Neck-breaker volatility in opposite directions in an unsettled market.

By Wolf Richter for WOLF STREET.

People are painfully aware of what happened to gasoline prices at the pump over the past two weeks, but what happened to diesel prices is even more astounding.

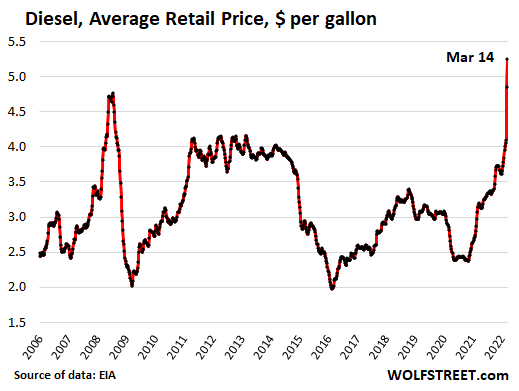

The average retail price of No. 2 highway diesel – to be passed on in the costs of everything that arrives at the house, office, store, construction site, or manufacturing plant – has been rising since November 2020, and on Monday jumped to a record $5.25 a gallon, the US Energy Department’s EIA reported late Monday, based on its surveys of gas stations conducted during the day. And this comes after the prior week’s spike.

Over those two weeks, diesel spiked by $1.15, or by 28%! This was by far the biggest two-week spike in the EIA’s data going back to 1994. Diesel is now up 64.5% from the same week last year.

The prior record high for diesel of $4.76 occurred in July 2008, after which it got blown out of the water by the demand destruction resulting from the Financial Crisis and the housing bust. Adjusted for CPI, $4.76 in July 2008 would be $6.40 today. So in “real” terms, today’s $5.25 a gallon is still not there yet.

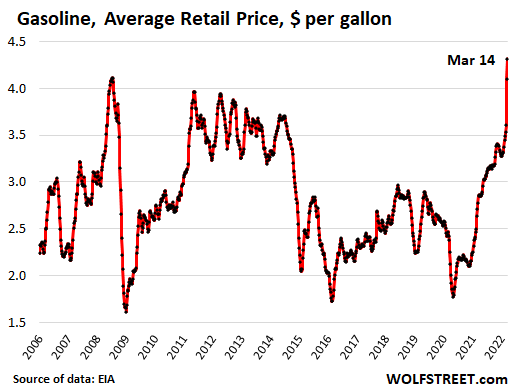

The average price of all grades of gasoline at the pump jumped to a record $4.32 a gallon on Monday, according to the EIA late Monday, up by 19.6% over the past two weeks, also the biggest two-week jump in the data going back to 1994. Year-over-year, gasoline was up 51.2%.

But adjusted for CPI, we’re not there yet either. In July 2008, gasoline hit $4.11 before demand destruction from the Financial Crisis knocked it down. In today’s dollars, this would amount to $5.30 a gallon.

But wait a minute… Crude oil futures and gasoline futures plunged.

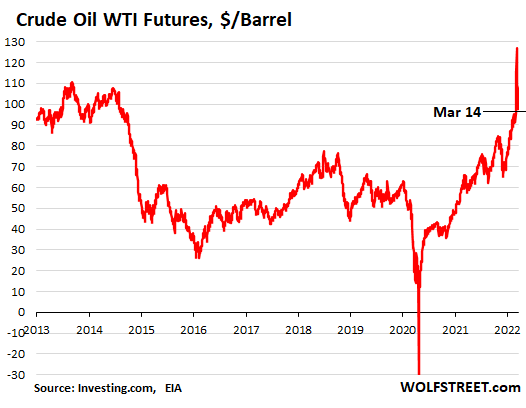

Crude oil WTI futures plunged 24% in one week, from over $130 last Monday to $97.96 at the moment, which put it back where it had been on March 1, when it had punched through the $100-mark for the first time since 2014, in white-knuckle volatility that seems to be afflicting everything these days (chart via Investing.com):

Still, even after that plunge, WTI remains far higher than it had been over the past seven years. And what a neck-breaker: from minus $37 in April 2020 to a closing high of $127 on March 6, 2022, and now to $97.96:

Gasoline futures plunged 21.4% in one week, from a high of $3.87 on March 7 to $3.04 at the moment, which would still be the highest since 2014. And even as gasoline futures plunged over the past week, gasoline retail prices — in the chart above — spiked during the same period (chart via Investing.com).

At the tourist gas station in my neighborhood in San Francisco, regular gasoline hit $5.99 a few days ago, and the two higher grades punched through the sound barrier of $6, even as gasoline futures were already plunging, and for now, prices at the pump, which were so record-quick to skyrocket, have turned out to be sticky at these record sky-high levels (photo by Wolf Richter):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Speculation has destroyed the world. Pigmen playing games with the necessities of life is a practice which needs to be culled.

A guy came to power back in ’33, declared a debt moratorium for his country and convinced his citizens the financial class (as he perceived it) should be culled. That didn’t go so well.

Huey Long?

If he hadn’t tried to invade Russia in the Winter, he would have succeeded.

Actually he invaded in June.

Winter, and Russian roads, defeated them.

The financial class were not culled, the big banks worked together with him and he needed them them for his megalomanic ambitions. And the super rich big industrial trusts smelled hugh profits in the near future.

