Inescapable consequences.

By Chris Hamilton, Hambone’s Stuff

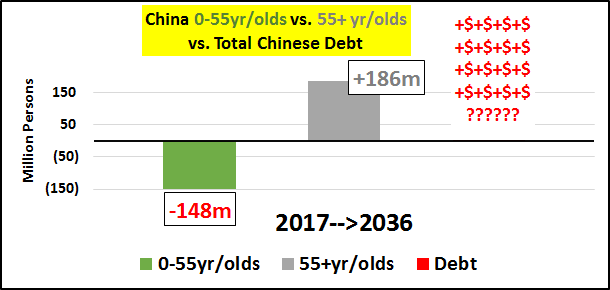

Over the next 2 decades, there will be an average of 7.5 million fewer 0-55yr/old Chinese every year vs. an average annual increase of 9.5 million 55+yr/olds. And the wealthy minority of the elderly have stashed their reserves in a whole lot of expensive, vacant real estate that they intend to pass along (rent or sell) to the declining young population. What could go wrong since housing prices only go up…right!?!

China, a story of a massive population and population growth. As the adult population growth began to wane, debt was substituted for the waning growth. Population growth turned to outright depopulation among the young, while all remaining population growth was among the “pig through the python” elderly.

But as the Chinese gained wealth, (particularly among the wealthy of the tier 1 & tier 2 cities), the wealthy soon to be elderly didn’t trust banks or the stock market. Instead they piled their savings primarily into real estate. The top quintile of Chinese purchased the bulk of the new speculative inventory of high-end housing, typically buying multiple apartments and condos.

The vacancy rate among the housing segment in these cities is supposedly in excess of 20% (compared to a peak of 3% during the US subprime crisis). There are roughly 500 million households in China and best guestimates suggest that there are 50 million or so vacant housing units…or 10% of the national housing stock.

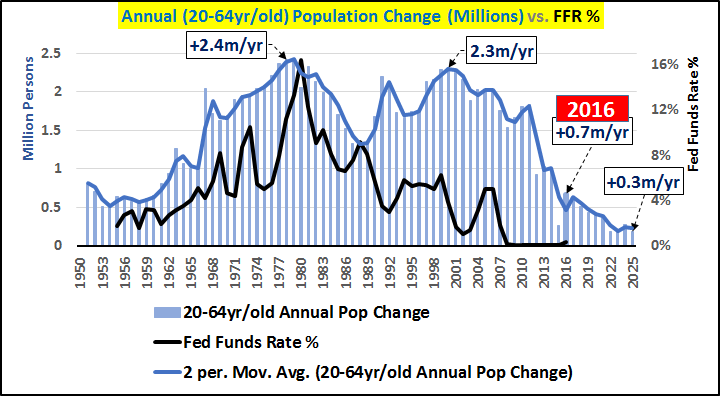

To put this in perspective, I’ll compare it to the US subprime crisis…a crisis that was likewise triggered by the demographic deceleration of population growth. But still, despite decelerating in the US, there was (and still is some growth…see below). The Fed was determined to use (ok, abuse) interest rate cuts as a substitute for decelerating population growth among adults. The chart below outlines the decelerating 20-64yr/old annual population growth through 2025 (this includes all permanent residents…legal or otherwise).

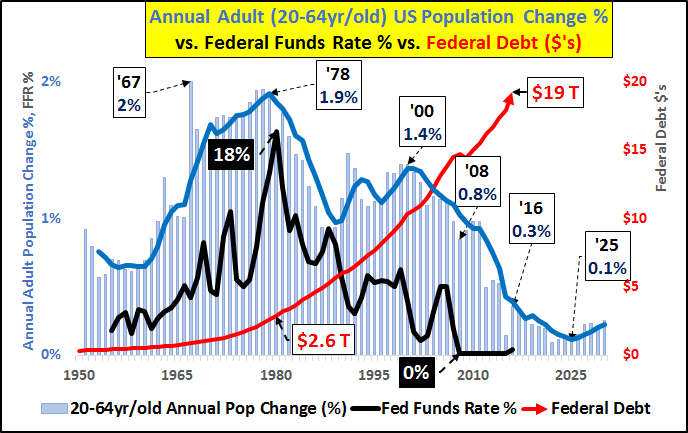

And on a percentage basis (below), the declining growth among the adult population correlated to the Federal Funds rate and federal debt. The introduction of nothing down, NINJA and liar loans was simply because there was a collapsing number of potential buyers to support a speculative bubble, particularly in the “tier 1” US cities and locations.

