Second half of March was the end of retail for many. But some had spiking sales. Brick & mortar department stores will never recover; they were toast before the lockdowns.

By Wolf Richter for WOLF STREET.

Retail sales in March were a doozie. As I pointed out with data on daily sales of new and used vehicles, early March was strong, as consumers were trying to front-run store closures. But then around March 12 sales began to collapse. But not at all stores: Some types of stores such as grocery stores, beverage stores, and general merchandise stores had a booming business. And ecommerce sales exploded. And we’ll go through by category.

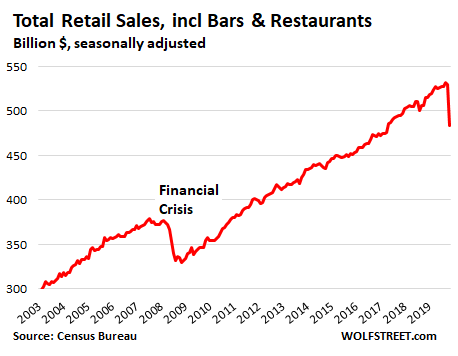

The stunningly good, the bad, and the incredibly ugly all averaged out: Total retail sales including at food services and drinking places fell 8.7% in March, from February, and 6.1% from a year ago, to $483 billion seasonally adjusted, the Census Bureau reported today. It was the lowest total since August 2017:

The mind-bending winners.

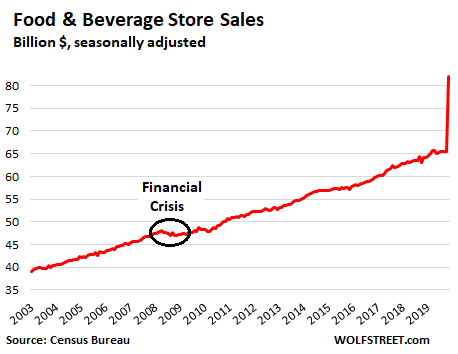

Sales at grocery stores and beverage stores soared by 28% from a year ago to $82 billion in March, seasonally adjusted. Grocery and beverage store sales have been proven “recession proof” – in the chart below, see that barely perceptible down-tick during the Financial Crisis – because people are going to eat, and when things get tough, they might self-medicate a little more with their favorite liquidity. And since then, grocery sales were largely spared the all-out attack of ecommerce.

But this was astonishing, triggered by a mix of panic buying and a shift from consumption to those stores, from restaurants, bars, schools, universities, mall food courts, company cafeterias, and the like. People were still eating and drinking, but they were buying those goodies at the store:

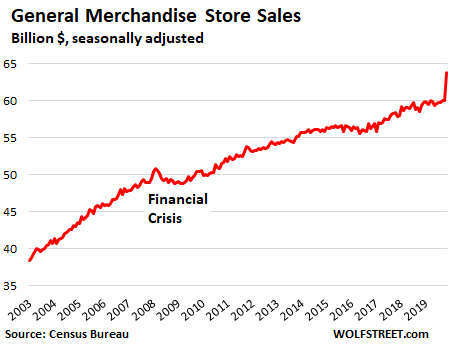

Sales at general merchandise stores jumped 6.7% in March compared to a year ago, to $64 billion. Walmart is in this category, but it’s also the largest grocery retailer in the US:

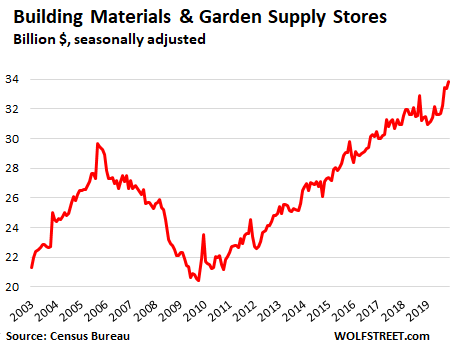

Sales at building materials and garden supply and equipment stores, which includes stores like Home Depot, ticked up 1% in March compared to February – a huge accomplishment these days – and rose 6.9% from March last year, to $33.8 billion, a record:

Stores where sales have collapsed

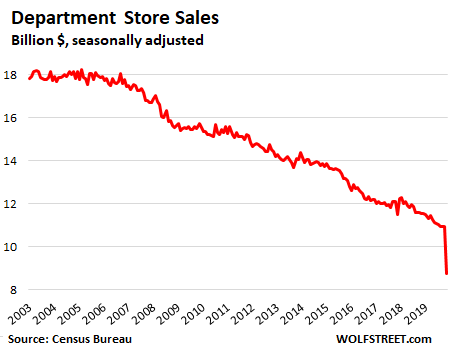

Brick-and-mortar sales at department stores collapsed further after two decades of decline. The once iconic category of department stores includes Sears and Bon Ton (both dismembered in bankruptcy court), JCPenney and Neiman Marcus (both considering a bankruptcy filing), and numerous local and regional department stores that are gone.

Nordstrom and Macy’s have vibrant and large ecommerce divisions. But their brick and mortar stores – and that’s what we’re talking about here – were in bad shape even before the lockdowns, and to survive, the companies may use this lockdown to close most of their stores and emerge as ecommerce retailers with just a few flagship locations.

Department store sales peaked in 2001 at $20 billion a month. Ecommerce started eating their lunch and sales declined. In the two decades before the shutdowns, department store sales plunged by 45% to $11 billion, despite inflation and population growth.

Then in March, sales collapsed an additional 24% year-over-year as most department stores shut down in the second half of the month. Brick-and-mortar department stores, as a concept, are dead, obviated by a structural shift in American shopping preferences:

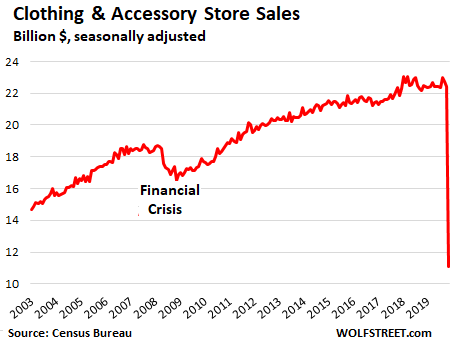

Sales at clothing & accessory stores — which had been essentially been flat for two years as ecommerce made inroads into that space — collapsed by 50% in March to $11 billion, the lowest since 1996:

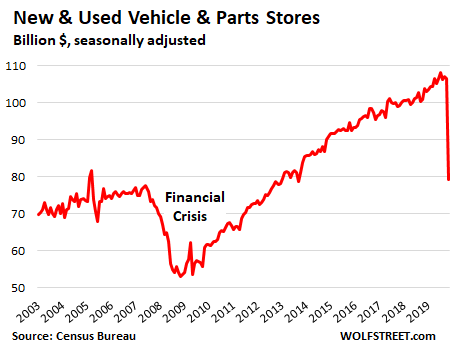

Sales at new & used vehicle dealers and at parts stores plunged in the second half of March, but had been strong through March 12, according to daily sales estimates that I reported a week ago. They started heading lower on March 13, and by April 5, the number of new vehicles sold had plummeted by 65.6% year-over-year, and the number of used vehicles sold had plummeted by 63.5%.

