Big shifts underway — work-from-anywhere, unemployment crisis, oil bust, people searching for a cheaper place to live.

By Wolf Richter for WOLF STREET.

The theme of renters getting out of the most expensive cities is now everywhere. They might retreat to mon and dad’s house to work from home or flee to a cheaper town, or finally buy a house in the suburbs or even out in the country, or whatever. These themes are running around all over the place, often with not a lot of data to back them up at this early stage. But one thing is happening: Rents are dropping like a rock in some of the most expensive cities. And they’re surging in others.

In San Francisco and New York City, rents plunged in August from July at a historic rate, and are now down about 20% from their peaks. Rents dropped in many expensive cities, and in college towns, and in Texas, the largest oil producing state in the US, where the oil bust is amplifying the issues of the Pandemic.

But there are 18 other cities, mostly those that are a lot less expensive, where rents are soaring by the double digits – confirming that there are some big shifts underway.

San Francisco, the most expensive market, skids hard.

The median asking rent for one-bedroom apartments in San Francisco plunged by 5.0% in August from July, to $3,040. This brings the decline since May to nearly 10%, and the 12-month decline to 14.1%, according to data from Zumper’s Rent Report. From the peak in June 2019 – which had passed by a hair the prior record of October 2015 – the median asking rent for 1-BR apartments has plunged 18.3%.

As in so many things, this drop had started before Covid, but Covid is speeding up the process. Homeowners and investors in San Francisco are also trying to get out, and “pent-up supply” has turned into a record glut of homes for sale.

But that 5% month-to-month plunge in 1-BR rents in San Francisco was outdone by Washington DC, where 1-BR rents dropped 5.1% in August from July. And in New York City, 1-BR rents dropped 4.9%.

In San Francisco, the median asking rent for 2-bedroom apartments dropped 3.3% in August from July, to $4,070, bringing the decline since May to 8% and the 12-month decline to 15%. Since the peak in October 2015, the median asking rent for 2-BR apartments has now dropped 18.6%.

Peak-rent in San Francisco occurred in October 2015. Rents then dropped by about 10% over the next 18 months or so before the “Trump bump” fired up the whole situation again, and rents rose. 1-BR rents touched their October 2015 peak in June last year, but 2-BR rents never got close. That “Trump bump” has now been unwound two-fold.

Despite the 20% drop since peak, San Francisco remains the most expensive city to rent in, among the largest 100 rental markets in the US, according to Zumper’s data. However, rents in the most expensive zip codes in Manhattan and Los Angeles exceed the rents in San Francisco’s most expensive zip code.

New York City re-opens, rents plunge.

As the “shelter-in-place” restrictions were lifted in New York City, new leasing activity started perking up two months ago – but at much lower asking rents. The median asking rents fell sharply in August from July for both 1-BR apartments (-4.9%) and 2-BR apartments (-5.0%), amid surging rental vacancies that in July reached the highest rates since at least the Great Recession, according to appraisers Samuel Miller Inc. Rents compared to August last year were down about 11%. And they were down 20% and 23% from their respective peaks in 2016.

The 17 most expensive rental markets.

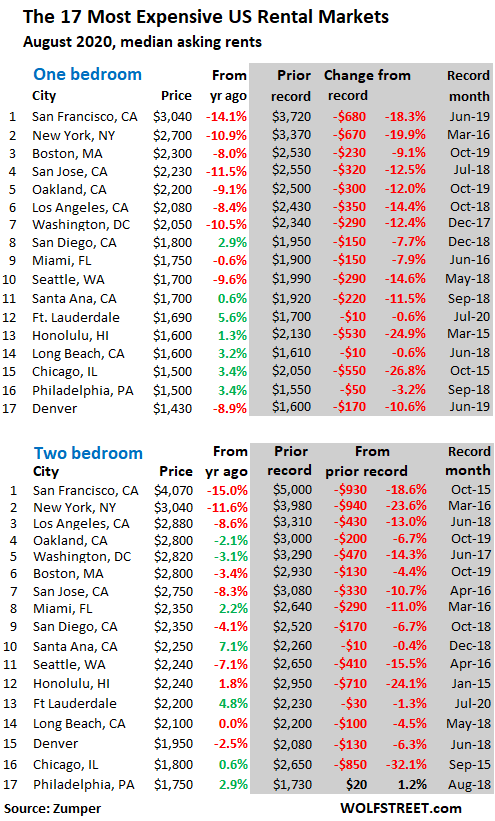

The table of the 17 most expensive major rental markets by median asking rents, based on Zumper’s data, shows August rent, the change from August last year, and in the shaded area, peak rent and change from the peak. Seattle, where rents are now down about 15% from their peak, used to be one of the hottest rental markets in the US! Chicago and Honolulu have experienced the largest declines from their peaks in 2015. But in recent months, they seem to have found a bottom.

What are “median asking rents?”

“Median” means half of the asking rents are higher, and half are lower. “Asking rent” is the advertised rent, which measures the current market rents, similar to a price tag in a store. Asking rent does not measure what tenants are currently paying in rent, such as under rent control. Asking rents do not include concessions. More on that in a moment.

These median asking rents are only for apartment buildings, including new construction, but do not include single-family houses, and condos-for-rent. The data is collected by Zumper from over 1 million active listings, including from Multiple Listings Service (MLS), in the 100 largest markets.

Rental concessions soar but are not included in median rent.

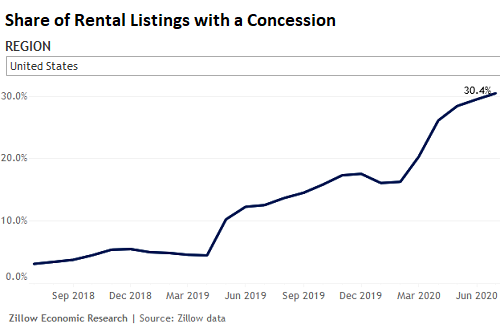

“Rental concessions on listings are now nearly twice as common as they were in February, as landlords strive to attract new tenants in a rental market that has softened considerably since the coronavirus pandemic took hold,” Zillow reported today, as the percentage of rental listings with concessions jumped from 16.2% in February to 30.4% in July.

According to Zillow, 91% of the incentives are for free rent, with the median amount offered being 6 weeks. That translates into a discount of 11.5% for the first year. This discount is not included in asking rents. The chart by Zillow shows the percentage of listings with rental concessions across the US:

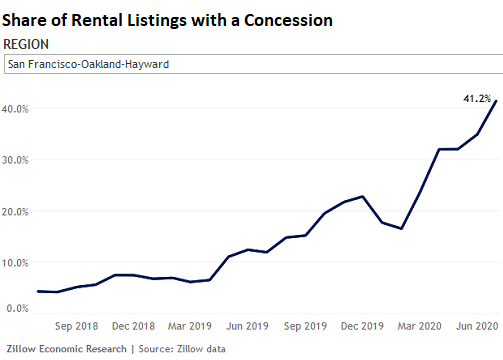

The percentage of listings with rental concessions in the San Francisco-Oakland-Hayward metro reached 41.2% (San Jose-Sunnyvale-Santa Clara metro similar at 40.1%):

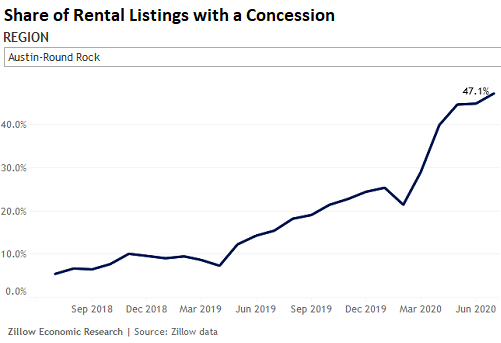

The rental concessions rate in the Austin-Round Rock, TX, metro reached 47.1%:

The 10 cities with the lowest 1-BR rents of the Top 100:

The cheapest city to rent among the top 100 rental markets is Akron, OH, where the median asking rent for a 1-BR apartment was $580 in August, unchanged from last year. In San Francisco, that apartment would be five times as expensive! Tulsa is second in line, at $650. And there are some big gainers in this group, including Detroit, where the median asking rent in August jumped 15.6% year-over-year:

| August rents

Cheapest cities |

1-BR rent | Y/Y % | |

| 1 | Akron, OH | $580 | 0.0% |

| 2 | Tulsa, OK | $650 | -1.5% |

| 3 | Shreveport, LA | $650 | 1.6% |

| 4 | Wichita, KS | $650 | 3.2% |

| 5 | Lubbock, TX | $650 | 8.3% |

| 6 | El Paso, TX | $680 | 4.6% |

| 7 | Tucson, AZ | $720 | 10.8% |

| 8 | Albuquerque, NM | $740 | 5.7% |

| 9 | Detroit, MI | $740 | 15.6% |

| 10 | Lexington, KY | $750 | 0.0% |

The 33 Cities with year-over-year declines in 1-BR rents.

