What gave the Fed the “Authority” to do this? Enter the “13(3) facilities.”

By Wolf Richter for WOLF STREET.

There has been huge hoopla about the Fed stepping into the markets and buying investment-grade corporate bonds and “fallen-angel” junk bonds, syndicated leveraged loans, CLOs (collateralized loan obligations), bond ETFs, and even junk-bond ETFs. The first intentions were announced in March and then expanded to include more asset classes and lower credit ratings. The Fed also announced that it would buy bonds and slices of syndicated loans directly from issuing companies, thereby providing emergency funding directly to companies that are solvent but cannot fund themselves because credit markets have frozen up. So what has the Fed actually done — and under what “authority?”

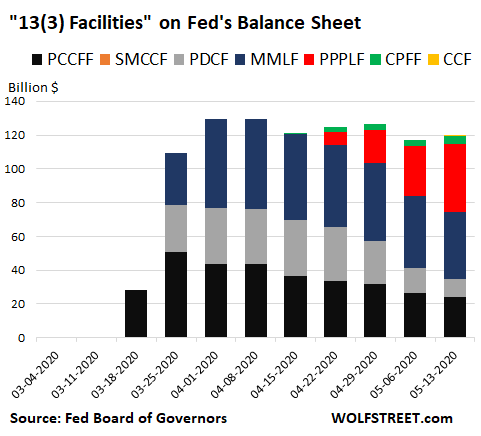

Three of the actions happened quickly: The money-market bailout (blue in the chart below), emergency funding for corporations (black), and loans to its Primary Dealers to be used to get markets to “function smoothly” (gray). They started showing up on the Fed’s weekly balance sheet in mid-March. But they soon began to taper off as the panic faded and as they were being unwound. In April, the Paycheck Protection Program loans to banks and some dollops of Commercial Paper started to show up. They filled the hole left behind by the shrinking first three.

The balance of all these alphabet-soup programs combined has declined from $130 billion on April 8 to $120 billion on May 13, as reflected on the Fed’s balance sheet released today. And none of the juicy stuff that the markets have so eagerly rallied upon – investment-grade and junk-rated corporate bonds and ETFs, CLOs, leveraged loans, etc. – happened until this week, and now it’s just a tiny wee bit, $305 million (with an M), the “CCF,” a yellow line on top of the green segment in the last column:

So why is the chart titled “13(3) facilities”?

That’s what Fed Chair Jerome Powell called them yesterday during the Q&A – “thirteen-three facilities,” is how he said it.

This “13(3)” refers to Section 13 paragraph 3 of the Federal Reserve Act, as amended in 1991 and then again in 2010 with the Dodd-Frank Act, which attempted to put some limits on what the Fed can do under this 13(3).

The section as amended allows the Fed, “in unusual and exigent circumstances,” to lend to individuals, partnerships, and corporations that are not banks (the Fed already lends to banks on a routine basis). According to Business Law Today, the limits set forth in the Dodd-Frank Act include:

Such lending must now be made in connection with a “program or facility with broad-based eligibility,” cannot “aid a failing financial company” or “borrowers that are insolvent,” and cannot have “a purpose of assisting a single and specific company avoid bankruptcy” or similar resolution.

In addition, the Federal Reserve cannot establish a section 13(3) program without the prior approval of the secretary of the Treasury.

Revised section 13(3) could be used to create facilities like the alphabet facilities of the financial crisis mentioned above [which is what we now face], but the intent of the revisions was to preclude loans like those to JPMorgan/Bear Stearns and AIG.

In its explanations of the alphabet-soup of bailout-and-enrichment programs, the Fed always refers to 13(3) of the Federal Reserve Act as the source of “authority.” The Fed sets up Special Purpose Vehicles (SPVs) as Limited Liability Corporations. The US Treasury (taxpayer) provides the equity cushion. The Fed lends to the SPV to leverage it 10-to-1. The SPV buys the securities. And Powell refers to these creatures as “13(3) facilities.”

The alphabet soup of “13(3) facilities.”

The current generation of 13(3) facilities is still incomplete. The SPVs for TALF, municipal bonds, and others have not yet shown up. But so far, this is what the Fed has on its balance sheet, and what is depicted in the above chart. The amounts are what the Fed lent to these SPVs and don’t include the equity cushion from the Treasury (the colors refer to the chart above):

Primary Market Corporate Credit Facility (PMCCF, black): $24 billion, down from $50 billion on March 25. This SPV can lend directly to companies by buying bonds directly from companies, including certain “fallen angel” junk bonds; it can also buy portions of syndicated loans or bonds at issuance.

Secondary Market Corporate Credit Facility (SMCCF): $0. This SPV can purchase corporate bonds, bond ETFs, and junk-bond ETFs in the secondary market, but hasn’t purchased anything yet.

Primary Dealer Credit Facility (PDCF, gray): $10 billion down from $33 billion on April 15. These are loans to the Fed’s primary dealers that they use to buy securities to support the smooth functioning of the market.

Money Market Mutual Fund Liquidity Facility (MMLF, blue): $40 billion, down from $53 billion on April 8. This SPV buys short-term commercial paper and other assets that money market mutual funds normally buy. During the panic, this allowed money market funds to sell those assets to meet redemptions.

