I try not to make predictions these days. But a few times I lapsed.

By Wolf Richter for WOLF STREET.

Normally, I report what is happening, based on numbers and charts. I analyze and try to make sense of our crazy times. It’s up to readers to project where this might be going. But a few times in 2019, I lapsed and made predictions. And here are six of them and how they’ve panned out so far, in no particular order, with my favorite one last:

#1: 10-year Treasury yield “snap-back” and “peak negative-yield absurdity.”

September 1: In my podcast, THE WOLF STREET REPORT: Here’s What I’m Worried About, and It’s Not a Recession, I included a section with a warning about a snap-back in the 10-year Treasury yield. On August 28 and September 4, the 10-year yield closed at 1.47%. There was incessant talk of the 10-year yield going negative, as it already had done in several countries in Europe and Japan. The coming negative yields in the US were the most hyped theme at the time. I stuck my neck out and took a contrarian position: the 10-year yield would snap back.

This snap-back happened promptly, starting on September 5, leading to a snap-back of historic proportions, which I discussed on September 15, “Snapback Bloodletting in the Overripe Bond Market,” and said this:

“If this snapback follows the pattern of prior snapbacks, we’re looking at something like five months of rising 10-year yields, more gently than in the past eight days, with sharp ups and downs, but rising overall, with the yield going to something like 2.7%. And that may be the optimistic scenario.”

In the podcast, I also said that “peak negative-yield absurdity” had likely been at the end of August 2019, when over $17 trillion in bonds globally sported negative yields, and that yields were on the way up.

What we got so far:

In terms of the Treasury yield snap-back, we’re 3.5 months into this 5-month time frame. The 10-year yield has snapped back from 1.47% to 1.90% (as of Friday at the close). There are seven weeks left in the time frame. So there was a snap-back, but the 10-year yield is unlikely to hit 2.7% in seven weeks. I would say my prediction went in the right direction – in the sense that I didn’t shoot myself in the foot – but it didn’t hit the 2.7% target.

In terms of “peak negative-yield absurdity” having been at the end of August, with negative yields edging higher from there: Negative yielding bonds globally fell from $17 trillion at the end of August to about $11 trillion now, according to Bloomberg. The central bank of Sweden, one of the first to dive into the negative-yield absurdity, abandoned negative yields at its meeting in December, raising its policy rate to 0%, the first central bank ever to do so. I think I nailed this one.

#2: Market turmoil if the Fed fails to cut 3-4 times in 2019.

June 6, 2019: I wrote, “Here’s My Prediction: If the Fed Doesn’t Cut Rates 3 or 4 Times by Dec 11, Markets Are Going to Crap.” The premise was that the federal funds futures market was pricing in a high probability of three to four rate cuts by the December meeting. My prediction wasn’t about the Fed cutting rates 3 or 4 times, but about the market’s reaction if it did not cut rates as many times – that any disappointment would bring turmoil.

What we got: The Fed did a lot more. It cut rates three times, bailed out the repo market, and started buying short-term Treasury bills, ballooning its holdings of Treasury securities at the fastest rate since the Financial Crisis. And stocks surged. So my prediction of market turmoil if the Fed refused to cut enough wasn’t tested, though it would have been interesting to see it tested.

#3: Downturn in shipments and in the goods sector.

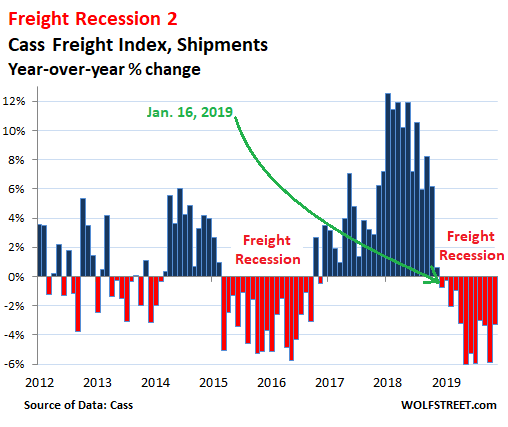

January 16: In the article, Boom Fizzles: Shipments Fall for 1st Time Since Transportation Recession, I predicted, in line with the cyclicality of the transportation industry, that the shipments boom in 2018 was unwinding and said that “this industry is a useful barometer of the goods-based economy.” I used data from the Cass Freight Index.

What we got: Manufacturing and construction have entered a (mild) downturn this year, with year-over-year declines. And shipments have fallen every month on a year-over-year basis in 2019. This is the most recent chart of the Cass Freight Index:

#4: Peak Unicorn Bubble was on June 10 at 9:59 AM.

June 10: In the article, Was this the Very Minute of Peak-Insanity in IPO Stocks?, I discussed the crazy stock price of Beyond Meat [BYND] since its IPO, which at 9:59 a.m. reached $186.43, giving this company a market capitalization of $11 billion. Tthe company had just $40 million in quarterly sales of fake meat products with tons of competition. I said:

It is this kind of head-scratcher that forms the ideal candidate for pinpointing the very minute of peak-insanity. This is the craziest IPO in at least a decade. But this is not to say that something even crazier won’t come along, and everyone jumps on the bandwagon for a while to drive it up into the stratosphere before it comes unwound…

What we got: The stock went on to skyrocket to $239.71 six weeks later. However, since the end of July, the stock has collapsed by 68% to $75.64; the super-hyped WeWork IPO was scuttled, with the company needing a bailout; and the shares of other unicorns with mega-IPOs, such as Lyft and Uber, having fallen on hard times. So clearly, 9:59 a.m. on June 10 was not Peak Unicorn Insanity, and my prediction was wrong. That moment occurred about six weeks later.

$5: Boom in Heavy Trucks Ends, Downturn starts.

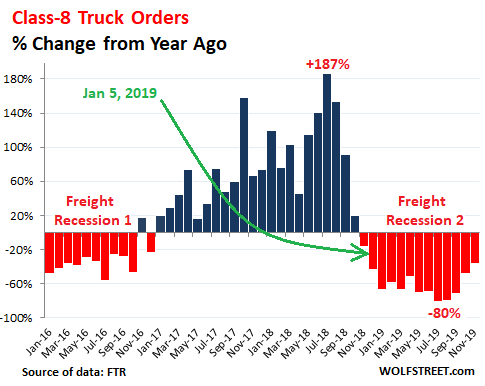

On January 5: In my article, Trucking Boom Ends, Next Phase in Cycle Starts, I discussed Class-8 truck orders for December 2018. Orders for these trucks had gone through a historic boom in 2018. But late in 2018, the boom began to fizzle, and I wrote: “It’s just the beginning of another phase in the cycle” – this next phase in the cycle being the decline.

What we got: Orders plunged through 2019. This is the most recent chart with orders for Class-8 trucks through November 2019:

#6: “IPO Millionaires” will not drive up home prices in the Bay Area.

April 7: In my podcast — and on April 14, in the transcript — I predicted that the New York Times and the entire media circus were wrong in predicting that the multi-millionaires from the mega-IPOs of 2019 would further drive up the Housing Bubble in the San Francisco Bay Area. And I explained why they were wrong, how the dynamics worked, and why the last two times we had this situation, we got housing downturns. I was furious – you can hear it in the podcast – about this sort of real estate propaganda being republished in the media in a brain-dead manner.

What we got. The median price of single-family houses in the San Francisco Bay Area peaked in May 2018 and has since zigzagged lower. By November 2019, the median price had dropped 12% from that peak and had dropped 6% from April 2019, when this brouhaha erupted.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Wolf, are you willing to make a general prediction for the stock market in 2020? Can a market that is forever primed by new zeroes from the Fed actually crash, absent a political intervention?

I love your writing! This blog has been a real education for me.

JoeinLA,

No, I’m not willing to make a general prediction about the stock market for 2020, but I’m willing to do something else. If I do it, you’ll read about it on Monday or Tuesday :-]

proper answer is

UP IS UP UNTIL IT AIN’T

and down is down until it AIN’T

Your predictions were pretty close

Yes, well done sir.

When J.P. Morgan was asked what the stock market will do in the future, he replied, “The market will fluctuate.” Some things never change.

