But raging inflation is a political bitch, and the White House got the Fed to acknowledge it, and that changes the equation.

By Wolf Richter for WOLF STREET.

Stock markets closed at 1 p.m. today, and there wasn’t enough time to rectify this evil situation that has emerged on Black Friday, when stocks were supposed to be meandering higher on very low volume, driven by a few algos that would make sure stocks meandered higher to easily book another winning day and a new record high for the S&P 500 to keep the hype going.

But the sellers had arrived overnight while the buyers suddenly weren’t super-interested at buying at these ridiculously inflated record prices after the largest and fastest money printing scheme ever. And voilà. What everyone knew would happen someday, happened on this Red Friday, and stocks swooned.

And already the crybabies on Wall Street have come out in force, clamoring for the Fed to end the tapering of its asset purchases, and to push out the expected interest rate hikes into distant infinity, and to maybe even re-start QE all over again before they even ended it, because, you know, stocks aren’t ever allowed to drop, not even a little bit off their ridiculously inflated highs.

But the Fed, unlike before, has bigger worries for the first time in four decades – and Powell and Brainard, along with just about every other Fed governor have acknowledged it: Raging consumer price inflation that has now spread broadly across and deeply into the economy, filtering into services such as rents that are unrelated to transportation mayhem and production shortfalls in Asia. Rents, accounting for about one-third of CPI, are just now getting started to flex their muscles in the inflation indices. And the mood of consumers has soured.

This comes along with large-scale and widespread wage increases amid massive “labor shortages,” as workers have refused to return to work at current wages, and this combination will provide further upward pressure on wages.

And there isn’t any reason anymore to think that this raging inflation will stop raging on its own while the Fed still has the foot nearly fully on the money-printing accelerator and fully on the interest-rate repression lever.

And this raging inflation has become a political bitch for the White House, and they’re now acknowledging it, and they got the Fed to acknowledge it, and no one can brush it off anymore.

So now, we’ve got this bizarre situation where stocks – despite huge money-printing still going on, currently at $105 billion from mid-November through mid-December – actually fell today, with the three major indices down by over 2.2%, and the Russell 2000 by 3.7%. I mean, it’s just outrageous that this is allowed to even happen.

It’s interesting what is down the most, among the big companies in the DOW Industrial Average. Note the finance & insurance giants among the losers of the DOW components, along with some industrial giants, and Apple, to make for a pretty good mix:

| Biggest losers among the DOW components | ||

| 1 | American Express | -8.5% |

| 2 | Boeing | -5.4% |

| 3 | Caterpillar | -4.0% |

| 4 | Merck & Co. | -3.8% |

| 5 | Travelers Cos. | -3.3% |

| 6 | Apple | -3.2% |

| 7 | Coca-Cola Co. | -2.9% |

| 8 | JPMorgan Chase | -2.9% |

| 9 | McDonald’s Corp. | -2.7% |

| 10 | Visa | -2.7% |

| 11 | Goldman Sachs Group | -2.6% |

| 12 | Microsoft | -2.4% |

The biggest losers among the S&P 500 were travel related stocks, including the three major cruise lines – given the renewed threat of international travel bans following revelations of a new Covid variant again – along with oil company APA:

| Biggest losers among the S&P 500 stocks | ||

| 1 | Royal Caribbean | -13.2% |

| 2 | Norwegian Cruise Line | -11.4% |

| 3 | Carnival Corp. | -11.0% |

| 4 | United Airlines | -9.6% |

| 5 | Expedia | -9.5% |

| 6 | TransDigm | -9.2% |

| 7 | American Airlines | -8.8% |

| 8 | American Express | -8.6% |

| 9 | Delta Air Lines | -8.3% |

| 10 | APA | -8.3% |

Among the biggest losers on the Nasdaq was a little bit of everything, from travel to cannabis. The #1 loser, Longeveron, is a tiny biotech startup with essentially no revenues that went public earlier this year at $10 a share and by November 17 had dropped to $2.90 a share, and then spiked, including more than doubling on Wednesday before Thanksgiving, to $42.30 a share, and then today plunged 27.5% to $30.67 a share, back to where it had first been on Monday. I mean, OK, folks gotta have some fun.

| Biggest losers on the Nasdaq | ||

| 1 | Longeveron | -27.5% |

| 2 | Jowell Global | -19.0% |

| 3 | Society Pass | -16.8% |

| 4 | Pinduoduo ADR | -15.9% |

| 5 | AirSculpt Technologies | -14.1% |

| 6 | Applied Molecular Transport | -14.0% |

| 7 | Centennial Resource Development | -13.8% |

| 8 | Sabre Corp. | -12.6% |

| 9 | Recruiter.com Group | -11.8% |

| 10 | NexImmune | -11.8% |

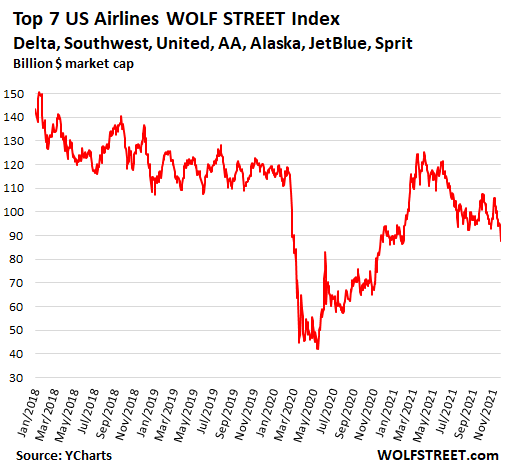

But airline stocks, after reaching pre-pandemic levels in the spring this year, have been selling off ever since, and today’s 7.7% drop of the WOLF STREET Airline Index was just an extension:

So the clamoring by the crybabies on Wall Street for relief from the Fed to soothe this insufferable pain of markets dropping a little from their ridiculously inflated levels is just hilarious, and provides great amusement on this Black Friday when people are supposed to try to prop up the economy by splurging with borrowed money on imports from Asia.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Replay of Dec 2018 starting in 3…2…1…

Bring it!!!

we see if game chicken were RINO’s capitulated is just a repeat

beside they wants to go on holiday mid dec

NY Fed Plunge Protection Team told to be in early Monday

Wolf,

I would suggest an edit to the title of the article,

“On Cue: Wall Street Clamors For Aid From Fed on Minor Dip in Retail Sales”

Retail sales projections are up. People are shopping.

Dec 2018 started in Sep 2018 :-]

It included one of the worst Octobers in many many years or decades.

I told you they couldn’t taper and were just tapping on the breaks and would stomp on the gas again. But what do i know im not the great all for seeing Wolf? I’m just a man with common sense. Tapering QE, what a delusion 😆

Nonsense. The Fed is ALREADY tapering. You missed the boat on this one. Forgot to pay attention?

Next step is speeding up the tapering, to be decided at next Fed meetings. So you have that to look forward to.

Replay of March 2020 is more likely.

I would be shocked if QE doesn’t exceed $200 billion/month going forward. The heroes at the Fed have the Covid Omicron virus to cure and house prices are going up so they need to finance mortgages at lower rates (maybe eventually negative).

None of us knows exactly what will happen, but if someone thinks stocks won’t continue to push even higher, I gotta ask that person where they’ve been the last 13 years.

I’m waiting for my next stimmie to buy more fine Chinese products because “folks are hurting”. Fear not America, help is on the way!

Three trillion in new infrastructure and social spending over next five years.

That adds three percent minimum plus multiplier to GDP each year.

Yes, stocks may go down but long term they look good.

Not selling but not on margin either.

It’s time for the FED to come out and tell Wall St. to shut up, that they are no longer the asset pumping arm for the wealthy.

Wall St, Banks and the top 1% own Fed!

Won’t happen.

Mkt reality has to tame them just like in 2008!

thank you sunny129 for obvious reason why not

maybe depth charge will observe more closely(of course 1% might just want the crash to happen)

But…

The Fed is there to protect the banking system…

not pump and protect stocks and real estate…

#historicus

Well, yes, but the bank owners want to maximize their profit. Now that turn the FED to just another vehicle alongside the banks to get maximum profit to the owners.

Just a little synergy to be gained from holding more than one position.😉

The FED is completely captured by the billionaire class. It exists to do their bidding.

