Curious things are happening on its balance sheet.

The last Fed meeting ended on September 20 with a momentous announcement, confirming what had been telegraphed for months: the QE unwind would begin October 1.

The unwind would proceed at the pace announced at its June 14 meeting. It would shrink the Fed’s balance sheet – “balance sheet normalization” it calls that – and undo what serial bouts of QE have done: gradually destroying some of the money that had been created out of nothing during QE.

The pace of the shrinkage would be $10 billion a month for the first three months, and then it would accelerate every three months until it hits $50 billion a month at this time next year. That was the announcement.

Reality Check

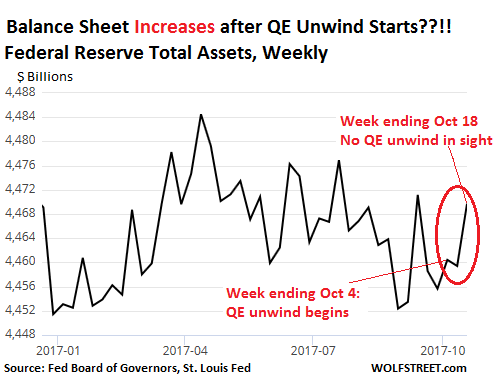

Thursday afternoon, the Fed released its weekly balance sheet for the week ending October 18. We’re now two and half weeks and three weekly balance-sheet releases into the QE unwind period. How much has the Fed actually reduced its balances sheet?

- Total assets on Oct 4: $4.460 trillion

- Total assets on Oct 11: $4.459 trillion

- Total assets on Oct 18: $4.470 trillion

You read correctly: Since October 4, the balance sheet gained $10 billion, all of it in the week ending October 18.

The Fed is supposed to unload $10 billion in October. But curiously, so far, it has done the opposite. This chart shows the balance sheet movements so far this year. Note the jump in the last week:

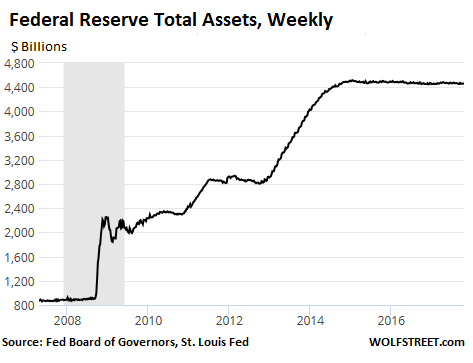

The chart below shows the Fed’s total assets over the entire QE period from before the Financial Crisis through the currently missing QE unwind. There was a mini-unwind after QE-1 and that was about it:

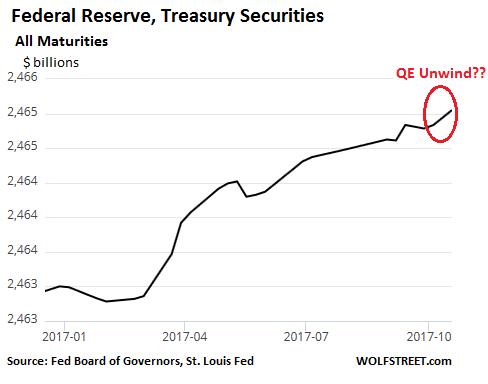

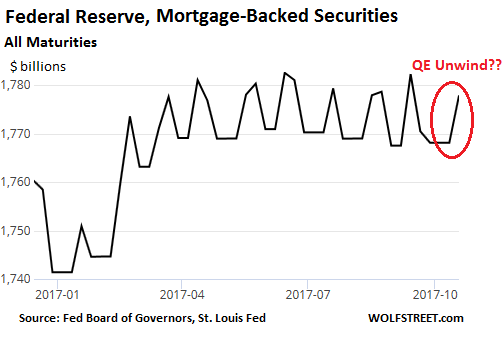

As part of the $10 billion that the Fed said it would shrink its balance sheet in October, it is supposed to unload $6 billion in Treasury securities and $4 billion in mortgage backed securities. How did that go so far?

Since October 4, the Fed has in fact added $176 million in Treasury securities and now holds $2,465.6 billion of Treasury securities of all maturities, a new all-time record high, and there is no sign of any unwind:

And even crasser: Since October 4, the Fed has piled on $9.8 billion in mortgage-backed securities, and there is no sign of any unwind either:

In fact, looking at the Fed’s Open Market Operations (OMO), the Fed’s “Trading Desk,” as it calls this entity, was very busy nearly every day in the MBS market, buying between $400 million to over $2 billion of MBS per day.

The Fed has done this since the end of QE in order to keep the MBS on its balance sheet about even. MBS securities constantly forward principal payments to their holders (as underlying mortgages get paid down or off), and unlike regular bonds, they shrink until they’re redeemed at maturity. To keep the MBS balance steady, the Fed has to constantly buy MBS. So this just continues its routine.

But clearly, there is no sign that the Fed has backed off from its purchasing activity – which leaves several possible conclusions:

- The whole QE-unwind announcement was a hoax to test how stupid everyone is. But I doubt this.

- The people running the OMO are on vacation and have been replaced by algos or interns, and they just keep doing what the folks now on vacation have been doing for years. I doubt this too.

- The FOMC told the public what it wants to have done but forgot to tell its own people at the Trading Desk. I doubt that too.

- There is willfulness in it – a sign that they’re not ready, or that they want to give the markets more time to get used to the idea of it, etc. And this could be the case.

- They’re seeing something that worries them, and they’re holding off for now to get a clearer picture. But I doubt this because their decision to commence the QE-unwind on October 1 was unanimous, and since then nothing of enough enormity has changed.

Whatever the reason, the announced “balance sheet normalization” is not taking place. The opposite is taking place.

By contrast, when QE was started in late 2008, the Fed kicked it off with an explosive vengeance. The folks at the Trading Desk didn’t dillydally around. In the 10 weeks between September 3, 2008 and November 12, 2008, they purchased $1.3 trillion of securities, ballooning the balance sheet by 144%.

Sure, some people may say that a few weeks are not enough time to judge the Fed on its QE unwind. But this is not something we’re going to ignore. And so far, the Fed is doing the opposite of what it said it would do.

Pricing of risk kicks the bucket in record central-bank absurdity. Read… This is What it Looks Like When Credit Markets Go Nuts

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

This is why the Fed should NOT be in charge. They are fine at spiking the punch bowl, but they haven’t the courage to take the bowl away when they need to. Instead they hide behind the BLS’s finagled numbers and quietly pray form a miracle.

