Will we see a “monetary shock?”

Back in October 2015, the three-month Treasury yield was 0%. Many on Wall Street said that the Fed could never raise interest rates, that the zero-interest-rate policy had become a permanent fixture, like in Japan, and that the Fed could never unload the securities it had acquired during QE. How things have changed!

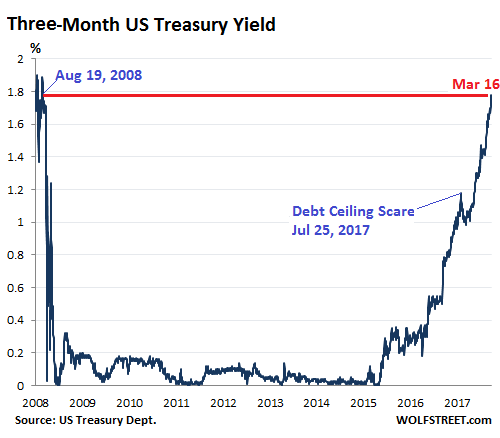

On Friday, the three-month Treasury yield closed at 1.78%, the highest since August 19, 2008. When yields rise, by definition bond prices fall:

The Fed’s target range for the federal funds rate has been 1.25% to 1.50% since its last rate hike at the December FOMC meeting. In other words, the three-month yield is already above the upper limit of the Fed’s target range after the next rate hike. So the market has fully priced in a rate hike at the FOMC meeting ending March 21. And it’s also starting to price in another rate hike in June.

No “monetary shock” now, but maybe later

In this rate-hike cycle, the Fed has engaged in policy action only at meetings that are followed by a press conference. There are four of these press-conference meetings per year. The next two are this week and June.

If, in this cycle, the Fed hike rates at an FOMC meeting that is not followed by a press conference – there are also four of them this year – it would be considered a “monetary shock” that the Fed decided to administer to the markets. It would be like a rate hike of 50 basis points instead of the expected 25 basis points. There would be a hue and cry in the markets around the world. But I think the Fed isn’t ready to spring that on the markets just yet. Maybe later.

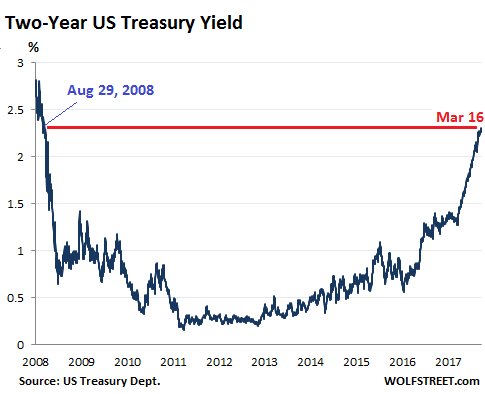

The two-year yield rose to 2.31% on Friday, the highest since August 29, 2008

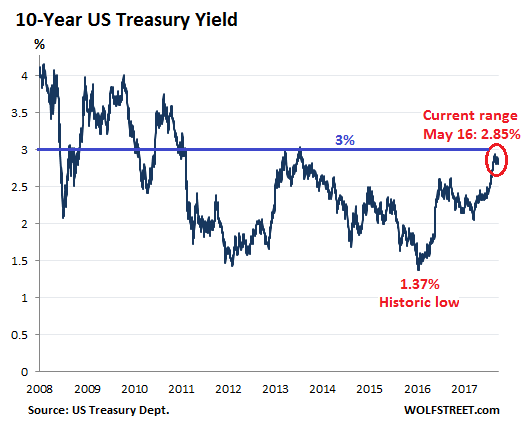

In past rate hike cycles, the two-year yield reacted faster to rate-hike expectations than the 10-year yield. This is happening now as well. The 10-year yield has its own dynamics that are not in lockstep with the Fed’s rate-hike scenario. On Friday, the 10-year yield closed at 2.85%, within the same range where it had been since late February, tantalizingly close to 3%:

Bearish bets against Treasuries leave skid marks

Back on February 13, as the 10-year Treasury yield was surging and threatened to take out the 3% level, I postulated that it would have a hard time doing so over the near term, for two reasons:

One, in the 3%-range – given current asset prices, dividend yields, etc. – the 10-year Treasury is appealing to more buyers, and this will keep bond prices from falling further, thus putting a lid on the yield.

Two, speculators were heavily betting against the 10-year Treasury. By mid-February, bearish bets had risen to about 960,000 contracts, an all-time record. On February 21, the 10-year yield reached 2.95%. Everyone was on the same side of the boat. And there would have to be a sharp snap-back rally that could turn into a short-squeeze.

