Airline bonds, holy moly.

By Wolf Richter for WOLF STREET.

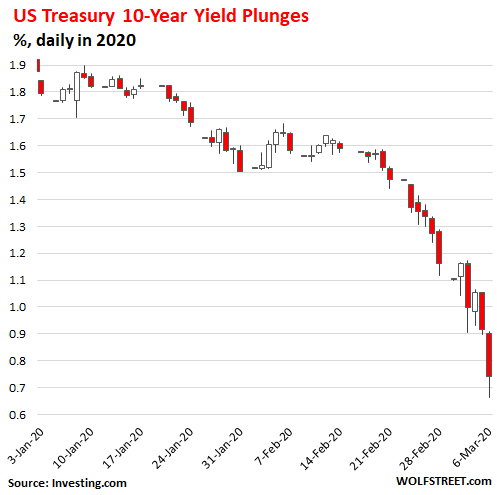

Someone got spooked. The US Treasury 10-year yield plunged in a magnificent manner to a new record low of 0.66% on Friday morning. When the yield of a bond drops, its price rises, and investors who were long these Treasuries made some money. The yield started out this year at about 1.9%, and meandered lower. By February 20, it was 1.57%. This was the date the economic consequences of the coronavirus began to sink in. A breathless plunge commenced, including a 25-basis-point plunge early Friday to 0.66%. By the close of Friday, it had ticked up 0.74%, having plunged by half in two weeks:

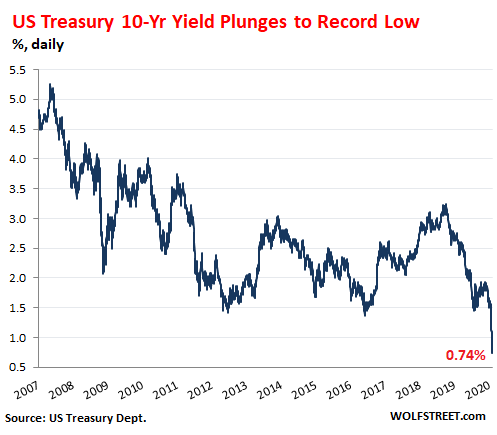

Back in 2007, before the Fed’s interest-rate repression began, the 10-year yield was around 5%. The chart below shows the trajectory of the 10-year yield since then. Steep drops and bounces are not uncommon, as you can see, but this plunge from over 3% in November 2018 to 0.74%, especially the stretch over the past two weeks, was something to behold:

The fear trade has something to do with it. But it’s not yet a broad fear of credit problems across the corporate debt spectrum. It’s a fear in specific pockets of the credit market. In addition to some hedging strategies and some complex trades that blow up when the 10-year yield moves this much this fast – and we may hear some stories about that in the coming days.

Airline Bonds got brutalized: prices plunged as yields soared.

There are specific pockets in the corporate credit market that have long been deteriorating, and now took another big hit, among them shale oil-and-gas bonds and brick-and-mortar-retail bonds. And airline bonds got added to the list and got brutalized.

Many airline bonds don’t trade at all on a given day. They sit in a pension fund or a bond fund or in an insurance company’s portfolio, and holders intend to hold them to maturity, collecting the coupon and then getting their money back when the bond matures. And they don’t sell.

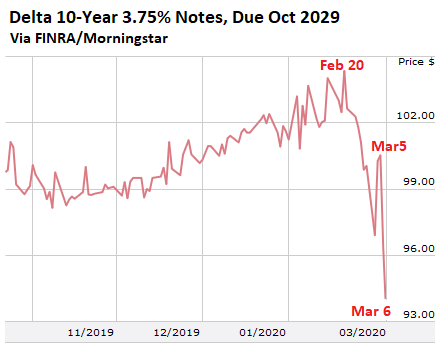

Delta Airlines.

Of the dozens of Delta Airlines bond issues outstanding, most of them had no trades on Friday, several had a couple of trades, and only a few bond issues traded actively on Friday, according to bond trading data published jointly by Finra and Morningstar. But among those that traded, there were some fireworks.

