Better Credit Ratings and Bond Prices Don’t Signal Better Finances

By Bill Bergman, Director of Research, Truth in Accounting, Chicago:

In recent weeks, Chicago municipal bond prices have firmed up a bit. And today, wire services are reporting stories along the lines that signs of progress in pension funding have stabilized the outlook for the city’s credit ratings.

Does this mean that things are heading in the right direction? Not necessarily.

If the financial crisis of 2007-2009 taught us anything, it taught us to be careful of taking market prices at face value. Let alone credit rating agency opinions.

But let’s give the market and the rating agencies the benefit of the doubt, for a moment. What else might these recent developments imply?

What’s good for GM isn’t necessarily what’s good for America, and what is good for the Chicago Teachers Union and Chicago bondholders isn’t necessarily what is good for Chicago.

A better outlook for pension funding doesn’t appear out of nowhere. More money flowing into pensions, and supporting promises to bondholders, is coming from somewhere else.

Is this somewhere taxpayers, and people paying fees to the city of Chicago? How durable will recent developments prove to be? Will they survive the response of taxpayers sensing a greater slice of their flesh being stripped off their bones?

This helps illustrate why we prefer a more holistic view of government finances, at Truth in Accounting. We study pensions in detail, but do not restrict our analysis to “pension funding.” We use that information to develop an overall measure of state and local government fiscal strength.

Myopic focus on pension funding and/or bond credit ratings risks prioritizing those interested parties above the interests of the Average Joe and Jane – taxpayers and citizens.

Take a peek at the disturbing charts below. Rapidly rising interest payments aren’t going to students looking for a way to get to school, or to communities trying to improve safety. In many ways, they are paying for sins of the past.

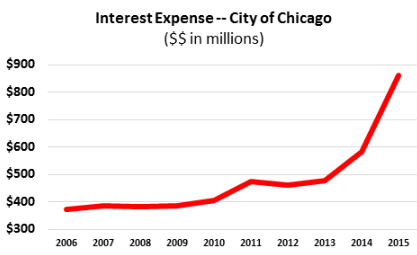

The City of Chicago recently reported an alarming 50% increase in interest expense from 2014 to 2015. Last year, the city spent over $860 million in interest, before spending a dime on any public services.

Here’s a look at what Chicago has reported for interest expense on long-term debt since 2006. Note that interest rates have been declining dramatically over this period:

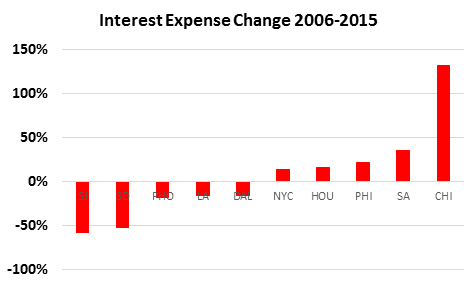

How does Chicago stack up against other cities, on this score? This chart shows the percentage change in interest expense over the last 10 years for the 10 largest cities in the nation:

From lowest to highest change in interest expense, these cities are (from left to right) San Jose, San Diego, Phoenix, Los Angeles, Dallas, New York City, Houston, Philadelphia, San Antonio, and Chicago.

There are times when organizations may find it beneficial to borrow significant amounts of money, given their growth opportunities. This does not appear to be one of them. Chicago has been spending more money than it has been taking in for a number of years, despite claiming to “balance its budget as required by state law.” By Bill Bergman, Director of Research, Truth in Accounting.

Moral Hazard Spreads: Are states too big to fail? Read… Worst “Zombie States” in America “Deteriorate Faster, Further”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Eventually the Fed will be forced to step in and buy the debt and cancel it.

Just like Ben did with the GFC banks. Of course they could declare bankruptcy but that’s a lot messier and is worse for the lenders, bond holders etc.

Are you one of those bondholders hoping to get bailed out by the Fed???

It’s probably a bad idea to hope for a Fed bailout.

The Fed didn’t bail out Puerto Rico, did they?

Whether a bailout happens or not depends on who’s on the hook. We’ve learned this at least if nothing else.