In terms of dollar-sales (not number of vehicles), all averaged out, the strong first half of March and the collapse in the second half, retail sales at new and used vehicle dealers and at parts stores, according to the Census Bureau today, plunged by 26% to $79 billion, the lowest since 2014:

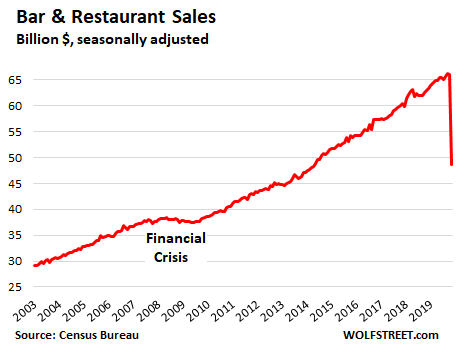

Sales at bars and restaurants collapsed in the second half of March, as lockdowns began cascading across the US. In most states, restaurants from fast-food to high-end dining can now only offer take-out and delivery options. Many sit-down restaurants are trying to get some revenues by offering take-out and delivery, and loyal customers are supporting them that way – but it’s not the same, neither for the restaurants (no alcohol sales) nor for the diners. Bars, which are mainly gathering places, have essentially no place to go.

Sales at these food services and drinking places in March plunged 23% from February and 26% from a year ago, to $48.6 billion:

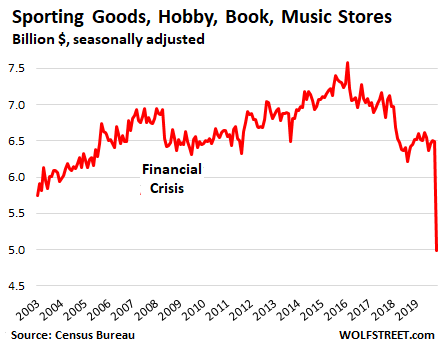

Sales at sporting goods, hobby, book and music stores, which before the lockdowns had already hit levels not seen since 2005 as much of this business has shifted to ecommerce, collapsed by another 23% year-over-year in March, to less than $5 billion:

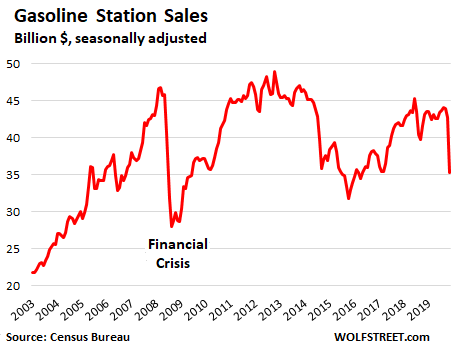

Sales at gas stations – this includes the other stuff that people buy at gas stations, such as junk food or cigarettes, where gas stations make their money – fell 18% in March year-over-year to $35 billion. But this business rises and falls with the very volatile prices of gasoline and diesel, and in 2015-2016, their prices collapsed, hence sales plunged, even as volume sales were maintained.

This time, prices are heading down, though they’re sticky and retail price declines take a while, and the volume of sales has collapsed as commuters drive less. So the decline we’re looking at today is just the first move lower:

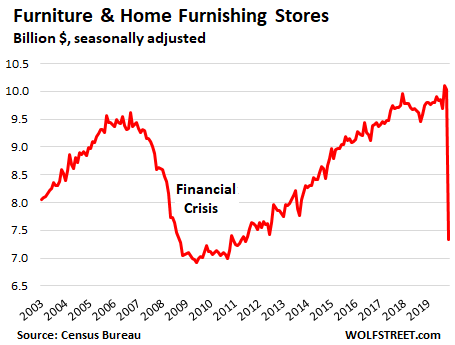

Sales at furniture and home furnishing stores – which had plunged during the Financial Crisis and then spent the next decade trying to reclaim the ground and finally set new highs starting in late 2017 – collapsed from one month to the next by 27% to $7 billion in March, a level first seen in 1999. Much of this business has wandered off to ecommerce, where you can find everything in every color and size, and get it delivered to your door (“minor” assembly required):

Ecommerce sales are reported only quarterly by the Census Bureau. On a monthly basis, it reports sales by “non-store retailers,” which has some overlap with ecommerce, but also includes fading retail categories such as TV shopping channels, door-to-door sales, and mail-order houses that didn’t make the transition to ecommerce. So “non-store retailers” is not a good stand-in for ecommerce. To get a feel for the boom in ecommerce during the lockdowns, we will have to wait till May 19 when first-quarter ecommerce sales will be released.

There is no chance that this collapse in some sectors, and the boom in ecommerce, will not alter the retail scene permanently, shifting around winners and losers.

In the era of ecommerce, malls have largely outlived their usefulness. This is now becoming clearer as they’re shut down and people are figuring out that they can buy whatever they want, and more easily and often for less, without leaving their home.

Grocery-store sales will remain elevated as long as restaurants and schools remain closed, even as panic buying has ended. But some grocery store sales have migrated to ecommerce during the shutdown, and this trend will continue to eat into brick-and-mortar supermarkets and will become more apparent after restaurants and schools start serving food again.

“There has been a clear divide between winners and losers.” Read… From Panic-Buying to Lockdowns of Eateries & Manufacturing: Truckers, Railroads Face Supply Chain Turmoil, Spikes & Plunges

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Consumers are sick.

Hence deflation, cheap gold.

Long-Term Care involves much more than a vaccine

from Bill Gates and/or a new car loan from the Fed.

“Hence deflation, cheap gold”

meaning what ? could you explain more ?

Thank you

Deflation will take gold down along with all other assets.

Jdog:

The value of gold rarely changes. It is pretty constant.

It is the value of the Federal reserve note that changes!

Curious how much % of the cost of mining gold is for the energy (petroleum) used?

Maybe but down ALOT less than all other assets

Google “ Gold in the Great Depression” and educate yourself doggie

Gold’s @ alltime highs in usd. May need to re-examine your theory.

Yeah. Gold going down while we run a $6T deficit this year. Are you Harry Dent?

@Heff No, gold spot is not at an all time high in USD. It needs to go up more that $190/toz to match the current all time high ($1917/toz Aug 2011). BTW, that number is not inflation adjusted either.

https://money.cnn.com/2011/08/22/markets/gold_prices/index.htm

“NewDewey” replied ( to me ):

> > Consumers are sick.

> > Hence deflation, cheap gold.

>

> Meaning what ? could you explain more ?

The price of copper, silver and oil

are low and falling.

Why should gold be any different ?

Rich people are fine, obviously;

but poor people have been suffering for years,

ever since the Fed tried to raise rates.

Obviously, no vaccine will solve this problem;

nor will more car loans help.

Today’s “Hoovervilles” ( tent cities ) are far

worse than anything seen in the 1930’s.

Mental illnesses are increasing,

along with illicit drug usage.