For example, this $600-million issue of senior unsecured notes, due in October 2029, was issued in October 2019 with a coupon interest payment of 3.75%. Moody’s rates it Baa3, which is one notch above junk (here are my plain-English descriptions of corporate bond credit ratings). It started trading last October with the yield the 3.75% range and with a price at around 100 cents on the dollar. This year, as the 10-year Treasury yield began falling, the yield of Delta’s 10-year notes also fell, and the price rose. On February 20, the yield bottomed out at 3.21%, with the notes trading at 104 cents on the dollar.

But then airline stocks came unglued as the coronavirus began to impact the travel industry. But airline bonds only gradually followed. On Thursday, this bond traded at 3.68%, and at a price of 100.5 cents on the dollar. But on Friday, all heck broke loose and the yield spiked to 4.5% and the price plunged by 6.4% to 94 cents on the dollar – and Delta is among the stronger airlines in the US (price in $):

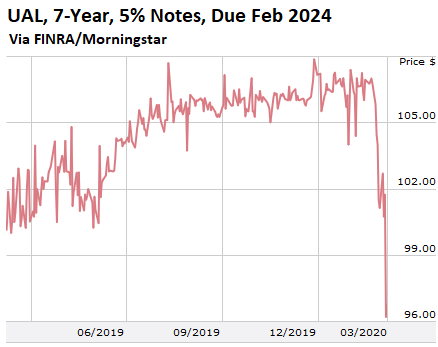

United Airlines.

United Airlines also has dozens of bonds outstanding. Hardly any of them traded actively on Friday. But those that did, good lordy.

For example, this $300 million issue of 5% senior unsecured 7-year notes, due in February 2024. Moody’s rates them Ba3, three levels into junk (my bond credit rating guide). The notes started coming unglued after February 20, in parallel with UAL’s stock, likely due to their junk credit rating, which makes those bonds more like a stock in terms of risk. From February 20, when the notes were trading at 106.99 cents on the dollar (nice premium to get the 5% coupon), the price plunged by nearly 10% to 96.8 cents on dollar at the close on Friday (price in $):

American Airlines and its Last-Minute bond sale.

Of the three dozen or so American Airlines bonds listed on Finra, most had no trades on Friday, a few had only a couple of trades. But a few did trade actively, and holy-moly.

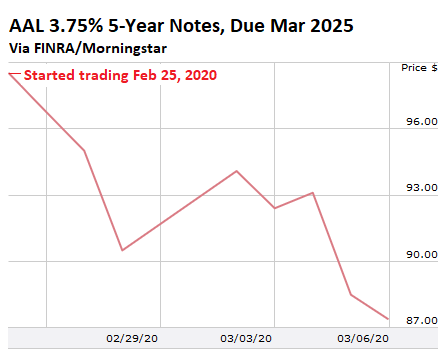

Here is my favorite: On February 20, the day before all heck broke loose for airlines, AA announced with impeccable timing the pricing of a new issue of $500 million in senior unsecured five-year notes, due in 2025, with a coupon interest of 3.75%. It was priced at 100% of face value. AA was borrowing the money to fund its pension obligations.

To rush the bonds out the door before all heck would break loose – which the top brass at AA must have seen coming – they were not offered to the US public but only to “qualified institutional buyers” and “to non-U.S. persons in offshore transactions outside the United States,” which dodged the lengthy process of an SEC-registered offering.

