5% is here, 6% beckons as the next target.

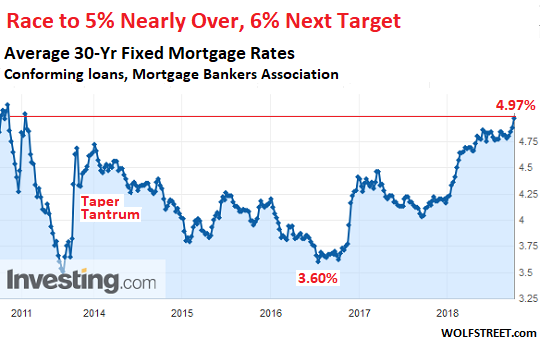

The average interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) and a 20% down-payment jumped to 4.97% for the week ending September 21, the Mortgage Bankers Association (MBA) reported this morning. A week ago, it was still at 4.88%. This is the highest average rate since the brief mini-spike that topped out in March 2011 at 5.01%. The last time before March 2011 that we saw this kind of average rate was in May 2010 (chart via Investing.com):

The average rate of 5% — some borrowers are getting lower rates and others higher rates — may sound sky-high for a 30-year fixed rate mortgage with 20% down, in this era of interest-rate repression that caused home prices to balloon. But now those inflated home prices must be financed at these higher rates.

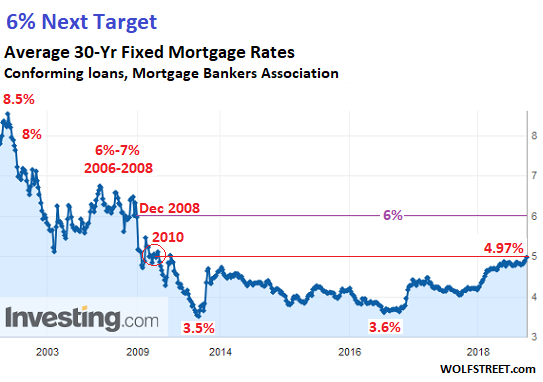

And 6% beckons as the next target. Even 6% is still historically low. It would take rates back to late 2008, just as the Fed was starting to repress long-term rates via its first big bout of QE.

But QE ended in 2014, and the Fed has been raising rates “gradually” since December 2015, and has started to unwind QE in October 2017, which includes shedding its stash of mortgage-backed securities that it had acquired to repress mortgage rates. This is a new interest-rate era that’s going to resemble the old pre-Financial-Crisis interest-rate era a lot more than what we’ve seen in the past 10 years (chart via Investing.com):

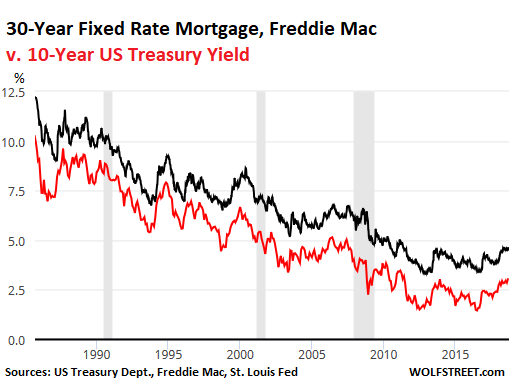

Mortgage rates follow the 10-year Treasury yield, but are consistently higher. The average mortgage rate, as surveyed by Freddie Mac (using a different methodology than the MBA) for the week ending September 20, was 4.65%. On that day, the 10-year Treasury yield closed at 3.07%. Thus, Freddie Mac’s measure of the average 30-year fixed rate was 1.58 percentage points higher than the 10-year yield.

By this measure, over the past 15 years, the average mortgage rate was between 1.3 and 3.0 percentage points higher than the 10-year Treasury yield. This chart shows that relationship going back to 1985:

The current difference between the 10-year yield and Freddie Mac’s measure of the 30-year mortgage rate is at the low end of the spectrum. The mid-range would be a difference of just over 2 percentage points. So a 10-year Treasury yield of over 4% will likely push Freddie Mac’s measure of mortgage rates to around 6%.

By the MBA’s measure, the average 30-year fixed rate of 4.97% as of September 21 was 1.9 percentage points higher than the 10-year yield. This spread too was at the lower end of the range. And by this measure, a 4% 10-year yield will likely push average mortgage rates above 6%.

OK, But When?

