The time for deals on new vehicles has arrived.

By Wolf Richter for WOLF STREET.

Tesla fired its latest salvo to stimulate demand for its vehicles. But it is not alone; the entire auto industry is now cutting record deals to move the iron in face of sagging demand.

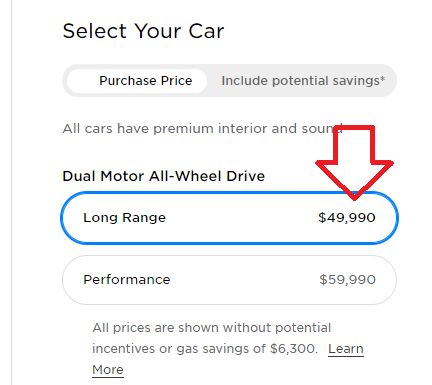

This weekend, Tesla chopped the price of its Model Y crossover by $3,000, or by 5.6%, from $52,990 when deliveries began in mid-March, to $49,990 (image from its website taken today):

The Model Y is Tesla’s hottest newest model, in the hot category of crossovers, and yet, price cuts are needed to stimulate demand.

Tesla has now cut prices on its entire lineup. At around May 27, Tesla cut the price of the Model 3 by $2,000, and the prices of the Model S and the Model X by $5,000. The price cut of the Model Y shows that the brand-new hot model in the hot crossover category is getting pulled into the maelstrom of sagging demand by US consumers for new vehicles.

Like all automakers, Tesla has to move the iron, and for Tesla, cutting prices is the way to do it. Tesla makes price cuts by quietly changing the price on its website.

Since Tesla doesn’t have franchised dealers that can make their own deals – the retail system that all other automakers are locked into by state franchise laws – Tesla’s posted price is the price buyers pay.

Other automakers rely on incentives that take several forms, including cash rebates to consumers, incentives for dealers to be passed on to consumers, perhaps, and subsidized finance rates. And these incentives in June have hit a record for any month of June.

Automakers’ average incentives per vehicle sold in June jumped 11% year-over-year to $4,411, according to estimates by J.D. Power. The average incentives on cars jumped by 13% from a year ago to $4,031, and the average incentives on trucks and SUVs, which tend to be more expensive than cars, rose by 10% to $4,524.

Automakers also try to stimulate demand with subsidized financing rates by their captive finance subsidiaries. Currently, 0% financing on seven-year (84 months) loans is now all the rage. Usually, subsidized financing rates are in lieu of some other incentives.

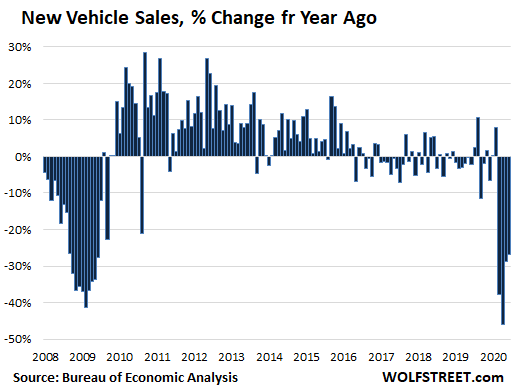

In June, new car and truck sales in the US were up from the deep-freeze of the prior months but were still dismal. Based on estimates by the Bureau of Economic Analysis, new vehicle sales were down 27% from June last year, the fourth month in a row of steep year-over-year declines:

The largest automakers no longer report actual monthly deliveries, so estimates for monthly sales are all we have. But for the second quarter, deliveries were dismal. Tesla doesn’t report US deliveries at all; it only reports global deliveries, and only on a quarterly basis.

And despite Tesla’s Gigafactory in Shanghai that sells prodigious numbers of new vehicles to Chinese consumers, and that wasn’t operational last year, global deliveries in Q2 fell 5% compared to Q2 last year. Based on this math, US sales must have plunged.

Part of the reason for the 27% year-over-year drop in total new vehicle sales was the 69% year-over-year collapse in fleet sales, according to Cox Automotive. Sales to rental car companies are usually the largest fleet segment, but in June, they collapsed by 95% year-over-year.

Rental car companies have been crushed by travel restrictions. Hertz Corporation filed for bankruptcy at the end of May (along with its US and Canadian subsidiaries Hertz, Dollar, Thrifty, Firefly, among others), followed days later by the bankruptcy filing of Advantage, the fourth largest rental-car company in the US.

Rental car companies have cancelled just about all orders that could be cancelled. The last thing they’re going to do – as they sit on a million or so vehicles that are uselessly parked in rented parking lots across the US – is buy more vehicles.

Auto dealers were open in June, but retail sales of new vehicles in June were down 17% year-over-year, according to Cox Automotive. So there was a recovery in June from the deep-freeze of the prior months, but not enough of a recovery.

And the battle of the incentives and price cuts and deal-making is raging to move the iron. Not all vehicles will have fat incentives – such as fast-selling vehicles – but other vehicles have super-juicy incentives.

Tesla’s price cut of the Model Y looks steep for a supposedly hot model in a hot vehicle category. It’s a sign Tesla is now no longer exempt from sagging demand in the US market where hype and true believers alone don’t cut it anymore. And Tesla is using the classic automaker method — offering deals — in order to compete and move the iron. Every car will be sold eventually if you cut the price enough.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Wow….a $5000 Incentive AND 0% Financing ??

If not for the $10,000 I lose to depreciation when I drive off the lot, those numbers are very enticing !!