Yep, J Powell needs to reinvent himself. He’s now re-appointed for another 4 years. No one can lay a glove on him. It’s time to morph in Paul Volcker part II.

Much to late the natives are angry these elites are out of touch never bought groceries or washed there car

Hear hear tell the Jamie Dimans of the world to suck it up. Its about time

More likely, the Fed might balk and loading up on more securities now that holding them is a good way to lose prinicple.

The problem is not only with the asset bubbles themselves, but the mentality that once new highs are made, that they are to be maintained into perpetuity. The “markets” are no longer markets. They are rigged to always go up. The FED, in their little closed door pow-wows, need to finally decide to just get out of the way and let things sort themselves out. So the rich take a 65% haircut? BEE EFF DEE.

Not going to happen.

Yep, the FED has a dual mandate: The Fed has two jobs: fostering maximum employment and keeping inflation low and steady. Both of these conditions have rarely been met at the same time in U.S. history, hence the FED can do as it likes, fully justifying their actions as controlling inflation or to max employment. The key word is maximum. Note that just before COVID, we had both low inflation and low employment, but, the FED made the excuse that while overall unemployment was low, there were specific employment sectors that were still experiencing high employment.

Frank…

You have bought into the great misdirection play…..

“dual mandate”……read the mission statement…

there are THREE mandates, and the one carved out of the “dual mandate” mantra is perhaps the most important

PROMOTE MODERATE LONG TERM INTEREST RATES

moderate definition….NOT EXTREME.

And what are all time lows in long rates if not “extremely” low?

Thus immoderate.

This keeps the yield curve positive, this keeps a balance between lender and borrower, this PREVENTS the irresponsible creation of debt which serves to pull wealth from future generations forward to fluff the present, thus burdening future generations with massive low cost created debt.

‘What are the three statutory mandates of the Fed?

FOMC policymakers set monetary policy to foster financial conditions they judge to be consistent with achieving the Federal Reserve’s statutory mandate of maximum employment, stable prices, and moderate long-term interest rates.’

So inflation at current rates violates stable prices.

There is another unspoken mandate: preserving the international purchasing power of the dollar. As the main global reserve currency and the one in which most international business is done, the dollar is measured against other currencies not just internal US prices. An example is the dollar price of oil. At the time of runway inflation, prices have been stabilized in the US via wage and price controls. This did not apply to Saudi Arabia’s price for oil and led to some thinly veiled threats by the US.

“the FED has a dual mandate: The Fed has two jobs: fostering maximum employment and keeping inflation low and steady”

Maximum employment and stable prices. How is 2% inflation (actually much more without their current BS methodology) “stable” prices.

Guess who added those requirements to the FRA. The idiots in CONgress (as usual) opened that Pandora’s Box in 1977:

Federal Reserve Reform Act of 1977 – November 16, 1977

Signed by President Jimmy Carter in November 1977, this amendment to the Federal Reserve Act was instrumental in shaping the current Fed.

Congress was motivated to increase the role and accountability of the Federal Reserve during the 1970s because of the adverse macroeconomic conditions of the time. The 1970s was a time of high inflation and unemployment, collectively referred to as “stagflation,” which led to the enactment of the Reform Act in November 1977.

The new Fed will have two more mandates. Climate change and social justice. Lail Brainard will be the real Chairman of the Fed. Any of you Navy dudes know what I’m talking about. The Exec Officer actually runs the ship. The Captain is just a figurehead and politician. Lail’s top priority is climate change. She’s already on record as such.

The mandate to preserve the dollar is the elephant in the room which is at the same time obvious and also not politic to mention. Volcker’s drastic action on interest rates was required by a dollar emergency: a world- wide run on the dollar. US tourists around the world were asked to pay in local currency. One couple delighted the hotel manager by offering to pay in lira! The greenback had fallen several percent during their stay.

At one stage the US had to sell bonds denominated in Swiss francs ( Carter Bonds) It couldn’t borrow in its own currency.

If there is one thing that drives Russia and China crazy it is the currently undisputed status of the US dollar as currency hegemon. The US can buy anything in the world with its fiat paper, Russia can’t buy anything outside Russia with rubles.

Preserving this status is Concern One, but part of the strategy is to seem completely unconcerned.

It would probably take an international dollar crisis to provoke a response like Volcker’s. But this would begin in the US and maybe has begun.

Your scenario would be the start of a 90%+ drawdown. That’s what “sorting things out” will eventually lead to, a decline bigger than the 1930’s since this market is far more overpriced and the actual fundamentals are actually a lot worse.

Great Reset is needed and would benefit more than it would harm in the long run…

As you state, the prices are BS to the max, so it can’t last that way.

Yes, a “reset” is necessary to place the economy and even society on a “sustainable” footing.

A 65% decline from current levels would price the S&P 500 higher than it was in October 2007 and March 2000 and still only about 20% lower than March 2020.

Stocks weren’t even close to “cheap” in March 2020. As for the prior two peaks in this mania (it’s the same one), it’s debatable how much real (undistorted) growth and increased prosperity has occurred since either.

I’d say very little which if even close to true means S&P 500 @ 1700 (65% below today) isn’t even close to being cheap either. I’d rate 1200 as “fair value” and this assumes earnings and dividends don’t completely collapse in any extended “recession” which is exactly what will happen just as in 2008.

There is a long list of companies even with current artificial economic conditions that should be worthless or valued close to zero. Some are now “worth” over $100B.

Yep. I run my retirement funds very conservatively now that prices are crazy. Today was basically a flat day for me, up maybe $100 or so. You sleep better at night that way.

yes, i made that point a few days ago in another article. people keep saying that the market’s 20% drop in december of 2018 showed that the market “couldn’t handle” even 2% interest rates. but that starts from the premise that the november 2018 prices were the “right” ones. maybe the right ones are half of what they are today.

I’m sure everything will be set for a big Santa rally next month

They have built the “perpetual money machine” on a “modern monetary system scheme”, what could go wrong?

“What could go wrong? ”

How about Flash Raids spreading across the country? Eventually shutting down most box store retail.

OR

Massive Hy-Jacking of UPS and FedX trucks?

Or just blocking their warehouses so they can’t come or go?

Inflation has already murdered much of what was a middle class in this country and the FED can’t fight it without raising interest rates which will murder housing, auto sales, student loans, corporate junk bonds and eventually the US debt.

More like the devil and the angry sea as options.

After 2 years of Pandemic I still can’t buy reasonably priced canning jar lids! What’s up with that?

You are correct, the Fed needs to get out of the way and let free market capitalism rule the day. Mis-allocated capital has to be lost and productive capital rewarded.

But that;s not going to happen. Explaining the virtues of free markets to socialist bureaucrats, such as Bernanke, Yellen, Powell and the rest would be as effective as reading Adam Smith to Lenin. They are set in their socialist ways and their minds are made up. Collapse it is.

Free markets are the natural order and can only be derailed by the hand of corruption. Our system is now rife with corruption. The sooner we can collapse the sooner we can get it over with, like vomiting after binge drinking.

I’m imagining that the cure of higher rates at free/fair market levels at this level of indebtedness would be devastating to the economy. The loss of jobs associated with the collapse of so many businesses that are currently borrowing their operating expenses would just radiate outward in a nightmare scenario. I’m pretty sure the FED has done this analysis and rejected it..

Yet > the rising prices of most everything also has a nightmarish outcome if not brought under control..

The solution to #1 is death by #2 and visa versa. What the FED is facing is the opposite of Win Win.. It is Lose Lose.. I’m sure the FED is just trying to run the clock hoping for a third option no one sees.

the only possible third option is unbelievable growth that is so intense that it not only is enough to pay off the existing debt, but to pay for the increased spending demands that will come with it.

i’m not seeing that being a reality.

Jake W, What’s against option 3 is demographics. Too many Boomers who are too old to be productive at a high level. Not because they don’t have knowledge or willingness but just because they (we) are old.

Your carelessness with the “socialist” tag does not inspire confidence in your grasp of the legal-market nexus at the core of mixed economies in the West, though I’ll warrant that your observations about corruption are nonetheless correct.

The irony is that the crybabies will get their pacifier and the markets will be higher by Christmass.

I very much doubt this time!