College town Syracuse, NY, led again with a year-over-year decline in August of 15.8% for 1-BR rents, followed by San Francisco (-14.1%) and by San Jose (-11.5%). The table below shows the 33 cities among the top 100 markets with year-over-year rent declines in August for 1-BR apartments. The list includes big overpriced cities, startup unicorn meccas, college towns, cities in the oil-bust region, and others:

| August rents

Biggest decliners |

1-BR rent | Y/Y % | |

| 1 | Syracuse, NY | 800 | -15.8% |

| 2 | San Francisco, CA | 3,040 | -14.1% |

| 3 | San Jose, CA | 2,230 | -11.5% |

| 4 | New York, NY | 2,700 | -10.9% |

| 5 | Salt Lake City, UT | 1,000 | -10.7% |

| 6 | Denver, CO | 1,430 | -10.6% |

| 7 | Washington, DC | 2,050 | -10.5% |

| 8 | Seattle, WA | 1,700 | -9.6% |

| 9 | Laredo, TX | 790 | -9.2% |

| 10 | Oakland, CA | 2,200 | -9.1% |

| 11 | Louisville, KY | 850 | -8.6% |

| 12 | Los Angeles, CA | 2,080 | -8.4% |

| 13 | Boston, MA | 2,300 | -8.0% |

| 14 | Fort Worth, TX | 1,090 | -7.6% |

| 15 | Madison, WI | 1,110 | -7.5% |

| 16 | Providence, RI | 1,470 | -7.0% |

| 17 | Orlando, FL | 1,230 | -6.1% |

| 18 | Plano, TX | 1,130 | -5.8% |

| 19 | Anaheim, CA | 1,650 | -5.7% |

| 20 | Charlotte, NC | 1,210 | -5.5% |

| 21 | Pittsburgh, PA | 1,070 | -5.3% |

| 22 | Tallahassee, FL | 760 | -5.0% |

| 23 | Irving, TX | 1,080 | -4.4% |

| 24 | Minneapolis, MN | 1,330 | -3.6% |

| 25 | Aurora, CO | 1,100 | -2.7% |

| 26 | Corpus Christi, TX | 830 | -2.4% |

| 27 | Raleigh, NC | 1,040 | -1.9% |

| 28 | Tulsa, OK | 650 | -1.5% |

| 29 | Knoxville, TN | 820 | -1.2% |

| 30 | Durham, NC | 1,100 | -0.9% |

| 31 | Virginia Beach, VA | 1,080 | -0.9% |

| 32 | Dallas, TX | 1,230 | -0.8% |

| 33 | Miami, FL | 1,750 | -0.6% |

The 31 Cities with 5%-plus year-over-year increases in 1-BR rents.

Of the largest 100 markets, 62 cities had year-over-year rent increases in August, compared to 33 cities with declines.

The table below shows the 31 cities with rent increases of 5% or more. In 18 cities, rents increased by the double digits year-over-year. But this was down from 23 cities in July. In 10 of these cities, rents spiked by 15% or more. None of these cities with double-digit rent increases are expensive markets – in quite a few of them, the median asking rent is less than one-third of what it is in San Francisco:

| August rents

Biggest gainers |

1-BR rent | Y/Y % | |

| 1 | Chattanooga, TN | 950 | 15.9% |

| 2 | Cincinnati, OH | 950 | 15.9% |

| 3 | St Petersburg, FL | 1,330 | 15.7% |

| 4 | Lincoln, NE | 810 | 15.7% |

| 5 | Indianapolis, IN | 890 | 15.6% |

| 6 | Detroit, MI | 740 | 15.6% |

| 7 | Norfolk, VA | 970 | 15.5% |

| 8 | Des Moines, IA | 900 | 15.4% |

| 9 | Baltimore, MD | 1,360 | 15.3% |

| 10 | Cleveland, OH | 980 | 15.3% |

| 11 | Columbus, OH | 850 | 14.9% |

| 12 | Fresno, CA | 1,090 | 14.7% |

| 13 | Reno, NV | 1,100 | 14.6% |

| 14 | St Louis, MO | 950 | 14.5% |

| 15 | Bakersfield, CA | 850 | 11.8% |

| 16 | Newark, NJ | 1,350 | 11.6% |

| 17 | Tucson, AZ | 720 | 10.8% |

| 18 | Memphis, TN | 850 | 10.4% |

| 19 | Lubbock, TX | 650 | 8.3% |

| 20 | Rochester, NY | 950 | 8.0% |

| 21 | Colorado Springs, CO | 980 | 7.7% |

| 22 | Chesapeake, VA | 1,120 | 7.7% |

| 23 | Richmond, VA | 1,150 | 7.5% |

| 24 | Gilbert, AZ | 1,300 | 7.4% |

| 25 | Sacramento, CA | 1,400 | 6.9% |

| 26 | New Orleans, LA | 1,450 | 6.6% |

| 27 | Austin, TX | 1,280 | 5.8% |

| 28 | Albuquerque, NM | 740 | 5.7% |

| 29 | Fort Lauderdale, FL | 1,690 | 5.6% |

| 30 | Oklahoma City, OK | 760 | 5.6% |

| 31 | Augusta, GA | 820 | 5.1% |

There are two sides to a price move, that’s what makes a market.

In expensive markets, such as San Francisco and New York City, where rents have been dropping at steep rates, and vacancies are rising, as people are leaving, landlords are getting nervous. This comes on top of the eviction bans landlords have to grapple with.

But renters who have been bled dry by high rents over the past years now are looking for “free upgrades,” meaning shopping for a nicer apartment at the same rent, or perhaps even a lower rent. This sort of reshuffling up the scale without paying more is now a thing in cities like San Francisco. Lots of people are doing it.

And in markets were rents are now soaring by 5% or 10% or 15% a year, renters are going to feel the pain. These kinds of rent-increases are not sustainable. The market will run out of renters willing to pay those asking rents because rents are outrunning wages – of the lucky ones that still have wages – and even all the stimulus money isn’t going to sustain those kinds of rent increases.

The Largest 100 rental markets, most expensive to least expensive.

