“The recovery is expected to be slow and uneven. It has not started quite yet based on the weak Class 8 orders in May.”

By Wolf Richter for WOLF STREET.

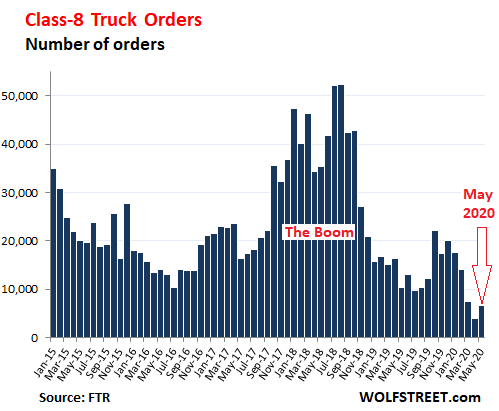

The last three months have been catastrophic for segments of the trucking business, after an already tough period that started in late 2018. In May, orders for Class 8 trucks – the heavy trucks that haul much of the goods-based economy across the US – plunged 37% from the low levels in May a year earlier, and by 81% from May two years ago, to 6,600 orders, according to estimates by FTR Transportation Intelligence today.

In April, orders for Class 8 trucks had collapsed by 73% to 4,000 units, the lowest in the data going back to 1996. In March, orders had plunged by 52% to 7,400 trucks, the lowest since 2010:

May was punctuated by the bankruptcy of Comcar Industries, operator of four trucking companies with about 950 employees, including 700 drivers: CCC Transportation, a bulk carrier, and CT Transportation, a flatbed carrier, both focused construction materials; CTL Transportation, a liquid bulk chemical transporter; and MCT Transportation, a refrigerated and dry van commodities carrier.

The privately owned company, whose largest shareholder was Pimco, plans to liquidate in bankruptcy court by selling off its trucking divisions, for which it had already lined up buyers.

In 2019, as a result of the sharp downturn in the freight business, declining mileage rates, and pressures from debt, hundreds of smaller trucking companies filed for bankruptcy. But Celadon’s chaotic collapse and bankruptcy in December that left some of its 3,000 drivers and 2,700 tractors stranded in North America marked the largest truckload-carrier bankruptcy in US history.

The May plunge in orders reduced the 12-month total of Class-8 orders to 155,000 trucks, down nearly 70% from the 12-month total at the peak through October 2018 of about 500,000 trucks.

This may be about as low as it’s going to get. Economic activity is starting to pick up from low levels, and freight volumes have bottomed out as well, though “fleets remain reluctant to order trucks,” FTR said in the emailed statement.

“The recovery is expected to be slow and uneven. It has not started quite yet based on the weak Class 8 orders in May,” FTR said.

“Most of the country still had some severe restraints in place for part of May. It is difficult for fleets to plan for future equipment needs under these highly abnormal conditions,” Don Ake, VP commercial vehicles, said in the statement.

“Carriers are more worried about what’s happening today, about their manpower needs and short-term issues, than ordering trucks. The concern about the pandemic goes beyond just the business and economic anxieties and greatly diminishes fleet confidence,” he said.

“Expect Class 8 orders to rise gradually, as caution wanes and fleet buyers begin to focus on the second half of the year and equipment requirements,” he said.

US truck manufacturers suspended production in March due to the pandemic. This too has now become part of the theme in many industries: a supply-and-demand shock happening at the same time. Demand collapsed and supply was shut down due to the pandemic. This can make for some unpredictable dynamics afterwards.

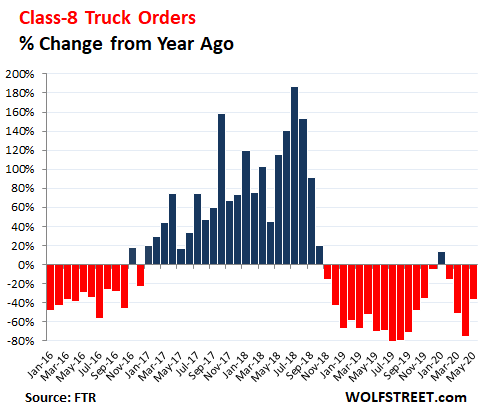

Class-8 orders – and much of the rest of the trucking business – went through a sequential double-whammy: First the freight recession in 2019 that followed the historic boom of 2018; and second, when orders were starting to bottom out in late 2019 and early this year, the pandemic.

