Why do they risk so much for so little?

Apple is doing it, everyone is doing it: US companies are issuing record amounts of bonds denominated in euros. On Thursday, Apple announced in an SEC filing that it would issue €2.5 billion in euro bonds, the proceeds of which will be used to fund share buybacks and dividends to be paid in dollars. These bonds will come in two tranches: €1.25 billion of 8-year notes and €1.25 billion of 12-year notes, with coupon payments of 0.875% and 1.375% respectively.

Yields are not yet established since the bonds have not been priced yet. But they will likely not be far off from the coupon. And they won’t even compensate investors for the loss of purchasing power based on the current rates of inflation: 2.2% in the US and 1.9% in the Eurozone.

Yet, demand is hefty in yield-starved euro land, where the ECB has imposed its negative interest rate policy (NIRP) on investors and is buying €60 billion a month in all kinds of paper assets: Underwriters have received over $5 billion in orders for those Apple notes.

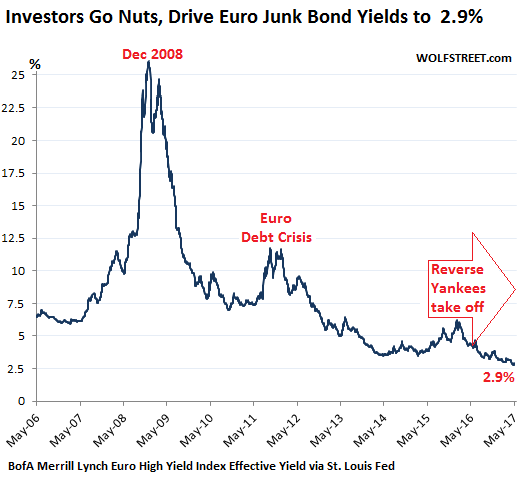

Issuance of these “reverse Yankee” bonds – euro-denominated bonds issued by US companies – has surged because the cost of borrowing in the Eurozone has plunged to ludicrously low levels. Even for the riskiest non-investment-grade corporate debt – called junk bonds, for good reason – the average yield is currently 2.9%. This chart of the BofA Merrill Lynch Euro High Yield Index (data via FRED, St. Louis Fed) shows this Eurozone absurdity:

With the inflation rate in the Eurozone at 1.9%, investors accept a “real” yield of on average 1%, in return for lending their money to junk-rated companies that have an appreciable risk of default with subsequent hefty losses for those investors.

By comparison, what is considered the most liquid and safe paper, the 10-year US Treasury note, trades at a yield of 2.24%. The yield of the US high-yield bond index – a basket of junk bonds that is roughly equivalent to the euro junk-bond index above – is 5.7%. Riskier CCC-rated junk bonds trade at an average yield of 10.1%.

These yields in the US are extraordinarily low too. But they’re multiples higher than the yields of equivalent debt in the Eurozone. For US companies, this is as close to free money as they can get.

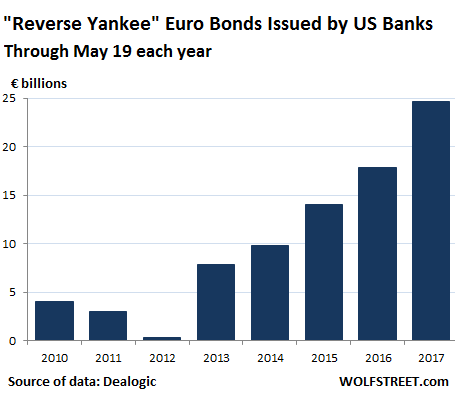

In 2015, after the ECB had announced its QE and other measures, issuance of reverse Yankee bonds soared 46% from 2014. And this trend has continued. With the Fed now in the mood of raising its target rate and unwinding QE, 2017 looks like another record year for reverse Yankee bonds. According to Dealogic, issuance year-to-date has reached €57.4 billion.

