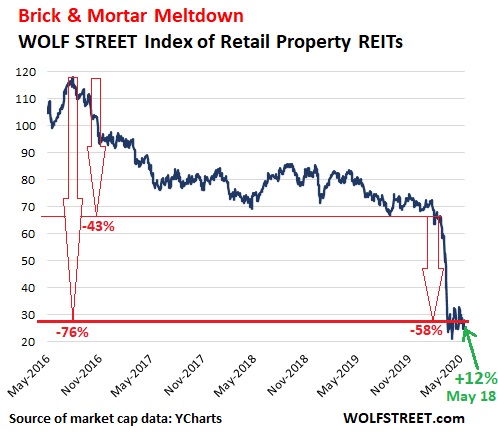

The disaster came in two phases: first, the brick-and-mortar meltdown, then Covid-19.

By Wolf Richter for WOLF STREET.

Retail property REITs had a huge day in the stock market today. The WOLF STREET market-cap-weighted index of nine REITs in this space surged 12.4% today! These nine REITs in my index are Tanger Factory Outlet Centers, Cedar Realty Trust, Macerich, Seritage Growth Properties, Kimco Realty, RPT Realty, Washington Prime Group, Brixmore Property Group, and the largest of them all, Simon Property Group.

But despite that one-day surge, the index remains down 76% from the peak in July 2016. This collapse of the sector came in two phases: Phase one, from July 2016 to February 22, 2020, the relentless brick-and-mortar meltdown that has been going on for years, powered by the shift of retail sales to ecommerce, resulting in tens of thousands of stores being shuttered over the past four years; and phase two, from February 22 onward. In phase one, the index plunged 43%. In phase two, it plunged 58%, including today’s 12.4% surge to 27.9 (market cap data via YCharts):

The latest drumbeat came today when JCPenney, which had filed for bankruptcy protection on Friday, said in an SEC filing that it would permanently close about 242 of its 846 remaining stores by next year. Earlier in May, Neiman Marcus, J.Crew, and Stages Stores filed for bankruptcy. All of these efforts to restructure the retailers will come with gobs of store closings. A bankruptcy procedure allows companies to break their store leases, and landlords get to stand in line in bankruptcy court.

Even in the three-plus years before Covid-19, the dynamics for mall and shopping-center landlords, including publicly traded REITs, has been a drumbeat of gloom under the brick-and-mortar meltdown.

At the time, this was a function of retail sales switching to online operations, including to those of brick-and-mortar retailers. Department store chains were hit the hardest and closed thousands of large anchor stores. Even surviving chains, such as Macy’s have been on a relentless store-closing binge.

Then came Covid-19. For mall landlords, the lockdowns, when most retail stores were temporarily closed, have turned into a mega-problem as many retailers have stopped making rent payments.

For example, GAP announced on April 23 that it was running out of money, and that it would issue $2.25 billion in bonds to get through this, and that it would not pay April rent. Simon Property Group has 412 Gap stores, including Banana Republic and Old Navy stores, at its malls, making these stores its largest tenant in terms of rents.

S&P Global highlighted this mess today in its report on rent collections, based on data released by US REITs. These are percentages of April rents that REITs reported to have collected by the week ended May 15:

- Tanger Factory Outlet Centers [SKT]: 12%. It offered tenants the option to defer April and May rent payments to January and February 2021

- Cedar Realty Trust [CDR]: 70%

- Macerich [MAC]: 26%

- Seritage Growth Properties [SPG]: 47%

- Kimco Realty Corp [KIM]: 60%

- RPT Realty: 58%

- Washington Prime Group [WPG]: 30%

- Brixmore Property Group [BRX]: 66%

- Simon Property Group [SPG]: has not disclosed the data.

Some of the malls are now opening up again, and some – but not all – retailers in those malls are now also opening up again, with many restrictions and prudent practices to reduce the risk of infection, both for their employees and customers. Other retailers are delaying a bankruptcy filing and subsequent liquidation until they can reopen their stores for liquidation sales. Lord & Taylor, the iconic department store, has already announced this strategy.

For the retail property REITs that were already stressed from the brick-and-mortar meltdown going into the Covid-19 era, this is a gigantic mess that compresses what was expected to transpire somewhat manageably over the course of many years into a few months.

Many mall landlords already made plans to repurpose parts of malls or entire malls that are in appropriate locations into offices and housing, which might require bulldozing the structures and starting from scratch. This is being done successfully, but it takes a lot of capital and time, and only works in appropriate locations.