The rate hikes are in full swing. At the moment I’m writing this, the world is awaiting the announcement by the FOMC that it raised its target range again by a quarter percentage point. Another rate hike in December is becoming increasingly likely. More rate hikes are likely next year.

So what will the 10-year Treasury yield do? It has been having trouble staying ahead of short-term yields that have been rising consistently in a bond market that has been in denial for two years that this Fed has turned hawkish (by modern standards of “hawkish”). But “gradually,” as the Fed keeps saying, it is sinking in.

The Fed’s “gradual” approach to raising rates in this rate-hike cycle is giving markets some space to be in denial and at the same time prepare and adjust. So I expect the 10-year yield to stay ahead of the 2-year yield for a while longer. In this scenario, the 10-year yield will hit 4% in the first half next year.

So just for the spring home-buying season, average 30-year fixed-rate mortgage, as the MBA measures them, could hover around the so enticing 6%. Potential homebuyers are in for a budget crunch that potential home sellers, if they’re still demanding the prices they’ve come to expect, will bump into.

And this is what’s going on in the cities with the most splendid housing bubbles: Seattle’s historic spike falters, New York condo prices are back where they were last September, and house prices in other metros get even more splendid. Read… The Most Splendid Housing Bubbles in America

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Just my opinion, but if the ability to handle a mortgage at 4-5-6% is that crucial then perhaps the buyer(s) are in overreach? Has progression through life become like ‘free solo rock climbing’, with no safety considerations, whatsoever?

“If we can just get in the place for a few months then appreciation will cancel out any future mortgage rate increases and we’ll be okay”. Nuts.

No, it’s worse than that – no calculation about rates at all, just desperation to own.

In the UK, and I imagine the States, it’s partly understandable, as renting is so insecure, and expensive.

When one buys a home, one becomes the ‘landlaird .. with all the rights, responsiblities, and frustrations* .. of maintaining their ‘domicile’ .. in the manner to which they feel they’re accustomed ..

One’s mileage may very .. formica vs granite, shall we say ..

*don’t even get me started on ‘the neighbor problem’

There are still a lot of cash buyers, and sellers will carry the note at lower rates to get the higher selling price. Car dealers have been laughing at cash buyers for a long time, cash buyers should at least get the same incentives. The market is so distorted that getting the cash/credit value equation back to even will seem like a big deal.

The calculus is pretty simple. If you get enough easy marks and hot money, you get a housing bubble. It certainly doesn’t help that you have a large cohort of ‘millennials’ with a decent FICO score but next to nil basic financial literacy who see nothing wrong with paying top dollar for a rundown ‘quirky’ shack with mold issues and 70+ year old wiring, but remodeled with brand new kitchen cabinets and granite countertops.

It’s not Millennials who are pushing these costs up. There are countless articles on the fact that their rate of homeownership is very low.

Here’s one that asks where they’re buying, and not-so-surprisingly Millennials are much more likely to be homeowners in cities where homes are cheaper: https://smartasset.com/mortgage/where-are-millennials-buying-homes-2018-edition

Not only “millennials,” to be sure. But anyone buying a residence in a bubble city in 2018 qualifies as an easy mark. ‘Investors’ (speculators) take the bulk of the blame for the run up in prices, and make their money from the easy marks. That is, until the music stops and it’s time to find a chair.

Buying homes is so oldies. Why take out a mortgage and pay 3X its price over the time of the loan and then have to pay homeowners and property tax(you don’t own it you’re a renter) on top of that. Waste of money. Rather buy a 2 year treasury and let it compound over 30 years. Or better yet open a business or invest in one.

Yes you have to have a place to live and have to pay close to anyway when you rent, but that’s the price you pay to be able to pack up and leave whenever for a new job or whatever adventure. Who wants to be the future victim of underwater mortgages and forclosure fraud? How’s that for financial literacy?

I keep waiting for Jerome’s rate hikes to drive a stake into the heart of Trump’s vampire economy but so far the beast is still alive.