Solve this problem, via long term care,

and homelessness and wealth inequality

won’t be so intolerable.

Thank you for the answer Jeff

Malls and department stores finished? Not so fast! They will need to get creative and innovative but there will likely be prosperous times ahead for those who do so.

Rand Passmore,

People have been saying that for 20 years, and for 20 years, sales at department stores have declined and declined and declined to where they’re now irrelevant, and chains have closed thousands of stores.

Look at the chart of department store sales in the article above. Sales peaked in 2001 and have since collapsed. I implore you, look at the chart!

You can convert the stores into roller-coasters maybe to do something with that space. But the concept of department stores is dead. There is a whole generation of young people that has never been inside one. Why should they? They can get all this stuff online, for less, have unlimited choice, get it delivered to the door, and don’t have to waste time going to the store only to not find what they’re looking for.

Department stores have become illogical for most American consumers, and you can see that in the chart above.

“They will need to get creative and innovative but there will likely be prosperous times ahead for those who do so.”

Creative as in topless donut shops? Sorry, but there will have to be at least several in each shopping center for this to turn around.

I agree but their business model, large space, high volume, and the mass produced products they offer, have worked against them. There will be opportunities soon in the new retail.

Rand Passmore

Now would be a good time for you to study up on the concept of “Greater Fool”

Wolf’s next mug should read, “I implore you. Look at the chart!” :)

“Nothing goes to heck in a straight line, until it does.”

I think that’s a fitting melange of two of wolfs popular / favorite phrases.

Deflation? What happens when people all flock to stores buying (with handed out money) the same few categories of goods, such as food and essentials?

you mean like, toilet paper?

The inflation is showing up in food prices. I haven’t seen any clorox/lysol wipes in a while. I wonder what the price of those will be once they get restocked on the shelves?

Cheap gold is oximoron. Gold is worth its weitght in $50 dollar bills, give or take couple of pennies.

Amazon dot com is worth 20,000 metric tonnes of gold, 8 years of world’s gold production, give or take a tonne.

Long term Amazon puts, priceless :-]

Cheap gold?

Not as long as ‘money printer continues to go brrrrr’ there won’t be, for reasons which are fairly obvious.

And personally I believe the global structural economic problems we have now, due to a failed system, means that money printing will never cease.

Dogmatically sticking to the line that ‘deflation is bad for gold’ in these totally unprecedented economic times is ridiculous TBH.

Gold was a lot cheaper when I bought it…so yes cheap gold….

In many (most?) places, food sales in grocery stores are not subject to sales tax. So, what happens when state & local governments can’t make payroll?

Good question Nate,

We could hope those 37 state guv mints that do not tax food, would actually let some of their ”appointed” employees get a real job, and maybe even figure out how to get rid of some of the elected employees as well, instead of living off the labor of others, eh?

Unfortunately, if that were to happen, it would more likely be the workers who actually work to take care of our roads, bridges, parks, etc., (rather than the super types who hang out at the bosses rear end,) who would get the ax.

The longer term question is what is going to happen to all the pension plans for all the state and local guv mint workers.

Maybe Wolf could give us another set of his excellent charts and information about the various state plans apparently under huge distress even before the arrival of the boomer remover?

That would be rather a revealing post …

Meister Wolf ! , what say you ?

Our county, in their ultimate un-wisdom ..has determined that a 60-day 1st payment tax deferral would be predicated on the taxpayer initiating the deferral, rather than a blanket county-wide freeze.

Typical County Attitude : Pay up ! you mofo plebs. MAKE US WHOLE !

Any delay is a good one if you are your way out of the state to move to another:

There’s a sad sort of clanging from the clock in the hall

And the bells in the steeple too

And up in the nursery an absurd little bird

Is popping out to say “cuckoo”

Cuckoo, cuckoo

Regretfully they tell us Cuckoo, cuckoo

But firmly they compel us Cuckoo, cuckoo

To say goodbye

Cuckoo!

To you

So long, farewell, auf Wiedersehen, good night

I hate to go and leave this pretty sight

So long, farewell, auf Wiedersehen, adieu

Adieu, adieu, to yieu and yieu and yieu

So long, farewell, au revoir, auf wiedersehen

I’d like to stay and taste my first champagne

So long, farewell, auf…

States could issue Disney’s. Would even work but would kill the US dollar

A government shutdown. They’ll just get the Fed to bail them out. Jerome can pretty much scoop water out of sinking boats as fast as he wants to. If he’s buying debt though, does the water ever have to back in the boat…? Hmm

I think Fed’s undoing will start once they purchase munies.

How do they decide which munies to buy?

Unless they buy everything, I can see lawsuits coming from those left out. It will get ugly.

If the Fed buys munies, then all municipalities will just default on their bonds, because they know the Fed will backstop them. Where will it stop?

Uhm, you do know that has begun?

The Fed could also give the munies money directly or is that an idea that does not make sense in America.

grumble, grumble, weird place, grumble, grumble.

The states make a deal with the Trump administration to end the lockdowns, piecemeal perhaps, in return for some big $$, as in an average of ~$10 bil per state.

Pogo:

That seems to be the blue east and west coast State’s plan!

Shutdown the economy (major ports) until ransom paid!

“Never let a good crisis go to waste”

You could keep the economy “open” but there are no patrons to serve. Keeping it open will clients don’t show up will kill the economy faster than a lock down. The economy will only return when the sickness is gone (locally) and the fastest way to do that is with a lock down

Saw yesterday that Illinois will be $4 billion more in the hole because of all of this. Or $7 billion without the proposed progressive tax on the nov ballot. I see nothing but tax inreases on the horizon here. Or maybe a bailout (depending who wins the WH in nov). Or maybe both?

When they can.t make payroll the fed will have to print more.

I wonder when the fed monitizes and when the value of the

buck collapses.Maybe never.

“maybe never”

Face masks went from $1 to $7 pretty damn quick.

G fraud does not repeal supply and demand.

1. They will try and raise taxes.

Fortunately in California, new taxes require 2/3rds voter approval.

2. They will raise “fees” for public services, where possible.

3. They will start to layoff people and or reduce their salaries.

Can’t wait for 3. The overpaid and mostly useless people in county and special district government deserve to go.

Here’s an outrageous example. Golden Gate Bridge board of directors. Look at these salaries! Except for public safety, the bus drivers and maintenance of the bridge, what do we get for our money?

Why can’t the State of California run this bridge, paid for half a century ago and thereby supposedly toll free?

https://transparentcalifornia.com/salaries/2016/golden-gate-bridge-highway-and-transportation-district/

Another one. A land development scheme with a lightly used rail system that stole most of its riders from previous bus lines that were eliminated.

https://transparentcalifornia.com/salaries/2016/sonoma-marin-area-rail-transit-district/

Another example, here’s an energy reseller. What do they do for their money? What value do we taxpayers get?

https://www.mcecleanenergy.org/our-team/

They raise taxes….

“In many (most?) places, food sales in grocery stores are not subject to sales tax.”

