Student loans: stalling repayments & hoping for loan forgiveness.

By Wolf Richter for WOLF STREET.

Most of the first quarter was still the Good Times, but in later February and early March it hit the fan, as markets were crashing. In mid-March lockdowns started to roll across the country, and the layoffs by the tens of millions commenced. So how were consumers positioned going into this crisis? Many of them, up to their eyeballs in debt.

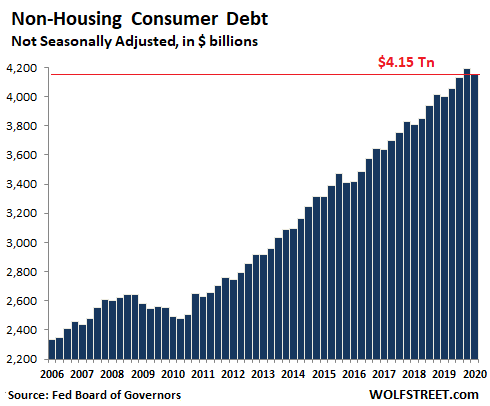

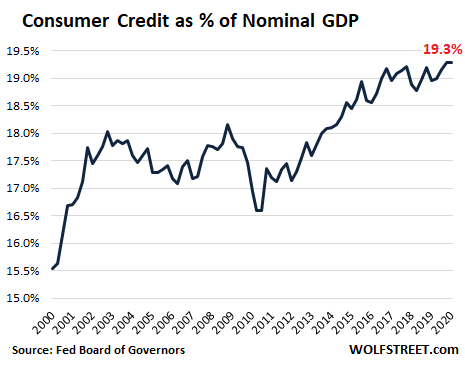

Consumer debt – student loans, auto loans, and revolving credit such as credit cards and personal loans but excluding housing-related debts such as mortgages and HELOCs – jumped by $153 billion at the end of the first quarter, compared to Q1 a year earlier, or by 3.8%, to $4.15 trillion (not seasonally adjusted), according to Federal Reserve data:

In March, the problems already became apparent. On a seasonally adjusted basis (the above is not seasonally adjusted), consumer credit fell 0.3% in March from February, and except for December 2015, when a large statistical adjustment was made, this was the first month-to-month decline since the Great Recession.

OK, we know consumer credit is going to plunge. Balances of auto loans and credit loans will come down not because consumers are suddenly more prudent, but because they have lost their jobs and will default on their credit cards and auto loans. Those defaults were already happening going into the crisis, and they’re now accelerating. When lenders write those loans off, the consumer credit balances come down. Nothing to do with prudence of consumers but with losses at lenders.

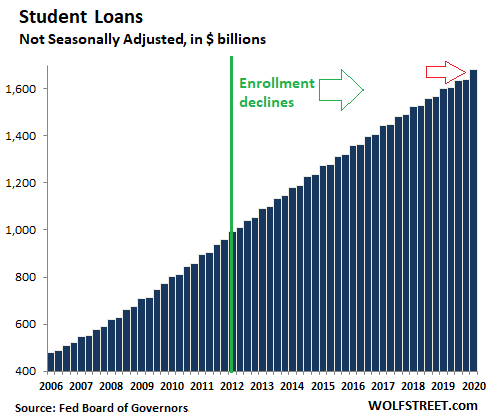

Then there are student loans. They’re the exception. They’re spiking. An increasing number of student-loan borrowers have stopped making payments and are waiting for debt forgiveness, funded by the Dear Taxpayer, now that this is being bandied about by politicians to buy votes with taxpayer money. And as old loans are not being paid down, and new loans are added on top, the total loan balances soar.

Student loans: stalling repayments & hoping for loan forgiveness.

There is a meme going around among student-loan borrowers, that only morons would still make payments on their student loans because they’ll soon be forgiven anyway. More and more borrowers are using the numerous options available to defer the loans, counting on debt forgiveness, funded by taxpayers.

And so in Q1, student loans rose 5.2% from a year ago, to $1.68 trillion and are up 70% since 2012, despite an 11% drop in student enrollment over the same period.

Slow repayments have been the driver behind these ballooning student loan balances. A study by Moody’s found that new loan originations had peaked in 2012 and have declined since then, given the decline in enrollment. This decline was driven by a 24% drop in new borrowing by undergraduates. In 2012, they took out $72 billion in new federal student loans. By 2019, they took out only $55 billion in new loans.

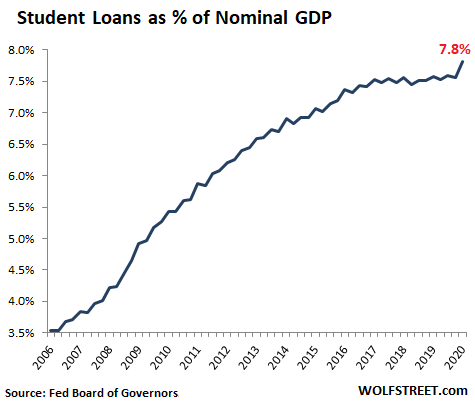

But compared to the overall economy, student loan balances in Q1 spiked to 7.8% of GDP, the highest ever, as student loan repayments have slowed to a trickle:

Many student borrowers don’t owe much: At the end of 2017, of the 45 million federal student-loan borrowers that have to make payments, about 22.5 million owed less than $17,500. This amount of debt is about what people borrow to buy a lower-end new car. In student-loan format, with payments spread out over many years, this debt is very manageable.

A disproportionate share of new student loan debt has been incurred by graduate students: 7% of federal student loan borrowers owe over $100,000 each. Combined, that 7% owes $500 billion, or nearly one-third of all loans.

According to Moody’s study, the repayment rate – the percentage of existing debt that is eliminated each year through repayments – averaged only 3% over the past 10 years. In 2019, it was down to just 2%, with only about $30 billion of outstanding student loans being repaid. Given the surge in balances in Q1, it appears repayments have slowed further – now that many borrowers are counting on debt forgiveness. And balances will likely balloon further going forward, no matter the decline in enrollment.

So how are consumers positioned going into this crisis?

Proportionately, how heavy is the burden of this $4.15 trillion in consumer debt? When measured against the size of the US economy, it amounted to 19.3% of nominal GDP in Q1 and in Q4 last year, the highest ever in the data. Here are the last two decades:

But these are aggregate numbers. Credit problems arise at the margin.

Many Americans have no debt burden. Over one-third of homeowners own their homes without a mortgage. Many other homeowners have substantially paid down their mortgage and have a large portion of equity in their homes. Many Americans have no outstanding credit card balances because they pay them off monthly. They have no student loans and no auto loans, and they’re awash in savings and investments.

Then across much of the rest of the spectrum are Americans who have more or less debt. In this group are the people that have maxed-out credit cards that cost them 25% in interest a year, and they have subprime auto loans that cost them 19% in interest, and they have student loans from years ago, and no savings. In this group are also people with fairly high incomes that have taken on too much debt, including credit card debt, and they need every last penny of their high incomes to make ends meet.

But the national data puts all Americans into one bucket – the group that will be just fine no matter what the economy does, and the group that is strung out, plus everyone in between. Credit problems arise among those who’re strung out and who scramble to make ends meet.

Tens of millions of Americans lost their jobs. Many will receive unemployment compensation, but not all. For lower-paid workers in less expensive areas, the unemployment package with the weekly $600 from the federal government may turn out to be a big raise, but that weekly $600, even if it’s extended, will eventually run out.

And for people with higher incomes in more expensive areas, this math doesn’t work, and it won’t cover their bills. A highly indebted dentist at a dental practice that shut down needs a lot of income to pay for the home in an expensive city, the nice cars, and student loans out the wazoo. This dentist isn’t going to make it on the unemployment package.

Credit cards and other Revolving credit.

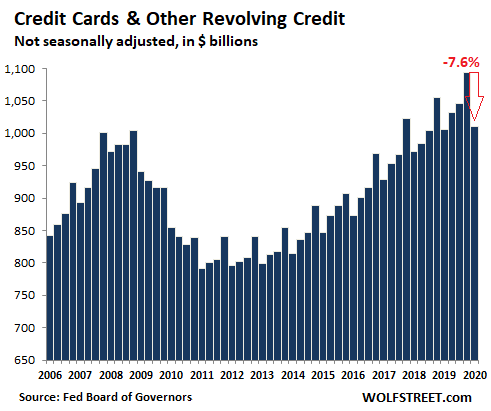

Balances on credit cards and other revolving credit, after dipping in March from February, were up only 0.5% compared to a year ago, at $1.01 trillion. In overall terms, it amounted to 4.7% of nominal GDP, down from peak-credit-card-craziness in Q4 2008 (6.9% of GDP).