The table shows 1-BR and 2-BR median asking rents in August and their year-over-year changes. The cities are in order of the dollar-amount of 1-BR rents. You can search the list via the search box in your browser (if your smartphone clips this 6-column table on the right, hold your device in landscape position):

| August rents

Top 100 Cities |

1-BR rent | Y/Y % | 2-BR rent | Y/Y % | |

| 1 | San Francisco, CA | 3,040 | -14.1% | 4,070 | -15.0% |

| 2 | New York, NY | 2,700 | -10.9% | 3,040 | -11.6% |

| 3 | Boston, MA | 2,300 | -8.0% | 2,800 | -3.4% |

| 4 | San Jose, CA | 2,230 | -11.5% | 2,750 | -8.3% |

| 5 | Oakland, CA | 2,200 | -9.1% | 2,800 | -2.1% |

| 6 | Los Angeles, CA | 2,080 | -8.4% | 2,880 | -8.6% |

| 7 | Washington, DC | 2,050 | -10.5% | 2,820 | -3.1% |

| 8 | San Diego, CA | 1,800 | 2.9% | 2,350 | -4.1% |

| 9 | Miami, FL | 1,750 | -0.6% | 2,350 | 2.2% |

| 10 | Santa Ana, CA | 1,700 | 0.6% | 2,250 | 7.1% |

| 11 | Seattle, WA | 1,700 | -9.6% | 2,240 | -7.1% |

| 12 | Fort Lauderdale, FL | 1,690 | 5.6% | 2,200 | 4.8% |

| 13 | Anaheim, CA | 1,650 | -5.7% | 1,990 | -6.6% |

| 14 | Long Beach, CA | 1,600 | 3.2% | 2,100 | 0.0% |

| 15 | Honolulu, HI | 1,600 | 1.3% | 2,240 | 1.8% |

| 16 | Chicago, IL | 1,500 | 3.4% | 1,800 | 0.6% |

| 17 | Philadelphia, PA | 1,500 | 3.4% | 1,750 | 2.9% |

| 18 | Providence, RI | 1,470 | -7.0% | 1,760 | 6.0% |

| 19 | New Orleans, LA | 1,450 | 6.6% | 1,730 | 7.5% |

| 20 | Scottsdale, AZ | 1,450 | 4.3% | 1,930 | -2.5% |

| 21 | Atlanta, GA | 1,440 | 2.9% | 1,900 | 6.7% |

| 22 | Denver, CO | 1,430 | -10.6% | 1,950 | -2.5% |

| 23 | Sacramento, CA | 1,400 | 6.9% | 1,650 | 10.7% |

| 24 | Portland, OR | 1,400 | 0.0% | 1,740 | -2.2% |

| 25 | Baltimore, MD | 1,360 | 15.3% | 1,670 | 12.8% |

| 26 | Newark, NJ | 1,350 | 11.6% | 1,790 | 15.5% |

| 27 | St Petersburg, FL | 1,330 | 15.7% | 1,640 | 5.1% |

| 28 | Minneapolis, MN | 1,330 | -3.6% | 1,920 | 6.1% |

| 29 | Gilbert, AZ | 1,300 | 7.4% | 1,510 | 2.0% |

| 30 | Austin, TX | 1,280 | 5.8% | 1,570 | 2.6% |

| 31 | Nashville, TN | 1,270 | 3.3% | 1,440 | 2.9% |

| 32 | Chandler, AZ | 1,250 | 4.2% | 1,470 | 0.0% |

| 33 | Dallas, TX | 1,230 | -0.8% | 1,690 | -1.2% |

| 34 | Orlando, FL | 1,230 | -6.1% | 1,400 | -4.1% |

| 35 | Charlotte, NC | 1,210 | -5.5% | 1,410 | -1.4% |

| 36 | Henderson, NV | 1,180 | 4.4% | 1,350 | 0.0% |

| 37 | Tampa, FL | 1,180 | 1.7% | 1,400 | 7.7% |

| 38 | Richmond, VA | 1,150 | 7.5% | 1,390 | 10.3% |

| 39 | Plano, TX | 1,130 | -5.8% | 1,500 | -9.6% |

| 40 | Chesapeake, VA | 1,120 | 7.7% | 1,230 | -1.6% |

| 41 | Houston, TX | 1,110 | 0.9% | 1,360 | 0.7% |

| 42 | Madison, WI | 1,110 | -7.5% | 1,380 | 1.5% |

| 43 | Reno, NV | 1,100 | 14.6% | 1,420 | 2.9% |

| 44 | Durham, NC | 1,100 | -0.9% | 1,270 | -1.6% |

| 45 | Aurora, CO | 1,100 | -2.7% | 1,440 | -4.0% |

| 46 | Fresno, CA | 1,090 | 14.7% | 1,320 | 14.8% |

| 47 | Fort Worth, TX | 1,090 | -7.6% | 1,330 | -2.9% |

| 48 | Buffalo, NY | 1,080 | 3.8% | 1,280 | 3.2% |

| 49 | Virginia Beach, VA | 1,080 | -0.9% | 1,250 | 3.3% |

| 50 | Irving, TX | 1,080 | -4.4% | 1,420 | -5.3% |

| 51 | Pittsburgh, PA | 1,070 | -5.3% | 1,350 | 3.8% |

| 52 | Boise, ID | 1,050 | 4.0% | 1,240 | 13.8% |

| 53 | Phoenix, AZ | 1,040 | 4.0% | 1,250 | -0.8% |

| 54 | Milwaukee, WI | 1,040 | 2.0% | 1,190 | 11.2% |

| 55 | Raleigh, NC | 1,040 | -1.9% | 1,240 | -0.8% |

| 56 | Las Vegas, NV | 1,010 | 1.0% | 1,250 | 3.3% |

| 57 | Salt Lake City, UT | 1,000 | -10.7% | 1,300 | -9.7% |

| 58 | Cleveland, OH | 980 | 15.3% | 1,050 | 15.4% |

| 59 | Colorado Springs, CO | 980 | 7.7% | 1,250 | 5.0% |

| 60 | Norfolk, VA | 970 | 15.5% | 1,100 | 7.8% |

| 61 | Kansas City, MO | 970 | 2.1% | 1,150 | 4.5% |

| 62 | Mesa, AZ | 960 | 4.3% | 1,200 | 3.4% |

| 63 | Chattanooga, TN | 950 | 15.9% | 1,070 | 15.1% |

| 64 | Cincinnati, OH | 950 | 15.9% | 1,150 | -2.5% |

| 65 | St Louis, MO | 950 | 14.5% | 1,220 | 1.7% |

| 66 | Rochester, NY | 950 | 8.0% | 1,160 | 12.6% |

| 67 | Anchorage, AK | 950 | 4.4% | 1,150 | 0.9% |

| 68 | Jacksonville, FL | 920 | 1.1% | 1,120 | 6.7% |

| 69 | Des Moines, IA | 900 | 15.4% | 950 | 10.5% |

| 70 | Arlington, TX | 900 | 4.7% | 1,180 | 5.4% |

| 71 | San Antonio, TX | 900 | 0.0% | 1,100 | -3.5% |

| 72 | Indianapolis, IN | 890 | 15.6% | 980 | 15.3% |

| 73 | Glendale, AZ | 870 | 2.4% | 1,160 | 9.4% |

| 74 | Columbus, OH | 850 | 14.9% | 1,100 | -2.7% |

| 75 | Bakersfield, CA | 850 | 11.8% | 1,000 | 11.1% |

| 76 | Memphis, TN | 850 | 10.4% | 900 | 9.8% |

| 77 | Omaha, NE | 850 | 4.9% | 1,060 | 3.9% |

| 78 | Louisville, KY | 850 | -8.6% | 950 | -4.0% |

| 79 | Winston Salem, NC | 840 | 3.7% | 900 | 5.9% |

| 80 | Baton Rouge, LA | 830 | 3.8% | 930 | 1.1% |

| 81 | Spokane, WA | 830 | 2.5% | 1,060 | 8.2% |

| 82 | Corpus Christi, TX | 830 | -2.4% | 1,070 | 0.0% |

| 83 | Augusta, GA | 820 | 5.1% | 900 | 8.4% |

| 84 | Knoxville, TN | 820 | -1.2% | 1,010 | 6.3% |

| 85 | Lincoln, NE | 810 | 15.7% | 970 | 4.3% |

| 86 | Syracuse, NY | 800 | -15.8% | 1,100 | 1.9% |

| 87 | Laredo, TX | 790 | -9.2% | 850 | -7.6% |

| 88 | Oklahoma City, OK | 760 | 5.6% | 890 | 0.0% |

| 89 | Greensboro, NC | 760 | 4.1% | 890 | 4.7% |

| 90 | Tallahassee, FL | 760 | -5.0% | 900 | -1.1% |

| 91 | Lexington, KY | 750 | 0.0% | 910 | -5.2% |

| 92 | Detroit, MI | 740 | 15.6% | 830 | 15.3% |

| 93 | Albuquerque, NM | 740 | 5.7% | 940 | 5.6% |

| 94 | Tucson, AZ | 720 | 10.8% | 930 | 5.7% |

| 95 | El Paso, TX | 680 | 4.6% | 830 | 7.8% |

| 96 | Lubbock, TX | 650 | 8.3% | 800 | 1.3% |

| 97 | Wichita, KS | 650 | 3.2% | 750 | 1.4% |

| 98 | Shreveport, LA | 650 | 1.6% | 800 | 8.1% |

| 99 | Tulsa, OK | 650 | -1.5% | 830 | 2.5% |

| 100 | Akron, OH | 580 | 0.0% | 720 | 1.4% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Thanks Wolf – very informative. On the topic of price surges in certain markets – I do work with new home builders – one of my clients in a Midwest state just raised pricing on new construction by 9%. No shortage of traffic in new home showrooms there.