Dealogic cites additional reasons: “The reverse Yankee market is also primed for further growth, amid currency volatility and rumored changes to US tax law, specifically the end of tax deductibility for interest expenses on debt.”

The two main components of that €57.4 billion are nonfinancial US corporations and US megabanks.

US corporations have issued €32.6 billion so far this year. This includes the recent €8 billion “megadeal” by GE but it does not include the Apple deal which hasn’t been completed.

US megabanks have jumped with both feet into this cheap money: Issuance of reverse Yankee bonds has soared to a record €24.7 billion so far this year. According to Dealogic, “The heavy issuance comes as banks raise debt to satisfy the total loss-absorbing capacity (TLAC) requirement and to boost their net stable funding ratios.”

This chart shows that surge, with issuance up 150% year-to-date from the same period in 2014:

In 2017, the bank deals include:

- Bank of America: €4.5 billion

- Morgan Stanley: €3.5 billion

- Goldman Sachs with two issues, €2.3 billion and €2.0 billion

- Wells Fargo with two issues, €2.0 billion and €1.5 billion

The winners in this ECB-designed game are US companies. And the losers? Euro investors. In theory, they could just say no. In practice, many can’t. They’re forced buyers. Institutional investors, such as bond funds and life insurers, are obligated to buy euro bonds. They’re facing the relentless bid from the ECB, whose objective is to overpay to drive down yields, not to make money. Everyone else is in the same boat, whether they want to or not.

But ultimately, the forced buyers don’t care. As long as they follow the market, they’re fine. They’re getting paid to play with other people’s money. And these other people who have their nest eggs tied up in these things can’t really complain because the interest they get at the bank is even worse – and in some cases negative.

For now, as yields fall, bonds issued in prior years show capital gains on paper. It soothes a lot of nerves. But as bonds get closer to maturity, their value falls toward face value regardless of what the ECB does, and these capital gains turn into fondly-remembered optical illusions replaced by capital losses.

It’s associated with a recession. The last time was the Financial Crisis. Read… Oops, this Wasn’t Supposed to Occur in a Rosy Credit Scenario

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

So there is so much money sloshing around in the top echelons of finance that losing less is the current game. No real possibilities of actually making a profit, just losing less. What an insane world!

I get why it’s happening, but I still don’t get it.

I saved money, lived within my means and worked hard while my neighbour took huge loans , paid 1 million for a house I thought its market value was only 400k.

When he went bankrupt, the unelected FED bureaucrats printed trillions to buy those worthless mortgages at face value while denying me the chance to buy it at market value.

How I am supposed to compete against the FED. I work hard for my money, they just print it. The game is rigged. It aint free market economy as we have been told. I am still renting.

Will the central bankers own the world eventually given their unlimited power to print fiat without any accountability? What is the end game?

Serfdom is the end game. Congress seems content. Voters are unconcerned.

They will all be aware of the end game when the concentration camps are full.

Cities are consumer concentration camps, without fences, that are pretty full these days.

This ^^

– The end-game is rising US interest rates.

Yup, inflation.

– Yep, the usual mistake people make.

– Falling interest rates is (credit) inflationary, rising interest rates are extremely (credit) DEFLATIONARY.

– Interest rates DO NOT respond to “inflation”. Take the timeframe from early january 2007 to mid 2008. In that timeframe the 10 year yield went down from say 5.25% down to say 4.5%. The 3 month T-bill rate went down from 5.25% down to say 2%. And that IN SPITE of RISING oil prices (to $ 145 in mid 2008). If interest rates would respond to “inflation” then rates should have risen in that same timeframe. They didn’t.

Can’t wait. Maybe it’ll finally reward saving!

“Will the central bankers own the world eventually given their unlimited power to print fiat without any accountability?”

Yes.

It’s not as if it’s a secret.

Read “When Money Dies” by Adam Fergusson to see what the end game is going to look like.

Spoiler alert: the Weimar Republic and what came after offers a preview of coming attractions.