But this is aggregate data and includes many people who don’t have credit card debt. Pressure on credit cards erupts among people who’ve maxed out their credit cards and throw in the towel when priorities change. Note the seasonality from the spike during holiday-shopping season in Q4 and hangover season in Q1. But this Q1 seasonal “dip” of 7.6% from Q4 was far deeper than in prior years when it ranged from 4.1% to 5.0%:

Auto loans & leases and defaults.

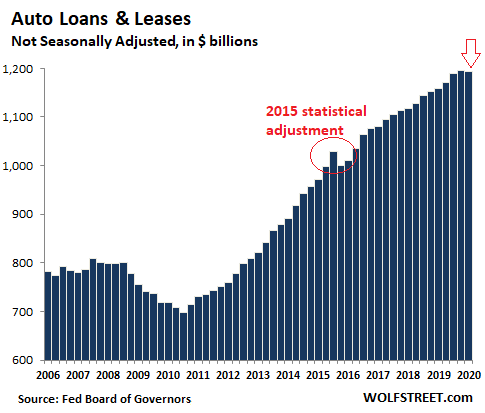

Auto loans and leases outstanding for new and used vehicles in Q1 rose 3.0% year-over-year, to $1.193 trillion. But this was the smallest year-over-year gain since 2010, pushed down by the first Q4-to-Q1 decline since 2010. Auto-loan data is released only quarterly, so we have no data for March. But subprime auto-loans were already exploding before March, and from what lenders are now telling us, it wasn’t pretty in March and has further deteriorated in April:

I’d never imagined I’d ever see this sort of spike, though in recent years I added an upward arrow with “Debt out the wazoo” to my charts, not realizing just how factually accurate this technical term would become. Read… US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion. Fed Monetized 90%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Almost like Lucy taking away the football. And Charlie Brown falling for it every time.

I guess the “morons” are the folks who actually paid off their debts.

And the taxpayers, of course, on the hook for the forgiveness-debt-bailouts.

“There is a meme going around among student-loan borrowers, that only morons would still make payments on their student loans because they’ll soon be forgiven anyway. More and more borrowers are using the numerous options available to defer the loans, counting on debt forgiveness, funded by taxpayers.”

‘the “morons” are the folks who actually paid off their debts’

Are they going to take this sitting ‘silently’?

Imprudence and irresponsibility gets rewarded just Fed doling out to Wall St! Where is the accountability and public outrage?

The public at large has absolutely no idea what the fed has really been up to. They think probably anyway that the Fed is part of govt. And I have heard plenty of outrage from people who have paid for their childrens’ educations regarding student loan forgiveness for other people. But a lot of these parents paid tuition before it went sky high, and the situations are not really comparable–the loan payers have possibly paid as much already halfway through the loan.

And now K Street and the Chambers of Commerce are likely going to get bailed out, because, I just suspect, the partys’ leadership having heard from them that corps are not paying dues and fees to lobbyists, these organizations have nothing to put in the campaign troughs for special interests. I wonder if that’s why both partys’ leadership is on board with pouring some liquidity on them.

Judge people by what they do, not what they say.

1.) FED has driven up stock markets everywhere on earth, ran by MMT

2.) Majority of plebes on earth have been forced into debt peonage

3.) Corporations ( owners of the oligarchy ) have used MMT cash to buy their own stocks, of which they’re paid in stock, thus in simple words much of MMT ( free FED fiat ) is/was fed to the oligrarchs

4.) Medical debt is far worse than student debt, yet nobody is talking about voiding medical debt. Go figure. A heart attack happens, while student-debt is a choice.

“Owe the bank a thousand dollars and you are a debtor. Owe the bank a million dollars and you are a partner.”

What would happen if a large number of unemployed Americans, or even those still working, with an ornery progressive streak, simply refused to pay any more debts or taxes? Would that force the Fed to create enough money for them to pay off their debts, or, and this is what I would hope for, would it lead to a debt Jubilee?

Technical question:

What percentage of debt refusniks among the non-solvent would it take to trigger a New Deal For Debtors? 10%? 20%? 30%?

Nobody has been “forced” into anything.

Nobody put a gun to consumers’ heads and told them to get the high end crossover vehicle with all the toys, the expensive apartment in a hip neighborhood, the Subzero range, the newest luxury electronics, or a house they couldn’t afford.

Americans did this willingly, and when they talk about “getting back to normal,” what they mean is getting right back on the treadmill.

I’ve lived among you for many years now, and this is your way of life. Fewer than half of you save and invest, despite investing being free of charge with no commissions! The vast majority of you cannot come up with $500 in an emergency, but you’ve got $1,000 smartphones in your pockets and a $50,000 crossover vehicle parked outside with a 70+ month loan on it.

Until that changes, complaining about “the Fed” is just blame-shifting.

Canadian:

Wow, you packed a lot of “talking points” into that comment.

Gotta AGREE, like totally dudes and dudettes, with the Can day un on this one:

Not one bit of force, except for the possibility that USA might just be the only place remaining where the ‘subliminal’ type advertising is allowed on media…

We have no debts except payments on my new pickup, easily paid by steady income,,, live modestly, with really nothing except my ”liquidity Wants”,, (as clearly differentiated from ”needs.”)

And to be sure, I cannot understand how SO many folks do not have cash in the bank for emergencies or even for really really good buys that appear to be getting closer by the day in every aspect of NEEDS, etc….

And that after starting absolutely without any ”net worth” just 20 years ago.

Brain washing by subliminal messaging on every media might be a valid explanation??

We seldom watch any kind of TV, and almost always, Superbowl excepted, turn off or away from any of the advertising,,, usually watching several shows simultaneously so as to have quick choices of entertainment versus ads, etc.

Can you look into that Wolf and Wisdom Seeker and MC01?

Thank you. ( and to be sure, I only ask because of my total distrust of other sites that seem always to be selling some thing or POV…)

They are observations.

Americans want the best of everything but don’t like to save and pay cash. They instead overleverage themselves and when a slight bump in the road comes up and they cannot pay the debts, cry “victim.”

It isn’t hard to do well in this country. Spend less than you make and invest the surplus over the long haul. Buy the compact Malibu instead of the full sized GMC. Shop at Walmart grocery instead of Whole Foods. Buy the $400 Samsung instead of the $1,400 Apple phone.

But try suggesting any of these ideas to the average Yank, and they look at you as though you’ve lost your mind, whip out their credit card, and explain how “they get triple points so spending more is better.”

America does treat its young people like garbage, but, student loan forgiveness, is unlikely to be the thing that brings people to the streets “many at least”. It’s however unlikely to happen, “student loan debt forgiveness”, for many at least. At most, there would be a write down of some kind for those meeting certain requirements, possibly at most, you have to pay a max percentage of your income towards student loans.

If however, there was ever loan forgiveness or substantial write-downs towards mortgages or cars loans; that would probably be the only debt forgiveness that would bring people to the streets. Credit card debt forgiveness is somewhere in-between. Health care debt forgiveness, because it effects older generations more, would probably be mostly socially acceptable.

In theory, if America somehow did end up in an extended deflationary period, some of these debt forgiveness/write downs might be necessary. However, this is unlikely to happen as although, America is likely to go through a deflationary recession/depression it will probably become an inflationary one before long.

Healthcare debt is assuredly full of fraud by the providers, as Denninger has been talking about for over a decade.

Sunny……most Americans are just waiting for their share……..the folks that would have been outraged are all dead. They died prior to 2000. We are headed for the abyss. Culturally we have gone from being independent to being dependent. Handouts for everyone. Heck…..the current group is so mentally weak they can’t even figure out how to close the southern border. They want higher wages for the lower class but allow millions in to depress wages. A generation of stupid.