One thing is becoming increasingly clear: There is no way back to the Old Normal of retail – no matter how much money the Fed prints. That train left years ago. Covid-19 will be a powerful impetus to dramatically, rather than gradually, change the retail scene in America. And retail property REITs – retail property landlords more generally – are going to have to figure out what their role in it will be.

Investors bet on this outcome for years. Covid-19 just sped it up by a few months. Department Stores Are Toast. READ… Zombie J.C. Penney Finally Files for Bankruptcy, in Deal with Distressed Debt Funds. Stock and Some Bonds Wiped Out

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Once again mug proven wrong. :(

Retail deserves to die off. High priced goods of poor quality, low grade materials and narrow selection. The internet came along and offered choices. It was like a welcome return to capitalism, where the same old commodity product finally got bid lower.

The american business model is produce low quality products, but market the hell out of them at jacked-up prices. In other words, abuse the customer. I’m glad that’s changing.

?? But the graph clearly shows it was not a straight line to heck ??

Wisdom:

Wolfe’s discovers his first dead cat bounce!

Not exactly…

https://wolfstreet.com/?s=dead-cat+bounce

But I’ve been hounded over the expression by commenters who love cats and who thought it was cruel … and so I try to avoid it if possible these days. Yup, never a boring day here at the comments :-]

Good piece. I always follow these REITs and play them both long and short. If they rally more this week I’ll probably be looking for Jan puts on one of them. I also believe that many retailers are waiting to reopen so they can then liquidate sell everything before filing BK. Why would they do it before then? Is SPG with all that debt a bankruptcy candidate? I am having a hard time understanding what the fed is going to allow throughout this. There just has to be a massive wave of bankruptcies all over. Would they step in and save the REITs??? Love your work!!!

The Fed has little role. No money means goodbye.

The way I see it the Treasury and the Fed back stopped the loan market that should allow the better REITs to roll over debt. Plus they were given a bone in the CARES act that allows them to depreciate some additional charges.

The one I follow used it’s credit line and now it’s cost to average cost to borrow is 3.1%. The way I read their finances the depreciation costs exceed the interest cost so they basically get money for free as long as they have a viable business. Time will tell if that is still going to be true.

If you had been lucky enough to have picked the bottom you would be up 63% as of now if you include the dividend. $6.14 – $4.05 plus $0.36 dividend.

Retail property will just add to the dead and decaying carcass collection of de-industrialization already littering America. Go out into the Hinterlands of America and open the eyes. Pavement is going back to at best road bond. The need for more taco joints or pizza holes are limited. Retail space around government centers or well tax fed universities will survive because of close proximity to the empire. If we can keep the rest of the world financing our consumption we will muddle along . There will be bright spots across the country but the Balkanzation of America is well under way.

Deindustrialization has been a done deal since the 1920’s. Consolidation is a b.

Real manufacturing output has been level since 2000 but it hasn’t declined. The idea that we’ve deindustrialized is a myth based on the notion it correlates with jobs in manufacturing. Jobs in manufacturing have plummeted while the output has held steady, which is a direct result of increased automation and efficiency in the manufacturing sector.

That’s not to say more industry couldn’t be growing here and real output could have been increased, but those jobs are clearly never coming back. Perhaps you’re noticing how the flow of money is breaking down when people lack opportunities to earn it to pay the machines?

Also outsourcing. Jobs that formerly were done internally are now done outside and not counted as manufacturing jobs.

Those empty factories all over the metro Detroit area must be a myth?

The one I worked in just outside of Detroit downtown, is now an empty lot!

rhodium.

Couldn’t agree more. for every automated robot arm in a car factory there may have been an employed worker previously. Enough robotic arms leads also to faster production and less production space requirement.

Hence parking lots in Detroit nd the west midlands in the UK.

I aapreciate that there are also other factors, such as the relocation of factories from western to eastern europe and from the USA to mexico, but automation continues to be a massive contributor.

Cars are also designed to need fewer steps so less work. A piece of plastic that you click in takes a lot less time than something that needs to be screwed in with 4 screws.

U.S. GDP is over twice what it was in 2000.

That the U.S. has deindustrialized is not a myth. It’s half the share of the economy, apparently, as it was just 20 years ago.

Strip malls imposed a low aesthetic, homogenized identity to every town in America. (Some wealthy zip codes outlawed the corporate logo, and the billboard). Whether you extol this new diversity or deride the balkanization, mutual hostility, or celebrate a lifting of the onerous corporate pax americana. So named American corporations must relabel themselves multinationals. They don’t share revenue, they extract wealth. Phrase next to be heard, “If you like your s**t job, you can keep it.”

That’s why I invest in capitalization-weighted REIT ETFs. The best REITs that have the largest market caps are the main part of the ETF. Right now in my ETF cell phone tower and data storage center REITs are the top holdings. The Mall and CRE REITs are lesser components.