We won’t have honest markets or sound money until the private banking cartel known as the Federal Reserve has been shut down and Greenspan, Bernanke, and Yellen are standing in orange jumpsuits and shackles in front of an honest judge, charged with counterfeiting and racketeering.

To be fair, the Weimar Republic in 1921 bears no economic resemblance to the US in 2017.

Hyperinflation in the Weimar Republic was the result of losing WW1, where they borrowed massive amounts of money to pay for the war… and then lost. On top of their debts, they were then required to pay enormous reparations in hard currency. And lest we forget, 50% of their 13 million soldiers were wounded, killed, taken prisoner, or MIA (plus the general disruption a global war brings to an economy).

We’re not even in the same conversation as the Weimar Republic, economically. Politically, maybe…

Get a clue, Smingles. The Weimar Republic tried to print away its debts and obligations. The Federal Reserve will do the same, with exactly the same outcome: hyperinflation and collapse. The Keynesian fraudsters at the Fed have already propelled us far down that road by creating trillions in funny money FedBux out of thin air. Next will be the rise of false messiahs offering hope, dignity, and simple solutions to the seething masses, followed by war and misery for millions.

We’ve seen this movie before, and know how it ends.

Gershon

Get a clue, Gershon. Smingles more or less has this nailed.

Could your apocalyptic view come true? Sure, just like almost any other possible outcome, there is some tiny statistical probability.

To call current events the catastrophic “the sky is falling! We’re all gonna die!” end-of-world-view is not really credible.

Gershon: “[…]Keynesian fraudsters at the Fed […]”

I share your antipathy for the Fed, but for chrissakes, learn the difference between Keynesian (fiscal) and Friedmanian (monetary) policies. Your are conflating two very different policies. In doing so, you do the elite banskters are very big favor, because you misdirect attention from the real problem and away from the real solution.

I saved money, lived within my means and worked hard while my neighbour took huge loans , paid 1 million for a house I thought its market value was only 400k.

The Federal Reserve has since 2008 engaged in financial warfare against the savers and the responsible.

I wonder what it will take to get people to realize that central banking has failed.

It’s amazing to me that the lesson of the Soviet Union “free markets are better at pricing assets than a centralized authority” some how does not apply to money in the so called capitalist world. You think the cental bank can price money through interest rates correctly? With negative interest rates they are telling me 100 usd is worth more 1 year from now than it is today, turning basic time value of money on its head. Ask any intelligent human if they prefer 100 dollars now or 100 dollars a year from now. According to ECB and the bank of Japan they prefer the later. Ridiculous….

But you can’t get money or loans from a central bank. Only registered banks can.

And the banks then compete in a free market for your business. Go to your bank and see what their rates are. They aren’t 0% or negative. Some folks are still paying 30% on their credit cards.

What will it take?

It might take a generation for the current economic academics to die off. Was just thinking about this as a parallel – plate tectonics and continental drift was considered heresy for the first part of the 20th century, and Alfred Wegener was considered a quack.

Now, there are decades of research and data to support these ideas, and it’s totally accepted as fact. As relating to the financial front, since this is a financial blog… it has led to huge improvements in the search for new oil/gas fields and ore bodies, now that geologists have a roadmap of where to look. Kids have been taught this in school for decades so at least the scientifically minded understand the concepts. (I am just old enough to remember when continental drift was taught as a somewhat controversial theory in public schools)

However my understanding is that it basically took most of the old tenured earth science academics to die off [who were solidly against Wegener’s quack ideas] before there were enough new academics with an open mind to conduct the research and collect data to support the new theories and change people’s minds. I think this has been a recurring problem for many revolutionary ideas in science-if you introduce an idea that obsoletes 95% of the lifes work of the people in charge, you’re going to get life-long resistance against the new idea.

And, I think that’s where we are with Keynesian economics and interventionist policies. The real problem is Keynesian economic theory and how it’s ensconced in academia, Wall Street, the media, and the public…. we’re starting to see people [including academics at the Fed, IMF, and ECB] wake up but it may take another 30 years before enough new decision makers can come in and make a change.