What is producing, saving and trading, other than seeking a selfish advantage? See Adam Smith, on what a baker does, and why.

Medieval law designated “fair” prices. It was jettisoned for a reason.

Speculating in necessities has nothing to do with the free market. It also happened in the past due to war or natural disaster but it’s endemic now.

It’s one thing for a commodity producer and the buyer who uses it in their business to hedge their future production and purchases. It’s a form of insurance.

It’s entirely another when two parties who don’t even use the commodity drive the price through the roof simply for speculation.

It’s another example of the virtually complete financialization of the economy which serves no productive or economic purpose.

Financial commodity trading has been around since I believe 1982 (or near it). One difference recently is that there are now commodity funds for “investors” to take a position indefinitely. An example are ETFs.

The other problem of course is central bank currency debasement. Commodity prices spiked in the late 70’s and 2008 but prices remained relatively stable since futures were introduced.

It’s also a sign of the government not doing its job. Lumber prices have no business being as high as they are just like oil. Rampant speculation isn’t healthy in any shape or form, especially when the government is now so willing to step in, choosing winners & losers when markets tank. We no longer have a healthy economic system.

“ One difference recently is that there are now commodity funds for “investors” to take a position indefinitely”

I own one of those funds, bought in during the March 2020 mini-panic and used my Roth IRA to avoid tax on future gains. So far so good. The key now is figuring out when to start trimming it back, ideally right before high commodity prices break the system.

Future contracts have someone holding the king position and some holding the short position. To say that this is market manipulation is silly.

Try collecting the Silver with your Silver Futures Contract.

Do they represent us,you and me? Need a convention of States to end this apparently 🐒

Bring back Glass Stegall. Separate the gamblers from the real economy.

now that was simple document – total 18 pages

and it had teeth

Hey America!!!

Wake the f-ck up

Your oil and gas producers are making massive record profits as they careless what affect it has on you American citizens

Sing it TC!!! Big oil is to blame, and any politician that takes money from them!! It time they are held accountable profit sure, but rape!!

If you actually look at the charts you will notice that prior to JB being installed, gas prices were low and we were energy independent. Putin had nothing to do with rising prices until February 2022. Green energy agenda has made us once again dependent on foreign sources.

The US has never been energy independent… Simple search on your search engine of choice will show you that.

The US is a net energy exporter. Over the past two years, the US has become a net exporter of crude oil and petroleum products. But it’s intimately tied to the global energy markets, and is therefore not “energy independent.” Part of the reason is that the Rocky Mountains cut through the US, and there is no pipeline across them. I explain this further here:

https://wolfstreet.com/2022/03/08/how-much-russian-crude-oil-petroleum-product-does-the-us-import-where-does-it-go-how-much-impact-will-the-russian-oil-ban-have/

You need to actually read about the subject…..

Russian imports haven’t stopped in decades the have only increased. We were never er energy Independent only energy neutral big difference.

Petrol is 3.40 per litre here in New Zealand. Diesel is $2.30 plus road user charge of about 8 cents per litre. That is $12.87 a gallon for petrol! It is cheaper to buy meth and run to work.

I like your attitude, Bob.

$9.70 a gallon, diesel in sw FR

Two weeks to flatten the gas prices. Stay indoors and don’t drive.

That’s how I think of it but I see while on out wee hrs of the am riding my bike to all nite store idiots just taking a drive as in we don’t care bout the price you charge. People the mid terms are coming up, we need to get all them out clean house

The ones missed we need to get to those come 24 elections .

Next week we’re starting a 3 week road trip using a car that takes premium gas. First stop CA. Yeah, I suck at market timing too.

Haha, or butane!

fyi, one doesn’t need meth to run (or bike) to work. at most one just needs a place to clean up and change. a running stroller could be adapted to hold a briefcase and other necessities.

And you would be happy and delighted with $5.00 a gallon, yet look at the hysterical and absurd reactions of Americans.

I am grateful for only paying $4.50 since I know people like you are paying 2 times, plus more, yet spoiled Americans are acting like it is a big deal, while we stuff our faces with junk food, potato chips, etc.

$4.50, here in America, is cheaper than any year up till 1964. In fact, up till around 2010.

The other day I saw an Italian gas pump manager explain that it’s not them rising prices, but the 7 big corporations that impose prices on them. Further he said for the small companies running the gas pump this is a huge problem. They risk running out of business, some don’t have the cash to lay out and with reduced consumption they are missing the volume. Their margin, in Italy is 2.5€ on 50€ of sales. By the way only 10% of the imported oil comes from Russia, the rest is shipped from Africa and the Middle East. To me this whole Russian/Ukraine military action looks like the perfect excuse to destroy of the world economy. The other day Diesel at the gas station was above 2.3€/liter, higher than gasoline. This is economic war on the people of the world.

“This is economic war on the people of the world.”

You lost that war a long time ago. These are just the mopping-up operations.

I am thinking the O.01% are being forced, due to the internet, to speed up their game plan.

I see “panic” in their actions. I see desperation before too many low information peasants put the facts together and realize something is going on.

Think of all the incredibly STUPID comments the Politicians are giving us. The INSANE excuses, the total disregard for Logic. They can not be that stupid, unless there is a brilliant reason.