Paycheck Protection Program Liquidity Facility (PPPLF, red): $41 billion, up from $0 a month ago. This SPV buys from banks the government-guaranteed loans they issued to small businesses under the PPP. The primary target seems to have been Wells Fargo, which refused to participate in PPP because it was bumping into its Fed-imposed limits on its assets (loans). By buying these loans, the Fed takes them off the books of the banks.

Commercial Paper Funding Facility LLC (CPFF, green): $4.3 billion, up from $0 on April 8. This SPV buys commercial paper, which are short-term corporate securities, to keep the corporate paper market liquid. The amounts are relatively tiny: $4 billion on a $7 trillion balance sheet.

Corporate Credit Facility (CCF, yellow): $305 million. Halleluiah, this SPV, managed by State Street as the custodian, has bought some corporate credit in the secondary market, some kind of corporate bonds, a whopping $305 million with an M.

But there are other signs that the gears are turning, that the mechanisms are getting set up. In addition to State Street, the Fed has hired BlackRock and PIMCO. They’re the custodians. The New York Fed gives them instructions.

The Fed appears to be in no hurry to get into corporate bonds and junk bonds and ETFs. Two months into it, and it has now bought $305 million, less than a rounding error on its balance sheet. But is sure was in a hurry with its jawboning about the program.

The whole 13(3) facilities combined amount to only $120 billion, on a $7 trillion balance sheet.

And yet each announcement about these 13(3) facilities over the past two months and what they might buy has been hyped at every twist and turn in the media. Hedge funds and banks and retail investors and whoever were chasing what they thought the Fed might buy. And this triggered a huge rally in investment-grade bond ETFs and junk-bond ETFs, and in corporate bonds and junk bonds, and leveraged loans, even as the Fed wasn’t buying anything.

But this allowed companies to issue record amounts of new debt in April and fund themselves that might otherwise not have been able to do so. Powell pointed out yesterday how successful this strategy was. He used two terms for it: “forward guidance” and the “announcement effect.” And he said, given how market have turned hot, that “it may mean that we actually aren’t needed.”

The reasons behind the Fed’s No-NIRP stance: It doesn’t work and kills bank stocks. One of the most revealing statements. Read… What Powell said About Negative Interest Rates, Their Effect on Banks, Jawboning, and Why the Fed Might Not Buy a Lot of Junk Bonds

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Blatant Corporate welfare. Prove me wrong. Socialism for the rich, Capitalism for the poor, again.

“I’ll have two mumluffs to go……(MMLF)…….

This is getting really ridiculous…maybe Jerome can play sideways with some new kind of “acronymic” SPV and suck all the speculators into the volcano!

Then I will “believe” in the FED!!!!

Why is income redistribution bad when taxes from the rich fund programs for the poor and middle class, but great if taxes collected from the rest of us go to the ultra rich?

I suggest that if they gave the money directly to the unemployed, the unemployed could pay their bills – creating a “trickle-up” effect. Of course, the ultra-rich couldn’t then buy the assets of folks forced into bankruptcy at super-discounted prices…

Is Fed & Treasury even following the law?

However, there is most certainly a significant limitation of the ability of the Federal Reserve—or any government agency for that matter—to inject emergency liquidity in a time of crisis: for example, liquidity available in the first instance under the Orderly Liquidation Fund authority in Title II of Dodd-Frank is limited to 10 percent of the total consolidated assets of a failing financial company.[20

https://www.americanbar.org/groups/business_law/publications/blt/2019/04/section-13-3/

Powell neglected to mention that the announcement effect also gave his Citadel buddies a chance to dump the crap they never should have bought.

Got to dip the the toe in the water first. Dont want to create a splash.

I have to say. It’s been amazing how little FED has to do to excite the”markets”.

On the other hand, think about how much fixed income money matures every single day and has to be invested every single day – so long as it does not get buried in back yard, it has to go someplace – debt, equity, real assets, or consumption.

In a crisis, equity, consumption, and real assets are “risk off” for most people.

So that leaves fixed income – which is constantly maturing…having to be recycled…and ending up in a new fixed income invt (long or short)…or ending up buried in the back yard.

And if you have a billion to invt…you are going to need a big back yard.

So, absent a cats-and-dogs-sleeping-together financial apocalypse, even pretty crappy *established* large companies can place debt…albeit at hiked interest rates.

JP is doing good, people thinks he take marching orders from elsewhere, but he knows the truth. YOLO, baby, YOLO.

Time to have fun with the printing presses, seriously, it’s a once in a life time opportunity. How often does something like this happen, free reign and no consequences.

History is written by the victors… unless… there is no history.

Trash the prudent savers, bail out the profligate, bring back the Weimar Republic. Happy days.

Sans the creativity or hedonism of the Weimar.

You think the US is running short on hedonism?

So the 13(3) limitations were put in place under Dodd-Frank so that no one gets a Jamie Deal. The piecemeal approach to insolvency and resolution did create quite a bit of controversy and inferred moral hazard in summer 2008.

And now it’s fixed. EVERYONE gets a Jamie Deal, no matter what trash, used bicycles, or mining slag waste they have on their books.