Love the comment. Mentally weak!

yeah sure Fred. Certainly not the generation handed the greatest economy in the world and then proceeded to allow the elites to cuck them and siphon vast sums of wealth while hollowing out the country and destroying the planet. That sounds pretty fucking mentally weak to me. Tell me who the fuck allowed the current state of affairs where the USA can’t even figure out a cohesive national responses to a pandemic. We are the laughingstock of the world now. Must be nice to be old and demented you fossil. Living in delusion

All these generational stereotypes are worthless cliches. They’re best abandoned with other worthless cliches.

I guess I’m the ultimate moron then I paid cash for my sons 4 years at Georgetown which was ALOT of money

But I was brought up under the understanding that that’s what parents responsibility was for their children If you can’t afford to take proper care of them then don’t have them I know , I’m a freaking dinosaur

Not in my family; since about 1881, all of us have gone on ”scholarships” or worked our way, including the ”trade school down the charles from the country club” prior to WW2, and THE best public university in USA prior to the incredible warping of USA education system starting with the ray gun guy as guv of what was the most wonderful state prior, when Edmund Brown was guv,,,,,,, then as pres, ray gun fooked us all forever since… and, to be clear, ever since that idiot, we all been paying the price for believing anything he said,,, and all those birds, raptors, chickens, and doves alike, are coming home to roost these days,,, eh??

If too much Engelish for anyone,,, just look around,,, you can see it everywhere in every state and in every continuing theft that ray gun started, etc….

The days have gone when young people could work their way through university. Nowadays they need some help at least from parents, given the increases in tuition costs etc.

The people who paid off their debt are now such a small minority that they are insignificant. The culture in America has now changed. We are now a nation of deadbeats looking for a handout…

$2000 a month coming to anyone with or without a pluse – once a carbon based life form gets a check from the government there is no going back – only question is how do I get a bigger check- it will all work MMT until it doesn’t – then and only then will there be any consequences for our fiscal party of the past 50-60 years

@2banana, Peter Schiff said on a podcast about 2 months ago that anybody making payments on their student loan is a fool, the way the politics are going.

Wonder how the rest of the country will react when the feds deposit the “$trillion coin” into The Pension Bank Of JB Pritzker (really Michael Madigan) In Illinois within a year?

Hah!

Everybody know the Fed can just “print” the money for anything the government wants.

They can add Trillions of debt to their books to backstop anything the government does want payment for.

Can they do that for the common person?

No way.

I think you’ve mis-spelled ‘person’. In the common tongue … the tendency of Royalty is to pronounce it with both the e & r in a silent fashion ..

oh boy ! ‘s’… I meant s, not e..

gah!

we knew that’s what you meant

My fear is the Fed makes these loans good by printing money. These companies need to be made responsible for the loans also. If you loan an 18-21 year old $100K you should realize there is risk and in a lot of cases it is an irresponsible investment. This irresponsible lending has just created extremely inflated tuition through the years.

I agree completely. Unfortunately I don’t think any of these loans to students, businesses, or anyone else will ever be paid. The first time the Dems get the Pres, House and Senate locked up the will give the money away. It makes me sick to think about all the days when I was younger that I wasted working. Now I get to pay for the people who threw the party and I wasnt even invited.

still, everything will be fine because…..well, just because.

I am guessing many of these debts will be “nationalized”. Some Dems are now calling openly for giving everyone 2K a month. I think it’s reasonable to assume that some of that will be used by people to pay down their debts? It’s unclear where the 2K will come from, but knowing America, I suspect the Treasury will issue more bonds that the Fed will simply purchase.

We could have used some of the $2.7 trillion allocated to Wall Street. 70% of the US economy is driven by consumer spending. I fully understand that we are in a once in a lifetime situation but once this does clear the majority of consumers will have to rein in their spending because they are broke and in debt up to their eyeballs.

With all the fed money that went to bail out Wall Street over the past 12 years, it is inevitable that political pressure will mount to use it to help ordinary citizens at some point.

Monetary expansion is simply a transfer of wealth after all, and has been used extensively to boost the top asset holders at the expense of ordinary workers.

The only delay in getting political change comes from the wealthy boomer generation who are carefully controlled by fear of the inflationary 70’s taking away their gifted pensions.

Younger generations saw their career aspirations crushed in decades of ruinous recessions papered over by Wall Street bailouts only to make their housing costs soar as wages went nowhere and benefits all but disappeared. When their votes finally overpower the boomers, we will see radical change.

That will likely be accelerated by this crisis, but may still take the bulk of the coming decade to play out.

I believe the thinking goes that if you monetize Wall St, they will create greater than 1:1 leverage on the investment. Treasury prints a trillion and buys stocks, and that trillion rises in value to maybe two trillion esp if they bury those shares on their balance sheet. Corporations print more stock, rinse and repeat. Then USG buys bonds to run the government using their collateral. First sovereign to do this gets first over advantage, EU, JAP, China all pour money into the US stock market, which may be why stocks are catching a bid here. Either than or IMF doubles the global monetary base adding SDR. That would do it too, planet Zimbabwe!

Mr. Bierce, all of the shenanigans and clever games the world’s markets play with each other matter nothing to me until “the House” keeps fronting them more money, and more money, and send the taxpayer the bills, while the players drain the taxpayers’ life force to get them a bigger yacht or another luxury home and cry about how hard it is to stay in business.

At this rate, COVID will accelerate things a bit. One silver lining I suppose

My preference would be no bailouts for anyone. Allow the bankruptcy laws to work. This will both reset the economy and redress some of the imbalances between the haves and have nots. We need to reintroduce the concept of “moral hazard”.

“I think it’s reasonable to assume that some of that will be used by people to pay down their debts? ”

I hope you’re being sarcastic.

They’re talking $2K per person for up tp a year, maybe longer. For a married couple that’s $50K tax free money. You think they’ll use it tp pay down their $50K credit card debt? Or buy a new boat? Hmmmm…..

They will buy a new Silverado to park in front of their $10,000 trailer.

I hope that’s sarcasm as where I live just the rent on a small one bedroom apartment starts at $1,800 per a month.

It is true that just like almost the entire FIRE sector as well as politics are one big grift and that some of the lower classes will take advantage of the situation. Really though, do you think that 24,000 per a year gets you much in at least third of the country?

$1800 in 80% of the country pays the mortgage on a nice house. You are the anomaly.

JBird Move It’s a great big world out there and it’s on sale

“$1800 in 80% of the country pays the mortgage on a nice house. You are the anomaly.”

So you can pay the rent with $2,000. What about utilities, transportation, food, and whatever else is needed?

Since states like California are the anomalies, that is tens of millions of people or at least sixty million people who simply will not have the money to pay for even survival.

I’m sorry, but ultimately most Americans will not be able to buy those fancy, smancy new luxury cars on a mere $2,000 although the majority will not starve with them. Pointing to the minority who will be able to unfairly game the system as the reason to starve most people is foolish and suicidal for everyone.

Don’t laugh in Canada some parent bought dirt bikes for their kids with the money. It’s good for the economy…sarkk..

It’s going to fill the shortage of US$….

And that would be bad why? Certainly some of these people spending that money would stimulate the economy right? Who the fuck cares what someone else would do with the money. You’re one of the most incoherent people on this site. Stop and think for once. Jesus

”It’s unclear where the 2K will come from’

If you don’t know ultimately, where it is going to come from

‘just look in the mirror’

;-)

MonkeyBusiness,

It was always $1,000 a month, from what I heard. Still Insane though. A lot of young people and others like this talk though, not because they think it will happen, or that it’s a good idea. But, that it shows they are not opposed to major changes to the US, and most young people want major changes to the US.

Not sure one part is quite that rosie. There have always been those with no outstanding debt and enough available to hold out for a lesser period…maybe just beyond those with debts who have access to temporary streams from unemployment. They shouldn’t be lumped in with the “awash” crowd, as they are also an “at risk” group for secondary effects waves.

I guess we can thank Bernie and Elizabeth Warren for all these new student loan deadbeats. Promise the moon and get endless destruction.

Yep and who can we think for the trillions of dollars spent on murdering innocents in the middle east? or the countless tax cuts decimating the tax base? hmmm…couldn’t be boomers

Wolf said: “increasing number of student-loan borrowers have stopped making payments and are waiting for debt forgiveness, funded by the Dear Taxpayer, now that this is being bandied about by politicians to buy votes with taxpayer money.aid:”

as usual, the Politicians lie with their words, and society lets them. The Politicians are not proposing debt forgiveness, but a debt transfer. Of course this helps the usual suspects – the Predator Creditors.