LOL. How about having the courage to name the ETF you’re talking about, so we can see what performance you’ve been enjoying this year?

I’ve been watching the sector and even the cell tower and data storage REITs haven’t been doing all that well. One might argue that they’re burdened by being stuck in an index fund with companies that are obvious zeroes. Or it could be that the economic slowdown will impact everything at some level??

I don’t know much about buying and renting out cell towers, but I do know a bit about data centers. You can’t just open one anywhere anymore, location matters, as do other factors such as weather, access to talent, transportation, power, etc.

It’s a specialty business. Buying a big cheap place is not going to work.

Sure, I bought FREL, RWX after a major correction. I’m down a little but I never buy when everyone is buying. My investment portfolio was down .30% today versus the SP 500 down about 1%.

If my REITs ETFS go down 30% I’ll be happy because the market it doing its job.

I sold my IVR mortgage REIT today for a 10% return after dollar cost averaging into the bottom.

I take what the market gives. I buy when everyone is selling and sell when everyone is buying.

I also proudly bought airline stocks after they crashed.

At the same time, cloud providers are eating businesses of datacenter providers.

My companies were leasing space from big dc providers but now we are moving out and moving into public cloud.

I’d be vary of investing money in reits of datacenter providers and would invest into cloud computing power house.

Data centers are a relatively new sector who only exist since the late ’90’s. This will be the third recession they will experience. First was partly caused by them and that growth wouldn’t be massive forever. Second was the housing recession which did not hurt them that much, but it was also the birth of Facebook, Youtube and smartphones and the massive growth in data-centers they created. At the moment i see the massive growth in tele-work but will that be good for the kinds of data-centers the REITs own?

You can read my reply to Petunia where I display what I own. I dollar-cost average over the long-run into orthodox ETFs that have crashed and trading below the industry average P/E ratio.

I take what the market gives me and I take emotion out of my investment decisions.

Low quality apparel, tools and equipment manufactured with subpar materials produced with poorly paid overseas labor-

I will not miss it.

When US military units started arriving in France in 1917 they were issued with the French-made Chauchat light machine gun.

It has already given the French Army so many troubles that in December 1916 General Philippe Pètain personally ordered an official inquest which found the weapon poorly designed and somehow even more poorly manufactured. Those assembled by Gladiator, a contractor that before the war had manufactured bicycles and car components, were found to be pratically useless on the battlefield.

Tragically while the Chauchat was acknowledged to be an absolutely unsatisfactory weapon, no measures were taken to replace it as the planned Nivelle Offensive was looming and it could not be scrapped to allow the French army to re-equip.

US soldiers absolutely hated the “Sho-sho” as they called it, to the point hundreds were “lost” every week in every possible fashion. As a historian put it “As US newspapers were full of glowing reports about the new machine guns designed by John Moses Browning, US soldiers had to fight their hardest war to date with one of the worst weapons ever mass-produced”.

Replacing malls with housing?! Hell, we need more air filled widget factories. Jobs for all, profits for none.

Residential estates of the future will have to invest heavily in traffic management to facilitate the delivery of online shopping. Perhaps a central warehouse on every block? We used to call those supermarkets.

Some of the malls were built on former environmental sites. Several were typical old “town dump” sites, not too bad, and may have had a few decades use as drive-in theaters in between, like The Chicago Ridge Mall, for example. But a few were on real Superfund Sites, like one that I know of in the Northeast on National Priorities List (NPL) site of a former chemical facility. These mall locations have environmental deed restrictions, institutional controls, barriers / caps and long-term monitoring requirements by EPA, states and sometimes former owners of the property as conditions for allowing the mall to be built originally. Any redevelopment will reopen these issues to more scrutiny and perhaps limit prospective uses and / or trigger further remediation based upon present environmental standards. PCBs, heavy metals and chlorinated organic solvents tend to hang around for a long time – not a mere “former gas station” thing. Prospectively, mall buildings falling into abandonment and disrepair quickly turn into a mold problem damaging the whole building.

They can just be demolisthed and turned into a park.

Judging by the state of things there are going to be lots of empty retail spaces; not just malls, also restaurants, car wheeler/dealers, schools, offices, possibly even medical clinics as online doctoring picks up.

I wouldn’t want any of my money invested in any kind of commercial real estate for the future.

Wolf,

I having been wondering for quite some time…

Why do not the townships, towns or cities, not use these abandoned or closed malls for low cost housing?

But that would be common sense and governments have lost this to the group think of knowing what is best for us.