If they start offering the same terms (at least 0% financing anyway) for 2-5 year old vehicles, I’m buyin !!

Looking at used Tesla prices, they do not depreciate very fast.

You may need to adjust your spurious beliefs.

I would say a lot of that has to do with mileage. The battery is the main value component, if people buy these for status symbols and park them in the garage they shouldn’t lose much value.

putting in 2 new batteries in my 2001 f250

sorry ambrose – you meant EV batteries that weigh ton and don’t last

try recycling that battery and NO ONE WANTS IT – being toxic and everything

@Joe,

The battery in a Tesla compared to an old fashioned lead battery is not toxic and none* have yet hit recycling.

*) those that experienced normal circumstances so not the ones that were in a fire or on the riverbed

Not sure why would you say this. I do find lot of used teslas depreciated quite a lot:

For example: 2017 Tesla Model S P100D + Ludicrous Plus mode – $79000

MSRP $144,000 as spec’d.

It’s a myth that teslas don’t depreciate a lot

BTW, this above tesla is in SoCal and mileage is 13K. kind of new

Exploding deals sure to knock your bolts off!

They will make that $5K up on what they offer you for your trade!

Teslas are garbage. What is the stupid obsession? If Teslas were held to the same safety standards as ICE vehicles they’d have been yanked off the road years ago! Elon is a deep state globalist who palled around with Epstein. He’s actually not too bright if you watch his interviews. He’s hardly an intelligent businessman. A mentally ill visionary maybe, but when investors and the government throw gobs of money and credit at you well……we have seen what happens over and over.

They are held up to the same safety standards. NTSB?

They’re fun and the EV thing isn’t bad. Friends cross country a lot with theirs for fun. Crazy acceleration! If you haven’t been in an S for a launch — find someone.

They forced an industry that was asleep to wake up a little. They’ve been out it how long, and where is the real competition from the big manufacturers? I keep hear it’s coming year after year but nothing inspiring shows up.

With a Tesla you don’t lose 10k on 50k purchase when you drive off the lot. Tesla’s are one of the best if not the best in retaining resales value.

Only because they’re rare enough that the people who want them are willing to pay almost full price for a used one. If Tesla increases production and grows as the stock has “priced in,” they would no longer be rare, and you wouldn’t see that phenomenon anymore.

Why buy used at all then? To save 5%? And inherent another owners issues?

If you’re spending 80k the 5% savings on a used car seems pointless.

Use autotrader… They seem to show the lowest price a vehicle was ever listed at… Look for outliers.

In May of 2020, I scored a 2020 Ford Fusion Hybrid for 14k UNDER INVOICE BEFORE rebates (Invoice is 35k I got it for 21k). Then I got them to throw in a 7 year/100k bumper to bumper warranty for free. This was in Southern California. I actually got two other dealers within 1k on matching this price too. (FYI Plug-in Hybrids get the same high rebates as full electric cars ;)

The deals are out there if you are not afraid to pit dealers against each other and you are comfortable with a calculator. I started a group text between 3 dealerships and had them fight it out.

For this to work though you gotta be looking for best value, and not fall in love with any particular car.

Bottom line at 40% under invoice… Once this Crisis is over… I should be well ahead of the curve on resale value.

This same strategy works on used cars as well, but I figured with the kind of discount I got why roll the dice on a used car.

Nice negotiating. Your strategy probably won’t be as effective on models not being discontinued, like the Fusion was. Wouldn’t work on a new truck right now from any US dealer – those are in short supply and at the moment the deals on new trucks just aren’t there.

Sounds like a very deep cut right across the throat. Explains why Tesla stock is at all time high?

Nothing explains Tesla’s stock. It’s a “supernatural phenomenon,” promoted by a guy who “walks on water,” according to me.

They should change the name of the company to “Tulip”.

Since Elon is always mouthing off to the SEC, how about “Teslip”?

or Tesron (Enron) perhaps?….

There are reasons for the stocks performance. One is the nature of monetary inflation, and the corporate bond market. The primary competition to automotive innovation, CNG, appears to be shutting down. It looks as though industrial nations are all in on electric solutions. Climate change begs the question, does it matter where fossil fuel is burned? The answer may be the global slowdown. In a few years scientists will note a tiny change in greenhouse gases, which gives the renewable industry another leg higher. The highly urbanized world cannot tolerate local pollution, so we manage it at the poles. The EV is perfect in the downsized world. You won’t drive your Tesla cross country. Tesla has the tech advantage in automotive design, whatever that is exactly. Self driving? Musk seems to have that as well. The analogy is to the Apple computer and the Iphone. In the first tech bubble Apple nearly went under, in the second they became a leader. Same products really.

An older vehicle v8 owner that lives 3 miles from work and gets 15 M/G, is more green than a new car owner that gets 60 M/G and lives 20 miles from work. In addition, the older vehicle is being recycled while the additional carbon footprint of manufacturing a new car is considerable.

With regard to “pollution”, I guess the ultimate disposal of the car batteries of all ev’s does not matter? Or, do we just choose to conveniently ignore it?

Trinacria,

Reuse and recycling of batteries is now common practice. Almost everything that’s on a car gets reused or recycled.

CNG as car fuel is not exactly innovation and pressure vessels have the problem that they need to checked after ten years or so. And that is expensive and often leads to the junkyard/third world

In Greater Qingdao, there are 6500 city buses. Half are CNG, as well as 99% of the taxis. CNG is going strong in China.