And in terms of weak paragraphs, this has all the structural rigidity of wet toilet paper: “Such lending must now be made in connection with a “program or facility with broad-based eligibility,” cannot “aid a failing financial company” or “borrowers that are insolvent,” and cannot have “a purpose of assisting a single and specific company avoid bankruptcy” or similar resolution.”

Easy: bail out an entire asset class, exercise regulatory forbearance so no one actually knows whether a company/bank/non-bank FI is failing, and aim the net at an entire sector rather than one or other LLCs.

I feel pent-up demand for this program. Especially now the machinery of Blackrock and PIMCO is in place. Has Kashkari recused himself yet?

C

“Has Kashkari recused himself yet?”

Mr. “Blind Ambition”….a most dangerous person with his sights on the Fed Chairmanship…MMT is his guide.

It seems like there are some excesses that the Fed should not keep papering over, but allow the recession to clear out:

1. 1 trillion defence and intelligrnce budget

2. Higher Education system

3. Health care system

4. Certain pension systems

5. Hedge Fund & Private Equity business

All of the above have sucked in too much of society’s resources because of Fed easy money policy and their corporate cronyism.

Allowing the healthcare system to collapse during a pandemic is just a terrible idea.

I know people here are very smart in economics. But think for a moment, what if we all are wrong? The Adam Smith and Karl Marx will not make sense anymore.

1. This might prevent a stock market crash and bring in peace and prosperity

2. Millions of this purchase will become billions and soon trillions

3. What if negative rates do not matter?

4. This fed based market is the new normal and we all have to adjust for them

5. Once everyone thought “Gold” is the standard but now there is no gold or silver currency.

Hunter gatherers thought agriculture is very bad, Romans accepted Christianity later and so on. Times are changing…

At the highest level of generality, I think we are witnessing an epic bubble based on trust. The removal of silver from coins in the 1960’s was a tiny step towards getting people to just trust the value of the dollar. The rising trend of net worth relative to GDP over the last decades is nothing other than a manifestation of an ever-increasing amount of trust. But looking at society as a whole, lies and scams are as prevalent today as they’ve ever been. The trust is entirely unjustified. We’ve figured out that we are all entitled to our own facts. Every viewpoint is worth the same. Why bother putting effort into being impartial and objective? Just take what you want by whatever means necessary.

One of the key things holding the system together at this moment is the mathematical incompetence of Joe Sixpack. He is willing to work based on the purchasing power of the money he earns. He is not looking at how M2 money supply has grown 23% year-over-year and saying, “[cuss word], I’m not going to work if I’m not getting my share”.

I think it has to be considered highly unlikely that this is going to change. A few months ago, I regarded a shutdown based on COVID-19 as an impossibility. People were too enamored with working for peanuts to risk destroying the economy. This is causing me to admit that I have no idea. I know nothing about how this complex system will evolve from here. The only prudent thing to do is to trust as little as possible, and that makes precious metals the ultimate TINA trade. Precious metals suck. They are outdated and a horrible idea. But when you can’t trust anyone or anything, what else are you going to invest in?

I do, actually, wish you that you are right.

But I wonder whether we are seeing at present an old thing coming back to bear.

A slow replay, for different reasons, of 10th July 1054.

Probanly wrong. wouldn’t be the first time.

The Christian schism? Charlemagne?

I am trying to make sense if the reference.

What gives the Fed power to do this?

What gives the Fed the power to promote inflation?

Or, to ignore their third, rarely mentioned mandate of “promote MODERATE long term interest rates.” (moderate meaning “not extreme”, and 4000 year lows are extreme by any metric)

Congress abdicated. The Fed IS the government. Or their boss Fink, who just shouted his orders a few days ago.

Did you read the article? Dodd-Frank.

The irony is that the writers of that law, at least some of them, thought they were limiting the Fed.

Just wow. Don’t bet against the Fed.

It seems to me that the Fed is walking their tightrope quite effectively. Maybe they’re spending more than they have to but they’re definitely spending less than they could.

The amount of strategic planning (guessing?) they have to do must be mind numbing and the consequences of their choices extreme.

There is no perfect answer yet everybody expects them to give one and criticizes them mightily on every perceived flaw.

I for one do not envy them their task.

Wolf for Fed Chair!

He’s far too sane!

I’m sure he’s quite got it that lives longer the moth that doesn’t wander to the flame.

Brian-of course there is no perfect answer, but it used to appear to me that anyone assuming a position of public service and responsibility knew that constant scrutiny, criticism and thanklessness were the true tradeoffs of those assumptions, those very large rocks being a public responsibility to provide a real counterweight to the constant corrupt temptations baked into those positions from basic human nature. Awareness on either side has declined, most likely from the pressures of an increasing population whose technology is losing the ability to best use available resources, natural and human, to maintain itself. Again, several tips of the hat to Wolf and everyone here for at least trying to observe and keep those rocks in the path of the virtuous and venal aspiring to lead.

May we all find a better day.

“but they’re definitely spending less than they could.”

20 years of ZIRP did not come about because the Fed was printing less than it could.

Interest rates are the “price” of borrowed money, determined by the demand for loans and the supply of lendable funds.

When the Fed prints a buttload (official term) of money – vastly hiking the supply of lendable funds due to leverage – it guts interest rates.

Which is what we have seen for twenty years.

I was speaking more of today than the last 10y.