Happy New Year everybody Wishing everyone sucess and of course good health and happiness in 2020

Wolf, as I read it, you got 6 out of 6. Rather than selling bear mugs, I recommend you switch to peddling Crystal Balls.

Blockhead,

I think I got 4.5 out of 6. But you see, I don’t predict stock market levels, stock price levels, elections, GDP (except to say that I don’t see a recession on the horizon), and things like that. If you look at it, you see that I only made predictions where cyclicality or actual dynamics have my back, and where I could say something that was contrary to what the market organs were promoting. I picked the easy ones. I leave the hard ones up to others :-]

I a new subsciber..love your perspective on the nuts and the bolts that are the building blocks of our economy. I will make one prediction… a major market correction in 2020.

Wolf,

The current consensus seems to be that all is rosy and that no recession will happen in 2020 and the stock market will keep rising for at least a few more years and that Trump will be re-elected

I doubt it (dunno about Trump). The Fed’s actions this year smack of shear desperation to keep a booming economy pumped up with even more PEDS/juice/air/free money to prevent it from blowing up from the massive junk debt accumulation.

So if you are not predicting a recession in 2020, Rabobank, which had been spot on for 2019, does:

The un-inversion of the yield curve, strong employment growth, solid growth in consumer spending, the low unemployment rate and a possible US-China trade deal do not change our forecast that the US economy is heading for a recession next year.”

“The arguments put forward to dispel our forecast of a recession reveal the absence of a coherent forecasting framework.”

“Our forecasting framework points to a recession in the second half of 2020. This will also force the Fed to slash rates back to zero before the end of 2020.”

A reminder that balloons generally burst when they are overfilled beyond capacity to look their biggest and best ever

I’m nervous as well. Back to 90% cash, 10% gold, plus a few option plays either direction.

We just had a major correction end of 2018, then monetary policies got looser and stocks went back to new highs but nothing else has really changed.

This summary is a helpful insight into your method, Wolf.

He has two balls and I don’t think any of them is crystal. We mortals should all respect our limitations.

If he only had one he could maybe call himself Einstein..? :)

There’s been a lot of rumors by the same folks that brought us the Beyond Meat insanity about three “possible” hemp mega-IPO in 2020.

The most likely to go public, Hemptown, anticipates revenues in the “$8-12 million” range for FY2019, which is not exactly the kind of cash I would associate with a company trying to go public: at least Beyond Meat has about $150 million/year in revenue.

However the Hemptown team anticipates “potential revenues” in the $60-180 million range for FY2020… albeit in their general enthusiasm they forgot to tell us how do they expect their (real? imaginary?) revenues to increase over sevenfold in the most pessimistic scenario in just one fiscal year.

But at least Hemptown makes an effort to impress us all with big numbers and colorful spreadsheets. Another hemp company aiming at a 2020 IPO, Stately, seems a complete unknown even on hemp websites. Nobody knows what revenues these chaps have, what revenues they expect to have or even how much growth they promise. But it will be a very sweet IPO… if it ever sees the light of day.

Wolf, you got your work cut for you for 2020 here.

MC01

You talk about Hemptown going public anticipating revenues of $8 – 12 Million revenues………then in 2020 $60 – $180 Mliion revenues…..bla bla bla.

Nothing mentioned about profit !

Turnover (Revenue to USA) is Vanity………….Profit is Sanity.

If the business is so profitable and has such a great business model, one would surely go to the bank and borrow (especially with negative interest rates……..ha ha ha) than have to account to shareholders (maybe even be expected to pay a dividend………ha ha ha) and even be thrown off the board of directors at a later date.

Both Stately and Hemptown have recently concluded rounds of private financing. I admit I don’t remember details about the former, but the latter has just raised $15 million on top of the 23 the raised last year. They have enough cash to send up in smoke for a while, quite literally. So these folks have no problems financing their companies regardless of profitability, or lack of thereof.

Hemptown management has admitted their goal is to either go public or sell off to a big group (Coca-Cola and Red Bull have been both named, and both declined to comment), so they are honest about it: they want to sell their company to somebody else before hemp legalization procedes further and everybody and his uncle jumps on it.

Yes, it’s crazy but at least there’s some kind of twisted logic behind it.

If you liked Hemptown you’ll love a couple more rumored 2020 IPO.

Palantir Technologies has, by their own admission, never turned a profit nor has any idea on how to do it. The company is valued at $6 billion, down from the absolutely ridiculous $9 billion valuation back in 2014: the IPO window is closing so I suggest they hire the Beyond Meat hype team on the double. If they pay me good money (I am open to offers and I take cash, cheques, direct bank transfers and most credit and debit cards) I may even tell people I know to buy Palantir stocks at any price.

But the big one is DiDi Chuxing, which Alibaba is considering making a public company next year. Nobody has a clue about DiDi revenues, profits (or most likely lack of thereof) or anything else because Alibaba makes public only those informations they chose to and Chinese law allows it. What we do know is that Alibaba passed over to DiDi their investments in Lyft, Uber, Grab and other certified money losers around the world. In short this is a “Shut up and take my money” purchase. Nudge nudge, wink wink. ;-)

It’s going to be a buuuusy 2020!

Here is why they can’t go to a bank.

The Economist explains – Why marijuana retailers can’t use banks | The Economist explains | The Economist

If these companies are selling non-pharma marijuana – how does the ongoing federal illegality of marijuana come into play?

As far as I know, the problem with banking still exists – and if they can’t bank, how can these companies go public?

Two things undercut the Federal Law, on a personal level UPS will ship anything no questions asked. On a banking level the expansion of shadow banking, dark pools and all other manner of private equity abolishes the old money laundering rules and sanctions. Trump gave tax breaks to US corporations which are really multinationals, GM makes more cars in China. He can selectively enforce trade laws, but he hasn’t the tools. States with legal status will trade with companies outside the US. The federal barriers are breaking down. The US charter banks are being made into GSEs, the Fed wants THEM to handle the NEXT QE. Fed banks are removing themselves from the banking system. Why does a company need to go public?? Listing provides access to capital, but if that access can be gained other ways, why bother with the whole SEC, shareholder thing? You buy back all your shares and go private. MJ only highlights changes in the banking industry. In this instance they do not even have to repeal an amendment (18th) to change the law. The rules about cultivation are probably not much different between DEA and State of CA BCC. I imagine they could both prosecute the same illegal growing activity. It’s now an administrative problem.

Neither sell marijuana. The sell CBD oil and products.

The market is incredible crowded at this point.

True and that’s another angle for 2020: there are plenty of markets worldwide that are incredibly crowded right now.

Hemp is one of them, for the simple reason entry barriers are so low and the market is already saturated. But a lot of sectors are in for a shakeup.

This is for me the big angle for the 2020’s: the ability of legislators, regulators and central bankers to keep horrible investments from the past decade from imploding, exploding, rolling over and generally throwing debris all over the place.

I suspect mankind will somehow survive without a multi-billion dog walking app company or without six meal delivery outfits in a city with less than 120,000 people but our central planners seem to disagree with that.

Reality always returns, but the wait can get excruciantingly long.

In Oregon, the State did it right in my opinion. Anyone can grow small quantity if they get their license. There is so much pot here now that you can get it for free in many cases. Cost out of the store is lower than from a dealer in 1990’s and much better quality. Stores are trying to add value through prerolls, edibles and CPD oil products (sky high in price).

So you need a license in Oregon, to grow your own dope (marijuana) ? My recollection from a very long time ago, when some of those I knew well were growing dope, is that it is easy to grow. I have lost track of erstwhile dope-growing friends, but sometimes find myself wondering about the potency of current cultivars. I’m guessing that it is frighteningly strong.

Love that government is getting into oversight and licensing (SARC).

….of course, then again, maybe the growers of today are developing “mild high” strains with shorter half-lives, for users with jobs and lives….kind of like your “mild burn” jalapeños; a usable cultivar of a potentially dangerous plant…..

That said, I see the legal availability of CBD as a likely positive: a few years back, I looked up (PubMed) some papers on trials being done on administering CBD to newly-diagnosed T1 diabetic children. The CBD was showing some promise in that, and perhaps likely to be of use in other auto-immune illness.