The chart below shows the monthly percent changes of Class 8 orders from the same month a year earlier. January’s first year-over-year minuscule uptick after 14 months in a row of declines was wiped out in the following months:

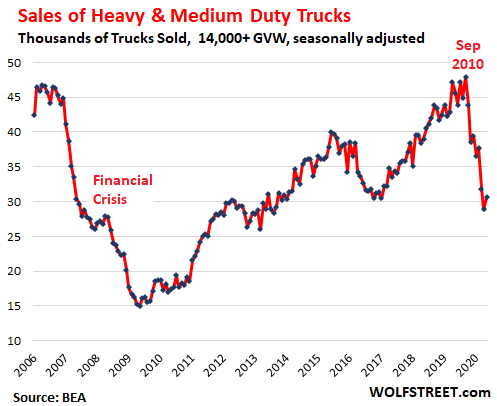

“Sales,” which lag “orders” by months, started skidding last October

The lag between the day an end-user, such as a trucking company, places the order, and the day the truck is delivered to the end-user spans many months. During the peak ordering panic of the boom in 2018, when the backlog at truck makers was huge, the lag between orders and sales could reach a year. So “sales” of trucks remained strong through much of the swoon in “orders” in 2019, as truck makers were working off their backlogs and booked record sales.

The Bureau of Economic Analysis reports sales of heavy trucks (over 33,000 pounds GVW) and of medium-duty trucks (classes 4-7, from 14,000 to 33,000 pounds GVW), all combined. Those sales peaked in September – over a year after Class 8 orders had peaked in August 2018. In October, sales started plunging.

In May, according to data by the BEA, sales of heavy and medium-duty trucks combined plunged by 32.8% year-over-year, to 30,600 trucks (seasonally adjusted) after having plunged 38.6% in April.

The May sales were for orders placed months before the pandemic. The impact of the pandemic – the historically low orders placed in March, April, and May – will not show up in the sales data for months:

During the Financial Crisis, sales of heavy and medium-duty trucks bottomed out at 15,000 units in April 2009, after having peaked in 2006. This time around, given the historic collapse in orders over the past three months, sales will likely bottom out near or below those levels sometime later this year.

And as the chart above shows, the recovery following the Financial Crisis back to the peak of sales before the Financial Crisis in 2006 took 13 years.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Does anyone think we’ll ever have another bear market in our lifetimes?

What is this market of which you speak? You keep using that word, I don’t think you know what it means.

If you are the owner of a Peterbilt or Freightliner dealership the bear market started in Q3 2018 and hasn’t let go yet.

Does this mean that there are just more old trucks on the roads? I have also been confused for as long as I can remember about “pork bellies”–how can that be such a thing?

Pork bellies = Bacon!

Oh, thx

Much of the future demand for large trucks was pushed forward by CA emission laws. Many fairly new used trucks had to be wholesaled to other States while entire fleets in CA and trucks from out of State operated in CA had to be purchased ahead of schedule to meet State standards. This has resulted in a unusually fresh fleet of trucks nationwide, and as the average replacement of heavy trucks is 500K miles, and truck usage is considerably diminished, I would expect that sales would be suppressed for at least another 5 years..

It could be even worse than that. Over the last few years, many companies have been pushing to raise the weight limit for general semis from 80,000 to 120,000. Normally, a semi and the trailer weigh, I think, 30,000. This would increase the weight of goods they can actually carry, from 50,000 to 90,000. It doesn’t change the volume though. This would mean a significant reduction in semis.

Overall though, I consider this dangerous, because, it could wear out alot of bridges alot faster. And there are already many bridges in America, on the brink of collapse. Some states have already been giving weight exceptions for trucks carrying CCP19 relief goods. It’s hard to say if this would actually, become, the new standard weight limit for everything though.