From abandoning $85 BILLION in fantastic guns and ammo, to totally open borders to any (armed) soldiers from any country in the world…..STUPID or intentional?

Not to mention the relentless war on law abiding citizens right to keep and bear arms here in the US…. What happened in Australia in the covid flu season of 20-21 cannot happen here just yet… not as long as there is a chance of citizens shooting back.

Good points. I wonder if it’s 5% profit on the 10% that the Russians exported was t cheaper with better margins? Like a black market for the Russians now

Too bad there’s no black market for gasoline and diesel!

I think there is, but you have to be China to access it

:)

Wasn’t Turkey purchasing Iraqi oil from ISIS?

It could be harder with natural gas, but I think there will be buyers if the price is right.

I figure the current (and future) diesel prices will knock the resale value of big guzzler pickups in to the cellar. Once they get cheap enough I will purchase one to put next to my shop and store scrap metal in.

It IS the economic war on the people.

BUT, that is called a “conspiracy theory” and you are not allowed to mention it. But, what if it is real?

Let us, for the sheer joy of it, imagine there is a plan. Imagine you are part of the 0.01%. What would you and your group do IF (just imagine “if”) you really wanted to rule the World (I know, it is ridiculous.)

\

Rest assured. Never in history has any person, or group of people, ever wanted to “Rule the Empire”.

Well said!

Long on scooters, mopeds, and small displacement motorcycles!!! What a time to be alive!! Can “Mad Max” and “the precious juice” valuation be far off??

” small displacement motorcycles ”

A little known fact – USA built Harley Davidson Sportsters ( 883 and 1200 cc) can get up to to 60 mpg on the highway. I personally have gotten 58 mpg several times on my 2001 883 cc on highway trips. Economy doesn’t have to be boring !

Small displacement motorcycles? I bought a Kawasaki KZ400 on my 18th birthday. (Legal minimum age in Minnesota without parental waiver)

Now that I am on my 7th motorbike four decades later, I can’t imagine being on a small starter bike. To each their own, but once you’ve experienced the performance of a modern super-bike, it’s hard to settle for less.

Spring is finally here in Minnesota, and I’ll be on my V4 rocket-ship in a couple days!

I bought a Cushman Golden Eagle at age 14 when mom was out of town for a month or so Dan.

She insisted that I must sell it when she returned (and had to go to court with me twice) ,,,, she apparently said, ”the scooter goes or I go!!!

I lobbied hard, but dad gave in for some reason.

Not sure the displacement, but it was allegedly bored and stroked, and had a carburetor from a 25 HP outboard. I could barely crank it,,, but it could get serious air off the line, and beat all the fancy foreign bikes and scooters at that time — mid fifties.

Very dangerous — far shore!!!

I’ve owned 12 motorcycles ranging from a Bultaco to a Harley Sportster. Sold the last one when I moved to Los Angeles from Connecticut. All were good on gas!

DanR-horses for courses, my friend, horses for courses (my series2 ’82 Jota litrebike with A12’s, standard comp pistons and 2d-gen Dell’Ortos gets 58mpg hwy and is still fun/fast enough to make me think about preserving my license. Then there’s my ’89 NX250, plenty fun with sticky tires and 78mpg. (Cautionary note-‘motorcycle’ doesn’t always mean economical operation-do your mpg/tire life (modern radials have fantastic grip and poor mileage compared to ‘vintage’ bias, and ‘vintage’ bias isn’t great vs. automotive tire life…) /chain-sprocket life costs research before investing…) Room for all on two wheels regardless of age/displacement-human or mechanical…).

y’all ride well.

may we all find a better day.

“To each their own, but once you’ve experienced the performance of a modern super-bike, it’s hard to settle for less.”

Not to mention sometimes you just need to get outta dodge. I’m not interested in being on a bike that can’t wax all over 99% of production vehicles. I want to be able to get away from psychos in cages. I’ve never seen so many reckless drivers and texters in my life.

In China the dominant scooter/small motorcycle engine is 48CC four-stroke. They are workhorses. One day I held the entrance door for a guy delivering spring water in the big office size bottles. His moped was fitted out with a rack to hold 6 bottles. And himself, of course. That’s a lot of weight. The name of the bike is Er Feng, which means Second Wind, I think. There are Harleys and Victory bikes from time to time, but not much.

roddy-2d/3d world use of Honda’s 50cc Cub and its subsequent knockoffs are a transportation legend dating back to the 1960’s…

may we all find a better day.

When oil start the recent trip to $ 130 from about $ 90 at the start of war margin for one /CL contract was about $8,000 , the margin required changed to $ 33,000 and oil dropped like a rock.

Could it be the Russian ran the future’s up on low margin and now margin calls have set in ? The new style of war is financial destruction, tanks are old school

Just another day of the elite businesses price gouging consumers while the Central Banks see no inflation.

In Canada, the Toronto elite own the grocery chains and they have made a killing, maybe literally with the way they exposed their frontline staff during COVID, billions richer than ever before.

Sometimes I lose hope that humanity has the ability to come to its senses. But on a smaller scale, am glad to have small 4-cylinder cars.