Toronto was using student dorms and hotels for our illegal boarder crossers and then tried to get home owners to add a room when students came back. So much empty offices and old abandoned manufacturers and malls and yet they keep encouraging for more people with no actual place to live.

A great many apartment buildings are getting past their prime as well and a couple have had to move out the residents due to fire and smoke damage due to aging infrastructure.

Codes and regulations and zoning laws about what’s considered habitable. You may recall the stories about people living in warehouses that had amenities added (by artists or otherwise) but then they were forcibly removed by law enforcement because the property was not considered intended for habitation.

A lot of malls are just concrete slabs with a pandeck roof and then they frame out individual store spaces. The problem is with the amount of hvac and piping and wiring that would need to be added to create individual units, you either end up razing everything but the concrete slab or you end up having to deal with an inefficient multitiered layout that will inevitably have units with no access to natural light and a pain when it comes to routing everything, especially ventilation. They would cost too much at the end of the day.

Tearing it down and rezoning for housing is the only real option generally if that’s the goal.

Codes etc. are not the reason why it can’t be done. They just have to few toilets/showers to function as housing and it would not be economical to make it habitable.

While your points are good Rhod, the negatives of any type of construction remodel can all be overcome by good design and engineering:

Many of the former manufacturing and other non residential facilities turned into residential were done with neither, and are not only not built to ”any known code,” but are actually very dangerous at any time with crazy occupant loads; we have seen some egregious loss of life in some cases, including recently, that is shameful.

OTOH, I have been inside some of the ”lofts” and similar, that have been done carefully, and are attractive, safe (IMO as an experienced code enforcement person,) and most importantly, very comfortable with modern utilities, lifts, etc.

BTW, most of the malls I have worked in have all had plenty of space above the ”drop ceilings” for the placement of additional utilities, and many of them could be made into two story ”town home” type residential with appropriate egress out of the top floors built on top of existing roofs, etc…

All boils down to creative design and ”life cycle” cost effectiveness for any particular situation, eh? Recent cost estimating has increased awareness of cost of entire cycles of buildings far beyond basics of construction only, to include cost of recycling of all materials and other likely eventualities.

Very true. Enclosed Malls are nothing more than a warehouse. A glorified warehouse with the throw-away decor and trendy fanciness here and there. But look behind the drywall partitions and you see the cinder blocks and cement and no windows or anything that anyone WANTS to spend time around.

They should doze them and convert the sites to tiny house parks. Would be a cost efficient way of adding low maintenance affordable housing. Wouldn’t have to build any buildings just install laterals, do some landscaping, and rent the spaces.

Joe,

Very tough to use big-box buildings with windowless tilt-up concrete walls and plumbing in only one corner for housing. Better to tear them down and build real housing from scratch.

Of course there’s always public condemnation. Give them a big IOU which they can use as collateral for loans to go back and rebuild those towns and mainstreets that were abandoned by the populations which gravitated to the places where homeless, low rent, and barely-above-water are now forced to be living. Maybe make some jobs to go with making housing. You know, profitable production like you have pointed out is lacking in the crap we’ve got running loose today.

Wolf

I’ve seen the Gap and Banana in the same locations. Makes sense as far as number of stores. Simon has a 9 million dollar bet on his properties. Captain of the ship in rough waters. He has wanted Taubman for 20 years, and Taubman keeps 20 percent and manages. It will be very interesting. Vol under 30 first time, fed money toning it down? The virus also. Traders market. Oil up. Drawdowns today. Shale money gone. Shell cut. Mostly gas. Oil higher with out a doubt or no market. Tobacco to boot. Talking the fall about the virus, a w? Libor coming down too.

I think there will soon be a backlash against online shopping. It doesn’t scale very well logistically because it is so reliant on physical delivery services. Intractable issues will soon become apparent.

Fat Chewer,

People have been saying that for 25 years. And ecommerce continues to take over retail. Because it’s the other way around. Ecommerce scales very well. One delivery truck with 100 packages on it driving along the delivery route and delivering packages is a lot more efficient that 100 people driving to the mall and spending hours to shop. No need for big stores with big parking lots. No need for staffing those stores. No need to put inventory in those stores, or to maintain those stores, etc. Instead of several stores in the city, you need one fulfillment center in a low-cost area outside the city, and a fleet of delivery vehicles. Works very well. It has been killing brick and mortar stores.

Totally AGREE Wolf,,, ”WE” just had to go to the local WM to touch and so forth the new and improved vacuum for the house that we had agreed was our best choice while looking at it on line yesterday for 15 minutes or so, (and I would have ordered to be delivered to the house today, but…) and it was supererogatory far shore…

Driving 20 mins each way,,, putting on the PPE,,, dragging across the 200,000 Square Feet,,, etc., what an ordeal, eh??