Those who are cynical might think the recently revised bankruptcy laws were devised with precisely this in mind, which is the opposite of decent policy. But it’s a great way to enslave the Citizens and their country, at large.

Wolf is WRONG! Taxes don’t pay for anything. They are necessary to go some way to balancing the money created out of thin air to prevent it becoming worthless.

if that is truly the case, i have a feeling they are taxing the wrong people in order to achieve the desired goal.

Thank you, p coyle, exackly–never more true than now

The basic idea of student loans is all about hope, and that’s a stupid strategy financially. I wouldn’t mind putting this on a national referendum, let’s see what happens then.

I find it funny that grad students incur a disproportionate amount of debt, apparently the more educated you are, the poorer choice you make. I would find a breakdown of the debt as a function of the chosen major to be very interesting. I wonder how many of those in debt are ones with hard science professions can ones with liberal arts education.

This just goes back to my long standing complaint that there is inadequate financial education in grade school, apparently they were too busy teaching social justice and all forms of nonessential sex ed.

MCH,

More and more of the top jobs in America, require beyond a bachelors degree, it’s not because those pursuing graduate degrees are dumb. Although, the liberal art majors get a lot of attention, they are FAR from the norm. Most graduate degrees are in business, STEM, education, or health. The most popular graduate degree is always in business “MBA, with various concentrations”, many/most of those getting this are older. The STEM degrees are obviously beneficial to society, but, those getting them can still end up not getting a job, laid off, or get paid less, because of outsourcing, H-1B visas, or bad luck. Health should be obvious. Education is probably, because, a-lot of teachers unions, have in their contract that teachers who get graduate degrees, automatically get paid more.

SJW degree programs do need to purged, but, they aren’t nearly as common as they are made out to be.

It’s been a while since I was in grad school, but back in those days, a majority of the STEM degrees had been supported through grants written by their Professors, that is still the case.

Now Doctors and Lawyers tend to have to pay their way through, but on paper those are at least able to get decent career prospects.

Like I said, I would be curious to see the breakdown on which degrees held the most student loan debts, I would guess probably not STEM.

Any high school guidance counselor who has ever mouthed “dream school” (college)to a student should pay off that student’s loans.

I’d just like to start off by saying the graphs and charts are always looking very professional.

I sometimes wonder if unlimited money printing will increase inflation and ease the debt load, although that will likely come with disastrous consequences.

Gulfstream G650’s and Caribbean islands are no doubt inflating as we speak.

The business aircraft market has been in the dumps for a looong time.

Too much supply, too little innovation and the boom of fractional ownership have all contributed. Last year I was at Altenrhein (a former Swiss AFB) and there was a long line of Dassault Falcon’s waiting to be scrapped. They had already been struck from the registry and were just waiting for the blowtorch. Nobody wants them anymore and why bother when fractional ownership gives you all the advantages and none of the headaches? But the problem is fractional ownership outfits want brand new and flexible aircraft, with the Pilatus PC24 and especially PC12 being huge favorites. There’s a very good reason why the assembly lines and test flights at Buochs never stopped even at height of the epidemic.

Textron, the owners of Cessna, has been shedding workers since before the epidemic due to reduced demand for their Citation families of business jets and their inability to develop new general aviation models. Bombardier has been in financial troubles for a while and has been selling off the family jewels to Johnny Foreigner.

Gulfstream, a division of General Dynamics, has been able to leverage its parent company’s defense connections to boost sales by selling their business jets to governments and State-owned companies, but that particular well started running dry last year already as their traditional Gulf customers are caught between big financial problems (especially Saudi Arabia) and a massive glut of business jets, including the BBJ/ACJ versions of Boeing and Airbus commercial airliners. Trust me on this: the G600 will not exactly fly out the assembly lines.

Just a rider. The French company, Alstom, bought Bombardier Train. Looks like the aerodynamics part of it is being left out to dry. From Railway Gazette:

“The signing of a memorandum of understanding for Alstom to acquire 100% of Bombardier Transportation from Bombardier Inc and Caisse de Dépôt et Placement du Québec was announced by the companies on February 17.

The transaction is expected to close in the first half of 2021, subject to regulatory approval.

The price would be €5·8bn to €6·2bn, paid via a mix of cash and new Alstom shares. CDPQ would reinvest 100% of its cash proceeds of €1·93bn to €2·08bn plus a further €0·7bn in Alstom.”

Readers might find the advisors interesting:

“Rothschild & Co and Société Générale are acting as financial advisers to Alstom. Société Générale, Crédit Agricole Corporate & Investment Bank and HSBC as underwriters for bridge and revolving facilities, with Société Générale also acting as structuring and co-ordinating bank. Cleary Gottlieb Steen & Hamilton is acting as lead legal adviser.

Bombardier has retained Citigroup Global Markets Inc and UBS Investment Bank as its financial advisers and Norton Rose Fulbright as its lead legal adviser, with Jones Day advising on antitrust and competition matters outside Canada. National Bank Financial and Rockefeller Capital Management are acting as financial advisers to Bombardier’s board.

HSBC acted as financial adviser to CDPQ, and McCarthy Tétrault LLP and Freshfields Bruckhaus Deringer LLP acted as legal advisers.”

Kaz, thank you for this very good information!

One of the great things about WolfStreet is the continuing contributions from folks with ”boots on the ground” and local knowledge of what is really happening from all over the globe.

Please keep us informed as to how these movements work out, plus, anything happening in your ”neck of the woods.”

thanks again, from one who got out of all the so called ”public markets, SM, commodities, etc., back in the 80s era,,, but am really ready to invest again as soon as it appears NOT to be just a gamble…

Must’nt forget all those mega yachts and helicopters now….

Woa Nelly, when all this consumer debt crashes very soon. ‘They have a plan?

Everyone has a plan until they are punched in the face.’ – Mike Tyson

regarding: “But the national data puts all Americans into one bucket – the group that will be just fine no matter what the economy does, and the group that is strung out, plus everyone in between. ”

Isn’t that the truth when folks make all encompassing statements based on averages and other ways of organising information. 50 states, but really hundreds of subsets and so many differences between regions.

I agree with 2bannana about student loans. If there are no consequences for borrowing, then how will the system continue to work going forward? And this applies to business even more. However, if the wealthy can afford to find loopholes and avoid paying taxes, or land softly after bankruptcies, then why should anyone pay taxes or pay off their loans?

Student loans are very different than houses or cars. In the past in America and in most of the rest of the developed world, it’s recognized that universities are required, for a country to do well, so it’s almost free. In America, only recently, was it decided that young people should start off their adult lives in debt. Most of today’s college students live in the same dorms and attend most classes in the same buildings, older generations did, but they pay several times as much, Is that Fair? No. So what to do? Just write off student loans.

Going forward, college should be almost free. The states will have to pay more, and it might be decided, although, some majors like business and history matter, we don’t need so many graduates. Instead of everyone getting in, it will be more selective. Because, average high school graduates, no longer have to compete with their likewise colleagues that went to university, the problem of employers requiring, college degrees for basic jobs will go away.

For a-lot of things like business, philosophy, history, and english; it’s possible to replace going to university with something far different and cheaper “perhaps a combination of online learning, combined with study groups and in-person final exams, that aren’t on a fixed schedule, alternatively much larger class sizes combined with a shorter time length 2 years as opposed to 4 can be instituted”. Music, arts, and the like should be handled by less expensive dedicated art schools, or just take less time to graduate and not require learning calculus to draw. Some things like the SJW degrees can be eliminated entirely.

The Academic year is very short at many universities, at some universities, the vast majority of students only attend classes for 28 weeks a year, if this was upped to 42, While going through the same amount of material, It would only take 3 years as opposed to 4.

There’s a-lot of options, what’s not acceptable, however, is to increasingly make it difficult for new adults who don’t go to college to succeed. While simultaneously, charging today’s new adults multiple times what older generations paid.

Good start TR,

I encourage you to both continue to develop the concepts you bring, and continue to refine, edit, and publish as widely as possible in this new age of world wide communications depending only on net connection, which, as most folks know is really and truly free in many places for anyone who really wants to connect.

Time and enough for younger folks to work it out for all folks who want more democracy and the freedoms following that to actually get organized and proceed.