So we have seen some of both, and the 10-year yield remains stuck until further notice.

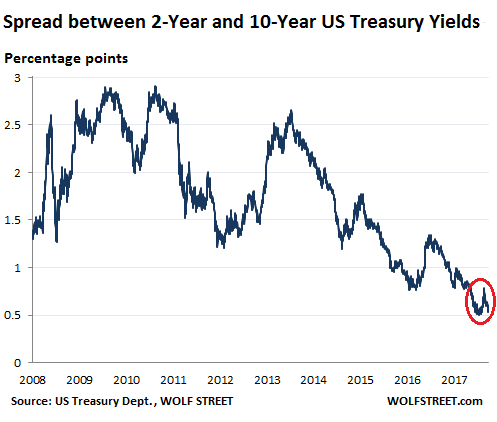

After the surge of the two-year yield, the difference between the two-year and the 10-year yield – the “two-10 spread” – has narrowed again. On Friday, it was at 54 basis points. In the chart below, note the narrowing at the end of last year to 50 basis points, then the mini-spike, as the 10-year yield surged faster than the two-year yield, and the recent fallback:

Where does this leave the yield curve?

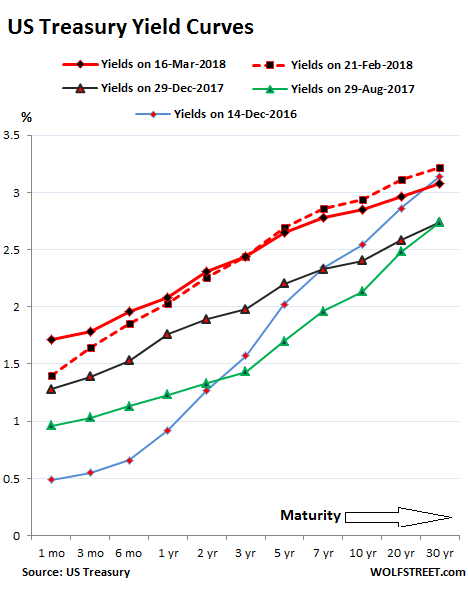

The chart below shows the “yield curves” as the yields across the maturity spectrum occurred on these five key dates:

- On Friday, March 16 (solid red line)

- On February 21 (dotted red line) when the 10-year yield closed at 2.95%.

- On December 29, 2017 (black line), before the 10-year yield started surging.

- On August 29, 2017 (green line) two weeks before the QE unwind was detailed.

- On December 14, 2016 (blue line) when the Fed stopped flip-flopping and started raising rates like clockwork.

Note how the spread widened toward the long-dated end (right side of chart) between the black line (December 29, 2017) and the dotted red line (February 21), with the 30-year yield surging 48 basis points over those seven weeks, and how the slope of the dotted red line steepened compared to the black line.

These yields at the long end have since reversed slightly, but short-term yields have surged, leaving the yield curve on Friday (solid red line) somewhat flatter than it had been on February 21.

But I do not think that the yield curve will “invert” – a phenomenon when short-term yields are higher than long-term yields, which has been closely associated with recessions or worse. The last such inverted yield curve occurred before the Financial Crisis.

This time, the Fed has a tool that it didn’t have before: During QE, it acquired $1.7 trillion in Treasuries and $1.8 trillion in mortgage-backed securities that it has now started to unload. It can start jawboning the markets by telling them that it will unload the securities more quickly, and it could then actually unload them more quickly. This would be a “monetary shock.” It would put a lot of pressure on long-term Treasuries, and yields would jump at the long end of the curve, thus steepening the yield curve and causing all kinds of turbulence.

It may already be in the works. The first Fed Governor came out and said that the QE Unwind isn’t fast enough. And because it’s so slow it may actually contribute to, rather than lower, “financial imbalances.” Read… QE Unwind Is Too Slow, Says Fed Governor, Thus Launching First Trial Balloon

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Looking at the Three Month and Two Year Treasuries charts.

It looks massive manipulation between 2008-2016.

Or corruption.

I think the rates can safety go between the 3% to 4% range before there is really trouble.

Remember that the apraisal of the mighty dollar also makes US debt bonds more valuable and that apparently there is a lot of those.

Then again no one expects a default from the US…

Is way more likely for Spain and Italy to crash before the US does.

But then again I can be wrong.