I often have vivid dreams where I imagine I can see into the future. Based on these dreams I submit the following predictions:

— The 737max is never going to fly again

— Trump is going to win a second term

— WeWork is going to dramatically implode

If I get at least 2 out of 3 right, I will consider myself a true seer, and will start marketing my unique talent. You read it here first :-)

Okay so pretty sure that Boeing are re-badging the 737max to 738 or 737mx2 or something like that – so when it does fly none of us will really be able to tell its a dud until after takeoff.

The aircraft will be fixed and fly again, that’s not the real problem.

The real problem is how Boeing executives are literally getting away with murder (and large severance packages).

Somebody gave the order to tell certification bodies the MCAS installed on the MAX was exactly the same thing as installed on the KC-767 military aircraft while the relationship between the two is about the same as that between a Pentium and an i7 CPU. Somebody gave the order to tell airlines their crews didn’t additional training to deal with MCAS to avoid paying a penalty to big 737NG users who had signed contracts for the MAX even before it flew. And somebody gave the order to introduce a single point of failure against Boeing’s own internal design guidelines. I am leaving a few out but I am sure you get the idea.

Like it or not the technical issues will be addressed whatever the cost. Again, that’s not the real problem.

The real issue is we need one or, even better, a number of heads on a platter. This is not a matter that should be settled by having Boeing as a whole fined and forced to make amends: it wouldn’t change anything because professional c-suites would simply migrate from selling jetliners to selling toothpaste and never change their ways.

As much as I would appreciate the idea we don’t need to go after every single one of the culprits: “to hit one to educate a hundred” as the Chinese saying goes. Seeing a few of their own tried, stripped of their wealth and sent to jail for a few years may not work wonders but would go a long way towards making people think twice about trying something funny.

I am not holding my breath because “it would send the wrong signal to the economy” (kinda like stopping real estate speculation) but that’s the only cure possible.

Maybe hit 5 or 10 to educate a hundred?

These guys are all professional gamblers, ya know?

PS: 737 Max will need more than improved software/detector inputs to fly again, and that is a hopeful opinion…….

Any solution has to newly qualify the pilots:

To properly certify the aircraft for flight, all pilots, male and female, to qualify must pass at least one set of simulator tests that demonstrate adequate strength and agility to manually trim the aircraft under the following conditions:

1. After transfer from AUTO to MANUAL , a pilot must alone use the manual trim wheel to recover correct trim after a MCAS -induced fault occurs, under these sub-conditions:

A.To account for left/right handedness, recover from out-of-control MCAS receiving the full range of maximum and moderate input errors:

a.From the left seat at any altitude during take-off, from zero-to- 10.000 ft. with MCAS operating at the corresponding low mach speeds, with full recovery before any ground impact [loss of altitude during recovery procedures must not cause terrain impact].

b. from the right seat, as in [a.].

B. As in [A.], with aircraft at routine cruising-altitudes and speed ranges.

C. As in [A.], with aircraft at maximum rated altitudes and speeds.

Tests must include a variety of cockpit alarms simultaneously happening [sirens, voice, stick-shake] that also demand attention and handling at with priotities.

Note: The above is to demonstrate required minimum agilty and strength regardless of pilot variables such as age, height, reach,experience, male/female, left/right-handed, etc. as crews are typically mixed.

Recall that Chief Technical Pilot Mark Forkner [developing training-simulator routines] had unexpectedly encountered MCAS -induced oscillation during a landing approach, then afterward learned that MCAS had been altered to normally operate down to 0.2 Mach [about 150 miles/hour] which occurs at takeoff and landing stages near ground level. That incident suggests that original MCAS software specs were for MCAS operation at higher Mach speeds and during simulator runs, the “in spec” vendor software was then modified at Boeing to include “down to 0.2 M”, which is when serious pitch-up risk [on takeoff] happens due to engine placement and center-of-gravity consequences. Recall that the [outside vendor]software was designed to meet Boeing specs supplied to the vendor.

“The CFM Leap-1B is more efficient … it is also much bigger. It weighs more and is bigger in size.” -Mr. Subramanian, Aircraft Engineer on 21 March 2019.

“Because of its bigger size, Boeing had to change the mounting point of the engine. In short, they put them further forward and much higher on the wings. But the different mounting point made the Boeing 737 MAX prone to stall. The engine positions on the wings forced the nose of the aircraft to stall.” Mr. Subramanian elaborates.

https://www.cfmaeroengines.com/press-articles/boeing-launches-737-max-10-powered-leap-1b-engines/

So Boeing forces out CEO Dennis Muilenburg and replaces him with David Calhoun. Calhoun had been Chair of the Board of Directors at Boeing and sat on the Board for a decade. He also worked in the private equity division of Blackstone and was a “senior executive at General Electric, where he led multiple divisions, including transportation, aircraft engines, and transportation systems.”

The CFM engine is 50% GE and 50% Safran Aircraft Engines.

Boeing makes and sells airplanes. They put a ‘Money-Man’ at the helm – not an Aircraft or Aviation Engineer. I have no doubt that Mr. Calhoun is talented at running a private equity take-over business, but Boeing needs a CEO who is an engineer first and a money-man (or woman) second.

Sorry, correction to second paragraph: “The engine positions on the wings forced the nose of the aircraft to go up.” -Krishna Kumar Subramanian

I am not an Aviation Engineer, but I think the general consensus to the cause of the 737 MAX’s problems start at the newer engines. Everything MC01 describes is quite accurate, and a sad reflection on Boeing and the FAA.

@MC01,

Fully agree with your analysis and conclusions regarding executives.

However, I fear there are also serious technical problems for Boeing to overcome. The FCC hardware is reported to be quite dated (Intel 286 generation) and most likely overburdened with the extra processing added by MCAS. I would not even be surprised if the single point of failure (monitor only one vane) was kind of an inevitable design “choice” because the processing power needed to fully monitor multiple vanes and intelligently dealing with sensor disagreements went beyond what the ancient FCC hardware has to offer.

If this is all true, Boeing either has to dump the MCAS or replace the FCC hardware, the latter case involving major software architecture changes. In both cases the whole aircraft would have to be re-certified and the pilots re-trained.

In this scenario we’re looking at multiple years and most likely a rebadge before the “new” AFKA737M (Aircraft Formerly Known As 737 Max) will fly.

Turkish Airlines has just reached a deal with Boeing regarding the MAX grounding: the airline will receive $150 million in cash plus $75 million worth of spare parts and training. As an aside I hope that cash will come out of some c-suite’s bonus and severance package.

This hints the main change will be the need for additional training for crews coming from the 737NG, which is exactly what Boeing management attempted to avoid so desperately. If extra-training is indeed needed Boeing will have to pay big penalties to several major 737NG users who signed contracts with such clauses: American Airlines alone has a $1.1 million/aircraft penalty clause should the MAX need additional crew training. This works out to $110 million, plus the compensation package AA and Boeing are negotiating.

Boeing is going to be financially crippled, so I fully expect some sort of bailout package to arrive from Washington.

Finally Boeing suspended MAX production for several reason.

The first is civilian 737NG production ceased earlier this month when the last aircraft was delivered to KLM. The military P8 Poseidon is in low volume production and likely to go into extra-low volume production to allow stretching the assembly line to operate beyond 2023, when the last aircraft should be delivered at the present rate.

The second is Boeing is running out of storage space, not merely for the finished aircraft but for parts as well. There are presently over 737MAX parked around the world, more than 150 at Moses Lake alone.

