It’s not the drop that worries me, it’s the historic neck-breaking volatility.

By Wolf Richter for WOLF STREET:

It started out ugly Sunday night and ended uglier today. Sunday evening, stock futures plunged 5%, hit limit down, and trading was halted. Futures remained pinned at limit down without further trading. When stocks started trading in the morning during regular hours, the S&P 500 Index opened at 2,490, down -8.1%. This was below the limit down rule during regular hours where trading should stop for 15 minutes if the index drops 7%. But it had blown through this limit-down from the first moment.

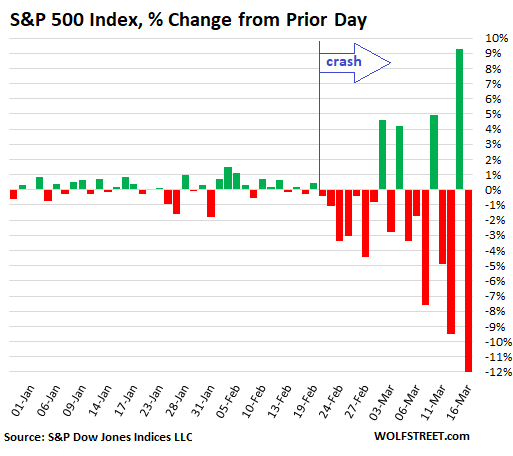

Trading was halted at the point. When trading resumed 15 minutes later, the S&P 500 index instantly fell to 2,412 (-11%) before it started moving higher. But the partial recovery, if you can call it that, only lasted about one-and-a-half hours, before stocks gave up their ghost, and the S&P 500 index broke through the 2,400 level, closing the day at 2,386 after a nasty drop-off at the end of the day. The index ended the day down 12%, the biggest ugliest one-day drop since Black Monday in October 1987:

The S&P 500 index has now plunged 29% in the 18 trading days since the peak in February 19 and is below where it had first been on March 1, 2017 – which was over three years ago. In other words, the S&P 500 unwound three years’ worth of gains in 18 trading days.

Another way of looking at this: Over the three years from March 1, 2017, through the peak on February 19, 2020 (3,386), the S&P 500 had gained a blistering 42%, all of which are now gone.

It’s not the drop that worries me, it’s the historic nerve-rattling Volatility.

What’s so concerning is not the 29% drop of the S&P 500; drops of this kind are sort of routine and part of larger crashes that recur every decade or so since the 1980s. The last two times, it led to sell-offs of over 50%. So that’s to be expected.

What’s concerning me – and what makes this such a dreadful harbinger – is the record-breaking, neck-breaking, nerve-rattling, immensely messy and chaotic volatility, the huge down-days followed periodically by a huge up-day, and the numbers are just gigantic and historic and mind-boggling, and they’re getting bigger.

Every one of the past six trading days was a move up or down between around 5% and 12%, including two moves over 9% followed by a 12% move back-to-back. This has never happened before:

Volatility is typical of crashes. During the Financial Crisis crash, the S&P 500 jumped by the double digits a couple of days as well. But these moves weren’t back-to-back like this. During the financial crisis, there was no single period of four days in a row of 2% or higher moves. Now we had six days of around 5% to 12% moves.

This worst drop since 1987 Black Monday occurred after the Fed’s emergency teleconference meeting on Sunday afternoon, when it decided to roll out another shock-and-awe program, after the shock-and-awe program it rolled out last Thursday. It cut rates to near 0% and threw $700 billion in QE on top of it, along with a series of other measures, along with over $1 trillion a week in repo cash.

This shows how record-scared the Fed is that its Everything Bubble that it so assiduously inflated over the past decade is coming unglued in just a matter of days.

Here is Fed Chair Jerome Powell’s reaction, upon seeing the 12% plunge in the stock market today, as envisioned by cartoonist Marco Ricolli, exclusively for WOLF STREET, because, folks, you gotta keep your sense of humor in these trying and crazy times:

The Dow Jones Industrial Average got beaten down even worse today, plunging by nearly 3,000 points, and losing 12.9%, to end the day at 20,188, down by 32% from its all-time high. I’ve started to dig through my junk drawers to locate my DOW 20,000 hat.

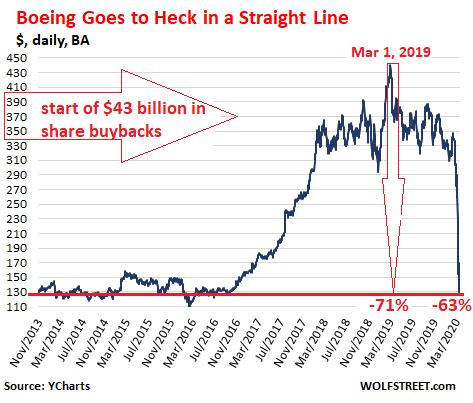

Dow component Boeing is in collapse mode. It is responsible for driving the DOW down faster than the broader S&P 500 Index. Boeing shares [BA] plunged 23.8% today, and are apparently willfully ignoring the dictum beautifully imprinted on our WOLF STREET beer mugs that “Nothing Goes to Heck in a Straight Line,” having plunged 63% over the past 18 trading days, and are back where they’d been in November 2013:

But don’t cry for Boeing shareholders: Boeing blew, wasted, and incinerated $43 billion on buying back its own shares to “unlock shareholder value” and “return value to shareholders,” or whatever Wall Street BS-nomenclature might have been used, starting in 2013, which is when the above chart begins. So you can see the effect of share buybacks, and what happened afterwards. And now, in its effort to survive this crisis, Boeing could use every penny of that $43 billion wasted on share buybacks. But it’s gone.

In terms of the economic data, this is just the beginning. There will be more of the same and worse. Read… First US Economic Data of the COVID-19 Era Emerges. It’s Ugly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Does anyone have any insight as to how low this can go as we work through the imminent recession? Are we looking at GFC lows?

About 1500 on the S&P 500 is the worst case. Have your dry powder ready for this one.

When I sold my 401k and taxable portfolio down to 5% equities (over the loud screaming of my financial advisor) last year at Dow 26000, I joked that I would get back in the market at 16000. Now, I am wondering if that would still be overvalued. And might be just a few days away!

Me thinks you lack imagination.

The worst case S&P 500 scenario is we test the dot.com or GFC lows.

If this virus does not stop as it warms up, watch out.

Advisor? You mean financialatute.