I’ll go with number 5. Can you guess what that might be?

Hint: the US Chamber of Commerce has said tearing up NAFTA would result in hundreds of thousands of lost US jobs.

√

The antagonistic approach of the p 45 team to the NAFTA negotiations has many convinced the P 45 team are in fact out to destroy NAFAT at the first opportunity.

The VERTY BAD current NAFTA situation was not fully on the radar when the public shrinking Balance sheet terms were first telegraphed.

If they are still over 4.46T by 4 Nov I would not be surprised to see the flip flop moniker return.

Without good justification from them. I also will be sad with them.

In the short run for sure. In the long run, assuming other items in the regulated parts of the economy are run correctly, it should lead to “optimized” US jobs: the right number at the right employment costs, etc.

Note that there are a lot of “ifs” in that statement, but in past decades, the US did manage this correctly. The thing that has changed is that the economy (of the US and globe) are a lot larger and more complex. I am not confident our government “betters” are up to the task.

They probably haven’t received permission yet from whoever really pulls their strings.

Wow, Wolf. Great data. I wonder, does the balance sheet include overnight loans (TOMO) or just what they call “outright purchases” (POMO)? Could it be that that Fed really is winding down purchases, but that the primary dealers (big banks) instead are taking on overnight loans using MBS as collateral?

The announcement said that they would let securities “roll off” — meaning that they would not replace maturing securities by buying new securities. But they’re not doing that. So far they have replaced all the maturing securities plus some.

I checked the various line items on the balance sheet to see if they shuffled things around some, but that doesn’t seem to be the case either. And the total balance of assets has gone up by $10 billion.

Hi Wolf, I understand the rolloff/replacement mechanics, but good that you mentioned it for those who may not have known. My question was really whether less POMO (replacement purchases) was being supplanted by more TOMO (temporary repo).

I also looked at the line items in the H4.1 link and also could not see and sign that TOMO was the reason for the increased reserve balances. So yeah, looks like Fed somehow got cold feet. A theory about why I have posted further below.

The big banks are not lending, they don’t have to, to make a profit. They can just increase their reserves at the fed and make a profit over the cost of funds. That would leave the mortgage market unsupported, this is probably why the fed is still buying agency MBS, because they have to.

Actually in reality they’re lending away like madmen let loose in an insane asylum handing out loans like candy on Halloween to any Tom , Dick or Harriet that can prove they’re still breathing for just about anything you can image .. but especially for real estate [ commercial and residential ]

Ahh …the joys of living in this Kafkaesque age of ours

At the risk of sounding naive, why does the Fed buy MBS?

“That would leave the mortgage market unsupported, this is probably why the Fed is still buying MBS, because they have to.”

I understand the the Fed is a collection of twelve regional banks that are ‘owned’ by the member banks in that region, but if one of those member banks packages up a thousand or so mortgages to sell as a MBS, why does the Fed have to be the buyer? If these MBS instruments are worthy investments, wouldn’t there be a demand for them outside of the Fed.

If a true free market existed, these MBS should be priced by supply/demand, not the Fed printing money to give to the the banks that wrote and packaged the mortgages IMO.

Thank you Wolf for telling it like it is!

Dan,

From what I gather, all the MBS is coming from the agencies, fannie and freddie. Since they are GSEs the fed has no choice but to support them, like they support the treasury borrowing.

Thank you Petunia. I wonder what is the breakdown on all MBS purchases by the Fed.

Dan,

I don’t know the breakdown of MBS purchases by the fed. But the majority of the 9.8B Wolf cites in his article probably comes from the GSEs.

“The big banks are not lending, they don’t have to, to make a profit.”

Exactly. Why bother conducting business when the Fed can simply shovel profits to you, backed up by the US taxpayer.

To be fair, the banks have been encouraged to manage their risks better, and nothing is more risk-free than not making loans.

The Mechanism itself has taken charge and is now increasing, automatically, what is on the Fed’s books. The Fed is not making any decisions, and cannot make any decisions. The Mechanism has taken over. The United States Government is now an automatic bankruptcy Court, making visible what has been known for a long time: the United States Government is bankrupt. Meaning that it is not governing the country anymore. Meaning look elsewhere.

Great piece Wolf. This is the kind of investigative articles and analysis that I like about your site.

Many other sites have since devolved into mere political grandstanding, without any data to back up either their left or right leaning tendencies.

check and mate, the Fed has so many more tools, the discount window POMO and TOMO, the only problem is they are only pale cousins of the real thing (QE) or QaE, Future Qualitative Easing, will Trump order Yellen to buy stocks? Well Reagan sent Bush down to the NYSE in 87 with an open checkbook.

In non crisis mode it is enough to keep the liquidity they have already put in the market circulating until the leadership has made its way to an undisclosed location.

Why do you need to buy stocks when you can keep zombie companies afloat, and keep their stock prices up (so executives can cash in), simply by making cheap loans available and then scooping up the bonds.

Part of the response to the 1929 crash was NEVER again to have the U.S. Government, or anyone else, being in the position to say Yes or No to bailing out the stock market directly. That’s what this hall of mirrors is all about.

Part of the response to the 1929 crash was NEVER again to have the U.S. Government, or anyone else, being in the position to say Yes or No to bailing out the stock market directly.

All of the reforms implemented following the 1929 crash – especially Glass-Steagal – have been systematically dismantled by the banksters who have co-opted both political parties and every presidential administration since Nixon. Bill Clinton’s repeal of Glass-Steagal at the best of his Citibank-owned Treasury Secretary Rubin set the stage for the speculative orgy that caused the 2008 financial crash, and is going to cause an even more devastating crash once the Fed’s financial chicanery can no longer hold off the long-deferred financial reckoning day.

As predicted.

The purpose of the Fed is to enrich the wealthy. Unwinding QE and raising interest rates significantly doesn’t accomplish that. It was an easy prediction.

“The whole QE-unwind announcement was a hoax to test how stupid everyone is.”

The markets didn’t believe it.

“The markets didn’t believe it.”

Agree 100%. I suspect they will sell off a little eventually. The big unwind won’t happen unless they have to do it down the road. Some ‘reason’ will come along that ‘necessitates’ a need to print money and have more QE. All assuming the swamp at the Fed isn’t drained.