They started trading on February 25 and by Friday morning had plunged nearly 20%, to 80.5 cents on the dollar. During the day, they bounced some and closed on Friday at 87.39 cents on the dollar, having plunged 12.6% since their offering price:

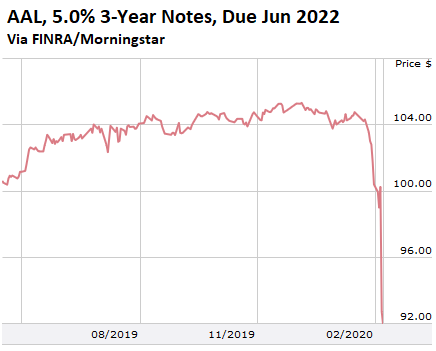

Most of the bonds issued by American Airlines are lower-end investment grade. But there are also some junk bonds in the mix, including these three-year notes, due June 1, 2022, with a coupon of 5.0%. Moody’s rates them B1. And they traded actively. Since February 20, their price has plunged 11.7%, to 92.00 at the close on Friday:

This lack of liquidity — or at least the lack of trades — in the corporate bond market creates some issues because it’s hard to price bonds that are not traded. After a sell-off like this, fund managers might not immediately mark down the bonds that haven’t traded in days or weeks. This type of thing caused some nasty surprises during the Financial Crisis, when some bond mutual funds collapsed after a “run on the fund.”

Southwest Airlines.

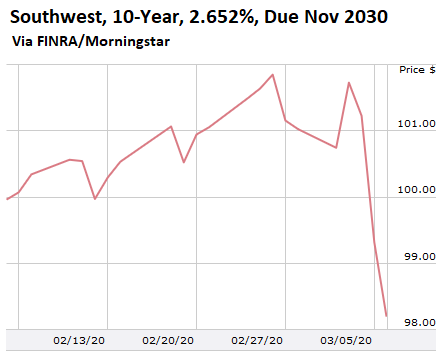

Southwest Airlines has eight bond issues listed on FINRA, all of them investment grade: Two had zero trades on Friday, three had three trades, one had 8 trades, and one had 14 trades, and one had 26 trades.

Its most-traded issue (26 trades on Friday) are 2.65% senior unsecured four-year notes due on November 5, 2020 – eight months from now. The price has remained relatively stable over the past few months, and closed on Friday at 100.6 cents on the dollar. The market is betting that Southwest won’t default over the next eight months. On November 5, barring a surprise default, bondholders are going to get paid 100% of face value plus the final coupon without further drama.

Then there’s its second-most-traded issue (14 trades on Friday): the 2.625% senior unsecured 10-year notes, issued a month ago on February 10, and due in February 2030: Over the last three trading days, the price dropped 3.5% to 98.2 cents on the dollar, with about half of that drop occurring on Thursday with 52 trades:

The ratings agencies haven’t lowered the credit ratings of the airlines yet. But the market has lowered them, now dialing in a significantly larger probability of default than a few weeks ago.

Since the shock-and-awe surprise rate cut, the S&P 500 has dropped 3.8%. Read… Stock Market Volatility Jangles Nerves. Something’s Afoot

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Is it a lack of liquidity or a lack of buyers?

Who is making money now (other than your short)?

Lack of one’s own ‘future’ within life’s probablities where some fuzzy biodice get rolled, would be my wag.

I’ve been drinking all weekend, and will drink all week from Wolf’s beautiful mugs with my wife… OTM puts on HY trash ive been throwing in front of the credit risk steam roller for pennies since 2018 are selling for dollar handles now.

Time for those “Cumulative Credit Losses”

https://www.marketwatch.com/story/pimco-its-just-going-to-get-worse-for-economy-2020-03-08?itm_source=parsely-api&mod=mw_more_headlines

401Kers had 3 days to move ‘money’ to ‘stable value’. All of this needs to be sold on Monday. There will be exactly enough buyers.

Beware the prophet (and the FED) who promises endless “mountain tops”. And while you are at it, gird your loins!!!

Iamafan,

“Who is making money now (other than your short)?”

People/algos who bought long-dated Treasuries before today :-]

This bond: Unsecured. One notch above junk. With a history of bankruptcies. 3.75%.

My (and many others) credit cards. Unsecured. Never missed a payment or paid off in full in over 20 years. No chance of bankruptcy. 19.75%.

I think I see the problem.