They will start to tax the “bad” foods first. Then eventually it will be determined mostly everything is bad for you except wheat and organic produce. Those are the only foods that may never get taxed.

Don’t worry, the Fed will back up the state and local gov bonds. They can just issue more to the almighty fed in the sky.

Surreal graphs these days. I think the beer mug adage needs “until 2020” appended to it.

I definitely have to revise the WOLF STREET dictum on the beer mugs. “Nothing Goes to Heck in a Straight Line” has been obviated by events :-]

For those who haven’t seen the mugs yet, here they are:

https://www.wolfstreetstore.com/wolf_street_store/shop/home

OK, I finally just ordered the originals, so now I am ok with you changing the motto!

As with others posting here, I am only going straight home from necessary shopping the last six weeks or so, and am saving up for the BIG night out at my fave restaurant — in other words, not spending as much as usual.

{{”The Day/week/? the Lines Went Straight to Heck” ?? (Month?}}

Re the news above, IMO the best grocery B&M stores will be fine, right back onto their usual results, perhaps with a loyalty bump for those who are doing concierge services these days, a serious benefit for some of us older and more frail and fearful folks.

Some of the others may be gone after this, but there have been many closings and consolidations in the last few decades, well before this virus event. I was surprised to learn a few years back that various former competitors in CA are now owned by the same folks who own Safeway, similar to my surprise at finding out the owners of TJs, etc… Surely more condensing to come.

Not sure we’ve found the bottom on the path to heck, yet. So it might not be a straight line. Recommend selling out the inventory before ordering up a new motto!

BTW, in a couple of years it’ll be time for a few classic books on the current historical events – sort of like the “Great Crash” book by J.K. Galbraith, or the “Hard Times” Depression book by Studs Terkel (IIRC). These graphs would be fantastic for showing how it felt to live through it in real time.

Also, Madam Secretary by George Martin.

Can I order one that’s made out of ‘cracked’ glass ?? … that leaks fiat copiously ..to go with this broken economy many of us currently experiencing.. ( well, I mean for most of us near assetless Lilyputians .. ) .. not those on the 90-.01% receiving-end of the Big $$$ bazookas … ?

I’ll even settle for a crackle glass mug .. with a holographic silver dime on the bottom .. as I drink from an empty vessel !

‘;]

The mugs I have appear to have an invisible hole at the bottom out of which drains invisibly the liquidity that I just put into the mug. The most annoying phenomenon. After a relatively short time, the mug is empty. It’s like the liquidity goes in and just disappears.

I was just getting ready to start lobbying or another Wolf Street event in SF.

I live in FL and missed he first one…doesn’t mean we can’t dream

Can you believe I have never been in San Francisco? Even when I lived in San Diego I never ventured further than Los Angeles, and even then just to buy musical equipment.

It would be a good occasion to visit the Bay Area… provided we are ever allowed out of the house and provided civil aviation isn’t sent back eighty years.

Peak Stuff.

Even before C19, we were just rushing home to watch TV.

Now, we cannot get out to see what the Jones’ just got. So, yeah, I’m in for popcorn tonight. Oh, when you call the grocery store, have them also put in some chips, salsa and queso in case things get spicy. No, the stuff from Texas, not the one’s packaged in NY. Oh, the boy just called. He’s having drinks downtown somewhere. He wants you to shoot him $100 bucks on his phone. Says he’ll pay you Tuesday. He said he’s just gonna drink with his friends on Zoom next time. That mean anything to you?

Wolf,

For the next version of your mugs could you please set a price then adjust it continually based upon the inflation or (inflation) reflected in the CPI?

I’m hoping that by this time next year they’ll be half price and I can purchase two so I won’t have to cry into my beer alone.

Respectfully.

”HollywoodDog

Apr 16, 2020 at 11:10 am

Wolf’s next mug should read, “I implore you. Look at the chart!” :)”

This my fave, so far: correlates well with, “When everything else fails, read the directions.” One of the phrases my dad teased me with most of our life together… use it myself once or twice…

Vintage Vet : How about this one you’re probably familiar with:

” If you can keep your wits about you while all those around you are losing theirs, chances are you don’t have a true grasp of the situation.”

Maybe the mug should say: Nothing goes to heck in a strait line until it does.

Vertical chart lines… a new normal?

Most straight lines ever in a single WolfStreet article!

They’re cliff hangers for sure ..

Good summation, Wolf. You’re winners and losers breakdown in brick and mortar seems about as accurate as can be predicted at this time. Since we have 3 times the square footage vs most other countries devoted to retailing (according to retail analyst Howard Davidovich) it could be quite a bloodbath. One thing for sure, advertising budgets will be a big loser with the possible exception of television.

I have noticed that some sites that I go to that would typically have a few “pages” of a grid of advertisements at the end of the page now have the same number of ads but they are all the same ad over and over again — for life insurance.

At first I was going to say that maybe SkyNet was sending you a clue… But then I realized that Life Insurers are probably getting financially hammered too, with mortality rates starting to run well above normal levels, and investment portfolios being crushed on the other side of. the balance sheet… so perhaps they need all the fresh revenue they can muster.

Wisdom:

You are the first to mention life insurance companies and the coronavirus, that I have seen!

I would imagine they are busy trying to “invalidate” as many claims as possible!

On second thought, if they have annuities as a second line of business, maybe the finances balance out. For every life insurance payout, there could be one less stream of annuity payments being required in the other book…

It’s really sad that we now live in a world where this macabre logic even comes to mind!

Life insurance companies should be coming out like bandits but their shares are down. I am referring to annuities.

In Canada the mortality rates for those over 60 is 90%!!

On the other hand they have a lot of market exposure with their floats which explains the down part.

To get rid of life insurance ads, get some suicide prevention cookies on your computer before you come on this site.

Interesting, start a site that sells ‘prevention cookies’. Sort of like paying premium for no-commercial television.

Endeavor,

Yep, the biggest problem is too much retail space/stores, survival of the fittest, who will then go head to head with Amazon or the then biggest online stores. Personally, I’d place my bets on Wal-Mart, Target, TJ Maxx, home improvement stores like Menards and the big box stores like Costco. B&M for the win.

TJ Maxx and Costco could get beaten by similar, but, better new competition.

As for advertising budgets, will have to see Wal-Mart and McDonald’s advertise a lot despite everyone knowing they exist, this could continue, most magazines probably going to go out of business, eventually, cable/satellite tv is being slowly replaced with streaming services, who are mostly ad-free, alot of online websites are already on their way out. But, new ad supported streaming services are popping up, so could go either way.

I love Menards, but it has an almost zero online presence. Weird.

TV had the advantage that it cost a lot so if you saw an advert you knew they were a “serious” company. With streaming it is all targeted and making a nice looking advert is can be done with an iphone* so being a “serious” company is not obvious for viewers of a streamed advert and as such does adverts are much less valuable.

*Almost true

You got that Exactly right Char,,, and even worse is that the amazing place does no checking on the ads and descriptions of what is sold, or very little,,, so it really is back to the ”caveat emptor” days of yore where that pig in the poke is just as or more likely to be a polecat than a pig.