Keynes didn’t have much to say about central banking. He was far more interested in fiscal policy than monetary policy. I think you are thinking more of Milton Friedman who is really the father of modern central banking.

Keynes wasn’t interested in monetary policy?

His whole theory is about about monetary policy- redefining the nature of money.

Up until Keynes, central banks believed their currencies had to be redeemable for gold. This is why as the Depression deepened, the US government and others cut spending to balance their budgets making it worse.

The idea that a central bank could create money is a Keynesian idea.

As far as I’ve read ( undergrad econ 101) he was little interested fiscal policy, or how governments spent money, e.g. housing or highways etc.

Nick Kelly: “As far as I’ve read ( undergrad econ 101) ”

You and every other undergrad know-it-all who’s taken Econ 1 thinks he/she knows everything about economics. I tool a biology class; can I perform heart surgery on you?

Mike: “The real problem is Keynesian economic theory and how it’s ensconced in academia, Wall Street, the media, and the public”

Following the 70s recession, Friedman’s “Chicago School” achieved academic hegemony in the late 70s/early 80s, and Keynes was banished. Keynes is taught practically nowhere, and there are no Keynesians in any prominent govt or quasi-govt office.

It’s a good thing for Gershon, Nick, and Mike that ignorance isn’t painful.

I don’t know all about economics but I do know the first thing about Keynes which is that he was a monetary reformer.

Friedman’s famous summary about inflation: ‘Inflation always has monetary cause’ is about the widespread abuse of Keynes theory that the government should run deficits in recessions.

Keynes believed in balanced budgets, but balanced over the economic cycle, not a year end.

So after running a deficit in the recession, it would run a SURPLUS after the recovery.

But politicians, especially left wing ones, hijacked Keynes and ran deficits for decades.

Friedman successfully turned around Chile by ending money printing and inflation.

Today no central bank has a gold backed currency- Switzerland was the last. Before Keynes they all did, or tried to.

Today all central banks operate on Keynesian principles; they add or remove liquidity as necessary but as usual, they are more likely to add. Keynes would be horrified at the size of government debt.

Now go have that third beer.

Since Glass-Steagall was taken down a blind alley and strangled, the criminally insane have control of the keys to the insane asylum.

Remember, another name for bond is debt. One and the same.

Another level of insanity:

PIK Bonds.

They allow interest payment deferrals.

They allow coupon payments to made with payment-in-kind (PIK) which means issuing more bonds to coupon holders as payment!

PIK Toggle Bond issuance amounts to $125.5 billion in the past 2 years.

– Yeah, sure. Blame it on the central banks again right ? I blame a force called “Mr. Market”.

– There’s a REASON why yields in Europe are lower than in the US. The US is running a Current Account Deficit and the “reward” for that is higher interest rates. Whereas the Euro-zone is running a Current Account Surplus. And that’s why the Euro zone interest rates are lower than in the US.

– And these “Reverse Yankees” is the reason why I expect the Euro to go higher against the USD. Not lower, like every man and his dog is expecting. And then these companies could be in for a rude awakening.

I think you missed the memo. Mr. Market died a horrible death long ago.

If there was any Mr. Market around, then you wouldn’t have some little old dirty shack in huge countries like Canada and Australia for over a million.

If there was any Mr. Market, Tesla which made less than 80K cars in 2016 would not be worth more than Ford and GM.

What a crock, Mr. Market.

The price of tesla is not rigged in any way that I know of. The market price is not explainable in normal terms of PE, but it is the market price. A very fair open market of stocks that anyone can buy and sell without barriers to entry.

Mr. Market (as you call it) may be irrational, but alive and kicking on tesla. the market price may be higher than you think reasonable, but the last person to buy did not think so…

Well, not that Tesla is unique in this, but Mr Market is not allowed to function against Musk too much. Plenty of gov subsidies are keep Mr M. At bay.

http://www.latimes.com/business/la-fi-hy-musk-subsidies-20150531-story.html

Oh really ? So a company that loses an average of $1 million a month despite multiple federal subsidies , federally funded and subsidized loans , tax credits , profits from carbon credits , tax payer funded buyer incentives and tax credits stock prices should be increasing in some far off reality ?