“this $600 million of senior unsecured notes, due in October 2029, was issued in October 2019 with a coupon interest payment of 3.75%. Moody’s rates it Baa3, which is one notch above junk…”

As I write, crude oil is at $32 and heading lower. Central bankers can’t print oil and extractors can’t extract at those levels. That’s all we need to know.

The solution to lower oil prices is lower oil prices.

Shale producers will go bankrupt.

Major oil drillers will cut back.

EV manufacturing will slow and many will go bankrupt. They made no economic sense at oil at $100. Guess what happens at $30?

Sales of lower cost ICE vehicles will pick up.

OPEC and Russia will eventually stop flooding the market.

And then…higher oil prices.

BS,

Saudi’s marginal cost of production has long been in the single digits.

It’s not about marginal costs for oil extraction for Saudi Arabia.

It’s about paying for their massive welfare state. Which is the only thing that keeps the current monarchy in power.

And for that they need oil at least $80 as they have nearly no other source of revenue.

So it’s a game of deficit spending and pain between the players.

Shale doesn’t make money at $100. $30? Doesn’t look good for the US energy independence meme.

I think there will be a war, or an attack on Saudi facilities by someone, PDQ. That will produce big time instability and whiplash pricing. Iran might do it by Houthi proxy. They are on the ropes and can’t endure this drop in oil prices.

Might buy a new mattress for cash.

Won’t the shale bankruptcies cause a lot of US bank insolvencies?

I feel like we’re living in WW3 but I can’t figure out who’s on what side.

Pardon me, but I rather doubt that Iran or the Houthis had anything to do with the MSM thingamabob. This is an old fashioned oil war controlled by those that “print”.

It’s like the inverse of Dallas: The Ewing family finds a bunch of oil in Texas and that makes them poor as church mice.

Or like that updated version of Monopoly, Professor. First one to own four railroads goes bankrupt.

“Sell it all” – John Tuld

“I recommend you panic” – Hugh Hendry

All good on short and put option side, but when

ETFs blow up things will really get interesting.

I prefer longer term puts over sqqq because when going gets tough they change rules on you, perhaps delisting all leveraged short ETFs. Just a theory.

Oil at $32 …… goodbye Texas!

If you want to pick up anything cheap and slightly used, go to Houston and keep your eyes open. You won’t have to look too hard, because when oil crashes everyone sells their stuff …. from companies to workers.

I know of no operators who make money after all drilling , interest and bond amortization costs. Maybe there are some that I do not know of.

Should ad shale operators

Covid Demand Destruction – Coming to a Region near You.

Think about the chaos that can result from stressed companies having hundreds of loans and bonds, each having claims on specific assets or general corporate net worth, held by parties from around the world, at different interest rates and types, with varying maturity dates.

And ZIRP has further encouraged a rats nest of debt obligations, each extremely difficult to disentangle from one another once the music stops.

You are such a Downhead riff. Get with the program.

Bring out your debt ‘ring-a-ling’.. Bring out your Debt ‘ring-a-ling … BRING-OUT-YOUR-DEBT ! ‘Ding-ding-ding-Ding’ !!!

polecat: Ha ha :)

I think the biggest issue is how do companies make good on their debts when their cash flow is severely decreased for 2-4 months?

By begging for a government handout and achieving welfare queen status?

Pay phat bonuses to execs. Declare Chapter 11 BK. Create second company to buy the good assets from BK company, leaving employees and creditors holding the bag.

e.g. sears

That’s how you know corporations aren’t persons. There’s no law against robbing and killing them.

Another good analysis Mr. Richter. It seems like we actually may have had a glimpse of price discovery for UNSECURED bonds trading at or below investment grade. It looks like J. Powell and the FMOC may eventually have to intervene and save the BBB bonds from going over the Proverbial cliff. Time will tell.

Luckily this is not the EU and the Fed can only buy US securities, so intervening directly is off the table.

I hope grandma isn’t hoping for interest income any time this decade. Because it isn’t gonna happen.