TSLA is at an ATH precisely because revenue (and assuredly profit) is unimportant to TSLA speculators. At least for now. But unit sales are important. So it is in TSLA’s best interest to do whatever is required to keep unit sales up.

TSLA will be fun to watch. The stock price is parabolic at a time when revenues appear to be dropping. It will not last long.

It is no Amazon. Amazon has consistently grown revenues at a superfast clip. Plus, Amazon serves a much larger market. Tesla serves a small set of believers that have enough money to buy $50k cars.

EVs dont stay 50k Prediction is that they will be cheap than ICE in 2025

I’ve had an epiphany recently that everything I’ve ever learnt about economics and finance is fake. This entire thing is an illusion – the conspiracy theorists were right

Ten Thousand Day Traders an Hour Are Buying Tesla Shares, according to Bloomberg.

You’d think from looking at Tesla’s stock price that they were getting ready to take over the automotive world. Every auto maker is bringing out new electric models at what will soon be a prodigious clip and new entrants like Rivian are also joining the party. This will not end well for new shareholders. Management should take the current bubble stock price as an opportunity to one or more companies for the long haul, as AOL did when they acquired / did a merger of equals with time warner. AOL otherwise was probably only a few years away from biting the dust.

The S came out in 2012. The other manufacturers are supposedly always bringing out the Tesla killers, but they never seem to deliver.

Until very recently, batteries have been too expensive to make EVs make financial sense to most automakers (well, to ones that are interested in making any kind of profit anyway).

With the costs of batteries getting nearer to compete with ICE vehicles you can bet’cha there is going to be a lot more competition from other car makers.

Moreover, most other car makers in the past sold EVs made on non EV designed platforms in the past. That is changing now with the other car makers coming up with dedicated EV platforms.

Last time Tesla cut prices (in China to meet the subsidy threshold), the stock went up. The explanation was that lower prices would boost demand. When asked what it would do for profits, the answer was:”not important, that will come in the future”.

When Tesla reported lower production in China, stocks went up. Explanation: “they have less (labour) costs / looze less money”.

Crazy world isn’t it?

Tesla stock will probably go up 10 % today, again. Or 13%, like last friday.

Nice, TSLA stock going to $2000 in the morning. Good for the guys who bought the Jul 17, $2K calls.

Yes, I’m perfectly aware that this doesn’t make sense. But as you can all tell, the laws of reality has been repealed, sense has gone out the window. TSLA $5K, here we come.

Elon will soon be Vice Prez., this all makes perfect sense. (irony)

And like every other American salivating at the thought of making easy money, you jump right in knowing its a total farce. lol and we wonder why our country is in debt, corrupt, and our ethical/honorable fabric if society is tearing away. Tesla has had gobs and gobs of free money and credit thrien at it.

What’s insane is that those $2k options expiring at the end of his week will be in the money by then.

People make fortunes in the tulip mania too. Until they lost it all…… It did not make sense either…. But, I know, this time is …. different.

That’s the truth, at the highest point this morning, the TSLA $2000 Call expiring at 7/17/20 was $63.05 per call, at this point, around 3:30 pm in the afternoon, the price is just about $18 per call.

The craziness of it is that if TSLA is at $1999.99 at the close of 7/17/20, these options will expire worthless. I can see the logic of playing with this gamble if you dropped pocket change, let’s say 0.00001% of your net worth just to take a long shot with the full expectation that you’d lose it all. But it would not surprise me if there are people who lost their life savings in that one bet.

The lack of education is just plain astounding.

And with that, I think we can safely tell the people who believe that there is always a win-win where to stick it.

Automobiles that you can live in for under $1000.

good one…a car is a car is a car, unless of a course it is a truck.

Now that’s an investment thesis I can get behind.

5.6% off a Tesla? Ha!

Try 34.5% off a brand new 7 series BMW.

BMW gets it back in service/repair costs!

Tesla has autonomous driving technology. Someone fell asleep behind the wheel and did not crash. One Tesla was driven 400,000 miles in about three years.

They wore out several sets of tires and needed additional maintenance.

A Model S accelerated 0-60 mph in 2.3 seconds.

And a few someones fell asleep and did crash. It’s a mystery in the super litigious US how T continues to call the cars self- driving and that the gov allows it.

(Isn’t T still the phone compney?)

The low gas prices may also be having an effect on Tesla. Sub-$2/gallon prices in most of the US make EVs less attractive to buyers.

WHAT A CROCK! I drove from MN to MO and throughout rural MO! Nowhere was there sub $2 gas. Where do you drive that you are seeing that? In fact IA and MO gas was pretty expensive. A few months ago yes, but not now.

I paid $1.74/gal just yesterday here in Oak Ridge, TN at a FoodCity gas station.

I just filled up for $1.89 here in South Florida.

I filled up in Joplin MO for 1.69 last weekend

I am visiting family in Ohio and the gas is sub-$2, if just barely ($1.99/gallon if I recall). I don’t know how extensive that price is.

Texas, I paid $1.59/gal. for RUG last Saturday.

Lot of young people can afford to buy cars. They never bought cars because

1. bike to work/uber/taxi

2. downtown living

3. no parking in the workplace

4. take the public transport

5. climate change virtue signalling (buy an EV)

COVID closed or reduced the public transit system. People who take public transport are more susceptible to catching the flu! Now, all those people are buying new/used cars.

Tesla is totally a different story.