Suffice it to say the market place as deluded as it is still hasn’t become that stupid . Which is to say … ‘ rigged ‘ .. is an understatement .. more like a con far too many on the inside are completely aware of I might add

doug

Well I agree there is a Mr. Market, for right now and for quite some time he has been on his death bed. Whether he survives is an unknown.

Too much money in too few hands is what sets pricing in the stock market. The big players can create momentum and the little guys can ride the wave until it crashes.

As corporations buy back and cancel more and more shares and as Central banks buy debt, at some point Capitalism will have chrysalis moment when we wake up and find a small group of people own absolutely everything. And Karl Marx was right.

– Mr. Market is still “alive & kicking”. If Mr. Market was dead then why did real estate prices in Silicon Valley go through the roof and remained flat in the US state of West Virginia ? In spite of all the Quantitative Easing the FED has done after 2008 ?

– Blame the psychology of “rising prices”

– Did you know that in the state of Western Australia (Australia is like the US a federation) high end real estate in metropolitan Perth already lost some 30% of its value in the last few year(s) ?

Watch this video (from the australian website MACROBUSINESS):

https://www.macrobusiness.com.au/2017/04/abc-wa-economicproperty-bust/

or

https://jugglingdynamite.com/2017/04/27/west-australia-a-cautionary-tale-for-canada-and-beyond/

The CEO of Ford got canned today because the Ford stock price and market cap wasn’t keeping up with Tesla.

That’s putting it mildly. The stock lost almost 50% of its value while Tesla almost doubled.

Smingles,

I got my butt kicked here, a while back, for saying my mad money long term bet was on anything Musk was doing. I’m doubling down after seeing his solar roofs.

No need to repeat the beating!

Those roofs and the controllers that go with them. have the potential to be a huge revenue stream. In New Builds.

I would not be surprised to see him getting involved in Home construction indirectly. To increase sales of the tiles and controller’s.

Converting a housing development to solar grid tie is expensive.

Scratch building one, is not much more expensive than conventional.

“If there was any Mr. Market around, then you wouldn’t have some little old dirty shack in huge countries like Canada and Australia for over a million.”

Bubbles are a part of human psychology. Bubbles existed long before central banks. If someone owns a closet in San Francisco and puts a $10m price tag on it, and someone else agrees to pay that price and makes a purchase… by definition, that is a market. The price is the price. Willing buyers and sellers make a market.

There is only one free market, and it exists only in anarchy, so arguing about subsidies, Central Bank intervention, etc. etc. etc. is a futile exercise going down the rabbit hole. There are a million different things explicit and implicit that make our markets not ‘free’ but yet they are still markets.

“If there was any Mr. Market, Tesla which made less than 80K cars in 2016 would not be worth more than Ford and GM.”

No. Equity is simply a long term interest in a company’s future cash flows. How Tesla did in 2016 does not necessarily indicate how it should be priced relative to other companies. If, hypothetically, Tesla becomes this wild success story in the future, by the time this happens it will have reached a more full valuation and your prospects for capital gain are diminished. That’s the risk people are willing to take, by purchasing shares… in… a… market.

R2D2

There was no “Mr Market is dead” memo. Mr Market simply prices in what ever currency is available – US$, dead chickens, gold, etc – governments and bureaucrats (not Mr Market) determine how long to run the printing presses.

There is no such thing as THE RIGHT PRICE OF A WIDGET, the price is just whatever people will pay for it at the moment.

Value is a human emotion: all Mr Market really does is aggregate & translate the emotions of millions of independent buyers & sellers into whatever currency you happen to be interested in. If people are crazy optimistic (aka: Uber), so is the price; if they are blind to opportunity (aka AMZN 20 years ago), they will miss opportunities.