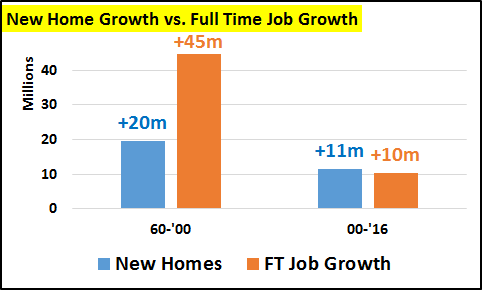

And the changing nature of US net new job creation vs. US new home creation (below). A 2.5 to 1 ratio has inverted since ’00 with more houses being created than full time jobs to support them. Further evidence that US subprime crisis was triggered by a demographic collapse (here).

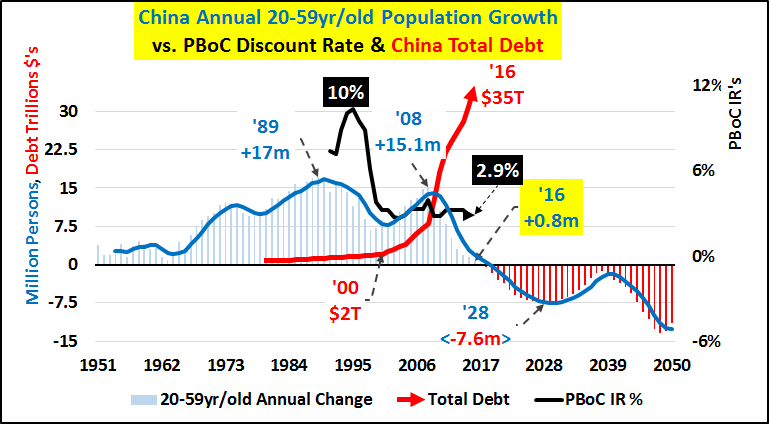

So, back to the biggest bubble leading to the biggest short (ever?). The chart below highlights China’s annual adult population change, the Bank of China discount lending rate, and China’s moonshot of total debt. The decelerating population growth offset by declining lending rates leading to excessive debt and asset bubbles. Pretty standard central bank stuff.

And just in case you didn’t quite catch why China is the biggest bubble and China’s housing market is the biggest excessive vacant inventory the earth has ever seen…a population boom followed by bust…and the bust concurrent with interest rate cuts to substitute debt for decelerating organic growth.

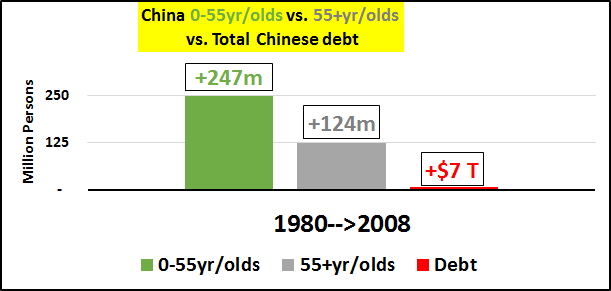

Below, China population and debt change from 1980 to 2008. And $5 trillion of the $7 trillion increase in debt has been incurred since 2000…just as the population deceleration became very noticeable.

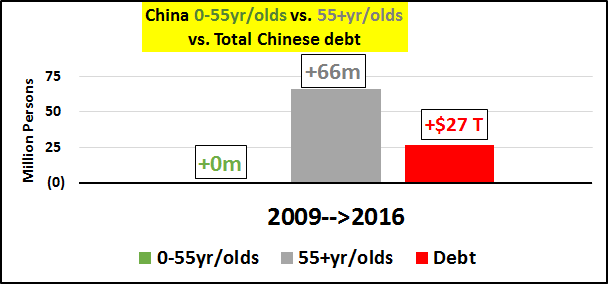

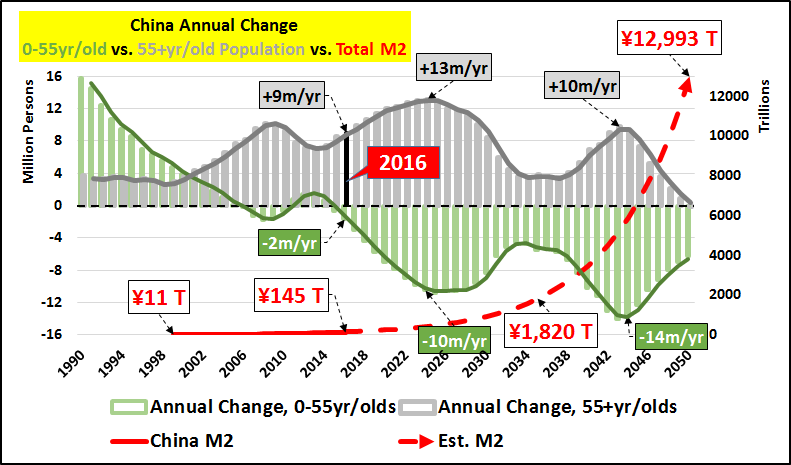

And below, the substitution of debt for the absence of any population growth among the 0-55yr/old Chinese population since ’08.