Gee..wonder why he was screaming? HAHAHAHA

Baypoor,

Yep, still overvalued. But, The market maybe would go higher than that for some amount of time “who knows”, very risky though. Overall, for decades companies have been promising their workers nice retirements, that both the company and workers barely funded “and the companies managing those pensions take enormous fees from”, but magically the stock market grew for decades faster than the actual economy to fund those pensions, even through massive outsourcing and gutting of companies. I really don’t even understand the argument that the stock market could be worth anything close to what it currently is. I think it should be valued at 1/5 to 1/3 of its current value “A very rough guess”. Of course the more well-off managed to buy most of the shares and to enrich themselves at the expense of the country they pushed for massive financial non-sense.

Ideally, the way stocks should be valued is based off of the predicted future profits of a company. Any profits that don’t get reinvested or saved are given to shareholders through dividends. Seems obvious I know. Depending on how long you are willing to wait to recoup your investment, would determine how much you would be willing to buy a particular stock.

If the established company Tinysoft has a stock whose individual share would yield $30 over the next 30 years “predicted” and I think that, I should recoup my investment within 30 years $30 is the most i should pay for that stock. Of course, it’s more complicated than that because some people might expect the company to do better than that or be willing to wait longer to recoup their investment and so the stock price could be higher than $30 for 1 share. And of course the risk and fees associated with buying stocks has to be counted in. As well as the fact the stock will hold future value after recouping it’s price.

This is my theory of how investing in a stock market should work “something like this”, instead we have things like index funds. Index funds “just buy a little of everything without thinking, because the stock market can only go up right?”

The actual value as everyone knows is based of how much it’s buying and selling for.

But Baypoor, i’m not a financial advisor, you gotta guess what to do for yourself. Just remember most stock markets are casino with very loose rules right now.

P.S. I wrote this in 10 minutes a new record for me to write something this long.

Did any economist or “financial advisor” ever see times like this coming? Other than the Chicken Little crowd who has been screaming about End Times since WWII, of course.

Very Amused – the virus is NOT stopped by warm weather.

The Philippines is very warm and it is spreading rapidly

Same goes for Bali.

I think we are looking at 1930’s lows.

The more i think about this crash the more I realize this is a big reset and in the true sense of the word. Do we need all this office space if we learn to work from home. Do we need all these retail and restaurants and gyms. Do we need all these airlines if we learn to only fly for truly essential travel. Do we need these hotels and convention centers and casinos. Do we need Boeing with all the extra planes we will have idle. Heck do we even need all these stocks and complex financial system. This is going to be a big reset for society and I would be careful of timing the bottom because the bottom may be zero. Not everyone will be able to get a bailout.

I know we will need some of these companies but even if I’m only 30% right it will be a huge reset for the economy.

Look at some of big stocks. They are only back to where they were a year ago e.g amzn, msft.

Actually there is no lower limit. 0 is a possibility when both parties are completely committed to printing every inch of value out of the USD and half the population is clamoring for even more socialist poverty than we already have. But I would guess SP500 at 1000 will be the most realistic low forecast.

And this excitement and concern over the stock market is ridiculous. It’s the bond/rate bubble ya’ll need to be watching. Hasn’t popped yet. Wake me up when 3 month libor is at 10%. And that could just be the start.

“half the population is clamoring for even more socialist poverty than we already have.”

Wrong The Ultra rich are making a fortune off their “socialism for the rich”. That’s the real core of US socialism – everybody else is literally on their own.

Winning

@Mark – every form of socialism in history (and its cousins like communism) are about controlling who gets to be rich and/or who gets to stay rich.

Socialism = riches and power for a few and socialist poverty for everyone else

deanSavers,

SP 500 PE ratio still at 18…when long term historical average is 15 (more or less peaked during this bubble at 25).

So far, it is just the air being let out of the ZIRP wealth effect bubble – no C19 earnings hits have shown up yet, when they do, the mkt will initially fall somewhat further…but then PEs will likely get weird and soar…probably because corp book/asset value will act as something of a floor…almost no matter how bad earnings get.

Cas127,

S&P 500 AVERAGE P/Es at 15…but what is the LOW P/E in a bear market? (sorry for the caps)

Typical P/Es at the bottom of a bear market… 7. (seven)

In the GFC the PE only dipped to 9.8 for a brief moment.

I got this from the Gundlach/Dimartino-Booth interview.

A long term P/E of 15 includes the bubbles. A healthy P/E is about 12.

Ben Graham had some pretty good advice for the average guy just run a 50% stock and 50% investment grade bond portfolio. If you want to try to time never go more than 75% in either asset as timing is very hard. Nothing wrong with going in 75% stocks at 1500 or 1800 if you aren’t too old but might not be the bottom

Ben Graham was very wise.

What happens to the guy who holds bonds and doesn’t get any of his money into the stock market after a 30% dip? Well, he faces the prospect of missing a big rally and is stuck with 0% return for the next 10 years as the market runs away from him.

You have to always hold some stocks, like Graham says.

This week, they could surprise the market with a coordinated stimulus effort, which in times of QE, would be pure money printing. Check out the return on stocks in Wiemar Republic, when they printed money.

If they do it in coordinated fashion, they don’t have to worry about currency rate fluctuation. In short, they’ll all do it, because its the only tool they have, and they’ll do it big. They’ll announce it after market hours and surprise everybody.

You mean the NOMINAL returns on stocks. Your actual purchasing power would be vastly impacted in the negative.

This happened Weimar & of late, Venezuela.

Also, most Folks don’t realize that in Weimar they reset Mortgages to the value of the old Mark to protect the Bankers & they did it multiple times.

It’s always the same- socialism for the elites and fuck you austerity for the masses.

Here is another theory out of finance. The value of the sp500 is only the dividends. You can’t sell shares or it diminishes dividend growth. Then use the dividend discount model.

Dividend on sp500 is $58. Nominal GDP growth is 4%, so that is the long term dividend growth rate. What is your required return? With zero interest rate world 6% is a pretty good number to use. Plug in the 3 variables into online calculator you get 1150. You want to make 10% on your money it’s got to fall way below that.

I’m shorting and continuing to leverage all the way down to DOW 3,000.

I’m a paramedic. There’s possibly no bottom to this market because there’s a non zero chance the global economy is about to undergo a forced change, permanently. Even if it doesnt, the length of time this will take to beat and the human as well as financial cost mean the panic will see some good companies die with bad ones just by being on the wrong side of opinion rather than whatever their reality is. . A crash is the complete takeover of fear in the market and I dont see it going away anytime soon. I pulled out of everything Feb 24th and until the vaccine is in place or some other definitive control we haven’t hit bottom. Dont shoot the messenger.

Will you allow a trade in credit on the mug if you do a edit on “nothing goes to heck in a straight line?

Small caps are down to 2016 low (2% dividend now, unless they start cutting).

Nasdaq has another 30% to shed just to catch up (no dividends in FANG).

Or small caps have to rally like 50%.

Made 10 times my money. A year salary in few weeks. Did lots of selling today. Keeping jan ’21, jun ’21, jan ’22 puts in popular “tech” stocks.