What “Mr. Market?” The one where the ECB is the biggest player, using its freshly created money to become the biggest single buyer of financial assets, and the one where the ECB has pushed its deposit rate below zero? That “Mr Market?” You’re kidding, right?

I look at it a different way. The ECB’s policies drive up all Euro-denominated assets (and to some extent everyone else’s as Europeans reach for yield). That makes it more difficult for those with less money to buy assets.

So Mr. Market exists, but with fewer players and those left will be on the higher end. Hence a big chunk of wealth inequality as assets get concentrated into fewer hands.

But, other than selected bonds, the ECB is letting Mr. Market decide where the money goes.

“the ECB is letting Mr. Market decide where the money goes.”

Only the anointed get the money, everyone else pays the bills. Central banks borrow on your future earnings.

Take away the government enforced mandate of Central Banks (the credit creation/ currency creation monopoly) and what them collapse into oblivion in the blink of an eye.

Agreed. Mr. Market is, if anything, a puppet on a string.

Even before Adam Smith, observers have pointed out that commercial markets are either regulated or are dominated by their most powerful players. Either way they are not free, and never can be. Even in regulated markets, such players militate to put themselves into a position where they can avoid, manipulate, or write the regulations, and maliciously promote the lie that markets can be “free”.

It is amazing to read all the responses of people who insinuate that real markets exist. The inference of course is that there is at least a small amount of logical and fair play involved.

I liken it to a baseball game where you hit a homerun, and arrive at home plate. The catcher somehow has a ball in his mitt, and you are called “out”. You look at the umpires and they say “well, we need to have a ball on the field at all times, so there is that”. Everyone walks off the field and the game is over.

Apple has nearly all the world’s cash, why are they raising debt to buy their own shares and pay dividends? Surely this breaches good corporate governance?

Because they can earn higher interest on their cash than they pay on their debt. And they’re buying their own shares because it causes their share prices to rise (hopefully). That’s good corporate governance from a shareholder’s perspective.

” And they’re buying their own shares because it causes their share prices to rise (hopefully). That’s good corporate governance from a shareholder’s perspective.”

As long as they don’t start dioing what HP did, with its buy program.

After decades of buy backs. There were more HP shares in the market than before.

As they recycled the brought back shares to executive remunerative program’s. Then back into the market to be brought from the executives that received them at high inflated prices, each time. Also instead of dividends, there were frequent bonus issues of shares, always when Executives were holding large volumes of Remunerative shares.

Buy back programs are not always run to benefit. Shareholders.

So what is the long game in buying back your own shares? Eventually there is only one shareholder left? Or does a corporation exist where all it’s public shares have been bought up and cancelled, leaving management reporting to nobody.

“leaving management reporting to nobody.”

Management or management and small group buy back all shares except their’s then they own it all.

Many American unit hive offs have effectively done this with the profitable parts of some entities.

One of the big retailers (Sears I think) staggering to wards bankruptcy sold off all its property and is waiting out the 2 year and a bit. period before filing chapter 11.

There effectively the shareholders get the debts and the selected Executives get the property a variation on the simple buy back deal.

D

Corporate bonds are issued in different classes reflecting their bankruptcy repayment priority (i.e.: bond seniority). Additionally, selected debt (final employee payroll, bankruptcy lawyers & advisors) is also prioritized for repayment.

In bankruptcy, bondholders usually get significantly reduced repayment & most of the new stock (the exact mechanism is usually to trade debt for new stock). Common shareholders may be 100% wiped out or may receive a token amount of the new stock (to inspire them to continue to invest in the company).

In liquidation, there is no new stock, debtors split the proceeds from liquidation. Common shareholders are 100% wiped out.

Under either bankruptcy or liquidation, common shareholders have no responsible for any remaining debt.

Once bankruptcy is declared, this process is controlled (or at least monitored) by the US Bankruptcy courts, not the corporate executives.