Overvalued Mkt

Nu covid uncertainty

Inflation, NOT going away

Supply chain problems persist

Any one who wats to buy in this ‘everything’ bubble deserve what’s coming down the pike!

Did you also doubt the last time?

That doubt is the spark that ignites the inferno of the widow maker trade that has burned for 13 years. People doubted at S&P valuation of 1500.

This time is not different. The Fed will keep printing and the market will continue to march higher.

Agreed. Sheriff Powell of Nottingham has an agenda and Robin Hood is just a fictional character. The Fed will never reduce its balance sheet again.

Sanity to the Mkts is being brought by ‘Nu’ strain virus uncertainty and inflation monster! Who would have thought, right?

Marging calls are going out thisd weekend and again Monday! i already see ‘sooth sayers’ on wall st, telling theinvestors ‘ NOT to Worry’ this is just one day Thing! Is it?

I love a day like this, where REALITY hits hard!

Chance favors the one who is prepared, Been in the mkt since ’82. I hope reversion to the mean will continue!

“CHAIRMAN GREENSPAN. I must say that I have not changed my view that inflation is fundamentally a monetary phenomenon. But I am becoming far more skeptical that we can define a proxy that actually captures what money is, either in terms of transaction balances or those elements in the economic decisionmaking process which represent money. We are struggling here. I think we have to be careful not to assume by definition that M1, M2, or M3 or anything is money. They are all proxies for the underlying conceptual variable that we all employ in our generic evaluation of the impact of money on the economy. Now, what this suggests to me is that money is hiding itself very well.”

The turnover ratio in other checkable deposits to transaction deposits is .05. The turnover ratio in savings deposits to transaction deposits. is .017.

Only a moron would claim M2 is somehow relevant. Inflation is a product of money flows, volume times transaction’s velocity. The peak in the rate-of-change (distributed lag effect), is not until January 2022.

“Only a moron would claim M2 is somehow relevant. Inflation is a product of money flows, volume times transaction’s velocity.”

There must be a lot of them then. Former Fed Gov Heller pointed to the M2 rising 20% each of the past two years….in a WSJ letter to the editor today. And his comment suggested that of course it brings inflation.

M2 is relevant. You speak of turn over ratios…

But, how do people spend on credit cards with big balances that show up in M2 but are mostly static? It effects their spending decisions. The money doesnt move, but the credit card is sizzling.

The market needs these doses of realism.

100%+

Tapering (reducing Fed balance sheet) was never going to really happen. The Fed is a political institution, not an economic institution.

The sudden discovery of the “Nu” virus will be used (fear porn) to postpone any Fed tapering. There is nothing new about the “Nu” virus. That is what viruses do, mutate.

The Nu variant will be the excuse for more QE and stimulus

Not if there is 3%+ inflation.

You should be correct, I wish and I hope you are correct but I fear you are wrong.

All evidence points to this fact: our monetary politburo sees high inflation as necessary and good. They fear only a crack up boom but believe they can avoid a crack up with jaw boning. I think they are naive and arrogant.

“It’s hard to make predictions, especially about the future”

Wolf you Need to sell this comment as an NFT. Along with your Tesla and Bitcoin calls over the years.

The fed has no where left to go but print it’s way into oblivion. I fear we’re on the last inning of the game. Markets must go higher forever or it’s game over for the USA.

Have you not noticed that the western governments never talk about the fiscal deficit anymore?

The fiscal deficit is out of control but it is not even talked about and there appears to be no policy to control it and the excuse of course is the Corona Virus.

We can either have NO RECESSIONS ever again or

MONSTER INFLATION, take yer pick.

A one studio apt for $3K/mo is monster inflation.

A 3/2 ranch house for $3.5m is monster inflation.

A dash inside Walmart for a few items that costs you $130 is monster inflation.

In order not to feel the pain of recession

we’ll have to deal with monster inflation

leading to hyper-inflation, it’s always been

that way. It’s already happening.

John- I think you meant to say —

We can either have NO RECESSIONS ever again or

NO MONSTER INFLATION, take yer pick.

??

Ralph, I’m glad someone understands what I said even if I didn’t say it right. I admit struggling with that one.

Thank you for fixing it.

No, there can be an inflationary depression. Governments and central banks do not create any real wealth which is what creates growth and stable prices.

One of the three original mandates of the USA government was to facilitate interstate commerce.

To that end we have roads. In theory paid for by gas taxes and such with the government writing the check to private industry contractors who build the motorways that our trucks roll on.

When you drive through Iowa, think about my friend in Reinbeck who’s company has built many of them in that state.

Government creates wealth in the employees working for my friend, and the people driving on the roads as they conduct business.

For today on Wall Street, a sell-down of a few percent once in a while is a good thing, eh? Check back next Wednesday though …

No, it’s the employees working for your friend and this business that create the wealth, not the government. The government taxed someone else to provide this firm with its revenue.

I’ agree that the legal framework which governments implement and enforce facilitates wealth creation, such as English Common Law and US Constitution.

The government is an expense to the nation (a tax). It does not create any wealth. Wealth is created through the production of goods.

OK, it’s Wednesday morning. Markets are looking up before opening.

Portfolio is down 1.9956% from market close on Wednesday, one week ago, to right now.

“My Aprilia does one-ninety-five

Still have my license, and I’m still alive

I can’t complain but some times I still do.

Life’s been good to me so far.”

Monster inflation helps the wealthy. I have a feeling which one they will choose.

Coffee

It does not help the true, super wealthy who want to own everything. They need high interest rates, in order for the banks that they own, to make mega profits. From the mega profits they then can claim all the land and houses and businesses that have escaped them when the owners can no longer afford their bank loan interest. It’s an old trick and has beeen done many times.

Inflation transfers the wealth of a nation from those who produce to the money lenders. It creates what the FED calls the Wealth Effect.. It creates a system whereby it is more profitable to speculate than to produce. The more inflation, the faster the transferring and the more speculation. Those who have to borrow to exist are transferring their hard work to those who control the assets, the lending and the speculation services.

Inflation means that the money earned buys less over time. So suppress wages and increase the money supply and you have a wonderful wealth creating machine for the elite who get the skim and the profits.

If this were even close to true, then every developed economy would have “monster” inflation consistently and so would others where it only happens intermittently.

Why hasn’t this happened?

Let me give you my answer. Because institutionalized inflation above a supposedly “moderate” level (such as the FRB’s 2% target) undermines an economy and society eventually. Of course, even prior to COVID, this 2% “moderate” inflation (assuming it was accurate) was the equivalent of Chinese water torture gradually impoverishing the middle and lower classes but this has been ignored.

Sure, a lot of the rich are greedy, just like a lot of others. But I’d guess that essentially all of them are knowledgeable enough to know that debasing the currency doesn’t actually make them richer.

Call me NOT surprised that the whining has started. The superrich are squealing and it probably won’t stop.

We’ll see how much pain they will be able to take before the Fed caves back to more ++$$$. ++$$$. ++$$$.

Before that, however , I expect a huge effort Monday to drive stock prices up to “normal.”

My prediction: the screams will get louder as the tapering gets rolling, as values get lower. The tapering will suddenly be declared as “premature” by the wise counselors on Wall Street who were yelling “inflation” before.

Interesting anecdote.

They did a study of charity giving outside Tim Hortons coffee shops in Canada. The point was to see how much a beggar was given by different economic groups. The groups being well-off, middle class, and working class.

At the end of the study, it turned out that the working class poor gave the most money to the beggar. And the rich gave the least, even though they could afford it the most.

How does this relate? The rich have always squealed the loudest when their hair got a trimmin’. Like the founder of Kinko’s said in the documentary, “Hell yeah I’d like another billion.” Some is not enough, and more is just the starting path for the well-off.

Many decades ago, we volunteered every year at school to collect money for the annual Red Cross charity “door-knock”. Even back then we were told to avoid the wealthiest suburbs as they rarely made a donation.

Plus ça change, plus c’est la même chose.

The ‘rich’ tend to write checks….to favorite charities, attend galas, etc.

not hand out singles outside a store.

I think an unfair study.

Except that it’s corroborated by all of the other social studies that demonstrate a correlation between wealth and disregard for fellow human beings.