The US can’t default in nominal terms. The treasury will always print any money necessary to pay its debt. Which is why the treasury market is the ultimately safehaven: you can’t lose your principal.

Spain and Italy only have that luxury at the discretion of the ECB.

We’ll see how much of a “safe haven” it is viewed as when confidence is lost in the currency, and it is worth a fraction of what it was when the Treasuries were purchased.

My political economy professor, Herman Schwartz, used to say that America is a bad bet, but the least bad bet. I also found him a bit more glib and optimistic than I liked, but over time his pronouncement seems to have been more true than false. If you are a vastly rich individual in India or an Italian multinational or a Colombian drug lord, where could you possibly stash the majority of your earnings other than dollars or dollar-denominated securities that would prove safer in a crisis?

I never realized the treasury printed money!

Silly me- and I’ve always thought it was the Fed that created the money that Treasury borrows.

rx

You’re both right. The Treasury prints CURRENCY and the Fed creates MONEY.

The Mint prints the money, the Treasury issues new bonds or credit, and the Fed sells their product to the charter banks in the form of reserves for lending. There is no course to repatriate a Treasury bond, you cannot turn in your bond for money. There is a secondary market for these things ( which keeps the Fed up at night) A recent bit I read says that new corporate paper it taking a hit in the secondary market, you are paying a premium for that “new car smell..”

Extremely common misunderstanding.

If you kite a check, you pay fines or go to jail. There’s no one to keep the treasury from do so. So it always does, and its checkbook is always negative.

No a hard default will not happen ,but a soft default where the dollar goes down is a distinct possibility

No Ambrose, the Mint does NOT print the US currency.

The Bureau of Engraving and Printing prints the Federal Reserve Notes.

The US Mint produces the coins in the USA. It mints the coinage used in the USA.

Minting and printing are two completely different operations undertaken by two completely different entities.

Maybe “you can’t lose your principal” in a fiat-currency bond, but you can lose your capital. Just ask Venezuelans, Argentinians or anyone from the many other serial-default nations out there.

raxadian, are you a politician or an economist? lol. Too much room for backpedaling with no conclusive statement.

So, whats the final word in your pointless opinion? Is US going to default within Trump’s term or not?

Don’t be such a wussy, be a man and make a clear stand.

IMO, US of A is NEVER going to default within at least the next decade.

Neither will Spain nor Italy “crash”.

(my definition of “crash” being their stock indices IBEX / Italian bourse falling 20% from current levels)

Spain and Italy may still meander and drag themselves slowly through hell, but every country goes through their cycle of excess, capital destruction and then recovery. Even the US had their gut-wrenching depression years (which is far worse than current economy of Italy and Spain) but over the longer-term the old will die-off inevitably and those pension obligations will lift from their economies. You just have to be very patient since ironically, no one is in a hurry to go to a blissful Heaven to meet their maker; even if they are now living like a beggar rummaging through thrash bins for food.

There…I’ve said it loud and clear and unambiguously.

Those who can’t say likewise are really fools who do not understand what they are mumbling about so they keep shuffling their feet back and forth with vague ruminations without any clear conclusions.

I missed out on the time frame for the Spanish and Italian “crash”. IMO, they won’t “crash” within this year.

They have been skipping along the bottom for many years….waiting for the old to die-off. Once sufficient numbers leave this earthly plane, their economies will start to recover.

I don’t mean to be harsh in my words, but our time here is all limited and shortened (I’d say intentionally…but thats another story) and the natural ecosystem works in similar dreadful ways too.

The new cannot spring forth if the old do not die-off on a finite planet.

Let me just comment on your statement:

“Neither will Spain nor Italy “crash”. (my definition of “crash” being their stock indices IBEX / Italian bourse falling 20% from current levels)”

Italy’s bourse (FTSE:MIB) plunged 34% between Aug 2015 and Jan 2016. It didn’t even break a sweat. That was just a standard selloff. Most Italians don’t even care because most of them don’t put their money into Italian stocks. Foreign investors like to do that. And that’s the hot money. And it’s going to exit at the next squiggle just as rapidly. So the next selloff in Italian equities, which may have already started, is likely to be much larger than 20%, the cap you put on it :-]

You’re more than welcome to comment Wolf…thats why I still read your site :-). As mentioned, I had to “define” what I mean by a “crash” and add the time frame in my second comment to qualify the forecast, otherwise as the saying goes, even a broken clock gets it right twice every day.

Yes, the financial “crash” for the PIIGS HAD already happened before, and it will happen again in the future. My own time frame is not within this year for their next “crash”.