He’s just a succubus .. the real vampires are the ones feeding behind the Fed’s black cape ! .. helped along by assorted graveyard-of-empire diggers, such as the likes of PE firms, goldenballsachs men, multi-nationals, their lobbyists, & other corpserate ghouls, flaccid regulators, grifting pols, and sycphopantic media — but I degress …

It’s boilerplate that we never accept the role of bond buyers in this market, (they grow on trees I guess) the ones where the vigilantes were hanged. The rate hikes give a modicum of respect, who is going to fund the ongoing tax cut, big spending circus? The most likely foil would involve (forced) reallocating from stocks to bonds, but paper securities can be recollateralized back and forth all day. Its only when yield outstrips projected S&P returns, and that market will take a lot of beating before people give up on it. Spec in this market is only secondary to money flow. The Feds tiny rate hikes means the EU/BOJ/PBOC can print money and that money will find a home. Sweet.

Last time the Fed raised rates 17 quarter point moves with 4 more being promised! And oh snap? Remind me to tell you the story some time. Stay solvent.

Non QM lending (alternative financing) is the largest growing sector in the mortgage market today. I believe it is similar to 2006, when Option Arms tried to “save the day” with low payments. If you recall, Greenspan had raised rates A LOT, mortgage rates were above 7% AND housing in PHX was nearing $400/foot. The ONLY way these two could coexist is if people had the ability to make an interest, or less than interest only payment. Countrywide financed a ton of these and paid dearly (well, Mozillo didn’t, but the company did). Everyone knew that it was an attempt to extend housing activity a little longer, but the writing was on the wall.

Today, we see programs being developed to help self-employed, poor credit, foreign nationals, and other fringe groups buy homes, BUT there isn’t enough to sustain a healthy housing market. AND these programs come with a 6% to 8% interest rate…combined with current prices, people are torn between buying and continuing to rent.

The WSJ had a great article a few weeks ago – 10 charts – comparing housing today to pre-crash. Quick takeaway from article, home ownership is the lowest in 50 years, mortgage credit is extremely tight, and with 0% Fed Funds rate, home sales at peak, were only 25% of the previous decade. Abysmal.

Housing (primary residence) should be the easiest financing out there – it is really glorified rent for most people. Historically speaking, housing prices rarely go down, so if somebody is willing to put 10% to 20% down, and determine it is a payment they can afford (we all do it with car payments) they should get the keys the next day. THEN, if they bit off more than they can chew, agree to move out if they don’t make a payment for 3 months. Pretty simple…worked for a hundred years.

With a decent down payment, people do not want to lose the house and the banks losses aren’t catastrophic.

THIS type of financing is foundation of capitalism and it is available in just about every other Country in the world!

Mortgage financing is completely broken. Housing prices are heading lower in most States. It should get interesting.

Representative Hensarling (R-Texas) seems to understand the problem and is trying to fix it, unfortunately, there are some powerful groups that like housing the way it is today)

Of course rising mortgage rates will affect housing. House prices were already stagnating in many areas before long rates were rising meaningfully. There is an upper limit on what the economy can support for asset prices; particularly housing.

The likely outcome will be a slowdown in sales and a stalling in price increases. Neither of which is bad. I don’t see housing “collapsing”. It will meander around for some time.

The bigger problem is with corporate debt; a good amount will need refinancing in years ahead. There are a lot of companies out there in real trouble; particularly if the economy slows a bit.

Look, houses are not bonds, they move much slower than a New York City market.

The Fed is deflating the money supply on a very gradual slope, and yet everyone still thinks prices can rise on the inflation.

The hardest part of the deflating dollar base is how it will kill leveraging. That will kill asset inflation, which is what everyone continues to expect.

Now, a rising dollar causes immense stress and pain throughout the world. Our trading partners are feeling it now, compounded by Trump trade policy.

Now, think about the rising dollar, look at dollar cost of commodity, and aside from small bubbles, most of the time it looks terrible.

Nothing since 2009 has been sustained in commodity prices.

Just remember that the Fed is committed to going slowly back to the old level of interest rates, and this process will return asset prices back to prices sustained through wages.

In short, the big wins from asset price moves are most likely done for a long time.

Pretty sure my rate in 1990 was around 10 or 11 percent.

It won’t be long before my property tax is more than my P & I

In 1990 we got an FHA loan at 8.35%, for a mortgage of $79,000, with approx 7% down … thought it was a good deal at the time as inventory was extremely tight — especially in our ‘first-time-homebuyer’ price-range, but took a full decade before we were able to throw That anchor off our necks, and move on with only marginal ‘equity’* !!

*didn’t make up for all the grey hairs begotten due to the ‘charm’ of living in the neigbor .. uh .. hood !