Except, of course, many of those people are working from home (or unemployed), so they don’t need to commute to work like they used to. Also in the pandemic, many people are learning to ride a bike or getting back on the seat after years off.

Wolf shouldn’t it now be ” moving the plastic”?

Use of plastic would defeat the purpose of Eco-friendly…

I admire the technology of Tesla and I think that they’re really cool automobiles. The company is blazing its own path, to use a cliche.

But I’d never own one. I’m too old school. I am my own mechanic and can do any and every repair on ‘regular’ vehicles — gasoline powered. I know nothing about electric cars and, anyway, Tesla likes owners to have Tesla maintain their cars. This old dog doesn’t want to learn any new tricks.

In theory, EVs can be repair friendly with some basic EE knowledge. The drivetrains are fundamentally simpler than gas cars, and other systems haven’t changed much.

The issue, as you mentioned, is that EV makers are more interested in making rolling iPads. Locked down, needlessly complicated, and a right-to-repair nightmare. To be fair, gas automakers have been heading in that direction for decades, but not as quickly as Tesla.

My concern is that a group of criminals or terrorists will be able to simultaneously “hijack” all Tesla’s and cause them to crash.

That’s the problem with a car driven by a computer.

It’s the reason I would never buy a “smart” gun. I want my guns to be purely mechanical, with nothing electrical that can be interfered with by a computer, EMP, or anything else.

Yes… welcome to the waking nightmare of every security expert on the planet, IoT.

To be fair to Tesla, gasoline cars are getting OTA updates as well. BMW is even toying with the idea of software subscriptions.

EJ, exactly. Imagine the PR nightmare that would result if a criminal was able to force a Tesla driven by a woman with no one else in the car to stop on a deserted road, and that woman is subsequently raped and robbed.

I’m okay with “updates” for the navigation. But if I put my foot on the gas, I want it to move, regardless of what a computer tells it to do.

I suspect Tesla is not alone in OTA software updates.

If they are, it won’t be for long. I know Mercedes is on the record, at least, planning to do it. They announced that when they announced their new joint venture with Nvidia.

There are a lot of computers in every car nowadays.

“That’s the problem with a car driven by a computer.” That would be like all of them since before 1990.

Harley, a motorcycle, held out till 99.

In theory EVs should only have repairs that can be done by Quickfit (changing tires, stuff like that)

Plus, it is hard to give up the sound of throaty V8….

Thats why they put speakers in new cars to make that ‘rum-rum’ sound.

The situation will get bleaker as the layoffs are still ongoing, the $600/week is ending, and there is still a huge amount of financial and economic turbulence in the system.

It is a rolling situation – like water pooling up before a huge wave. State and local tax revenues are really battered. If we could stop the covid shutdown/slowdown non-sense, I think we would see some steady claw backs of lost ground. Tesla has its obvious supporters and detractors as you can see from this forum and Zero Hedge, but Tesla still operates in an overall declining global economy. It will always be a good niche product, but will it be able sustain production and massive valuations as the reality of a shuttered global economy starts to become more apparent?

There is NO NO NO sagging demand. Sell every one that they make. The price cut is due to lowering costs. They cry that EV costs are too high. Well like a tech products, prices are coming down. I means that nobody can beat them. Their factories are built faster and at a cost lower than anybody else. We are opening ne factories everywhere.

If there was a demand problem, we wouldn’t be opening new factories. Expanding/opening Fremont, Reno, China, Germany, OK/TX and now another in Asia…..

I would guess, like all electronic stuff, once you have enough factories, and the tech is in place, they will be selling Teslas in Walmart, Costco, etc. next to the TV’s and cell phones. I could just see it:

70″ LCD TV – $458.00

32″ LCD TV – $129.00

2022 Model Y – $4995.00

Maybe I’m missing the sarcasm in this thread… but low LCD prices come from brutal, cut throat competition, in addition to sheer volume and mature, cheap manufacturing. If Teslas were to show up in Costco for $5k, they certainly wouldn’t be the only manufacturer on display.

Also, I don’t think auto prices are going to scale down like they do in the semi industry.

Ej,

I think Teslas will scale down. Everything is the Tesla 3 and Y is built for ease of manufacture. This explains the extremely simplified dashboard. The battery is currently the most expensive part of the car. If there is a so called “battery breakthrough” the Tesla purchase price will drop dramatically and Tesla will wipe out other auto manufacturers. That’s what our friends in Switzerland are counting on. (I own some Telsa stock–call me crazy).

Seems to me decent laptops and phones have continued to go upward in price. Besides, this tech stuff is all about control and monopolizing the markets. Help us all if Musk gains too much market share.

You’re wrong. All tech has gone down in price. You must be comparing apples to oranges, i.e. faster/better tech which costs more because it’s in a higher performance tier compared to older/slower tech that costs less than the expensive tier, and yet costs vastly less than the same tech costed 5 or 10 years ago.

Surprised there is this much demand. All the negative news and shutdowns should crater consumer demand except for those who absolutely must replace a vehicle. I think the pent up demand theory may be exaggerated this time.

2 years ago, seeing a Tesla where I live was a rare occurrence, like whoa was that a Tesla I just saw? Today they’re ubiquitous. The closest dealer is a few hundred miles away and people are still buying them in droves.

Just Some Random Guy,

“The closest dealer is a few hundred miles away…”

Tesla doesn’t have “dealers.” It has online sales via its company-owned website and it has company-owned stores and “Galleries.”