Add in the fact that supply chains are being reconfigured, which, could mean less cheap junk ends up being bought. Especially, as most B&M stores will go OB. There are a lot of possibilities, of why the number of semis will go down.

The only thing I see potentially reinvigorating semi sales, is self driving semis. Those are probably, at least, about 10 years away though.

Small stuff like this, could actually convince the government it’s safe to raise the weight limits.

https://www.ttnews.com/articles/states-suspend-weight-limits-trucks-involved-coronavirus-relief

The federal limit for semis is 80,000. I think some states have slightly higher limits, that only apply in that state, I assume on non federal highways.

In Minnesota:

“Weight limits are also increased by 10 percent from the beginning of harvest to November 30, each year, for the movement of sugar beets, carrots, and potatoes from the field of harvest to the first point of unloading. A permit is required.

No vehicle pr combination shall exceed 88,000 pounds on all routes.”

Normally the weight limit in Minnesota is 80,000 lbs, but if you’re hauling taters or beets in October & November, you can pile ’em up higher in the trailer, eh.

No, I don’t just make this stuff up. Drive around East Grand Forks between Halloween and Thanksgiving, and you’ll feel like you’re in a Coen brothers movie.

Maybe they can retool and make Amazon trucks? That’s the only thing you can bet on, Amazon getting more market share of all the things

That is only transferring, who the goods are being delivered for. Once, the package gets to your city, it’s delivered with a small freight truck “sometimes in the case with the post office, a personal vehicle”.

I assume, we already hit peak stuff. Basically, I think people will buy less random house filling stuff going forward. This will likely increase “people will buy less junk”, because, of the trade war.

A large change to working from home, might also impact total stuff bought, in the whole country. I assume, it will result in less stuff bought. Though, there will be an initial surge in home office and electronics stuff, but, that means that room can no longer have other random stuff.

With less B&M stores, it’s likely there will be alot less impulse buying. It will be interesting to see, if Amazon and other online stores, effect impulse buying.

Any idiot that would approve that increase has never had the wonderful experience of seeing one tip over into the lane in front of him on a freeway. (Good fortune paid off again.) They could have twenty axles and I wouldn’t trust the stability.

The argument is that, although, it’s less safe to have such a heavy semi, there will be less semis. I’m not sure, if that REALLY evens out. I oppose the idea, because, of the potential damage to bridges. Even if, we realize that damage is happening, it might be too late, alot of damage might have been done already.

Still, I could imagine something this stupid, happening quite easy.

There would have to be restrictions on many highways, including some interstates, for trucks to be hauling this much extra weight. Brakes overheat quickly traveling down steep regions and trucks can easily overshoot off-ramps which were not designed for slowing with this extra weight. When brakes overheat, they are worthless and drivers would have to gear down to a craw in some areas.

Simple math!

A five axle truck grossing at 80,000 lbs equals 16,000 lbs per axle.

An eleven axle truck grossing 120,000 lbs equals 12,000 per axle.

The bottom line is the heavier truck puts less stress on the road than to 80,000 truck.

I’m sure there is a math formula, but, that isn’t it for this. In particular, that formula wouldn’t work for bridges. On a road that formula makes more sense because the weight for each axle is pushed right against the ground. On a bridge, the weight has to be carried by the bridge and not just pushed against the ground underneath.

There’s both weight per unit of surface area and weight per stress point “each tire”. Especially, in the case of a traffic jam, there is also the total weight on the bridge, it would also vary on how the weight is distributed for each particular type of bridge. And the length and width of trucks determine, how many fit on a bridge.

It could be true that an 11 axle truck is safer “because, there would be less of them” and better roads and bridges. But, the companies are pushing for raising the weight limit on regular size semis/and big trucks. 5 or 6 axles.

SIMPLE ANSWER, YOU DONT ALWAYS HIT YOUR AXLE WEIGHTS. HOW DO I KNOW? IVE SPENT A LITTLE TIME SNEAKING AROUND SCALES.

Big trucking companies drive their rigs about 800k, then sell them in bulk to Asian, Latin and S. American countries who rip all the anti pollution stuff off the truck.