Their real economy consisting of actual household goods and services was long disassociated from the financial markets…as in most places, even in the US. Can anyone name me a real economy (i.e. real wages, real goods/services prices, real people’s concerns etc.) that is actually correlated with their bourse/stock market indices?

I recall Venezuela’s stock market actually rose strongly last year even while her people in the streets are starving.

So yes, I agree to your statement that fluctuations in the stock markets often doesn’t register in the everyday lives of common folks.

Fact is, even for the biggest and most liquid market in the world, USA has less than 20% of her tax residents directly owning stocks, excluding their employee-funded schemes [which IMO are scams with high fees that are benefiting the wrong group of “investors”, but thats another story].

Across the pond in Germany, direct stock ownership in their DAX listings is barely 10%.

Same with fast-growing China, less than 15% of their population is directly holding any stocks.

Which means, the financial betting system is largely a game for the very wealthy, capital-owners, top management with significant stock /stock options to vest or people like you and me with more than a passing interest in the markets.

Perhaps, that is a good thing, even though it means the vast majority will never stand to benefit from the “relentless”* growth. I can’t imagine what the volatility is going to be if we have a situation whereby we have 50% of Americans, Germans and Chinese being directly holding equities. Maybe by then, 60% index fluctuations will be just another walk in the park? lol.

*I say “relentless” because if you look back at the long-term charts for the S&P indices, it is a curve that continues up in spite of two major world wars, countless small wars, cold wars, trade wars, depressions, epidemics, pandemics, civil riots, presidential impeachments, sex scandals, banking fraud, investment ponzis, earthquakes and what nots over the last century.

Short of a gigantic meteorite hitting earth and wiping out humanity (in which case nothing matters anymore). The stock market is still a strong contender for wealth building which most people ignore at their own risk precisely because of a fear of risk. Ironic isn’t it?

My point is financial market cycles are just a process like the seasons. Over the longer-term the Warren Buffets of this world will win, while all the rest worry themselves sick over the next 20% “crash” and “recovery” and “crash” again…and so on.

Thats my own conclusion on the financial markets. Either one gets invested with it long-term and ignore all the inevitable fluctuations, or you totally ignore it altogether and don’t buy into any stock investment at all.

Over-analysing all the fluctuations will only give one stomach ulcers.

I was just advising raxadian to make up his mind and stand by it because flip-flopping, second guessing or just being woozy-doozy in your market opinion will destroy both your wealth and mental health.

Disclaimer: I have not had any holdings in the Italian or Spanish markets so far.

However, I will dip-buy into them, if I’m proven WRONG and WS puts out an article to remind me later it really crashed 20% or more within this year. :-)

Kevin, I fully agree with your view. I am one of those who has made up mind to avoid stawks if it is NOT justified by stable long term cash flows. The stawks are “wealth builder” in your terms. My view is that they are “buckets” to gather money showered by money printers. Is it wealth builder? More like a wealth transfer. Why don’t I get in then!? Because if I am in, they will be out and I will be the bag holder at this price level. I have NO problem holding bags at WareemnBuffet price level, which is to cut current price by 60% The market has stayed at this level for this long is simply because NO suckers come in and hold the bag for the rich. I am NOT seeing a day when the rich gets poorer. I am seeing the well off mid class become sub prime, just like sub prime in last cycle got wiped out. I am seeing the top 20%’s wealth will be transferred to the top 5% just like the bottom 80%’snwealth got transferred to the top 20% in last cycle.

JZ, thanks for the correction. Yeah, “wealth transfer” is definitely a more accurate term than “wealth creation”, when referring to stock markets.

Is it possible that the Fed & ECB are swapping Dollars and Euros whereby the ECB buys 10 year Treasuries and the Fed buys Euros of an equivalent amount?

This is one of the possible scenarios of how Treasuries yields are being sustained despite the massive sell-off that we see in the markets mainly by China & Russia and some other countries.

This this is true, for how long can this farce continue?

The Fed actively wants the yield curve to steepen,so any scenario which encourages foreign buying of the 10 year is not likely to involve the FED

If the Fed is selling there treasuries at the same time the Government is selling more treasuries than ever because of the govt’s overspending problem who is going to buy all those treasuries ?

The primary dealers. The fed may also directly monetize Treasuries themselves. There are objectively no limits on the Fed balance sheet, its just the perception that a swift turn in policy will take, hike hike hike, drop rates. Look at the chart of Fedrates and you see historically what happens every time.

