Apple shares are currently getting crushed. At $95.66, they’re down 8.3% after the bell. The company reported second quarter earnings that, as it has been termed, “missed across the board.”

Revenue dropped 13% to $55.5 billion. Net income plunged 22% to $10.52 billion. Earnings per share plunged 18% from $2.33 per share a year ago to $1.90 per share.

Oh, and iPhone sales fell for the first time ever. Not “fell.” But “plunged.” In dollar terms, they plunged 18.4% from a year ago. In unit terms, they plunged 16%.

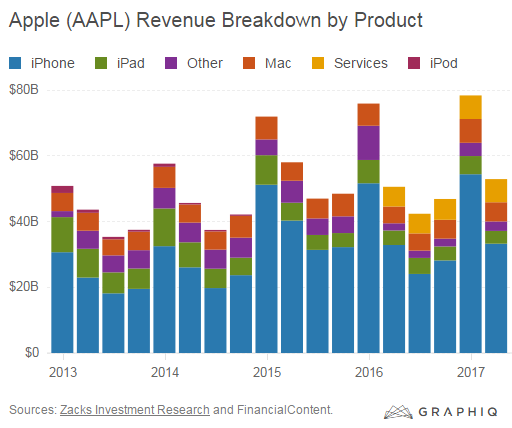

Here are four interactive charts depicting the revenue and unit-sales fiasco in the different segments. Hover over them to get the specific data (Data curated by FindTheCompany):

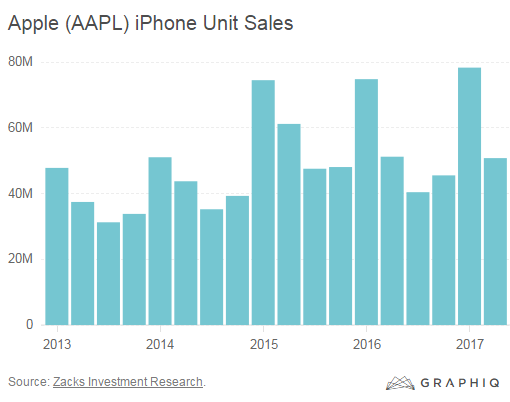

This one is the crux. iPhone sales have propped up the entire US tech sector since 2007 with an unbroken record of booming sales — a prop that has now crumbled as unit sales plunged 16% year-over-year to 51.19 million units:

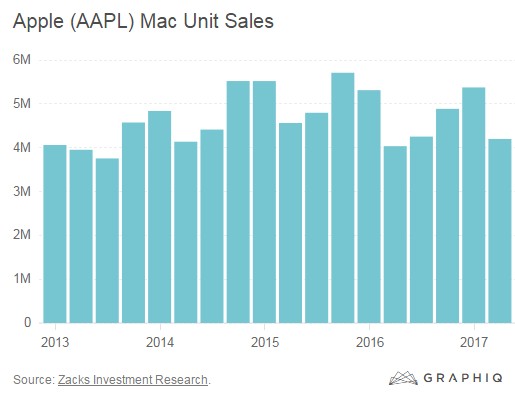

And here are Mac unit sales, which dropped “only” 12% year-over-year, to barely over 4 million units, similar to the overall PC universe, which is sinking deeply into the mire:

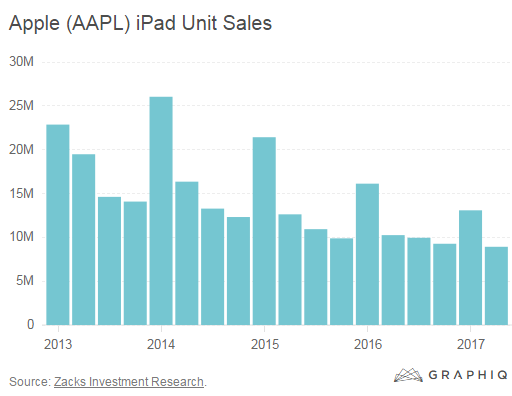

And iPad sales:

“A challenging quarter” is what CEO Tim Cook called it in an interview with the Wall Street Journal. And for Apple investors, an ugly one.