Also except that a lot of the “giving” by the wealthy isn’t actually giving. It’s social engineering and retaining asset control.

I’m not very familiar with the more recent foundations but look at those established by Carnegie, Rockefeller and Ford. Ford’s in particular was necessary to maintain family control of the Ford Motor Company due to the estate tax. It’s outlined by Ferdinand Lundberg in “The Rich and the Super Rich” published around 1964.

That’s why Ford Motor has two share classes. After Henry Ford’s death (1947 I believe), they owned 100% of the Class B shares representing a 10% equity interest and 40% voting. The remaining (close to 90%) Class A shares were donated to the Ford Foundation which were sold off over the years.

I consider the creation of these foundations to be one of the worst outcomes of the estate tax. I’m aware that some of it has been used for worthwhile purposes such as medical research. It’s also substantially if not mostly been used to fund policies and programs which I (and many others) consider to be disastrous for this country.

what eg said. There have been studies of things like tax deductible contributions, which would eliminate the “I’d prefer to write a big check” effect. In general, the less money someone has, the more they give as a percentage of their income. Reflective of the biblical story in Mark 12:44, and possibly due to that influence, I’m curious if this phenomenon holds up when controlled for religious affiliation.

August,

I lived in Palm Beach County, FL and got to see the Palm Beach charity industry up close. They fund their fancy parties through charity organizations, where 99% of the money goes to throwing the party and 1% to the charity. Then they get to write off the entire amount as a tax deduction.

historicus-in his dotage, it’s reported that J.D.Rockefeller walked the streets of NYC attempting to hand out shiny new dimes but was puzzled by the lack of gratitude, or even scorn, he encountered having lost touch with the dime’s purchasing power by that point in time (his public reputation probably didn’t help him much, either…).

may we all find a better day.

After living and working around rich people, I expect them to be super cheap with everything that doesn’t benefit them directly. They give to charity only when it benefits them through taxes or media exposure. They are incapable of giving a homeless guy $20 on the street.

I always gave money to people on the street because I assumed it was very hard to have to ask someone to help you survive. Still give to street people and more than in the past, considering what we went through in the last 10 years.

I lived around some very rich people in Sag Harbor and my next door neighbor was a black gentleman named Earl Graves He was generous enough to offer to send me a check for half the cost of a fence I was installing at my cost between our houses And my friend Glynn Hiller down the street on the bay was very generous and supportive to me during my divorce so they aren’t all bad

Federick,

The fence guy was willing to pay you half to get half an interest in the fence. This way he could paint it or hang stuff on his side without any problems. He proves my point, these guys never do anything with money that doesn’t benefit them directly. The other guy was obviously a friend helping a friend, unless this cost you a favor down the line.

On an unrelated note: What is going on in Turkey with the devaluation. Are you buying more property?

Been watching “Some Guy Rides” on You Tube. A guy is riding Honda 125 cc Trail bike across country.

People in rural Mississippi and rural Arkansas have been the most kind to him so far. I think if you don’t have money to buy all the services you need then you tend to have a culture where you give of your time and skills because everything hasn’t been monetized in rural culture yet.

I always gave whatever was in my wallet to people who were ejected from the emergency room across the street on NW 23rd and having a breakdown. It happened too often. I’m still amazed that no one during this pandumbic has been clamoring for universal free health care. Just goes to show that it’s not about public health.

I almost never give a penny to any others on the street unless it’s an old dude in work boots. I tell them I need my money for child support. Shuts them up completely.

Oh, yeah, and one other thing.

Monster inflation could boot Joe Biden out the front door of the White House.

Doesn’t matter how much he does for the masses, inflation could kill his

presidency.

Yep, it’s the likely outcome: Biden is the Jimmy Carter for the Millenial generation (with the same old corrupt relatives to round out the story).

For the GOP to lose in 2022, it’d be even more shameful than Clinton losing to Trump in 2016.

For entertainment only : basically SPX had a new backbone – Nov 5/10,

followed by a Buying Climax and AR.

Michael, lessor mortals such as me don’t know what yer talkin about.

I doubt any of us have the carnal knowledge needed to decipher Mikael Angel

Michael Engel almost always speaks in jargon related to technical analysis of charts. His bulleted lists seem like random TA notes he takes while looking at charts which are (presumably) related to the article topic.

There are no prizes for predicting this would happen. It’s a no brainer. Much like the whiners themselves. Of course, predicting whether they get what they want is not the fait accompli it was last time.

The management are spooked by the inflation, but what Ralph Hiesey said sounds about right. Tapering and raising rates will be declared premature within the next two months. Buy the dip. Mmmmm, dip.

To be clear by SA I mean southern Africa not the countryn of South Africa.

Avi Gilburt said earlier this month he expected to see up to a draw down to the SP500 level of 4450 or so for the biggest sell off since March of 2020. He also mentioned that everyone would be in agreement that this is the beginning of a multiyear bear market (but he says not quite yet).

Avi’s contrarian assessment is we’re still very much in a bull market and that a level of 5500 for the SP500 is likely to be seen during 2022, with an ultimate market top of about 6000 at some future point. That would mean there is still about 35% upside left when we get to bottom of this little retrace back to 4450. Time to buy the dip?

Avi is an Elliott Wave practitioner. Questionable on it’s own. Almost all analysts are correct in a bull market. But 99% miss the turn. Caveat Emptor!

I’ve subscribed to Avi’s service for almost four years now. I can assure you he has caught every major turn during my time there.

Look for the SPX/ES to bottom next week or so and then grind up for several months.

Yep

Irving Fisher lost most of his fortune in 1929/30 because he thought that the markets had reached a permanent sustainable plateau. It wasn’t until afterwards he analyzed what went wrong that he wrote some of his most famous interpretations of interest rates, markets and investing.

Wonder who will be writing after this current euphoria collapses?

Wolf maybe!?!

If anything a new NU Covid will create even more inflation……which will require more taper…….the market is assuming the fed will cave……

Not this time……..unless they want a depression. They must accept a recession or the consumer will be out of bullets very soon due to inflationary impact on their resources.

If they cave the inflationary impact will be a 10% plus per year inflation rate and accelerating.

Powell is still nursing his heartburn from yesterday’s turkeyfest. Come Monday though, he’ll get in front of the microphone to assure markets that he’ll do “whatever it takes”. Today is another bear trap.

this time though, it’ll be transparent that the fed is looking out for stock holders and ignoring the middle class. they don’t mind doing that, but not if it’s obvious that that is what they’re doing.

I think you are overestimating the intelligence of the masses. Give them a thousand bucks every 3 months and they’ll shut up.

Correct. Much more stimulus is needed, increased dramatically every year forever. We have already seen how well this is working out.

No, then they will ask [demand] $2k every 3 months. No amount of free money is ever enough.

Based on the articles out there, Wall Street is fretting about the new virus variant, which they say has 50 mutations and might escape existing vaccines. That seems like a pretty big uncertainty to me that could send stock prices plummeting again. If the new variant shows up in the US, stocks could have a REALLY BAD Day. In 2020, the market tanked shortly after the virus was discovered in the US. This time around, people might not wait for that second shoe to drop.

It’s way to early to cry about halting the taper. No business has been remotely impacted by the new variant yet. The virus news is all speculation at this point. The inflation, on the other hand, is very real.

As an aside, why is the WHO director saying countries should not “jump the gun” on border closures with South Africa, where the new variant is spreading? The sensible approach is to close borders quickly then reopen them if they discover the variant is not a serious risk. The WHO, under current leadership, is proving to be a constant source of irrational advice in my opinion.

Bobber,

Hahahaha, I for one won’t let Wall Street analysts tell me anything about any virus. I don’t even believe them when they’re talking about earnings. They’re the last people anyone should listen to ever about anything except recommendations for brothels.

It is interesting how news of the virus variant came out suddenly on one day, which happened to be a traditionally low volume day. If somebody was trying to tank the market with a media blitz, this was a good way to do it. I think it was a big morning surprise to most people.

In the rest of the world, where the news came out of, it was just a normal Friday after a normal Thursday.

Bobber

I had the exact same thought…

then the fretting over the weekend, and Monday’s opening

Curious timing.