I understood QE1 and QE2. QE3 seemed to me to be more about getting what they wanted rather than a necessity. It also seems to me that they didn’t have a realistic plan of how they were going to unwind it.

But that’s “to me”. They have far more information than I do. Far more knowledge than I do. Far more understanding than I do. And far better models than I do.

Just because I don’t understand their reasoning doesn’t mean their reasoning was wrong and it could very well be that the only reason we’re complaining about the results of a decade of near-zero interest rates is because they prevented us having something significantly worse to complain about.

I’m willing to give them the benefit of the doubt.

And yet, somehow, the US managed to survive decades (centuries really) without the G intentionally driving interest rates down towards zero via money printing (which empowers the G to confiscate almost all of the earning power of accumulated private savings…without that ugly process of democratic accountability called voting).

There have been some horrific market crashes in those centuries, too. It’s easy to discount them because they’re far in the past and didn’t affect us personally. What if a Fed had been around to avoid them like they do today? Would that be better or worse? I’d guess “better”.

Besides, it’s not low interest rates that push up asset prices. It’s people abusing those low interest rates to leverage themselves into the grave. The Fed didn’t entice any company to borrow money to buy back their own stock.

Low interest rates enable such behavior, I grant you, but they don’t cause it. It’s the greed of Traders that causes it.

With Wolf’s accurate charts and his clear, extremely focused and easy to understand analysis, who need Jeffery Snider.

Moderation : Muddy & fuzzy Jeff Snider.

Jay Powell:

“Fear me not good people of Oz, fear me not. For it is I the great and powerful Wizard of Oz! I know I’m not the wizard you expected, but I might be the wizard that you need.

“I don’t want to be a good man, I want to be a great one! You have nothing to fear so long as you believe. For when you believe, anything is possible.”

One thing for sure, this isn’t Kansas anymore

Dear Dr. Frankenstein:

Stop trying to animate the dead. Even if you succeed, it won’t be pretty.

Hi Karen, I’ve read your latest investment paper, very interesting.

One question if you don’t mind..

Why is Japanese yen considered the ‘safe haven’ currency? I mean it is already like a penny. What am I missing? Are Japanese hitting the extra zero limit by now :)

Hi Andy, thanks for that.

As it happens, I’m working on a piece focused on precisely that. Japan is perennially underestimated, in my view.

Sure, they made mistakes (30 years ago). Guess what? Europe and the US criticized Japan, then followed in their footsteps, making the exact same mistakes! At least Japanese companies have had a chance to learn from their mistakes, even if the govt. is still fumbling. Much of corporate Japan is highly competitive, with scads of cash on the balance sheet. In many cases, cash>book value.

Plus, the currency is perhaps 2sd cheap to fair value, and Japan is a trusted partner to the US in Asia. So, when China pushes the rest of Asia to ditch the US$ as its invoice/reserve currency–which will probably lead to capital controls by the US–Japan can be our bridge to some great investment opportunities in the region.

Ok now to your question, why is the yen a safe haven? Because Japan has been a net creditor to the rest of the world for decades now; they have a huge net foreign asset position. When times get rough, Japanese firms can repatriate those investments back to Japan, strengthening the yen. It’s gotten a bit more complicated of late, due to the temptation of Japanese banks to build FX liabilities; this was triggered, I guess, by the disappearance of their banking interest margin in the local market–hence the large FX swap liabilities the BOJ has with the Fed, as Wolf has pointed out.

But that’s a transitory issue, in my view. Just look at history; whenever the US$ rallies in a crisis, it moves much less against the JPY (and CHF).

Japan is the complement to the US in terms of culture and business. Everything you don’t like about the US–is probably much better in Japan, and vice versa. Wolf can speak to that much better than I, but we both share an appreciation for that society.

Having traveled and made friends in Japan over many years, I would never underestimate them. Nor the Koreans. Freakin’ warriors.

The world’s currency has evolved into two world centers .

Eurodollar – London

Asiadollar – Tokyo

No Military Pay Currency (MPC) used since 1972.

Thanks so much Karen. I was actually planning to research Japan as an investment target. They are, like you said, decades ahead of us in this strange monetary policy. Perhaps they will come out first.

Looking forward to your paper and research.

Andy,

“Perhaps they will come out first.”

Hmm.

Thirty years of digging and still no pony/unicorn (see old Reagan quote).

I think governments’ faith in the ability of printed money (otherwise known as confiscated private savings) to grow their economies is…misplaced.

But it does keep said governments in power another year/month/day.

And that’s what really matters, right?

‘Just look at history; whenever the US$ rallies in a crisis, it moves much less against the JPY (and CHF).’

US $ dominates in the Fx currency mkt and also in the global trades (commerce) us $ – 61%, Euro 23% and Yen around 12%!

In any kind of global crisis, financial or otherwise where do the investors park their cash? US $, NOT yen. Read mkt history!

‘Everything you don’t like about the US–is probably much better in Japan, and vice versa’

For Japanese, definitely, YES but NOT, especially for Gaijin

With 13(3)n who care about Nancy ice cream.

If you think figuratively that the stock market is a casino (which I do). then the Fed’s “announcement effect” is the casino’s hep talk to players scared of losing: don’t worry, keep betting, more house money will cover your bets.

Stock market is a casino in the short run but a pretty reliable weighing machine in the long run.