Company executives (interestingly, in Sears case, the CEO owns a lot of Sears debt) do not “just get the company” (unless they own the debt).

Debt is a “tax shield”. Not to issue new debt would be foolish and just lead to a higher tax burden.

Kf6vci

Statements like yours are why you’ll not soon be considered as a corporate executive or CFO.

Interest on debt is (currently) deductible only to the extent the corporation makes a profit (for example: neither Uber or Snap qualify).

Even with a profit and paying the highest US corporate marginal rate (I think 35%), only $35 of every $100 of interest is “shielded”. Paying $100 to “shield” $35 is simply stupid.

The only two reasons for debt are:

1) The corporation can invest the borrowed cash at higher return than it pays for the debt (tax deductible interest reduces, but never eliminates, this cost).

2) Debt is generally less expensive than issuing new equity (e.g.: stocks).

There are other plays in this

1 for Apple there is the possibility the Euro implodes and the issued bonds become effectively worthless. In effect free capital. After they have invested it in, something Not euro Denominated. (Apple is quietly becoming an investment and Bond Trader)

2 Apple cans save its euro denominated profits to pay the coupons and pay down any of the Euro Debt it dosent roll. So reducing its Forex issues/costs further.

For the Buyers in Euroland who have over subscribed the issue by over 100 %.

1 They get then ability. To put their money into something with a lot more stability than the average Euro Bank. With a much higher chance of getting it all back.

2 They get to posses a bond, others will want to own, if they need to liquidate it.

Borrowing in another currency to save interest is really a currency speculation that very often turns out to be disastrous. Think Mexico, or Argentina, or countless others who took out loans in dollars, or East Europeans who took out mortgages in Swiss Francs – to ‘save interest expense’.

What Apple and others are really doing is betting against the Euro with the value of the dollar somewhere near all-time highs. I suppose if they actually have Euro denominated deposits of earnings to offset the bond liability, it’s a wash – paper for paper. If there’s a worldwide implosion of all inflation-based currencies then it’s also a wash as long as they gain their value in relative terms, but that’s an unlikely scenario. More likely is a universal debt holiday, or forgiveness, and everyone starts from zero.

All the bonds of course end up no-bid, and the value of all the derivatives end up at zero with no solvent counterparties – the only value of insurance is in the ability of the insurer to pay.

Even so-called gold-backed securities/bonds is not a protection – the US defaulted on them in the ’30s when they devalued the dollar relative to gold, made gold illegal, then paid in devalued fiat dollars at face value, plus interest. Corporate gold-backed securities, same story.

“Borrowing in another currency to save interest is really a currency speculation that very often turns out to be disastrous. Think Mexico, or Argentina, or countless others who took out loans in dollars, or East Europeans who took out mortgages in Swiss Francs – to ‘save interest expense’.”

This does not apply to apple as Apple has an income, in that currency.

It is also possible the the Euros apple gets will be invested in Euro land or in Euros somewhere.

The revenue from the trial which was Yen issuance, stayed in Yen. Agin Apple has a yen income, to cover the overheads and has almost made enough profit in Japan on its operations to buy pack the Bond’s in Japan.

So now they have FREE other Japanese assets, on their offshore book’s.

As I wrote elsewhere, These-days Apple is not Just a tech company.

\

What would be nice to know, is what Apple brought. Apple is on its way to join Blackstone, in owning a measurable % of global wealth.

Blackstone currently owns over 1 % of all GLOBAL Equities.

At what point do these global entities, when they make request of countries they can afford to buy and sell. Become “to big to deny”?.

It’s an expression of political support for the Euro zone, as well as, currency speculation. The Euro zone is slowly imploding and increasing demand for their bonds is a show of public support. I don’t think any of the trades that matter are doing it for the money, more likely it is pay to play politics.

“It’s an expression of political support for the Euro zone, as well as, currency speculation.”