The stock market didn’t even come close to “tanking” on Friday. Less than a 3% decline happened hundreds of times previously. Looking at a longer term chart, it isn’t even noticeable and this one won’t be either unless the market actually ” declines substantially.

@B

Uk tanked 3.5% on Friday! Europe 4% Asia 2.5%

Travel, hospitality much worse.

I lost a shedload but maybe I’m just imagining it like so many other things in this crazy world.

Conspiracy theory to blame the new virus scare story.

Wolf. Don’t sell the short. They also know where to buy music and blow.

Wall Street is full of houses of ill repute.

This is a black swan event.

There is little question that Omicron is far more contagious than Delta. However, it appears to only cause mild signs and symptoms: nausea, headache but no loss of taste or smell… It may turn out to be a contagious vaccine…

For those of you who followed my advice to buy SRTY have a profit.

The biggest rallies in the stock market are during bear markets.

Bulls make money.

Bears make money.

Pigs go to slaughter.

Shorting the market successfully requires timing. Since over long periods of time, the market rises, shorting requires an entry and exit.

The bonds rallied on the Omicron news.

Yes, the US stock market is ridiculously overvalued. But it might take a long time to hit bottom with huge volatility.

We are forced to guess when it is time to take our profits and forced to guess when to short again.

You said it yourself, “significantly inflated prices”. A stock priced at $100 just 10 years ago, should be priced at $200 today if it was adjusted for true inflation, which according to alternate sources has been raging at 8% – 10% for the last 10 years. The PE of the S&P sits just below 29 after today, but was over 120 in April 2009 before the crash. Historically, 29 is high, but is it crash worthy. I think there is a lot of hype/spin being perpetrated when the real problem we face is the consequence of misguided monetary policy … the dollar is dying putting everything dollar denominated into question.

DXY doing good this year. Walking dead?

exactly, …still tall on its knees and ‘not dead yet’

The only thing your post confirms is that the PE is unreliable as a market indicator. Of course the PE was high in 2009 after the crash (not before), because the market had already “crashed” but earnings crashed even more.

That’s what happens when a mania ends. At the peak, the “fundamentals” supposedly look “great” making PE supposedly reasonable. Then the market takes a dive, earnings crash, and dividends take a (major) haircut making stocks look expensive.

Except that in 2009, stocks weren’t really that cheap historically on March 9 either.

A couple more of these and the Fed will have its cover to walk back its recent statements and to keep the money printer going brrrrr. But will it?

The DOW is currently at 34,900 – an impossibly massive bubble number. Crying over that? These toddlers need a swift, firm spanking and a time out – the kind we used to get before said discipline was deemed “abuse.” Nothing sets a crybaby straight quite like some hot cheeks!

right, which is nearly 20% above the pre-covid high. is the economy 20% better than it was then? i think not.

Aw but that extra value is needed to prop up my retirement fund.. Who’s going to pay my pension if the market falls to its real value?

Much like the mom of Veruca Salt…one little tantrum, WS will gets it’s black Friday wish come next week, afterall the market has to from time to time flex its muscle to show pussboy Powell who is the real B in this F up relationship on the backs of working middle class.

Thinking of tapering? Not so fast, as much as Biden would like to do act like he is doing something about let’s face it, he is dumb enough to appoint pussboy to another 4 years and he is not going to call him out like Trump did, so that punchbowl will come back out real quick..

Call Powell out like Trump did? You mean when Trump threatened and bullied Powell to make Fed rates negative, turning the punch bowl into a swimming pool and dialing up the creation of free money? Pussyboy Trump wasn’t successful in that, like many other of his deranged tantrums.

“Trump’s call for negative rates threatens savers”

(Reuters, Sep. 2019)

drifter…

exactly…..Trump was just as bad as anybody cheering for low, negative rates and higher stocks to be pinned on his administration.

Trump has always been a borrower, in business…..hates interest rates, and hates the Fed who put him out of business in 1981…big time out of business.

Once saw an old King Cobra eat a baked potato,

He wasn’t a rebel, just a jazzed tomato,

Bummed a smoke and disappeared into the fog,

Gone in a flash like a knucklehead hog.

Woke last night to the sound of a saxophone,

Ringin’ in my ears like an old black telephone,

Knew I couldn’t get the current time,

Can’t buy that info with a tinfoil dime.

Decideded to take a long night’s drive,

Headed on out at forty five,

Turned toward the highway where we got our kicks,

Shoulder littered with trucks all waitin’ for a fix.

Out in the badlands where the dark sits heavy,

Came across a wreck ‘tween a Ford and a Chevy,

Heard a voice whisper, “Here’s a deal to be made,

Ten percent down buys the whole charade!”.

Got back in the car, put my foot to the pedal,

Said, “To heck with this, I don’t need another medal”,

Doors shut tight and the wind wings open,

Radio blastin’ just a wishin’ and a hopin’,

“Dangerous Curves Ahead” read the neon sign,

Keep to rule of ’76 and I’ll be fine,

Watchin’ for that big one on the last incline,

Rusty ancient words…”End of the Line”.

Happy Indigestion Day…the native’s revenge.

NY Fed to be busy sunday nite

The Fed, as it always does, has telegraphed its coming moves and those moves are not going to be good for the stock market. The smart money is getting out now.

Those who say “the Fed CANNOT raise rates” are about to find out otherwise. IMHO.

billy

we have dystopia created by the manipulations of the past decade.

Magic wealth creation is coming to an end, IMO

We will see a trap where being in cash will be punished from inflation and a sloppy Fed policy to fight it.

But the meager rate increase from the Fed will be just enough to keep stocks from rising. In a flat to down stock market, inflation can have a double effect on the investor.

The money you have in the stock market is dropping by 6% in value too, dont forget. Stocks drop 10% while there is a 6% inflation, well you just lost 16%. Oops

Under inflation, an earthquake in equities provides the rocket fuel for real estate.

How long have you been a housing shill? We’re at the peak of the most massive housing bubble in history, with rate hikes coming, and you are talking about “rocket fuel for real estate.” You’re like a parrot, just mindlessly repeating a talking point.

Look at home prices in the 70’s. They went up a lot. He’s not wrong about the end result w.r.t. real-estate values, although I’m not sure about equities performance being the driving force.

The 70s had a massive population entering a prosperous workforce and starting families. They also had little to no debt coming out of school.

The 70s didn’t begin with a massive housing bubble. Look at the data. This time around is different in so many ways. Yes, I am old enough that I remember the seventies. Housing is going to crash very hard this time.

According to FRED (Federal Reserve Economic Data), the median price of a single family home was about $24,000 in 1970 and $64,000 in 1980. That was wicked bad inflation.

> You’re like a parrot, just mindlessly repeating a talking point.

About half the comments on this site get covered by that critique, including the people who consistently respond to every SoCalJim comment saying the same thing.

Let me play the devil’s advocate: what asset class is going to absorb negative returns in equities? T-bills? Money market funds? NFTs?

If you’re a cash buyer for income-producing properties (or you can borrow at a below market rate, which is one thing Wolf has repeatedly pointed out is an option for big pools of money), why would you care about rate hikes? In fact, if you’re a cash buyer, rate hikes are your friend, they’re driving away the average buyer who now is priced out by high prices and high mortgage rates. One possible outcome of this is that individual home ownership plummets and the majority of the country turns into renters.

It might be a bad time to buy, but it might be a worse time to not own anything at all.

Your “income producing properties” are going to be getting a big slap down from voters. If you don’t expect it, you are delusional. The millennials will be firmly in charge of politics in the next few years, and they suffered through the GFC. Regulating rents is going to be a huge issue with them.

Also older geezers, like me, are already getting priced out of the rental markets, and when you merge those two voting blocks, you get a winner.

The important thing to remember about real estate is that everyone has to live somewhere and nobody is making anymore of it [real estate]. You might have a gazillion in Tesla shares or bit coin but you still need a place to live.

Ultra-low mortgage rates have fueled this housing bubble – not much to do with equities. Once rates rise, the housing market will cool, at minimum, or simply cave-in. In the downturn of ’82, many big home builders went broke. The stock market collapsed, too. Dow P/E was at 8.

Don’t forget the oil-bust when housing in Texas, AZ, OK, Alaska, Colorado went down for the count. Big, big losses. Housing isn’t bulletproof but the myth that it is continues to march forward, with flags flying.