JDog:

Result: “Sleeper” parks for upcoming inexpensive housing……….

Converting cargo containers is a thing, but, using the trucks themselves as stationary housing, isn’t very practical.

More “good” news to push stock prices higher.

Everything is fine. PACCAR is near it 52 week high. Fed will print to Mars. Ride it till it blows up.

Everything is bad and stocks do nothing but go up and up and up. Instead of tear gassing churches and the American people, we should be tear gassing the Fed and putting Powell in prison where he belongs. Dow 40k by end of year… that’s all you need to know that Powell is the grey thief in history to date.

He was just following orders….

Is it just me … or does anyone else think that governments will need to continue to wage subsidies, mortgage holidays and other stimulus/bailouts… forever?

Otherwise the economy would tip over.

Forever is a very, very long time.

Amazingly I’ve found Powell to be the most human and sympathetic figure in this current turmoil.

A private equity guy that that may actually have a heart – ironic.

The Fed is not currently set up to help out the people and I think Powell has empathy for this.

A thought: if we abolish private debt, we end the Fed’s cancerous control over a huge part of our economy. Just throwing that out there.

Does that include the hundreds of billions in bonds that public sector pension funds hold?

Since it couldn’t have been virus issues that took out Celadon, what was it?

Declining volumes of real goods for transport…a big fraction of the supposed recovery largely consisted of paper gains driven by ZIRP…real goods transport volumes require broad based increases in real consumer demand…something mostly lacking when GDP increases are mostly driven by ZIRP rooted financial speculation.

Also, ever since the stock market nearly stroked out in the fall of 2018 when the Fed tried to hike rates by a piddling 1%, everybody and their dog realized just how paper thin US economic health was/is. Not great for consumer confidence.

And a 20 years late, China-US trade battle did not help either.

The cost of operating, their profit margin was thin and when GM went on strike it sank them. everybody in trucking runs on credit. great when you have cash flow, terrible when you dont.

Anybody know why log trucks are so cheap? They’re Class 8 trucks with some guardrails and winch instead of an overnight cab. Do they skip some kind of expensive safety gear needed for interstate freight hauls?

I regularly see 1990s/2000s log trucks in working condition (olympic dot craigslist dot org) for around $30k-$40k, which seems stupefyingly cheap.

Here’s an example:

97 Peterbilt Log Truck – $35000

97 Pete 379 Log Truck

5EK Cat

15 speed

40 rear ends

No Bunk Gear included

$35,000.00

Call for more info

This sounds ridiculous, a working Class 8 truck for $35k? No matter how many million miles are on it I can’t imagine buying an articulated highway-hauler for that price.

(if I post the link wolfstreet’s software will flag my posting and you won’t see it until Wolf wakes up in the morning)

I’m still here, but thanks for not posting the link.

Why don’t you like links, Wolf?

I’ve always wondered since I’ve gotten some great info from some links on here, especially to books.

Commenting guideline #2:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

Real trucks have 44 rear ends.

THOSE TRUCKS HAVE THE SHIT BEAT OUT OF THEM. WANNA BUY A HEADACHE?

Log trucks lead very tough lives: mileages aren’t high but working conditions are extremely hard on them. Parts wear out and/or break down fast.

A 1997 truck like the one you listed below needs a lot of maintenance just to stay operative, not to mention a driver who can jury-rig repairs at the side of the road.

If it also has a pintle mounted crane or other extra hydraulics the fun multiplies: nothing leaks and breaks down as fast as old hydraulic equipment that was abused, poorly repaired and run on low/poor quality fluid.

Thanks, that makes sense. I guess that logger’s headache rack says “this vehicle has been worked hard and repaired with duct tape”.

FWIW, all the log trucks I’ve seen (and I see a lot, every time I leave my house) are as stripped-down as possible. The only Class-8 trucks I’ve ever seen with any kind of crane on them have been parked in town in Aberdeen. Most of them look like the hydraulics on a tow truck, except much bigger; I guess that’s what a pintle crane is?