Below, over the next 20 years, China’s 0-55yr/old population is set to collapse. A 20%+ fall over the next two decades. And the 55+yr/old population is set to more than double this same time with the vast majority among the 65+yr/old population. Again, there will be an average of 7.5 million fewer 0-55yr/old Chinese every year vs. an average annual increase of 9.5 million 55+yr/olds. This in a nation with net emigration.

So, to summarize, China’s retirement age is 60 (50 to 55 for women)…and the wealthy 55+yr/olds (especially the 65+yr/olds) hold huge numbers of speculative, vacant apartments across China’s cities. These apartments / condos are intended to supply the wealthy elderly Chinese with rental income and/or be sold to fund their later years. But the fly in the ointment is the whole collapsing population of buyers vs. a swelling quantity of elderly sellers.

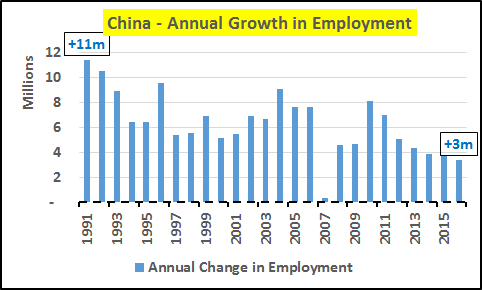

And funny thing, according to the World Bank, the declining Chinese employment ratio divided by the 15+yr/old Chinese population yields the below annual job growth in China. A 70% deceleration in annual job creation since 1990. This probably matters.

And finally below, the mismatch of 0-55yr/olds vs. 55+yr/olds from 1990 through 2050; and for jiggles, I include the Chinese M2 monetary supply. From ’99 through ’15, the Chinese M2 has increased 1400% compared with a 260% increase for the dollar…and that was while the 0-55yr/old Chinese population was only decelerating. Now that the 0-55yr/old population begins its rapid decline, my estimates for China’s M2 and China’s debt are likely to be hit decades early.

So, ok, where’s the short? Well, it probably isn’t housing or construction or even commodity suppliers. If China follows the same path as every other quasi-capitalist (er-communist?) state, we can expect a flood of money like the world has never seen. Bailouts across industry and state buyouts of investors. And the Yuan, swallowing all this debt and spewing all this bailout cash, is probably the short of a lifetime. And how does this fit into the global macro picture? Here.

And there may be a few implications for the US since the Chinese have been net Treasury sellers since July of ’11. Here. By Chris Hamilton, Hambone’s Stuff

Global overcapacity, plunging demand, and a price war have some peculiar effects. Read… Shipbuilding Industry Collapses, Hits China and South Korea

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Where’s the short?

There is no short – at least not one that will pay out.

When this goes – everything goes.

I’d suggest owning physical gold.

But that said – canned food will probably a better store of wealth.

Exactly. I would retitle this: “The World is the Biggest Short ever”. Any of the major economies having a real “hard” landing, it’s good bye my love.

The short suggested at articles end is the Yuan…relative to all other currencies, it may fare the worst. But you are both right China’s sickness is likely to spread far and wide and global economic growth without China as an engine probably means global stall or even potential global economic decline.

The Chinese don’t expect a population shrinkage because it hasn’t happened to them before(1336-1343 the Black Death does not show up in long term graphs).

http://www.china-profile.com/data/fig_pop_0-2050.htm

Some Americans expect Stock Market Shrinkage because they are old enough to remember ’64-’84. If they were Paying Attention.

http://home.earthlink.net/~intelligentbear/com-dj-infl.htm

i disagree with the premise.

however, things are all fucked up over there. they are deflating the world, and at some point, like now, they are realizing it’s not……ah, they can’t change.

Unlike the US where things are not at all fucked up?

It would seem we can not change either.

I think if you look back into the early 20th century you might find that countries that were completely fucked turned to war to resolve their economic difficulties. I would not be surprised to see more warlike stances world wide.

“they are deflating the world”

Quite the opposite actually, the Chinese central bank is printing Yuan like mad and the Chinese are bidding up RE worldwide with that funny money……paying $1,000,000 over asking for Vancouver RE……then there was the story of somebody paying $40,000,000 over ‘not even asking’, they just offered and selling in 7200 seconds.

deflationary?