My ‘pre-boomer’ gen, (apparently AKA ”the silent gen” by some) tried to do this because of the very clear support from our parents/previous gen who did have to go to war just to keep the world from ”devolving” into outright extremes of both right and left, etc., which I certainly hope can be avoided by all the actual peoples of the world uniting against all extremes.

The system runs on guilt, and a general lack of self respect.

They set the system up for you to fail, then they can use that failure against you at any time to make you do what they want.

Yes. How the richies see the world:

‘WE’ can Always abscond, grab, steal, with impunity .. regardless of our perfidy….. whilst YOU, you little sheep, must pay for your guilty transgressions, due of course, to your everlasting animalistic impertinences!

Let student loans be included in bankruptcy. If the borrowers can’t

pay then they get relief but pay a price.

Moral hazard is avoided.

I hope some compromise can be reached. People should be on the hook for part of their debt at least. Complete debt relief is not fair. Bankruptcy isn’t the black mark it once was, and many people are back to the casino in a few years. For corps and individuals, there should be clear and certain price to pay for bets going wrong…the former being shareholder gutting and the latter being future docking of wages.

In 2005/2006 the government made it harder for an individual to declare bankruptcy and discharge student loans. The rise of for profit colleges that excelled at getting students loans prospered.

Below is an interesting read regarding one such for profit institution.

http://americanradioworks.publicradio.org/features/tomorrows-college/phoenix/story-of-university-of-phoenix.html

I agree with all that, Sporkfed. Alas, too straight forward…

Agreed. I’ve said before that the student loan industry is much like the liar loans and other next to zero oversight loans that took down the housing industry in 2008-10. In this case, colleges are the winners instead of banks and loan originators. Colleges have zero skin in the game when they keep raising tuition and other education prices, then encourage students to borrow, borrow, borrow. So what if your degree gets you a job in a coffee shop! The colleges are getting rich.

Solution? Instead of the government guaranteeing loans to students, the 1-2% loans are made from the gov’t to the colleges on a non-guaranteed basis. Colleges loan to students at a 200 to 400 basis point increase. The colleges then have skin in the game and perhaps would care if their students could get jobs after running up big loan tabs. Maybe colleges would even start caring about controlling costs. Not perfect, but a step in the right direction.

A friend that teaches at a well respected college with a good football team told me administrators are expecting 20% of their students to not return in September.

Enrollments were already projected to be decreasing bigly before this—will be interesting to watch now that you bring that up.

Many not coming back will be the highest tuition paying Chinese students.

The football team will be back 100%.

You cannot see the moral hazard in bankruptcy? Really?

There really is only one solution to the student debt “crisis.”

In three simple steps.

1. Get government completely out of the student loan business. No loan guarantees, no scholarships no tax credits.

2. The only student loans will be between a college/student or a bank/student.

3. Student loans will be treated as any other debt in bankruptcy.

Not only would this solve the student debt “crisis” – it would also make higher education extremely affordable again.

Without a dime of taxpayer money.

OF course, this doesn’t buy votes – so here we are.

Bad idea, as everybody who got loans would simply go bankrupt the day after graduation.

Knowing that, NO lender would grant any loans without guarantors, like wealthy parents, and we are back to college being only for those who can afford it.

I am not saying that is all bad.

I worked nights, weekends and holidays for 7 years to get my degrees.

> NO lender would grant any loans

That’s. The. Idea.

@Paul

The fact is most people try to pay their debts even when it puts excessive strain on them. There are very few people that game the system.

People would not get a degree and then declare bankruptcy. There are ramifications to bankruptcy and there is a court hearing.

Agreed, the government backing the loans and the prices climbing can’t be a coincidence.

along with all those ‘grievance’ social jw studies that’s all the ‘rage’ …

which is nothing more than a divisionary ‘tool’ put forth by the backrow elitists, in keeping the plebs separate, but unequal, and at each other’s throats .. solely for the anointed’s own personal gain n grift!

There really is only one solution to the student debt “crisis.”

Bananas,

Not so fast. Government could assume the debt, treat debt repayment like unemployment or Social Security taxes…3-4% of earnings, for the life of the debtor. Infrastructure is already in place to do so.

yes, wage garnishment is still happening, and Ed dept got sued.

It sounds like you are saying quote: “this debt is very manageable”. The debt has dropped in 2020 in many of your graphs like in “credit card and other revolving credit”. That’s good… (if you want the economy to recover that is).

If the debt is ‘dropped’, is it b/c the lenders wrote them off b/c of default or consumer paid!?

this happened in 2008!

I’m not sure. Actually I thought the debt would have sky rocketed because of the shutdown and all the Fed’s lending programs. Maybe people paid down their debts with their helicopter money? I don’t know.

In the Non-Housing Consumer debt chart above, he says this is the first month-to-month decline since the Great Recession, but if you look at the chart, you’ll see a bunch of declines between 2009 and now.

Either way, I’m not sure why consumer debt has gone down during the virus shutdown. Anyone know?

Tim, how many times do you need it explained to you???????

Hello Tim2

Being Tim, would you care to pick a different handle?

Best wishes.

Wolf,

Really.

Does the above sound listen me me at all.

Like me at all, I mean to say.

Tim,

I can see the difference because I see the login email. So I know which Tim is Tim, so to speak.

MC01 used to be MC until another MC showed up, and MC01 added the 01. This worked. The other MC hasn’t shown up again or changed alias… So now there is no MC.

So it’s easier for you to add something to Tim than it is for you trying to get someone else to change.

I recommend that for everyone with a common screen name: add some numeric characters.

For example, joe just changed to joe2 today after some confusion with joe.

the Debt Slaves look pretty responsible compared to the government.

Imagine if Debt Slaves could print their own money.

Touché ?

I handled Chp7 bankruptcy cases – liquidations – for over 20 years, thus both before and after the 2005 bankruptcy law change. Having been in the trenches, so to speak, I find most of the bankruptcy comments here to be, like the change in the law in 2005, both absolute on one side or the other and short sighted. The pre-2005 system did need several changes but not the complete re-write which resulted.

The bankruptcy system could have a much more nuanced approach to matters if allowed. Take student loans. There are tools which could be used to differentiate types of borrowers and type of loans, like a ‘look back period’ before filing (I like 12 years post date of initial debt, but this is a societal judgment) or amounts to be discharged (you could take a national average, or a regional average – the government keeps track of these things down to the county level – or a set amount or percentage) or you could take a Chp13 ability to pay over a set period of years – 10%, 20%, etc – approach. The point is we could devise these tools quickly and easily whereupon student loans would, after a period of adjustment, be handled much like other debts with the debtors paying a substantial price – bankruptcy, contrary to popular moneyed opinion, is not an ‘option’ but a last resort.

But now this ‘fresh start’ is missing. A ‘fresh start’ is available for businesses and individuals struct by unbelievably high medical costs, but is not available to kids wanting, for the most part, a better life – why they took on the educational debt to begin with – but now struggling, in part because they were taken advantage of by the colleges, the bankers, and their high schools which failed in their educational duties. Why this differentiation? The ‘why’ of course, has to do with other bad public policy decisions (let’s talk about how a graduate education came to be required to do agency work, like law, for example), most made well before the birth of our current student loan obligors. Thus as a result, what can not be seen and which most practitioners predicted before the 2005 change in the law, is a permanent overlay of debt upon individuals just starting out, an overlay which has a dampening effect upon these young individuals becoming contributing members of the consuming society.

Finally, enough of this ‘I’m paying for these deadbeats’ sort of posturing. Last time I checked the top 1% of taxpayers (who, admittedly get ridiculously low tax rates) paid around 38% of ALL income taxes and the bottom 90% of taxpayers paid around 30% of the total tax bill. As a now retired member of the 90% club I am far more concerned about what my government does with my taxes, such as guarding Saudi oil facilities and bailing out bad bets by the 1% by sticking as yet unborn generations with the bill, than I am about giving students a better shot at being more productive members of society. And I am acutely aware that, although I worked all through college and grad school, my semester tuition at the Univ. of Texas was around $250 – cheaper than my books. So I am simply part of a lucky generation. I don’t ever forget this.