I am happy for you Andy. Do you also post when you lose money on a bad bet?

By the way if I knew more about exotic (to me) trading mechanisms I might have joined you. I also believed things were going down but all I did was the easy thing available to me, which was to get out of stocks before it all went down.

Perhaps I should learn about puts and things like that and incorporate them into my investing strategy.

I posted all my thinking here, concentration, acceleration, waiting for euphoria, even the day I bought most of these puts. Euphoria was confirmed when tesla went to 1K.

I bet you think I did not see this coming. I did not see how fast it would go, thus really long term options, otherwise I’d have 20 bagger with closer puts.

Watch and learn.

By the way andy the reason I asked was not to be rude. I genuinely would like to know if I’m only ever reading the upside on people’s investment strategies because if I am (and I am pretty sure that’s all I get to read) then I’m not going to be making very informed decisions if I let them sway me …

To test your theory try counting comments from people who lost money this year.

andy and Zantetsu,

While my short positions were in the red, I was being hounded and ridiculed here :-]

And there have been plenty of folks here who talked about how much they lost on a particular bet.

You must control risk if you want to be confident you are going to end up with financial assets. If you take too much risk you can go from rich to broke in a very short period of time.

How much of that Boeing $43 billion was borrowed?

I believe all of it.. Friends working at the Boeing plant in Everett, WA are figuring on being laid off. No date given but some bad news memos were passed around work.

Will Dennis Muilenburg give up his $60,000,000 bonus as a good will gesture?

Time for the DOJ for pursuit of criminal charges on the Max.

The layoffs at Insitu, Boeing’s subsidiary in White Salmon, WA, that makes the ScanEagle drone which identifies targets for the predator drones, began three or so months ago.

In my mind, volatility is purely a function of leverage, which explains the VIX.

how on earth do you spend 43 BILLION on buy backs, during the

“greatest BULL MARKET IN HISTORY”

complete c-suite malfeasance malpractice….

it is high time people go after elites

That question matters when you discuss debt levels of a healthy company. But now we’re talking about a company with a liquidity crisis, and possibly a solvency crisis, and at this point in time whether all of it was borrowed or only some of it was borrowed is irrelevant. What matters now is that Boeing doesn’t have the $43 billion.

Boeing could have designed 2 brand new planes from the ground up, from scratch for 43 billion dollars.

2 epic planes! maybe even 3!

instead they shit the bed by putting eps before customer life and limb and patched together a shitty plane with vaporware;

took out 43 Billion in loans just to buy back its own stock;

yes, jobs will be lost;

but those who are angry about that, should burn down the Boeing C suite and not look for a bailout.

no fcuking(sic) way.

Aircraft engineering is expensive, time consuming and risky (risk hard to hide). Financial engineering not so much.

Forget the stock buybacks.

So far “fixing” the MAX has cost Boeing something around $10 billion, and that’s without taking into account the penalties Boeing is paying to extremely angry customers (“we’ll have it fixed by October at latest”) and the huge discounts they are forced to give on list price to avoid losing orders and options.

$10 billion to fix a re-engined early 80’s design (itself based on a late 60’s one) are completely nuts, something beyond comprehension. It’s simply not worth it. The original estimate in April 2019 was $2-3 billion: more bizarro stuff from c-suites who ran the company into the ground.

I hope Boeing shareholders will now see the foolishness of their actions and demand those who destroy’d the company will be forced to commit ritual suicide. Plenty of kaishakunin candidates around.

the 60s designs were great, but boeing by the 80s was relying on software more than hardware….executive compensation is the root of the problem; corporations are feudal fiefdoms…

99.44% of the money goes to the C-suite…

twice, bush sent checks directly to people (not the unemployed though) averaging $800 dollars…

mitch mcconell needs to take that butttplug out his ass and start writing $2000 dollar checks directly to people, anyone with a SS# (including babies)…

hey btw, where are the red baiters now????????

where are the dogs crying SOCIALISM NOW??

make govmint small enough to be able to drown it in the bathtub I thought that was the war cry!!!!!

where the fuck is grover norquist now???

where the fuck is newt? (under the desk of the sole living koch brother at the Free America Git’ sum Institute)

….i thot so…

But it does have a nice board full of scapegoats. That’s gotta count for something right?

The only right thing to do at this point is for the entire board to step down…. but then that would leave Calhoun in control, and his hands aren’t clean either. Sure, he can blame DM and JM, but he was sitting on the board for at least some of that time.

He needs to go too… which would leave Boeing leaderless. I wonder when they’ll split the defense portion of Boeing’s business away from the commercial side.

We haven’t seen much news regarding how all of this is going to spill over to city and state pension funds. OUCH.

here come higher property taxes and/or reductions in services.

That’s what I want to know. My state pension fund is underfunded, like all of them, and if this keeps up they will run out of money in short order.

The Federal government is going to assume al state pension obligations as it printing program goes into overtime

I sure hope you’re right (about Fed Gov’t taking over State & Muni Pensions when they sink), but it’s likely to be, uh, politically “contentious”. The alternative will be default ( = collapse of government, then society). But “centrist” Dems are so afraid of being painted Red that they won’t propose it; worse, they’re likely to oppose it when Sanders & AOC bring it up.

Guys, what would happen if this cofid19 dies down with warm weather ?

Or what would happen if covid19 does not die down but the condition become worse for next few months..

I totally understand that the valuation of market was at bleeding edge before covid19 hit.

Even, if the valuation was not at bleeding edge, the hit from covid19 would have been pretty bad.

Also, wondering if there would be any impact on real estate as it has increased quite a lot in comparison with otherwages.

Mt friend with multple properties says covid19 won’t make any dent to real estate in California.

I think otherwise. but who knows.

I really really hope your friend is wrong on real estate, but who knows, maybe that’s the last “safe heaven” from a matter of perspective or at least for now. Also real estate prices move way slower than stock so perhaps that much needed 30-50% haircut in areas like LA, SF, SD, NY..etc are yet to come. Another question would also be, what will the Chinese and foreign owners do with all their parked real estate properties, if they all start selling, this can trigger something. If you ask Lawrence Yun though, he will probably tell you the market will have minor correction and demand will still be strong…

I think at this point the market is damaged beyond anything a mild case of the virus would fix. This market was priced to perfection. It is all about the debt. Now income streams have been trashed. The defaults are still on the horizon. No amount of wishing is going to fix this mess.

The settlement on the ETFs have to be a huge problem right now along with any margin left.. Next will be the junk and almost junk that sure won’t be let out at a couple of percent interest. Then of course will be the downgrades and then the defaults. But those probably won’t happen for a few months.

I suspect that the real estate market is going to go on hold.