The third is Boeing need to gear up for the modifications needed on the MAX. I am still to read the final estimate by Ryanair, but so far they have kept their end of Q1 2020 prediction intact. One thing I learned is never to bet against Michael O’Leary but even he can be wrong. Perhaps. ;-)

You sure are right…. Your example reveals how the higher tier is a closed separate independent economy really. It just feeds off the revenue streams of the lower real economy. It just depends if there is anything left from the lower stream economy to keep feeding it. We all are watching that play out. It’s criminal really. We (meaning anyone not a Billionaire) are on the other side of the invisible fence, that is becoming more visible. It just depends if there is any free food left for the taking. With the present pull-back ( nationalism and political), some of the players are starting to get affected by their own weak strategies. Just depends on whether or not the “Target 2” funding maneuvers get affected by Saudi, Russian, and Chinese billionaire moves. The games of the likes of Soros (old monies- prior to 1980’s) and a few others (individuals- like families, Corps., HFT, or GSE, etc.) that can tip the buckets that are really hinging on revealing the fine critical black-lines of who has really been playing the black-market schemes the worst and the most. These maneuverings will hit the Target 2 funding liquidity issues. I personally think the liquidity crunch that the Fed stepped into is due to il-liquidity (a first indicator of the global problem) that was first analyzed by a few of the German economic analysts in 2011. Roubini has referred to the “systemic” failure issues too in the past. The liquidity problem is the culmination of all the lies that get sifted down to the fine print that no one ever looks at when “the ledgers” get only those superficial, pass-the-buck passes. The global economy is really 3 independent economies. The elite. The masses. The black-market. Now the game gets a bit more shifty. The real players don’t have the “TIME FACTOR”s that they used to have to be able to play around with. The “what I see and know” is becoming more timely globally. So, what I see and know is becoming what you see and know. I can’t fool you all the time like I used to be able to do. Your RISK is becoming my risk 2. Then the playing gets a little bit more a-count-able. How shifty can sneaky get? Kinda like snakey!

Hemptown=Pipe dreams. Look at the cannabis market in Canada and I think that people may have smoked weed because it was illegal as well. Not that that buzz is gone, so is half the enjoyment. Could be wrong.

In my accountancy practice, the clients I have that are making money and don’t have cash flow problems are illicit drug dealers.

They are even complaining that the illicit drug market is becoming very competitive (clear by the stabbings in the UK now over market control), margins falling and stock that is difficult to move (as in too many suppliers).

You wonder what GDP would be if they counted everything?

The EC does make all EC member countries add a guestimate of GDP from illegal prostitution and drugs.

https://www.telegraph.co.uk/finance/economics/10861170/Drugs-and-prostitution-add-10bn-a-year-to-UK-economy.html

Dow 35,000 in 2020!

three handred fifty thousand !

3500!

At the end of 2017 there were 3,600 listed stocks, less than half the number in 1997 and it is still decreasing. Perhaps the existence of an index itself and not it’s value will become the larger issue if this trend continues?

Wolf’s PE stories are among the most interesting to me.

Questions for 2020.

Will the tariffs (import taxes) raise enough money to lower or make a dent on government debt?

What will happen to all the debts made speculating that long term Treasuries were heading zero? Will they contindued to be financed through repo or will the Fed just buy them ala QE4?

Where and how will the excess liquidity created by the Fed flow to? How to benefit in the short term? Happy new year.

Wolf,

Lets hear your predictions for 2020 such as :

Stock market

Interest Rates

President in 2020 election

Gold Price

Unemployment

etc.

I am in the UK and I am predicting:

More QE by the bank of England

More Debt (Corporate, Government and Personal)

UK Pound to rise against the Euro (wrong way round……..Euro to fall against the GB pound).

Gold to go up and stay above US$1500

UK shares to go up.

More foreign investment into the UK.

I credit being given is crazy.

I have availabe credit on credit cards of over £140,000 (US$168,000) yet pay my credit card balances off so never pay interest or charges.

Yet just offered £6,000 (US$7,200) cash withdrawl on one of the cards interest free until January 2021 for a 2.1% fee (treat that as interest).

The bank mortgage on my house is 2.94% and they have a charge on the property while the credit cards have nothing.

Cashboy,

This is precisely what I stay away from. As I mentioned above, I only made predictions where cyclicality or actual dynamics have my back, and where I could say something that was contrary to what the market organs were promoting. I picked the easy ones. I leave the hard ones up to others.

I agree with Wolf. None of the five are worth forecasting and I forecast for a living.

Stock Market—no explanation for Black Monday 1987, and with machine trading today –forget it.

Interest Rates–we are not the FED.

Elections–“wait and see” is all I ever say.

Gold—goes along with Stock Market, throw in cyrpto, too.

Unemployment—by the time it gets bad several easier items to predict were already bad. Same with GDP.

I like housing permits ( not starts ) and National Retail Sales—the unadjusted numbers. I compare housing permits and National Retail Sales on current month, versus same month from prior year.

The factors that would cause gold to peak out or fall are extremely unlikely. Thus, $1700 gold is a given, but I’m willing to say $2000, which will make for an upside breakout and a stronger rising trend after 2020.

I predict a 100 percent chance that in 2020 I will keep reading Wolf Street.

There is another prediction which was not included:

Perhaps it’s more of a general rule than a prediction. General rules have exceptions, but not many, which is why they’re general rules and not hard and fast rules.

Prediction is not the same as speculation. Speculation relies on guesswork. Prediction is not just guessing.

The six predictions listed have largely been correct because they’re based on hard data, careful analysis, and a real understanding of the dynamics which govern how things play out. This is how valid predictions are made. Errors in any of the three can cause a given prediction to fail, but WR, being WR, is hardly prone to such errors.

Weaknesses in any of the three can result in lack of accuracy even where the prediction is largely but not perfectly correct. Data, analysis, and understanding of dynamics can never be exactly known, and neither can random events which affect them. Weaknesses are not necessarily errors.

The arts and sciences of prediction make for a large complex field. Confidence intervals, balance of probability, statistical inference, that sort of thing. Space and time limitations preclude any broader discussion here, but generally speaking, if the principles are valid the predictions based on them will succeed, more or less, and if the prediction is wrong, those principles or the understanding of them should be adjusted.

That’s science. Science has predictive value. The concept of predictive power differs from explanatory and descriptive power (where phenomena that are already known are retrospectively explained or described by a given theory) in that it allows a prospective test of theoretical understanding. This will cause that. This infers that, and therefore this other must also be so. There are numerous examples in the sciences. Religion, not so much.

People rely on prediction all the time, though they may not realise it. It’s why people can do things with the reliable expectation of a particular result. It’s how many scientific discoveries are made. It’s why farmers can successfully plant crops. It’s why businesses can put together successful budgets and marketing plans. It’s why people can invest successfully. And so forth.

What did you say about Tesla?

anticlass,

I will likely say something about TSLA and a few other things on Monday or Tuesday. I got a plan… I’m still skiing today in the Sierra (past six days, gorgeous!) but will drive home today, and then tomorrow, I start working on my plan :-]

Wolf- I would love to hear your thoughts on the Lake Tahoe second home/ski condo market. I don’t know of any statistics or market data made available on area prices.

I venture to say this: If you own a condo/house in the Tahoe area that you’re offering as vacation rental, you can never afford to stay there when you want to stay there, namely during holidays and peak skiing season, when/if there is snow, and when everything is booked out at maximum rates. But off-season, such as during mud season when no one else wants to stay there, you can afford to stay there.

I actually wanted to ask the same question. I am still part of the generation that dreams about Lake Tahoe. I still remember driving my first son around the lake.

Wonder what it would be like owning a cabin there now especially on the NV side.

Having lived in Reno, I’d say it would be a lot easier and cheaper to live in Reno or Carson City. One hour drive to Lake Tahoe from Reno, 30 minutes from Carson City. 4-wheel or AWD a must. Both are great little cities to live in, with good healthcare systems as you get older

Living in Tahoe itself would be only if you MUST live in a semirural area surrounded by big trees, which in these days of raging wildfires may not be a great idea

One of my cousins owns a timeshare townhouse on the Nevada side of Tahoe, btw. They bought this a long time ago. She and her hubby go skiing there every year during Christmas break, the peak of the season. They were thinking of moving there (Nevada side) permanently for retirement from SoCal for tax reasons

Forget the plan ski some more!

Did you mean in the Sierras or at Sierra? That’s a cool place, always thought it was under rated. Awesome tree skiing

How’s the powder?

Just Some Random Guy.

It was awesome. We had super-luck weather-wise. When we left SF it was still snowing up there; when we got there (in less than three hours, this being Christmas) the sun came out. It was perfect until this afternoon when it started snowing again, but we were able to get out of there before it got bad.