Conspiracy is in full inflation mode; we can thank the fat boy for bringing it center stage, which brings us back to COVID… Remember someone saying it was a “hoax”. Phoenix-Ikki probably doesn’t – cognitive dissonance they say. Selective ignorance, I’d say.

Not sure why you brought up my name, never believe Covid was a hoax and I do remember certain folks on this site stating it was and I just kept my mouth shut and roll my eyes, cause you know arguing against conspiracy theory on an internet forum is kind of like punching yourself in the face over and over again just because you have an itch on your nose, can’t win and doesn’t make a whole lot of sense.

It’s funny, I was going to reply back to SoCalJim and his take on RE but honestly why bother? Just know what his talking point is and just move on, it’s the same every time. I am just glad at least we have SoCalJohn to balance it out :)

To give credit where credit is due though, so far SoCalJim has been right about the home prices going up and up and we’re the ones with eggs on our faces. Will this last forever? My stubborn cognitive dissonance side tells me no but the FED had for the last two decade created a paradigm far from fundamentals and reality, couple that with an almost religious zealous like belief that owning a house can’t lose, a perfect formula for turning this into a real this time is different scenario.

Amen.

Eventually, the real estate rally will end. That will happen when inflation drops substantially. I expect inlfation will be with us for at least another year. I doubt the FED can do much about inflation as long as the supply side inflation pressure exists. Furthermore, the FEDs hands are tied before the midterm elections. Because of inflation, I expect a substantial amount of money to be reallocated from equities to real estate. Personally, I am not adding new real estate posiitions at this time, unless a screaming deal shows up … not many of those.

there are no supply side inflation pressures. there are supply side inflation pressures caused solely by excess demand. reduce demand, and the former go away too.

Jake W, if what you say is true, then the FED would already be raising rates. But, they are not because they know better.

The low rates is just a factor … not the main story.

The globalization story we have been told for 30 years was too good to be true. As they say on Wall Street, there is no free lunch. We are seeing years of pent up inflation hitting all at once. COVID was the straw which brought down the house of cards called globalization.

Every president from 1992 though 2016 is responsible for this unfolding disaster. That is 16 years of Dems and 8 of Republicans. Both parties are responsible. And, they all hate our last president for highlighting the problem before it hit.

I don’t call them crybabies anymore. I call them crybullies.

Hahahaha, might hafta steal that from you.

Agreed. It’s healthy for markets to correct. Typo in last sentence: by not buy.

Wolf, if you’re going to write quickie about the crybabies, could you at least give a few quotes or sources, please? Think of this as you cool graphs.

Now, if we could somehow have about 10 more days of this, then we’d be talking about a much needed correction.

Thanks!

I used see the title and post a relevant comment but today I read the articles. They are of good quality with hard work and input. Anyway I digress. My comments are below.

1. The spark for this dip is actually a new strain of virus which can potentially cause more lockdown and relief measures. There will be additional dollars this year

2. A small dip is a very good opportunity to buy stocks. Inflation or not, all the corporate welfare programs will begin again. Buy the dip.

3. Anyone who expect a sensible correction or bear market or even recession will be disappointed. May be zero interest rates forever.

4. Even if this stain turns out to be a normal variant, even then everybody will act like this is the worst of all virus

5. The biggest threat to our nation is obesity. Today the battle is lost.

“A small dip is a very good opportunity to buy stocks.”

Of course, since the definition of a dip is that it goes back up.

Would you agree with:

A small drop is a very good opportunity to buy stocks. Buy the drop.

“May be zero interest rates forever.”

That will DESTROY the American worker/earner/saver…… the country will implode. With inflation and no interest, the future is dim.

More subsidized debt creation by an uncontrolled federal government working in conjunction with a Hijacked Fed.

I completely agree. If there is one thing the past year and a half should have taught us it is this:

Pandemics are great for stock and real estate valuations. Omicron is great news for owners of assets and dip buyers.

Congratulations to those who have learned from the past and have the cajones to act, the Fed will make sure you are well rewarded.

Would more agree with the new phrase I learned. Don’t fight the FED. They will use whatever excuse to pump money into the markets. They now how a playbook full of positive experiments where disaster = success

Amazing ride we are on…..

Inflation at the same time assets lose value?

No one is able to predict with much certainty just about anything…..

As a retiree I am amazed at the lost of purchasing power in such a short time and think that there is much more inflation to come.

New variant? WOW….

At this point I do not believe anybody or anything said.

Next week I will look back to see if this was just another money making gyration from those who know how to manipulate the markets….

There is no such thing as Capitalism in the world anywhere. Everything is “engineered” and those of us schooled in Western Civilization have an obsolete worldview platform for analysis that is of no value whatsoever.

It is like trying to describe a car using the analogy of a horse.

The past does not have much relation to the future…. Now the game is data science in relation to mass/individual behavior.

Example, I am always looking at zillow and realtor.com and found that those searches result in flippers calling to see if I want to sell when all I am doing is watching mindblowing price increases…. I am now going to use my VPN on firefox or Brave search engine to avoid this data trap.

“Inflation at the same time assets lose value?”

Stocks and real estate way way way ahead of services, labor, and essential items. One side could drop as the other rises….easily

“much more inflation to come”

Agreed. Oil may drop some more with lower demand from the wild card new COVID variant….but services, food, etc…..all to continue a runaway .

Every union in the country will go on strike, and giant price increases coming after the new year. This is a mess.

Wealth destruction is coming …. some of it was fluff in markets……some of it hard earned cash losing its value. A double edged guillotine

historicus said: “some of it hard earned cash losing its value.”

——————————–

The problem is that hard earned cash has been mixed with loads and loads of funny money, created from nothing digitized “cash” or dollars, and very few, if any, have a clue of how much exists.

“Everything is “engineered””

Sure looks like a new world order where virtual reality can be manipulated at ease by clever “financial engineers” whereas the real world requires a lot of hard work to make changes.

But soon, and you can see it starting in the primitive flash mobs in San Francisco, the Willie Sutton philosophy of “Theft Engineering” will emerge and parasitize the virtual reality parasites. Thieves will loot the financial engineers because “that is where the money is.” Let them collect it and then steal it from them. When a mob can waltz into your house and take everything, what’s the point of being rich?

AdamSmih said: “There is no such thing as Capitalism in the world anywhere.”

—————————————

There is lots of Capitalism, and Wolf is describing it. There just aren’t free markets, which too many people try to juxtapose with Capitalism. The Capitalists have captured the FED.

Talking about labor shortages. At my favorite Irish Pub the other night which was packed wall to wall, Thanksgiving eve, when all the drunks come out in full force there weren’t enough servers to serve the beer. A riot almost ensued. Irish don;t like when it when they don’t get served their firewater. They had to bring out the chief chef and the dishwashers to fill the void and serve up the beer.

There’s nothing worse than a slobbering, angry drunk.

A slobbering, angry drunk behind the wheel is.

DanR.-check infinitum…

may we all find a better day.

From Spring 2020 through last week, Wall Street shrugged off every piece of bad news regarding Covid. Now that QE tapering finally started last week, they suddenly care about the 10th or 11th variant of interest?

This selloff was orchestrated for one reason only: to scare the government & Federal Reserve into unleashing more stimulus & QE.

Also, notice that commodities were indiscriminately dumped today. Oil was down 13% but almost every commodity fell.

When Wall Street last tried this in 2018, it was enough to bring down inflation by half a percentage point, so Powell was able to point to “below target inflation” of 1.5% as his rationale for lowering rates in 2019. Which, of course, was more politically palatable than admitting you’re rescuing the stock market to serve billionaires. With inflation at 6% instead of 2%, it’ll take a lot more dumping to work…but who knows.

That would be hilarious if there was actually a concerted effort by Wall St. speculators to hurriedly drive down commodities prices in order to continue to enjoy FED pumping. How pathetic. These people offer nothing of value whatsoever. They’re a cancer upon society.

The worst thing ever was the 401k sham. That opened the door to Wall St. getting their hooks deep into the flesh of society, so now they can cry “but you NEEEEEEEED to save the markets because of peoples’ retirements!!!” These vermin need to be eradicated like an infestation of lice.