People will not be able to sell now because no one is even allowed to go visit open houses and stuff. Buying will be supressed.

If people get laid off and can’t pay their mortgage, the response is going to be a demand for mortgage deferment and/or reduction, which I think the government is strongly going to encourage and/or enforce by decree.

So I think that basically the whole housing market is just going to mostly go into statis for a while.

I went on Zillow today and saw an almost livable 1500sq ft house in Palo alto for under 2.5 million, so there is definitely been downward movement.

It’s very simple problem to solve. Stock prices dictate housing prices in the Bay Area.

No one will buy these houses If they don’t have the stock valuations they needed to put a $600k down payment.

Ha yes I am seeing all the “almost liveable” ones as well. So far they are all in bad locations (right next to Oregon, Alma or other busy roads). Hopefully the continue to drop but more than the stock market is probably the employment. Without layoffs I suspect the prices won’t fall too hard.

This is what my friend is saying: Prices would stagnant but won’t go down as real estate is special.

Especially because, how are you going to sell your house without the ability to easily move somewhere else? Who would sell their house now expecting to live in a hotel for a few months while preparing their new house or whatever? Who is going to want to go through the hassle of moving now with all of the problems associated with free movement?

I tell you now: real estate is going into lock down. Nothing is going to move. Real estate brokers are going to have a tough time with no sales happening.

Real estate was also special in 2005.

Nonsense. Here in the Bay Area so many dual income families are mortgaged to the hilt. One loses a job, still have equity in the house but cannot pay mortgage….

As I said Baypoor, they will just ask for mortgage partial forgiveness or deferral and they will get it in the current situation/climate. If this whole thing goes more than 2 or 3 months then maybe it will all fall apart but I highly doubt it will.

‘Buy now, or the Ferry Man will price you out Forever’

I couldn’t help it … honest !

New username, socaljim?

Housing is going to suffer. No more unicorn stock money for down-payments. Demand will be crushed.

My guess ( I’m a Real Estate Broker in Sonoma County) is a 50% drop in transactions and a 25% drop in the Median price by the end of June 2021.

I’ve been pretty lucky in my guesses over the years, but take it for what it is, a guess.

As a commercial real estate appraiser my guess is prices will drop by 40-50%. Our values are already down 10% just from 3 weeks of coronavirus. Wait until the data actually starts coming out. This is more brutal than any prior downturn.

IMHO, watching this market since 1956, RE will divide into two very different situations: Residential, especially SFR will take a hit of between 25 and 50, depending on location, maybe even hitting 75 down in really out of the way small towns, etc.; ( neighbor was buying $30-40K houses at courthouse steps for $2-$3K in 2009-10, fixing another $K or 3, then selling or renting with re-fi to continue. )

Commercial likely to hit at least 50 down fairly quickly, 12-18 months, almost everywhere, even Bay area & SoCal before starting back up… It was already started in 17 in SoCal as Asian money stopped flowing into new and remodel projects.

I tried to get company I was estimating for in 17-early 19 to get into the Fed arena, but they had no experience and wouldn’t/didn’t, similar to when all but the fed market disappeared in 09, and the feds went to ”best value to guv” as they were the only game in town, and knew it.

I was a Realtor in CT during the Eighties and early Nineties. Home prices started to drop in Feb. 1988. They dropped 50% in many towns and cities in CT. They did not return to the Jan. 1988 level for ten years. Ten F’ing years! I left real estate because I had sold a home to everybody I knew or was related to. Most ended up upside down in their mortgage. I was in that crowd. When I got divorced I ran the Financial Trifecta-divorce, bankruptcy, and foreclosure.

I survived almost 30 years ago. People will learn that they can, too.

I am now comfortably retired and watching the show from 7000 miles away.

Wow Roddy, I had always thought I was the only one!!

Same deal as you, then and now, very happily re-married, comfortably re-tired too, maybe ex-pired with this damn virus, though a little closer, 2500 miles, to where my ”trifecta” happened…

I can see, and have heard direct from family and friends how crazy panicked folks are, even the younger ones who are apparently ignoring this, but the fact is that around 99% will survive, some actually to do better, be a bit or a lot more careful with their wealth maintenance.

Real estate in the expensive parts of the country like CA is going to dive. Many millennials are paying a high % of their income as rent.This is just as irrational as the stupidity of the tech stocks 1 month ago

Thanks all the experts for your comments !

I wanted to buy a home.. I mil usd is my budget but I dont see decent homes in my budget and I am now not so sure about the things around including my own job..

I am cash loaded but lost some money in recent events ..

Wait a while, 6-18 months, while watching the location you want to live in carefully, as is so easy on various websites these days.

Keep your cash as liquid/ready as you feel safe to do and pounce quickly once you are convinced.

Pay entirely in cash! Cash will talk very loudly for some time going forward, as will the ability to close quickly.

We did this exact scenario, a bit late where we needed to move to take care of very elderly parents, in 15, (prices had close to doubled already from the lows of 11-13 ) and although it had almost tripled since, in ”market value” a couple months ago, the house will likely go back to at least where we started, maybe revert to the lows of the last crash.

Well, after all that heaping expired cordwood* is removed, there’ll be PLENTY of inventory …

* assuming this really IS a pandemic of major lethality ..

I wonder about all the properties that were bought up to be used as vacation rentals on AirBnb, etc. If owners are leveraged to the hilt , and with a collapse in travel, things probably aren’t looking so good. Might be interesting…

Dear Ripp,

As an Englishman, I’ll go past my usual understatement and say it may be, very interesting….

That is… not something I’d thought about. Going by the number of “investment properties” in my area, I wonder….

Boeing downgraded to what, BBB?

Baa1.

Powell and the FOMC will buy all the corporate bonds teetering on the Powell proverbial BBB cliff.

At least that what the bulls hope for, despite Powell saying last night that there weren’t interested in buying anything other than Treasury and Agencies, and that they also aren’t legally authorized to do so…

They cannot buy corporate bonds. Please educate thyself

LOL.

Review section 13(b) of the Federal Reserve Act.

https://www.minneapolisfed.org/article/2002/lender-of-more-than-last-resort

New Rating group:

BA-0

Suppose you are a pension fund manager and you have to pay retirees. If you sell your high coupon yielding bonds to the Fed’s QE program, where would you get any yield in the future when yields are almost zero today.

Those who sell are usually forced to liquidate.

Wonder why we haven’t heard pushbacks to the Fed QE and lowered Fed funds from funds.

I was asking myself that same question yesterday when the FED made the announcement!

Covid will solve the pension manager problem.