Slowing down now over last 2 weeks

The lumber price chart will make you do a double take. Something doesn’t smell right.

Shortage of lumber at my local Home Despot, with absolutely no pressure-treated lumber and unknown when they’ll get more.

Prices of lumber up in BC, and we make the stuff:-) Lots of supply; pressure treated, red and yellow cedar, spruce framing…. Fir plywood sheathing really up in price, big time. With the lower US dollar prices must be screaming higher down there.

To be honest, I don’t even look at the prices anymore. I’m so used to climbing prices I just get what need and want. Screw it. If you want it you pay what it costs.

Yup, Home Cheepo and other outlets here in San Diego have the same problem. All of the homeowners are building decks and outdoor spaces. Maybe the gummit should come in and price fix or demand they provide the lumber for free to everyone.

Dear Wolf, I don’t know if you remember me I am Brad Doenges son. My grandma Betsy Wright put me onto your blog and I wanted to say as someone that is planing on majoring in economics this is a great place to get current info.

Hi Will,

I heard so much about you over the years, from Brad and from your grandparents. Awesome for you to check in! Planning on majoring in economics, wow! How time flies. I’m just so pleased to see you here in the comments.

Glad your seriously considering pursuing an economics career! A caveat, a big one, be extremely diligent in evaluating the schools you consider. There is ample evidence that much of economic education over the recent decades has been quite incorrect.

California just banned evictions until February 2021.

How do these bans skew the data?

Lease vs actually collected?

“This comes on top of the eviction bans landlords have to grapple with.”

The eviction ban does not impact these asking-rent data. These are rents posted by landlords to fill vacant or soon-to-be-vacant units. If anything, the eviction-ban extension leads to lower vacancy rates NOW, and later (next year) when evictions rise, those newly empty units hitting the market could put additional pressure on rents.

Something I don’t understand , Pelosi and cie are saying 40million Americans face imminent eviction.

NMHC rent payment tracker says that 90% of the Americans paid their rent for August which is similar to previous years.

Someone is lying here big time.

Article coming on that.

I just heard that the state is going to expand on their rent control ordinances and prevent landlords from lowering their asking rents by more than the CPI plus 5% and under no circumstances let them lower rents by more than 10% in any year. Oh wait, that was only for raising rents…who cares about when rents drop and the free market actually works as it’s supposed to. The rent’s too damn low.

Shame on you.

The ballot issue on rent control was probably a trial balloon. The gov is pretty smart about this stuff. If they institute rent control, they will probably waive permit fees on granny flats, and there will be a new wave of building (which is good for the economy). Might be what we are already seeing in lumber prices.

Rent control is well proven to decrease apartment construction, granny flats can’t remotely keep up with demand.

I think it would be interesting to see exactly how many people are leveraging the eviction ban at this moment, then combine that with data on those who actually had their $600 a week.

Just got done with my trip to NYC to help my son move out of his 1 br apartment in Williamsburg. He is heading to a new 3 br townhouse in Eugene OR where his fiancee is from. They will be paying half his 1 bedroom NYC rent. My son is in video editing and only recently have streaming speeds become high enough to do this work remotely. Before Covid most news organizations and production companies did not want their footage to leave the office. So Covid has given him a chance to leave New York that he did not have before. And only after 10 years at it ,has he gotten the credentials, contacts and awards to give him a good chance to make a living remotely.

I dubbed this last weekend in NYC the “Exodus of the Finance Bros.” Everywhere you looked were u-haul trucks being loaded by guys who looked like they played lacrosse at Princeton and had entry level grunt jobs at Goldman Sach’s the last few years. Not sure if they were heading out to work from a new apartment in Syracuse , or going to live in mom and dads basement in Westchester because they got laid off. But leaving town, they were.

That is a really good news story, Seneca. It will be nice for you to have your son closer and a great lifestyle change for him!!! A win all around.

Rentals and kids means my own son is moving back to Vancouver Island this December. When Covid hit he stayed in Alberta to avoid air travel. He rented his house out to my buddy this last February. When son moves back he will be buying a 2nd place zoned for suites in our nearby town, (40K population), and will also be taking in a roommate. Because he is away 50% working, rent will pay mortgage and taxes, plus there will be someone in the place. That’s the plan, anyway. Rentals are very tight in this area.

Finding tenants is pretty much word of mouth around here. There seems to be a real shortage.

In some cases real estate purchase price increases concurrent with declining rents, mass layoffs. More WTF.

Sacramento, Fresno, Bakersfield …

So, all those former silycon avatars are doing real-life, rather than Sim-ian City .. in the BigValley of $h!tholes .. thus in need of new digs??

The mind reels .. to another spool!

San Fran rent percentage drops ? BIG YAWN. Call me when its down 50%, or something like that, and then it’ll be news. Their rents have been climbing decade after decade.

Same with many of the other historically priciest cities.

The Fed’s super loose monetary policies, all starting under Greedspam in the late 90’s, led to a massively exuberant boom that went well past the dotcom bust and crash. It will take years to deflate all the excesses in the global system. What ? $300 trillion in global debt, mostly denominated in US dollars. That’s never going to be ‘re-paid’ in any usual form. Though generations of the world’s citizens will be ‘paying for it’ in standards of living that will be very hard for anyone in the US today to imagine could go to sub-human levels. Or as the conmen CEO’s in Sillycon Valley would say, ‘sub-optimal.’

It’s down 20% from peak. That’s a start. Don’t get impatient. These things normally take time.

Libs fleeing their urban utopias streaming by the thousands per month to Boise, driving rents and home prices thru the roof, pricing out locals, turning once nice areas into densely packed neighborhoods that are clearly going to turn into pandemic traps and areas of social unrest. 5 foot lot lines on new home construction

now standard. Huge, cheaply built apartment complexes everywhere. Tomorrow’s slums being built today and a growing “underclass” moving right in, but the progressives, developers and leadership refuse to see. Water shortages developing, and even the nice homes now mostly come with tiny xeriscape lots while many people in older neighborhoods can no longer afford their water bills.Traffic on main arterials nearly as bad as any major city. Land prices long since out of reach. BLM-worshipping mayor assures is that we can solve the problems of growth with more growth and “inclusiveness”. If you’re looking for somewhere to run, scratch Boise off your list. It’s only a matter of time, now, before the center-right locals are overwhelmed by the leftiy newbies and Boise becomes Portland West, complete with Portland social scene and prices for everything.

Welcome to California Marilynn,,, enjoy your beautiful state why you can, cause as you say, it’s going to ”heck” in some kind of a line…

Been through it in rural CA, small town FL now megadeveloped, and wild OR in the early 1970s.

Won’t mention the only place, in deep ”flyover” woods where we didn’t experience a bit of it, in spite of the good soil, abundant rain, springs, and ground water, though likely going on there too these days.

Only thing is, wouldn’t Boise be Portland East, rather than west?

Driving through there from Ashland in 18, it seemed to me I was mostly going east to get to Boise,,, and then east and north a bit to my destination east of Monida, MT.

P.S. Loved the atomic burger at pickles place in Arco, better get that too while you can, before the lefties make hamburgers illegal, along with all the pleasures of life.

Oops! East, you are correct! Can’t believe I made such a dumb mistake. Thanks for catching it! Have been in mourning, now, for a while for a city that COULD have done things the right way, but now is too deep down the rabbit hole to return.