The ski area is at ca. 7,000 ft elevation, right at Donner Pass. One time a few years ago, we got caught in heavy snow at night coming back from dinner in Truckee, when they closed I-80 for whatever reason, and we couldn’t get back to our lodging. Things can get rough up there in the winter.

We do cross-country skiing (classic and skating). So we love to look at powder, but we really don’t like to ski in it. We like to ski on freshly groomed trails :-]

BTW, the mountain range’s name Sierra Nevada means “snowed saw” in Spanish, because of the white peaks, like the teeth of a saw. For that reason, I don’t call it the Sierras (“the saws,” plural, because it doesn’t make sense) and stick to “the Sierra.” But others call it “the Sierras” and that works too, as far as I’m concerned.

That makes sense about Sierra Nevada. I’ll start using it :)

My pet peeve is people from the east who call Nevada that weird thing, like you’d expect someone from Chicago to say. Same with Ore-GONE. Grrrrr.

My wife’s family grew up in the area and she has some amazing pictures of their house growing up, nearly covered in snow. You could earn a solid living as a roofer, never want for work.

Predictions is very difficult when human psyche is involved. Emotions are very bad for financial decisions. Economics is not just numbers and game theory but involves human mind and free will. All the predictions can be very sound based on calculations but exact timing is impossible. That is why shorts get burned. Powerful people loose all their money.

I am also predicting a few things

1. 2020 = Mr. Trump

2. Stocks = more than 30 K easily

3. Rates = unchanged overall

4. Tariffs = withdrawn after elections

5. Bitcoins = bust

Lets See I am taking a screenshot of my predictions.

“2. Stocks = more than 30 K easily”

Does this mean the ‘Dow 36,000’ guys can come out of hiding?

We agree on some things, here are my predictions.

Here we go:

1. Bernie will win Iowa and New Hampshire. The Democratic Party will do everything to tank his chances and there will be a long drawn out fight again – Biden versus Bernie. Biden will eventually implode.

2. Trump will do everything in his power to keep this market up until his re-election.

3. Fed will cut rates again in April ( maybe twice in 2020) and by summer start QE 4 officially

4. Trump will win in 2020.

5. Market will start to crap out by October/November and implode by March 2021. We’ll officially be in recession by June 2021. It will be global financial crisis led by China, with few tools to get us out of a major liquidity crunch. Asset prices will fall by 50%+.

6. US stock markets will not reach highs seen in 2020 for another 30 years.

“US stock markets will not reach highs seen in 2020 for another 30 years.”

change that to never…

However, to really screw things up takes a human with a computer, which is my prediction. Whatever happens, machine algos are likely to be involved.

My prediction is the purchasing power of the dollar will go down this year probably around 2%.

In Europe where the purchasing power of the Euro only decreases by 1% it will be seen as a crisis.

In Japan where the purchasing power of the Euro remains flat it will be seen as a super crisis.

We all know it is dishonest money and when the debt bubble gets too big things don’t work like central planners thought.

Should have said Japan = yen

You know in the big picture something big has happened in the last decade. It is now clear that the central banks will not allow market to impose financial discipline on government borrowing. That is a big freaking deal.

Happy new year.

I wonder if something in 2020 will force the FED to raise rates?

I think so A sudden crash or collapse in the Dollar index and gold blastoff might do it

I cannot see a “crash” of the US Dollar because most westerncountries have the same issues as the USA (Central Banks printing money; government deficits) and the USA will tehrefore remain the reserve currency and the currency you change your local currency to when there are economic or political issues (as in South America at the moment).

Rising rates is what no one is preparing for, and we all know why. However, a sufficient rise in defaults will push rates the other way. Don’t ask me when, but I have cyclicality on my side….

Question for 2020

What affects will increasing repo operations/POMO have on HQLA collateral availability?

Spreads are widening across the curve with the 30 year, only since august it seems like short end (ON to 2y) has caught up with the others spreads which have been stuck near resistance since march 2019 (https://i.ibb.co/VTVKrXh/num-inverted.png)

Seems ominous for duration considering this was happening during rate hikes and cuts…

3ms30s spread looking like we could get another +70bps in q12020

Thanks for your answer. What will this likely do to those who bought long and expected yields to go near zero?

ahh, the good old long-$-denom-duration-to-zero-and-beyond- trade, aka an implicit short interest rate volatility…

hopefully they are hedged

The number of residential units under construction (US) has risen to levels last seen during the housing bubble. This statistic includes both single family and multi family homes.

Home prices continued to rise at a national level.

Rental vacancies are lower than when housing peaked c. 2006. At that time people were moving out of rentals speculating they might be rich if they owned their own homes. The Price/Rent ratio was high. In 2006 it would have been cheaper to rent than to own. Inflation is variable and difficult to forecast.

David Hall,

There is NO NATIONAL HOUSING MARKET. This notion is an illusion. There are only local housing markets, and they’re all VERY different, in terms prices and rents, and in terms of level and direction. If you’re looking at national average data, and that’s all you look at, you’re putting blinders on your eyes.

Was curious in my neck of the woods price of new construction. Followed construction of 3br, 2bth 2 car garage on city lot 1/3 acre in middle class neighboorhood. Around 1500 sq ft. Above average finishes. Reputable builder. 45 minutes outside Raleigh, NC. Presold so no real estate agent involved. $216,000.

In California houses like that can’t be found for less than 400k.

I’m from Raleigh also. Someone told me Raleigh is the next silicon valley. Everyone moving here, traffic gets crazy now.

In the bay area, it’s going to be more like 1 million. In parts of the Bay Area more like 2.5.

That’s a real distortion. Zillow has median house prices at $283+. There may be a few developments in the low-$200Ks, but, those are exceptions, far from “the rules”. And they’re probably out in the “hollers”.

The notion of “National (most anything)” is usually an illusion, often pushed by sociopolitical propagandists.

E.g. there is no national “Black Community”.

There are millions of individuals, some in smaller, genuine communities, such as families.

An era of reverse segregation may come to pass. People tend to want to live in neighborhoods of like people. Politically segregation has been a tool to disenfranchise minority voters, through gerrymandering. It always comes to pass when a police department has a racial problem they hire more minority cops. China has a far bigger ‘diversity’ problem. XJ wants to tie North Korea in the trade deal which I think is only further evidence of their racial, ethnic and social differences.

Honesty at this point you could make a FAQ for these type of things.

Or save it for your next book or something.

I suppose a resident of San Francisco may be concerned about San Francisco real estate prices crashing. With Florida population growing 300,000 per year, different calculations may be needed in Florida. The Federal Reserve Economic Data reports are calculated by the Federal Reserve Bank of St. Louis for evaluating national trends, lest San Francisco residents think national housing prices are crashing down. Some thought Tesla was toast while there was global growth in electric vehicle sales. Wider trends might be worth some review.

Predict this: The Fed is now routinely deploying it’s tools (ie that which is in it’s tool box for Finacial Crisis sized emergencies) for lessor situations like repo crisis and whining by Mr Market or propping up some unknown marginally ethical investment strategy of no particular importance shld they croak and bite the dust. It’s extremely hard to see any significant market decline can happen or be allowed to happen without the Fed intervening massively to prop up assets markets essentially forever until it can’t.

Predict This: Fed tool creep. Fed tools for all occasions when asset prices don’t always rise the way asset holders think they should.

Let’s keep it simple, because this is what history demonstrates. Things boom when the debt is blowing out faster than incomes. How to mop it all up, that is what money printing is for. I think they are still trying to mop up 2008.

Let’s keep it even simpler. How do I/We make money with these predictions?

I do have an answer to that question. Don’t change investing styles. If you are an index, index your whole life and you will do ok. If you are a value investor stick with it. If you are a diversification investor, stick with it. Changing horses is where you are likely to fall off.

Simpler still:

Job #1 at Fed is keep assets prices going up.

End of story.

The Tool Box exists for that and that alone. We know that because those tools have never been deployed to do anything different, if they were it wouldn’t matter because they can’t do anything than what they do which is inflate assets.