Either by stealth, or by force.

truth is even 737 maxs flying into the ground couldn’t stop the BS surge from $130 to $440 a share. “that” was insanity. . .now we get (maybe) honest price discovery thanks to a pandemic that brings us all back to earth.

we don’t live in a perfect world. i think the world (and especially) wall street forgot that point.

. . .and don’t get me started on the stupidity of the fed, who pretty much created the debt quagmire we are in up to our ears.

That’s about the most intelligent thing I’ve read on here.

Perhaps the reason for the break neck volatility is the proliferation of algorithmic computer trading over the past 10 years or so. Also, the increased amount of liquidity applied by the Fed. Wicked combination. Things are different now on how fast things move, but the end will be the same.

Agree with you there calm one!!

As a kid, i used to go to the local brokerage to watch the big board with an uncle who had got out of college with engineer degree at height of what has, up to now, been called the great depression, and he had to go to work parking cars in downtown chi town,,, he owned, with the banks, several parking lots there a few years later, and retired to FL except when his ( regressive?) analyses showed one of his guys was stealing, then he would go up and watch to find out how before he fired the guy.

He would give an oral order to a guy at the local brokerage who would call it to their pit guy at the NYSE, and we would watch to see it executed. Don’t remember the number of transactions per day, but it was tons lower and slower, that’s for sure.

In at least that sense, it really is different this time, so will be ”rather interesting” to see how this one shakes out, eh?

An brief update for Gandalf, who find “gold bugs” to be so irritating:

From their recent peak until now, the DOW and S&P are down ~30%, while gold has lost only ~7%, in spite of forced selling due to margin calls. And if history is any guide, that spread is likely to widen considerably before the dust settles.

I am not comparing them as investments, but rather underscoring yet another example of gold serving as insurance during times of economic crises.

It may well go down further as widespread liquidations continue, as it did in 2008 before shooting up in value, but relative to fiat currencies, and especially given how they are now being degraded it can be expected to again perform very well, as it has for thousands of years.

I’m still earning about 1.5% on my 6 month Treasuries until end of June.

Still way ahead of you.

You know what’s nuts? My money market is paying 2.2% through June. I am sure they are now beating themselves over the head and not think that it’s possible for FED to bend over and drop rate that fast..

I’m glad that you’re doing well, Gandalf, and am not trying to convert you. Nor is it a competition, so I hope that you, and everyone else who contributes to the site does well.

PS., in the early 80s when gold was sky high, inflation was sky high, and 30-year Treasuries were in the 10-15% range, some people did buy those 30-year Treasuries despite the gold bugs. I remember talking to one of those people. a fellow physician, in the 1990s, when inflation had come down, gold had crashed to $300 an ounce, and this guy had hundreds of thousands invested in those 30- year Treasuries earning what? 15% interest? I forget. Wow, what we would do for those yields today.

Nobody back in the 70s or 80s ever thought interest rates would drop.

Nobody today thinks interest rates will ever go back up.

The only advantage of being old is having seen more than a few cycles of this stuff happen. Heck, Im older than Wolf. So yeah, there’s lots more to this story than “gold is good for a thousand years”

If you follow what’s going on with future gold prospecting, it’s not that different from oil. When the price goes up, more expensive extraction technologies get deployed to extract this stuff. This market force puts a cap on gold prices as a commodity. And it is a commodity because worldwide NOBODY is on a gold standard anymore.

Gold mines now go TWO MILES underground, and they use poisonous cyanide to squeeze minute quantities out of literally TONS of this very poor quality rock (I hesitate to even call it “ore”) to get just a few ounces of gold per tons of rock

It is the gold mining equivalent of shale fracking, in other words.

Except that gold is NOT really a limited natural resource like oil. There’s an unimaginably large amount of gold sunk into the Earth’s core, and it constantly gets brought up in small amounts in volcanic eruptions to the surface.

So where are there as yet unexplored deposits of gold? How about 70% of the Earth’s surface? The ocean floor, with volcanic vents, has long been known to contain rich deposits of all sorts of minerals, including gold.

Yes, it’s an ecological disaster to do ocean mining, no, there are few rules and regulations, so guess who is plowing into this ocean mining after companies from western countries have floundered around for decades?

China! And I think they will succeed.

Gold is very necessary for plating contacts on all the electronics they build and they love shiny gold jewelry like everybody else. But they don’t like expensive shiny gold jewelry, so my guess is they won’t care if their ocean mining wrecks the ocean floor and plunges the price of gold somewhere down to the price of aluminum foil.

I posted this before, but did you know the Washington Monument was capped with a block of solid ALUMINUM in 1880 because at the time aluminum was more precious and expensive than gold? And today we use aluminum to wrap baked potatoes

You can also extract gold from seawater. It is a cheap process outside of the energy you need so ecomicaly viable with free electricity.

And when you have to reinvest at the end of June, your rate will be closer to zero than 1.5%

That’s still better than losing 50% or 7% or whatever. I’m hunkering down for the long haul. I can’t afford to make a huge mistake in investing. That’s true for a lot of people posting on this forum.

Yes, silver fell to $12 today but online bullion dealers will not sell in-stock 1oz for under $20. There is a total disconnect between the Comex futures and physical precious metals.

I just looked and the only leafs available on Apmex are $23. Financial silver hit an 11 handle today.

Paper derivative manipulation. JP Morgan will be fine paying a $400 million fine.

Hi Tinky, I think you are being disingenuous if you do not include the increases in value of stocks over longer timeframes.

If you are saying that gold “only” lost 7% relative to the market which makes gold a better store of value then … just put your money in cash, which has lost 0%. Of course, if and when there is massive inflation the equation may change considerably.

I do not know if massive inflation is on the horizon. I suspect it is though. People are making less stuff and performing fewer services and yet the government is increasing liquidity. Doesn’t that mean more dollars out there to compete in fewer transactions? Doesn’t that necessarily mean inflation?

Zantetsu –

You did not read my post carefully, as I am not talking about gold as an investment.

It is true that cherry-picking timelines can be misleading, however, gold has significantly outperformed the markets since around 2000, and that is a fairly long timeframe. Of course it is no coincidence that that is also when central banks began to go nuts.

As far as cash goes, as an alternative, it would again depend partly on what timeframe one uses. But it also depends heavily on which currency one is using. Gold remains at or around all-time highs in many currencies. And given how badly CB’s are going to further degrade their currencies in response to this crisis, I’m not sure that I would want to hold cash for very long!

Right now, and to use when the dust settles, cash should be fine. But I would also expect gold to “outperform” currencies during that period.

Good luck navigating the rough seas!

The mantra used to be “buy the dip” and now its “sell the bounce.”

“Buy the dip” —-> “Sell the Rip”

Good analysis of Boeing Mr. Richter. Just remember that a significant amount of the $43 billion share buybacks were probably pocketed by Boeing executives exercising their stock options, in other words they were turning them into cash. They weren’t the typical buy and hold “the bag” investors.