That is the main reason, though clearly not the only one, why I do not think B&M stores are all going to HECK. I have seen many smaller stores competing successfully with WM and amaze place, mostly, I grant, on the type of ‘hands on’ service(s) not even possible with Ecoms, but also due to expertise of small store personnel usually well beyond any big box as well.

This is partly true for TV,

But, considering that for years infomercials aired on tv, with that guy who claimed that the fda was hiding the cures for every single disease, but, his book has all the cures. That ad was on comedy Central for at least something like 5 years.

Also that bidding site bee something and many other bidding sites are a scam.

There is zero quality control for advertising on tv.

Also the daytime shows themselves like Oprah have “Dr. OZ” nuff said.

Fake news channels.

The history channel has a lot of aliens.

Tv has an unearned reputation for being even slightly trustworthy.

During 2008, online competition for departmental stores and clothing was low. Now in 2020, even without the virus the B&M were struggling. Like animals, we are habit based. If we avoid restaurants and stores for a few months, habits will be formed, cooking and used to old clothes. Oh the horror!

Gasoline is very cheap now, but stay-at-home order and teleworking means, I filled my gas a month ago.

There’s only one solution. Take the jobs back and embrace wage increases. Don’t vote for any politician selling anything other than jobs.

No jobs to take back. Sadly you don’t get that.

He’s right. This crash will obliterate a lot of IT spending, and automated solutions. Just in time inventory management is out the window. A lot of people on the phone, what have you got, what do you need? I will send a driver right away. Really makes you nostalgic.

I live in rural MA. I expect to see a rise in bartering by us regular folk. I figured some kind of disaster was likely in my lifetime, as it has been almost a century since the Great Depression. We got chickens and learned how to grow our own food – pretty standard around here, and now priceless. I’d like to see jobs in climate-friendly infrastructure improvements. If the gov is going to flush money propping up corporations with pre-COVID declining earnings and artificial stock prices from buy-backs, let’s change that and at least get something for our money- a safer planet. Then maybe nature will not try as hard to purge us. That and investing in remote teaching set-ups for the next wave, next pandemic, next whatever. It’s interesting- seeds are more valuable than gold in a real sense, however, they are fugitive and require labor to perpetuate. Gold just sits there. I can see how it evolved into use as wealth storage, even if I find it a bit Yahoo in the Gulliver’s Travel’s sense. Maybe PPE is the new gold? An aside- I wonder how many rich folk have fled to their underground luxury bunkers, and who cleans their toilets.

OK, having a retail ‘Clothing & Accessory Store’ that’s brick and mortar is tough enough, but you gotta feel for Ronald W. Beattie who owns a nice little store in Brainerd, Minnesota.

“According to charges: Police received information on March 31 that his store, Risky Business, was open. An officer found two cars parked out front and the “Open” sign lit up. Then, a third vehicle pulled up.”

Risky Business is a lingerie and underwear store. Mr. Beattie, who was charged on April 9 with violating Goveror’s Walz’s stay-at-home order after police found his lingerie store open, maintains that, “his store was an essential business as a ‘general merchandise’ store,” the charges say.

Hell, if it’s your wedding anniversary, and you want to give your spouse some nice new lingerie to help celebrate the occasion, or get some to wear for your spouse, I’d say it’s essential. But for now, if it’s your anniversary, Brainerd, MN is not a good place to be for this type of shopping, eh?

For the judge that gets this case. A ‘Landmark Ruling’ is sure to ensue; probably based on ‘An Exploratory Evidentiary Hearing’ no doubt.

” police received information”…..good job comrades an extra potato in your soup.

Wife: You must buy me a lingerie as a present.

Husband: No shop open.

Wife: Risky business is still open. Do you want to or not want to buy for me?

Husband: (calls the cops)

.

.

.

Husband: See its closed honey, fake news….

Double plus if he was selling condoms … as accessories of course ..

Now tell me, how that can NOT be essential ! ..

the lingerie, I mean.

Citizens need to remember these incidents when it comes time to bonfire the government pensions.

“Risky Business is a lingerie”

He could have used the argument: many of my female customers resell used underwear. Sounds essential to me.

The virus is the last straw for B&M which just made the collapse arrive sooner. Also, I would say shipping from the warehouse to the customer is much cheaper than leasing prime retail property plus overhead.

But the monopoly is even greater for online sales. Anyone with their own manufactured product to sell must be owned by Amazon. Even then, you will likely be bumped off by a knock-off product from China pushed by Amazon. The internet is a great place to sell your own quality products but it’s almost infeasible with the power and craftiness of Amazon lurking.

Amazon was king in the B&M to Etail era. But we now live in the Etail era. No big growth anymore. Local government does not earn money from it nor will it provide local employment so will not support Etail. The need to show profit because the era of big growth is over. Competition is not B&M anymore but other Etailers. Those other Etailers don’t crap. Manufacturers don’t want to sell their products next to crap. They will choose Etailers who don’t sell (other manufacturers) crap. In short the golden age of Amazon the webstore is over.

ps. The glorious years of Cloud Amazon or Distribution Amazon have just started. Amazon the website/app is just the big face of Amazon but not that important. It is the distribution and cloud that are really big and will work for others.

So, what happens to Private Equity firms behind the retailers and malls? Probably too much to ask that these vultures choke on their carrion.

They’re all trying furiously to get some forgivable bailout money for their companies.

Black Rock got a sweet deal bailing out out its junk (busted) corporate bonds . They not only got dollar for dollar but a little extra since they will now been in charge of a fed hen house , good gig. Gotta be in the club or you’re SOL.

And so it goes. ?

I’ve seen enough “family tree” corporate org charts from private equity to figure that they must be grabbing all of the “small business” bailout money now.

For sure. Where there’s money left is in the real estate underneath all those malls that are going bankrupt. That’s where the rebuilding needs to start. Residential, with fiberoptic etc. etc. @ affordable prices. but that won’t happen, any resale after development will be over 300,000 for international market of the second and third generations of the super-wealthy entitled progeny. Surrounding slums will be for the indebted “Americans” caught in the net.

Given the sales crash for car dealers, does anyone know what kind of prices are available now, say at the end of April, in terms of discount percentage? I’m thinking of a Nissan Murano or a Ford Ranger, low end versions.

Don’t get your hopes up (at least, not yet):

https://jalopnik.com/dont-assume-car-dealers-might-be-desperate-to-give-you-1842617815

I haven’t seen super good deals (discounts) yet. So far, it’s just full price, financed for 84 months at 0% with possibly 3-6 months payments deferred and or comped.

You have to wait a little longer: right now dealerships in most areas can only sell the cars avilable “in the local network” due to lockdown orders, lack of shipping capacity etc. This means a limited pool of vehicles for sale.

But once lockdown orders are lifted (and in the US they will be lifted, if by executive order if needed) the market will be flooded with all those unsold cars now stuck in the manufacturers’ lots near factories, ports and logistic hubs. And if China is anything to go by, demand will pick up only slowly as people have other things on their minds while dealers and manufacturers will need the cashflow more than ever.