Apple has been the largest contributor to overall tech earnings. It has dominated the sector. Without Apple, the tech sector in the S&P 500 would have been suffering from declining revenues for the fifth quarter in a row. But Apple’s revenue growth propped up the entire sector. But now, that’s over. Here’s what the iPhone sales plunge, and more specifically the Apple earnings plunge, will do to the overall tech sector. Read… How the iPhone Will Maul Tech Sector Earnings

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

There are only so many whistles and bells you can add to a phone. For a while tiny phones were the rage. Then big screen phones. I went from a Samsung S2 to an S5, skipping a few iterations until I dropped the S2 and broke the screen. A cell phone makes calls, does texting, surfs the web, plays music and videos, plays games and takes pictures.

I think there might even be a bit of backlash against all these features, at least among older users. I see more people going back to basic phones that make calls and send text messages.

Just as with PCs the price/performance curve flattens. When I’m home I hardly use a PC any more, mostly for photo editing and printing.

People just don’t have the incomes to roll over from one model to the next.

This is why I have no sympathy for the middle class nor any sympathy for the “captains of industry”, who sat idly by and let the FIRE sector destroy the consumer base. Without people to buy, they cannot sell.

But, then again, modern management is no longer about actually “doing” anything. Most modern managers believe their very existence brings value to an organization and so delude themselves into thinking that what the company sells doesn’t matter.

Well, it does.

I love Apple products, and I had to break down and buy a new iMac this year, but I’m still using a three year old iPad and a four year old iPhone. If I had money to replace my iPhone 4S, I might do it. But I certainly can’t do it because any income that I do have is continually sucked up into the FIRE sector, not to mention the health care racket.

I have a note and a basic dual sim waterproof phone. As and Ipad is to big and slow.

This gives the the high speed net access when I need it, but otherwise leaves me with a cheap small strong pocket phone.

Paying $20 a year for a new phone that ends up at the bottom of a liquid container/puddle/the Harbour, is a lot smater than paying for a new Iphone/phablet every year+.

You learn this after trashing several quiet new phones. (1 only lasted 3 days)

Macs are a different game migrating to a big screen one was the best computer move I ever made.

They have quality, durability, resale and dont need updating untill they finally become to slow to run the bloated browsers the only reason Ihad to move from dual to quad core.

How many pension funds, insurance companies, mutual funds, and hedge funds holds Apple?

The wailing and gnashing of teeth can be heard everywhere.

Well, what can we read into this?

1. Samsung and Huawei eating into Apple’s market share?

2. Teenagers getting bored with new toys?

3. Young adults unable to pay for rent and needless toys – even in their parent’s basement?

We will be smarter a few quarters from now.

I believe Samsung is suffering declines as well. I suspect that Apple’s track record might have allowed it to weather the storm better than it’s competitors. As for Huawei, who knows. We can barely trust the statistics from our own world, and it’s less likely we can believe Chinese numbers too.

I heard shit’s really bad at Dell but it’s a second hand rumour.

You’d be spot on: on the all-important Chinese market Xiaomi has now surpassed Samsung as the top smartphone brand.

While both Samsung and Apple slashed prices on their latest offerings on the European market, Samsung did it before Apple and with more “enthusiasm”.

I won’t even go into the whole smartwatch fiasco…

This always happens with Apple mid season, have to wait for new product updates/releases for back-to-school. ;)

It seems ideas are running low at Cupertino.

Their latest offering is the iPhone SE. It’s nothing more than an old iPhone 5S with a new camera and improved WiFi transceiver sold at the same price as an iPhone 6.

Why bother when Apple itself still sells the 5S at a lower price, nevermind all the used units available these days?

Predictable, unless you are an Apple fan boy. Its the $50 per month and up plans that are killing cell phone growth. Some of my colleagues have Samsung devices, they are as good as if not better than I phones.

I would suggest Tim Cook focus on R&D and less temple building in Cupertino.

A cell phone is a hand-held computer. A utilitarian device. Not a substitute for real live. Just a machine.

My wife has a new Apple because my daughters have the same. I have a Note 3. And, I accomplish much work with my machine when I am on the road – voice to text in two languages. Checking my stuff. Making and getting calls. What else.

Hell, I am the person driving with no music or radio on. Listening to the rubber rubbing off on the road. My truck or car, just another machine to be used to “take care of business”.

Sounds boring right. Ennui. I remember how exciting it was when I got and sent my first emails in the early 1990s. Before email – telefax. Before that telex. You were tethered to the machine in a fixed location. With telex, you needed an operator to input the message, resulting in a tape with a bunch of holes in it. Then, you had to run the tape through the reader. All of that took a lot of time and cost a lot of money. And, don’t step on that tape!