As I posted many times. I don’t give a rat’s a$s about the stock market. Don’t have any stocks or 401K’s. The only investment I have in Wall Street is a mutual fund that invests in sewers and water treatment infrastructure. I believe that if you invest in s$it you can’t lose.

Depth Charge: “The worst thing ever was the 401k sham.”

——————————————–

It is a top competitor for worst sham. Don’t forget the Federal Reserve itself, or government guaranteed loans, lifetime public sector employment vs at-will private sector employment, and a few others.

Credit cards and credit extension in general have had a questionable effect on society …………

Never seen commodities fall without a fall in M*Vt. I don’t think the FED is reporting the money stock accurately.

Jackson

“Wall Street shrugged off every piece of bad news ”

As the Fed was pumping the heck out of M2.

Not happening this time.

Y’all are forgetting that Yeljen has the “Exchange Stabilization Fund” ESF that she can use to intervene in markets in times like this. Mnuchin used it to great effect. Every time there is a swoon for a few (two to three sessions) miraculously the market goes up the next trading session. It’s like they prime the pump and everyone piles back after they’ve been spooked and sees they were skittish for no reason.

I think after it drops about 5% total from high it will bound upwards

Alex,

“the “Exchange Stabilization Fund” ESF that she can use to intervene in markets in times like this.”

Nonsense. Under Mnuchin, the S&P500 tanked 20% from Sep 2018 through Dev 2018. And the fund didn’t buy stocks.

Exchange Stabilization Fund can be used to stabilize the dollar exchange rate against other currencies. It has only three types of assets: USD, foreign currencies, and Special Drawing Rights (SDRs).

It doesn’t buy stocks.

“The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments.”

https://home.treasury.gov/policy-issues/international/exchange-stabilization-fund

or, they can set up Special Purchase Vehicles or some other circumventing entity. It is pretty clear there are no rules for the Treasury or the Fed when it comes to saving Wall St.

What is the difference between purchasing Special Drawing Rights (SDR) and foreign exchanges when the SDR is just a basket of foreign exchanges?

Mr. Powell circumvented legal restriction by creating SPV (Special Purpose Vehicle Funds) to bailout Corp bonds (junk++) last year. No one in the Congress or any regulater voiced their opnion.

Stocks will be allowed to be bought( Ms. Yellen alread voiced her opnion in favor of this, on record) all in the name of FINANCIAL STABILITY! They have already done with throwing the good ole’ genuine Free Mkt American Capitalism, out the window in March of ’09! It has been replaced with crony or predatory system favouring the few at the top, at a cost to the rest!

The new Covid mutant, supply chain problems, increasing labor wages ,increasing inflation ‘expectation’ and possible lock downs even if it is limited are a high bar for the Fed to land softly! I am delighted that Omicron variant is forcing to them to face the problems (insane credit creation) they have created for the last 13 yrs!

In fact my trading on Nov 16 was one of the best days in the recent years, for all my portfolios! I never believed in this prolonged ‘surreal’ mkt any way. I read late news on 25 on the new variant and was ready with PUTs and hedging CALLs ( Had alreadystarted selling all overvalued stocks with a few exceptions, afew ago but loaded up on Energy various ETFs, XOM and CVX and metals stocks (EV industry related) and that worked smoothly on Nov 26.

The current period reminds me of 2007-2008! I see already sooth sayers on Wall ST, belittling the new variant. GS is even proclaimed that there no need change in the portfolio! This reminded me of, how Wall ST iinitially ignored sub prime mortage bomb in 2007-’08 claiming that those were JUST 2% of all Home mortages! ) Been in the mkt since ’82)

I was waiting for days like Friday. Chance favors the one prepared!

I hoot for the REALITY and ‘reversion to the mean’ and am prepared with a lot PUTs and hedges

Those who cannot the past are condemned to repeat it (G. Santayana)

Re Nov. 16th –

So you had a PUT with an offsetting Call? How much spread did you make, how much did it cost you and much risk was in it?

Re Nov. 26th –

So what did you do, and when you know if it worked out?

@cb

I have been trading OPTIONS since 2003. B/c that I lost nothing during GFC (2008) I use tactical/stragic trading using PUTS (hedged with CALLs at different frames) also use Inverse leveraged ETFs but paired ‘loosely with long leveraged versions. NOT for the novice! ( I have taken special courses including exposure to MBA curricum)

Read the blog article at Naked Capitalism re Omicron NOT the kool aid spewed ot by MSM!

I always had a relatively high cash position(40-50%), since I am deep in retirement. I don’t DO paired options trading (bull spread/Bear spread) since it limts one’s flexibility, in volatile environment!

The night prior to Nov 26, I positioned to see many long positions and replaced with CALLs ( of different time frames but with 2-3 months) and also PUTs for the expected bounce back (like today) Now my cash position is nearly 60% but geared long towards Info tech, biotech, cyber security, robotics, EV related, ENERGY (fossil fuel!) Medical/health – Mostly ETFs although I buy some individual stocks. Very minimal MFunds!I have a high risk tolerance since I started trading since ’82. I NEVER believed in this SURREAL bull mkt of my life time, all supported by EASY-PEASY courtesy of Fed(CBERS!)

The DOWN cycle has begun withBEAR trend along with hiccups and bear traps along the way! Trade accordingly and Be safe!

Thanks sunny129-

I appreciate your generosity of explanation, and hopefully it has helped some of the readers here. It is beyond my current understanding. It sounds like it takes a lot of experience, focused thought and deep work. Unless someone has a very large portfolio or a real passion, I always question if some of these trading strategies and the time to attain the skills and knowledge is worth the investment. Is the increased yield over alternatives worth it?

Wolf produces great content. The site is even the better for commenters like you, historicus, vintageVNvet, the gone but not forgotten unamused, etc. A lot of good minds on this site. (I suspect even the incomprehensible Michael Engel might be a genius I just don’t have the ability decipher.)

Anyway, thanks again.

Imagine the suckers who bought Doggycoin at $.74 – do you think they like slummin’ it at $.20? Do you think these people are still TRUE BELIEVERS?

Yes,they are TRUE BELIEVERS !

For my dose of inspirational poetry I often go to reddit:

Buy Dogecoin when it’s low…

Buy Dogecoin when it’s high…

Buy Dogecoin when it’s rain…

Buy Dogecoin during sunshine…

Because crypto trading

Beats work on assembly line…

10 minute limit reading such poetry is advised.

Unless you want to lose your marbles.

Actually made some money today dat trading XLE and UNG.

Ain’t schadenfreude fun!

Let’s see how long this lasts before the dip buyers come in, claiming Oil’s fall means blue skies ahead. It was bizarre that the little bit of information or rumours about this Nu-Variant caused such a sell off especially in Oil. Looks more like a cover story for shorting Oil and getting if down (10% in one day?) and off the Biden Admin’s political back (look inflation is Transitory again) and in the buy-side crowd’s good books.

There are some suggestions this is from the new variant but I think its at the very least possible that the new variant is not the cause, and Powell is simply and observably running out of excuses.

I think the Friday cryptocrash and stock wobble is more in line with Granthams idea that the air seeps gradually from the most exuberant stocks first of all, because if the new variant is bad then that means -more Fed pumping- not less.

UK opinion “Sir John Bell, one of the Government’s most senior advisers on vaccines, said the new variant may end up causing no more than “runny noses and headaches” in those who have been vaccinated.”

Dr Angelique Coetzee, who chairs the South African Medical Association. Dr Coetzee asked why everyone was “up in arms” and said: “So far, what we have seen is very mild cases.”

Could it not be, that leaving aside the winter catastrophe for Germany with Delta, that the world is basically moving on from the cover for the Fed to avoid normalising policy and the fabled “doozy” of a crash is finally incoming.

Wage inflation, expensive onshoring on supply chains, persistent higher oil because investment crashed, fewer workers. All these problems would be forestalled with another lockdown.

So far the “tapering” is like a 400+ pound guy whining about upcoming changes in his Dickey’s Barbecue Pit “3 Meat Plate” meal.

Calories: 3,816

Fat: 190 grams

Saturated fat: 133 grams

Sodium: 6,834 milligrams

Added sugar: 149 grams

He’s thinking of replacing the regular coke with a diet coke. Shouldn’t that be enough?