Michael Brush wrote one of the early analyses maybe 15 years ago, and others have since, itemizing the long list of failures (for shareholders anyway). The buybacks to mop up options scam has been going on for a long time. One of the masters, a CEO, was pocketing 2 to 3 billion dollars a year on cheap options, the company borrowing money to pay for buybacks when the cash ran short, never paid a dividend, the stock started at 50 and ended at 10 after years of buybacks.

It’s just a way to loot the treasury without writing yourself a check.

Wall street always loved it possibly because they could cash in on the blip when it was announced, or possibly because you could show theoretically that it made sense even when it actually never did.

The most amusing one that I remember was/is a Canadian company that’s been doing them for years because the ‘shares are undervalued’. Once, many years ago they actually announced a bought deal for 50 million dollars; 2 weeks later they announced a buyback for … 50 million dollars worth of shares.

Share price at that time was about 30, before the recent crash they were about 15, today they’re about 8. Shares out 13 years ago were 24 million, shares out now, 42 million. Funny, if you’re into that type of humor.

It was illegal for a company to buy its own stock until the 1980s. Low interest rates enabled companies to buy back their own stocks.

For the last 5 years companies were the only net buyers of stock,while individuals and funds were net sellers

I just saw that Las Vegas casinos are asking for a bailout! Not asking for loans. They are requesting CASH PAYMENTS from the federal government to keep them afloat. Probably the most ridiculous idea I’ve seen in a while. If some poor idiot goes to their establishment and loses everything does the Casino bail them out?!?

Do casinos give cash bailouts to the gambling folks they have helped bankrupt?

The Wall St. casinos always get bailed out, so they figured they could tag along this time.

Casino scene explaining derivatives in The Big Short movie was great.

See ya in single digits LVS just like 2009!

Yeah, Adelson went from having 22 Billion to 2 Billion, then all the way back to 30+ Billion. What a ride.

While not necessary to repeat, it certainly may rhyme.

Picked up my first car being 15-1/2y.o., (savings my own). Dad and I (first jet-liner trip for me) arrived to drive home to PDX my ‘new’ five year-old Impala SS convert. I recall during a BA retrenchment, an Interstate-5 billboard. Southcenter area, near Renton, the confluence of 405 and I-5…

‘Will the last person leaving Seattle, turn out the lights?’

It is not politically in the Democrats interest to bailout any large corporate interests. Small businesses and individuals ,YES , corporations NO

Macau opened most of their casinos a week ago. It’s business as usual.

Never underestimate the possibility of face ripping rallies during bear markets.

This might be (a part) of the financial instrument re-set that does not impact the real economy too badly- one can hope. I am thinking the real economy (in the US) will recovery relatively quickly after the spike in virus cases.

A lot of selling is supposedly from money managers who have to sell based on value measures (~forward looking). The leading indicators are (understandably) horrible. It’s funny how this doesn’t really match the supposed buy and hold/markets can’t be timed/markets are efficient hypotheses.

Luck to all.

With 3k pts down today, it’s probably almost certain 1k pts up minimum tomorrow…these swings are getting nuttier each day, at some point it will diminish and then turn into bloodletting, double and triple digits down multiple days.

Creating products to get in the market as etf’s is robbery and I feel like I got robbed, but really I didn’t. The shorts are winning but boy were the losing. Holden.

So far

GOOD CALL!!

It’s funny how this doesn’t really match the supposed buy and hold/markets can’t be timed/markets are efficient hypotheses.

Those are jokes, but not the funny kind.

“Buy and Hold” is an excellent strategy if one is a Vampire.

I have a question about Boeing. Obviously the company destroyed itself by moving from aeronautic engineering to financial engineering. It’s a rotten shell of its former glory. However, I also think Boeing is likely to be first at the trough of government bailout money in the name of “national security.”

So, my question: how does one buy Boeing stock strategically? Or is my premise misguided? Thanks for your thoughts!

You want to invest in an incredibly complex commercial flying machine, controlled by software written by $9HR programmers in India? While those programmers are still involved and the people who hired them are still running the company, I would stay away.

Yes. I like what Buffet says about investing that goes something like this “You don’t get extra points because it’s difficult”. Sometimes selling chewing gum or candy bars is a better investment than something with hundreds of thousands of parts.

Hence, his recent investment in Kroger, which is holding up very well.

Well I suppose the US Government could wait until the bottom of this crazy business cycle and scoop up an assortment of rather shattered and bargain priced “state owned industries”. Among them could be Boeing, GE, Exxon, etc. However, such a move might be viewed as a wee bit socialist.

Before getting to a bailout in any way shape or form there’s still a lot of pain for Boeing

Most airlines with large orders for the MAX have legal agreements in place that will considerably increase penalties in both cash and kind (spare parts and training) if a road map to return the MAX to revenue-generating service isn’t announced by the end of Q1 2020. Meaning in two weeks.

And don’t forget travel restrictions are devastating the airline sector worldwide. Yes, bailouts are unfortunately coming, but this means a lot of orders will be cancelled or postponed.

Until a few weeks ago none of this would have mattered in the least: Boeing was able to get through one of the worst safety and PR scandals of the past three decades with a share price firmly over $300. But now? Panic has taken over. Every negative piece of news for Boeing will send stocks lower. While Q1 results will be bad, Q2 are likely to be much much worse and all of this will finally matter.

Equity can be zeroed even with a bailout

The first chart looks like an op amp with positive feedback blowing up.

Take a look here:

https://www.dtcc.com/charts/dtcc-gcf-repo-index

Why is the Treasury Repo rate HIGHER than 33 basis points than the MBS Repo rate for the FICC GCF on 3/16?

I’ve never seen a gap (spread) like this before?

As the Banners said in Wall Street 2008, “Jump!! You

Fu-kers Jump!!

https://youtu.be/uX8Nj8ABEI8

I think you nailed it Wolf.

Scary scenario:

As you might have heard, Puerto Rico is now on lockdown. Government offices and private businesses are closed, and no one is allowed to leave their homes except to buy food, attend medical appointments, etc.

I think a lot of people are still in a deep fog right now. Reality still hasn’t quite hit.

I imagine a lot of folks still think that the government is going to sound the ‘all clear’ in a couple of days… that the virus has been eradicated and life will quickly go back to normal.

Realistically that’s probably not going to happen.

The only way to really contain this is extreme social distancing– to eliminate any non-critical interactions with other people.

But that’s obviously going to have a catastrophic economic impact.

A friend of mine just sent me an email this morning saying that he was going to have to lay off all 45 of his employees this morning.

I can’t even begin to guess how many millions of people will lose their jobs, and how many companies will go bankrupt, because of this virus.