Yes, all staff had on face masks, mostly properly in place; about half of customers did not, including elderly who really should know better by now, in spite of the below.

Basic problem being made SO clear with this virus event is the total lack of planning and preparation of policies, not to mention actual practical implementation; scattered responses from one end to the other end of the nation, states, counties, and even medium cities leading to endless confusion and uncertainty!

Face masks are for you to not spread the disease to other people. They don’t work that well in stopping other people infecting you.

In 2017, online was 9% of retail. This year, it is expected to be 12.4% of retail. At this rate, it will be a long long wait for online to takeover retail.

Jim, you’re going to need to bone up on your exponential growth math to get that Wall Street job. That 38% growth rate you’re talking about leads to domination within 5 years!

9% last year, 12.4% this year implies 38% growth implies doubling every 2 years. 5 years hence: 61%

But more seriously, if you factor out groceries and gasoline, there’s not much that can’t be bought online. Or done without, given the new health risks of going to a store. And gas purchases have plunged.

My family has avoided in-store retail (other than groceries) for 2 months with no real issues except for having to get some PVC cement that couldn’t be shipped. We’re spending about as much as normal but having everything delivered.

We pick up our packages with gloves and put them in a space we just to quarantine deliveries for a couple of days, and avoid the health risks of shopping altogether.

I thought I might miss the serendipity of finding other neat stuff at the store while browsing, but you know what? It’s just stuff.

SocalJim,

Please read the article. It tells you for example that gasoline sales are not under attack from ecommerce, for obvious reasons. Nor are new vehicle sales (state franchise laws). Grocery sales are just now coming under attack. But gasoline sales, auto sales, and grocery sales = 55% of total retail.

It’s the other 45% that is getting crushed = the mall stores. If you’re in CRE, that’s what you need to understand. Look at the second chart. Ecommerce has already blown past them.

You really should read this stuff before posting here. It just sounds so silly.

As for myself I have few problems with retail stores. They would all be dead if for problem folks such as me.

I tend to buy stuff that Amazon doesn’t list, such as large machine tools. Fedex will not deliver a thirty ton machine to your front door.

What cracks me up about this place, that I do support, is the emphasis on real estate. Few now have the slightest notion of the heavy industry that backs up your lives. I refused to shudder in place from the cops. I will not get a penny from those alphabet programs of monetary inflation, but I will use my savings to buy junk that I have no use for at my age. Perhaps one of my employees that cost a pile of in-house training can carry on without a mask and become a gombit hater.

A small business is a life link for bigger businesses that make stuff that a NY lawyer or banker cannot comprehend. It likely is the incorrect response to the modern thinking on economics, but I will piss away my dough on machines rather than Bangladeshi underpants.

With the capabilities around curbside and in store pick up, this is making e-commerce even more attractive.

And of course the physical store will still exist, But now I would expect it’ll be part show floor and a good part of it will become a warehouse. Think Best Buy but with less show floor.

This is the reason Amazon is pushing so hard for physical locations, and look at Walmart. According to their quarterly report today, their online capabilities have increased dramatically. I certainly don’t expect them to reduce their physical presence, they may change the layout of the store to accommodate changing demands.

Did you not read about the massive store closures. The physical store will for many people no longer exist.

@char

I did, and those stores that do not adapt will continue to die. The list is potentially endless. Ask Best Buy, Walmart, Target, etc, about how they are faring.

One other thing I have to point out, Walmart and Target didn’t always sell groceries, that’s a recent change. (meaning within the last 20 years) Basically, these guys have adapted to the circumstances, having seen far enough in advance the threat of Amazon gobbling up everything, they reacted. The other guys, well, they haven’t adapted fast enough or they were just plain too late to the game, and they are all going to die.

Case in point, Barnes and Noble, it’s a miracle that they still have stores out here. I remember in the late 90s and early 00s, they were quite the place to be.

@MCH

I doubt that an electronics seller like best buy has made a profit in the last decade. Walmart and Target are supermarkets with some side hussle. They are also threatened by pure play supermarkets

But the treat is not so much for big box retail as the store closures is a threat to malls. Malls work on the principle that combined is more than every part individual. Too many stores gone and the mall is death.

char,

“I doubt that an electronics seller like best buy has made a profit in the last decade”

Best Buy made $6 billion net income over the past five years — I just looked it up.