To his credit, Powell recently said something spot on correct, 100% exactly right in terms a maximum effective government response to help the economy in this depression.

He said the Fed can only influence things on the debt side. But more and different is urgently needed by Congress: Government action to create demand stimulus by putting cash into the hands of people.

More money in the hands of the people, and locally also their agencies like state and local governments. Only this will help provide the means the Fed lacks, to help to people to get thru the Covid crisis and generate aggregate demand to help the economy.

If this is not the very core of what government is meant to do, what is?

Every time someone here notes the need to help state & local, something that provided help for 90% of Americans instead of the Fed bailing out the 1%, out comes someone presumably living off the land who writes that’s not fair because his state local doesn’t provided police/water/sewer/fire dept/public education.

So that is suppose to mean 90% of America shouldn’t, either?

And pensions. They always mention pensions yet this it not meant to be part of help to state and locals.

Never mind the aid being proposed does NOT include pension bailouts, many are separately funded, and it would be easier to bar Federal going to them.

Done with state and local. Now pensions.

If you want the economy to recover, bailing out pensions is a no-brainer as it would deliver far more Keynesian punch that what has been done so far.

And Powell is correct saying we urgently need Keynesian punch big time. He’s right.

In theory, you need both monetary and fiscal. Monetary without fiscal means inflation. We are getting substantial fiscal … the drug and bio-tech industries are being pumped with govt cash. The only problem is most of that fiscal is showng up in Boston, North San Diego county, and Jersey. Not much fiscal anywhere else. But, it does appears the monetary is larger than the fiscal, meaning some inflation is in the cards. Cracks me up when I see some predict outright deflation when monetary is outpacing fiscal. They covered this in Econ 101.

timbers, sorry … my post was not directed at you .. I put it in the wrong spot. Oh well.

Powell is right but it can’t happen. A good percentage of Americans live in a constant fear/rage about other Americans getting “unearned benefits.” American politics is organized around resentment, which is why so much power is transferred, by default, to the Fed.

All of these “free markets solve all problems” types turn into naked hypocrites when they insist that they have to throw money at the failed actors for one reason or another.

Sure, there are a lot of difficult decisions, who to bail out who to let fail etc but all my life I’ve been told (skeptically sometimes) that the markets will sort it out the best way. I think that there are certainly SOME exceptions to that rule but not nearly as many as the Fed seems to think.

I am not at all sure that the Fed’s continual meddling will give the country an overall better result in the long term.

The Market now plays both ends against the middle anyway.

And it sets itself up to fail as it collects the fees, and then the bailout. That is sorting itself out, lol, for sure. Chumps need not apply.

“Whistleblower: Wall Street Has Engaged in Widespread Manipulation of Mortgage Funds”- from Pro Publica

“Whereas the fraud during the last crisis was in residential mortgages, the complaint claims this time it’s happening in commercial properties like office buildings, apartment complexes and retail centers. The complaint focuses on the loans that are gathered into pools whose worth can exceed $1 billion and turned into bonds sold to investors, known as CMBS (for commercial mortgage-backed securities).

Lenders and securities issuers have regularly altered financial data for commercial properties “without justification,” the complaint asserts, in ways that make the properties appear more valuable, and borrowers more creditworthy, than they actually are. As a result, it alleges, borrowers have qualified for commercial loans they normally would not have, with the investors who bought securities birthed from those loans none the wiser.”

The Fed 14(15) will click helicopter money to build several AMZN type supply warehouses, in the back country, covering US from east to west. Those hubs will ship medical supply, made in USA, in response to any eruption of covid19, in the front line of their zone.

Low wages employees from the service sector will find employment, paying higher wages, in high tech mfg of medical equipment, supply and warehouses.

The trend is your friend. 6 straight weeks of declining UE claims along with 4 weeks of increased mortgage apps.

While the initial weekly claims is falling the overall number of unemployed continues to grow substantially. To call that a win is really convoluted.

Numbers, statistics, not human beings. Forget the humans.

It’s Kool-Aid calculus. If the series looks bad, go to the first derivative. If the first derivative looks bad, go to the second derivative. Keep going until you find the Kool-Aid.

JSRG:

A while ago you wrote that recruiters were calling you almost daily. Just curious if this trend continues.

It has definitely slowed down but I still get calls/emails.

So this is how Capitalism works? Could have fooled me.

Flouride toothpaste?

‘The announcement affect’?

Wow, that’s kind of new. Could it be translated as: the false forward guidance effect, or the head fake effect or the BS effect? If Powell says he is going to buy 10 billion worth of corporate bonds, and you buy some based on that, and then he says he was just saying that for effect, wouldn’t you feel not just misled but betrayed?

Half a dozen long- time market bulls ( or ancient, like Buffet/Munger) have pointed out that this market is historically overvalued even without the virus effect. But if Powell scatters a few crumbs the newbie piglets come running towards the slaughter house.

This may be the stupidest market in history.

“This may be the stupidest market in history.”

ZIRP-addled.

Equity over-valuation is the product of decades of Fed-gutted interest rates.

If you are resigned to remaining in the Disneyland Dollar Demesne it is largely zero return fixed income or paint huffing equity…or you could go the real asset route and render yourself prey to illiquidity and the multiple slavering tax authorities of the US.