The Fed isn’t selling any treasuries (yet) just letting some of them start to roll off at maturity instead of repurchasing. But yes the general thought you are putting forth is true, the Fed is letting treasuries roll off (and is considering possibly selling) at the same time the government is selling treasuries then ever before, and as you correctly surmize this should have a pretty significant effect on the bond market once it has been going for a little while.

As for who will buy, well it is important to realize that yields will keep going up untill all treasuries are bought, so if they have to go to 33% to find a buyer they will, but ultimately the will all find buyers at some yeild. Thus te problem is not will all the treasuries find buyers, but rather if treauries have to go up to like 33% yields to find buyers what will that massive shock do to global finance and credit rates?

“This time, the Fed has a tool that it didn’t have before: During QE, it acquired $1.7 trillion in Treasuries and $1.8 trillion in mortgage-backed securities that it has now started to unload. It can start jawboning the markets by telling them that it will unload the securities more quickly, and it could then actually unload them more quickly. This would be a “monetary shock.” It would put a lot of pressure on long-term Treasuries, and yields would jump at the long end of the curve, thus steepening the yield curve and causing all kinds of turbulence.”

Looks like Yellen knew what she was doing !!!

You said : ¨Looks like Yellen knew what she was doing !!!¨

She most certainly DID NOT know what she was doing.

If it looked that way it was only the most ordinary and un-noteworthy of coincidences. That woman never had a real job in her entire life. Academia and Government posts qualified her for nothing at all.

She, like that pretender Bernanke, earned her sinecure through political posturing and connections, not through real work and achievement.

Name one real thing she ever accomplished ? There is not one.

The FED Chairman and Board of Governors could be replaced with this algorithm : ¨Keep a steady hand on the Tiller. Loan limited amounts of money into existence to address exogenous shocks. Withdraw that money more quickly than slowly.¨

And that is precisely what the FED Board DOES NOT DO. Hence the troubles we have had — and the much worse troubles yet to come.

A stopped clock is right twice a day — but how does one know WHEN it is actually right ? As the genius Wolfgang Pauli once said of another physicist, ( the physicist´s paper was so so bad ) ¨that’s not even wrong!¨

https://rationalwiki.org/wiki/Not_even_wrong

Janet Yellen is a hack who is not even wrong. So was Bernanke.

Who would you rather see run the Fed and have they written any books worth reading? I am genuinely curious.

The reality seems to be there may be no one who could properly do what the Fed theoretically is intended to do. Which is lessen the severity of boom and bust cycles in the economy. At any given point our financial lives are part of a massive experiment where the Fed is trying to accomplish these goals with no record of success or guranteed.

Steve Forbes. Warren Buffett perhaps. Even H. Ross Perot. But NONE of the NYC Bankster Elites. And no one from the Giant Squid. There is another Harry Truman out there, someone who led the effort to root out fraud and abuse in the war effort :

https://en.wikipedia.org/wiki/Truman_Committee

Imagine if we had a Harry Truman-like person to clean up the mess that the fictionalization of America has wrought ?

Here’s what the FED never does :

(1) It cannot recognize self-evident bubbles, ever. As a regulator it could increase down-payment requirements in the Mortgage market and Margin requirements in the Equities market when they get ‘frothy’. Not ! Never did !

(2) It could keep interest rates steadier. Say perhaps between 3 and 5 percent. (I think Milton Friedman recommended this course.) Not collapsing them from normal down to zero — and staying there for almost a decade, thus destroying capital formation.

(3) IT COULD REGULATE BANKS and BANK-LIKE INSTITUTIONS ! ! ! That’s its job. No regulations to calm the frothy equity markets (during the dot.com mania) or the real estate markets (in advance of the 2005-2007 mania) ever emanated from the all-knowing Fed.

The FED regulates nothing that is headed over a cliff, ever.

That there is a business cycle is historically well-established. There is much evidence that FED actions exacerbate the booms and busts, (associated with the cycle), both.

The debate on whether the FED moderates the booms and busts — or exacerbates them may never end. There is much good evidence that the FED is a contributing cause, and not a cure.

(Darned spell checker ! !)

FINANCIALIZATION, and not fictionalization.

Although fictionalization might have a certain ironic appeal.

Who says the FED isn’t well compensated for their hard work?

Yellen knew what she was doing? Ha! Someone already did a great job of describing her credentials and lack of any accomplishments And will add that the Fed has NEVER correctly predicted a turn in the economy, i.e. The price of money has not been set properly by the Fed EVER. Their error correction is ham handed and there is a media promoted scape goat, like “greed” as if that’s a new thing.