@char,

Best Buy’s 10k says otherwise for 2019

Mediamarkt, a European version of Big Camera/Best Buy, was split of from their parent company because it was allegedly making a loss for a decade. Understandable seeing the development of demand and price of electronics and electric appliances. Smartphones eat everything else and they are not the first stop to buy a phone. And then you have also webshops.

ps. IMHO it was split off on the assumption that it would blow up

Wolf Richter,

The real question is whether online could actually be cheaper than streamlined Costco’s and TJ Maxx like stores; Right now, B&M stores aren’t really bringing it. If online really could be cheaper than cheapest possible B&M, I could see online being bigger then B&M. Alot would have to be done to accommodate the changes; among them is how to handle grocery delivery. Everyone would probably have to some sort of automatic locking fridge freezer on their curbside.

We also have to have in account; Amazon’s pricing model doesn’t make money and charges a membership fee, other online stores actually plan to lose money, if stores like Wal-Mart adopted these strategies, they would be competing much better. Planning to break even or even losing money, as opposed to making money, could dramatically change the prices of B&M.

There will also be alot of changes in consumer buying over the coming decades, among them, I expect electronics sales and other such items to plummet in volume of sales, as yearly iPhone upgrades and the like become less meaningful. This is a major part of online shopping. Over time, I expect groceries and everyday household items like soap, paper towels, and pharmacy stuff to become an increasing percentage of total sales; B&M hold certain distinct advantages for these items.

As for real estate, we already know most B&M stores and malls will disappear. Will the remaining space taken, really matter that much? As for the location of the remaining B&M, not many Wal-Mart’s and Costco’s are on the ocean and lakefront land. Often Prime real estate is described partly by it’s proximity to shopping. So the argument that a warehouse could be located somewhere less valuable, isn’t necessarily true. We would also have to figure out, how having a fulfillment center outside of town, would effect road traffic, right now, the roads are already built around shopping centers or vice versa. Likely fulfillment centers would be located near highways, just like Wal-Mart.

As for number of workers, Wal-Mart is already automating most checkouts, installing automatic gates so only 1 entrance has to be watched at night and other such actions. Amazon is even trying to create entirely automated grocery stores. For online, eventually delivery could be done entirely by self driving trucks, but B&M will have their own automation tricks.

Also Wal-Mart and target are trying to figure drive up pickup, so you order online, but pickup at store on your way home. Which blurs the line.

In the end, I think B&M will be cheaper and more common.

Way before corona online had 1/3 of the everything but supermarket/fuel/car market. They don’t need to scale up a lot.

Ecommerce is making inroads in grocery sales. Once electric cars take over which seldom breakdown and has mobile mechanics that come to your location, Ecommerce will have that as well as the gas stations won’t be needed.

Commercial real estate of any kind in the future is NOT the place to park one’s money.

The lack of security in malls has been their biggest problem for the last 20 years, but especially since the GFC. This is an uncomfortable conversation to have in our society, but it is nevertheless real. I think they need “casino” level security with a big physical presence to make shoppers feel safe. I try never to go to the mall alone, which means I don’t go often.

Years ago I read about the malls in Brazil having a reservation system where shoppers had to call in to gain access. This system basically allowed for the creation of a list of screened shoppers, which ensured mall security. I wouldn’t mind having that available in the US.

The problem is the malls don’t make casino like profits so can’t afford casino like security.

And your Brazilian suggestion would be met with screams of racism inside a heart beat in America.

You need to move to a safer State that has a functioning government. Try New York.

Petunia you need a very big govt if you want to be safe and protected by others at all times. Preferably with every other person being a plainclothes police officer. You may enjoy life in Vietnam, Cuba or Burma.

Or, say, London with Johnny-one-eye watchin’ over you all the time. Creepy and scary. War of the Worlds without the aliens.

All the unsafe malls die, people stop going. In every town I’ve lived in I have seen it happen. In West Palm Beach, FL there was in indoor mall that was a haven for criminals. The town knocked it down and built an outdoor outlet mall, which is much safer than the old one. If the owners don’t deal with the problem, the mall dies.

I grew up in NYC and left ASAP which was a few years later than I should have. NYC is a terrible place to grow old in, and I already knew that when I was young.

As an investor things get interesting when a sector is in the eye of the storm.

Sometimes a company gets marked down too much or not enough.

One of the REIT stocks in the list above got marked down to 1.8 times trailing twelve months free cash flow based on March 31 earnings report and is still investment grade. You have to determine is that a reasonable price and then buy, sell or hold depending on your goals.

REITs by their nature are leveraged with a lot of debt. Cash flow isn’t as important as their debt to value ratio which probably is negative

I agree you have to look at the whole picture.

I am just trying to say when something is marked to 1.8 free cash flow a lot of bad news is built in. Amazon is at 65 times free cash flow a lot of good news is built in.