Oh, almost forgot- the school system in Idaho stinks. And everybody here, old and new, is delusional of the local grade school that passes for a university – Boise State. They think that because it’s local and has blue football turf, it’s the envy of any Ivy Leagie. Seriously! No academic standards there, but P.C. as hell!!

@ VintageVNvet,

Where on earth were you going east of Monida. My families original homestead is east of there in the Centennial Valley and it is truly the middle of nowhere.

Saw a Wildlife Preserve on the net from here in FL on sat pic, could not believe it was actually as beautiful as was showing, so went by dirt road east from Monida to Lakeview.

Wonderful US folks shared a bear chem with me when I was thinking of going to the upper lake camp site, but the skeeters there tried to lift me out of my truck as soon as I opened the door, and it was prime bear habitat IMO.

Ended up staying a couple days at the lower lake campground, and found it was every bit as beautiful in fact as on the net, with the snow topped Rockies on three sides, abundant wildlife,,, absolutely beautiful!

Was spitting snow as I was leaving, mid June of 18.

Can’t wait to get back with a bit more appropriate gear (and my bride) to stay a while.

As someone who’s planning on moving to Idaho (although much farther east than Boise), it’s sad to hear that it’s going through the same plague of Californians that’s happening to Arizona and Colorado. Hopefully the idiots stay in Boise and overpriced resorts like Sun Valley.

Arco (that’s a place you don’t hear much about) should be safe, the SPOOKY ATOMS will keep the morons away.

I saw a comment by a Chicago resident who was leaving. It went something like, …well, we don’t care if they loot or even damage our car, which it looked like would happen one evening. (i.e. it’s OK to riot)… BUT, we have become concerned for our personal safety, so we think it’s time to leave…

This is the “plague” of which you speak.

Further note- many dismiss the losses by businesses (and residents!) by saying that insurance will cover things. 1. many small businesses are uninsured (barely squeak by), or 2. many insurance policies specifically do NOT cover riot damage. (Check your policy- you might be surprised).

Yes! Those evil Libtards! They want to take your cheeseburger away! And DJT said Biden wants your God, your guns, everything!! There won’t be anything if he’s elected!

One of my favorite memes is the skeleton looking out the window (“Still waiting for Obama to take my guns.”). I also remember back in the early 90s when some ignoramus came on the radio (he replaced Mort Downey Jr., victim of fake Nazi toilet attack)…his name was Rush Limbaugh…he claimed Bill Clinton and the New World Order were going to put everybody in FEMA CAMPS!!!

That was “Jade Helm” part I. I guess you might, at some point in your life, stop gulping down right wing BS fantasies and embrace some reality.

Liberals/Lefties/Libtards are the people who:

1) Wanted to get the children out of the coal mines.

2) Brought you Social Security, the most successful program in US history (cutting elderly poverty in half or more).

3) Brought you the 40 hour work week, the vacation, health care, etc, etc. Do you like those things?

4) Wanted to end slavery, allow women to vote, care about social justice and not getting into unnecessary wars. Do you like those things?

I could keep going on but you get the idea, right? You certainly realize that you would humiliate yourself on the internet if you went around saying things like a “leftie wants to take your burger”.

Because that’s utterly ridiculous….

All very good points. It’s just that quite a few lefties want to control what I think. That scares me a bit.

Is it still illegal to give kids a toy with their cheeseburger in San Francisco? That one was weird.

Social Security- known to be unsound in an actuary/math sense. It’s like smoking. The bad results don’t become apparent for a long time. It is quite popular, and will remain, but as has been testified to many times by several administrators, Fed chairs, etc., the value of the dollars one will receive may not be worth what one would hope. If it were put on a sound basis, it would be more ethical.

Ending slavery was not a plank of the Democratic party. The first attempts at passing these bills and amendments were defeated- in 1864 on the first attempt to pass the amendment all but 4 democrats voted against it.

“Health care” (meaning health insurance) is part of social security (i.e. medicare), and suffers from the same actuary problems. Again, if the truth were to be made clear to the voting public, it would be a more ethical approach.

The public likes things that they don’t have to pay for, and/or make their kids pay for.

wke-long-term, one needs to be able to raise well-fed, housed and willing armed forces among its population to deal with the extranational threats that have always been presented by the wheel of history (how many divisions can the current ‘1%’ raise among themselves? Do many at the top believe the mercenary model, or the looming spectre of ‘slaughterbots’, or just waving the flag will serve to protect their interests adequately? As a drafted combat medic, i dealt with too-many of ‘the public’ who picked up the ‘free stuff’ tab for those found a way or were fortunate enough to opt-out of the conflict. One might consider the twilight days of the Roman Empire in this context…).

This implies that the majority must have a genuine stake in the preservation of their nation and society by possessing BROAD-BASED OWNERSHIP. W paid lip-service to this, much as the current chief executive does, but the reality of the nation grabbing that can has been kicked down the road as far, or farther than the problems of existing social programs by the clear and present size of income-disparity that reflects the total hollowing-out of a large middle-class tax base addicted to easy credit introduced in the ’80’s by banking/financial markets. Markets benefiting from a long-term reduction and degradation of sensible regulations, even those of basic accounting (Wolf, you have brought up the essential discard of GAAP so many times that, i, too, howl into the wind…).

In a perfect world, i would take your points (your take on the Republican ‘Southern Strategy’ effected in the Nixon campaigns and apparently alive and well in P45’s, as long as party character is being discussed, i would find interesting…). Sadly, our world is far from perfect. We believe in the current version of ‘American Exceptionalism’ (perhaps ‘American ECONOMIC Exceptionalism’) at our peril, as it implies the job is done forever, ignoring what still needs to be done to realize the promises of our past, future, and Constitution.

United we stand-divided we fall. As simple, and brutal, a calculus as Supply/Demand.

My apologies, rant over.

May you, and we, all find a better day.

It’s not like the good old days when JR Simplot lived on the hill above town, and ruled Boise like a Feudal Lord. If any pesky left wingers had shown up in those days JR would have run em out of town for good.

Sure you aren’t talking about Melbourne, Australia?

I’m sure Boise has lots of jobs to support the newcomers. I’m just glad they are not coming to Texas! Oh, wait……….!!

Boise makes no sense. All the jobs are terrible. But now we have an Amazon center! House prices to the moon!

I see a lot of “Don’t California My Texas!” bumper stickers lately.

Libs???? Lol, where??? I see little fleeing.

The liberals are going to put us all into FEMA camps fantasy is a story I’ve been hearing since 1992-94 and a quarter century later, I’m still waiting for the black helicopters to come and round me up!!

Sadly, most of the folks aren’t that engaged with reality as they’re getting their info from Fox, breitbart, alex jones, etc, etc.

As George Carlin so aptly stated, we live in a country where more people believe in angels than evolution. Hence, the state we find ourselves in….

Well, about half now believe in liberals. I guess that’s today’s angels.

Marilynn-California bashing is a popular pastime, here, but i wonder why those who do so don’t acknowledge that so much of the state’s population CAME FROM THE STATES OF THOSE THAT ARE BASHING IT??? Those folks left for many reasons, and given the so-far freedom of movement allowed in our nation, why would they leave anywhere if that place was so great to begin with? The answers appear to be perceived/actual BETTER OPPORTUNITY and/or AFFORDABILITY than that available at the point of departure-neither aspect lasting forever-anywhere-when the ‘new’ area is subjected to the (bad analogy) effects of a firebase being hit and overrun by superior numbers that exhaust the existing/generated resources (in simpler terms, it’s ALWAYS ‘supply/demand’). ‘Liberal’ ideas probably suffer more from their successes in this area than anything, ultimately pushing history’s pendulum towards an equal-but-opposite reaction to ‘Conservative’ ideas later in the timeline. The ‘Center’ rarely holds given the capriciousness and self-serving aspects of ‘human nature’ (“NIMBY’ is baked in to ALL political slants…). In the meantime, human population continues to expand, the globe not providing equivalent, suitable land and resources for same…

In terms of Americans, i highly suggest an early piece by the late Hunter S. Thompson: ‘Boomers’-not about the current demographic moniker, but of those who have always followed perceived better economic opportunities around our nation.