On a macro scale it is kinda what you would expect from a long declining economy and end stage government.

Even Boeing raised $25 Billion from bond sales. And Boeing is less then half the size of Tesla.

Nassim Taleb defined Intellectual Yet Idiot as an aspect of folks without skin in the game. I would like to add Educated Yet Stupid to define folks with advanced credentials, but blindly having skin in a game with constantly shifting house (FRB) odds.

I approve, but educated idiots have been observed in the wild for quite a while. Maybe their populations are growing due to the eradication of natural predators.

I’m working on some of Nassim’s book recommendations, starting with The 6 Pillars of Self Esteem. Very good. One pillar is being interested in, rather than threatened by reality. But right now… WHICH reality? I think I’m confusing “reality” (magical omnipotent Fed) with what, in my head, “SHOULD” be (natural selection) A common confusion, it seems.

The stock market is headed down, this morning. My analysis in terms of the stock market being a figurative casino: The players are pushing the family for more money to cover their debts. The family is the U.S House of Representatives, set to vote on three trillion dollars of “help” for everybody.

The Fed is the spawn of Congress. If Congress is moot on $300 million it will be moot on a Trillion . Other than a weak bleat or two the People will stay moot while they are being sheared. From the near future I can hear the words wafting to my ear “Fed rate went negative by a whopping minus .1% “

The notion of forward guidance takes us back to Fed “policy”, which Fed abandoned during Yellen. Having no policy allowed the Fed to turn rates in 2016 (effectively) and allowed Powell to walk back his rate hike program and end balance sheet reduction. Before the virus Fed was looking pretty good. Emergency rate hikes took recession off the table. Nobody wanted a repeat of (endless) QE, and long term policy distortions in the market. FED is making another huge mistake here. Volatility is going to rip them apart. If FED doesn’t shovel at least 40B a day into REPO this market will not hold up, SPV or no.

A lot of the REPO demand comes from big wall street funds. When holding Treasuries, the Treasuries are repoed out, then that cash is invested in high quality floating rate securities with long maturities … there are many to choose from thanks to structured finance. These floaters return more than the interest paid on the loan. This is how alpha is generated. If the regulators were to put a stop to this, the REPO demand would drop way down.

CIBI>>>Chemically Induced Buying Inc….”Proudly serving the markets since the 1920’s”…our founder, J. Gatzby. Coming events…Free Fall Fridays…Hangover Mondays…Black Eye Tuesdays. Come on down and get a short order with every drink..you’ll feel better.

“What gave the Fed the “Authority” to do this?”

Ha Ha Ha. Fools. No one did.

They have no choice. QE of all elite assets to the moon or negative rates.

Rule of law? Fools.

Ha Ha Ha. There is no rule of law.

Wolf said: ” The Fed also announced that it would buy bonds and slices of syndicated loans directly from issuing companies, thereby providing emergency funding directly to companies that are solvent but cannot fund themselves because credit markets have frozen up.” (1st paragraph)

Article said: ” “13-3″ …. allows the Fed, “in unusual and exigent circumstances,” to lend to individuals, partnerships, and corporations that are not banks”

According to Business Law Today:” Such lending must now be made in connection with a “program or facility with broad-based eligibility,” cannot “aid a failing financial company” or “borrowers that are insolvent,” and cannot have “a purpose of assisting a single and specific company avoid bankruptcy”

____________________________________________

a bit of contradiction taking place here …………

That whole logic is based on the difference between a liquidity problem (market freezes up and even a profitable company cannot meet its funding needs) and a solvency problem, when a company is losing so much money for so long that it’s beyond hope. But a company that is essentially insolvent can keep operating if it keeps getting new liquidity.

So the Fed should stay out of keeping insolvent companies liquid and should instead let them die; but it should keep solvent companies liquid when the market freezes up — that’s what this says.

and cannot have “a purpose of assisting a single and specific company avoid bankruptcy”

_____________________________________

Thanks Wolf, but isn’t that exactly what providing liquidity does ……

it assists a company from avoiding bankruptcy?

There is a classic distinction between an insolvent company and an illiquid company. An insolvent company needs to be restructured or shut down; an illiquid company needs liquidity.

But I agree with you: the distinction is somewhat in the eye of the beholder on occasion.

Thanks Wolf. a thought or two ……

Being illiquid to the point of needing a liquidity bailout shows questionable management and judgement. Liquidity is always available at a price, even if that price is a transfer to new management or ownership. The blur between liquidity and solvancy is just a convenient ruse to pick winners and losers. And when that picking of Winners is done by the FED through liquidity injection, particularly with digitized funny money, it rewards errant speculators/managers and punishishes prudent savers. This prevents market clearing and deprives those savers the opportunity to place their stronger hands on assets that need better management, and instead slaps the saver by making their savings worthless and inconsequential.

With the FED and guys like Mnuchin, all pretense of free markets are ridiculous. Hence the rise of MMT. AOC gains more traction every day.

MMT = Modern Monetary Theory

AOC = Alexandria Occasio Cortez

sorry for the acronyms. they should be outlawed.

If you study the Constitution, you will find that it does not give Congress the power to delegate its responsibilities to create the nations money to the Fed or anyone else. To do so removes the accountability to the Citizens.