You have to try to build you model even if it’s a mental one to see which one will outperform expectations.

If something has 1.8 free cash flow than it likely wont have 1.8 for long. It is an indication that a lot of people think that the business is near a collapse. With malls a given. Rents will collapse and that is if the place is still rented out and still creates enough footfall.

Thanks for this! People have lost the ancient art of stock-picking, but those who do it will will make fortunes this time around.

Trouble for me is that it’s really, really hard to distinguish between stocks that still have value, and ones that are just doomed for reasons I can’t see due to all the layers of financial obfuscation. (“Is still investment grade” is a worthless add-on since the ratings agencies don’t provide timely updates.)

Another problem is that it only takes a couple of adverse events to turn a deep-value turnaround story into a zero. So you need to diversify among a lot of selections.

You have to use different valuation models….I get free access with my broker to Morningstar and compare it with SnP and a few others with analysts rating changes, then look at cash flow debt etc…

Hi earning growth have different valuation models…far removed from classic models…

I stay away from etf s any clunkhead has better odds figuring out their own system if they followed them for years…even with a retail disaster avoid the worst ones. Brookfield is looking for properties it can buy from failing ones so there must be some long term value through the cycle..

Yes mall REIT’s have gone down- how far would they have to go down to be considered an investment bargain? I think a lot further.

A lot of stuff called bargains in the press really is not. Just because something went down 76% doesn’t mean it’s a bargain.

Now when I can buy an investment, and the earnings or dividend income pays me back all my investment within 1 or 2 years, and I still hold the equity, and have a good shot at a lifetime of income after getting paid for taking the huge risk- that is the kind of bargain I’m looking for. If Simon Property Group (SPG) hit the -$8-$12 range, and assuming many of the properties recover, that might qualify as the type of bargain I am looking for.

Howdy fellow Texan I like your style! I too follow a similar template for risk/reward.

Raging Texan said: “Now when I can buy an investment, and the earnings or dividend income pays me back all my investment within 1 or 2 years, and I still hold the equity, and have a good shot at a lifetime of income after getting paid for taking the huge risk”

____________________________________

If you can find and execute those opportunities you should soon become one of the wealthiest men in America. Start a fund. I will be an early investor and greatful for the opportunity.

@cb

I have found a couple of investments that good. Very hard to find. As in hundreds of hours of searching and diligent surveillance for years to find one opportunity like that. Usually have to move quickly as the buying window vanishes as others see it and rapidly bid up the price. This is extreme Graham style investing that I am talking about. And it works.

working on getting bigger and yes I have thought about making my own fund or buying an existing company and running the investments (like Buffet, except kick his trash).

FYI due to the stupid regulations (which are designed to protect the establishment and discourage people like me from getting started) I have to get a lot bigger and richer before I can take on investors. I need to be able to afford a couple of lawyers before I start something like that. I started investing with my lunch money when I was extremely poor.

Texan,

If Simon goes down as much as you would need in order to make a killing, it means their business model is as dead as the RE. It means the real estate has no commercial value as a retail venue. There’s no coming back from that except as a totally different business.

BTW, the dead mall in my town was purchased by Amazon as a distribution center, for the cost of a really nice house. The mall died because nobody goes there anymore, because it was unsafe.

@Petunia

There are a multitude of reasons why a stock may trade at a low price. One of them being that stock prices are frequently set by mentally unwell intoxicated reckless psycopaths. Or someone made a mistake and sold 10,000,000 shares instead of 1,000,000. Sometimes share prices go down for reasons that have nothing to do with the business model.

And I get it, you are into safety when you go to the mall.

Pier 1 just bit the dust. This may help contribute to your target price for Simon in an indirect way. But it’s Kamikaze investing in my view, you get your price, right before the end. Best of luck anyway.

Thanks, Simon (SPG) not really on my shopping list, but the Pier one example means that my interest price for SPG now goes even lower than $8-$12. I meant $8-$12 assuming a recovery!. If 50% of their tenets do like Pier One, then the price would have to be even lower or probably just pass and find something else where the share price is extremely low and the underlying business is at least OK.

Pier One, what a store! For the past 15 years my wife and I drive past one, have never seen a single car in front and never saw any customers at all inside. We went in once just out of curiosity and the prices on their products were 500% more than we would pay elsewhere. I guess we missed our chance to pay 500% more than fair price on junk we never really wanted!

It would seem so but in today’s globe&mail report on business here in Canada there was an article on how mails reits will be restructuring the space. It was thin on details but could be long risky on time.

At least retail space here is a lot less per population density. The malls used to be so packed one could not find a parking spot and it draws in the surrounding areas where there is very little local retail.