Rant over.

May we all find a better day.

Thank you!.

I give a raised eyebrow to those complaining about the influx from other areas with their ‘liberal’ politics.

It is the free market so loved that allows this.

…and thank YOU, Saylor!

again, a better day to all…

Remember when Republicans ran California while Democrats ruled Texas? Things are constantly changing. Nothing new under the sun.

Couldn’t happen to a nicer city government!

San Francisco was wonderful, and could be almost as good, if the carpetbaggers running city government are run out of town and go back where most of them came from. They can take the homeless with them.

Imagine San Francisco with a conservative, pro-police mayor, little crime, citywide elected supervisors and a real district attorney.

The greedy landlords that have priced themselves out of business in commercial spaces, the third generation wastrels living off office building rents, the apartment house pimps, can all go to hell.

This is like watching your enemy about to starve to death. It puts a warm glow in the guts.

If they turned SF over to the free market it would become an enclave exclusively for multi-millionaires.

It would no doubt become cleaner and prettier, but few current resident would be able to stay.

I never said anything about getting rid of rent control.

That is what has allowed many of my fellow natives to remain. Shut down the D.A. allowed and almost encouraged criminality, especially around the housing projects and more people would want to live in such areas.

Stop putting out the food bowl and benefit packages for homeless and south of Market and other bumfested areas would become desireable again.

Get rid of the hundreds of expensive commisions, agencies and services for foreigners, or chosen minority communites, in exchange for their votes, and there would be more money for schools, parks and libraries.

Restore and allow neighborhood schools and parents would want to live here again.

Tax the crap out of tech and corporations instead of raping us with parking, user fees, onerous building inspections and taxing small business payrolls.

…how about just cutting down government borrowing? They have no intention of ever paying back the trillions in debt, you know. Which essentially means default and currency implosion. That should be fun.

Teachers should be cut by 20% along with admin… and people told there is plenty of tech out there to replace them at a lower cost. What’s wrong with 4 days a week of school? We don;t need more tax…we need less govt. debt.

…and usury laws to be re-instated.

Your kidding right??? Your post is lol.

Nothing you suggest will help. I don’t agree with the poster below. The rich would be toast as well as capital flees.

You think they care about capital flight in China? Huh? Well? Do ya? Don’t like it? Go live in Russia!!

…both sound like reasonable alternatives these days.

(p.s. – the food is MUCH better in Russia.)

I don’t understand why a lot of companies center themselves in such expensive real estate areas in the first place. Is it a prestige thing? Do you need offices at a highrise in downtown SF to make more money? Which then forces you to pay employees more to live in $3000 one-room apartments? Why can’t you conduct the same worldwide business in Tulsa these days?

It all seems to be shifting now, though. Work at home and Zoom. Even the techs are catching on.

Is Congress and the White House working on a plan once the moratorium ends? Or is the moratorium in place to allow people time to save as much as they can until they get evicted. If this is the case it concerns me, because many people aren’t good with saving. I am genuinely curious. I’m worried for those people that could possibly be out on the streets.

Don’t worry too much…they will all have new iPhones…

OH, and Congress and the White House are currently working on getting everybody there reelected.

The moratorium is already over.

Bobby Dents,

At the federal level, the CDC just issued an eviction moratorium through the rest of the year. This is in addition to whatever states are doing.

Wolf, I read that CDC article and it was somewhat confusing. Is this CDC moratorium on stuff they manage or is this on everyone or fed stuff or what? How does the CDC have any authority to do this, regardless?

Yeah, it’s pretty crazy.

Mnuchin said it would apply to about 40 million renters. There are some income limits and some other limits, but it’s very broad.

Brant Lee

Where do you live & work, and why?

Just my opinion BL, but it would seem in the case of SF it started with it being the only real city near the gold fields in ’49 making the fortunes of merchants, bankers, and of course tons of scalywags of all sorts providing all the amusements of all kinds, and hence the original draw.

Maybe it was also where the ships from the east frequently made their first stop, having rounded Cape Horn, then working way out west and back due to prevailing trade winds, etc… supposedly half the waterfront was at one point built on top of sunk ships.

And for the last century or so up to now, the presence of what are still likely two of the world’s top universities driving the gradually increasing technological developments of industries from mining to quantum computing, biochemistry, etc., etc. One (Canadian) roommate 50 years ago was working for his PhD at CAL, and told me he thought it was the best mechanical engineering school in the world at that time. Other former roommates (at UCLA) from other countries told me the same.

Local reporting in Austin is talking about rent declines. Occupancy rates are down and there are 14,000 units expected to be completed in the next 12 months. That’s in addition to over 37,000 units waiting on permits.

Anecdotally I am auditing a 200 student astronomy course at The University of a Texas at Austin. The class is on Zoom and many of the college student backgrounds look like they are home with mom and dad. Definitely not the kinds of apartments I could rent when I was 21!

fyi, you can choose any background you like. Maybe most you are seeing are not the real deal. ;-)

@ VintageVNvet, 50 years ago the best mechanical engineering school in the world was the place that both Stanford and Cal are a copy of. If you need a hint, my fellow classmates over the years have invented air conditioning, put man on the moon ( engineered and built the lunar lander) and invented the mighty Hammond B3 organ.

Cornell

SC,

You mean CAL Poly? LOL

Maybe so if you’re referring to CalTech, but if you mean MIT, forget it,,, it was done and gone due to the amazing arrogance of its graduates by then. (Speaking from experience with 3 in the family.)

Vintage, what you say is true, the only port on the West Coast at the time, or at least the first one to be arrived at pre and post-Panama Canal. Transcontinental railroads had to wait another generation practically after the Gold Rush.

However, what makes S.F. a tech hub is the proximity to the Terman School of Engineering at Stanford, which became the nucleus of Silicon Valley. So, why not San Jose?

Because the banks were headquartered in S.F., as were the law firms as was the Pacific Stock Exhange. Later the city gave tax breaks to entities like Twitter.

Besides, who wants to live in San Jose when the average window above the toilet in Northern San Francisco has a view of the Bay, roaring fresh clean air, the smell of the sea, barking seals and a shadow memory of a decayed and ossified bohemianism left over from the internatinal trade attracted by the now moribund port.

Lovely last paragraph t4,,, with which I agree totally!

Miss my first apt in Berzerkeley with a three bridge view and all of what you mention; $50 per month in ’70, now $2500. Crazy!

Took the bus to The City often, and would walk all over town, sometimes after dim sum on Sundays,,, loved the place and hope to at least visit a few more times before I get picked or kicked off from this plane.

Easier to find talent, and they can poach from each other. Plus there is a perceived safety net of living in a city near several good employers. Plus many of the companies are VC cash furnaces, and the VCs might demand the companies be close by (board seats.)

It makes sense. I lived in a smaller area (Hampton Roads/Norfolk/VaBeach) that had mostly weak jobs, and the talent flees. Just because it’s forced to return for now doesn’t mean it doesn’t dream of escaping again and will do so when the opportunity arises.

Seems like new condo and rental supply has been for high end for many years. Anecdotally, demand and prices for reasonable garden apartments in the suburbs seem to be holding up ok.

Honolulu rents: not much change. As before most places are condos for rent, but nobody really moving to Honolulu and not many leaving yet.

A sort of state of nothing changing, but once the jobs are really gone for good, you’ll see a lot of people move out of the state.

And in Australia today:

“Australia is now officially in a recession for the first time in three decades.

The economy contracted by 7 per cent in the June quarter, following a 0.3 per cent decline in the three months to March, Australian Bureau of Statistics data released on Wednesday morning shows.’

And the result:

“GDP falls 7% and recession confirmed, but ASX up 1.6%”

And the government here is now the biggest indirect employer:

“Treasurer Josh Frydenberg said on Tuesday that an extension to wage subsidy scheme JobKeeper, which is currently supporting 3.5 million workers, would continue to be an economic lifeline for businesses during the downturn.’

Do the math and compare to the USA: the USA has 14 times the population so I guess that means that using the above figures and transposed to the USA the equivalent would be……….49 million workers being on some kind of support in the USA.