The coming Fed nomination will be the inflection point for a return to a normal world and growth or the continued decline into a weird world where countries band together to print money, monetize debt, and confiscate savings from workers to help pay for it.

Right now, the markets are betting on the latter.

Absolutely Walter Map. You’re one of the few people I listen to online.

And to think the Fed actually gave a specific date about it, and then reneged. If they can lie here, what else are they capable of?

“The last duty of a central banker is to tell the public the truth.”

-Federal Reserve Board Vice Chairman Alan Blinder, Nightly Business Report, 1994

It is widely, if subliminally, know that the current US/global [financial] :economy” is not only based on debt, but continually expanding debt.

The FRB may well have developed an ACCURATE computer model of the US/world economy, and has projected what will occur if debt expansion is curtailed, and interest rates are allowed to increase to historically normal levels. The effects of any reduction in debt expansion [ and the resulting interest increase] will be greatly amplified by the rapid increase in [good] job elimination by automation/computerization and other technological advances.

Banksters have pursued debt peonage for centuries, probably millenia, even before Pasion. It’s what they do. No computer needed.

Their eventual goal is to absorb the entire world’s economic surplus in interest costs. To accelerate that process they have arranged for maintenance of the status quo to be dependent on constantly-increasing debt. Computer models might be useful in predicting when that will be achieved, but not to see that this is happening.

Well … if it is based on debt as you say …( and I do believe you’re right ) …then what the senate just did today passing the largest budget in history increasing our overall debt to stratospheric levels … to be followed by a proposed $1.5 trillion tax cut…. ( that’ll work out real well ) … that must now make us the wealthiest country in the universe … never mind the planet

Ahhh the joys of delusional economics / thinking

George, I think I disagree with the conclusion, if not the assessment. Capital and labor are the two primary inputs in all production, and business firms cost optimize wherever possible. It may not be possible to consume *zero* capital or labor, but you can shift the balance between the two within any given industry or business.

The ZIRP/NIRP policies effectively mean capital is cheaper – so businesses move toward more capital consumption (automation, technology, stock buybacks, etc.) at the cost of labor consumption. If the cost of capital increases (interest rates normalize), then the knee of the curve on diminishing returns shifts to the left and leaves a wide gap between where returns diminish *now* in the higher interest rate environment versus where they diminished *before* in the low interest rate environment.

Even if wages don’t move at all, increasingly expensive capital makes labor relatively cheaper – and more prone to being consumed by businesses. In the very short term, the effects could be reversed in some areas due to cheapening of capital *goods* due to liquidation but this would be short lived. Once enough firms (most of the big ones) go bankrupt, they will get scavenged to make good on whatever amount of outstanding debt can be satisfied. This will lead to a reduction in price on certain capital goods (software, machinery, buildings, etc.) but the cost of capital (in the capital markets) remains high relative to the previous condition. The reduction in price of capital goods could cause tremors in the labor markets for those associated industries, but overall labor becomes comparatively cheaper and demand would probably increase. Employment competition comes from a number of places (developing world, medical costs, ad infinitum) but labor also competes directly against capital, as both are the basic requirements to produce anything.

Fast food chains aren’t investing in expensive hamburger-making machines because paying a person to flip burgers costs to much – they are doing it because interest rates are so low that they can finance the machines over a long period of time and end up having complex and expensive machines that are cheaper than men. In a normal interest rate environment, this would probably not happen (at least not so soon or at such a large scale) because the machine wouldn’t pay for itself if capital costs are higher.

The shorter-term disruptions of a rising price of capital will probably manifest in both the capital and labor markets (the sudden shortage of repo men notwithstanding) – a severe recession or possibly a depression. After liquidation, though, labor would come out with an advantage as compared to capital.

Higher capital costs should lead to more employment and not less, because the main labor competitor just got more expensive. This is, I suspect, why we had the so-called “jobless recovery” and the continued reduction in the participation rate – you can’t have both cheap capital and high employment.

You are 100% correct in your assessment of how capital costs vs labor costs affect the workplace.

Low cost of capital will let me buy more efficent machines that will reduce my labor requirements and those labor costs for the life of the machines.

High capital costs can reduce the $$ advantage of automation in a plant.

“Low cost of capital will let me buy more efficent machines that will reduce my labor requirements and those labor costs for the life of the machines.

High capital costs can reduce the $$ advantage of automation in a plant.”

Unless you are talking only about new business setups that’s a bit to confining/narrow a position.

Equippment has a life .

Equipment that is not replaced becomes cost prohibitive to keep operating. Hence the difference in replacement with same or upgrade to automation is the only cost differential.

so only a small segment of the cost is bound by your position.

D wrote “so only a small segment of the cost is bound by your position.”

Please explain what that statement infers.

As far as the costs go, it does not matter if the company is a new startup or a old guard company that is replacing 2 manual machines with a automated one. The labor costs of producition (theoretically) will be less in either case. A “small segment of the costs” can – and is – VERY important over a long period of time.

IF I can replace 1 person that has a all in labor cost of $75,000 a year with a $250,000 machine – one that has a expected life span of 10 years – you tell me that it is just a “small” segment of my costs and means nothing on the bottom line??? That $250K machine will save me $500,000 in labor costs over those 10 years. And I should get consistently better quality parts over that time.

I will take the half million anytime – old line company or new startup……

Good example of the dangers of using silo/enterprise accounting in the current highly integrated socioeconomy.

The overall effect on employment and taxes paid by the [eliminated] employees is not considered.

While it is true that A FEW isolated businesses can “automate” and release A FEW workers back into the labor pool with little effect on the aggregate economy, the widespread adoption/implementation of automation [or off-shoring] and reduction of domestic employment has a catastrophic effect on the aggregate economy, not only because of the loss of the tax/FICA revenues derived from the employees, but because of the loss of their wages into the economy and the demands the un[der]employed place on the social safety net from unemployment and food stamps to increased public safety costs resulting from over-consumption of alcohol and spousal abuse.

IMNSHO the very least that is required is imposition of a “tax,” equivalent to the lost FICA and estimated economic contribution the eliminated employees would have made over the 10 year period used in the example. Without such an equalization tax or fee, we are allowing the employers to “externalize” much of the overall cost of “automation” onto “society at large,” which increasingly we cannot afford, in not only money but social costs.