No, I’m just a pensioner [retired architect/builder] with an interest in economics as it really exists. That is, not the mainstream model. The mainstream model which posits the false idea the government gets its funds from the private sector is 100% erroneous. While the conclusions I post here are my own I am well served with a solid foundation in genuine macroeconomics courtesy people like Warren Mosler and Bill Mitchell, Stephanie Kelton etc. You should read them.

>>> “I’m just a pensioner”

So yes, you’re one of those bondholders (via your pension or retirement fund) who wants to get bailed out when the S hits the fan while spreading the costs to everyone else.

Chicago area finances (including pensions) is exhibit #1 why the US FED is being FORCED to raise the discount rate in September. The inflection point has already been reached at which the gain of continuing to drop interest rates for the financial system is MUCH LESS than the need to re-stabilize the financial system itself.

Chicago’s interest payments are on an recognizable exponential rise (even without this year’s legal decisions that there is no effective way to kick the pension payment can down the road) even with dropping rates….signalling the futility of trying to continue the old failed policy.

All the whispers from the FED signal the change in policy is there…..TRIAGE is needed to save what CAN BE SAVED….because clearly there are going to be failures EVEN IF Congress (or various State legislatures) could ever get off its duff to show some fiscal discipline.

Chicago WILL go into bankruptcy proceedings within 2 years (possibly much less)…and pensioners will see their pensions reduced by 50% or more.

Gov’t has been satisfied with tradeoff of lowering rates to push up asset prices because even though its healthcare and pension liabilities are GREATLY WORSENED by the policy, it has been able to create the paper (accounting) illusion that the higher liabilities payments in the future don’t matter (i.e. “gov’t” accepting accounting standards).

Chicago is the canary in the coal mine however since the Illinois constitution makes pension payments rank higher than other spending and the law now requires Chicago to begin paying its fair share….and cash receipts were already getting scarce relative to all the spending. If there were a different way to kick the can down the path (into the future), Chicago would have already been talking about it but the best they have been able to do is suggest amending the state Constitution….a VERY UNLIKELY prospect when voters are understandably angry at the politicians for allowing/encouraging the looting of the system for years.

Valuationguy

What’s a GFC bank?

GFC = Global Financial Crisis. Those banks, The Fed bailed them out without using one cent of taxpayer’s money. If they did that they can bail out Chicago just as easily, in principle anyway. Depends if they want to face the flak from opponents of doing so.

“without using once cent of taxpayer money”…. well not directly the “taxpayer” but they stole it from everyone a little at a time

My family has land in Illinois and I’m betting the crooks in Chicago are going to take a lot of money from Illinois farmers before this is over. Let Chicago declare bankruptcy, and the associated bondholders take their hit for believing in promises that couldn’t be kept. If Illinois splits off from the rest of Chicago in the meanwhile, that would be a bonus. But probably too optimistic.

Yes, Thin air money isn’t free, it is balanced by the resources [savings] used to fund the debt thin air monetises. It has its own accounting identity. See here;

http://carnegieendowment.org/2015/10/19/thin-air-s-money-isn-t-created-out-of-thin-air-pub-61679

Si it can be done, as with the GFC but it has a cost

The interest paid graph clearly shows the effects of compounding or exponential growth that occurs when a debt is “serviced” by borrowing new money to pay off the principle and interest due on the old loans. However the steepness of the rise is surprising, given the ultra low interest rates from 2008. This suggest there is a significant amount of “rent seeking” involved, ultimately to be charged to the taxpayer. FWIW – because of the tax preference/exemption for municipal bond interest payments, it is well to remember that all taxpayers, even those far removed from Chicago, are subsidizing these payments.

Another observation is that clearly Chicago is no longer capable of self-government, and a conservatorship should be imposed ASAP, while there is still something left to conserve, rather than waiting for total collapse. It is to be hoped (but not expected) that all the financial records would be impounded, forensically audited, and the accountable individuals prosecuted [RICO?], with as much of the missing money as possible recovered.

In many ways Chicago (and indeed Illinois) is yet another “failed state” within the United States, with not only municipal white-collar crime out of control, but also the crime in the streets. Martial law, with the imposition of dusk to dawn curfews, limits on alcohol consumption, and preventative detention would seem to be one palliative, albeit temporary/emergency measure, until corrective measures such as employment programs can be implemented.