SPX future, breached Jan 2018(H), entered the trading range.

Gotta laugh at the ads popping up on Wolf’s page for my device…. Invest in shares now, online….. Yeah right. Pull the other leg it’s got bells on it. Ha ha

WTI futures plunged to 30.01, but up to 33.

32.49 right now Got Gold?

US10y = 0.55%

The fear is increasing at a ridiculous rate.

I am going to need a much bigger tub of popcorn.

And a bigger bar of gold it seems

If oil pops down into the $20’s, it might be time to buy some of the oil majors that are in decent shape. My problem is that it will take too long to figure out which ones are so over leveraged that they will file bankruptcy this time around. Two oil majors that seem to have high chances of surviving an extended oil rout are Cheveron and Total (ADR). Opinions anyone?

Exxon has too much exposure to shale oil where the breakeven point is probably at an oil price much above $50. And it has been said that Exxon needs to continue to rely on asset sales to keep its dividend payments at past levels. And it is not a good time to be selling oil assets.

XOM, CVX? XOM has had over a decade knocked off its price.

5% trading limits triggered. Markets cant go lower over night. PPT has plenty of time now to start buying hard at the open. The fun has only just begun.

Are the limits the same as during normal hours?

If so, 5% is not going to stop them.

7% during normal hours…

They WILL fail and fail BIG

Oil at $10 is too expensive for the world. Too much debt and too much leverage, makes the price plunging inevitable. Let me know when Dow reaches 5000 and the S&P 500 gets to 600, and THEN we can start talking about realistic valuations. Until then, this market is a super bubble that needs some major pricking. The virus is just an excuse.

What does that even mean?

In a competitive marketplace, there is cost for oil extraction, moving the oil to a refinery, oil refinement, end product transportation and compliance to all environmental/tax laws.

Do you have any info or sources that it can be done for $10 a barrel

“Oil at $10 is too expensive for the world…”

600, that is some funny stuff, pass it on…..

Even lower yet…

The benchmark 10-year Treasury yield broke below 0.5% for the first time ever as coronavirus fears, coupled with an all-out oil price war, sent investors flocking to safer government bonds.

The yield on the benchmark U.S. 10-year Treasury briefly touched an all-time low of 0.487% in overnight trading Sunday.

The 10 year is going to go negative.

Get your free mortgage soon !

selling a good chunk of bonds here…..paid well, it will start pushing back into equities now as divi yield is higher for SNP now..

Well 10-year treasury is already at 0.48%.

Glad only sold quarter of the puts. Be right and sit tight.

Maybe too late to be buying otm puts, but atm sqqq calls still fair game on any significant bounce. Thoughts?

1) In 1973 Faisal stabbed US in the back and confis… ARAMCO.

2) WTI ftures = 30.80 // Nikk (-) 5.5% // DOW (-) 1.200.

3) SKA stab shale in the back.

So, if you are a pirate on the Jolly Roger, and if you threaten to;

a) keelhaul a banker, or

b) make the banker walk the plank, or

c) use the banker for shark bait

what will you discover?

That sharks won’t eat their own.

That’s a human-only trait. So, bankers will gladly sit down to a dinner of Shark, but a shark will avoid a banker in the water.

Hmmm, maybe its just the bad taste they leave in the mouth to anyone ever unfortunate to be in the same room as a banker?

Sorry to tell you Oscar, but there are many well verified accounts of sharks eating other sharks, and even their babies…

So, suggesting that this will, or at least I can testify for sure I hope this will, get rid of at least some of the sharks who have been eating my personal profits for the last 50 years or so,,, although I must admit, in all honesty, I did so more than once in those same years, early on of course…

Can’t wait until Monday morning to hear the ultimate BS from the FED and Trump. The FED is dead, be the first get your helicopter money falling soon on a mansion near you.

Cash with zero return will look better than other assets with negative returns. These airline bonds will be a tough sell. Maybe other assets will join the list as this round of price discovery continues.