George McDuffee – Thanks for your comments.

You appear to know and understand what the industrial revolution has wrought upon mankind over the last century and a half.

You also recognize some of the darker side of automation in the workplace and how it effects society overall.

As far as I am concerned automation is not the cause of our current or past economic troubles. The chase for higher and higher profits by large corps and the chase for lower cost labor no matter what that does to the human beings in the labor chain is one of the culprits.

In the early days of Samuel Gompers and John L. Lewis the union was a neccessary “evil” that fought for the common man. Their movements became, in time, as self centered as the rich folks that they had stood up against.

Off my soapbox………

For the moment.

These days youyr 10 year lifespan is questionable. and you have maintenance, supervision etc, costs, so you half million is inaccurate already.

And what sort of 75 K worker gets replaced by a 250 K Machine???

The numbers you are using are loaded and self serving to your argument.

Further unless you have in house automation controller and maintenance staff you will need to hire this in as required.

The hourly rates for that will make your nose bleed just thinking about it, (or the salary you will need to pay you new staff do do that).

It is painfully apparent that you have ZERO idea of todays (or even pre 50’s era) machine tool life spans. IF a new machine tool will not last at least ten years of 80 hour weeks with just normal maintenance it is not worth buying…

“These days your 10 year lifespan is questionable.” That may be true. More like 20 year working life. Reality is that the machines of today become obsolete before it wears out.

“and you have maintenance, supervision etc, costs, so you half million is inaccurate already.” Supervision costs are already baked into the plant operation. Replacing 2 machines with one actually lightens the supervision load.

“And what sort of 75 K worker gets replaced by a 250 K Machine???” A journeyman machinist that can run darned near anything in the plant. His – or her – replacement can be a lower cost machine operator with a strong back and the ability to not get bored and fall asleep watching a CNC machine run thru its cycle.

“The numbers you are using are loaded and self serving to your argument.” How is that????? Details please….

“Further unless you have in house automation controller and maintenance staff you will need to hire this in as required.” Programmers and maintenance staff are already part of the plant operation.

“”The hourly rates for that will make your nose bleed just thinking about it, (or the salary you will need to pay you new staff do do that).”” Answered above.

Next.

Further in reality the majority of savings found in automation are in payroll tax costs and capex deductions.

Capex deductions, (Including finance costs) for equipment that replaces tax paying workers, are doomed

How are CAPEX deductions doomed?? LOL

Once again, with feeling: no matter how much Yellen and her flying monkeys dissemble and prevaricate, there’s no such thing as unwinding a Ponzi.

Peter Schiff has been saying that they would never reduce their balance sheet and that it is far more likely that they would do more QE I guess he is right again

Especially when the Ponzi is the U.S. Government itself. That means revolution. Overthrow it NOW.

It can’t be called a Ponzi if you can print the money that goes into it.

I don’t think there will be a QE is as much as I want it personally

Trump is interviewing potential Fed heads to ensure they DON’T unwind QE -> crash the (so called) Trump rally.

While he was honest before election that this was bad for the country, I speculate that since being President he realizes this is the only thing going for him in the media.

So QE unwind will NOT happen, not atleast in the short term

The people who failed to stop the last financial crisis, and are failing to stop the next one, are fretting about how to get out of the mess they created, without being blamed for what they did, because what they did didn’t work, and they don’t know why. This is a textbook case of why people trained by economics textbooks shouldn’t be given even the slightest opportunity to ruin the economy.

Why on earth would they be blamed? The people knew every step of the way that this was going on, it was at issue at every election since 2008, and at every election it was ratified. The problem is the people themselves, not the flunkeys, butlers and pratfall artists we call “leaders.” Blame the people. Always blame the people. You, me–everyone. It is the people who are at fault. Victims don’t rise up, oppressors bear down, referees look the other way.

What we will see is fascist groups at each other’s throats. Look at Catalonia–who are the heroes there?? Spain is 100% corrupt. How do you choose sides in a fascist farce?

Could it be that the Fed just temporarily got cold feet this week, due to two days of stock market downdraft that was perhaps related to the 30-year anniversary of the 1987 market crash?

Of course, if that is the case, one may question the Fed’s resolve when it comes to unwinding of QE. There will always be the reason-of-the-week NOT to unwind QE. Bastards!

QE is the only tool left to forestall or arrest a market plunge.

The effect of any tightening will be amplified by other central

banks. Draghi and the ECB would be dead set against ending QE.

Get ready for Wall Street’s version of Halloween.

Great job, Wolf, keeping tabs on the Federal Reserve puppets and their criminal overlords!

Side Note:

Back in 2015 when China banned selling stocks, I was watching the daily miracle recoveries of the Shanghi Composite Index. It was humorous… ‘No such thing as down market in China’ ;)

Lately I have noticed our daily indexes look eerily familiar…

I guess there is ‘No such thing as down market in the USA..’

Here’s something I have been thinking about: The US/Fed “cannot” unwind QE alone. All the other parts of the world has to get on board and their central banks have to follow suit. Otherwise US markets will crash, whereas European asset valuations will stay up, or at least not fall as much as ours. That means that foreign capitalists can gobble up US assets (stocks, real estate, whatnot) for cheap, and that is the LAST thing the US 0.1% elite wants.

This is one of the main reasons that central banks mostly follow in lockstep with interest rates all around the world, but it never gets talked about.

Taking another step back, for the last 40 years, all the world’s countries and their central banks have (within limits) been engaging in a competition about who can generate the most asset inflation IN THEIR OWN COUNTRY, thereby making their own elites more wealthy than the elites in other countries. So far, the US has been winning, and Japan failed badly in their attempt in 1992. What will happen next?

I told you. I heard on the tv, of all places, that they are expanding duration and buying up all the long term treasuries.

Did they say why? That seems to me the opposite of what they should be doing. Wouldn’t you want to boost long-term yields (sell 30-years) to give you room to boost short-term yields?

It all depends on your objectives and time frame. Short term bonds, t-bills, etc. generally pay slighty less interest than longer term bonds, so the “government” avoids considerable debt service costs in the aggregate by going to shorter term financing.

However this is hazardous in that significant interest rate changes are felt much sooner than if the bonds were longer term.