I chalk it up to youthful naivete of being induced by the siren song of ‘Better Buy Now .. or Be Forever Priced Out .. !!’

I love these comments (sarcasm).

A starter home in 1990 wasn’t $500,000. Good luck getting approved to borrow that kind of money when rates hit 11%. And if you’re a millennial, good luck coming up with that $100,000 down by the time you’re 30. I hope the bank of Mom and Dad is flush.

Seriously though, at these prices, if rates go up, prices must go down.

Econ 101 time: as monthly payments go up due to interest rate hikes, demand goes down. This is especially true in overpriced markets.

The price of money strikes again…. gradualy….low and slow…. and the demand is still there ’cause people want somewhere to live… and no one’s flipping at a loss and it gets faster and they’re building cheaper and selling tents butitsafrenzy andthere’shollerinoutsideascrowdsofpitchforkbearingunderwaterstreetdwellersmarchingwithfailedtech.amazondropoutslivingincardboardpods…

Sorry. I get carried away sometimes.

“Econ 101 time: as monthly payments go up due to interest rate hikes, demand goes down. This is especially true in overpriced markets.”

Well, if you are a student of “classical finance”, then what you say is definitely true. But, in the new world of “creative finance”, there is always some new plot twist to get those homes sold.

As an example, I’ve been following the interesting world of Recreational Vehicles. Sales are at an all-time high, but so are loan term lengths! Folks are more than happy to jump into 20 year mortgages for a *rapidly* depreciating asset like a motor home or travel trailer. I wonder if Wolf has been sniffing around n the same venue? It would make a great article when you look at the prices paid for these units, their rapid loss of resale value, and the interesting demographics pushing these record sales. The industry is in constant flux as larger players gobble up smaller players. Heck, one of the largest entities in the field (Thor Industries) just recently purchased a German RV manufacturer – to now be the largest RV producer worldwide. The sad part of it is, Thor is noted for their very poor quality pretty much across the board, and Hymer was noted for their good quality. Do you think the products offered in the US market will be improved, or the units sold into the European markets diminished in quality?

Interesting, because I saw an article last week regarding the concern in Elkhart, Indiana due to slowing of sales in RVs. Apparently RV manufacturing is big Biz in Elkhart. I also wonder if Wolf has any input on this story.

I am considering purchasing an entry level RV to do a little traveling for a few years as opposed to a vacation home. I know it depreciates, but at my age that is just the cost of getting a little enjoyment out of life.

From talking to people who bought RV’s. I now believe that it is cheaper to hire a limo to drive you from one nice hotel to another nice hotel.

I guess you would miss out on the “pleasure” of driving a truck for long hours on the interstate.

True.

Which type of mortgage is in the majority?

My suspicion is that its ARM (adjustable-rate mortgage).

These mortgages usually offer a beginning low ‘teaser’ interest rate for the first few years, then reset to the adjustable rate for the remainder of the term.

With higher rates slowly climbing now these ARM mortgage holders, will find themselves caught between a higher rate and lower equity as residential property values fall.

Faced with a stagnant economy and a low to no wage growth trend, it won’t take long for these mortgage holders to find themselves underwater.

Fixed is now much more common in the US. To spare posting a link, search “Why Is the Market Share of Adjustable-Rate Mortgages So Low? – Federal Reserve Bank of New York” for a not too outdated pdf and charts.

Crysaangle,

Correct. 30 yr fixed is by far the most popular.

About 5% are ARMs after 2008 crises: https://www.cnbc.com/2018/03/01/as-home-prices-soar-buyers-turn-to-riskier-mortgages.html

ARMs have pretty much disappeared. People got scared of them. I am guessing a big chunk of ARMs that exist now are probably higher-net worth individuals who just want cheap money (it can/was up to 1% lower rate than 30-year fixed, even less than 2% at one point!) and if needed, they expect to pay off before the rate resets.

It is hard for us to avoid thinking that the next time is going to be like the last. But I think there are many reasons there won’t be a significant decline in overall housing prices during next recession. And this right here is one of the main reasons: existing home owner’s payments are not going to increase for the life of their mortgage, ever. This will keep the number of distress sales to below what is typical for a recession.

One other reason why only higher net worth folks use arms now. I have read that after Dod Frank rules, lenders had to calculate borrowers ability to pay at a much higher rate for ARMs than the initial rate. So it was probably even harder to qualify for an ARM than a 30 year fixed.

