By Steve Sjuggerud, Daily Wealth:

Oil’s below 50 bucks a barrel. That’s down from more than $100 a barrel during the summer – a truly massive price fall. Shares of energy companies have been hammered, too. XLE – the main energy-stock ETF – is down from more than $100 this summer to $75 as I write. Many energy stocks have fallen much farther than this ETF.

In short, it’s horrible out there – particularly in oil investments.

After such an incredible fall, the bottom has to be near – right? You might expect – after such an incredible fall – that I would be a buyer of oil companies now.

That’s a reasonable guess… as you know that I look for investments that are cheap and hated. I hate to disappoint you, but I am NOT buying oil companies – yet. The reason is simple. Oil stocks are not hated enough – yet.

For the bottom to be here in oil stocks, investors have to give up on them. You want to be a buyer of oil stocks AFTER everyone has given up on them. The problem is, the opposite is happening. Investors are getting extremely bullish on energy stocks.

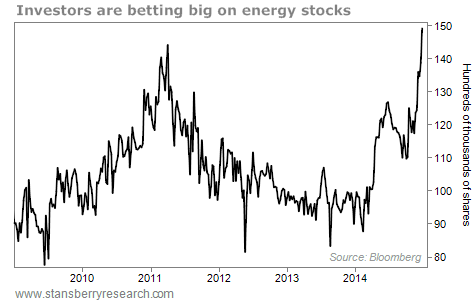

As one example, you can see this in the shares outstanding of XLE – the largest energy-stock ETF (its full name is the Energy Select Sector SPDR Fund). ETFs like XLE create and liquidate shares based on demand. So the total shares outstanding fluctuate depending on whether more investors are buying or selling.

And as you can see in the chart below, investors are buying up energy stocks through shares of XLE.

XLE’s shares outstanding have skyrocketed 30% over just the past seven weeks. They’re now at an all-time high.

And it’s not just XLE. Last week, Bloomberg reported that “more than $3.13 billion went into exchange-traded funds holding stakes in energy stocks this month [December].” In short, investors believe that energy stocks have crashed enough at this point, and they expect them to soar from here.

I think investors will turn out to be wrong here. My opinion has nothing to do with the fundamentals of energy (I am not an expert in energy). Instead, it’s all about investor psychology. Before I will consider buying energy stocks, I want to see “the crowd” become less enthusiastic on them. We need energy stocks to become more “hated.” Today, at this point, energy stocks are just not hated enough – yet – to interest us.

Also, I want to see a legitimate uptrend in XLE and in oil prices. We don’t have any of these things yet.

So I am not buying – yet. In short, after the huge fall in oil prices, everyone is buying energy stocks. I think it’s too early. There’s no hurry to buy. We will have a fantastic opportunity to buy oil stocks someday soon. But that day is not here, yet. By Steve Sjuggerud, Daily Wealth

The oil-price crash, as it’s tearing up an entire industry, was supposed to goose consumer spending. But that’s not happening. Read… Consumer Companies Issue Most Negative Guidance Ever, Despite Lower Gasoline Prices

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()