A return to “normal” interest rates will have very substantial immediate impact on governmental debt service costs, while Volker interest rates would be immediately catastrophic. FWIW: the UK government issues and relies on 50 year bonds called”gilts” for much of their debt financing, thus reducing their exposure to instantaneous interest rate changes, albeit at slightly higher interest rates.

Kent,

They went long to support the deficit, housing, and the banks.

If the Fed is buying long-dated treasuries why did the 10 year shoot up 6 pips today?

I think we can expect that this will be another data set that Fed will stop releasing then!

“Whatever the reason, the announced “balance sheet normalization” is not taking place. The opposite is taking place.”

Continued bias to the upside. The Fed has stated that Quantitative Tightening (QT) would start in October, presumably because the U.S. economy is doing so well and that “Everything is Awesome”.

—————————

https://wolfstreet.com/2017/09/20/this-fed-is-on-a-mission/

This Fed is on a Mission

by Wolf Richter • Sep 20, 2017

“The two-day meeting of the FOMC ended on Wednesday with a momentous announcement that has been telegraphed for months: the QE unwind begins October 1. It marks the end of an era.”

“Here’s the schedule:

Oct – Dec 2017: $10 billion a month.

Jan – Mar 2018: $20 billion a month.

Apr – Jun 2018: $30 billion a month.

Jul – Sep 2018: $40 billion a month.

From Oct 2018 forward $50 billion a month.

So $300 billion over the next 12 months, and $600 billion a year, starting October, 2018. If this goes on for four years, the Fed will cut its balance sheet by $2.1 trillion.

This is the amount of money the Fed will destroy – just as it created this money during QE. It’s the reverse of QE, with reverse effects.”

—————————

Based on the high correlation between Fed balance sheet and S&P 500 index, one might conclude that markets won’t correct significantly until there’s an actual balance sheet unwind. Time will tell, but if history is any guide, market cycles may be extended (i.e. current bull market is second longest in history at 8 1/2 + years), but not prevented.

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.” – Chuck Prince, former chairman and CEO of Citigroup (told to the Financial Times on July 10, 2007).

“The last duty of a central banker is to tell the public the truth.” – Alan Blinder, former Vice Chairman of the Federal Reserve, 1994 on the PBS Nightly Business Report

To paraphrase Airplane

Clearly the Fed picked the wrong time to stop smoking crack.

There is no conspiracy. https://www.newyorkfed.org/markets/treasury-rollover-faq.html

The fed will simply roll-over a smaller amount than before. October securities are maturing on Oct 31st. Thus, there will be no difference in the balance until after that date.

Your interpretation is wrong.

1. These roll-overs apply only to Treasury securities, and not MBS. But the $10 billion increase of the balance sheet came from MBS, and MBS are acquired in the market from counter parties (via FedTrade).

2. Even for Treasury securities your interpretation would be wrong. There are TWO roll-over dates every month: mid-month and end of month. The mid-month date was in the balance-sheet week ending Oct 18 and results should have shown up on the balance sheet.

Ya gotta wonder if the holders of the MBS paper?? are looking over their holdings, picking the ones most likely to fail and getting them off of their books by giving them to the fed???

OR – does it not work that way?

All MBS that the Fed holds are based on mortgages that are guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae — therefore by the taxpayers. So only taxpayers are at risk of taking any losses on the underlying mortgages, and the Fed doesn’t have to worry about that part.

Thanks for teaching me how that stuff works!

Have you called the Fed itself for an explanation rather than guessing. This is very newsworthy

If it is as you surmise WSJ should here about it

Whatever happened to the free market if the Fed still feels stimulus is needed 9 years in?

Can someone explain to me (like I’m a 10 year old) what exactly Quantitative Easing (QE) is and how it works?

Thanks.

It’s a fancy way of saying, the fed buys all the debt nobody else is buying, to support the markets for those instruments. For example, if the market is not buying or paying a low price for mortgages, then the fed buys them all up at the highest possible price. This money goes back into lending for more mortgages, etc. It is an artificial way to support a market that has no real customers.

Thank you!

Ant Naples, Petunia is one of the many great posters here. I’m also trying to get my head around the whole QE thing. But if I am getting it, then her answer needs one clarification. In QE, the money The Fed uses to buy ie MBS is “printed” not real. The Fed creates this money with a ledger entry. A mortgage payment from a borrower consists of principal and interest. If the principal is reinvested in MBS then that is continuing QE. If entered against the printed money, the real and fake money cancel each other out and cash is destroyed…That is QE Unwind. The interest is real money earned on the fake money.

How QE Unwind works with loans to Big Banks I’m still trying to figure out.

In short, it’s a bankruptcy court with a social service agency attached to it. Gotta keep the proles working and eating, otherwise they will dig up Hitler and put him on a chair, and salute him!

saying one thing and doing another…Wow they really are taking cues from Mr. Dimon….

Nice catch Wolf. Thanks for your efforts.

Once you understand that the Federal Reserve is a criminal private banking cartel masquerading as a central bank, while colluding with its oligarch handlers to defraud the 99%, you learn to ignore the dissembling of Yellen, et al. and focus solely on watching the Fed’s swindles and racketeering unfold. As the middle and working classes become increasingly pauperized by the Fed and its “No Billionaire Left Behind” monetary policies, the proles are going to be left with a stark choice: do away with the Fed or consign themselves and their progeny to a future as serfs on the oligarchy’s incorporated neoliberal plantation.

How these lunatic conspiracy theories, which include the word ‘criminal’ do not alert the host that this calls for ‘moderation’ is beyond me.

These well- researched, reasoned publications are degraded by this utter drivel. which if acted on by a latter day Tim McVeigh. could result in consequences. The unbalanced are a clique.

Facebook, to name just one is starting to take responsibility. “We’re not just a site’

When discussing finance, a much better word to use than ‘criminal’ is ‘ammoral’.

It covers a world of sins – both of commission and ommission.

‘Beyond Good and Evil ‘ might also be valid. :)

As much as it can be tiring to see the same generic comments from the same people time and time again, the level of censorship you advocate for is far worse.

The comments that are most valuable offer detailed points, good links, or number breakdowns.

We are still at emergency rate levels, therefore the emergency never ended. Within the lies of the FED are some truths such as when Bernanke was asked about the timing of rate normalization he replied “Not in my lifetime.” The ponzu will end when it collapses

October’s not over yet.

Well said old farmer.

Comes, Caesar, but not yet gone.