AS,

This is true for ARMS that typically have a fixed period of 5yrs or less. To qualify typically it’s the rate + 2%.

On 7yrs or longer; they can use the start rate for qualifying purposes.

Six months ago I got a 3.1% ARM that resets after 5 years to a max of 5.1%. Considering real inflation, it’s free money.

Regardless of the type of mortgage, I think what will really determine the extent of defaults during the next recession will be the job market. Most folks I know with a mortgage are dual-income, and more importantly, spending upwards of 50% of their combined income on housing. If either spouse loses their job, they immediately lose their ability to make monthly payments.

On the other hand, most of these same Millennial couples could only afford the down payment in the first place thanks to Boomer parents, so perhaps their parents will continue to bail them out.

MaxDakota, your argument cuts both ways: dual income is better than single income since one it creates some redundancy. Btw I doubt anyone can qualify for 50% of their income as mortgage payment anymore (except some that somehow squeezed by).

Anyway, there will be distress sale in a recession of course. Like any recession.

AS is correct, *mostly* cannot qualify with 50% Debt to income ratio

The problem Max mentions isn’t everywhere in the US, but concentrated heavily in particular regions.

http://zillow.mediaroom.com/2017-02-16-Mortgage-Payments-Take-Up-Biggest-Share-of-Income-since-2010

The article above shows charts claiming that in the Los Angeles region in Q4 2016, 43% of incomes went to mortgage payments. Add in utilities, internet, property tax, etc and it’s over 50% on housing.

The people I know who stretched like that have kids and very little savings, plus credit card debts from small emergencies (car trouble, dental, medical, etc). A job loss of either parent would make it extremely difficult to keep payments going. Unemployment benefits will help somewhat, but there’s really no meat to cut from these budgets outside of housing.

If the housing price drops enough to cause negative equity for stretched buyers, it could spiral out of control. These people will walk just like in 2008 after a job loss, especially if they have to relocate for work reasons. They won’t want to but they won’t have much choice.

One difference though is that big investment firms and REITs will likely be quicker at buying the dip this time – particularly if prompted by the Fed. The only thing that could change that scenario is the kind of economic crushing that caused the ghost towns they’ve been bulldozing all around Detroit… very unlikely though.

Overall I’d say there could be a bit of a dip in a couple years but I wouldn’t count on homes becoming affordable again this next cycle. Houses won’t be affordable again till the boomers finally age out of them, which will be too late for Millennials to raise families in. We’re just gonna have to get used to raising kids in tiny apartments, multi-family houses, or enduring 2 hour commutes. Unless you and your wife can land a decent jobs in an area with affordable housing, but there are relatively few of those so it won’t work for most people.

Jon you are misunderstanding the data from the Zillow article.

That is saying that (1) if you were to buy an average abide in LA today AND (2) if you earned median income, then you would spend the 40% of your income on mortgage.

(1) This is not about about existing home owners and their mortgages and (2) this does not mean that people with median incomes can even qualify for a mortgage today!

I know it affects affordability. But those numbers do not imply unusually high number of distress sales in the next recession as of now.

This is absolutely not true. 30yr fixed is the prevalent term. I have written exactly 1 ARM loan in the last 5 years and that was on a portfolio (non-conventional / non-fha) program b/c the borrower had a short sale within the 4 yr period.

ARMs are about 6% of all mortgage originations , according to the Mortgage Bankers Association, down from about 20% before 2008. But their share has been ticking up a little recently. I think the low was around 1% of mortgage originations after the Financial Crisis. They were essentially dead.

In Spain it was reverse that, always well under 10% new originations fixed up to 2015, then last two years something over 30% fixed new originations. Just saying because when people compare rates and markets and policy this has a big effect on what goes on and direct comparison will be off without understanding the difference. Fixed rates make more sense, but variable get chosen when rates are high. Now people will be locking in low rate fixed in Spain even if it is half a percent or so higher. I think a lot of Europe is ARM, but not sure.

Cash will once again be king! Albeit briefly

It will be interesting to see if the Fed’s ‘gradualism’ makes the ‘landing’ any softer when this bubble pops.

More interesting will be if the Fed’s gradualism can stay ahead of inflation enough so that they don’t have to hike more quickly. Greenspan ran out of runway in 2007 after keeping rates too low for too long, and we know what happened then.