The truth is, we ceased to become a free country practicing self determination when the Fed was established.

The Constitution did not answer the ultimate question i.e. who watches the Watchmen.

What happens when all branches of the government turn out to be crooks?

The Constitution is just the tortoise shell of the Republic (aka The People). The prior shell was faulty and had to be abandoned. The current shell is not perfect but was designed for patching-up. You can discard it for a new one, but are exposed to hostile elements during the exchange. The present one answers the questions in the fine print which lawyers try to muddle. There is hidden from view an unwritten If/Then escape clause as such: IF “all else fails”>THEN “resort to prior” (ie refer to Declaration of Independence). We’re just trying to find ways to stay-off what may someday be inevitable. Those Patriots were a lot smarter than we give them credit for.

Yes it does. It is the voters who are the ultimate watchmen. Congress was given certain powers and the people elect Congress.

It did not however give congress the power to delegate any of its duties to entities that do not answer directly to the voters…

Then the second amendment comes to the fore.

Correct, in case the “watchmen” need to revert to the “minutemen”. Carefully added to be separate from those war powers already defined in the main body. Much mis-understood as fast talkers try to make it into what it is not. The peel back in the hard copy unwinds the mess of where powers reside and are derived from…the people. But there was little to enforce this should voting be stolen or invasion not be repelled. This was the fall back position for the reset if it ever came. The programmer’s backdoor.

Jdog:

“The truth is, we ceased to become a free country practicing self determination when the Fed was established.”

And, the CIA. (1948)

Both have their own interpretations of, “self-determination!”

And, they don’t include you or me or our neighbors.

Self determination only has one definition, it is when the people are in charge. When the people are not in charge, you have tyranny.

kudlow just “Floated” (Reuters) cutting the business tax rate in half. Not fair, Kudlow. Our biggest and best businesses pay nothing like the tax rate.

To get the result you want, you’ll have to give these business a cash payment equal to the maximum tax they could have paid on their gross receipts.

The funny thing is that business taxes are the only legal taxes under the Constitution. Income tax for Citizens is an illegal scam. It was deemed unconstitutional by the SCOTUS in 1912, then the Justices were bought off and allowed it the following year….

According to Powell and paraphrasing…the Fed does not spend money, they loan money. The newly created 13-3 SPVs allow the FRB to spend leveraged taxpayer money with the blessing of the US Treasury and Powell. The taxpayers also will have to pay “minimal” fees to Blackrock and PIMCO. The price of monetary stability and manipulation is getting more expensive as the liquidity pipes get set up. More pipes to be established.

Thank you Wolf for another excellent article. And thank you Jay Powell for your unwavering courage. The actions of the Fed have been nothing short of heroic. My favorite line from Jay throughout this whole ordeal: “We’re not going to run out of ammunition.” Buy those corporate bonds! Let’s go!

And keep pressuring Trump for stimulus part 2 and state and local bailouts including pensions! We need to keep this economy greased! We can’t let the virus defeat us.

Go Jay Powell and go Fed!!!

Printing to the moon. That is the “plan”. Forget existing economic theories and the quaint notion that bills must be paid. The upcoming cold war with China is the solution. A new super bully capitalism is lining up per our dear leader/s. All countries on earth will be forced to choose. Those that choose the USA will LOVE the dollar. As many as we care to print ad infinitum. Or else. Carry on, nothing to see here.

So, here we are all sat, a company of skepticalities.

Spinning around in a marinade of ire.

How do we use all our combined experieces to good end?

Well, first up ,what do you think?

Petunia, Paulo, Wisdom and Doom?

Are, nuts!

Left out of the elite symposium.

Fair point.

I’m only trying to lighten the mood.

Me, too.

Right on …

Billionaire Bill Gross, co-founder of Pimco, charged that Pimco owed him “hundreds of millions of dollars” after engaging in “improper, dishonest and unethical behavior.” “Driven by a lust for power, greed, and a desire to improve their own financial position and reputation at the expense of investors and decency,” the 2015 lawsuit complaint begins, “a cabal of Pacific Investment Management Company managing directors plotted to drive founder Bill Gross out of Pimco in order to take, without compensation, Gross’s percentage ownership in the profitability of Pimco.”

That Pimco you mean?

There’s a cluster of six thousand computers at Blackrock that monitor the assets of over 170 pension funds, banks, foundations, insurance companies and others. These computers watch interest rate changes, bank failures, look at natural disasters and, you know, look at every change in consequences, positive or negative. And of course, this system is called Aladdin and there are 17000 traders around the world that decide when to buy or sell assets. Based on what this data center spits out, it’s the heart of BlackRock and they single handedly managed most of the money that is in private equity and hedge funds combined worldwide. The only other big company out there that owns just almost as much as them, they’re dwarfed by half. But three trillion is Vanguard. And so although almost all of their holdings are stocks, they are the largest shareholder in 50 percent of the world’s third largest corporations. So they not only hold stocks, but they hold bonds, commodities, hedge funds and real estate. And according to an anonymous European insurer, if you’re looking to buy or sell something or invest, it’s very difficult to get around BlackRock.

That Blackrock of Aladdin you mean?

These aren’t real corporate bonds though. These are something that are bought all the time. Not your best effort Wolf.