Dyno,

I looked at big 3 pick ups couple days ago on local, tpa bay, dealer websites: Did not see anything worth a second glance, just the usual ‘loss leader’ type of very basic stuff; however, last time I spoke with my fave sales guy, he mentioned they were not offering much ‘on line’ in the way of discounts, but that folks had to come in, sit down, and deal to get the good buys that were happening because too much time was being wasted trying to do so over the net.

This was in Feb, before widespread awareness of virus on it’s way here as is now the case. Last crash, it took 12-20 months for us to buy a couple of pick ups, first at about 30%, second 50% under MSRP.

Be patient if you can, but in any case, figure out your ”deal negotiating” plan/script with a partner if possible before going into the dealership.

Wolf may know a thing or two about what happens in the dealership ”closing” arenas.

I was actually going to mention this to Wolf, because I thought it was so odd. We bought a new (used) car last year. And a few days ago the salesman from the dealership emailed us & asked if were interested in “switching” cars because the owner was being “aggressive” with trade in values, & then linked a bunch of newer cars, for cheaper than we paid last year. ?

I assumed they were already seeing the downturn & desperate for some business but I can’t imagine turning in a car we just bought ?♀️

And I dont know why I never realized we could use emojis. My heart is filled. ???

?

Yes GirlInOC, just press windows key and period key together!

?

GirlInOC,

The entire industry is now dreading a collapse in new and used vehicle prices.

For the used market, there is a lot of supply coming down the pike from lease turn-ins and rental car companies. These are going to hit later this year, and there may not be many buyers. When those prices drop, this is a HUGE problem for leasing companies, rental car companies on their risk units, and automakers on program units where they guaranteed rental companies a price.

And when prices of 1-3-year-old used vehicles are dropping, they’re pulling down prices of new cars, at least in that range of models.

This is a real fear in the industry, and they’re trying to hold the line and not kick off this process. Once it starts, it turns into a self-feeding process until there is enough demand at these lower prices.

The thing that pulls in the other direction for now is that supply of new vehicles has essentially come to a halt (plants are shut down). So it’s unlikely that the new market will crater under a flood of supply, which was the case during the Financial Crisis.

Expect the trend to automation to increase. Machines do not get sick, and you do not have to stop production…

I read an article about a McDonalds employee who was working while having the virus. I wonder how many customers he infected.

I have been avoiding fast food drive thru’s, but I would probable feel more confident if the food prep was automated.

Of course this will be detrimental to jobs…

Virtually all automaton is good, the problem is politicians not working in the 99%’s interest. Since automaton picked up in the 70s i think, the work week should have been shrinking and vacation time growing. If that would have happened, we would also have a better more equitable and technology advanced and richer country. But, gotta focus on those quarterly profits, above long term.

Thomas:

You have this ass backwards!

MacDonald’s automated their restaurants in France way before they did in the US!

Okay, how does that go against, what I said?

As far as I heard, they were first being tested in new Zealand, despite anything McDonald’s says, they will try to save money, no matter what minimum wage is. They would try to automate jobs away, even if minimum wage was falling.

Almost all politicians in the world are extremely corrupt. France is no different. Over in frenchy land there is this guy, called macky boy, who is president “allegedly”, who dreams that he is similar to Napoleon, that gladly kowtows to the rich, at every chance.

They’ve been automated in Poland for years

Wall Street doesn’t seem very concerned about those graphs.

And why should it be? The Fed and Washington have made sure Wall Street has absolutely nothing to do with anything related to the economy.

This is what I am seeing as far as the stock market goes. Reminds me of the housing bubble back in the day, and even more like the dot com crash back in the day. For the past 10 years stocks have always gone up after any retrenchment.

Seems like you can’t lose, I remember people laughing us saying that housing could only go up. That worked until it didn’t and those who were in a cash position made out well. That is the way I see it, we won’t see capitulation for many months.

This is a global problem and will be with us for a long time, look to Russia, Brazil, India and the African continent for the next leg down. For stock prices to maintain, the global economy needs to grow, so many companies get profits from offshore sales. PE ratios are going to explode and eventually capitulation will come. The Fed can only do so much when businesses are unprofitable. See Japan/BOJ.

On the bright side, I’ve noticed a huge difference in air quality in my neighborhood near Seatttle. It actually smells like mountain air outside my front door now.

Wolf you must notice a huge difference in San Fran.

Bobber,

The soot on the window sill is mostly gone. We always have some windows open, and within two days, you can draw a line through the soot on the window sill. There is no industry between our place and Asia. Just a few miles of neighborhoods and parkland, and city streets that eventually turn into Doyle Drive, which leads to the GG Bridge, and the rest is the Pacific full of ships burning bunker fuel.

My theory is that the soot comes from the container ships, bulk carriers, and tankers out on the Pacific (the wind nearly always comes from the Pacific and blows this stuff in) and in the Bay as they pass by at a distance of less than one mile from our window on the way in, and about two miles on the way out. Bunker is terrible stuff to burn. We use two big HEPA filters inside to clean the air.

But recently, shipping traffic has thinned a lot, and visible soot has stopped settling on the window sill.

some soot comes from jets, and I assume flights are less there.

Most soot comes from within about 300 yards upwind, though with the bunker and JP types of fuel, it may very well be a lot farther.

Around here, we seem to get more when the wind is blowing from the interstate, in spite of it being about 0.6 miles, though the detritus from the various trees override everything else, especially when they are in their pollen mode.

Any trees west of you in SF these days Wolf? When I was a constant visitor to SF, the spray from the crashing surf at Ocean Beach when the wind was howling was always noticeable, especially at the Family Dog, though never a problem inside with its usual weedy prevailing atmosphere.

I was at our local nursery/garden center (No! Not the Depot or Wally world ..). It Was PACKED ! – with rather a few masked-up, I might add. After accessing the scene, polecat swiftly deployed all screens before commencing to shop. Most were keeping their distance from one another, however. But it was quite busy.

Polecat:

In Toronto, about 2/3rds are wearing masks, up sharply from 2 weeks ago.

I would too, in memory of Jacques Plante.

You can really get creative with masks these days. When in the past could you pull pantyhose over your head holding a coffee filter over your mouth and nose?

Wolfe:

You have lately been discovering too many vertical straight lines!

Do you have something against horizontal straight lines?

I’m staring to long for horizontal lines :-]

2 thoughts from a guy whose been under house arrest for a few weeks:

o Suggestion for beer mug slogan v2.0: things only go to heck in a straight line once a lifetime

o Suggestion for Wolf Street donation page: have a yes/no option for “get free beer mug with >$100 donation”.

Explanation: I already have 2 mugs, which of course I treasure, but I just donated $99.99 so I didn’t get a third mug. I’ll donate more when the slogan changes.

Javert Chip,

Thank you for your donation!!! Just saw that. And for making clear by a penny that you don’t want another mug. Other people do that (minus 1 penny) too. It works.