It depends also if they are off hwy trucks (what we call fat trucks with 16′ bunks), or hwy trucks. Current practice today is to take highway trucks, throw a self-loader on them, then beat the sh*! out of them on logging roads….because they are cheap and fast. Whereas, there are a lot of Pacific etc fat trucks hauling on the coast that are well over 50 years old. They go very slow with their loads but haul massive weights on impossible grades.

I was in one logging camp not too long ago and the Super was talking to me about the highway truck trend like this, “When I come down to the sort I always want to see one truck waiting to unload. If I don’t see a loaded truck waiting I’ll bring in more trucks.”

Using hwy trucks for logging is like seeing Cessnas used as bush planes. Compromise for price. Plus, roll overs are a possibility. When approaching one on a good curve I am always prepared to hit the ditch if they start rolling. It happens around here, not often, but several times per year. It’s all go go go money money money.

There are still posted signs on my way to town advertising for log truck drivers and hoe operators.

Actually, Cessnas make very good bush planes. Especially the old taildraggers like 170s and 180s (just add tundra tires and some STOL mods). The Caravan is a popular hauler in Alaska.

Thank you MC01.

Our freight recession was quickly ended by urgent TP consignments to every supermarket in Australia.

When someone sneezes 10 people sh%t themselves

There’s a lot going on in trucking and none of it’s good. In 2018 into 2019 rates were high, few trucks and lots of high paying loads and everybody and their mother bought a truck (on credit cuz nobody has cash anymore) and went out and made money. Now rates are completely in the toilet (under what it costs to operate) but all these guys have payments to make so they still take the loads. this works until something big breaks (which is just a matter of time) and they are out of business. but in the meantime, they are driving rates down and larger trucking companies can’t run those loads, so they end up selling off (that no one wants). And so they get smaller or rapidly go under.

Margins in trucking are extremely small (well under 10%) and almost every company out there (esp the big ones) are leveraged to the hilt. It’s not going to take much to knock more of these companies out. Nobody buys a $150,000 tractor with cash. Even the biggies get credit. You’ve certainly noticed that credit is drying up in the entire economy. Someone is not going to be able to roll their credit in these down times and boom, that will be it for them.

New trucks (since 2010) have been killed by emissions. Used to be you could take a truck bought by a mega (who sells them as warranty expires at 500k miles) and put some money into it and easily get another 500k miles before needing a rebuild (30,000 dollars plus). But now, the emissions are just a total crap shoot. It might work and never give you a problem. It might sideline you for 3 weeks and 20,000 dollars every year. And the trucks are all now computer controlled (like cars) so you can’t just “rip it off”. It simply won’t run. This is part of why you see so many older trucks on the road. It’s cheaper to do a full rebuild and keep them on the road than to guess if your new truck is a good one or a bad one.

Anybody who says self driving trucks are coming has clearly never driven a truck. It’s NOTHING like driving a car or a pickup. (and cars aren’t coming either, but that’s a different argument).

Liability insurance has gone insane for trucking companies. Like tripling or more. easily $25,000 PER TRUCK. That’s just liability. That doesn’t include cargo insurance (which isn’t cheap either). A lot of smaller trucking companies are out of business, they just don’t know it yet.

it’s a perfect storm in trucking. volume declining (and not coming back with 40 million unemployed), costs rising, reliability declining and credit decreasing.

Thank you LGC.

Also, a truck is not a truck. Trucks are completely different underneath. Every one is configured for the job it is to do. Including gearing, tires, engine, frame, transmission, etc, etc, etc. Put two trucks side by side, externally they look the same. But one might weigh 15,000lbs (very light weight) for hauling gasoline in Iowa) and the other one might weigh 27,000lbs (built for heavy haul). But you would never know by just looking.

It isn’t 15,000 copies of one truck. It’s 15,000 totally different trucks.

Wolf,

Many thanks.

One question. Are these Class-8 sales numbers adjusted for inflation? If not, then apparently heavy truck sales have never truly recovered from 2006.

Orders and sales in this article are all for “units” — meaning numbers of trucks. No dollars or inflation involved.

I’ve heard that recessions accelerate existing trends. Will be interesting to see how this plays out.