“These aren’t real corporate bonds though. These are something that are bought all the time”

what do you mean????

Is there a corporate bond that is not a corporate bond? Did you have too much liquidity too early in the day?

It’s the weekend – now there’s an idea as things go to heck…..

Sunny 129: I made my living for many years as a foreign exchange analyst and trader. To cite some recent examples of yen strength in a crisis: From 2007-09 usd/jpy fell from 122 to 90. From 2015-16, it fell from 124 to 100. It’s one of the few currencies that did not fall vs. the USD in March 2020.

US $ is recognized and accepted almost universally except few countries like China. There are more US $100 Bills stashed out side the states than the YEN currency. Carry trades in Fx -currencies is not cup of tea.

Been in the mkt since ’82, have MBA background and has under gone more than one bear. US $ is despised, but desired most, world wide! Can you claim the same with Yen?

Perhaps the fact that the US has been shipping pallets of $100 bills out of the country for decades has something to do with the external hoard of $100 bills. I’ve never heard of another country exporting pallet loads of their paper currency.

any idea how many of those $100 bills are stashed outside the states?

Whether jawboning or not, I felt that Fed will end up supporting the Corp credit mkt, sooner or later. Yeh, I did front load with those ETFs being affected! Even ZH provided a list! Mr. Powell often mentions for the mkt to function ‘smoothly’ It could be any thing. That’s why there is frequent hiccups in repo mkt, Euro-Dollar pool out side USA, credit stress in EM issued Bonds.

The current Equity mkt is born and nourished with insane credit creation. Without healthy Credit mkt, the Equity mkt cannot stands on it’s own. There is a lot of if and when, conditions re which and what kind of bonds they will accept.

If and when the liquidity stress crunch comes in the high yield/Junk mkts, Fed will buy them. otherwise there is domino effect in the remainder of IG mkt. 50% of IG – etf LQD has BBB shares or below! Their action will be justified under for ‘financial stability’ Didn’t they provide liquidity to Hedge funds recently!?

Warren Buffet dumped most his Goldman shares and trimmed his JP Morgan holdings.

The Fed buying corporate bonds should be a bullish signal for Investment Banks. Yes it’s small, millions instead of billions, but apparently Uncle Warren is not convinced. He must be seeing a very dark future for America.

After selling his airline stocks, sounds as though he just wants out of the market. Not hard to see that there is too much money chasing too few investments. At his age he might not feel comfortable picking winners in the next generation of companies. We also have a political crisis, which will not work itself out until we have a constitutional convention. This appears to be the next leg down. 9/11 delayed the political moment, while QE delayed the financial crisis moment, after GFC, and now Covid brings the (public vs. private) health care crisis to the front. Good time to be in America if you have guts, energy, and vision.

…and very, very deep pockets and a pristine credit rating.

How does bank leverage play into this? i.e. banks can create money out of thin air simply by making loans. if so how can a bank lose on sometime (money) that technically didn’t exist before?

Not only do they create money, an AI bot processes pooled data from 17000 investors worldwide acting as one brain to fractal growth of said created money. Versus Ignorant Joe Bloggs dumbed down neurologically on flouride who sweats for his paycheck. Hereditary entitlement eventually stops breeding and that is why genetic experiment and robots will be slammed down Joe’s throat while he sweats. Until he picks up a pitchfork. Joe’s salvation is meeting in the street by the townhall at noon and agreeing with others a local barter protocol to distribute the fields produce effectively. Law back to rope. Keep it simple. How much does free to choose mean to Joe? Freedom is getting expensive. How did mankind come to this? Its not just mankind on this lil planet. Thats how.

You have to remember that money is simply a way to keep score. In order to keep the game functioning correctly, you cannot cheat on the score keeping. If you do, no one will follow the rules anymore and you have societal breakdown.

When BKX hit 1998(L) support line, Warren Buffett sold 85% of GS

and few millions shares of TRV, JPM, PSX… to raise cash.

Look at the SPX graph. They headed off a three wave heading to retest of lows. The market manipulation is down to the freaking out. Don’t ever want to hear another gripe about China backstopping Chinese corporations. Its worse here – it’s not the corporations; its the speculators (read market manipulators) the US government bails out on an hourly micro managed basis.

Wolf, there are hoards of investors and traders hyperventilating over prospects of the FED’s infinite flooding of liquidity.

– Interesting. Did the FED also buy this kind of (over-) inflated rubbish ?

https://www.propublica.org/article/whistleblower-wall-street-has-engaged-in-widespread-manipulation-of-mortgage-funds

Willy2,

Yeah, old hat. I revealed a month ago how this system of overvaluation of collateral worked by using as examples some specif buildings and their mortgages that were packaged into CMBS. My article includes this paragraph on one of the buildings:

“This is the environment in which the debt behind One City Centre at 1021 Main St. in downtown Houston is blowing up. This 602,000-square-foot office tower backs $100 million of CMBS debt. The collateral was appraised for $162 million at the time the debt was packaged into CMBS in 2015. And now, it turns out, according to Commercial Real Estate Direct, citing estimates by DBRS Morningstar, the tower might be worth only $35.7 million.”

https://wolfstreet.com/2020/04/26/how-unicorn-blowups-oil-bust-bleed-into-commercial-mortgage-backed-securities-cmbs/