No other automaker is allowed to do this under state franchise laws, which prohibit direct auto sales by manufacturers.

OK fair enough the closest “gallery”. Point is you can’t go out on a random Saturday and test drive one, without spending all day driving to a gallery and back. So my hunch is people are buying them sight unseen. And if you need service, it’s not easy either. Although I have read Tesla has mobile mechanics dispatched?

They are definitely buying them sight unseen. They queue up when the new models come out.

In many overseas markets, there are still queues waiting for their Tesla deliveries. I read that Tesla is very cool in S. Korea and the waits are long. The volumes may not be that high but they are buying and waiting

I say this but I view Tesla as a long put candidate. ;-)

JSRG,

Whoa? Doesn’t Tesla 3 looks like Dodge Neon? Where else do you find plastic wheel covers?

My GF in college had a first gen Neon. I drove it a bunch as well and was pleasantly surprised by it. For its time it had some pep, handled well. Fond memories of it.

“Ubiquitous?” “In droves?” Given that they only have sold a total of 1 million cars worldwide since their inception (I can’t find data on how many were sold in the U.S.), I think you may be exaggerating a bit.

Rav4s? CRVs? F150s? Those are ubiquitous. Teslas? Not so much. And I live in a relatively wealthy area.

Teslas are ubiquitous in silicon valley. JSRG is probably in southern California, where I imagine they are very popular as well.

I am nowhere near SoCal. I live in an icky red state where people own guns and don’t wear masks. A while back Wolf said I live in a “village”. :)

Yes, the “village” comment was based on your descriptions over time as I remembered them. You have since clarified it ;-]

EV’s in general are a niche market, and will be for a long time. Their only practical use is as short distance commuters. They do not fill the needs of long distance drivers or families who travel.

Niche markets tend to reach saturation soon after novelty sales begin to wane.

Around here, The Woodlands, TX, I see 100 BMW’s and MB’s to one Tesla. And the Tesla is usually being driven by a young female.

Jdog, exactly.

The problem with EVs is that if you can only go 200 miles, they really don’t work as a “family vacation” car (there are nowhere near enough charging stations in America). So for that, you’d need an additional car.

That’s why the Tesla market only works for upper middle class families with multiple cars, who can afford to have a car that is solely for commuting/local driving.

That isn’t close to most of America.

On this vehicle demand issue…..this is just the start of the PAIN. Wait until businesses get closed up again due to increasing virus cases, no summer travel, and also when the $600/week UI stops at the end of July.

QE = malinvestment.

UBI = malinvestment.

Made up money seeking yield.

Yield is the issue.

But we can’t go back now without pain. The malinvestment needs to be realised.

Debt needs to have an associated cost to make sure the proceeds seek worthwhile investments.

I agree. The unwind will continue and there will be an increasing number of layoffs. Just a hunch.

I’m preparing for that, anyhow

Wow, for that much money you can buy a real car! A used German luxury that doesn’t fall apart and it’s not a tin can. I don’t care about the environment that much, and nobody’s driving anyway.

Used German luxury cars are notorious for being very expensive to repair and not all that reliable.

Car articles on wolfstreet are always full of the most backwards claims. Not sure why.

My 2002 C230 Kompressor with it’s 2.3l supercharged motor is going on 270,000 miles now. Largest repair was an alternator gone bad. Other than that I’ve even thought about having the SC ported for a bit more performance. The efficacy of any tool always depends on the skill of the user.

Things change a lot in 20 years.

One counterexample does not make a trend. But you knew that already, didn’t you?

It feels too spooky to me owning a Tesla. Elon could push a button and make all his cars drive back to California by themselves with me in it or not. Besides, technology moves too fast and I don’t think buying an EV to last for ten years+ like my Camry, would work out right now.

These Tesla’s will sell great in Random Guy’s neighborhood, but only if they can bid up the price. Maybe Elon should make a boat too, since those are so hot in that neck of the woods.

Best to make a combination boat, airplane and automobile that can also run on railroad tracks.

Featured article in Popular Mechanics (again)…

I’m old enough to remember when people were sure TSLA would crash and burn at $1000 a share. That was what, a week ago? Today it’s at $1750.

Prices on Tesla puts price-in crash by all apearances; time will tell.

Time spoke 4 hours later – dowm $300 from the top. Go figure.

Just Some Random Guy,

This stuff moves so fast, it’s hard to keep up, and if you try to keep up, it gives you whiplash. TSLA is now down $255 from your $1750 to close at $1,495. -$300 or -16.7% from intraday peak to close.

I think you’d have to have algo trading this kind of market. It’s especially true on things like options where the shift is directional based and seemingly have little to do with pricing. Those options literally has no anchor to any reality.

I spent 20 minutes watching the $2000 calls terminating this Friday. And I literally couldn’t believe my eyes on how fast that thing moved up and down.

Tesla is up like $100 Billion since the last WTF article, and 3 times the value of Boeing.

This will end awesome.

Tried to buy Tesla put, current price 1700+, but even 50% off puts are expensive. Settled for Amazon.

I think the great hedge fund manager Jim Chanos shorted Tesla around $300 and declared he can wait.

If he isn’t leveraged and he doesn’t need the money, he probably will take a profit down the road.

There are a lot of leveraged buyers with stops that will be taken out.

It is not a loss or gain until sold.

Tesla investors are leading the unrelenting march towards the Wall Street cliff.