You know what else pays zero dividends?

Gold.

How are all these downgraded to non-investment grade corporate bonds going to perform in an existing $1 trillion dollar market? Who’s going to buy them? What a world. . .

As of Sunday, 11:20pm ET:

* 10-Year Treasury dropped below 0.50%!

* S&P 500 Futures Halted Sunday night (per nasdaq post — link below)

nasdaq DOT com/articles/stock-futures-fell-fast-enough-sunday-to-trigger-a-trading-halt-2020-03-08

Dow Jones futures is down by 1200 points. Monday is going to start off with a bang!

The Nikkei 225 is down over one thousand (1,000) points despite the now common late session bounce due to dip buying. Old loves die hard but old lies die harder.

FTSE-MIB is testing minus two thousand (2,000) points. Dip buyers are likely to make the day less horrible this afternoon but tomorrow they’ll realize nothing has changed.

Let’s see which central bank blinks first, and which one will look a greater fool than the Fed.

PS: Wolf I got your email. I’ll answer in due time because this morning it’s been pure chaos and we are only starting to breath right now.

Thanks. Take your time. Kinda chaotic around here too :-]

Long time listener first time caller. I’m trying to understand this. How does this work? Is this just debt the airlines took out as financing? People bet on this stuff? Delta and Southwest seem okay in terms of cashflow. They all fared pretty well coming out of the 2009 flu epidemic.

Wolf – I would suspect that the fed steps in with a QE program Monday or later this week. I bet they will throw the kitchen sink at the markets as there is only another 3% before we hit the magic 20% “BEAR MARKET” range. Could stop the free-fall for a few weeks, yet if this virus does go rampant in the US, how can infinate QE help?

Curious if you cash out any of your shorts position before the Fed throws the kitchen sink at the markets? Fed has to do something huge as all hell is breaking lose over the weekend on multiple fronts.

Fed Kitchen Sink,

I’m very worried about my short position, always. That’s the nature of a short position. That said, the last time the Fed threw the kitchen sink at a real bear market, back in 2008, it took nearly 3 months of continued plunges before the kitchen sink finally had any effect.

The coming debt jubilee will be produced by the market itsself. Since everyones debt is someone elses asset, the coming wealth effect reversal will impoverish millions. How do you prep for that?

I’ve been checking the Tom Tom traffic site.

It looks like most all major cities in China have returned to near normal to supra normal traffic levels (Shenzhen, source of iPhones and a mass of other electronics, is running supranormal) except for Wuhan, which remains locked down and barely moving. Chongqing, a mega city in west central China, is back to near normal.

China is claiming victory with no new indigenous cases of COVID-19 outside of Wuhan.

??!! Something is seriously dodgy about this. Viral pandemics just don’t get dramatically cured like this, especially with what we know about the SARS-COV2 virus -highly contagious, many asymptomatic infections. There are alleged smuggled reports from China of hundreds of new cases being suppressed by the central government.

We’ll see in another 2-4 weeks, with all the workers returning from rural China, and China clearly determined to go full steam ahead ramping its economy back up

China uses plasma therapy. They took blood plasma from recovered SARS-2-CoV patients and infused it into people infected with the virus. They have approved two drugs, were using chloroquine and also testing Remdesivir. There is strict testing, tracking and quarantine. There have been no new cases in Hubei Province outside of Wuhan for two or more days. The virus may die.

David Hall,

Good for you to repeat the CCP party line. If you have access to non-restricted internet (ie, you are not inside the Great Internet Wall of China), try searching for the alleged coverups in Hubei province that I wrote about.

The quarantine has been lifted all over China. A huge majority of the workers in the industrial cities of China come from rural areas, and many had already gone home for the Chinese New Year holiday including people from Wuhan, before the central government clamped down with the quarantines and travel restrictions. About 30% of China’s population still lives in the rural areas, where healthcare is fairly limited, and I can guarantee you nobody there will be getting the really hard to get stuff like blood plasma or remdesivir. Maybe Chloroquin, cuz that’s an ancient anti-malarial drug that’s super cheap.