“Excluding shelter, the core index has risen just 0.6 percent over the last year. There is little reason to expect core inflation to reach the Fed’s 2.0 percent target in the foreseeable future.”

Why don’t you try doing something radical – like waiting until a full month has elapsed and then see what the Fed is doing? This is just noise!

I will certainly post updates as time goes on. So don’t worry, you’ll get your full-month October update. The QE unwind is very important, and we will follow it, whether or not you think it’s “noise.”

IT AINT noise.

It will filter into the US $ rates. Quite fast.

If you mean foreign exchange rates I think not. In fact I expect QE reduction to have little discernible effect although increasing/decreasing the Fedfunds rate will have an effect on $ value in the foreign exchange markets as has already been demonstrated over the last 2 increases whilst the Fed did nothing with it’s balance sheet.

“If you mean foreign exchange rates I think not. In fact I expect QE reduction to have little discernible effect although increasing/decreasing the Fedfunds rate ”

The expected QE reduction is already priced in.

What will cause problems, is the flip flop.

The “failure” to adhere to “Forward Guidance”.

“Forward Guidance”. Is a waste of time, and will quickly start to be completely ignored, unless it is TRUTHFULL “Forward Guidance”.

If you are not going to adhere to your “Forward Guidance”. You had better explain why. QUICKLY, and your explanation must be sustainable, otherwise “PANTS on fire Etc, will be the reaction following any further “Forward Guidance”.

“Forward Guidance”. is a useful tool. More CB’S are starting to use in the pursuit of stability.

It is not in the interest of CB’S, to make “Forward Guidance”. Nothing but more jawbone spin. AKA Propaganda noise.

It’s interesting to see the comments on here as I suspect most are people inside America. I am in the UK and see things differently. The Bank of England (BOE) has provided “Forward Fantasy” for about 3 years now where the base rate being increased was “sooner than markets might think” in 2013 according to Mark Carney the Governor of the BOE. Following on from that we had a further 25 basis point cut in August 2016 to “save us from the Brexit vote”.

So, looking at events over the other side of the pond from a UK perspective with experience of the BOE where the Fed says it’s going to raise and then does so a couple of months later I don’t see a Fed that is untruthful – a bit slow to act maybe but not untruthful. As I said to Wolf Richter in a post that has not been put up here it’s early days to admonish the Fed for not reducing QE yet when they said they would do it monthly and a month has not yet passed, in fact if you were waiting for the BOE to act I’m afraid you’d still be waiting in 2021!!

What are my thoughts on QE unwinding?

Simply that the US economy is reasonably stable (but not massively so) and whilst the S & P is fully valued it is not overvalued so I don’t see any reason why investors should take fright at QE reduction and accordingly, I expect a little volatility but over the course of the next 12 months the S& P to trade sideways or slightly up whilst treasuries coupons slowly rise (along with mortgages) and the value of older T bills slowly falls.

If you’re a trader you may be interested in a short position on old T Bills but I think you’d have a substantial wait to make a profit.

Economy wise? Business as usual, meaning slow growth barring any of Trump’s Twitter announcements. There again if he forces his tax cuts through and actually spends anything on infrastructure then it’s take off for the economy with simultaneous meltdown on dollar FX along with sky high Funds rate as the Fed tries to defend the dollar.

My thoughts are that there are 2 big big threats at the moment for the US:

1. The debt ceiling not being increased followed by a default and I have no idea what will happen in the World then if the US defaults on a debt but I expect it to be vary bad whatever it is that does happen

2. Donald Trump….

“Economy wise? Business as usual, meaning slow growth barring any of Trump’s Twitter announcements. There again if he forces his tax cuts through and actually spends anything on infrastructure then it’s take off for the economy with simultaneous meltdown on dollar FX along with sky high Funds rate as the Fed tries to defend the dollar.

My thoughts are that there are 2 big big threats at the moment for the US:”

1 he would have to spend “HUGE” on infrastructure to cause that (like Trillions huge) in a short time frame.

2 there is only 1 BIG threat to the US and it isn’t a debt ceiling default issue.

As to the untruthfull FED

FED said it would do A.

Not only has it not done A. Which would be vaguely acceptable much like carneys behaviors.

Currently it has done B. Which is increase the Balance sheet MORE QE.

QE PROGRAM is supposed to be over.

So at the moment we potentially have multiple Nellies from the FED, It could just be abedding in of eth program which could change in 2018.

The FED is aiming for stability if ir goes back to green-spanning us it will get Volatility in the FX markets.

And I am not in the US either, and no longer in the UK or EU, thank god (if there is one).

You seem to think the Fed has already announced it is shrinking it’s balance sheet a long time ago, It didn’t, it made it’s tapering announcement back in 2014 which it has implemented. The full announcement stated that eventually $ 20 billion a month would be retired but this wouldn’t happen until the Fed funds rate was at 2%, it’s nowhere near that.

This means that the Fed would continue increasing it’s balance sheet at a reducing amount which it has done.

The storm in a tea cup is now about whether they have actually started reducing the size of their balance sheet in accordance with their announcement in September 2017. It’s too early to say but I would point out that they are now ahead of their original timeline if they do start reducing the balance sheet as this was not supposed to happen until the Fed funds rate was 2%.

Meanwhile following on from an announcement that the BOE was not increasing it’s balance sheet beyond £375 billion a few years ago it did an about face in 2016 adding another £60 billion although it did communicate that.

A further question – what effect do you expect unwinding of QE to have? As you will see from my reply to “D” I expect it to have very little effect.

If the QE unwind takes place in the amounts announced, reaching a max of $50 billion a month a year from now, my guess is that it will have a significant effect after a fairly long delay (nearly all monetary policy changes entail fairly long delays). This will impact longer term yields, mortgage rates, asset prices, etc. My model is the reverse of what happened during QE, but reverse only part of that at a slower speed, with plenty of ups and downs.

after the bottom at the beginning of QE 3.

There was a period of ‘NO news is bad news” no matter what the fed or others did or was said after each FOMC the $ and markets went up.

What are your thoughts on a possible reversal of that, as QE unwinds at least for the markets.

For the dollar it is positive as it is a 3 T Reversal of the QE “Debasement” of the $ in QE.

Hence if the FED keep telegraphing an action, the do not carry out. Their failure to follow through MUST HAVE A NEGATIVE effect on the $ value.