Also if you don’t include your address and phone number — which I’d need for shipping — I assume that you don’t want a mug.

I was at our local nursery/garden center (No! Not the Depot or Wally world ..). It Was PACKED ! – with rather a few masked-up, I might add. After accessing the scene, polecat swiftly deployed all screens before commencing to shop. Most were keeping their distance from one another, however. But it was quite busy.

Driving down our ‘mainstreet’ has been disconcerting – many businesses closed, with the exception an organic grocer and a few eateries .. which looked rather bare of clientele to me. It kinda had the ‘STAND’ like feel about it … just add Nick & Tommy, and your set !

You did a great job on AGNC. Since then it’s been all filler. Get back to the Federal Reseve and how the moneyey is disbursed.

I was propably wrong. I thought you were educating the public when you are really trying to educate the investers that want to gain the system.

Here’s a thought. As bad as those numbers look, it’s actually pretty good for most categories. The silver lining is that even with the shut downs, the sales have only dropped to mid 2010 levels, depending on the category you look at. Now, I may have missed it, but it’s hard to figure out the granularity of the X-axis, so, may be sales are much worse, but at least it ain’t zero.

But remember, the drops occurred in the second half of March. The first half was fairly strong. So the charts show the combined number for March. If you want to see daily sales of new and used vehicles, and how they plunged in the second half, check this out:

https://wolfstreet.com/2020/04/08/how-covid-19-lockdowns-impact-u-s-new-used-vehicle-sales-beyond-ugly/

Keep in mind the numbers do not take into account population growth or inflation. Since 2010 we have 20M (~6%) more people in the US and the dollar has lost about 18% of its buying power.

You mean gained 18% of value.

Huh??!!

BIMCO (Baltic and International Marine Council), the largest shipowners’ association in the world representing over 65% of freighter capacity, actually announced “the worst is yet to come”.

In particular they warned that while manufacturing capacity in China is now back to almost normal (automotive will likely remain depressed for months) “consumer sentiment in developed markets” is deteriorating and it’s likely to get worse as lockdowns are progressively lifted and consumers grapple with the new reality.

In particular BIMCO expects container traffic to decline around 10%, something unheard of that would make even the 2008 Financial Crisis look like a walk in the park and the predicted 20+% drop in US GDP in Q2 2020 a serious and scary possibility. And mercifully the US hasn’t shut down the economy at the same level as Italy and Spain whose predictions for a 6-7% GDP drop in 2020 are wholly based around a speedy end of the lockdown and an extremely strong recovery in the second half of the year. In short best case scenarios.

Finally a lighter note: as soon as an end to lockdowns is announced expect grocery sales to collapse and sales for threadmills, running shoes and miracle “fat burners” to shoot through the stratosphere. ;-)

MC01,

“…as soon as an end to lockdowns is announced expect grocery sales to collapse and sales for threadmills, running shoes and miracle “fat burners” to shoot through the stratosphere.”

Depends on where you are. In our lockdown here in California, and in the local lockdown in the Bay Area specifically, we are URGED to go outside and exercise — but maintaining safe distance to others. I have never seen so many people in the parks along the shore, walking and jogging and exercising.

It’s a good thing to urge people to go outside and excercise. It helps their spirits and makes them feel better, and makes the lockdown more endurable.

So here at least, I don’t expect a surge in sales of exercise equipment, but maybe of running shoes to replace the ones that were worn out.

California, especially south is a “mecca of bodybuilding and sports”. Mild weather, Hollywood inspiration and so on. Every one gets tons of inspiration to stay healthy and look good. In mid-west and other places not much.

One thing I want to add is, (a sad situation), lot of men are posting their equipment for sale in Craigslist and check them out before you buy online. Shoes and athletic wear are better purchased new in stores.

May be one reason the virus hasn’t hit CA as hard as NY. We “exercise” our demons. :)

Same here. I’ve never seen so many people outside exercising. The trail I use was so packed I’m now avoiding it because it kept bottle-necking with people & there was no way to keep 6ft distancing.

When I told a German colleague all forms of outside exercise in Italy are not merely forbidden but actively punished (we had police helicopters looking for joggers and trail runners) he answered “Your government likes health crises: from the virus to diabetes and obesity”.

Sad but true.

As I stumble around Utah delivering packages, I am always faced with the question “where does it all come from and where does it all go?”

Whoopee, 10’s of billion lost into the ever expanding US black hole of debt.

I remember watching the movie the big short when the bank manager finally levels with Steve Eisman and admits that the banks derivative exposure is somewhere around 15 billion.

A 15 Billion loss, who cares?, The US government burns through 15 billion in one to two weeks tops.

You can write all the articles you want about the economic activity of the US, the EU, etc, it means nothing in comparison to the every increasing march of debt that the world continues to create.

Oh wait, lets all get hung up on terminology…

Deficit spending gets added to the debt. Debts can always be paid back so we should never label them as a loss.

The US alone currently loses around 50 billion a month and the pace of loses will continue to escalate. Softbank lost how much this year and it matters why?

In real life, a bank’s derivative exposure is in the trillions of dollars which explains all the asset purchases by the fed dating back to last year. The result is shown in the South Park episode called “Margaritaville” where Stan invests $100 in a money market account at the local bank, and its gone. They didn’t mention derivative exposure in the episode, but it aired months after the then latest recession started so most viewers likely got the reference that the bank was a “Too Big to Fail” and playing with money.

Do not think for a second that monetary value has lost all meaning. History is filled with monetary distortions that are rectified by crashes, revolutions and wars.

History may not repeat but it always rhymes.

I have a bad feeling we are going to rhyme like it is 1929.

A bit past nineteen twenty-nine

Rings ever in that memory of mine

Nineteen thirties, no piece of cake

All downhill, no parking brake

My local bike shop is doing record business. Lots more people riding bikes for recreation, and repairing old bikes out of storage. Combined with supply disruption out of China, they’re running out of bikes to sell.

If I remember right, someone else here — was it Dan Romig? — was saying the same thing about bike shops in Minneapolis.

On March 31, I commented: Minnesota Governor Tim Walz declared that bike shops are an essential business which may stay open. (but not lingerie shops)

My local shop, Grand Performance in St. Paul, is always busy this time of year. On my ride today, I’ll stop in and ask how sales are doing.

Please look into ladies lingerie, too.

“Business has been good. Sales are OK.” is the report from my friend and owner. His shop doesn’t carry much entry-level stuff from China; brands are: Basso, Bianchi, Orbea, Pinarello, Colnago, Scott, Wilier & Moots.

No trouble on getting inventory – yet. A few delays from Wilier, but that was probably because, “they weren’t on top of it (preparation for the endemic). Bianchi is OK.” He does expect to have some supply issues in a month or two.

His wife is from Fabriano, Italy (north of Rome & east-southeast of Florence), and he keeps a Wilier with Campagnolo at her parents’ villa, and they usually visit twice a year. “I love it, and I love riding over there! But, we’ll probably not go this year.”