These Tesla’s will sell great in Random Guy’s neighborhood, but only if they can bid up the price. Maybe Elon should make a boat too, since those are so hot in that neck of the woods.

Funny enough nobody in my immediate neighborhood has one, at least not that I’ve seen. I do see them driving around town.

Lots of boat owners in my nabe, this is true. An electric boat would work. Would be nice and quiet which would be a great selling point. The engine in my boat is essentially a GM V8, so I assume a battery powered engine would work. Only issue is how do you keep it charged for a full day of use? I have an 80 gallon tank in mine. You’d need one hell of a big (and expensive) battery to replicate that. It will be available some day I’m sure.

\\\

JD Power has released their yearly review, and guess who is at the bottom and tried to prevent from being on the list…I understand they are into inovation and are trying to get new ideas through, but I am not sure they should make a separate category for how bad you are. It is also interesting to see that the more expensive car types are, most likely due to their gadgets and complexity, the more likely they are at the bottom of the list. The only thought that comes to my mind is that the basic car is drained of any furhter meaningful costdown, and now the high-end segment is being “cost optimized”. What surprised me mmost is that the Germans are at the bottom with their high-end class cars.

\\\

https://www.jdpower.com/business/press-releases/2020-initial-quality-study-iqs

\\\

I’m no Tesla believer, but I think those reliabilty scores are inflated by infotainment problems, which the survey even mentions.

“My iPhone won’t connect” is very different than “my transmission fell out of my car” or even “my window won’t roll down.” I’m not sure how JD weighs them, but CR seems to gives infotainment problems the same weight as mechanical issues.

\\\

It would be awsome if we could see an itemized breakdown for each system and subsystem, for each manufacturer. If the pareto chart would show one outstanding column, we could call it a single system fail. If you see a generaly elevated distribution, then you know you have a systemic product problem. But we cant.

\\\

Inflated or not, Tesla is in the game for 7 years. By now they should have gotten a hande on things. And if they have a product that does not deliver what they promised, then they fail. The same goes for everyone. They need to get better, much better and very soon.

\\\

Why are you surprised that German cars were close to the bottom? It’s been well known for many years that German manufacturers were not top tier in reliability.

\\\

To pass down liability to their suppliers, car manufacturers allow the suppliers themselves to provide the majority of the quality checks, whilst testing only a few samples for critical dimensions from the millions manufactured. This also increases the turnaround speed and decreases cost. Reliabilityin the car industry ,to my limited understanding, is defined in ppm before the guaranteed number of cycles or years of use (it is not part of the early fail). Have in mind this is not the same as the warranty provided to the end-user, but an internal contract between the supplier and the car manufacturer. Early fail of systems indicates that, to cut cost, these quality checks are trimmed down too much having low intercept yield.

\\\

I worked for a German company supplying German car manufacturers. The standards they impose on their suppliers are ludicrous. That is why I am surprised about the outcome.

\\\

Hm, whenever I read about reliability ratings, the Japanese manufacturers were always on top, with the Germans following and Americans behind that, although there is always some overlap depending on model and year of vehicle.

Also German cars generally being in the luxury category means they very often have overly complex systems intended to provide some incremental convenience benefit. Those are exactly the systems most prone to fail due to complexity and often times being fairly new systems because “new features” sell.

I used to work in the auto industry and have worked at auto suppliers. This is how it works, in general, at least in the last 20 years.

BMW and Mercedes innovate. They introduce their innovations first. Then they get picked up in Japan and/or the U.S. (Surprisingly?) the U.S. sometimes picks up the technology before Japan. This is the general flow, not ironclad.

The result. Serious reliability issues with the BMW 7 Series for YEARS because of their fiber optic infotainment system. Same issue, though perhaps not quite as bad, at Ford, a relatively early adopter on high end infotainment.

And, yes, those faults count for full demerits at JD Power, as I understand it.

My 2017 Subaru Forrester has all those computerized gizmos. I don’t know whether they work or not – I’ve never turned them on.

Wish I could’ve got the car without that stuff, at a lower price.

But no, things are moving in the opposite direction: Subaru is no longer the only little crossover offering a manual transmission. The newer ones only come with the EV “rubber band” transmissions.

Tesla is probably at the bottom because the owners are probably the type to moan most. The Kia folks understand that at some point you have to actually wash the windows and vacuum etc. Tesla owners bitch when a bug splats on the windshield, and expect more from the mfr.

Get a PhD; do the study!

The Carvana CEO discussed used car prices with the CNBC cheerleaders this morning. Mostly about used car prices. You would thin happy days are here again.

“Carvana CEO on the used car market amid the COVID-19 pandemic.

“Used car prices now the highest they’ve ever been”?

The electric paradigm is a joke. 500 locomotives from coal train service parked in one Wyoming yard alone. The electricity to run these cars comes from fossil fuels whether natural gas or coal. Solar power marginal energy producer at best. Then all of the external costs to build Tesla’s and the batteries.

Tesla lost $862m selling 367,500 cars in 2019 = $2300 lost per unit.

If they cut prices by $5k, does this mean Tesla loses $7k per unit?

Note this despite Tesla’s “blowout” Q3 and “turning the corner” into profitability.

I don’t want ‘new-n-shiny’. I don’t want the the latest, and greatest whizbangs on my personal conveyance .. I want a used, reliable, and inexpensive uncrushed ride that is not a stasi-box on four wheels bleeding me slowly of my previously few remaining $$$!