So let’s please stop this generational sniping. I’ve been following this site since the days of Testosterone Rage, or whatever it used to be called. Most comments are polite and many thoughtful and educational, representing a true spectrum of opinion in this country. But lately they’ve become petulant (even Wolf has become more ill tempered). With the Ads gone, I’m not exactly sure what type of business model this site runs upon but surely it most have something to do with the total membership level and not just cheap plastic mugs. And from the increasing irritation shown in the comments, my guess is such irritation will ultimately drive down this membership and thus Wolf’s ability to make a living (I seriously doubt this is some type of altruistic endeavor). So do Wolf a favor: calm down. Be respectful. Limit your comments. Let others contribute. If you have something informative to add, please do so. But if you just want to bicker and fight, please take it outside.

The final vote in the Senate on the ‘Bankruptcy Abuse Prevention and Consumer Protection Act of 2005’ took place on March 10, 2005.

It passed 74 to 25 with one senator, Clinton D-NY, not voting. Senator Obama D-IL voted no. Senator Biden D-DE voted yes.

“Lenders blamed the steady rise in personal filing rates on “soft” bankruptcy laws that motivated households to borrow more that they could afford, with the bankruptcy option in mind, then repay less than they could afford in the event of bankruptcy.”

“In 2000 to 2004, student loan securitizations averaged $30 billion per year. Prior to 2005, most student loans guaranteed by the government or made by non-profits were not dischargeable in bankruptcy. In other words, a bankrupt borrower still had to pay these loans off. With the new Act, most privately funded student loans also could not be discharged in bankruptcy. They too had to be paid off. Suddenly it was safe for private lenders to make these loans, and it was also safe for investors to buy securities backed by these pools. Private loans and securities surged.”

A long time friend of mine rose to a position of a vice-president of a large regional bank (which should be kept anonymous I reckon) in charge of the student loan operations. This caused him some internal conflict to say the least. He was well paid and making large profits for the bank. His job did help some students continue on with school and graduate. But at the same time he could see what was going on with the onslaught of debt load being put on their shoulders; debt load that he helped put there.

My friend retired five years ago at an early age. He and his wife live well, but don’t spend a lot, and he’s very happy to be out of the business of putting 18-year old kids into debt. Needless to say, he’s still a good friend and I have a lot of respect for his decision to walk away from a good salary in order to keep a clear conscious.

Longtime Wolf lurker but have never commented, but CrazyC, that was a great comment.

Agree a lot with your very good comment CC, except that the mugs I just received are solid glass, and very nicely made, just a little on the small side for my overall liquidity positions.

IMO, though I certainly don’t have the experience you do with the BK system, it appears to be, in the main, just another aspect of the steal from the poor to pay the rich policies that have become all too prevalent in USA today.

Certainly, a lot of minor changes were needed, equally certainly from what I have read, the ”rewrite” went to far in some ways.

I am thinking Wolf is joining the crowd that is disgusted with the clear theft going on for the last few decades and continuing to get worse and worse these last few months; although I am retired with sufficient income, and really ”don’t have a dog in this fight” per se, I am not at all happy at what it is doing for the lifetime prospects of my grandchildren’s generation…

IOW, it seems inevitable that it’s either BK for USA or hyperinflation, etc… NOT GOOD either way!

Best. Comment. I’ve . Seen. In. Months. Anywhere.

Well done, Crazy Chester. I look forward to reading your posts.

Crazy Chester,

“With the Ads gone, I’m not exactly sure what type of business model this site runs upon….”

I’m not sure where you’re getting this. The only explanation I have is that you’re using an blocker or a browser that blocks ads by default. As many people here can confirm, there are plenty, or more than plenty, of ads running all over this site

Maybe you should buy a Wolfstreet mug so that you can support this site with your ad blocker on and you would know it is solid glass mug.

Wolf:

Mr. TXRancher is right. Either I should shut up or put up some money. So I just sent you $100. Please send me the ‘glass’ mug. And please alert TXRancher for me. Tell him I just could not refuse such a request from another Texas boy.

Crazy Chester,

Thank you!!! Got it. Awesome. Cheers!

Thank you, TXRancher!!

Mr. Crazy Chester,

Cheap plastic mugs? Those suckers are glass, which is the only reason i don’t want one. I actually would prefer plastic, so there.

Nor do i concur with you that Wolf is ill-tempered. On the contrary he shows far more restraint than i could. And i too have been a reader here since TestosteronePit days.

Crazy Chester said: “Finally, enough of this ‘I’m paying for these deadbeats’ sort of posturing. Last time I checked the top 1% of taxpayers (who, admittedly get ridiculously low tax rates) paid around 38% of ALL income taxes and the bottom 90% of taxpayers paid around 30% of the total tax bill.”

________________________________

Well that’s nice to know Chester, but what % of all income did they receive? …….. particularly before tax deductions, and dubious offsets like oil depletion allowances, etc. And what % of assets do they own.

A lot of people are proud of what “they” earned, when in fact it was the assets they owned collecting the rent and doing the “earning.”

Ownership ……………….. it’s the easiest way to go.

CrazyC-thank you for the points re:civility. Must concur with VVNV’s view that Wolf is, and has been outraged and disgusted at the levels mendacity, mopery and dopery have reached in our contemporary economic world (indeed, that is what has always attracted and kept my attention on this site, even though, like VVNV I’m not a ‘player’).

Maybe it’s a generational thing about the ads, or maybe it’s just my email program that keeps them static and out of the text, but as someone who has always read newspapers I’ve found little problem in ignoring those ads which don’t evoke my interest (TANSTAAFL-operating revenue’s gotta come from somewhere, right? At least for those of us who can’t print our own…).

May we all stay well and find a better day.

“I am far more concerned about what my government does with my taxes, such as guarding Saudi oil facilities…”

Chester,

You do understand that maintaining our relationship with the House of Saud is the lynchpin of our past prosperity and the current hegemony of the US dollar. End that relationship, and you will experience the Weimar-type inflation always promised.

When Saudi Arabia no longer requires Dollars to purchase Oil, the World will pivot away from the dollar THE NEXT DAY…inflation will be in the double/triple digits within weeks of the event.

What a curious bunch of monkeys we humans be. See a flame…stick in a finger. See funny rock…turn it into a bomb. Now might want to play with Supernova…maybe see what we can do with the resulting black hole. Answer-Nothing ever escapes beyond the Event Horizon….best to avoid altogether.

BuySome:

Yeah, and as monkeys, we eat bananas incorrectly, from the bottom to the top!

Real monkey’s know how to eat a banana properly!

Bring on the stagflation—Konnichiwa

When it comes to savings, only the top 10% or so, really have any savings.

If people are saving more due to the virus crisis, it will be the top 10% where the bulk of the savings occur.

The likely hood of these top 10% spending more and boosting the consumer economy, is very unlikely because there is only so much they can consume. Likely they are already spending at their preferred (cut back?) level.

This crisis has mostly stressed the bottom 90%, not the top 10%.

If consumer spending is to rebound, it will have to come from the bottom 90%.

With recent job losses, combined with so much future uncertainty, the bottom 90% will be in no mood to spend and increase their debt burden.

If anything, the bottom 90% will be inclined to try and save more, like the top 10%, not spend more!

For many, the only way they can save more is by stopping payments on their debts! They have seen the rich being bailed out, so I have to wonder if they will be less motivated to pay off debts owed to the rich? Ironically, there may be some herd safety in their scheer numbers!

If there is no moral hazard for the rich, why should there be any for the poor? Fair is fair!

For these reasons, I just can’t see a V-shaped economic recovery anytime soon.

An academic career is based on the simple desire to never do a hard day’s work in your whole life. All you have to do is write a convincing grant application every so often. The rest is party down conferences, international placements (read:18 month paid holiday) and awesome toys to play with. You load up on debt to get the necessary degree for each succeeding level until booyah! You get tenure. But hush! Don’t tell anyone!

Some of those academics are working on a vaccine for the coronavirus right now.

Obviously you aren’t aware of the “adjunct” system…it’s the preferred way for some time now.

Been reading this site for several months now, love the real data, and there is usually some solid gold in the comments here.

I don’t always agree with everyone, which is expected and gives the opportunity of legitimate growth from new ideas.

However, I find this assertion on academia to be highly inaccurate. I am currently working towards a doctorate in chemistry, and you could not pay me enough to stay in Academia.