It was Bernanke by then, my mistake. Greenspan bailed in 2006 just as the runway was running out.

Everything is local. Depends on the market you live in.

I work in housing, 22 years. In NW Indiana there is a mix of prices. 190K and up. When the rates rise, the smaller, cheaper units will sell.

Nothing like the bubble of 1997-2006. Giant homes everywhere. No options for smaller units. Piggyback loans etc..

No comparison.

Rates at the midlevel are rising while US denominated debt in the EM is cancelled, so the Fed is operating under cover. In the big picture mortgage buyers are small potatoes.

Not so sure this bubble will mimick the last one, especially with SFR’s, since they do not seem to be overbuilding these this time around. Multi-family might be another matter, however. In any event, save your cash and scoop up as many properties as you can on the way down. There is a silver lining if you are prepared.

The record may speak otherwise, but I think drawing a hard line between housing types is of limited value. For the right price, in the right situation anyone will switch over. Economy out-ranks housing preference when push comes to shove. Any port in a storm.

Nothing. There is an astronomical amount of money sitting on the sidelines waiting for the first sign of pricing weakness in the housing market. All cash deals and a quick Cash out Refi (All in half out) are going to become the new normal going forward and the result may be stagnation but not pricing weakness.

Maybe the astronomical money you are referring to are the lucky millienals with holdings in “pharmaceutical” pot stocks, or the lucky few that sold their bit coins..

I am looking at this as an outsider, so to take it as a different point of view but not from someone who knows first hand who is able to take up slack. I also think that the aim now is to level off the market, that might see the hottest areas drop a fair amount in price, but people overall are not as leveraged as they were previously. So you end up with existing home sales about at a “normal” level they seem to taper off at now, and prices dropping a little then going sideways, so basically stagnation.

The trouble I have with that though is firstly you are assuming new “real buyers” ( households) are going to be able to afford this current level ( apart from renting speculative investors are not there usually to hold and maintain long term no?) . Maybe the rental market is what is being aimed at?

Secondly I am not sure, apart from well known addresses, if investors are going to be able to, or want to, buy up across the whole country.

Thirdly, with prices just going down you buy at new peak instead of at new low? That is confidence prices will be staying high or moving higher, but that confidence can change.

Fourthly, and the main point to me, is that if price and volume stagnate, so does contribution to gdp, of which realty is a main segment. In short that means that the economy would slow ( without some new input or direction) , making housing even less affordable to “real buyers” and for rent , which is overall deflationary.

Maybe there are enough funds returning to US, or just waiting to buy in, I don’t know, but the point I am making is that the whole structure is so complex in reality, that it is really very difficult to say with certainly what prices will do. That is even without mentioning other outside shocks that might tip the scales to a greater or lesser degree, or purposeful support provided to the market.

The above is more placing questions than providing answers, so I just leave it for anyone to add their opinion.

The adjustments are happening on the coasts, but in the booming N. Texas area A.K.A. Frisco, the reality has not hit, prices here are outrageous. There are no affordable starter home prices to be found, while construction of 5 and 6 story apartment buildings are spring up overnight with very high rents. My household was financially hurt in the Great Recession, so we are waiting and saving on the sidelines for the price adjustment reality to hit. As it will when the economy takes a hit as well, then there will be bargains to be had… just as it was in 2008 where cash is King.

The way the Case-Shiller is computed, it has an inherent lag in it.

By year’s end though it should start showing a downwards move.

With plenty of properties still sitting there accumulating price cuts we should see continued weakness in pricing.

In retrospect I think the May-June timeframe was the peak of the current pricing cycle.

Max, May-June was definitely the peak for Sonoma County.

For the last six weeks or so price reductions and new listings have been running neck and neck for Marin and Sonoma Counties.

One day it will be 100 new listings and 104 price reductions, the next day 98 new listings and 95 price reductions.

The ratio of properties coming back on the market to new listings is rough, ly 1/4.

The ratio of Back on the Market to Contingent ( Fell out of escrow to entered escrow) is about 1/3, sometimes close to 1/2.

More FHA 3% deals are happening, last year most sellers wouldn’t give a 3% down offer a second look.

Quality matters, a $1.25MM home here in Sebastopol went into escrow in 3 days with a bidding war.

It was a “Fine Home” with excellent landscaping and in a very nice location.

Those are few and far between.

Yep, Florida also.