“We can come to our senses, but how much are you willing to pay?”

~Pigmen

Whoever owns the stuff gets the money. The Federal reserve has one tool: Interest rates on debt. Congress has a whole bunch of tools, running from spending to taxing to capital controls, to anti-trust, to price caps etc. etc. Doesn’t use any of them. Prices will go down, but nowhere near as quickly as they go up.

Buy a gas guzzler. Profits like this bring Mullahs and kleptocrats out of the woodwork worldwide eager to sell to the American Muppets who have to drive their Chevy Suburbans. I am seeing some really good deals on Corvettes right now.

Finally! Maybe now we will see some relief with used big gas guzzling SUV, truck, and mid-life crisis sports car prices.

This was the shortest lived price bubble I’ve ever seen. After today’s wipeout of another 7%, crude is back to where it was at $95 before the insane spike. There was no time for sentiment to materially change, it lasted for one tank of fuel, maybe two, and all those people who have order guzzlers but are still waiting for delivery missed it entirely.

One “man’s” GazProm Guzzler is another man’s family transportation.

One man’s junk food is another man’s McDonald’s, Pizza, Donuts.

One man’s Sunday Football game is another’s man’s waste of time.

I hoping to get a good deal on one more Vette before I turn 80. I’m living my third midlife crisis! Looking at hair dye and getting my eye lids fixed too!

This will be a good year for corporation profits with commodity connections in all areas, especially oil and food. For those who can’t live without food, which includes quite a few people, you’re gonna be paying for market spikes over and over just like gasoline.

The commodity is up, you pay. The commodity price goes back down, you’re still paying the new higher price. Food prices will stairstep higher as markets play. The commodity ends 5% up for the year, retail food prices up 30% for the year.

When you have a few retail monopolies, it’s not hard to do.

That’s why it is more important to start “victory gardens” or community gardens/farm that can produce food at the local level. Of course it won’t be able to replace all the need for food, but overtime it can reduce the level of food dependence on the system.

Monopolies?

Everywhere. Banking, Politics (different bait, results largely the same), production, retail.

Commodities? There is so much money sloshing around from the Fed’s brethren, that no commodity market is too big for the big players to sway, any way they want. Effectively over-riding any true demand/supply mechanism in any given commodity.

Funny how that works…

“prices at the pump, which were so record-quick to skyrocket, have turned out to be sticky at these record sky-high levels”

I saw an 80 cent increase in a day at a local diesel station. All of those crude oil gains have vaporized since that day, yet the station remains at $5.99.

I was in Mariposa, Calif over the past weekend of March 12, and saw diesel at $6.70/gallon

distances are long out there: you drive 20-30 miles just to find a grocery store or more. There are very few wealthy people out there, lots of retired people on Social Security and hard working people scratching a living out of the land. They are hurt badly by this and the resentment of the illegitimate Biden administration is almost boiling over.

Richard-begging the question of shouting ‘socialism’ when confronting energy/food price levels. How quickly does one change the colors on their masthead???

may we all find a better day.

Down here in Texas, feeling a bit ambivalent about this.

Texas is the world’s fourth largest oil producer (after Saudi Arabia, Russia and the rest of US) so Texas economy (especially Houston area and Midland) should benefit.

Also high fossil fuel prices might discourage the epidemic of gas guzzlers and mcmansions …..

Energy booms come and go quickly enough. Gas guzzlers, McMansions, and the credit they rest on, are even more sticky as liabilities than high gas prices. Hence Texas seems to remain a land of booms and busts. Banking crises there reflect this.

Watch out about benefiting from oil booms. I have family in Vernal, Utah, which is shale-oil country. They’ve gone through at least 3 book cycles during my lifetime and while it’s nice when it’s happening it is usually devistating when it ends. Maybe it works different down in Texas but I remember after the 80s oil boom Vernal be was so gutted only 1 in 5 houses were even occupied.

During the Arab oil embargoes #1 and #2 in the 1970s, which sent oil prices spiking, I was living in Tulsa (“Oil Capital of the World,” as it called itself) part of the time, and money was flowing knee-deep in the streets, and lines at gas stations is what we saw on TV. The bust of the 1980s was terrible, though.

The book “Funny Money” by Mark Singer is a good documentation of that oil boom bust period in the early 1980’s

I hope high “fossil” fuel prices might 1): discourage going out to diner and

encouraging people to prepare their own meals, 2): Buses used by lazy students rather than walking or biking to school, 3): Worthless trips to a “beach” or theme park, 4): Driving over to a friends house when we have phones. etc.

Your posts such as:

“worthless trips to the beach”…………

Reminds of the guy telling the doctor he doesn’t drink, smoke, gamble or fool around and asking his doctor if he’ll live to be a 100 years old………..

The doctor says: “why bother”.

Marcus-from what i’ve seen in the last 20 years, students avoid taking the bus, bicycle, or walking because many, many get door-to-door car service from parents fearing the dangers (real or imagined) of mean streets…

may we all find a better day.

I find it funny that people will pay $1000 for an i-phone and not complain that Apples’s net margin is 23% but complain about gas at $5.00 per gallon when Exxon’s net margins are 8%.

Good points. I wonder if it’s also 5% profit or if they take a hit. Russia’s exports now like a black market for now.