We are all spoiled by simple, cheap and efficient communication. So spoiled in fact that we put 95% of what we get on ignore because the volume and inaccuracy of the unsolicited inputs are overwhelming.

Are we not saturated with inputs and machines and tired out by trying to learn the truth. Wolf helps out a lot.

In simple English, who gives a shit about APPL or the other FANGS. Just vehicles used by the Government to bloat the value of stock indexes. Don’t get me wrong: Apple is a good money-making company. Trading now in the after-market a tad above 93, being 50 day MA on the 5-year and 200 day MA on the 10 year charts. 93 is the 50 day MA on the 35+ year chart.

So, 93 is probably the line in the sand. Better get the Swiss Central Bank to buy more shares. We can’t let our precious Apple fall to reality, which is in the mid 50s. After all, if money-making Apple gets marked down to reality, how much would a buyer pay to take Amazon private.

It seems there are over 160 funds that own apple. Check out this link/chart, scroll down to various buy/hold/sell recommendations & look at the stock price projections. Only 3 weeks ago Needham rated it a strong buy with $150 price projection. Many others have rated apple a buy in 2016 & out of the list of ratings given, the lowest is a hold from dooshbank. Yes ladies & gents, listen to your financial advisors, they will certainly steer you down the right road (for their profits).

http://www.finviz.com/quote.ashx?t=AAPL&ty=c&ta=0&p=w

Apple will take the growth route that most companies do when they start running out of magic bullets, acquisition (profitless expansion). I’m sure they are scouting for some companies to scoop up as I type this.

I don’t own a smart phone or an apple product, never have, & spent a whopping $200 on my laptop a number of years back. I’d skip my flip-phone across the pond if I could but it is useful in the current life mode. Somehow, I manage to go from point A to point B while traveling without the latest app. I have this ancient device called a road atlas. I’m not anti-technology, I just have a deep dislike for these huge multinationals & their predatory actions on people worldwide that are made possible by government collusion with big business concerns. Do some research on the foxconn factory (and others) where apple & many other global electronics companies have their crap manufactured. Their employees make just enough $ to sustain themselves & like most of the poor (majority of the planet) are seemingly saddled into this legalized slavery. They cannot afford to buy the products they are involved with manufacturing! This is the global blueprint for the 99% & is predicated on infinite growth in a finite system. While it’s obvious to me that this system is slowly falling apart & unsustainable, it’s impossible to project a timeline for it’s ultimate demise & what will replace this. I think we will eventually fall back to a more agrarian society if we don’t completely ruin the planet. A private shift in that direction is currently frowned upon by the power structure & they do everything they can to keep the populace dependent on them & the matrix they have created. The majority of mankind has lost it’s roots or had them suppressed, the connection to the real world has been hidden from many. Sad to watch.

Just about everything today including apple products are made as cheap as possible with planned obsolescence. You can’t hardly buy a toaster that lasts more than a year, yet all you need is a much thicker wire in the heating elements & a heavier switch mechanism (like they used to have) to have such an enduring product. If products were made to last, it would damage sales at all these multinational companies & we can’t have that. Screw the consumer, screw the worker, screw the environment, all for what? Power, control, & money. At some point, evolution (devolution?) will cure this. I’m sure I’ll be long gone by then.

Apple, take a bite, just watch out for the worms.

I am not an Apple fan.n’t like cults. You have to admit Apple has done a great job of holding thier margins and profits for years versus all of their competitors. Apple had it so good for so many years that they dictated all the terms to the telecom carriers.

No more Steve Jobs and no more hiz bang products from Apple. All the products that were created when he was alive have run their course. Most of the Apple phone related products are playing catch up to Samsung and other handset manufacturers.

The best thing Apple has going for them is their ecosystem (iPhone, iWatch, iTunes, ipod, Airbook, Macbook,…). Musicians, artists (digital and otherwise), and millenials love their products.

Apple will still make profits but they won’t grow forever. The decline has started. I suspect the stock will bounce so that whomever wants to sell can sell before the stock continues down. Too many institutions depend on that stock staying up.

Should be interesting to see how Apple engineers their finances with their profits kept off-shoe and debt kept on-shore.

My random thoughts on Apple.

Being the devil’s advocate here, there is a strong seasonal impulse to AAPL retail sales. Leaving aside the Christmas factor the underlying trends are steadily higher for iPhones (higher lows), steadily lower for iPads (lower lows), flat for computers.