Once the market consensus become FED “whoever” is the same as, p 45 “Pants on fire”.

Option 6: the Fed is fundamentally corrupt and tells the public one thing while telling insiders what is actually going to happen.

Wolf, you were scratching your head for months wondering why the markets didn’t care about the Fed talking about reversing QE whereas they had tantrums every other time. Maybe they had illegal inside information?

It wouldn’t be the first time. NANEX did some great analysis of bulk trades on fed futures at the CME on the day when the Fed publishes its monthly guidance. It showed definitely that the news was being consistently leaked to insiders, because the trades were happening earlier than literally the speed of light from DC to Chicago would allow.

There’s also Taleb’s old story that if someone flips heads 50 times in a row, the next time will almost certainly be heads because the chance of 50 random head flips is much smaller than the chance you’re dealing with someone who has a loaded coin.

How many times does the Fed have to say one thing and do something else before we realize we’re dealing with a fundamentally broken, captured, and corrupt institution?

Option 6: the Fed is fundamentally corrupt and tells the public one thing while telling insiders what is actually going to happen.

Bingo. We’ll never know the full extent of Fed collusion with its oligarch insiders unless some post-collapse tribunal waterboards Yellen, Bernanke, et al along with performing a real audit of the Fed to find out the full scope of their racketeering since 2008, at least. But now and then even the corporate media smells something rotten about the Fed’s dealings with its insider cronies.

http://www.integrity-research.com/policy-firm-medley-global-dogged-fed-scandal/

… whose purpose is to fund wars.

Just thought I’d mention, although not for posting, that the definition of enormity is not really big, it’s monstrous wickedness–ie, think Stalin, Moa, Pol Pot. You probably meant to say immensity. But maybe not since you were talking about the fed. ;-)

From Random House Webster’s Unabridged Dictionary:

3. greatness of size, scope, extent, or influence; immensity: The enormity of such an act of generosity is staggering.

that’s only because people have been misusing the word for at least a generation.

I think there’s another way to explain this.

Could it be that Yellen is angling for one more term? She met trump yesterday for 30 minutes. For a person with no chance of renewal, that’s a awful lot of time to spend with potus.

IMO, she doesn’t undo the balance sheet to signal to trump that she’s willing to play his game. We know he likes this game (he was against it earlier in the campaign days — he scoffed at a 17k Dow) because he takes credit for every new high. So she makes sure that the Dow cracks 23k.

It is beginning to look very likely that she’ll continue. The unwind will probably have to wait for reappointment.

If the United States has decided to attack N.K., there will be no shrinkage of the Fed’s balance sheet anytime soon.

True.

Would they let “Dammit Janet” know that?????????????

So Quantitative tightening is the same as quantitative easing…..got it.

“Normalization of the balance sheet”…..that’s a good one.

If the Fed doesn’t cut $10B off its balance sheet by end of October, I will start buying gold even though it’s just a yellow rock. I wouldn’t be surprised to learn the Fed didn’t sell anything yet because it was asleep at the wheel. Wolf’s article may wake them up.

When the Fed announced the balance sheet reduction on June 14, 10-year treasuries were at 2.14%. The strategy to reduce the asset base is targeted to raise long-term interest rates. How is the Fed doing? Today the 10 year is at 2.38%, a significant move up. Maybe it is just jaw boning or maybe there is some increased selling pressure but they are getting the job done.

Today, Oct 20 2017, might be a historic day = a market peak.

The time between Oct and Dec, in the stock market, can be infinity.

If correct and we have peaked, a low slog will not change market

opinion that the Fed will raise rates. The almost retired lady might disagree. Why should Dr. Zanet in her last 4 month react, take a risk.

This is Oct and as usual a lot of unexpected things can happened in October, even cutting rates !!

From Oct 20 to Feb 2018, time is short.

Dr. Zanet will do everything not to rock the boat.

She is a tiny, but has a powerful kick.

She will kick the can down, as far as she can, beyond Xmas time,

beyond winter time, to send the bear to into his cave, for a good deep sleep.

As of Sep 27, there were no bonds that matured before the 31st of October. There are two under the T-notes and bonds.

If you go to the maturity schedule for “Agencies” (debt from Fannie Mae, etc), you’ll see that it lists only $6.76 billion (with a B) at par value maturing over the next few decades. However, the Fed holds $1.78 TRILLION (with a T) in MBS. And they’re not on the schedule. So this is only a small fraction of its mortgage debt holdings and the schedule is not complete. T-note and T-bond schedules however appear to be complete.

https://www.newyorkfed.org/markets/soma/sysopen_accholdings.html#export-builder

Yes. The fluctuation seems to occur monthly with the agency MBS holdings total. It will be reversed.

The only other explanation is that this fluctuation occurs with the monthly receipt and remittance of interest on their holdings. It will be reversed by the end of the month.

I’ve seen this in the past. It seems to be what they’re doing is injecting liquidity within the framework of a stable balance sheet. All of the parties know when it will occur each month and when the funds have to be returned to the Fed.

Option 7 — Fed is waiting for a budget & tax bill to “congeal” before commencing with QT , to me sounds more likely

The Fed like everyone else thought there would be more progress here by now.(?)

Conversely the FED thought there would be NO progress on the handout’s to the donours.

And is disturbed by the possible fall out from these Handouts to the donours, by the P 45 team.

The Fed s trapped in it`s Fraudster`s Utopia; Zero Interest Rates and Money Printing. Central Banks in the US and Europe are Feeding their Systemically Catastrophic Banks with Free Money and pumping their Stock Market Balloons with Monopoly Printed Paper. They are terrified of even minute increases in the Interest Rates because of Squeals from the Wall Street Pigs.

The real reason…I Suspect.

November Fed meeting has no conference call so no one will be able to call them out on stalling.

December meeting is Yellen’s last so she’ll be able to bumble thru it and use double-speak to dodge any questions.

Comes down to, it’ll be somebody else’s problem. From day one Yellen’s phoned-in the the Fed chair position so why on earth would she ever start doing her job right before leaving. She got that job by claiming (falsely) that she warned of the ’08 Financial Crisis, and now she’ll be claiming (falsely) that she wrapped up the ‘recovery’ by initiating unwind of the stimulus.

– There’s one factor that will help the FED to reduce the size of their balance sheet. Houston and Florida were hit by 2 hurricanes. I assume that will reduce the size of the FED’s balance as well.