Imafan,

An interesting concept that I have is to, basically, just take the old Permanent Portfolio of Harry Browne fame and pick what you think is the least desirable asset class out of the four and at the very least, stay away from that one. OR, maybe even better pick the one that is beaten down the most and deploy funds within that space.

Like the RE Sector even amongst each asset class like Equities “it’s all local”. You could say that, for instance that, largely, at this point in time, you might want to avoid the FANGS, however, you might think something like a KHC, or God forbid (the horror) that a GE might be a good pick. My highest conviction picks are Imperial Tobacco IMBBY & Jr. Miners GDXJ. There was money to be made in 30yr Treasuries (and there might be again after the steepener) and the Gold & Silver have done well. I’m staying away from broad based Indexing as well as Residential RE because that is where the “cattle” are all proceeding up the Temple Grandin style chute currently.

The only way out for the FED is to inflate away the debt at this point. I do think that when the recession does finally come, that we will go into a very short deflationary spiral before the printing/MMT kicks in. I also think that no matter who’s in residence at 1600 Pennsylvania Ave., it won’t matter one bit with regard to monetizing & inflating away the debt & entitlements. I am going to position accordingly for the long haul in hard assets minus RE.

Tools indeed !

Those mope-torquing vise-grips don’t squeeze themselves, you know …

RE: Torquing with vice-grips.

Having used many tools for almost all my entire life, for work and pleasure, I soon ran across the term “creative misuse”, (of tools), that was usually much admired if it worked, especially when the proper tools were not available. Even by instructors, although very begrudgingly.

Knowing little about economics or business, I wonder if there is an equivalent phrase that the practitioners of those trades use?

Sure:

1. Baffle them with BS.

2. When all else fails, manipulate the Data.

Prediction:

US auto sales will drop 8% this year in unit volume.

Trump will win election and betray his base with an austerity agenda.

Stocks will go up as the monetary firehouse is directed at them.

Retail store closings will be less than 2019 but still alarming.

So #3 was a mild transportation recession? According to the Wall Street Journal, many banks are sitting on hundreds of thousands of empty rail cars!

I wonder if banks always competed with the private sector to buy rail cars. In my day they used to just provide loans.

https://www.wsj.com/articles/banks-own-thousands-of-railcars-but-dont-know-what-to-do-with-them-11577356201

What was “mild” was the yoy decline in manufacturing and construction. But the transportation recession — or freight recession — is fairly severe.

Currently, “the few” ( government workers )

are riding-high at the expense of “the many”

( Homer Simpson ) — banning gig workers and

raising the minimum wage, to prevent competition.

No one suppresses the poor like “progressives”;

and voters know it.

“Carbon Taxes” hit the poorest hardest;

the rich are unfazed.

To Bill Gates:

We need densely-packed micro-apartments,

standardized, modularized, built in China,

robotically maintained.

The government won’t do it,

because it’d threaten its existence.

A few corrections. Government workers are underpaid in general as is labor in general and replace progressives with Noeliberals, which is the dominant philosophy of both parties not just in America but throughout the world. That’s why capital and profit makes up ever more of the economy and wages are a shrinking part.

“Government workers are underpaid in general …”

Really?

https://www.forbes.com/sites/adamandrzejewski/2018/12/11/making-a-fortune-19-million-public-employees-across-america-cost-taxpayers-nearly-1-trillion/#4eb39f7d3b67

I was referring to Federal employees. Your link appears to focus mostly on state and local government employees. Should have specified that.

So yes, really.

Federal employees are not underpaid but don’t have the lavish compensation of police, fire and some teachers and state union workers. They contribute around 7% toward their pensions and pay into Medicare and SS. They can retire at 55, without SS, but the retirement health care has been crapified over the years compared to municipal workers especially so most work far longer.

More to the point RD Blakeslee, your link is about specific instances of overpaid government employees…not ageneral or complete list of government pay levels. I would recommend you apply critical thinking skills in this case. For example, if I said Zuckerberg & Gates are overpaid and therefore private employees must be overpaid in general, that would not be logical.

Endeavor…I don’t agree. I applied for several Federal jobs a few years back when unemployed. The pay was bad and I think many pay freezes have remained in affect.

Endeavor,

Your information is dated and based on the old Civil Service Retirement System. The new system which started in 1984 is the Federal Employee Retirement system. Any federal employee younger than about 58 is on the FERS. A federal employee covered under FERS pays social security tax and gets a retirement plan that is based partly on defined contribution and partly on social security. Also they can no longer retire at 55. The retirement age moved up on a sliding scale to around around 57 or 58 I think. I’m not an expert on FERS because I just made

the cut off for CSRS in 1983 and retired the day I was eligible. The bottom line is a FERS employee works longer and gets a significantly lower retirement pension than a CSRS employee. The only advantage is that the FERS pension in portable. So when the economy is good many new federal employees leave for the private sector

I think the big difference is if you are drawing a paycheck the govt is taking part of your paycheck and that really limits your ability to grow wealth.

Although, I think that assets are so inflated that we might have a decade where the only real money made is through wages as asset values go south.

Govt workers can generally retire in their 50s with full pension and benefits. That alone is worth millions of dollars of income compared to suckers in the private sector who retire at 70. I keep telling my kids, the way to easy wealth is govt work. And I use the term work loosely.

Government workers may not be overpaid on the whole. The market shows generally which jobs are. In my area, firefighter jobs are massively oversubscribed, with hundreds of people applying for every opening. Police and school teacher jobs not so much.

But there can be no question that the public sector is “overpensioned” relative to the private sector.

In most states, government workers can retire by 60, and for public safety workers, often earlier, with pension benefits worth far more than a private sector worker can accumulate. Here are examples from the state of CA:

https://blog.transparentcalifornia.com/2019/04/23/calpers-100k-club-has-more-than-doubled-since-2012-new-data-show/

Almost 50,000 retirees with 100K per annum pensions, and average pensions for full career employees that far exceed private sector employment for similar skill sets.

As to whether labor is undercompensated relative to capital, that’s hard to quantify. Much of the world is still earning less than a dollar a day. As long as people are willing to work for less than US minimum wage, and as long as capital is free to find the lowest cost worker, labor in the US will be undervalued to some degree. But some kinds of labor are clearly very highly valued, including technical and software and finance skills. It seems to me that there is a bifurcation in labor, with low skilled labor including some white collar labor being devalued, and other high value skills doing very well.

The government won’t do it, because it’d threaten its existence.

And yet, the only thing standing between the people and the corporatists determined to reduce them to serfdom is government of the people, by the people, for the people. The government you despise because it’s in your way.

No one suppresses the poor like “progressives”; and voters know it.

Sheer gaslighting.

Have you no sense of decency, sir? At long last, have you left no sense of decency?

Mr. “Unamused” replied ( to me ):

> the only thing standing between

> the people and the corporatists…

I’m talking about THE POOR, you know,

the ones the government suppresses by

outlawing the competition ( gig workers ),

and raising minimum wages.

Bill Gates and Jeff Bezos have benefited me

far more than the government could ever

pretend to do, much less actually do.

Fortunately for me, “progressives” are

laser-focused on billionaires, green with envy;

meanwhile, Homer Simpson knows the real story,

he knows who’s helping him, and who isn’t.

How easily you have learned to love your chains.

I’m talking about THE POOR, you know, the ones the government suppresses by outlawing the competition ( gig workers ), and raising minimum wages.

Wow, if it wasn’t for those overpaid poor people those gig workers would have it made.

Oh wait! Those gig workers are poor people. You got to stop them from getting a living wage, because that would just ruin them.

Since when is government helping people equal oppression? Since you moved to the anti-factual alternate universe?

Mr Relf, your narrative is somewhat garbled, please clarify:

Are you actually saying that poor people are being oppressed because some at the very bottom are getting pay raises?

Are you saying that bureaucrats are the ones who have decided to raise the minimum wage in certain places, and not the politicians (aka “lawmakers”) who preside in those places?

This is fascinating, do tell me more; what do you call this philosophy you subscribe to?

Envy is a sin, best to avoid it or it could be a ticket to the lake of fire, since all things are predestined.