“To put this in perspective, I’ll compare it to the US subprime crisis…a crisis that was likewise triggered by the demographic deceleration of population growth.”

WTF. You can point to the Fed or what have you, but how about the criminal banks?

Hi NotsoSure – I appreciate your question. My point isn’t that demographics ruined the world…instead, it was a very flawed system and flawed premise that perpetual growth in a finite world was somehow a sound basis for a global economy and finances. My point is just that it was population growth which gave out first and triggered all the rate cuts, debt, bailouts, etc. etc. Four decades and counting now. Plenty of room for discussing CB, Wall St., and Fed Gov roles in perpetuating and promoting something they knew logically ultimately couldn’t work.

Hedge accordingly, but India has a much better demographic profile, stellar economic growth…oh yea, and they’re a democracy.

If you’re brave, Africa will continue to see positive economic growth for decades – it’s the final frontier.

Hi Nicko,

thanks for reading. Regarding India or Brazil or Africa, I”m skeptical and of them will be able to replace the growth China provided. Some data on them in the below link.

http://econimica.blogspot.com/2016/01/sources-of-growth-examined-and-found.html

Unless I, B, A, follow the same insane path of chinas money printing, credit fueled, building for the sake of building.

They will never be able to replicate the manipulated growth numbers china used to produce.This is not necessarily bad

Building city’s for ghosts is only paper growth, not real people growth.

The world need to go through a period of managed sideways whilst the NPLS unwind everywhere except china that will just keep rolling them until it implodes.

Historically this is what china has always done.

The vast majority of the chinese civil wars in history, had: Excessive money printing, and defaulted bond’s, along with all the other ills that go with that, at the the bottom of them.

Historically china always destroys itself from within.

The questions being in this much faster paced world how much damage will they to to the rest of the planet before they implode this time in a much faster cycle than normal.

India has the demographic profile but if you are not an Indian it can be very dangerous place to play.

Mucdh like china they change the rules to suit themselves, then tell you about it.

After they have done it.

India is self sustaining because they kept America out of their country. They may not be richer but they are more secure for it. Just look at Africa to see what American help looks like.

Nope. China is the last country to pull themselves up with the labor-intensive manufacturing, and that is already dying out thanks to increasing automation, and that means once the star attraction of poor countries = labor costs, are also increasingly becoming irrelevant. Your hordes of young workers means nothing when they are competing with even cheaper machines working in already excellent infrastructure, and globalization would deal the final death blow.

Anyone who has ever been to India (I’ve done 3 extensive trips) would know it is absolutely NOT another China in the making — it is actually a basket case.

I don’t know how to compare the aggregate value of Chinese residential real estate over time to the US housing bubble, but here’s a telling metric.

The Economist, in August of 2006, put out this stat. Aggregate home value in US on 1 January 2001 was $14 trillion, and five years later on 1 January 2006 it was $23 trillion. I believe we are just above the 23T number now after hitting 15T in 2008.

regarding statement: “To put this in perspective, I’ll compare it to the US subprime crisis…a crisis that was likewise triggered by the demographic deceleration of population growth.”

Author might enjoy watching the doc/drama Inside Job.

I think the sub-prime crsis was a little more involved than ‘demographics’. Although, if you count on the Crooks being old, that might work.

Thought it was a great movie but painful in it’s honesty. Again, the point isn’t that demographics suddenly caused the ’08/’09 subprime but instead, that the long and gradual wind down from peak annual US population growth in ’80 was offset by Fed interest rate cuts encouraging higher debt w/ lower servicing costs. It went on and on in a hundred different ways substituting credit, leverage, and debt for decelerating population growth until in ’05 or ’06 there were simply no longer net growth of potential homebuyers (a demographic decline). In the absence of qualified buyers, unqualified were substituted. In the absence of qualified incomes came NINJA, no down, etc. etc. But what brought this situation about (and will only continue to worsen…from an economic and financial pov) was the demographic deceleration.

Not many Americans can retire at 50-60. Those vacant apartments are mostly not built (just the exterior walls) completely so they remain vacant until someone moves there. It’s not comparable to US. No property tax in China so basically they are moving their money from yuan to a physical object. If the yuan collapses, this might turn out to be a good investment. Although the number of 0-60 people is going down, I would expect average household size to go down as well. When people get wealthier, living with relatives becomes a lot less attractive.

it’s all a write off to them just like what the USA owes them ect. .They and a majority of countries will no longer accept the $ as payment for anyhting and will go the way of the peso or whatever.

Great article and good comments too ! Thank you.

TD