The history of remdesivir is that it was developed for Ebola virus, had some effect, but not enough to make a huge difference. So they stopped trying to approve it for Ebola.

Yes, some hope for treatments, but no proven cures or magic bullets.

After all these years, the only anti-viral we have for the flu is Tamiflu, which at best reduces flu symptoms by……one to two days.

Remdesivir was the Tamiflu of Ebola, in other words

Like Gomer Pyle used to say:

Goooooolly! Shazam!

I will wait and see if this alleged cure of the COVID-19 pandemic in China stands the test of time and the stoppage of mass quarantines.

There is absolutely zero chance China killed off or will kill the virus. They have simply claimed there’s no new cases, in certain places. They need people back to work or the economy will collapse. All the Chinese government has done was a guaranteed to fail quarantine, because, they waited too long. The fact they thought it would work at all, after they covered it up for at least nearly 2 months and planned the quarantine to line up with the Chinese New Year, shows just how extremely worthless Xi Jinping is.

All they did was slow it down for awhile. Now that everybody is starting to go back to work the number of cases will skyrocket immensely.

It’s important to remember that the Chinese government has been lying the entire time about it.

Most people haven’t realized yet, just how evil and inept Xi Jinping is. Ever since seizing power in 2013 him and his followers have been purging the ccp and replacing it with loyal yes men and getting rid of those who actually built China into what it is today. He has made himself into a cult figure modeled after Stalin, but he really is no better, probably worse than kim jong un.

Until he is gone, there is no hope for China and nothing the Chinese government says or does can be trusted.

As a USA Navy guy who visited HK and Taiwan in the early 1960s, and has been a big fan of Chinese people ever since, because of their work ethic and other reasons, including meeting many USA people who were either born in USA or elsewhere, I must disagree as a ”relatively objective observer.”

Certainly, Xi has his problems, as do all humans that I have known so far, including my own self. And, equally certainly Mao had his problems similarly.

None the less, China has done and is doing what they can to contain this virus ASAP and putting their people back to actually ”earning” their great leap forward, as was and is the hope of Chinese people, at least since others tried to beat them down and keep them down for many many centuries past.

Chinese people and USA people have been great friends and great allies for many decades, and I for one, hope that friendship and shared effort will continue always.

Thomas Roberts,

Agreed. And, I would note, that is why the CCP actually had set a term limit of 10 years for the Presidency, which was instituted by Den Xiaoping, to prevent another really, really bad leader like Mao Zedong from assuming dictatorial powers for life and totally screwing up the country.

Xi made sure to get rid of his term limit in 2018. Having purged the CCP of his opponents and increasingly clamping down on dissent in China (it’s worse than it has ever been since the Mao era) it’s quite likely he will become the new Mao, Emperor for Life.

Having said that, Xi, at the moment, is not entirely insane or stupid, not to the same extent as Mao was anyway. He’s more of a modern technocrat and has a good understanding of how modern economic systems work. The problem is how long that will last once he’s been cocooned inside his power shell for over a decade.

I’m not against China, I’ve been there before as well. Before Xi Jinping took over in 2013, China was growing more free and richer every year. Since then, even before the trade war, the economy stopped growing, and human rights have been getting worse every year, and to control the masses he has been instituting a massive surveillance state and promoting nationalism. To a growing number of Chinese instead of being welcomed like you would have been before Xi, you are now a “white pig” to them.

A country as populated as China successfully and sustainably integrating itself into the world economy was always a long shot and Xi Jinping took over the reins and is crashing it into the ground.

Instead of a very large moderately well off country, China is turning into the newer bigger North Korea.