Calvin is strong with this one.

I would agree that Mr. Relf’s arguments are a mixed bag.

But I would strongly argue that the government is the much larger threat to the freedom of most people. People working for big business need to spend less than they earn and save until they can opt out of work. There is no opting out of your property taxes, or from the Fed devaluing the dollar (I guess you can buy gold, but you will not be paid in gold).

To everyone who has been brainwashed with this “government jobs are so overpaid” mentality I just have one question.

If the free market is so perfect and government jobs pay so well then wouldn’t supply and demand balance out? Wouldn’t everyone be clamoring to get a government job? Aren’t you – the writer – being silly for not having a government job? Shouldn’t you go get one right now?

These statements don’t ever hold up because when someone says “oh there’s this imaginary job where you get a $300k a year pension for life” my response is just to ask – well, why don’t you go get that job? Apparently it’s really easy to get and there’s tons of them out there according to you, so go and get that job if it exists.

Funny enough, no I’ve met ever has managed to get one of these amazing unicorn jobs. It’s almost as if they’re as real as unicorns.

Mr. “A” replied ( to me ):

> Aren’t you (Relf) being silly for

> not having a government job ?

I’ve been a gig worker ( in Seattle )

since my divorce, in 1988.

I would no sooner work for the government,

no matter what it paid, that I would get married.

In fact, it only makes sense if you are married.

Health, especially mental health,

is my only concern, not money;

there is no substitute for health.

Pass laws until you’re blue in the face,

it doesn’t matter,

society is becoming more like me, not you.

You are being screwed but not by some amorphous government. You’re being screwed by the 400 billionaire families who have managed to destroy the middle class and enrich themselves. They get 0% loans and bankrupt all the small business owners then only hire “gig economy” workers for minimum wage or less. Meanwhile they keep all the loot for themselves.

In a democracy, government action would usually be demanded by the people by now. The people would make their dirty tricks illegal, investigate and jail the abusive billionaires who break laws, institute a wealth tax, and create socialist systems like the police department, fire department, and libraries which everyone loves.

But the 400 billionaire families own the media. The own it all from Fox News to the New York Times. And they brainwash the people – making up fresh enemies (government, immigrants, Muslims, etc.) to distract them from the truth.

But because of the internet, people are starting to get the truth and are starting to open their eyes. And we’re all getting pissed at how badly we’re being screwed. Soon we will be able to fight back!

Yes, mental health is everything. One’s mortal shell means nothing.

300K pension jobs are indeed rare. But 100K pension jobs are quite common. Almost 50,000 such retirees in the state of CA alone.

https://blog.transparentcalifornia.com/2019/04/23/calpers-100k-club-has-more-than-doubled-since-2012-new-data-show/

Regarding the market for public employment, it’s true that some jobs are not desirable. But not all. In my market, there are hundreds of applicants for each full time fire fighting position.

I don’t have any idea if Government workers are over paid or under paid. What I do know, it is almost impossible to terminate the employment of the under productive.

Wolf,

Your call on the 10-year U.S. Treasury yield likely comes to pass but will take just a bit longer this time.

Yield likely rises to at least 2.5% at some point in 2020. That’s what the chart is indicating.

Rates headed higher elsewhere as well. Appears that LIBOR stopped its year-long decline earlier in December and looks to be reversing trend.

Have a healthy 2020.

Slainte!

PS – China still in serious trouble. Overnight SHIBOR set a new all-time low on Dec 26th at 0.848% but since this has to be the most volatile interest rate benchmark on the globe, won’t be surprised to see it rise 150 basis points or more in just a matter of weeks (or days).

Read 30 years ago that basically trying to predict interest rates a year out is a big waste of time. Don’t think anyone has proved that author wrong yet. It might just be too large of a market and all that can be known is already in the market.

Interest rates seem to be more a function of FED actions than “The Market”. I see no Bond Vigilanties. I do see continuous FED interest rates rate suppression.

Morning… Happy New Years to all. Wolf enjoy your skiing. I’ll get it started for everyone re Teeeeesla. Supposedly the short of all shorts. Still spinning like a top that won’t stop. Flame throwers be damned.

1. Most humans like to gamble.

2. If you can’t do a discounted cash flow and get a stock value it’s gambling.

Fear and greed tend to move in a bipolar manner, toward advice, or predictions. I told family and friends in 2007 to clean up their debt, and their investments. Couple of them lost their homes in REFIs. You hand out bad news, nobody listens. Let me tell you about this tiny gold mining stock, going to do a tenfer?! They would have bought some.

I agree with you, A.B, – don’t usually do that …

No one is seeing the big picture, hmm..

Depends what the big picture is.

I do see mine: Trees and meadows for miles in all directions. Cows and calves in the pastures. Deer and an occasional black bear, all manner of smaller animals and birds, wild turkeys among them…

Money is a minor vignette.

Money is an environment as well, like yours, and people tend to get sentimental about it.

A.B. It is sometimes said that “time is money”.

Tell that to a man on his death bed.

I would recommend that you spend more time working on your critical thinking skills. For example big picture is not small picture, and general government pay is not specific government pay. If you grasp this it will vastly improve your knowledge and ability to be immune to fake news.

My 2020 predictions

1. Stocks take a slight dip in January/February as Bernie Sanders support increases, but when it appears he has no realistic chance of winning, Dow hits 30K in April. or May

2. House prices continue to increase with low to mid single digit appreciation in 2020. West coast will do even better, making up for its lackluster performance in 2019.

3. GDP growth stays in the 2.5% range

4. Everyone commenting here continues to predict the opposite of 1-3 :)

HAPPY NEW YEAR everyone.

If you use a regressive trend line for the last hundred plus years the stock market has been overvalued since 1995 except for a few months during the 2009 crash to 666. Is this a deflection point that once the tech bubble burst in 2000 the central banks are having to stimulate so much that markets can not be allowed to have true price discovery or wheels come off? I am investing as if we will return to trend which would be around 1350.

Might be wrong but I can get by on what I assets I have. Hussman says the Fed really is not that powerful unless Congress grants them additional powers and when the selling starts there is nothing they really can do til the fear of losing money is gone.

Hussman says the Fed really is not that powerful unless Congress grants them additional powers

Hussman is mistaken. The Fed has already assumed powers not authorised by Congress. And yet, its power has been checked by a greater power which countenances no abeyance.

Unchecked power always assumes more power to protect itself. No one ever seizes power with the intention of relinquishing it. Power is not a means; it is an end. The object of power is power.

You forgot to ad, ” Let not your heart be troubled”.

Recently purchased and moved into a 55+ HOA in Sacramento. Talking to many of the seniors (men) all are still heavy in the stock market and many are deep into their 70’s/80’s. I am one of the fewer maybe should say the only one so far with significant CD’s and no money in the market Since most if not all the HOA members have sold an existing home many if not most decided to take out a new mortgage put up 50% and invest the rest in the market. In discussing net returns none of them had any concept of market return after deducting taxes, inflation and fee’s. A retired Doctor even told me he purchased with a mortgage to get the tax write off and invest the proceeds from his sold home in the market. The man was 82!

If the market makes a U turn the boomer generation will be left high and dry.

It will occur almost instantly. Few will make it out intact.

Then it will be time for cheap investment purchases for those of us with more than single digit years left to live.

Wolf, just want to say thanks for all the great work you did in 2019! I really appreciate your “just the data” style.

I consume a lot of business media and the big corporate media publishers have such an annoying level of bias to be pro-billionaire, pro-FED, pro-wall-street, pro-multinational-corporation and they suppress and hide information that doesn’t fit with the “praise the billionaires” religion they preach.

I’ve bounced around various outlets looking for the unreported and underreported stories for 10 years. But what I often found were apocalyptic writers like shadowstats and zerohedge who would spread more misinformation than information, who made predictions, and when those predictions didn’t occur would just turn into conspiracy theories.

I’m grateful to have found your site where you report the stories the mainstream misses but haven’t fallen into the trap of becoming apocalyptically negative and making wild predictions for views and clicks. Keep up the great work, I love reading this site as part of my daily media diet to balance out Bloomberg and CNBC.