No problem: under the new EU “Marshall Plan” we will start incentivating exports of some goods that so far have been reserved for our domestic consumption.

These include French, Italian and Spanish politicians who will immediately proceed to ban all forms of outdoor activity with a zeal unseen since the days of the Albigesian Crusade. This includes cycling!

If you purchase three or more of these amazing articles you will get a free (free!) sycophant to snitch on dog walkers, joggers and those pesky children playing ball.

And bulk purchases are always rewarded: buy fifty politicians and you get a free police helicopter to fly them to their vacation homes while you serfs are locked at home and, hear this, swoop in on unsuspecting joggers to show them how big and strong you are. Amazing!

We are glad to report that at the present we are massively overstocked with politicians so we will be able to satisfy all orders for a long time, no matter how long the lockdown they will impose on us.

Ah, yes, that’s an ‘OUT OF STOCK’ notice I’d truly love to see……

Hard lock down is better than wishy washy or no lock down. Economy will only restore when the disease is defeated. With a hard lock down it takes 2 months. With wishy washy 8 months and with no lock down only after herd immunity ( literal years). The Southern European politicians are correct in their action.

cough, cough… time will tell.

My friend’s bike shop in small town Ontario, Canada is also quite steady…

I had to warn him though to start beefing his security, especially with 50 new bikes on the floor once the lock down loosens!

Good day Wolfers

I will dip my toe into the fray here…..

when its all said and done, will you all go right back to buying everything from China or will there be a resurgence in american made goods to stock those B&M stores?

Or will the average guy be so broke he will demand the absolute cheapest thing he can find?

Just wonderin’

Gonna be both, at least in the short run diedell.

It will take time, likely in the 12 -24 months range at least, for some/many of the long time USA brands now manufacturing in China to return to domestic production. It has been a long time movement of many of our best tool manufacturers to move out, so the return cannot be reasonably expected to happen immediately.

There are a few of the long time top brands currently/still producing here; they are not ”cheap” in either sense, price or quality, and although, generally, similar quality made in Japan and/or Europe are equally costly – last time I looked, American made had a slight edge in price, as would be reasonable to expect.

It might take some of the stimulus money, apparently currently heading to pockets of politicians, hedgies, PE firms, etc., actually being used to expedite the very clearly critical manufacturing returning to USA; perhaps even the use of the war production authority, etc.

If no other good has come out of this pandemic, it has certainly made clear the need to reverse the long trend of degradation of the manufacturing capacities of USA!!

Just put in a my order to buy 2 Sofas made absolutely in USA or LA

I am tired of cheap chinese made furniture.

I avoid amazon like a plague if I can but do buy online from ebay or target etc

The internets say my house is worth more than ever.

The internets are smart. They are always right. They know how to make the Fed do it’s job which to make the stocks always to up.

timbers,

Put it on the market and sell it. That money, if and when you get it, is what your house is “worth,” not what the internet sez. Good luck!

1) It is hard work cutting hair all day.

2) I skipped paying $3K/m rent on my own hair salon in the Bronx.

3) I also skipped on my $2K/m apartment rent, because I can’t.

4) I worked all day to please my customers.

5) I do piece work and collect, including tips, $15/ per head, because there is a lot of competition nearby.

6) Since the virus shut my place, most of my customers shaved their heads.

7) To cover rents I need : (3,000 + 2,000):15 > 300/m customers.

8) to cover my car & insurance I have to cut 25/m pcs.

9) For food I have to cut 50 pcs.

10) There is no chance that I will see 400-500 customers in next few months.

11) To open or not.

12) There is no risk staying home and having few cans of beer to relax, covered by the gov.

Wow. Michael Engel is a true hairstylist market philosopher. Who would have guessed? I thought you were sitting pretty in Westchester County with Iamafan. Best of luck to you. I know someone who had to shut their salon down, too. Well, I guess maybe everyone knows someone.

Some ecommerce is really the old catalog stores with a website. I used to skoff at my elderly mom buying clothes on Blair, now I do it. Things fit and the quality is good. I also buy clothing from Amazon, but without the same level of confidence.

1) Vertigo from verticals.

2) You can put the money in, but can’t get it out.

3) The 401K is a semi closed-end fund.

4) Since 401K is almost closed, your vertigo is just noise.

5) The 401K semi closed-end fund will filter the noise.

6) What u get on the screen is just traders snow.

7) The price is always right and 401K will adjust.

8) Get your beer, stay away from idiots who predict the end

of the world, buy an AAPL per day, because there are too many idiots

in the world.

I’m a leading edge boomer. I’ve gotten to a point in life where I simply don’t feel like going out and “mingling”. About the only reason I go out regularly is grocery shopping and I dread it. I dread it less since I discovered the midnite to 3am time slot – in/out in 20 minutes. The only way Coronavirus has directly effected me is the grocery stores are no longer open 24 hours a day.

Let’s face it- social security isn’t a lot of money. But with my life style I find I can live on about 65% of it. Of course this would vary depending on the cost of living in your area. We might reason that since I’m a leading edge boomer the whole of the boomer generation is just starting to acquire my life style. Think of the impact this will have on the economy. I’m not saying retail sales are going to drop off a cliff due to the boomers like Wolf’s article is saying due to Covid-19. But it might cause a mild, consistent down trend.

My retirement nest egg is in an IRA. I haven’t even started to withdraw from it. Minimum required distribution at 70 1/2 was supposed to hit me this year but they changed the age to 72. It sounds like they don’t want me withdrawing my money from the markets. Which makes me think the government might be increasing the age year by year. Maybe doing away with it entirely.

I don’t understand what they mean by means testing social security but whatever it is I think it might have some nasty unintended consequences judging by my situation.

In short, a V recovery from Covid-19 is probably out the cards except if the right side of the V has a very low angle of ascent. So let’s all pray the V never gets that low in the first place.

Justin Bieber – Pray

I just can’t sleep tonight

Knowing that things ain’t right

It’s in the papers, it’s on the TV, it’s everywhere that I go

Children are crying, soldiers are dying, some people don’t have a home

But I know there’s sunshine behind that rain

I know there’s good times beyond that pain

Hey, can you tell me

How I can make a change?

I close my eyes and I can see a brighter day

I close my eyes and pray

I close my eyes and I can see a better day

I close my eyes and pray

Sales are down in many categories because the damn stores are closed!

It makes limited sense to compare y/y numbers when prior year sales include open stores and current numbers refer to closed stores.

That said, the numbers would be ugly even under normal conditions.

You may not think Y-O-Y sales comparisons are meaningful during the COVID lockdown, but store managers, workers, investors, and most customers are paying a lot of attention.

B&M sales are down for three reasons (listed in priority sequence):

1) People don’t like shopping at B&M. Period. That explains the huge secular shift to ecommerce; COVID-19 lockdown simply accelerates B&M store closing

2) 22 million people are out of work (with more to come); when the lockdown ends, only a fraction of B&M sales will recover (the rest will migrate to Ecommerce)

3) “non-essential” B&M stores are closed; some will never reopen