America is mentally trapped between its free market ideology and the reality of its socialized risk markets. The country will tear itself apart to avoid looking in that mirror.

“So the clamoring by the crybabies on Wall Street for relief from the Fed…is just hilarious”

Hilarious till the Fed restarts its printing press and then revelry sets in on Wall Street.

Which is something that one cannot say will not happen. After all, the Fed might well say that while inflation does not appear to be transitory, with the new strain that is something that will come down and it has to focus on its mandate of economy and employment. When you can speak from two sides of your mouth you are free to choose which side to use while speaking.

While inflation is a bitch no one can really say whether it is still such a mean bitch that it will make the Fed back pedal. Mean bitch could be when it enters double digits and is galloping.

One can say with certainty that the Fed will not let down its chummies very easily and will spin it as a gift to the dummies.

Many things at work here, including foreign investors who exert their influence on NYSE through the futures market. They are worried about the pandemic, and the empty gas pipeline from Russia who is knocking on the door in Ukraine. Mostly this is a news driven market, and US investors like the weekend turn, they can play off the foreign markets which open ahead of it. Today seems very much to be influenced by that process.

NU slogan for the NU mugs in the NU era…NUthing goes to heck in a straight line!

For entertainment purposes only :

1) The DOW daily got support from the cloud and the NR area on Sep 13/15. Possibly EW wave 3 of 1. Wave 4 of 1 next.

2) The DOW weekly : DM #2, a trigger bar. Got support from T&K of

the cloud.

3) NDX monthly : a shooting star with a large selling tail.

4) NDX weekly : a setup bar, an Engulf.

5) NDX daily got support from T&K of the cloud. NDX might form a small H&S that might send NDX lower to the cloud. Chikou indicate that K will be losing it’s lows. That might cause a bearish flip, unless NDX make a new all time high.

6) SPX monthly : a selling tail. In Oct SPX reached 18 DM months of moving nonstop up and DM #13. T&K are too far apart. The cloud is too far below.

7) SPX weekly : a setup bar, a DM flip.

8) SPX daily : a setup bar. It’s the first close below Nov 22 low. If next

week SPX will move lower, SPX will have a trigger.

9) SPX will trigger what ?

10) BTC/USD daily got support from the bottom of the cloud. The front end of the cloud had a bearish flip !

11) BTC/USD weekly : have both setup + trigger bars. Most crypto surfers

don’t care, because they bought a house on the beach with the crypto profit.

I get it! It all makes sense except for the last line: “because they bought a house on the beach with the crypto profit.”

My guess is that the PPT will be hard at work on their keyboards buying everything in sight Sunday night and Monday.

b

They will be high balling SP futures no doubt, around 3am

AI can do it better : T1 = 38% of BC, T2 = 62% of BC.

1) Sept high is A, Oct 4 low is B and Nov 22 high is C :

2) Both SPX and NDX retraced BC slightly less than 38%. They might get there to T1 next week, or breach it, but under 50% BC, before testing Nov 22 high again, or even breaching it, to a new all time high. A new all time high means more volatility.

3) Thereafter both SPX & NDX might move to 62% of BC, to T2.

4) It might be wild a Dec :

– SPX case : BC = 1.75 AB. SPX went vertical.

– NDX : BC = 1.83 AB. It’s even more vertical rise in less than 2 months.

5) Both SPX & NDX might osc between T1 and T2 more than twice, to build a cause.

6) A cause what bs ?

7) C should be on Nov 6 high, but I tried to keep it simple.

Oh my gosh.

But TSLA is not among the biggest losers. Pooh. Then everything must be fine.

I was getting worried for a short moment.

You may label Wallstreet as crybabies but at the end of the day these crybabies will prevail when the Fed stops the EQ unwind, puts interest hikes out to the very distant future, and even starts up EQ again but this time at warp speed – moral hazard be damned. The Fed has two options: (1) fight inflation and let all markets crash or (2) let inflation run hot. Actually, letting inflation run hot is the optimal approach because with 15% annual inflation over 5 years that brings the debt to GDP ratio down from 130% to under 50%. At a 50% debt-to-GDP ratio now they can come in and raise rates. Choosing the first option brings the Fed to this end point anyways because they will have to print the money to bail out pension funds, deficit spending increasing with the tax base decreasing, etc. so why even go that route.

Revision: Debt to GDP ratio would decrease from 130% to 65% if inflation runs at 15% per annum for 5 years.

The flaw with that argument is that debt will not stay constant. It will even increase faster than 15%/year. Just look at the last few years.

@ GvsCfa – show the numbers if you really think you have a thesis

It’s actually funny how many Wall Street crybabies are crying out loud here :-]

Luv u wolf but there’s no way J-Pow! Doesn’t use this new “emergency” to extend and pretend.

Inflation be damned, we r in an emergency!!!!!! (for the past 12 years)

Clearly the Fed has Zero interest in helping anyone but themselves Clearly the President is supporting the Fed by nominating them all over again.

Forget Fixing the Fed, and the President. The Fed needs to be abolished .

Impeachment comes to mind.

Why Try to fix Crooks with Crooks That’s like hiring a Bank robber to protect Your savings ,to have the Markets controlled by Crooks is insane .

Do you really wonder why all this Smash and Grab is going on across the country ?

1) Crybaby Dr Larry : JP + Brainard are an excellent team. They will vix

us and give us booster shots to protect us from the sticky inflation.

2) WTIC daily : a plunge under BB #2 June 16/18, above BB #1.

WTIC weekly : a plunge to Mar 8 fractal zone.

3) Silver weekly : There was a certain high, the Aug 3 2020 high.

4) The first close under the lowest point of that high, the setup bar

was : Sept 21 2020, It took six months to get the setup bar.

5) The first bar that breach the low of the setup bar, the trigger bar, was :

Sept 27 2021. It took a year to get the silver trigger.

6) So far silver breached T1 and move up to 50% of the plunge.

7) Silver daily : testing the lows, before T2.

8) For entertainment only.

ME,

There used to be a daily cartoon in the New York Daily News titled “Chin Chow,” it was used by many New Yorkers to devine the numbers in the daily illegal number’s game. People would try to decipher single digit numbers from the line drawing and play them.

Befitting a true New Yorker, from now on I’m using your posts to get my weekly lotto numbers.

You are SO late to the party 😀

Everybody uses Mr.Engel’s numbers nowadays.Major improvement from:

-last three numbers in the published daily balance of the United States Treasury

-the middle three digits of the number of shares traded that day on the New York Stock Exchange.

After US Treasury started rounding its numbers-

-last dollar digit of the daily total handle of the Win, Place and Show bets at the race track, read from top to bottom. For example, if the daily handle (takings at the racetrack) was:

Win $1004.25

Place $583.56

Show $27.61

then the daily number was 437.

In the mid-70’s one crowning achievement was fixing the daily number at “776” on the 4th of July considering than many Patriots choose “776” this day.

Never red the Daily News, Infatuated with the NYT, especially the Sunday Times, but stopped cold decades ago.

The stock market climbs a wall of confidence.

When confidence peaks, so do stock prices.

While consumer confidence is not exactly the same as investor confidence, the two are related.

The most recent University of Michigan consumer confidence data released November 24:

Consumer Confidence at 10 year low

Buying Conditions at the all time low

Inflation Expectations highest since 2008.

That’s something to worry about.

Such large declines of consumer confidence in the past have predicted recessions. And I’m sure Jumpin’ Joe Biden will do his best to make the numbers even lower !.

The western governments want another lockdown and this new Corona Virus Strain is what they are hoping to use.

They want this lockdown for an excuse to start stimmi payments in the USA, furlough in the UK etc.

Unfortunately it might go wrong this time because there are a lot of protests in Europe against lockdowns.

Cashboy,

Not sure about “Western governments” but in the US, there won’t be another lockdown. There might be mask requirements, as there already are. But that’s not a lockdown.

Japan cannot even do lockdwons if it wanted to, and it worked just fine without lockdowns because everyone has been wearing masks — masks are not political in Japan, just a low-cost public health measure that works.

If health/Medical care facilities run out of resources (already happening in many states like MN with jusy rise in Delta variant) a definite increase in the winter months with 2 different pandemics (delta and Omicron!)