Housing bubbles, like all bubbles, are unhealthy and transitory. They all end. People don’t die. Some lose their houses and have to rearrange their lives to accomadate. Some lose the money they put into their houses that become upside down. It needs to happen.

Expect the media to try to blame it on the political party that is currently in office. I remember Dan Rather on the nightly news with his clenched teeth and adrenaline reports on life as we know it coming to an end. Such drama!

It will be a good time for Doom & Gloom blogs. I have seen and ridden the Real Estate Roller Coaster. It’s not the end of the world.

To nitpick, people actually do die from these things: 10k suicides in USA, CA & EU (“Economic Suicides in the Great Recession in Europe and North America”). Add stress-induced heart-disease and cancer, homelessness. People SHOULD keep a healthy perspective (it’s not “The End”) but… easier said than done in a hypercapitalist society. We should probably take the ramifications of corporate and federal mismanagement seriously too. But you have inspired me to start a doom & gloom blog. Now crowd-funding. Sorry Wolf. :)

Glad to see the fed blowing off the President’s tantrums and powering on with the rate hikes.

Interesting… ‘Interest Rates Do Not Affect Home Prices’

https://www.google.com/amp/s/seekingalpha.com/amp/article/278146-interest-rates-do-not-affect-home-prices?source=images

Well, I’d say we’re staring nonsense in the face. Let’s look at what this article says. I quote:

“1. Post WWII to early 80s. Home prices marched steadily higher despite a 30 year period of rising rates,

“2. Early 80′s to 2008. Interest rates dropped off a cliff, yet home prices went to the moon.”

Since the early 1980s, home prices soared as interest rates fell, the author says. But in 2004 interest rates started rising and peaked in 2006 – and those higher rates eventually triggered the housing bust — just like Greenspan’s lowered rates had triggered the housing bubble.

The next housing boom started in 2012, after short term interest rates went to zero, and long term rates were declining sharply.

To counter these recent examples of strong correlation (albeit with a delay) between interest rates and home prices, the author uses the 40-year period after WWII when home prices ALSO rose, DESPITE rising interest rates. So let’s see: INFLATION rose during that time and peaked in 1981 at around 16%. So in that year, your home price would have to rise at least 16% just to stay even with inflation. In other words, in the high-inflation period, the dollar’s loss of purchasing power had a lot to do with rising home prices, and rising interest rates (they were rising because inflation was rising).

But didnt you just show that inflation IS rising at a steady clip?

https://wolfstreet.com/2018/07/12/but-who-pays-the-price-of-all-this-inflation/

So it is possible house prices and rates could rise again in tandem?

Especially with the millenial generation hitting their peak earning years?

Or maybe rising rates won’t have the same impact on housing prices as they do on treasuries?

Or maybe we are just talking in circles here…

There’s a HUGE difference between inflation of 2.7% (currently) and 15% (in 1981). Between 1973 and 1982, the US experienced several years of double-digit inflation. I remember what that was like. Money markets yielded 18% in 1981! There is no comparison to today. Let’s not mix apples and oranges.

There were prior bouts of big inflation since WWII, including 1946-1948 which topped at 20%, and again in the early 1950s when it topped at around 10%. From around 1966, inflation started creeping up again to peak in 1981.

If housing just keeps up with inflation during high-inflation periods such as 1966-1983, home prices are going to soar:

— Over the 13 years between 1966 and 1983, CPI rose 219%.

— Over the 13 years between 2005 and 2018, CPI rose 32%.

There really is no comparison. But if you leave inflation out when juxtaposing asset-price growth in high-inflation periods and low-inflation periods, the results are going to be misleading.

Powell picks the wine but not the music? There is a strong emotional attachment to owning your own place (programing)that some people paid 18% in the near distant past? This time its in corporate paper and not fed controlled mortgages! The Fed needs the mortgages like vampires need to suck your blood! PAY FOR YOUR FISCAL IRResponsibility. Everyone will need too full time jobs and a sawed off?

I am curious what the angle is for Viglioni. An analogy for his report is along the lines of taking a telescope and pointing it at the moon, and fixating it on the moon alone. Then with said evidence he will boast that there are no falling stars in the night sky, even though with your naked eye you can see one in the sky just outside the view of the telescope.

Once the eye left the eyepiece light became normal and not parallel?

Wolf, can you show a chart of house prices and rates in the 1970s and explain why they both increased during this time?

Please see my response above.