This! Consumerism is about signalling status and reproductive fitness to other mammals.

Great writers on this are Thorstein Veblen (“conspicuous consumption,” “conspicuous waste”) and Desmond Morris. Consumer-land’s “logic” is worthy of Lewis Carroll.

“Consumerism is about signalling status and reproductive fitness to other mammals.”

Mostly just people. Humans possess a characteristic shared with no other animal, the neurotic need to feel “special”. You might be amazed at the problems this causes, but then again, maybe you wouldn’t.

Whenever I pay attention while the price of oil and gasoline run up noticeably, there are always commentators claiming collusion and price fixing.

It’s easy enough to track the price of both in the commodity markets and the oil companies don’t control the price of either.

As for your example, the difference is that the buyers of the iPhone actually want to buy it. They usually have to buy gasoline or it’s a big inconvenience not to buy it.

Well, we don’t buy iphones every day. I paid about $900 for my iphone 12 that is going to be used for awhile, couple of years. So no complaint in that. However, my family spent about $4000 a year on gas/diesel. Now the price is up, this month we see an immediate rise in our expense. If the price stays at this level, we will be looking at a $1000 to $2000 increase in fuel cost. Also, the cost in gas/diesel is hardly avoidable. While I don’t have to and won’t get an iphone 13.

“I paid about $900 for my iphone 12 that is going to be used for awhile, couple of years.”

LMFAO. A couple years is all? Man, they’ve got you on the treadmill, huh? $40 per month just for the phone (and that will increase with your next purchase), and your monthly service on top of it.

I don’t mean to cite you as an example, but your comment just illustrated how corporate America has lassoed the public into a lifetime of debt servitude, month by month.

Nobody needs a brand new iPhone every couple years – unless of course Apple starts playing software games, intentionally ruining the phone’s performance to where it is almost not functional after that period of time. Now they wouldn’t do that, would they? Oh, wait…..

The business model in the US went from selling a quality product which would last a lifetime to selling a product with inherent designed obsolescence, to force people to continue to buy new on a repeating basis, and grow the landfills of the world at a rate unimaginable. And at the same time this would be funded by neverending monthly payments – a lifetime of indebted serfs.

^^^ This

Years ago Andy Rooney made a comment about Microsoft and the need to get a new computer for the updates to work which would also apply to Apple’s iPhones:

“If Microsoft made a typewriter, you would have to buy a new one every time the ribbon ran out.”

It’s not a phone.

It’s a multifunctional device. You can read websites like this one, read email, get directions, trade stocks, book an airplane ticket etc.

For many people, it has completely replaced their laptop or desktop computer.

A girl I dated ghosted on me last year when she saw me pull out a Iphone 6, manufactured less than six years ago.

Funny thing, she was a social and financial liberal who was against fossil fuels, believed that the world consumption is polluting the environment, and protested against illegal mining in developing countries during her high school years.

Guess when it comes to dating, it’s hyper-capitalist?

I don’t think it was the phone, tbh. Just a hunch. But she did you a favor. Stay away from cray-cray.

I have a $20 TracFone. I use it to look at my retirement accounts online. I also have over 6000 photos on that phone of all the countries I have visited since I retired. And lots more on One Drive and Amazon Photos. I also use WeChat and FB Messenger to talk to people all over the world. Gotta love these broke-ass posers with $1200 phones who have never left their Zipcode.

Where I live, if you don’t own an iPhone with the 3 cameras with the monthly mobile charges of higher than C$100 a month, people laugh at you or think you are poor.

Haven’t seen a Tracfone here in Canada yet. It’s all C$1500 iPhone without the plans, or C$800 down and monthly payments on a plan.

I paid A$100 for my Motorola which does almost everything that same phone of yours does and was A$1100 cheaper…………………..

If you have to fret, worry, and become miserable due to the price of gas, then you have a strong clue about the habits, attitude, and direction of your life.

Do you fret over Netflix? 6-Pack of beer? ESPN sports? The last pair of shoes you bought? Why not?

Live your life so you never have to worry about a (safe) place to live, clean natural food, and gasoline.

Yes, it is that simple. Once you are an adult, YOU are responsible for YOU.

Brilliance. The shell game actually overtakes the identities of people.

Consumption is the old fashioned term for tuberculosis, and sadly the yardstick by which current Americans gauge their sense of worth by buying stuff often to impress others doing the same thing.

“ yardstick by which current Americans gauge their sense of worth by buying stuff often to impress others doing the same thing.”

The new metric is how many storage units you have rented :)

Can you imagine how much “stuff” is in these buildings…. Jeez….

Very nicely put.

At some point, you have to be satisfied with what you have, or you’ll never be happy.

“At some point, you have to be satisfied with what you have, or you’ll never be happy.”

Probably the best advice given in this thread today. It really works once you have tried it.

My millennial aged daughter and her husband are at that point these days.

“The new metric is how many storage units you have rented :)

Can you imagine how much “stuff” is in these buildings…. Jeez….”

Really? I have never heard of this before – people talking (bragging, I assume) about how many rented storage units they have. I remember reading once that the US is one of the few, if not only, places in this world that even has such a thing, because paying a bunch of money every month to store a bunch of stuff that you never use is about the biggest waste of money you could endeavor.