When I was wintering in Phoenix you could not go for a few blocks without finding a storefront.

French Connection is the latest to go on life-support.

Plans to build are not developed in bad times. Will we be in a bad time in a years time? I don’t know but the US doesn’t seem to be on the right track. I doubt a lot of former malls will be redeveloped into new uses in the next couple of years.

You’re wrong again here. Plans to build ARE made in bad times. Those plans begin to execute when the bad times begin to turn around. And then they are exceptionally profitable during good times.

Key point is that if you don’t have the plans or the vision, you’re going to be late to the party when the punch bowl returns.

I mean plans to build are not executed in bad times. That is not even true but you need money which the mall companies don’t have. And making plans cost money too

The Big Boys control the narrative for the retail investor.They are selling out while the retail investor rushes in mouthing the words planted by the Big Boys of buy ,buy ,buy while the Big Boys are waiting to short,short,short. The Wilshire 5k Vs GDP ratio has put Buffet and Munger patiently waiting on their vulture perches. At some point they will take wing and start circling for the fresh rising ripinning stench of the retail investor carrion.

I agree with you. In the age of Neiman Marcus and Lord & Taylor going bankrupt, nothing looks as bad to me now as a CRE REIT.

Pier 1 is going to be gone as well. These companies are disappearing faster than I can type.

Petunia,

I like on-line for somethings, but not for shoes or clothing. I am a little sensitive to how the fabric feels and the fit. If a fabric doesn’t feel good on my skin I will not wear it. Unless it’s improved sizes are often not true against a standard.

Aircraft lease company specializing in 737 Max, 747, 757, 767 A340 and A380 aircrafts.

Those are worse than CRE REIT

I know this is not relevant to what is the focus of this website and this article.

But maybe we could spare a thought for those in the path of Super Cyclone Amphan in Bangladesh.

Less than 100 miles from the anticipated land fall,according to Reuters, is a refugee tent camp for hundreds of thousands of Rohingya.

I’m not a bleeding heart liberal, but God help them.

good discussion…thanks Wolf and others.

How can we use this to make money?$

You’re obviously not reading. FED(ex) and Treasury are doing that for us. Just make out a Christmas wish list and mail it to Santa Klaws c/o IRS @ 101001100011 Hell-froze-over Street, Washington, D.C.. Now bake some cookies and milk that cow. Might bury some cash & coin behind the barn while out there.

Jon,

I’ve been writing about the brick-and-mortar meltdown for years. And also about mall REITS for years… so I just went looking … and found one from May 2017… so the time to short the mall REITs and make money was then:

https://wolfstreet.com/2017/05/09/retail-meltdown-demolishes-mall-reit-investors/

Wolf, there’s even a Decline of the Retail Store ETF (ticker: EMTY) … but it looks like their approach is wrong (or execution poor)

Bob Moriarty: Okay, well let me give you my short technical description of what’s going to happen with commercial real estate.

Goldfinger: Okay.

Bob Moriarty: They’re f*cked. They are absolutely catastrophically unequivocally f*cked.

Bob sure has a way with words, no beating around the bush there ?

In my city, San Diego rents have gone up quite a lot in the las few years, a average 2BR/2BA apartment cost $2k/month or more. Lots of investment properties and also lots of airbnb

a lot of my acquaintances are lving on shared basis basically 1 or 2 adults in single bedroom to save $$. This is not the USA i wanted to see

I am wondering if these places would be affordable over time.

I suppose what scares the Fed so much is that with such high unemployment there will be a shattering demand crash and so deflation and ever on. Deflation is historically THE bogeyman for a Central Bank because it’s hard for them to fight, according to my non-professional understanding.

The reasonable conclusion is that the Fed is very, very, very serious right now.

So . . . where are the limits of their power, where all this seriousness and will to “do whatever it takes” cannot go? When will the Fed’s two decade journey into extraordinary intervention fail?

Failure is not an option. It is not an experiment in intervention. This is about loading up electronic credits and debits in order to kill the remaining cash economy. Paper was withdrawn early in this mess. Most of what has gone out is direct deposits or checks that lose a percentage unless they are deposited for more Star Trek credits. If the fein stability, people will bring back cash and deposit it. They really don’t want to issue that paper they’re printing..it’s for show, like carrying in gold to the American Express offices in France during WWI. Once the hammer drops and paper is reduced to nothing, they can start raping the accounts to pay down the big ball of air. Just watch, it’s coming. If they were serious, a call to the folks at AA could tell them you can’t get sober by opening more bottles. So for now, it’s “bottoms up” and “release the balloons”…we’re having a party!