How hard is that for CorporateAutoMania to comprehend ??

Carguys would say you want a Mazda. Used MX-3, or MX-5 (‘Miata’) if you want ‘sporty.’

‘preciously few remaining $$$!’ … I suppose ‘previously’ works too, as in previously HAD $$$!

Damndable AutomaniacalCorrect!

Gaaah!

What Tesla insiders care most about is not cars but stock price. Stock. It is a lot cheaper to make and demand seems unlimited.

Up 13%. There seems to be a concerted effort to make Elon Musk the richest person in the world.

And now down after comments from the Fed. Man you really need b**** of steel to trade this thing.

The Jerome Giveth, The Jerome Taketh. Or he delegates the work to his minions. Who knows. May be TSLA will be down to $50 by Friday. Then I’d laugh.

Check TSLA’s price now. It closed in the red, down 16.7%, or $300 a share, from the intra-day peak.

Wolf,

TSLA is about one thing only, and that is Elon Musk. As we both know, if a fake tweet came across that something happened to Musk, that stock would lose >50% of its value instantly. It would be akin to Steve Jobs suddenly dying in 2002. It would have tanked Apple.

Oddly enough, SpaceX is actually in a better position over all relative to Musk. They at least have a more solid underpinning. If and when that stock goes public, it will be as good as alchemy at that point

Concerted effort by those feeding on free money from the Fed and who already own yachtes and mansions on private Islands and also by an army of wanna-be day traders and fanboys. When the bubble pops, the former will still be rolling in dough, the latter, not so much.

From Marketwatch:

According to the cost calculator available from the independent website Teslanomics, consumers would need to pay roughly $712.80 in charging costs annually for the lowest-cost Model 3, assuming a daily commute of 40 miles. Fueling a gas-powered car that gets 30 miles to the gallon would cost you significantly more at $1,195 a year.

(Okay a savings of $400 per year, but I can buy an excellent used corolla with a 400 mile range for $2500.)

And: “In our experience Teslas have been very unreliable,” Montoya said. “To their credit, they fixed it every single time, but it’s something to keep in mind.” Montoya worries that the fast production timeline for the Model 3 could result in more reliability issues.

If you want to charge your Tesla at home, you may need to pay for an electrician to make sure your house’s wiring can handle the job, Montoya said, which cost as much as $1,000 back in 2017. And buying the Tesla wall charger is about another $1,000 on top of that, he said.

Will there be any 40 year old Teslas for sale for their original price or more? Doubt it. VW Vanagons retain that kind of value. Mind you, owning one is a hobby, but at least owners can work on them.

The only Tesla’s for sale 10 years from now will be static display units for museums and such. Tesla will be long gone by then, disappeared down the unicorn drain like We Work, or Snap Chat when the market finally has a real correction. When your Tesla motor controller takes a dump you won’t be cobbling up a replacement down at the corner auto shop, or finding one on the shelves of NAPA. I have been working on CNC machine tools for 30 years and high voltage/amperage electronic and electromechanical components have limited service lives and can not be replaced with equivalents.

Tesla’s have already done 400k miles. With battery replacements of course every 150k or so.

I think service life will be better than that of an ICE car even when you factor 1x or 2x battery replacement

And how much will that battery replacement cost$ $10k? $15k? More?

Vanagon owners generally don’t end up burning to a carbony crisp!

other than mania the only thing that could possibly be behind such a move in the stock is a new battery that gets say 1000 miles per charge. Now that might just be a real game changer?

Below $1000, maybe.

$1750 is more like discovering a nuclear battery or a Star Trek transporter. Its basically saying “we’re going to monopolize the entire ground transportation market.”

So to put Tesla stock in perspective now, their market cap is the same as TSMC. The TSMC that makes AMD, Nvidia, Google, and Amazon chips, self driving and ML hardware, Apple and Android processors, networking and military chips… Basically they make the heart of almost every cutting edge piece of tech in the world, at disgusting profit margins.

https://www.tradingview.com/markets/stocks-usa/market-movers-large-cap/

That seems reasonable…

During the crisis some people with car debt have been allowed “payment holidays”.

Here in Europe, some manufacturers are now offering car finance with a “payment holiday” starting *on the day you BUY the new car*.

How does that work?

re: “Here in Europe, some manufacturers are now offering car finance with a “payment holiday” starting *on the day you BUY the new car*.”

Been a sales gimmick in the ‘States for decades: Drive the car home, don’t make a payment for 30/60/90 days; plus, cash on the hood and an 84mo loan.

In South America about 20 years ago, the cars were all paid for in cash. They were also all stolen out of Southern California, loaded into containesr and shipped south. South American farmers were paying maybe $5k for a less than 1 year old 4×4 pickup.

The trade is still there, right? Is San Diego still the main heist spot?

Gone in 60 seconds.

I guess I just don’t understand something very basic. My friends all think I’m nuts because I won’t get into TSLA stock, but I cannot bring myself to invest in a 19 year old company that has never made a profit (annual, not monthly). And now Wall Street wants to invite them into the S&P 500?

The skeptic in me says they are positioning TSLA to be the scapegoat when the market crashes. My pragmatic self is trying to understand how they can be a better investment than companies that actually make money. My avaricious side keeps turning the knife with every upsell.

Are you saying Tesla is the new WeWork ;)

The later supposedly will turn cash flow positive and be profitable next year. Yeah seriously, people will continue to work from home and yet they are going to be “profitable”. They must be doing all sorts of BS metrics like Community Adjusted EBITDA to show people that they are PROFITABLE.