I was talking to an old friend long ago and he was remarking that he had to move his elderly father’s bedroom set into storage to pacify him. He said it was hideous, but his dad kept telling him that he and his deceased wife had paid over $10,000 for the thing, and he “wasn’t going to just give it away.” Apparently he had tried to sell it with no takers (shock).

It stayed in storage until his father passed away, then he gave it away for free and got rid of the storage unit. His dad paid more for the storage in the end than he did for the furniture. It’s almost like a mental illness – hoarding.

At what point, and under what circumstances, does a person decide to be responsible to the only person he/she can be responsible to?

Nobody can come anywhere near your ability to change, or effect, your own life. Nobody can live through, or for you.

Try arranging your life that you will never even LOOK at a gas price sign. Imagine the freedom. Imagine having other things far more important to think of, and do. I am not saying be an ignorant fool, I am saying look at the world the way it is, and adjust your own life.

Work more. Work longer. Cut costs. Cut debt. Cut out the nonsense purchases. It is better than blaming others and having excuse after excuse. Stop dwelling on what another does, or writes, or comments, but concentrate on becoming the best you can (I am beginning to sound like Jordan Peterson).

It still can be fun, like planning a nice garden.

Perennials are easy, and come back every year; the older you get the

less work.

Gasoline/diesel as the cheapest, most compact and most convenient form of energy that allows the regular people of America the ease to travel to work, shop and go about other daily routines. It also provides us with cheap goods and other necessities of life such as food and various items in the supermarket and other general stores. On top of that it provides us with the freedom and mobility that no other people in history or other countries have experienced.

So with the rising of gas/diesel price, life is becoming more difficult for the common regular people. I do not blame anyone who is fretting or worrying about the future. Because gas/diesel price is not a luxury item that most people in the US can do without. It is not just for entertainment, it is not just for leisure that we need gasoline and fuel.

The continue rise of the gas price will alter and fundamentally change people’s live styles. And it will not be for the better. People will have to choose to move into cities. Less people can afford to live in suburbs or rural areas. They will have to cut down on their non-essential drivings. They will have to pay more for the food and all the goods that are shipped and trucked. They will have to cancel or avoid driving trips. They may have to avoid visiting parents, children, relatives and friends that live further away. The mobility and freedom to move about with affordable costs that we took for granted will be gone forever.

Yes, people can adapt and change their lives to make it work. But it is not comparable to losing a netflix subscription or having less beers to drink.

The thing is that commodity smuggling became such a huge industry that they can reinstate Russian materials (both crude and diesel) into the world trade just under a few days. Your company decided to sanction materials of Russian origin? No worries, we’ll take it to Egypt, Malta or India first, falsify the documentation and sell it to you as completely clean Western-authorized stuff. Vitol, Trafigura, Gunvor all doing it, it’s a lucrative business.

Sanctions include the pretense that “black” markets do not exist.

The futures market in oil is starting to see the coming recession and all the demand destruction to goes along with it. The same is true in the bond market- inversion has already been seen in the 7y-10y spread, and will likely continue to spread out over the coming weeks.

Wolf- I think you are misassigning the causation direction between oil and the 2008 financial crisis- it wasn’t the financial crisis that caused the demand destruction in oil- it was the other way around. The same thing apppears to be happening this year.

Nope

The cost of oil products is meaningful to the less affluent segments of the population, both directly and indirectly. This is probably the bottom 60% generally and the bottom 80% depending upon geographic location.

Concurrently, the only reason most of these people are solvent in the modern bubble economy is due to government transfer payments and easy access to (relatively) cheap credit.

It’s the top 5% to 10% that account for the lopsided proportion of “growth” in the US since about 2000. (Look at real median income and net worth which have both flatlined this century. Look at the distribution of both generally.) The rest of the population is effectively economically irrelevant. They don’t have much if any discretionary income, which is one reason for inflating the asset markets to create the wealth effect.

Cheap credit and the asset mania are both a lot more important to GDP than the price of oil. It’s the fake economy and asset mania that enables the more affluent to keep the economy from falling apart.

Yancey Ward,

Look at the data. Oil was a small increase in monthly expenses for consumers (housing, food, healthcare, etc. being far bigger items in the budget). But when the housing market collapsed (started in 2006) and the stock markets collapsed (started in late 2007) and banks collapsed, including Lehman (started in 2008), many trillions of dollars went up in smoke and people were scared, and they stopped spending. And businesses stopped spending even more and laid off 10 million people, who then couldn’t spend. Companies collapsed into bankruptcy, including GM and Chrysler.

Spending on durables goods plunged by 11% from Lehman through Sep 2009, a historic plunge!

From the Lehman bankruptcy through March 2009, total consumer spending (which includes housing, healthcare, food, etc.) plunged by 3.8%, which was a huge sudden drop historically and didn’t recover for a couple of years. This happened despite the collapsed price in oil.

We could get a recession this year, but it’s not going to be because of oil. Higher long-term interest rates have a good chance of doing that though.

just read the lehman bankruptcy is still grinding on ! 14 years of legal fees- that is what as known as a “long tail” revenue stream

Imagine.

One could get out of Law School 14 years ago and be doing the same case for the same firm.