And not a peep in the international markets either.

So who got the ‘goods’ in the last quarter:

“Company gross operating profits, however, soared by 15 per cent in the quarter thanks to government programs such as JobKeeper. The ABS said the subsidies underpinning the lift in profits would be netted out in the calculation of GDP income.”

And in Victoria, the government passed the extension of the emergency legislation with the help of Greens:

“Victoria’s state of disaster has been extended for at least a further 11 days.

The existing state of disaster was due to expire at 6pm today. It will be reassessed on September 13, when Melbourne is due to emerge from its strict stage four lockdown.”

And my SWAG is we are in for another 4 weeks of some kind of lockdown after that as well. We are going for he ‘lockdown’ world record it appears.

Hoo Hah! Now this is getting wild! This will do wonders for rental property values.

In Unprecedented Move, CDC Halts Most Rental Evictions Until End Of 2020

“In an unprecedented move on Tuesday, with Congress unable to reach a common ground on virtually any stimulus extension, the Centers for Disease Control and Prevention unveiled today it would temporarily – at least through the end of 2020 – suspend most rental evictions for Americans struggling to pay rent due to the pandemic…”

Bobby Dents,

You’ll have to take that up with Trump. It’s his administration that’s doing this, not the poster. The poster is just reporting it. It has been widely reported today, everywhere. So go out an inform yourself. Since when does Trump care whether or not his administration has “authority” to do anything?

Whether it’s Trump involved or not, how does the CDC get involved in housing if all things? This is truly crazy stuff!

Dano,

“This is truly crazy stuff!”

I agree. But there have been a bunch of these things, including the payroll tax deferral, and other stuff… hastily conceived, badly put together, tough to implement measures that defer something until after the end of the year.

@ Dano

“you asked how does the CDC get involved. . .”

Easy, what happens is a few hundred million people forget where their freedom came from, and neglect to keep the federal govt within the limited powers granted to it in the Constitution.

Happy-bullseye.

May we all find a better day.

To where are all these refugees fleeing? I’m seeing property price CUTS in NYC suburbs, Philly suburbs, Portland, Austin, midwest…

Yet homebuilders (DHI LEN PHM) all claim huge demand for new construction — where is all this new construction happening?

I think they are lying.

Supply chain, labor, and property availability will cool down the new builds.

There have been comments & articles stating a slow down was starting prior to Covid. Not were I live & work in flyover. January & Feb were record months. After we were paroled and deemed worthy of being essential again it was off to the races.

No doubt a slow down is coming. When the cuts roll through the white collar & public sector it will be felt.

A property price cut is a reduction relative to the former price at the property the day before the cut. Rent data are medians across metros and yoy or mom.

Even for one property, sellers may have led with huuuge price and had to trim, though even trimmed price still up yoy vs expected prior price

See Daily Mail Online – “Upper West Sider who broke her rent stabilized lease to move to Vermont got bored after a month”

Once COVID hysteria subsides, SF rents fall back to a reasonable level, Work From Home becomes less fashionable many will come to the conclusion the grass isn’t greener on the Green Acres. They will be back eventually, so will the cafe’s, restaurants, theaters and other attractions. Some friends already fretting over tiptoeing on ice in cold Idaho winters as opposed to walks on the beaches in their t shirts back in SoCal where they came from.

Honestly i don’t see SFO rent and home prices stabilizing

It was quite bubblicious anyway and covid19 just became a trigger

Hang in there

Buckle up your seat belt and prepare for a bumpy ride

Marylinn and Tony, I don’t post much here, but a word of advice: stop acting like partisan Republican hacks mad because the party is irrelevant in California. California is by far the biggest GDP contributor period. Deal with that. Boise and its ilk is a pimple on the butt of the world compared to Cali. Capital is not all going to be in California, but it damn sure tells us where it is going. Idaho was a poverty stricken shit hole and still is. Little surprise as Millsian liberals move there, its becoming less so in many areas………..I wonder why???

Free Market Capitalism is the debt based system. The “West” has been on a 70 year bubble after WWII that will eventually end some day. It doesn’t matter if you extend and pretend or metal currency pump and dump. All growth ends. Capitalism is not a system forever. Maybe Republicans need to think about that.

Well you take the cake, mate.

Sheesh! And it’s this kind of arrogance folks don’t want moving to their town!

“Idaho was a poverty stricken shit hole and still is.”

It is? I guess I like “poverty stricken shit holes.” I suppose I don’t to have worry about being graced with your presence.

But, please, keep telling people this. Send ’em to Texas!

:)

GDP is a measure of money churn but is a very poor measure of economic well being. GDP of NYC is very large, but if you are middle class and raising kids you are probably better off about any where else.

Bert,

Enjoy the coming 16%+ wealth tax coming from your compassionate govt. Don’t overlook that it’s a wealth tax and may cover your big fat 401K, even ten years after you are long gone from utopia.

Idaho is definitely NOT a shithole.

I’m pretty sure current residents would prefer things to stay the same, or what it was like 20 years ago. Who wouldn’t?

When my parents moved to CA in the early fifties my mom thought it was the Promised Land. When they left in ’68 it was pedal to the metal and a big sigh of relief.

Bert,

You sound upset. What’s up?

Ouch. Idaho is pretty nice, and as I recall, had more millionaires per capita than any other state not that long ago. Also not much arrogance.

Bert,

“Idaho was a poverty stricken shit hole and still is.”

Go back to not posting much here.

This pales compared to what our dear commenters routinely say about San Francisco. And I love it here :-]

What will they say about all this in Udell Iowa?!! (I’ll bet most people have never even heard of this place.)

I’ve heard of an online education company called Udemy. In order to connect you need a Wi-Fi connecfion, not necessarily a landlord or a mortgage.

I also think rents going downin SF will be good in the long run.

Wolf, any chance you can do a post with data on condo prices in these cities?

I’d be very curious to see if rent drops are correlated to condo prices up or down.

Thanks!

Hi Wolf,

I think you need to add that college kids are going to school from home to your narrative. I have rental property in the triangle out in Raleigh. Rental prices there got crushed because NC State, Duke, UNC, and Wake Tech all went online. I am weary of the Zumper’s data, since I had a bad experience posting rental ads through them. Facebook market data might be better if you can get your hands on it.

Lastly, you may want to add that job openings are still depressed and a lot of newly minted college grads probably don’t have jobs or well paying jobs to move out. The Job Openings data on FRED is still depressed and I can’t find the report, but LinkedIn announced that it was reducing its workforce due to a slowdown in job listings and requirement activity.

Best

University of Oregon is charging for a full year of dorm accommodation even if student is attending fully online. I wonder how many students are paying for the same room? The education scam continues.

“The education scam continues.”

Petunia, you’re so right on! When will students (and parents?) figure this out?

I see a fundamental shift away from the public university model as it now stands. And what will be the impetus, besides saving money, is not the current pandemic but uber-fast bandwidth.

And if young people today see a univerdity education as their ticket to a lifetime of good wages and a rewarding career, perhaps they ought to at least glance at the skilled trades. Less time to complete (and paid while learning if in an apprenticeship program) and good income. My son dropped out of the university, got into an electrian’s program and is now making double what I did as a public school teacher.

Amen,

I urged my son to go into electrical as almost all energy can be transformed into that form. As such, it will endure a future switch to green if it ever occurs. Meanwhile, he earns 200K+ working on the electrical systems and computer controls of heavy haulers and monstrous shovels in the energy mining industry, and works less than most at 2 weeks on and 2 weeks off.

What was I doing at the time he enrolled? Teaching carpentry and electronics with a trades ticket and masters degree that earned me an extra 10K per year. Plus, all the politics you can stand. He goes to work, does his job the best he can do, and then goes home and lives life without any of the bullshit.

regards

I fully support the trades but a university education should never have been a ticket to a job. Sure some professions require advanced studies, but many don’t. Those that don’t have been degraded in the process. I consider a journalism degree worthless.

LibertysGoldenCross,

This is not “Zumper data.” It’s data that Zumper obtained from the MLS, among other sources, as I pointed out.