– Perhaps the FED needs to re-arrange the maturities of the T-bonds they’re holding.

Even if they are doing this, rates will still rise. There is way more pressure in favor of rate hikes that against. All of companies who make money lending money want more profits and investors want to earn more. The only real loses are companies operating with red numbers like retail and most Unicorns.

Sure, company hollowers may cry because it means the companies they are hollowing go under faster than usual but they don’t have the presure over the FED the big wigs do.

The age of cheap credit is ending boys, time to pay!

And the Eurozone? Well that’s a big mess I wouldn’t touch with a three mile pole. Unless most European countries ditch the Euro currency and go back to have their own currency that they can print and devaluate at gusto, I don’t see a exit.

The thing “project Eurozone” missed was that the US dollar is always losing value in the long term, unless they can do the same with the Euro they are screwed.

Fed Total Securities Held 9/3/08 = $745,594,000

Fed Total Securities Held 11/12/08 = $984,903,000

The total only grew $239,309,000 in that 10 week period.

Also, the total back then included Repos and Term Auction Credits which are now zero as stated on the 10/19/17 H.4.1 report.

$1.3 Trillion Fed Total Securities Held did not occur until 4/22/10

This can be verified in data history of Fed H.4.1 report put out weekly by the Fed.

But I still agree that for the month of October the Fed, so far, has increased the Total Securities Held by $11,902,000. I have been charting the data since Q4 1999. Can send you the chart if you like

You’re leaving out some of the key line items, as you also mentioned. By Nov 12, balance sheet assets totaled $2.25 trillion, also including these items:

Term auction credit = $415.3 billion (up from $150 billion in Sept)

Other loans = $316.6 billion (up from $121 billion)

Net portfolio holdings of Commercial Paper = $257.3 billion (up from $29 billion in Sept)

Other Federal Reserve assets = $613.4 billion (up from $100 billion in Sept)

I double checked the H.4.1 report data there is actually a -$6,750,000 difference in the Total Securities Held between 9/29/17 report and the 10/19/17 report

As the first chart shows.

Ever since the fed announced the reduction of their assets I’ve been warning people that they will do the same thing they did for about 80 months after they started QE which is to promise to raise rates. Month after month we had been promised that they would raise rates, but every month we were lied to. Now that failed to reduce in October they will now announce that they will start reducing their balance sheet in November and then they will promise to do it in December and then January, February, March, April and so on and so on! And we the sheep will fall for it month after month.

People may have missed the following: Two days ago, Janet Yellen gave a speech that warns that the likelihood QE and ZIRP will be employed again is “uncomfortably high”. Also she warns that

“the neutral level of short-term interest rates is significantly lower than it was in previous decades,”

WOW. Just WOW. Is there no limit to what these criminals will do?

https://www.federalreserve.gov/newsevents/speech/yellen20171020a.htm

Conclusion

Let me conclude with a brief summary. As a result of the Great Recession, the Federal Reserve has confronted two key challenges over the past several years: One, the FOMC had to provide additional policy accommodation after short-term interest rates reached their effective lower bound; and two, subsequently, as we made progress toward the achievement of our mandate, we had to start scaling back that accommodation in the presence of a vastly expanded Federal Reserve balance sheet.

Today I highlighted two points about the FOMC’s experience with those challenges. First, the monetary policy tools that the Federal Reserve deployed in the immediate aftermath of the crisis–explicit forward rate guidance, large-scale asset purchases, and the payment of interest on excess reserves–have helped us overcome these challenges.

Second, in light of evidence suggesting that the neutral level of short-term interest rates is significantly lower than it was in previous decades, the likelihood that future monetary policymakers will have to confront those two challenges again is uncomfortably high. For this reason, we must keep our unconventional policy tools ready to be deployed again should short-term interest rates return to their effective lower bound.

I don’t think Yellen referred to QE with her “uncomfortably high” comment, just near-zero interest rates (which is bad enough). She was referring to (as per your quote) “neutral level of short-term interest rates.” Here is the whole quote:

“Consequently, the probability that short-term interest rates may need to be reduced to their effective lower bound at some point is uncomfortably high, even in the absence of a major financial and economic crisis.”

My sense is that she would want to reserve QE for a major financial-crisis-type event, not a run-of-the-mill recession. But also, her voice as Fed chair may be largely irrelevant since she might not be reappointed.

“My sense is that she would want to reserve QE for a major financial-crisis-type event, not a run-of-the-mill recession.”

=======

MY sense is that whomever the next fed chairman is, he or she will have no other choice than to “roll the presses” for all of the US’s upcoming, vitally-necessary wars of USD-hegemony-enforcement.

What’s interesting to speculate about is whether or not the US’s foreign mercenaries will continue to accept as payment the Fed’s printed-out-of-thin-air USD to do the US’s very dirty work, or will it take something more real for the US’s future wars — gold for example.

If foreign mercenaries suddenly become unwilling to die for the Fed’s USDs, unless the US has the wherewithall to pay the new price, I guess young Americans are going to be the ones that will be called upon (paid or drafted) by their government to continue to bomb and battle the people of recalcitrant nations into “freedom”, “democracy” and, most importantly, a newfound willingness to accept USD as payment for their nations’ real products and natural resources.

Now it’s the ECB’s turn to dissemble about a mythical tapering of QE.

Once again, with feeling: there’s no such thing as tapering a Ponzi. Draghi, Yellen, et al will keep finding ways to inflate their stock and asset bubbles until they implode under the weight of their own fraud and fictitious valuations.

http://www.zerohedge.com/news/2017-10-23/key-events-coming-week-ecb-taper-q3-gdp-and-durables

Per my understanding, Fed would not do anything to crash the stock market or anything that’d would have bad effect on economy in the short run.

Although Fed has a time table to unwind QE I am pretty sure the moment they feel it has an adverse impact on stock market or assets, they’d stop it and may even do QE.

There is this thing on television from General Electric about Mollie and the garbage invention for taking out the trash that made her a software engineer. The Fed wants that for every girl and boy! The new mortgages make the bad mortgages look less bad when the Fed finally stops buying .GOV paper? Welcome to the barrier comrades!

The big secret:

The Fed does not control its balance sheet, the banks with excess reserve assets parked at the Fed, control the Fed’s balance sheet.