Now THAT is specializing.

Bleak House, sequel. Lawyers unemployment plan.

I am surprised by the apparently paltry drop in consumer spending on that graph. I had thought it was much worse. Wow, it’s almost like the GFC was but a blip. 2006 was when the economy was absolutely on fire, and people were signing mortgage contracts on the hoods of their cars and I could barely get around, yet the spending pales in comparison to mid 2010 when all I saw were a bunch of broke MFers and the roads were empty? This is weird.

Wolf

Recession will be brought by on going factors:

-Demand Destruction -Oil, discretionary items

– Persistent inflation(+ chain supply squeeze) with wage growth lagging behind

-Commodity/fertlizers inflation affectimg the global food availability

-Secondary and Tertiary effects Ukrane war

– Possible defaults in Corporate Credit mkt

-Cyber attacks between East and the West

– Initial rate increase will reverse once Mkts fall 30-40 (or more)

Currrent inflation(/ Stagflation) will slowly descends to dis-inflation and then into Debt-Deflation ( Time frame(?) uncertain b/c CBers response!)

High cost rises in transport and other energy intensive industries will cause a recession- guaranteed.

Are oil futures plunging in advance of a fed announcement?

I think the run up was probably a small rally with traders knowing that the big squeeze is coming and so we had a sell off with a small handful of people taking profits on those futures

Or this could be the moment we all look back to in 5 years and we realize that this was the end of the petrodollar.

Not yet. US military will enforce the petrodollar just a little while longer :)

Interesting article on the petro dollar in the WSJ that the “Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales”:

Maybe a move starting to replace dollar dominance in world trade?

Dave Clark 5:

“Why, won’t you Stay-yay-yay,

Just a little bit longer?

Please, please ….

Just stay with me……”

Since late December, Pacific Gas and Electric’s base rate for electricity has gone from 26.175 US cents/kwh in early December 31.465 cents in early March, an increase of about 20%. The price of natural gas actually dropped slightly during the same period. For people who live in larger homes and use more than their allotment of Tier 1 electricity, the price of Tier 2 electricity is now 39.454 cents. Local user taxes are extra.

Gees. Here in the midwest are at .10 per kwh. , no excise rate for residential. Base bill is $30 , and solar farms are saving us $11 a month on 1000 kilowatts.

Allotment? Can you elaborate for non CA residents? What is the base allotment and subsequent tiers?

Northern California – or at least some parts of it – still have low electrical prices @ 11 cents +/- Kwh.

A rebellion should be on the cards!

While it is interesting, aren’t futures bets on what oil, gas, and diesel might be in the “future”.

Comparing those to the actual cost of acquisition for production seems like apples and oranges.

If coffee futures were up 80% but today I paid only 5% more for a month’s supply, the real cost to me is not the future’s price. It may or may not be up in the future as the future’s prices speculated.

Do I have this wrong?

“Comparing those to the actual cost of acquisition for production seems like apples and oranges.” and “Do I have this wrong?”

Futures prices are the current price for a certain delivery or expiration date. Indices of futures are based on the front-month contract (nearest date, now April delivery). Also, WTI is a benchmark grade, like Brent. What comes out of the wellhead in Louisiana is unlikely to be WTI. Wellhead prices are different all around the country.

There are roughly 150 different crude oil futures prices across the globe. Oilprice.com has a link to that list if anyone cares to look t it.

Makes no difference ! Oil company’s Pump the Oil out But to Buy it we just print out Money much easier . The USA wants the easy way that’s why we don’t make anything anymore.Its called Lazy

Every new picture of the tourist gas station is like a ticking bomb 🕚

Do NOT press the big red button, labeled “Snack Shop,” or else it will blow up within 10 seconds :-]

“Year-over-year, gasoline was up 51.2%.”

Is this going to put a damper on the summer tourist season? The return of the ‘stay-cation?’

I kind of hope so. I hate those RV logjams on the highway.

I’m starting to see used RV’s parked in shopping center parking lots with “For Sale” signs in the windows and they have been sitting for a few weeks. Can this be the time to pick up a newer RV for great price? Or for a “REALLY GREAT PRICE”?

Not yet…

They are trying to sell into travel season…

Probably in the fall you can beat ‘em up and give them terrific losses…

RVs are the new tiny home.

Not yet. There are no good prices on anything right now. I’d say fall of 2023 is when we’ll start to see some real pressure on RV prices. Remember, many models are up 50% from just a year ago.

I hope that the gas price eases, summer formulation is still a thing ( i think) and drive-in tourism feeds the local kids, so do the military bases and defense subcontractors in this area, and they need lots of gas. We have over nine thousand vintage and classic cars and hot rods that come every September for a week long block party along the beach. Be nice to offer them cheaper gas than their home states as we usually have been able to do. Our senator is trying to suspend state gas sales tax collection for six months. I don’t know what that would amount to, but it doesn’t hurt my feelings for almost any tax to go away, if only temporarily.

It’s also been far too long since anybody offered me an free iced tea glass with a fill-up, at these prices Lalique wouldn’t be inappropriate.

So, these Nine Thousand Vintage car owner can purchase the cars, fix them, pay outrageous amounts for parts, insurance, drive them, get a hotel room, eat 3 meals a day in restaurants, etc. etc……yet worry about gas going from $2.50 to $5.00 which most likely is the CHEAPEST part of this event?