Frankly I expect entire nations to go broke over the next few months.

The SAN FRANCISCO BAY area( but not the wine producing counties of Sonoma and NAPA are under shelter in place for at least the next 3 weeks.At least traffic on 24,80 and 680 will improve in the East BAY!

Homeless exempt from shelter in place order.

The real issue with this economic catastrophe is the unknown. Money printing can’t fix a pandemic. 3 weeks is only the beginning. Those in the know suggest shelter in place, quarantines, stay at home orders will only intensify after the initial 3 week period. Maybe Alioto’s will provide the homeless free Crab Louis’ while those that built The City wait at home for Social Services to bring them a box of Rice A Roni.

“But that’s obviously going to have a catastrophic economic impact.”

Let’s try this:

Tell every abled body citizen to stay home for the foreseeable future….

I am not surprised by the volatility. For years trading operations have been co-locating near exchanges or having fiber links to gain several hundred milliseconds of advantage over the competition. Since, in that several hundred milliseconds, the price of a share may move by several cents, the shares have to be traded by the millions to turn a profit. Computers do the work, along with algorithms that link to newsfeeds, Facebook, or whatever, looking for keywords that may move the market faster than any human can put down their coffee and reach for the mouse. The algos also have circuit breakers of their own that will dump entire portfolios, and go short, if certain parameters are met. If there were no limiting circuit breakers in the markets, and the humans were removed, we should be able to see several boom, bust, then boom cycles per week, instead of years. We might even refer to this compression of the cycle as “volatility”, since we have never seen anything like it before…..

Maybe this is SkyNet’s one chance to do us humans in ..

‘;/

And where’s Arnold .. and by extention, his pet goat … when we really need him ??

/s

Wolf: Regarding the new volatility, do computers controlled by algos employ limits when doing a trade? If so, what do they do when their limit is pierced before the order is executed? switch to a market order? recalculate the limit? Replace the original stock with another stock that looks like a good substitute to the computer?

With half (?) or more of all trades executed by computer these days, could this be an important driver of the new volatility? Or better, how can it not be? And perhaps this was also part of the problem in yesterday’s world when the volatility was on the way up to the point where reason was replaced by blind FOMO?

Also your recent short sale episode looks nice on paper. But you seem to realize how lucky you were not to “get your face ripped off.”

(charming phrase.) That should protect you from yourself for a while at least.

Every high frequency algo deployed in the markets is different. The most common strategy is to cancel the order if it cannot be executed at or below the limit. They will try to find the best price at several exchanges and then move on to the next thing in the queue.

The number of shills expounding on how TESLA is going to get through this and how it’s an excellent opportunity on YouTube today is astounding. My favorite was the guy talking about how much cash Tesla raised in FEB ($1.8 Million) and while they had to use “a chunk” (little more than half, actually) to pay off “a load” of debt they still had “a ton” of cash “to burn”. No mention of the “chunk” still due this year, or the $10 Billion still unpaid. Nope, Tesla’s “cash rich”, and you should buy more stock now.

Just a month ago I bet a 21 year old bottle of Cognac that Tesla wouldn’t make an annual profit in 2020 and 2021. Bet another Boeing would be asking for a Federal bailout in the same time. I may never collect, as my buddy may not have a job in 6 months and just watched his planned retirement get cut in half.

Recession be damned, we’re seriously looking at a global depression of epic proportions.

Futures up 4%, halted.

What?

How is that even possible when signs indicate..bad things. My first-ever sale went through today instead of Friday’s closing (rookie), decreasing my account 7% from what I intended. Was glad to have what I wanted out, but…

I am so annoyed at all players involved in this (even myself) !!!

/rant

“drops of this kind are sort of routine and part of larger crashes that recur every decade”

A typo there Wolf. “drops of this kind WERE sort of routine, PRIOR TO 2008”

Not since 2008. For any 2-3% drop mommy will come running with oceans of liquidity, rate cuts and buy up anything and everything to save the wall-street cry-babies from tears.

IMO, this is to be expected when the system becomes unstable due to the constant machinations by the Fed. An unstable system simply gives way (you do not know which is the last grain)!!

I also think it is just desserts when you play god … when you are just a bunch of PhDs [with no common sense] with the sole intention of saving wall street (in the guise of saving mainstreet) . Just as commoners were watching these machinations and felt helpless to do anything about it, the Fed can watch their machinations make matters worse. Retribution indeed.

“Dow component Boeing is in collapse mode”

That too is not surprising since the coronavirus is going to bankrupt the airline industry (that is a given).

Additionally, if you call yourself an aircraft manufacturer but cannot manufacture a plane that is fly worthy then your share price should be ZERO when your props (FAA, Government) vanish and the airline industry is in dire straits.

Yah what could possibly be causing this “slam down slam up” macine gun volitility? I can’t figure out what would be behind this extreme behavior carrying on for so long like this. As you said Wolf, fast drops are one thing, but this “accellerating paint shaker” behavior has to be doing some serious damage to market makers and other finacial institutions that basically have to participate actively in the market everyday to keep the wheels from completely falling off the finace side of the economy.

How long can this last before it either runs out of its insane energy, or just does so much ireprable damage to market makers and company that they all just “Nope”-out and run for the hills?

Dear Wolf,

While I truly enjoy reading every single post, I’d hardly ever left a comment. First of all, thank you! I learnt a great deal from you and your commenters, and in fact, when Dow was ~25kish, I pulled my 401k out of stock and bond completely. Needless to say that over the course of past few months, as it was marching towards 30k, I had to calm my FOMO and remind myself to stick to my strategy (stay in cash until the crash comes and goes, then invest). I knew the bull was going to come to an end but i couldn’t even imagine in my wildest dreams (nightmares) that it could be like this. I feel we’re being bombarded by this invisible bomb called covid 19 with no place left on earth to flee to.

Now, having said that, if I am to survive the covid 19, I must get back on track with my strategy and build a meaningful retirement portfolio with a reasonable ROI. In addition, we were priced out of the housing market in the bay area. If as a result of the inevitable downturn, housing becomes somewhat affordable, we’d want to consider investment in that front. And that’s where I need your help with.

I’m wondering if you can share any insight as to what the best strategy could be for someone like me for managing their 401k account. What I’m thinking of is to identify some reliable undervalued stocks (blue chips, tech, commodity, energy,…) that i could invest $10k in each after some sort of bottom is reached. Do you think that’s a sound strategy? Or investing in index funds is a better choice? Needless to say, I don’t have the heart to gamble my hard earned saving in option trading having lost a lot in the past. Great experience though!

Also, what’s your take on the future of housing market in bay area? When do you think we’ll start to see price softening?Looking forward to hearing from you.

Thanks much!