TR,

I found this terrific 2015 article in the Atlantic which addresses a lot of what happened in China in the past decade:

https://www.theatlantic.com/international/archive/2015/06/china-dream-liu-mingfu-power/394748/

Basically, this former colonel in the PLA and now a professor at the China National Defense University, Liu Mingfu, wrote a book in 2010:

“The China Dream: Great Power Thinking and Strategic Posture in the Post-American Era”

It’s basically a nationalist call to arms for China to strengthen its armed forces and take control of the world away from America.

Coming on the heels of the GFC in 2008, one can easily see his point of view that the US was in sharp decline and that China should step up and take its place and no longer allow the US to push it around..

According to the Atlantic article, Xi clearly must have read the book, as he started incorporating many of the author’s words and goals into his speeches, starting in 2015.

A few years ago I read excerpts of some of those Xi speeches (I can’t seem to find those sources now), and they make clear in no uncertain terms that Xi wants China to become the world’s dominant military power and to take over the world as #1 in place of the US. Xi has even set a date – 2049 – the centenary of the CCP taking control of China as to when that will happen.

Japan went through a similar period in the 1980s when it seemed to be rife with right wing anti-America nationalists who wanted Japan to be in control. Japan eventually got run over by the economic might of China, so we don’t hear hardly a peep from Japanese right wing nationalists anymore.

So, nationalism and a desire for world domination is hardly unique to Xi or China. And in China, those ideas were already there before Xi came to power.

Nationalism, patriotism, tribalism are all the same thing and inherent to all humans from the time of the cavemen and before. Individual Americans, Germans, Japanese, British, and Chinese, might all get together and have a jolly great time together as people, and yet massive wars have been fought between these countries over the last 250 years.

As I’ve posted before, Xi’s brand of repressive central governing is great for marshaling the full weight of a country into achieving well thought out central directives. This top down command structure is not so great, in fact, it’s TERRIBLE at figuring out exactly what the right thing is to do next when things don’t turn out like what you expected (like COVID-19). It’s not so good at innovating new ideas either.

The chaotic magic of democracy and freedom of speech and thought is that they are the engines of technological innovation, which is what is most likely going to keep the US in the running as top dog for a while longer.

Gandalf

I’ve been having the exact same thoughts. They are either displaying impressive success at containing the virus or shamelessly lying and manipulating the data (something not completely unheard of in that country).

One could go as far as to wonder whether this might serve a later narrative, i.e. to shift the blame from China to other (Western?) countries in public opinion, something along the line of “the CCP managed to contain the virus in Wuhan, however western countries didn’t make the same efforts; as a result the outbreak went global and China got re-infected from the outside”… one can wonder

I’m more inclined to believe that this is just another end result of China being under the thumb of the rigid centralized governing system that’s been made more rigid and repressive under Xi.

Xi ordered the quarantine, therefore, the quarantine MUST be successful. Any reports of bad results (more COVID-19) would only embarrass the Big Boss and more than likely get YOU into big trouble rather than get you praise.

So, everybody clicks their heels and salutes El Presidente Xi, proclaim what a great success the quarantine has been, and China immediately revs back up into full production mode.

Rather than malignant scheming, I think it’s more like lemmings driving themselves off a cliff without knowing why. Rigid top down command structures have the great advantage of being able to quickly mobilize a large population into changing directions quickly and suddenly (i.e., like lemmings), but they lack the freedom of thought and flow of information from the bottom rungs of the pyramid to question the effectiveness of the direction change, and warnings of looming peril.

(lemming #1255 in the herd, squeaking:

Hey guys, guys! Why are we going this way???!!!

HEY GUYS! THERE’S A CLIFF AHEAD!

WE’RE GOING OFF A CLIIIIIIIFFFFFFFffffffffff……!!!!!!)

That’s exactly how the COVID-19 started in China, with the efforts to suppress information about the infection, and I expect that’s how it will end.

The full truth won’t come out until missing workers with COVID-19 and dead bodies start piling up again, and leak out to the Western news media.

I give this temporary success story about 4-6 weeks, tops.

That’s nothing. Have a look at ASX:VAHHA, the formerly 8% yielding Virgin Australia bonds, current price $69.7.