APPL products are expensive but well made (retina display was a deal-maker) but the company has not had a breakthrough product for several years. They have become ‘just another company’.

I understand this the problem is falling sales in China which might say more about that country then their puffed up growth rates..

China’s a joke. But that joke has been supported and promoted by many U.S. and European conglomerates.

So I guess they are all jokers. The U.S. is the Best at pretending to be solvent and prosperous. I guess it’s the cleanest dirty underwear.

Half joking but not really.

Don’t worry guys, Apple earnings will recover next year when the Donald becomes president. How you think?

The iWall. Made in China. Designed in California.

As they said, when all you have is a wall, everything looks like Mexico or China.

Please: its “Assembled in China”. Mostly from components made in Japan, Taiwan and ROK. ;-)

Close but not quite that simple.

http://ipod.about.com/od/glossary/f/where-is-ipod-manufactured.htm

I wonder how much of this drop is correlated with the death of the shale economy and the money that was everywhere in the heyday.

I was reading about how hedgefunds are going to take a blood bath tomorrow. I suspect that this came as a shock to them (and everybody else) because they all drank the BLS koolaid that all those people getting laid off from shale jobs were picking up some very highly paid waiter jobs.

Their first drop since 2003-thats over 12 years…not shabby at all…

MSFT are down -1.29 vs APPL -.69

Their sales are second only to SAMSUNG, they can’t keep the iPhone SE in stock for weeks, and their PCs are the only ones selling

Why people insist on making light of others misfortunes tells me much

I am an Apple customer, with 3 imacs, 2 ipads, and 2 iphones.

When my iphone started to play up, even thoigh I was using it any differently that before, I took it to the mobile phone shop, where I was told there were only two possibilities: either to send it off for repair or upgrade to a newer model. You have forgotten the third possibility, What’s that? Upon hearing I could get a samsung galaxy, the shop said they thought I was an apple customer. To which I said so.

the samsung galaxy s6 running on android connects calls at first attempt, unlike the iphone which would take 3 goes, and is a pleasure to use.

The Apple phones are still nice, useful products but I think their prices are way too high. Of course they left the Mac prices way too high and missed some big opportunities because of it. I guess there’s always the watch and the paradigm shattering Apple Pay.

Google’s search business is a one trick pony as well, but is easier to obfuscate when taking about software

btw, its TIM Cook, not JIM Cook.

Thanks!!! You’re telling this to a guy who has become famous for his recurring “brick-and-mortal” retailers.

Facebook CRUSHING the quarter. Probably need a separate article.

Online advertising is still doing very well for a few companies in the middle (the two biggies are Google and FB). FB got the sweet spot in that market.

Note that online advertising is NOT doing well for publishers.

Does Facebook make money.

What is the after-tax profit – GAAP

% return on equity

% return on sales

nothing else matters in business

Q1 earnings, just released: on $5.2 billion in revenues, it made $1.5 billion in net profit under GAAP (up nearly 200% from a year ago).

FB sells ads and user information. That’s its business. Watch what happens during the next advertising recession. Advertising budgets are the easiest thing to cut, and they get cut brutally when companies are under pressure. FB’s revenues will dive. FB has no other source of revenue to balance this out. FB has never gone through an advertising recession as a public company. So this will be interesting to watch.

Thank you. I read the 8-K. I wonder if Wolf does or knows of anyone who pay to advertise on FB.

I wonder if there is a revenue breakdown for advertising and data sales. $5 billion is a lot of money paid to get what (to make how much money).

Or, does the Government pay $5 billion per quarter to get the data feed.

The fundamental question is this: Who is the paying customer.

And what does the customer get for his money. Nobody throws away money for ads that do not produce profit. Nobody buys data that does not generate profit, unless it is a Government hell-bend on maintaining control.

Crushing it ? Against Apple’s$50 billion in sales and over $10 billion in earnings for the quarter, which is more than FB will turn for year.

Crushing it ? Against Apple’s$50 billion in sales and over $10 billion in earnings for the quarter, which is more than FB will turn for the year.

Apple is doing FINE. Why are all you fossils just TOO OBSESSIVELY eager to report bad news-no fanboy here-but i notice a lot of “I just love to bring other people down”

You MS dinosaurs are afraid of the emerging mammals

Apple hasn’t had a bad quarter wind 2003…

Time will pass you antiquated ‘techies’ by…into the fossil record

Is your unrequited love for Apple clouding your thought process?