Yea. That’s not gonna happen.

Best realistic course of action: move out of the great state of Illinois before it metastasizes into a Detroit-like place that grows a lot of corn.

“Eventually the Fed will be forced to step in and buy the debt and cancel it.”

Yes that along with corporate bond purchases would assure our final ascent to Banana Republic .

I am looking forward to the barrage of California taxes on the ballot in November.

Chicago will continue to follow the Detroit model of tax payer flight. That is the smart and mobile ones any way.

Gold star award:

You don’t see “Detroit” an”smart” used in close proximity very often.

Taxpayers have historically accepted higher payment simply b/c they have no idea how corrupt their government is.

Nope. Not buying it.

Chicago/Illinois voters are all adults – and most of them are willing victims.

Chicago has ben corrupt for 100+ years, and, frankly, that seems to suit a lot of people (not to mention JFK, who received his voting majority from Mayor Daley).

Citizens aren’t being conned – they’re part & parcel of the con.

Well not Illinois. Just as with California and New York, the residents outside the one city are saddled with the decisions of that city. I grew up in Illinois and the politics used to fluctuate. Then Chicago democrats got almost full control of the state government. In several gubernatorial elections for example, only 2 counties voted for the Democrat and it was enough for the Democrat to win.

Some people get the government they deserve; some get dragged along for the ride. A guy like my dad who bought farmland in the 50s had no idea how much things would change during the last 25 years of his life.

Be interesting to see who Chicago actually Bill’s, and how much actual gets paid, by whom.

My bet, is the biggest direct and indirect payer in Capone ville, is Uncle Sam.

Chicago, Cook County and CPS need to get on the Draghi bandwagon, print some 100 year or perpetual zero coupon bonds and trade them in for cold hard cash at the ECB window. Jamie and Lloyd will be happy to arrange this, for a fee of course.

Let Chicago bring down the rest of IL. If the “courts” believe that pension promises are so dam important, let the money supporting the courts, elected politicians etc be funded to support these promises.

Bullshit IS bullshit, and the city of Chicago, the state of IL failed to adequately tax their citizens in years past, and now the bill is DUE.

Sure, pensioners will get a haircut, tax payers will get slapped. The money has to come from somewhere, nobody better than the good property owners, and taxpayers of IL. I live in neighboring WI we paid higher taxes for years you will note our state and city workers here are adequately funded. No sympathy for bad actuaries here.

Anyone ever notice the long correlation between democratic mayors in places that are now facing fiscal problems like Chicago, Detroit, Philadelphia, and Newark? Curious isn’t it??

Or Republican governors whose states are now facing fiscal problems, like Illinois, Kansas, New Jersey, Oklahoma….

Fiscal problems are a bi-partisan syndrome.

RE: …Anyone ever notice the long correlation between democratic mayors in places that are now facing fiscal problems like…

—–

IMNSHO the operational word is “long,” and not “Democratic.”

It appears that whenever one political party/machine, Republican or Democrat, is in power for too long, things become increasingly “inefficient.” While this inefficiency is indeed due in many cases to fraud and corruption, a significant amount is due to people learning how to “game the system,” cronyism, and “corner cutting.” For example the selling of municipal bonds using the “negotiated sale” rather than the mandated public auction process. In many cases the “loan package” has become so arcane and convoluted that the public auction is no longer practicable, which is a criticism of the loan package and not the process.

Indeed, in many cases the governmental process has become so esoteric and complex, “gaming the system,” and “corner cutting” have become necessary to get anything done.

Therefore there appears to be a two step solution:

(1) Replace the “ins” with the “outs” preferable with a third party group not affiliated/allied with either major party.

(2) Drastically simplify and systematize the existing governmental structure/operations for “transparency,” possibly including public web read-only access to down-loadable accounting data files, meeting minutes [video on demand?], proposed legislation/regulatory changes, and check registers, as well as eliminating the need for “gaming the system,” and “corner cutting” to get anything done. As a follow-on, criminal and civil action may recover considerable amounts of mis-appropriated funds.