Imagine them flying a plane and they never know how much thrust or whether forward or reverse thrust is actually needed at the time. And the flight recorder has shown that they have never gotten it right…some severe turbulence (blame it on weather) but always had enough loft to make corrections.

Yellen has now parachuted out and left the plane at a very low altitude.

If that happens ,there will be blood in the bond and equity markets

If the 10y treasury hit 3%, it may attract a lot of buyers. But if the market behaves like inflation is really coming on, will bonds be very appealing? Maybe the Fed wants to get enough raises to show tightening may be effective and then find a reason to back way off in order to make buying treasuries very attractive. This cycle is getting pretty old and wage increases are one of the last things that happens.

The 10 year will be going up just in time for the Spring selling season. We could see the frenzy taken out of the RE market soon, even in place like Seattle.

Treasury yields are spiking because of the supply of debt hitting the bond markets, courtesy the Trump tax cuts. This is the first excess supply issue the market has faced in years.

Do not confuse a temporary blip in yields with economic calamity or the Feds rebalancing.

Perhaps the most important question is… with the FED only raising rates by a teensy-weensy bit each time, will interest rates gain enough altitude so that decreasing them in the next crisis will have a meaningful effect.

I think miminum altitude would be greater than 4%. However, at the rate they’re going it’s going to take them 2.5 to 3 years to get there. That’s probably too long.

Note that in the previous rate raise cycle in the mid-2000 the FED funds rate got to over 5% before they started lowering it.

I think it is mostly psychology. Did decreasing interest rates help the stock and real estate markets after the last recession? Then they will this time too. Only because we believe they will. And the resulting actions will cause them to.

It’s more than psychological becuase investors actually shift around between different types of investments depending on the prevailing interest rate.

if i didn’t need the money, i’d load into 2 years.

and then take a nap.

Yield curve(s)? Some yield curves are probably going to invert. The dynamics are as you said, short interest, jawboning, ( I wouldn’t call their balance sheet a tool, since removal takes the backstop away from corporates – more like I loaned you a tool, now I am taking it back) In any case the Fed cannot do much as long as LIBOR continues to set the tone. The LIBOR-OIS spread widened (one market crash indicator) and the rationalists were quick to paint over that. OIS is essentially the floating rate, so the perception of where rates are going and where they are fixed is out of step.

Collateral is being pulled off the market at the same time we repatriated profits with the tax cut, capital available to banks in London. The factors alone may be uncorrelated, even if they are do not constitute systemic risk. Since the Fed is (jawboning) the rate hikes and balance sheet operation, they are saying “who do you believe, me or your lying eyes?”

Is true the US can keep printing money but if the value of the currency goes too low no one will want US bonds.

Hence why the plan for 2017/2018 and probably for 2019 is to make the dollar stronger. That means highter FED rates.

Getting 3% to 4% range plus getting rid of “imaginary money” plus reduced federal expending in theory, because in reality is not reduced at all due to the debt ballooning, plus new taxes & raising existing taxes is the usual formula.

I mean if the Fed starts to give you 3% to 4% rates no one will want junk bonds unless they pay at least three to for times more. And yes that will make many companies get in trouble, but at most that will just stop the raising of rates for a few months because the FED cannot afford to lower them because they do need a mightier dollar.

Right, and this is the WHY of the Fed rate hikes; to protect the dollar. Doug Noland thinks that higher rates are putting a squeeze on derivatives, insurance against currency and interest rates, costs more and the underwriters are reluctant. Without the insurance investors have to pare back on risk.

When they start raising taxes, which they eventually will have to, watch for this Administration to try to shift from taxing income to taxing consumption. Herman Cain is likely whispering in Trump’s ear about resurrecting his 9-9-9 plan from the 2012 election, i.e. a 9% national sales tax. Trump has already proposed a 25 cent per gallon fuel tax, and an across-the-board sales tax on Internet purchases. A VAT tax ala Europe is likely in the cards. Bad news for retirees who spent 40+ paying income tax, and will now be double-taxed when they consume their retirement savings.

The Fed will elaborate a new doctrine after the wealth effect is swamped in the coming Blue Wave. Eight wonderful years, oh what it seemed to be!

Just a simple question

Why is the yield between the 10 year and the 30 year so narrow

At 23 basis points

Neither should be affected by the Feds policy of raising short term rates

Because talk is cheap.