Relative to private industry you make far less, especially with the pedigree required to even be eligible as a college professor in chemistry. On top of this, writing those grant proposals is a full time job, with extremely limited federal funds being sought by all of your peers in every other university in the country. Besides which, good luck coming up with a solid research project that hasn’t already been done or is even remotely possible in terms of viability. And the list goes on and on….

In short, I have to basically laugh at this comment for how off base it is from what I have personally seen in the sciences at a tier one research University.

Be safe out there.

My daughters boyfriend is 3 months away from a PHD in chemistry from Berkeley, but all grad students have been locked out and does not know when he is going to finish.What is your status?

Rcohn, don’t worry, he’ll finish.

I got my PhD from Berkeley. If you make it past the qualifying exam (~halfway mark) they treat you very fairly and honestly; as long as you don’t give up you’ll make it to the other side. The ugly “disposable humans” stuff happens before/at the qualifying exam and after graduation if you want an academic job.

Berkeley is in the business of issuing PhDs; undergrads are just sort of a side hustle they’ve got going on. Letting people waste more than a few years of their life before screwing them out of a degree is bad for business. They can’t do that too often.

“good luck coming up with a solid research project that hasn’t already been done or is even remotely possible in terms of viability. ”

The real buisness of academia is being an propaganda machine for Corporations. Science today is a product that is bought and sold.

The Corporations build the labs, and finance the studies, providing the studies find what the Corporations want them to find.

There is no truth or integrity anymore, just propaganda bought and paid for by the vested interests….

@jdog

Getting grants from NIH or NSF does not require any corporate allegiance and both agencies fund the majority of Academics in chemistry.

I realize what you are on about, but the bias in media against science seems to have gotten the better of you.

My current lab does funded work by an industrial counterpart, they never stipulate anything in terms of research activity or desired goals. This is a huge name in LCMS and other instrumentation.

Are there examples of corporate/industrial influence on researchers, yes. However, if you look in the real peer reviewed journals this tends to be the exception, ie bad apples, rather than the rule.

@rcohn

My status has not been interrupted. I will resume my analytical chem research in June. Thanks for asking!

Biorganic

You are kidding right? If you want to get grants, you had better be a “team player”. Team player is the euphemism used to label going along with the corruption. All government agencies, all politicians and all ranking bureaucrats are on the take from corporations. Pharmaceutical companies own the NIH and dictate what the agenda is.

Conventions are now a 30 billion dollar a year industry, and are used to bribe most bureaucrats in decision making positions.

In exchange of playing ball, bureaucrats are invited to ” training or educational conventions” which are in fact lavish world wide vacations where they are treated to the best of everything. In exchange they steer their grant money in directions that benefit the corporations. That is how the real world functions, if you are not a team player you are simply excluded from the process.

Not kidding sir.

There are certainly hot issues that are more likely to get funding, such as anti cancer small molecule treatment etc, but there is also funding for all sorts of seemingly esoteric science for science sake experiments. Having a direct application that benefits society and is potentially marketable may assist you but is not absolutely required.

Also, wouldn’t it make sense for projects that can benefit society, such as new anti-cancer drugs, to receive funding precedent over some insane physics project with no realistic real life application besides theory? Something about resource management being a thing.

What’s entertaining to me is that I fundamentally agree with your outrage at the extent of corruption and cronyism in society/govt/markets at large. However, the assertion that the scientific community is in league with these forces is laughable. How would you prefer they fund their research? Maybe you’d like to front a few hundred k for a mass spectrometer so I can develop novel cannabinoid analysis? Cast stones at them as you wish, I see no actual ideas for alternative here, and the premise of some alliance because we are all corrupt is more than a little insulting.

Hmmm, Fat Chewer, when I spent a year slogging around South America with a backpack some years ago, one of the people I met was a US archaeologist who was working on Chimú sites in Peru. He worked on construction sites in the US during the northern hemisphere summer in order to finance his archaeological digs in Peru during the northern hemisphere winter. I’d say for many academics life is a lot of hard work and dedication to a field of study for very little material gain.

Archeology is a rough field. I’ve heard that unless you’re backed by one of the small number of institutions with a reputation to continue there is no money at all for these things. I went to a dig once and got to chat with some grad students that were excavating. Money was definitely a worry on their minds as they tried to plan out gig income in between various archaeology/paleontology jobs that did not always pay either.

Construction is in some ways a perfect income source for half the year between digs. I found out that a bunch of the people working at the site I visited were volunteers. Apparently if you can convince them you know what you’re doing and interested enough you can be an archeologist without a degree, just enthusiasm. Then you just have to go work construction or a gig job and quit every time your hobby career comes up. You’ll be poor but maybe satisfied?

As an ex-academic that is now in the private sector I can tell you that this is bs. Academia is rough and the pay is low unless you are at a top university (even then it is relatively low for level of work). Of course, there are many academics that slow down considerably after getting tenure but they get assigned a lot of admin work. Altogether, I make twice as much in private sector and work 25% less and have half the stress.

Well, boo hoo,

we all cry at your pathetic existence.

Me too James: had several very attractive offers in academia and then guv mint,,, but, after cracking and cranking the numbers went straight to private enterprise, mostly, only going to guv mint when wanting to have ”most” of my time free to write ”the great American Novel” of my era,,,

and i am sure that most here, except for Wolf who seems to have got/done a pretty good start already on his ”million words” needed B4 the actual ”Great one” will understand when I say I am ”still working on it.” LOL

School politics are a pretty nasty arena to work in. Most people couldn’t stand it from what I’ve heard. Plus, for quite awhile now all new prof jobs are temporary, semester to semester, with no benefits. Many adjuncts work at several schools with no benefits or security at all. The gravy has all gone to admin and coaches.

My brother in law decided to end a long long business career teaching at U Wa. His job sucked, as far as I’m concerned, and luckily his wife had medical from her job. Nice title, though.

“All you have to do” …

People taking a PHD are paid about the same as the lab-janitors, they have to relocate every 18 months to continue their career, typically 3-5 times, and by the time they make ‘Adjunct’, basically on tryout for ‘Associated Professor’, which puts them on the tenure track. They are now in their 30’s and still can’t afford a family unless their partner has a real job (and He or She will have tripled their salary in the time it took the PHD grad to get his/her foot in the door at a university).

Then there is a huge fight for getting tenure with office politics and backstabbing worthy of Renaissance Venice and of course ass-kissing “upwards” because it is a college of full Professors who recommend new people for tenure.

Once tenured, one will spend ones time with begging for money, office politics, supervising PHD’s, publishing papers and unless one is in the top 5% of the researchers, nobody will ever care nor notice the work.

If you want *really* flashy conferences and unlimited money for client entertainment, I’d recommend instead pursuing a career as “Senior Sales Consultant” for a defence company.

That is, if you think your liver is hard enough: These guys do a 5 days conference in a row, whipping out the Black Mastercard or Platinum AMEX, on every evening with different clients, everyone getting smashed on 200-1600 EUR bottles of whisky (price goes up if another Senior Sales Consultant is at the same venue), cognac and cigars on top. If there is also a red-light district near the venue, it gets geometrically worse. Then two-three weeks later, they do the same all over again some other place. They only come home to detox, and maybe beat the wife, yell at the kids and kick the dog.

The last time I tried to keep up at one of those ‘suppliers dinners’, I lost the ability to see colours the morning after and the normal hangover only kicked in properly during the afternoon!

WES

The somewhat predictable moral hazard of the 90% – I think you are on to something there !! I recall in 2008-12 when some of my co-workers who were untouched by the recession did strategic defaults on their homes, saving their non-payment to buy the same (similar) home 2-3 years later for 40% less, probably for CASH. I was outraged! We all then learned more about all the Fat Cat banks who originated and dumped on Fan/Fred so they could bend more people over and fee them to death with new liar loans in 2009-2007. Did not take long for most people, including me, to see what my co-workers did as simply strategic and it looked like much less of a moral hazard.

Prolly gonna happen again with much of the credit outlined in this article….but this time, possibly with our legislators endorsing it. THAT is the moral hazard.

Sorry….date range in above post was meant to be 2000-2007. :-)

Definitely a herd safety in mortgage defaults. If too many of the houses are empty Blackrock will not be able to mitigate the mold fast enough, sort of like a negative oil futures contract. In any event the “Zillow” of the block / neighborhood starts to go down the elevator shaft.

