need

And furthermore!

From MarketWatch:

“In the Atlanta metro area, 42.8% of for-sale homes went to institutional investors in the third quarter of 2021, while investors purchased 38.8% of homes in the Phoenix-Glendale-Scottsdale area during the same period, the committee’s memorandum said“

So bottom line:

Income tax is a con to stiff the working stiff while allowing highly inflationary asset hogging activities to evade appropriate taxes.

If you want an inherent inflation resistant model, you need transaction tax funding of the government, not income tax funding.

See link in my name for details…. If you dare!

FWIW as usual …

transaction tax?

So a person who has worked and paid federal taxes and saved the balance…..will be taxed once again by the federal govt when he spends it? (already taxed by the State)

A transaction tax might make sense IF everyone started at zero….but as proposed, it is a double taxation for many.

Howdy Historicus!

Not taxed twice.

Abolish the Federal Income Tax and replace it with a Federal Consumption Tax.

Thanks for asking!

Jack

You’re totally nuts, Mr. Avraam Jack Dectis. You’re trolling for billionaires.

Expat, where have you expatriated to? If it’s anywhere other than Cuba I suggest you move there right away so you can experience on your own what the real life application of Marxist principles is like.

I’ve read Marx. He’s an idiot. Countries that followed that path are disaster zones of poverty and repression. The problem here isn’t capitalism, it’s crony phony Fed driven dollar destruction and government sponsored oligopoly and regulatory nightmare. Marx is opposite of what we need.

Mortgage interest rates in the 6% range are NORMAL AND LOW and people should be very happy they are this low and have returned to a normal and reasonable and sustainable range.