I ask myself a very basic question when faced with this dilemma. What do I feel like when I’m down heavily in the red when I buy against all better judgment at the top and then the stock tanks? And what do I feel like when I don’t buy into hype and miss out on what looks like a rocket taking off? I don’t know about you but for me, the former is an absolutely horrible feeling and the latter, though bad, is not even close to the former in pain and confidence-destroying potential.

This helps me make decisions and stay sane.

In those times of indecision.

Apply the 0.00001% rule. (the number of 0s after the decimal point can vary depends on your tolerance of risk) To me, that means, if you have to participate, take 0.00001% of your net worth, plow it into that “bad idea.” (Alternatively, just take that amount in the stock account you plan to use, because that is likely less than your net worth) The expectation is going in you lose that entire bet.

That’s one way of dealing with FOMO. If the idea goes up 1000%, it meant I didn’t miss out. If it crashed and burned, I don’t feel a thing

But trading with 0.00001% of anything (unless you’re a billionaire) is akin to doing nothing at all. I don’t think that’s how people actually trade in real life and it doesn’t help fighting FOMO at all. I personally take decent sized positions when I think it’s appropriate to do so and in what I think is a good choice. Of course, it’s good sense to buy little at higher prices and more at lower prices. However, if you think something truly has potential and is a good buy for that reason, sometimes it makes to take a position in it even when it’s at an ATH.

So as a realistic option, your approach won’t work for me. If I believe something is going to make a move, up or down, without having skin in the game, you’re just wasting time. But don’t let me dissuade you from what may be working for you really well.

DIH,

I tend to think of this 0.00001% rule like a rule of thumb, more like a way of getting a smoker his fix, think of it like the patch.

I do agree, if someone firmly believes in something, they should bet (yes, that’s the appropriate term in this current market) a reasonable amount.

But in this market, if someone has to play in it, use small amounts, and treated like Vegas money. The excitement without the risk

I have made good gains in stock but mainly with good quality stocks unlike speculative stock like tsla

Ofc I have missed on good gains by not being in Tsla but.

I like Tesla Cars as they are the best out there but waiting for other good oems to come with their own EVs..

Reading through the comments, it seems to me that the TSLA fanboys seem to conflate the technology with the business and the stock price, either purposely or just out of ignorance. EV tech definitely has merits, it’s hard to deny that. My one gripe with EV is that many seem to gloss over the total carbon footprint of this technology, i.e. how much carbon does an EV consume vs an ICE engine not only in its manufacturing but also over its entire life-cycle. Is that footprint significantly better than ICE, at the level of the industry itself. If it’s not today due to the lack of necessary efficiencies of scale, it can be tomorrow. At least I hope so.

How all of that justifies a share price of 1800 when the actual KPI’s of TSLA’s business are not only below average but severely lacking, is something that’s just not clear to me. Until it is, I will continue to be a bear when it comes to this one.

” how much carbon does an EV consume vs an ICE engine not only in its manufacturing but also over its entire life-cycle”

I think that answer is well known but conveniently ignored. Sorta like how does that EV perform in cold weather? Suggestion for operation in cold weather is to wear additional clothing/coats so you don’t have to run the heater.

Yeah, well, if you live in Alaska, don’t buy an EV. If you live in Texas, an EV will do just fine the few days that it gets cold. EVs are doing fine in Norway too. And that’s a lot further north than North Texas.

If you live in West Texas, you can charge it up with all the wind-generated electricity you get there, Texas being the largest wind-power generator in the US. “What? They’ll pay me for wind?” said the astonished rancher and then jumped on the deal to put wind turbines on his land. And so you can charge up your EV with wind… go figure.

And why does an EV buyer have to be concerned about the environment when it’s OK for an F-150 buyer not to give a shit about the environment? People don’t buy EVs or F-150s for environmental reasons. They buy them because to they want them.

I’ll buy an electric vehicle when they stop bursting into flames. I’ve read one too many articles about the combustible nature of lithium ion batteries in Teslas.

Tesla = Experimental vehicle with the driver as test pilot. (or guinea pig). Not to mention all that self driving nonsense.

For some reason all the problems with Tesla are swept under the rug.

Because ICE cars never burst into flames upon impact?

Not intentionally so … unlike a muskmelon

We’re all guinea pigs. Covid vaccine anyone?

I must admit.. I am an admirer of Tesla and Musk. Yes he is eccentric but he is a genius! He has a vision that I admire and is a disrupter. Four years ago I waited in line and plucked down $1000 for a deposit on a model 3. But being financially conservative and still seeing lots of years and miles left on my hybrid I canceled and got my money back.

I had lots of enthusiasm for the Y. I thought it would be at least in size comparable to an entry level SUV. Yesterday I googled an image of the Y from the tail and searched for an identical image of the 3. Except for the slightLy higher trunk and cosmetic fin there is no difference in the cars. Today I passed one parked (I normally drive by this parked car every day) drove around the block got out and took a look. In my opinion the model 3 is history and the Y is just too small. It will survive in Europe and China but I see no market for the 3 and Y after Detroit and their European competitors bring cars to market in 2021 and 2022. VW’s ID Hatchback is a nice looking car with more room.

It would not surprise me if Musk partners with domestic manufacturers to supply batteries and drive trains. Just my thoughts!

If Tesla becomes the drive train OEM for all its competitors then the stock is fairly valued.