Still don’t get a real feel for what servicing this debt means. Okay maybe those student loans which are small and go on forever are manageable. 84mo car loans. 50 year home mortgages? As the aging consumer demographic passes its wealth through a more narrow funnel (smaller families) those debts seem trivial. Ultimately credit may vanish, for only the young and poor anyway.

Consumers know they will get bailed out by politicians looking to buy voted with someone else’s money. There was a bill introduced in the Senate a couple fo days to give everyone $2K a month. Straight up cash no questions asked. And this is only the beginning.

“There was a bill introduced in the Senate a couple of days….”

Don’t worry. Not going anywhere. That was done for show.

Don’t be so sure, Wolf.

Don’t be so sure.

Give money to the commoners. Not ever, even in Canada they are taking a lot back and taxing what doesn’t come back. People got cheques that weren’t supposed to and the government wants it back.

In an election year, what better way to show “you care” than sending people money? I think there’s a better than 50% chance this happens.

Consumers don’t know anything.. Consumers are livestock, and their purpose is to work for 45 years and die penniless with the fruits of their lifetime of work going to the bankers and corporate officers who live off the labor of others.

There will be no helicopter money, the $1200 was one and done. Just enough to keep the cattle from stampeding, so that they may continue with the financial culling..

You see, they never abolished slavery, they perfected it……..

to 2banana yes – we are the morons – who worked our way thru school, who didn’t go out to beer drinking parties if we didn’t have the funds….etc etc. I resent the idea of paying other people’s debts. Yes I know “everyone can go to college” was a con but “student debt” borrowed to pay the rent or go bungee jumping with the guys is just irresponsible. So, as others have said, let them go through bankruptcy like the rest of the grown ups and actually learn something.

Ditto for the hedge fund idiots.

I wouldn’t mind waiving some debt related to tuition, but I wouldn’t want to forgive debt related to lifestyle. Students on limited budgets should have roommates, and live frugally, so I wouldn’t support forgiving anything beyond the tuition. Many responsible young adults who have gone to a fancy private college out of state chose instead to live at home with parents and go to the local college. What message do we send when we forgive debts of their spendthrift peers going to fancy schools and living sex-in-the-city lives.

what message are employers sending when they only hire from ivy league schools, or from their own prestigious alma mater?

You know EXACTLY what message they are sending.

The ultimate problem is how do you sort the wheat from the chaff now.

And what would one do considering that there might be one out of a hundred graduate student in art that can earn a reasonable living and pay off their debts. (I am picking art major as an example, don’t have anything against them)

“(I am picking art major as an example, don’t have anything against them)”

Really? But they came to your mind, no doubt as “the chaff”. Creative people are generally despised in this country because they are worthless to the slavers, except that many take a menial job so that they can keep doing what they love. In Europe the difference in attitude is striking, indeed many musicians and artists leave the U.S. in order to have a nurturing environment.

He couldn’t remember Shawn Hannaday’s (or whatever idol on the right) “UNDERWATER BASKET-WEAVING MAJOR” trope. Maybe that’s been retired after 20 years.

I’ve never understood the need for someone to make someone else’s choice of major!

Yes, noname, probably too young

Well, I could say engineers, but oddly, they are in demand.

The issue with the art majors who rack up the debt is that it’s much harder for them in this economy… whether that’s right or wrong isn’t an issue, it is a fact. For every “insert your favorite artist name here,” there are a 100 or more who doesn’t get there.

By the way, the chaff in this case refers to the people you were complaining about who were bungee jumping using their student loans. Because you can sort the art majors from the engineers, but harder to know what people did with their loan from five years ago.

MCH,

I don’t recall kvetching about any bungee jumping students, I think you have me confused with some other commenter.

And concerning your world view on “the Arts”, it’s a poor, stark, world you seem to inhabit. I doubt you realize what the world would be like without “the Arts” and artsy fartsy creative people. “Getting there” is not for any of us to decide for someone else. I am just going to take from your comments that really, you think there is no place for an arts curriculum in any institution that you can get a loan to attend.

MCH:

Second time u have related to the “arts”.

My reply to anyone who thinks the way I believe you are, is that I wouldn’t want to live in a society that elevates lucre to the humanities…….We are going in that direction but it is a dark pit.

In the long run it may the “Underwater Basket Weavers” that may win the day and make the most money!

It’s kinda nice to have some authors, artists, and actors around during this time of lockdown and stay at home lifestyles. In fact, my wife and I are going to watch a BBC detective show on PBS…in about 5 minutes. Thank God those sensible stemer boosters haven’t totally de funded public radio and television. Yet.

Show is on. Bye. :-)

S7

Hilarious, not sure if I should laugh because you conflate art majors with the idea of liberal arts (two different things by the way), or that you managed to assume that you know how someone thinks by not even reading what was put up.

I am making a point about the challenges of making a living based on the different types of choices made in graduate school. After all, there can only be so many Hillary Hahn and Ray Chen of the world, just like there can only be so many Tom Brady and Peyton Manning.

If you feel that means I’m knocking the arts, far be it for me to correct such thinking. But let’s face it, it’s harder to earn a living as a musician than an engineer if you look at the average. Which is why I was curious about what was the distributions of majors as it related amount of accumulated student debt.

Considering that culture is the main export of the US economy, you would think art majors would be doing better. Art like other endeavors relies on shameless self promotion. We had a local who did an illegal mosaic, called “The Surfing Madonna”. He was found out, given notoriety. Turns out he studied art in Italy and was no slouch.

How about ZIRP for everyone – NOT just Wall Street, junkety junk hedge fund bonds, stock buy back corps, the rich and Wall Street?

The Fed should offer 0% loans to everyone.

And if the Fed and Washington are going to extend “loans” to the rich, junkety junk hedge bund bonds, stock buy corps, and Wall Street, we should have any debt we take on forgiven, too.

It’s only fair. No can argue with that.

ZIRP for The People.

Loans that have to be paid back for The People.

It’s only fair.

*Loans at 0% that DON’T have to be paid for The People (just like we do for Wall Street).

It’s only fair.

Actually, rewarding bad behavior all around isn’t a good idea, it smacks of no responsibility. My preference is to send guys who screwed up major industries to the poor house and jail them when they knowingly cause harm.

Guys like Immelt, McNerny, the moron who ran Wells Fargo, etc. the one thing I approved of from the Enron debacle was that Skilling went to jail. He should have spent the rest of his life making restitutions afterwards…. that would send a message at least to those who aren’t capable.

Glass houses, though. So many crooks, so little perspective. They are not going to police each other.

Portia:

“The Kid (Portia) nailed it!”

(“Margin Call”)

Because they almost All reside behind glass of the most impervious & tempered kind – hard for us lessor mortals to break That ceiling for restitution’s sake!

…. ESPECIALLY went it’s government agengies, and their revolving-door policies, at the ready to install those ‘strong ties’ .. to hold the Crooks together.

On the other hand, NOT rewarding bad behavior universally, is even worse than NOT rewarding bad behavior all around.

Because in addition to be bad behavior, it’s also bad behavior be used to create inequality and injustice.

‘When lenders write those loans off’

In the past that was mis-interpreted as that Consumers ‘paid’ their loan off!

What’s the balance of such loans on Bank’s balance sheet? Hidden by opacity by purpose!?

I remember an Arizona rancher who had open heart surgery. He told me the debt collectors seized his ranch to pay the hospital bills. Mesquite, palo verde and prickly pear is not rich ranch land.

The American health care system causes people to lose their home and life savings because they got sick or hurt. If you add all this into the cost of health care, it is even more expensive.

Wouldn’t it be prudent to wrap whatever one owns into a corporation so there is nothing in ones name to seize?

Better yet, incorporate yourself, so that there’s a corporate veil to be pierced by the debt collectors.

Anybody else reading the unemployment rate has been massively fraudulated…err I mean adjusted, to a lower number? Might should be around 20%?

Good start wood to bee,,,

Some of us who have been watching the statistics from BLS for decades know without doubt that anytime the real numbers do not coincide with the stories of the puppet politicians,,, the BLS numbers find some kind of different basis,,, bases,,, etc., etc…

Same as with the CPI; whenever it is not in accordance with the policies of the paid puppets of our masters, the basic rules and regulations of what is officially ”inflation” change to make it conform, while the clear theft/stealing of our wages continues.