I figure that Apple is hedging the Euro and waiting for it to crash – NOT in any way supporting it or the EU overall…

“The Euro zone is slowly imploding and increasing demand for their bonds is a show of public support.”

Not hardly a show of support for the EU. More like betting on a crash in value of the Euro and paying back in pennies on the dollar…

“I don’t think any of the trades that matter are doing it for the money, more likely it is pay to play politics.”

SOME may be playing politics but I think most are wolves wating for the kill. The ones that are playing politics can win a little if the Euro survives – and make BIG MONEY if it dies…. Best of both worlds for them?

Just my thoughts about the whole EU mess…

robt

You said: “…More likely is a universal debt holiday, or forgiveness, and everyone starts from zero….”.

That has never happened (including during the USA great depression), and will never happen. Unrealistic “solutions” is how we got into this hole, and digging deeper with even worse “unrealistic solutions” won’t get us out of the hole.

What you’re missing is, while the USA has more debt than it should, the USA represents 5% of world population, but 35% of global economy. Our GDP is still growing faster than most other developed nations, still manufactures things the world wants, is the largest exporter of food, has services (educational, financial, engineering, etc) the world wants, has he world’s most stable reserve currency, and one of best educated, most productive and most mobile workforces. Oh yea, we also have a military who can & does actually protect, as opposed to just killing its own citizens (i.e.: China, Venezuela, Philippines., Cuba, Argentina, Turkey, Syria, Egypt, ad nauseam).

All these things aggregate to financial power. Politicians and

central banks are certainly frittering away some of this strength pretending to give people things they really cannot afford (health care, school loans, social security). It’s called “getting re-elected”.

If it spent every last cent it had, the European Union’s 510 million people may (it’s not certain) be able to afford forgiving all Greece’s (pop: 11 million) debts, but there would be absolutely no resources left for Italy, Spain, etc, etc.

So we have a financial problem; you don’t just light up a bong, sit in the hot tub, hug and sing Kumbaya before you give everybody a debt holiday.

correction: USA is $18T of $78T global GDP, or 23% (not 35%)

According to Dealogic, “The heavy issuance comes as banks raise debt to satisfy the total loss-absorbing capacity (TLAC) requirement and to boost their net stable funding ratios.”

Pardon me for stating the obvious, but taking on more debt does not improve TLAC for a bank. It *may* temporarily do so, I suppose. Capacity to absorb loss is from CAPITAL, not DEBT.

Just one phrase: CoCo bonds … contingent convertible bonds designed to be bailed in. And similar types of bonds.

“The Euro zone is slowly imploding and increasing demand for their bonds is a show of public support.”

For the globalists to have a free hand to carry out their swindles against the 99%, they need a dumbed-down and docile electorate that mindlessly votes for the crony capitalist status quo. French voters meekly bent over for them by installing a globalist-bankster water carrier, Macron, as their new leader. But events like the atrocity tonight in Manchester could still awaken millions to the fact that globalism is not all it’s cracked up to be and nationalists are the only defense for sovereign countries and peoples against being turned into bankster looting colonies. Nationalism is the only force that presents a viable bulwark against the schemes and scams of the globalists, and might one day kick to the curb the “former” Goldmanites running the central banks as lucrative rackets for their oligarch pals.

looks like the euro has become the new carry trade currency. However in the case of APPLE these transaction types might not be necessary if US tax code would allow repatriation of foreign profits at a low tax rate and going forward, a globally competitive corporate tax rate . these transactions will also contribute to currency volatility and from what i can surmise will weaken the euro when the funding currency (euros) are sold to purchase stock and pay dividends in dollars .

Euro nominal rates are lower than US nominal rates even if expected inflation rates are similar. Rudi Dornbusch’s old overshooting model may be one simple explanation here. The ECB has engineered a jump devaluation of the Euro with respect to the US$ (with the aid of the FED drifting towards tight money). Of course the rest of the story would be expectations over time of the Euro appreciating. Put this all together with the standard international Fisher effect and the total expected cost of borrowing is the same across currencies.