Thanks!!

I second your comment

Me too. Just Data period.

I predict that I will be invested in short-term bonds and some gold throughout 2020, unless the stock market drops 20% or more.

The Refi Economy….

Wolf, I would love if you could do an article on how many people are living off of the proceeds they receive from refinancing their homes!

I currently work as an Amazon delivery driver but I have worked for large companies as well. I worked for EDS in San Fran during the 2000 crash through the 2008 housing crash.

Working as a delivery driver has been eye opening. There are no working class neighborhoods in Utah anymore.

As a delivery driver I am constantly amazed at how many people, often very young, living in million dollar homes, are home during the day for their deliveries….

Corporation do not hand out million dollar salaries, yet everywhere I go, that seems to be the reality..

The percentage of people living off of refinancing their homes and student loans is staggering, it is not understood and will be devastating(IMO)…

Cash-out refis are definitely a thing once again. But what you’re seeing too are people who work at home — this includes people like me and a number of commenters here, for various reasons. Some, like myself have their own businesses; others are telecommuting; others are gig workers in software engineering, etc. I know a lot of people who work at home.

I think many are under-estimating the effects of rich dads and moms or grandparents.

I believe most of this are inheritance, gifts, or trusts.

This skews the numbers and reality.

Mr. “Unamused” replied ( to me ):

> How easily you have learned to love your chains.

You’re married, I assume.

How’s the ol’ ball and chain ?

I don’t think this is a psychological self help website. But Ts & Ps, anyway.

Predict this:

Fed balance sheet moves up to $4.166 trillion, highest level in 14 months, up $406 billion over the last 4 months.

In no sense is this QE. This is nothing like it. – Jerome Powell, Oct 8, 2019

Mr. “Unamused” replied ( to me ):

> Since when does “government help” [?!]

> equal oppression ?

Your idea of “help” is to force me

to work like you do, no gig job,

so I have to suffer, like you. . .

so I can’t steal your job away from you,

charging less, and giving more.

With help like that,

who needs a slave master ?!

Your idea of “help” is to force me to work like you do

I have no desire to force you to do anything, Jeff. I prefer to avoid you entirely because you’re toxic and have little if anything to offer anybody. It doesn’t have to be that way, but that is up to you, and you have chosen otherwise.

I can’t steal your job away from you

I don’t have a job and I don’t need one. I have pleasant, constructive hobbies which are useful and pleasant to other people. It’s work, sometimes onerous work, but we retain all the benefit and do not pay tribute to parasites, so I don’t mind it.

Mr. “Unamused” replied ( to me ):

> > > Since when does “government help” [?!]

> > > equal oppression ?

> >

> > Your idea of “help” is to force me

> > to work like you do, no gig job,

>

> I don’t have a job and I don’t need one.

I’m talking about unions and California AB5,

not you specifically, Mr. “Unamused”.

Your money doesn’t impress me.

Health, especially mental health, is everything.

“My head’s right boss”

-Cool Hand Luke

My predictions for 2020:

President reelected.

Democratic Party implodes.

Fannie and Freddie do IPO, just in the nick of time.

Big tech firms starts to get broken up.

#1 depends on when the recession kicks in.

I’ll predict recession in 2021 at the earliest.

Petunia,

It sure does look good for now for DJT, doesn’t it? Just tied Obama for most Most Admired Man in America in a Gallup poll!

I am reminded of HW Bush’s 80% favorability ratings in the spring of 1991, right after the first Gulf War ended successfully, some 6 months before the next election. And Hillary’s consistent 80% favorability ratings as Secretary of State under Obama. Boy, all of that sure changed fast, didn’t they?

Politics can change in a microsecond and favorability ratings can drop like a rock in a straight line.

Polls don’t measure reality, they create their own reality, they are trying to drive the vote not measure it. I don’t care about them at all. I watched a video of a focus group being polled, by a famous pollster, in the last month. It was a totally liberal group, very urban, very gay, trying to convince the audience this was representative of America. It was sickening to watch.

Now look at the president’s opposition, there isn’t any. The left is building sand castles and after the last decade of do nothing politics, people want results, not more lies.

He who must not be named is the last man standing when you consider real results. Even his failures can legitimately be blamed on the useless opposition. The choice is more of the old rot or not.

You definitely prove on a continuous basis that the business fake news is as robust as the standard MSM fake news.

The business fake news now needs someone to expose them to the masses of sheep, not that it would matter to have of them anyway…..

No predictions…maybe a resolution and statement.

I just returned from an in-law visit down Island. It was very interesting. They do not watch the news (ages 47 and 54). They had no idea about interest rate trends and history, any kind of history…. When we discussed politics, they did not know what Twitter was. I had to explain the concept and gave some examples, which was strange and odd since I don’t practice any social media nonsense beyond personal emails. They just bought their first house together, and for both it is a 2nd marriage. They are on their phones often often often, and text a great deal. My wife and I do neither. We use a land line.

While I am reluctant to make any predictions for this coming year, I was interested in the idea of living for the day in willful ignorance (for lack of a better term/phrase and I am not judgemental in using that term). Maybe that is the wise course, after all.

I also know of an old family friend who lives in northern California; redneck boonies, grow op country, leaning towards militia. He has retreated inward and is now focused on friends and family. For him there is no more evening news or current events. He has had enough, and he has enough.

Then I came across this little gem from someone named D Hauser

Here Today, Gone Tomorrow

Here today, gone tomorrow

Too often comes as a surprise

From the joy to the sorrow

All can happen overnight

What you have that you hold onto

Often can slip out of hand

Be it old or be it brand new

Be it life or be it death

Here today, gone tomorrow

Where have you placed all your eggs

Do you beg, steal, or borrow

Where on earth have you made your bed

Are your possessions of any value

Do you treasure all you have

What would happen if they left you

Would you think there’s nothing left

Here today, gone tomorrow

Would that mark the end of it

Does the thought leave you hollow

Or would you make the best of it

Pick yourself up by the boot straps

Do your best to carry on

You’re not the first nor the last

When here today, gone tomorrow comes along

My predictions for 2020:

Most 1st worlders will still live far beyond their means and will embrace debt without thinking about it. It will be normal. Everyone does it.

The pie will continue to shrink and the connected will maintain their share at the expense of regular people.

Many will continue to run the treadmill without much thought or without living deliberately. Everyone does it. It’s easier, they think. (or not).

Thoreau said it this way, “The mass of men lead lives of quiet desperation. What is called resignation is confirmed desperation. From the desperate city you go into the desperate country, and have to console yourself with the bravery of minks and muskrats. A stereotyped but unconscious despair is concealed even under what are called the games and amusements of mankind. There is no play in them, for this comes after work. But it is a characteristic of wisdom not to do desperate things..”

I read the above posted example about the 82 year old who sold his house and invested proceeds in the market to make more money while mortgaging his place in a seniors living situation. At 82. !!!??? This is one effed up and hollow shelled world if you want my opinion.

Resolution: Practice gratitude more often. Enjoy the days.

If you liked that speculation-crazed octuagenarian, you would have loved my paternal grandfathers. My grandmother was busy losing money in get-rich-quick schemes up until she died at 94.

They (and a gaggle of other similar relatives) are living proof financial media don’t lie when they say 76% of retail investors lose money even during bull financial markets and why family funds and wealth management outfits regularly underperform even the dumbest stock market index funds while managers laugh all the way to the bank.

It’s not merely a matter of wanting to become richer, it’s a matter of being so greedy as to be to all effects blind: my paternal grandfather threw money at stuff that made even Wag look like a sensitive idea, and did so without being compensated for the risks he was taking. The present situation is merely what he was doing back then on grandiose scale.

PS: I have always considered Thoreau the equivalent of that ascetic Buddha Sakyamuni met in the forest, the guy who after twenty years of privations had gained the useless power to walk on water. Asia is full of such sadhus: some of them are genuine ascetics but the rest are a motley collection of thinly disguised beggars, conmen and posers. After a while you learn to see through their disguise.

An underhanded way of disparaging Thoreau without having to admit that he was right.

What, doing away with flush toilets or bringing back cavorting druids? ;-)