Oh, they will drop $8 for a drink ………….and complain?

I’ve never heard them complain. Nice visitors who have a good time every year

“for now, prices at the pump, which were so record-quick to skyrocket, have turned out to be sticky at these record sky-high levels”

CHUCKLE… I had a Commanding Officer in the Reserves who owned some gas stations in the Deep South. We were talking about the “collusion” that drove prices up after the 9-11 attacks and he laughed at us. He said there is no collusion when prices go up… gas stations simply charge what is required to purchase the gas from the wholesalers. They only make a couple of pennies in profit per gallon so they have to follow the wholesaler price really closely.

The “collusion” happens when wholesale prices go down but the gas stations don’t drop the prices. EVENTUALLY one of the gas stations will lower their price to get the cars to come to them and competition will break out… but for every day they can ALL hold an extra penny per gallon they can make an extra 50% in profits. According to him, there may (or may not be) “conversations” amongst rivals to keep that extra penny profit in place.

Wolf, I would like to see an article on fed rate hikes and eases for the last 40 years or so. How many over what period of time for each course change. My memory says when they get going they do at least 6 to 8 but would like confirmation

Iona,

I just did that a couple of days ago, with charts going back to the 1950s:

https://wolfstreet.com/2022/03/12/why-this-is-the-most-reckless-fed-ever-and-what-i-think-the-fed-should-do-to-reverse-and-mitigate-the-effects-of-its-policy-errors/

Btw, the only historic period that is any guidance to right now is the 1970s and early 1980s, when inflation spiked similarly and more — and the Fed’s policy rates were between 7% and 20%. That’s the only era that is comparable to today, in terms of inflation. Everything else is irrelevant.

All this, including the charts, are in the article.

After losing 7% of global production, but maybe that was already factored in, then US is transitioning back to maximum output. Apparently that is working. Should we bet on corporate credit making a rebound?

Perceived corporate credit quality (which is actually the lowest ever) is a function of the mania and nothing else.

WSJ reports that the Saudis are getting close to selling oil for Yuan based pricing.

If that happens the banks that are restricting the price of gold are going to take huge losses.

As Wolfe has reported, slowly the dollar is losing reserve status…..if this happens…….it ain’t going to be as slow. More like a locomotive. Considering our trade deficit is now about a trillion per year.

If you do buy gold demand physical delivery. The ETF’s are a bad joke.

fred flintstone,

An international currency has three functions: trading currency, investment currency, and reserve currency.

As trading currencies, the USD and the EUR are on top and about even. Paying for oil in Chinese renminbi (RMB) would increase the RMB’s role as a trading currency, which is still minuscule. It makes sense for the RMB to move up higher in that trading currency ranking, given the vast amount of trading that China does globally, most of it in foreign currency.

China’s paying for oil with RMB does not impact the RMB’s role as reserve currency, which is still minuscule. That role is determined by how many countries hold RMB-denominated assets, such as Chinese government debt. The RMB is still not fully convertible. And that is its biggest handicap for being a big reserve currency. And this is a different problem.

I paid 6.50 in Concord on Tuesday and 6.30 in Santa Rosa last night. It’s not just the SF tourist trap station leading the way on these prices. Its everywhere I look.

California gas prices are much higher than the rest of the nation. It’s due to high state tax on fuel there and the high cost of living in dreamland.

Just filled up half a tank of my Subaru Forester an the tab was $32.75

I can live with that, Gas was $4.59/gallon for regular.

I wonder how those Covid temporary WFH lemmings are feeling now, when they bought houses 60 miles away in the middle of nowhere and now have to start reporting to work and have to pay $500 or more for gas each week.

Bear in mind that a lot of them never sold the old house, so they have options. When I was looking for my new rental house I had an offer from one of these types of a house on 5 acres for $1,000 less than the mortgage – “or best offer.” Many are bleeding cash on the monthly.

Farmers are ready cutting back on acres planted this year due to the higher fuel and fertilizer prices. If you think fuel prices are crazy wait for a few months when you go to the grocery store. China has been buying massive amounts of grain crops. Why?

Bill gates has been buying up farmland like there is no tomorrow. He wants more money. He wants it all.

Why is everybody so upset (everybody = mainly Americans) that the price of a substance that is the #1 cause of almost everything bad in the world (climate change, health issues, road deaths, war, etc) has doubled in price? Frankly I wish it would go to $15/gallon in the U.S.; I understand about the short term pain it would cause but the long term benefits would be worth it.

Stop whining.

I’m guessing you don’t drive a car to get to work.

You do know the clothing on your back, the phone in your hand, and the food you eat, and nearly every other product has been transported in bulk by semi trucks and ships right? They aren’t running on butterflies and rainbows. Your pizza delivery guy didn’t walk all the way to your house.

I actually believe that these fuel price gouges will be short-lived. Demand is up temporarily as people keep their tanks topped off in anticipation of possible shortages. They also drive less because, well supply and demand etc.

In the intermediate term demand will fall as prices rise and prices will fall also. Just my IMHO.

This is nothing more that goverment control and corporate greed.nothing more