P.S. IMHO, everything seems to be going to heck in a straight line (for now). Something to think about when you design your coffee mug or beer mug 2.0. ;-]

Tomorrow morning there will be a bounce that will prove the beer mugs correct :-]

The wild swings in the Nikkei 225 and FTSE-MIB today require larger mugs. :-)

Mr. Richter:

2-17-20 close: DOW up 1,048 and change..

Good call…..

Only gamble what you can afford to lose is the old saying. A house at least you can live in it no matter what (assuming you can make the mortgage payments)

Would be interested in a broader post about stock buybacks in general – perhaps this ETF and its holdings list history could be a start:

SPYB Fund Summary

The investment seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P 500 Buyback Index that tracks the performance of publicly traded issuers that have a high buyback ratio. The fund generally invests substantially all, but at least 80%, of its total assets in the securities comprising the index. The index provides exposure to the 100 constituent companies in the S&P 500® with the highest buyback ratio in the last 12 months. It is non-diversified.

(Yahoo Fin)

Dear Wolf Richter,

I do not understand why you assume Boeing’s accumulated share buy backs would amount to USD 43 billion. Boeing’s Q4 2019 form-10k states on page 53:

“Treasury stock, at cost …. USD 54’914 million”.

However, could be that the difference between 43B and 55B is due to my insufficient accounting skills.

Thanks for all your insightful articles, always a pleasure to read.

Most companies cancel the shares they buy back and don’t put them in treasury stock, for example Apple, which has zero in treasury stock. So that’s the wrong place to look. Also treasury stock is a life-time account. But I only counted the share buybacks since the Financial Crisis, because that’s what’s relevant here. You need to dig up the data of actual share buybacks. Standard & Poor’s and other entities track this. I get my share buyback data from YCharts.

Thanks for answering. all the best and stay healthy!

I don’t believe Apple are closing stores world wide because of danger to staff but more because they have few China made iphones left. Apple turnover(yes I know lol) could be down 50% or more, with no sign of coming back any time soon…….

Apple’s online sales are doing OK, and Apple sells most of its stuff online.

Is there one sure punt? Abbott laboratories owns Abbvie Inc makes Kaletra using for treatcure virus. 91% success in Kenya trials on HPV virus aka pre cervical cancer. Jan 28 Brian Yoor VP CEO purchased a load of shares. Chairman background Fed Reserve Bank announced step down in Nov 19 when virus (was) started – will step down Mar 2020. Progress report if you dip your toe.

Dear Wolf and everyone,

I just wanted to say thank you, thank you for posting your thoughts, opinions, and comments everyday!

I’ve been following Wolf, reading everyone’s comments, and basically using you guys as a giant crystal ball for a long time.

I’m just another Boeing bee, who saw people throw up the warning signs. So I pulled out of Boeing stock, and pretty much all stock about a year or so ago based on a big gut feeling. Right before that big pre-Christmas dip, I was bummed because I thought I made a bad call and should have stayed 100 percent in the game.

And oh boyyyyy I would have lost almost everything if I just passively left my money sitting where it was. Some of my greedy co-workers who went all in and stayed in Boeing stock, thinking it’ll shoot to the moon, the amounts they lost made my head hurt.

I was so glad to have mostly sat on the sidelines, playing it safe, watching, and investing small amounts.

I’m not financially literate like a lot of people here, but I’ve learned a lot from you and your guidance has been priceless! And many decisions I’ve made based on the comments here have turned out correct! But I’m just trying to find my way toward financial independence, hopefully it’s somewhere out there.

I used to bite my tongue and hold my breath

Scared to rock the boat and make a mess

So I sat quietly, agreed politely

I guess that I forgot I had a choice

I let you push me past the breaking point

I stood for nothing, so I fell for everything

You held me down, but I got up (hey!)

Already brushing off the dust

You hear my voice, your hear that sound

Like thunder, gonna shake the ground

You held me down, but I got up

Get ready ’cause I had enough

I see it all, I see it now

I got the eye of the tiger, a fighter

Dancing through the fire

‘Cause I am a champion, and you’re gonna hear me roar

Louder, louder than a lion

‘Cause I am a champion, and you’re gonna hear me roar!

Oh oh oh oh oh oh oh oh

Oh oh oh oh oh oh oh oh

Oh oh oh oh oh oh oh oh

You’re gonna hear me…

Roar – Katy Perry

S&P chart looks a heckuva lot like a mechanical/electrical system with excessive differential feedback going into uncontrolled increasing oscillation. It eventually destroys itself. All it needs is external energy. Or in this case external liquidity. “You can’t fix stupid.”

Makes last years $200m in tax breaks from the state of Washington look like chump change. At least our propity taxes went up 20% for schools cuz a poor Boeing exec should never have to hold a bake sale.

Re: Volatility caused by Algos & general increase in transaction speed…

…is a big reason that I advocate Financial Transaction Tax, at a miniscule rate (dunno, WAG, say .001%, but more zeroes might be appropriate). I suggest that adding some friction to the system would go a long way toward damping heterostatic swings. I haven’t done the math, because I no longer can (age, exacerbated by behavior). Seems like Chaos Theory would point the way. Anybody heard of any academic work on this?

Of course, the real reason for FinTrans Tax is that it’s a great way to tax the FIRE sector and reverse the flow of money/value/power that they’ve sucked from the rest of us for decades now.

Anybody have a reasonable estimate of the Total Daily Volume of all Financial Transactions (Stocks, Bonds, Currency Arbitrage, et-f-c)? Maybe, USA, $100T, World, $1Q? I could be off by a few decimal places. In any case, it’s Big, so big that a tiny percentage of it would cover government Deficits. Yes, taxing FinTrans would decrease the demand & volume a bit, but that’s just gets us back to my original point (friction decreases volatility).

Mr. Richter, you are absolutely right concerning online buying such as Apple etc. I think my wife averages about one online purchase a week. I was discussing her frequent purchases with the UPS man, the Fed Ex man, and the USPS mailman who is planning on retiring this year. Oops, I forgot the Amazon delivery van, driven by a lady.

Obviously, equity exchanges & other financial schemes including insurance parasites, been fraudulent, exploited, & criminal yet undeservedly unethically unjustly indulged by systemic corruption, kleptocracy, politicronies, & complicit shills with subsidization & fascist nationalization, socialize risk, impose usury, distort prices, commodify, promote socio-economic disparity as the fiat getting laundered through propped-up market scams & else. Stock buybacks like pump & dump along with inherent insider conflict, … Fiat flowing into exchanges et al scams then siphoned away by usual suspects so these crooks stowing this ill-gotten booty; nothing in ScAmerika operates as should much less accountable, honest, reliable, but thank you for the insight & worthy information.