Big cities are dead.

The death of big cities is greatly exaggerated. They will come roaring back.

“They will come roaring back.”

Sure they will: in flames.

I know someone who used to own 8 rental properties. She’s down to 3. Each time a lease came up, she sold the property this year. And by year end she hopes the other 3 are sold as well. She knows that in the future being a profitable landlord will be next to impossible. The CDC stuff is just the beginning. She’s a shrewd investor and knows which way the winds are blowing.

One thing this thread is missing is that a lot of the “exodus from NY” is not heading for the heartland but rather is families leaving the city for NJ and Long Island.

The NYT had an article last week about homes selling very quickly for above asking. I get that this article is about apartments, but a real dynamic in NYC, which is largely apartments, is people leaving their apts for houses in the suburbs.

The homes NYers are buying in NJ are those of people leaving for Florida. The billionaires are already gone and have left a huge hole in their budget. The hole will be fulled by the newbies.

NYers buying homes in NJ……………..dumber and dumber.

Both are bad states with high costs, high taxes(inomce and real estate), and crap governments.

If you are paying $1000 month on a mortgage with no equity and you notice rents are half that amount, do you sell?

I think selling would be the panic reaction we saw in 2008.

And the big sell off we saw in stocks in March 2020.

Many people who sold or walked away back in 2008 still haven’t recovered.

They’ve been fearfully renting since then and predicting the next big crash since 2013. Meanwhile, their rents had doubled.

Some are panic buying now with boatloads of stock equity. Not many are panic selling yet.

A house is long term. Buy it, enjoy living in it, and plan ahead to not lose it during downturns. In the next 10-15 years it will be up again at some point. Meanwhile, you don’t have to endure rent increases ever again for the rest of your life and will have some kind of inheritance for the kids.

Under rent control you might assume that housing prices would remain high relative to rents, (which would distort the CPI equivalent rent metric. How would they adjust for that?). Some Gen Z’s here, said they were working, renting and saving money. I see that as the new post-consumer normal. Lots easier to split the equity that way. No home repairs, lost weekends painting the garage.

Rent Control is another factor. But even CA state rent control is capped at 5%+inflation = 7%-8% increase per year.

A fixed low interest rate mortgage should still be a better option for the long run compared to rent rising 7%/year. By a quick calculation, at 7% increase per year, $500/month rent will reach $1K/month rent in 10 years.

Of course, a mortgage will be the same for the term (or maybe lower with a refi) but materials and labor will go up with inflation. The crossover is probably about 15 years before the true cost of owning a home is better than renting for this case if it was under CA rent control.

Of course after 30 years for a 30 year mortgage, the mortgage is 0. Rent will be $3800/month at 7% increase per year from $500/month. You might never be able to retire.

For me the Rent vs. Buy argument is about peace, privacy and quality of life.

It’s not purely financial: it’s possible to lose money on houses, or save money in apartments.

I just won’t live in apartment situations with constant aggravation from neighbors. Tho maybe something with thick concrete walls and no common areas would be OK…

I think we’re really close to the bottom in cities like NY, SF, DC, Miami, etc. Not to say there’s a rebound coming but I don’t see much more weakness from here. Rents will probably stay at this level for another 2-3 years at least. Some level of rental assistance is going to be necessary.

City life was deemed the most dangerous but that’s no longer so. In fact the cities have all the hospitals, universities, resources, etc. that people cling to in a crisis. Governors and mayors will quickly put an end to these illegal riots and order will be restored as it always is.

Urban living has great appeal especially to the younger generation. So all those empty units will get released to new kids pursuing their dreams. I get how telecommuting is more of an option now, but no kid dreams of videoconferencing to work every day from his parents house or some remote or suburban locale. Not everyone can afford the Hamptons. The youth want to live near the 3D action- and the women! And of course women do too.

Human nature will prevail and the cities will rise again, albeit in a modified form for a while.

Such an urban optimist! In the case of San Francisco with tens of thousands of homeless having arrived in the last few years, and many times as many more desperate post covid arrivals to come, in a place like that where certain selected homeless are being housed in luxury hotels, with alcohol and drugs being provided by social service agencies, what makes you think that they will diminish in number?

The public schools are a dangerous and deficient joke, there’s a shortage of private schools which can’t even meet in person any more, the streets are dangerous with petty crime etc, So what makes you think that people will want to move back from Mom’s basement in Minneapolis when there are so many nicer places to live and work from all over America?

Yes, by all means visit S.F. when the weather’s good and enjoy the beautiful geography, views and what’s left of the shutdown city, but to live here? Wolf swims in frigid water and walks for miles a day. This is the ideal place. Most Americans don’t have that kind of physical endurance, nor a desire to do so.

A compete and needed political reversal would improve life in the city, but even that will not change the economy built on office tower occupants paying a local payroll tax, now meaningless as people work from home–has anyone challenged those demands for payment?– and there are fewer parking taxes, fees and other extortioate monies being extracted.

Based on economics, you can stick a fork, or in my case, a voodoo needle, into the occupation government of San Francisco and it’s political future. Nice place to visit, but you probably won’t want to live here with few small businesses left and a desperate demographic in the streets.

Today’s Forbes on San Francisco public employees:

“We found truck drivers loaded up with $262,898; city painters making $270,190; firefighters earning $316,306; and plumbing supervisors cleaning up $348,291 every year. One deputy sheriff earned $574,595 last year – including $315,896 in overtime.”

“On average, the city’s 44,526 employees received pay and perks costing taxpayers $131,335 apiece. Four out of ten – 18,749 city workers – received a compensation package exceeding $150,000 per year.”

Wow. The internet really gave everyone a grade A set of brain worms. The ridiculous state hate so prevalent in every comment section on every article is a perfect example. UNITED States. Remember that? No wonder why we are imploding and the Russians, Chinese et al are having a rootin tootin good time.

oh yea… those commie libs and scary BLM lol. At this pace, enjoy the future folks. Yugoslavia didn’t.

Yer-check. It appears to me that many still think the oceans and a belief in a non-self-critical ‘exceptionalism’ excuse us from paying close attention to history and the aspirations, motivations and machinations of our fellows in the rest of the world.

May we all find a better day.

May we all find a better day, indeed. Where’s the reset button? I told my wife this is the worst year since 2001 when she pointed out to me that at least then we were united.

The high rents here in St. Petersburg make no sense to me and assume they are mostly the newer downtown apartments. As I wrote once before, downtown St. Pete is trying to be a rather exclusive boutique place and yes it does have a lot of charm but it is overpriced and the jobs/salaries here do not match with the cost of living. I don’t know what’s happening with the million dollar condos (many of which were already owned by non-residents) but the neighborhoods around the downtown area, (Old Northeast, Kenwood, etc) are already too pricey. I guess time will tell if any escapees have landed here. Frankly I hope they stay away. Traffic and parking has been a nightmare since forever and it would only make things worse…

Did I say St. Pete was charming? I’ll take that back… it’s a hell hole and no one should move here… please?! (heh)

People are fleeing NYC and moving to places like St Pete. A year from now you’ll be longing for today’s prices.

And another day of the indexes soaring for no reason at all…

The Govt. can’t delay evictions forever.

Most of the people currently avoiding evictions will never be able to catch up on their rent and will eventually be evicted.

Soon, millions will need to attempt to secure new housing with a reported eviction on their records.

GW,

Sure…but if *millions* have covid evictions on their record and it is a new lease disqualifier…who are landlords going to rent to?

Having lived through the illegals-for-higher-rents scam once, even libbish CA voters are unlikely to fall for it again…

Agree on the homeless factor. Coastal CA is a natural destination for transients; offering handouts only encourages influx. But this needs to be addressed on a state level; maybe establish “opportunity communities” somewhere in the vast interior — it worked before with the NRA/CCC/WPA.

Your other points seem mixed: conservative gov’ts are typically pro-landlord, pro-corporation, anti-corporate tax.

As an aside, I’m happy with our SF resources: great library services, our public school is great, DPW keeps the streets clean. Worlds better than my home city in the Midwest.